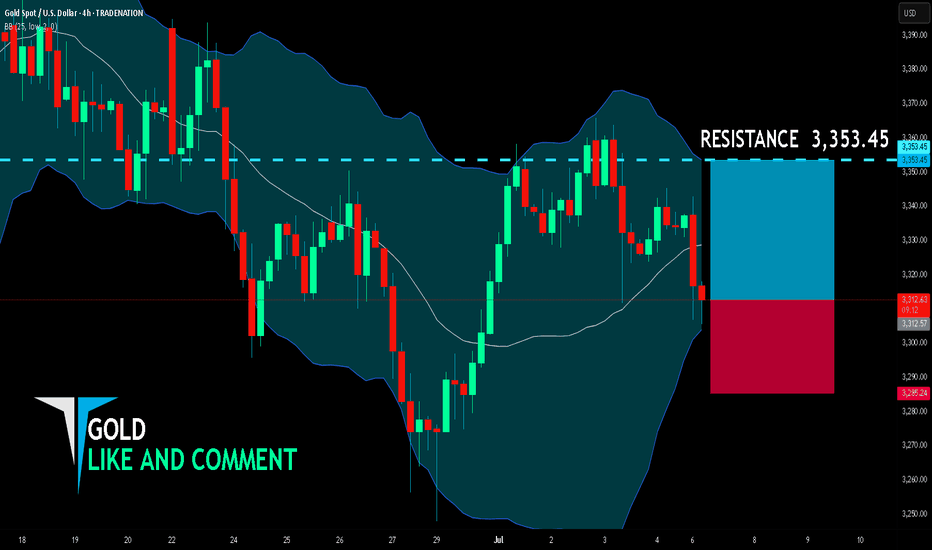

GOLD BEST PLACE TO BUY FROM|LONG

GOLD SIGNAL

Trade Direction: long

Entry Level: 3,312.57

Target Level: 3,353.45

Stop Loss: 3,285.24

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 4h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Trading

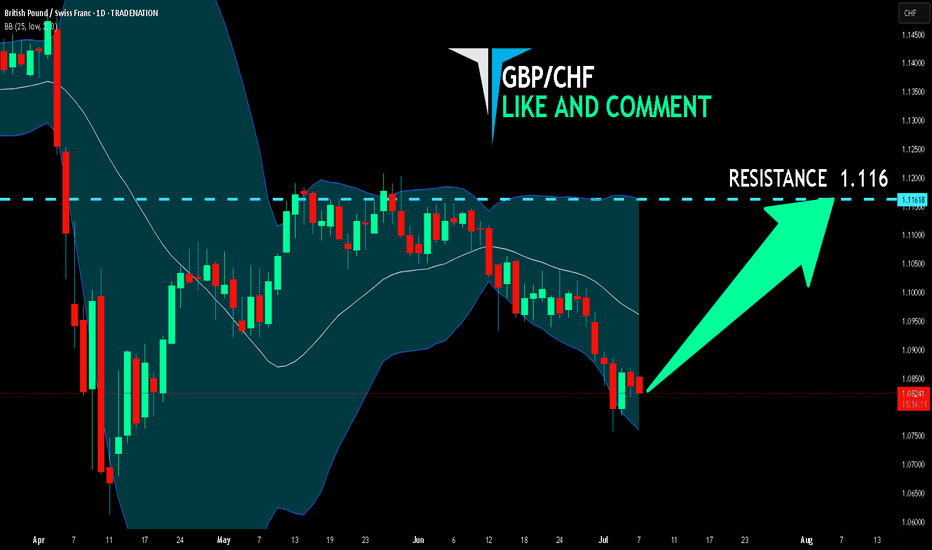

GBP/CHF LONG FROM SUPPORT

Hello, Friends!

GBP/CHF pair is in the downtrend because previous week’s candle is red, while the price is obviously falling on the 1D timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 1.116 because the pair oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

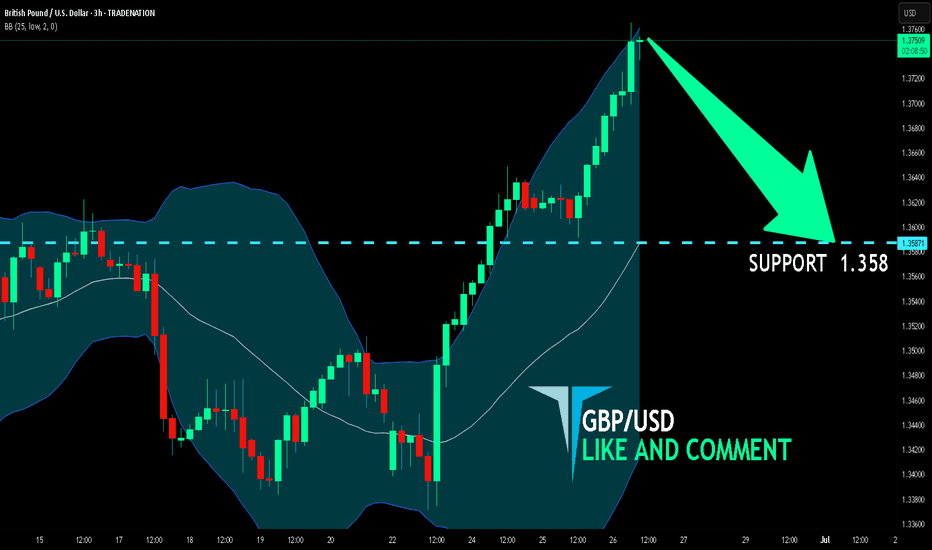

GBP/USD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

GBP/USD pair is in the uptrend because previous week’s candle is green, while the price is clearly rising on the 3H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 1.358 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CAD SELLERS WILL DOMINATE THE MARKET|SHORT

GBP/CAD SIGNAL

Trade Direction: short

Entry Level: 1.872

Target Level: 1.866

Stop Loss: 1.876

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

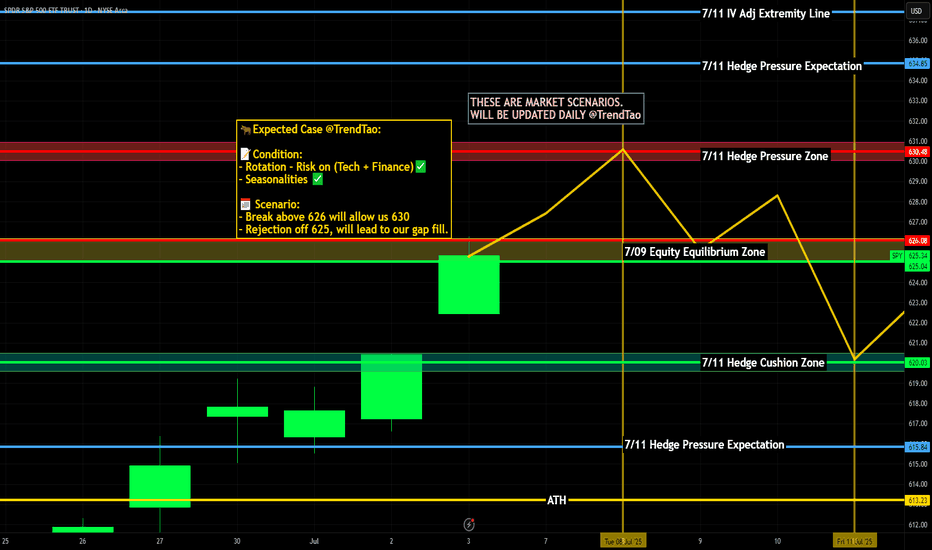

Weekly $SPY / $SPX Scenarios for July 7–11, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 7–11, 2025 🔮

🌍 Market‑Moving News 🌍

📈 From Panic to "Goldilocks" Rally

The S&P 500 and Nasdaq hit fresh record highs, surging ~20% from April lows. Markets rallied on a combination of easing Middle East tensions, the 90‑day tariff pause, a new fiscal bill in Washington, and strong June jobs data. Still, strategists caution that optimism may be ahead of fundamentals, especially if trade volatility returns

💱 Dollar Weakness & Bond Market Watch

The U.S. dollar remains near 3.5‑year lows amid rate‑cut speculation and trade progress. Treasury yields are volatile this week, impacted by concerns over escalating debt issuance, upcoming tariff deadlines (July 9), and the Federal Reserve’s stance .

🏢 Tech Leadership Shifts

With the “Magnificent Seven” tech stocks near heights, growth is spreading: cyclical sectors, small‑caps, and industrials are gaining momentum. AI remains the primary engine, but resilience across a broader stock base is signaling a potentially sustainable rally

⚠️ Tariff Truce Deadline Looms (July 9)

The April tariff pause expires mid‑week. U.S. plans to extend exemptions via trade talks with partners like UK, Vietnam, and Canada—yet any delay or failure may shock markets. Watch for headlines that may trigger spillover effects .

📊 Key Data Releases & Events 📊

📅 Monday, July 7:

Independence Day markets resume. Light trading expected ahead of data and tariff deadline.

📅 Tuesday, July 8:

10:00 AM ET – Consumer Credit (June)

Gauges borrowing trends—an indicator of household health in a low‑rate environment.

📅 Wednesday, July 9:

EIA Crude Oil Inventories & MBA Mortgage Apps & Wholesale Inventories

Key mid‑week data points; oil builds may pressure energy stocks.

Tariff Pause Deadline – Expect market volatility on news of extension or reimposition.

📅 Thursday, July 10:

8:30 AM ET – Initial & Continuing Jobless Claims

10:00 AM ET – Natural Gas Inventories

Markets focus on labor health and energy trends.

📅 Friday, July 11:

10:00 AM ET – Treasury Budget Statement

Details on government borrowing and fiscal outlook—markets sensitive to deficit risks.

⚠️ Disclaimer:

These insights are for educational purposes only—not financial advice. Consult a licensed advisor before making investing decisions.

📌 #trading #stockmarket #economy #news #tariffs #Fed #AI #technicalanalysis

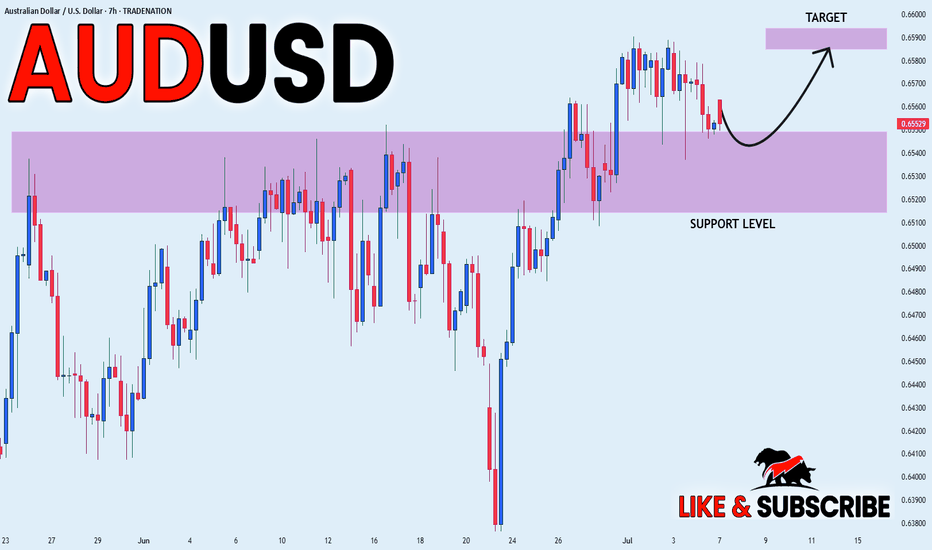

AUD_USD WILL GO UP|LONG|

✅AUD_USD has retested a key support level of 0.6540

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 0.6584 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

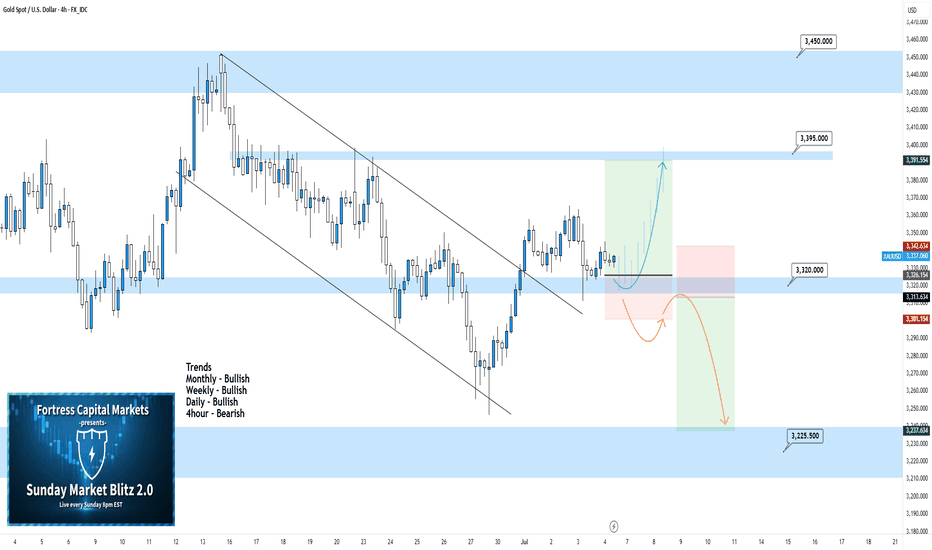

XAUUSD 4Hour TF - July 6th, 2025XAUUSD 7/6/2025

XAUUSD 4 hour Long Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

Back to bullish here on Gold but that comes as no surprise when you look at the higher timeframe trends.

I’m mainly considering long scenarios for the week ahead but let's take a look at two for the week ahead:

4hour bearish continuation - Currently we can see price action broke above 3,320.00 resistance and is currently looking to find some footing. We’re keeping an eye out for higher lows at or near this level to then consider long scenarios. 3,395.000 seems like a good target but gold has potential to go higher.

4hour trend reversal - If we are to consider short positions on gold we would need to see a break back below our 3,320.000 zone. Look for confirmed lower highs below 3,320.000 and target lower key support levels if this happens.

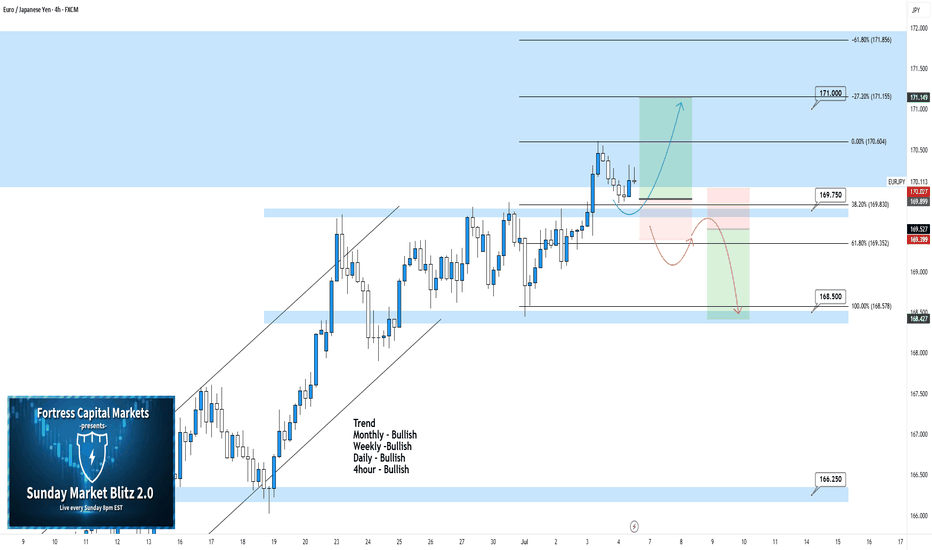

EURJPY 4Hour TF - July 6th, 2025EURJPY 7/6/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

EJ is doing it’s thing and sticking with it’s bullish trend for now. The only conflicting signal is this major monthly zone around the 171.000 area so we will have to be careful.

Let’s keep a look out for two potential scenarios going into this week:

Bullish Continuation - We just saw a break above the 169.750 4hour zone which is fairly significant and it is signaling new support for this currently forming higher low, which is great. From here we’re looking for this bullish trend to continue, look for strong bullish conviction coming off this 169.750 zone and look to target higher.

Trend Reversal - This is a possibility with our 171.000 looming overhead. If we start to see bearish rejection look for a lower high below 169.750 and look to target lower toward key support levels.

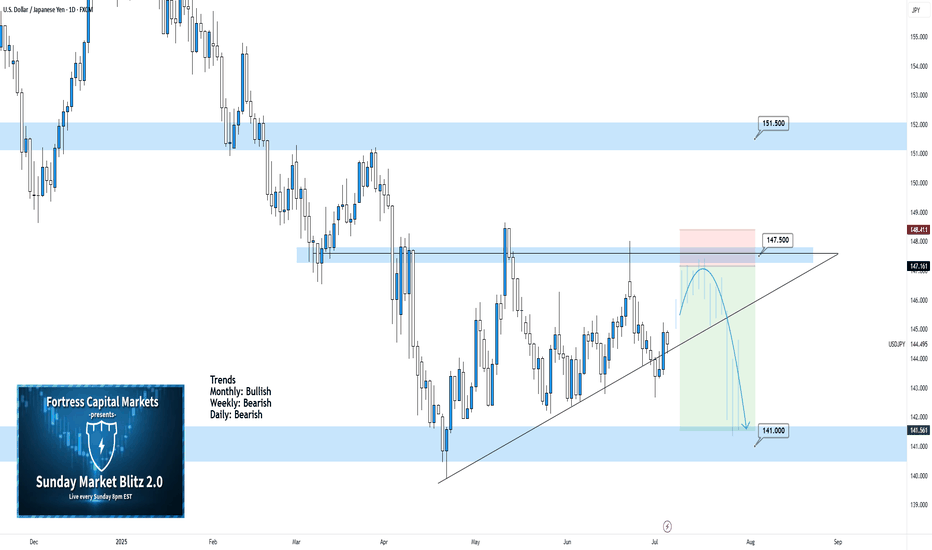

USDJPY Daily TF - July 6th, 2025USDJPY 7/6/2025

USDJPY Daily Neutral Idea

Monthly - Bullish

Weekly - Bearish

Daily - Bearish

We’re still on the daily timeframe with UJ as there is nothing worthwhile. We are clearly in some daily consolidation phase and price action has no clear direction from a swing perspective.

Bearish Continuation - For us to consider a bearish continuation, which is the most likely, we would like to see a retest of our 147.500 zone followed by strong bearish rejection. If we can spot rejection around the 147.500 zone it could present some decent short positions. I’d be looking to target lower toward key support levels.

Aside from this potential setup i’m not looking at any other scenarios for UJ.

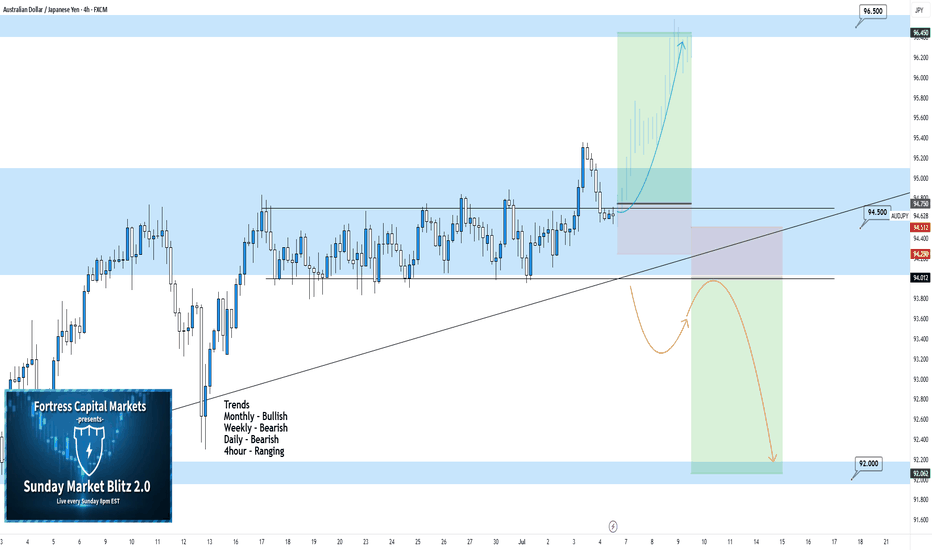

AUDJPY 4Hour TF - July 6th, 2025AUDJPY 7/6/2025

AUDJPY 4hour Neutral Idea

Monthly - Bullish

Weekly - Bearish

Dailly - Bearish

4hour - Ranging

We’re getting some mixed signals here on AJ so i’ll keep this as a neutral idea as we need more info from price action. Most of the major trends seem bearish but the 4hour trend seems to have some bullish pressure. Let’s see how this could play out this week:

Bullish Breakout - We already saw a pretty significant bullish attempt to break out of this range around 94.500. If we can spot some bullish conviction, now that we're retesting what seems to be a broken range, then we can confirm a bullish 4hour trend and prepare for potential long scenarios. I’ll be looking higher toward key resistance around 96.500 if this happens.

Bearish Breakout - For us to consider comfortable bearish scenarios, we would need to see price action fall back through our 94.500 zone and form a lower high. If we see structure formed below 94.500 we can begin targeting lower for potential short positions. Look toward key support levels as targets.

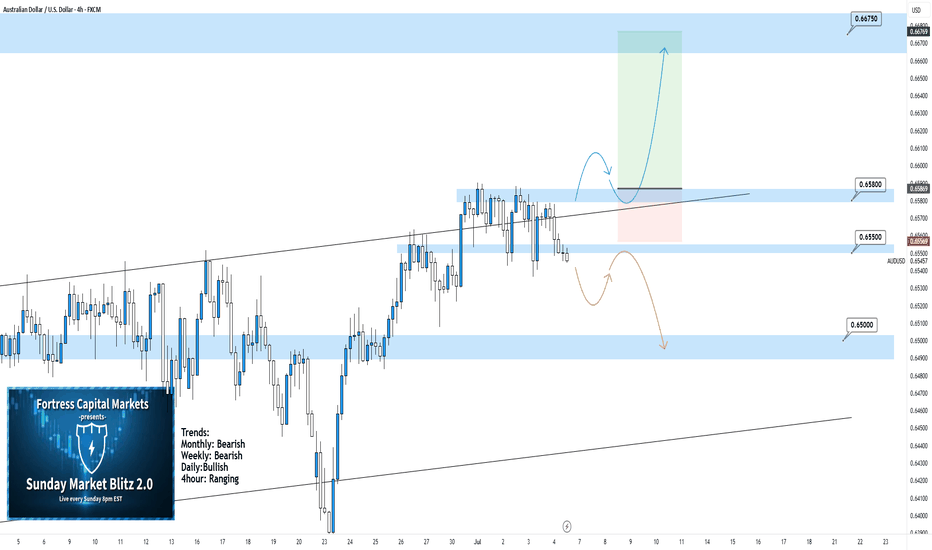

AUDUSD 4hour TF - July 6th, 2025AUDUSD 7/6/2025

AUDUSD 4hour Neutral idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Ranging

We are still technically bullish overall but we can see here on the 4hour that AU is ranging between 0.65800 & 0.65500. This is a fairly small range so we’re not that interested in taking trades while price action is bouncing between these two zones.

We’re looking for conviction above 0.65800 or below 0.65500 before we can comfortably make a move. Let’s see what both of those situations would look like:

Bullish Continuation - Most of the trend data is suggesting AU is still bullish but we would need to see a strong push above resistance around 0.65800 with a confirmed higher low above before getting into any trades. If we do see this play out I'm looking toward 0.66750 resistance as a target.

Reversal back into channel - Price action seems to be poking out of the bottom of this range but we are still not convinced just yet. For us to strongly consider this a bearish move we would like to see a retest of 0.65500 as resistance followed by bearish conviction. Look for price action to move lower toward key support areas if this happens.

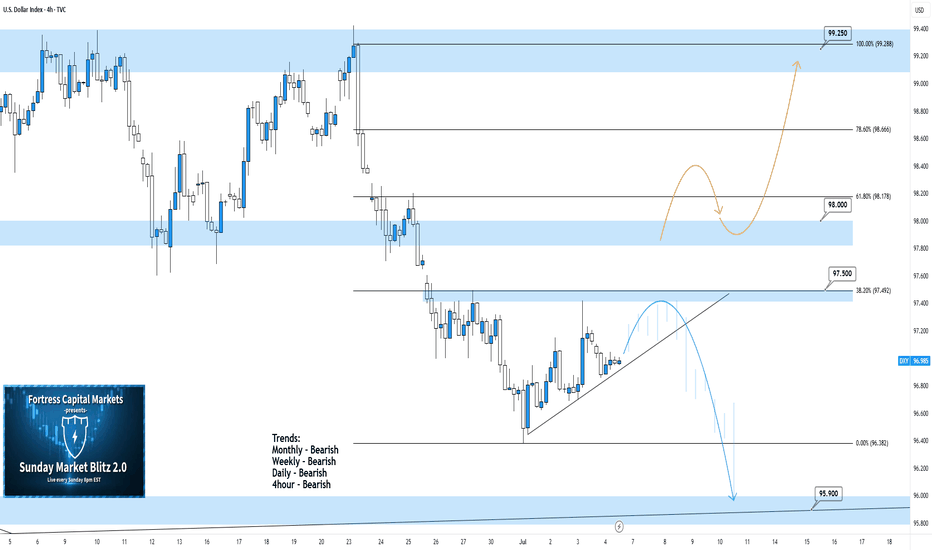

DXY 4Hour TF - July 6th, 2025DXY 7/6/2025

DXY 4hour Bearish Idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bearish

4hour - Bearish

All timeframes are suggesting we are sitll very much bearish. Going into this week we can spot two scenarios that will consider DXY either bullish or bearish.

Bearish Continuation - Ideally we can see price action stay below our 97.500 resistance zone which is also our 38.2% fib level. Look for price action to reject 97.500 with strong bearish conviction. This will most likely confirm a bearish dollar for the week ahead. Keep in mind, price action can push up to the 98.000 zone and still remain bearish.

Reversal - This is the less likely move for the week ahead but not impossible. For us to consider DXY bullish again on the 4hour timeframe we would need to see price action push above our 98.000 resistance area with a confirmed higher low above. Look for strong bullish rejection above & off of 98.000 acting as support. This is the first step for DXY in becoming bullish again.

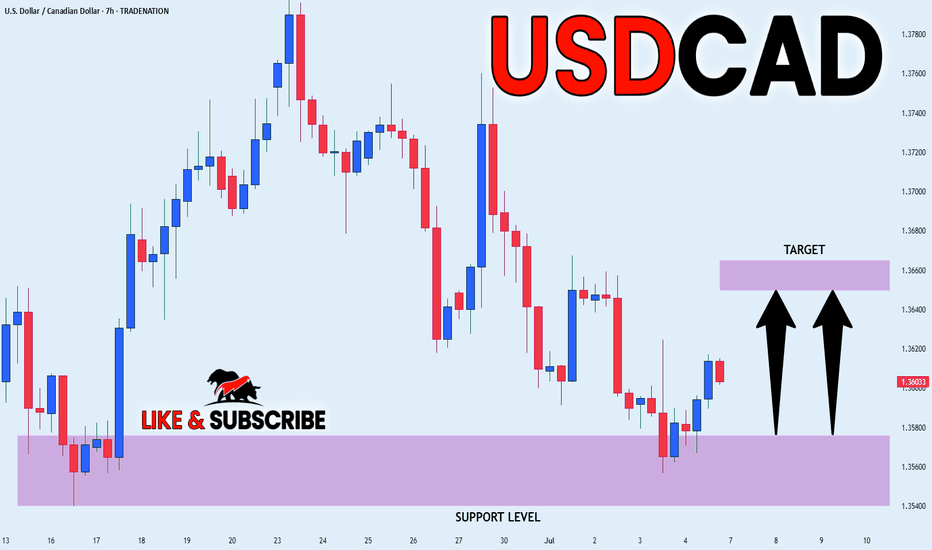

USD_CAD POTENTIAL LONG|

✅USD_CAD went down to retest

A horizontal support of 1.3560

Which makes me locally bullish biased

And I think that a move up

From the level is to be expected

Towards the target above at 1.3652

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

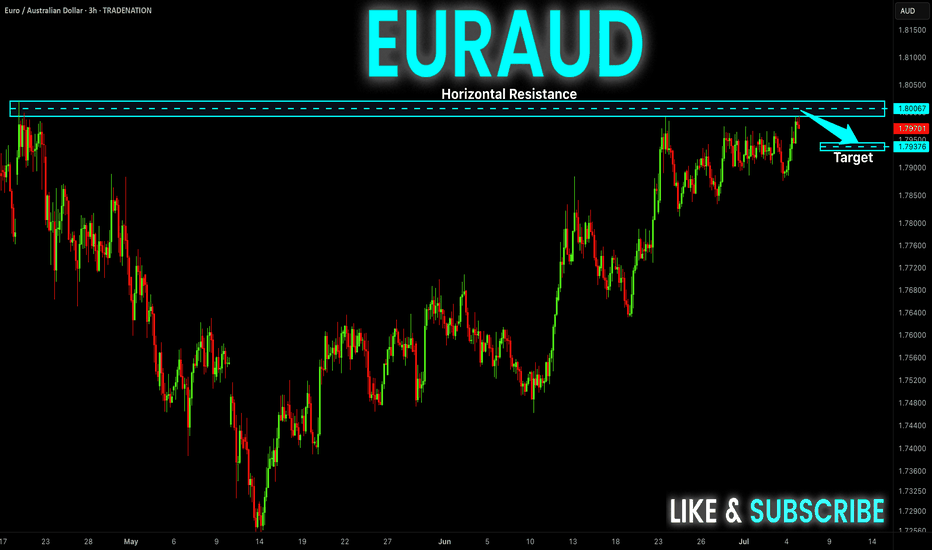

EUR-AUD Will Fall! Sell!

Hello,Traders!

EUR-AUD keeps trading in

A strong uptrend and the pair

Is locally overbought so as the

Pair is retesting a horizontal

Resistance of 1.8019 from

Where we will be expecting

A local pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

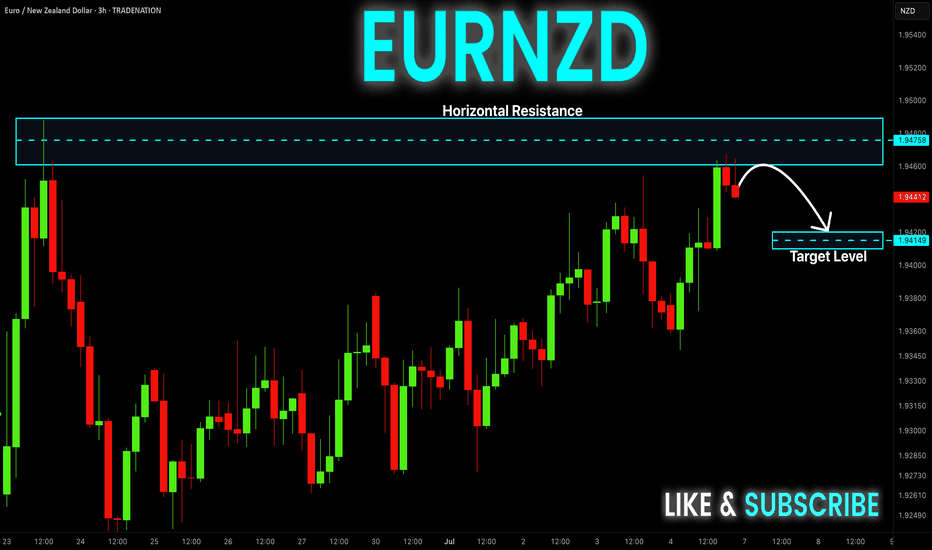

EUR-NZD Risky Short! Sell!

Hello,Traders!

EUR-NZD made a retest

Of the local horizontal resistance

Of 1.9485 so despite the uptrend

We are locally bearish biased

And we will be expecting a

Local bearish correction

On Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

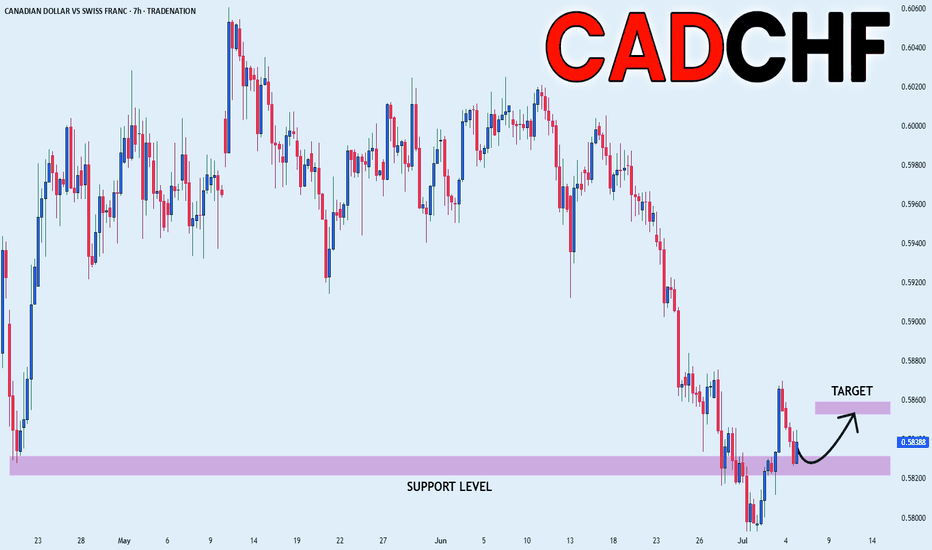

CAD_CHF GROWTH AHEAD|LONG|

✅CAD_CHF made a retest

Of the horizontal support

Of 0.5820 and we are already

Seeing a bullish reaction

So we will be expecting a

Further bullish move up

On Monday

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

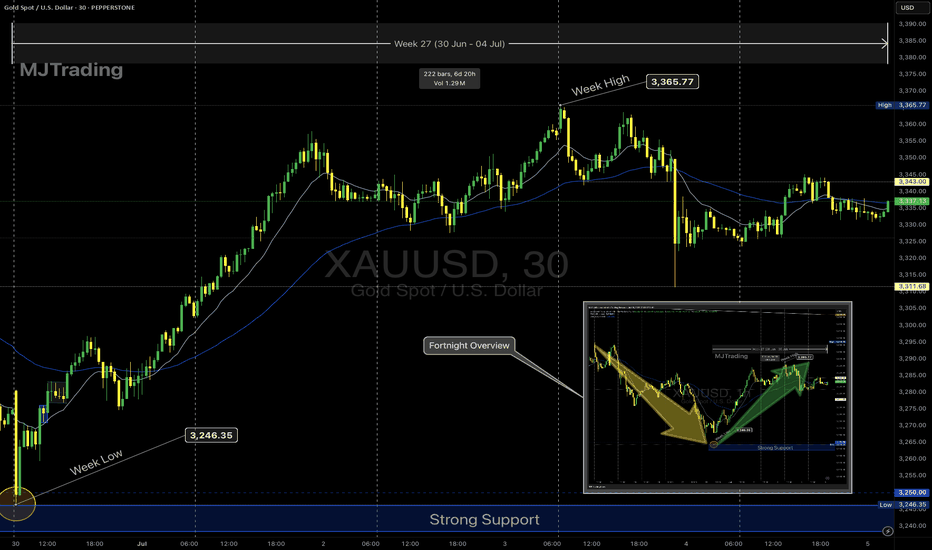

Gold Weekly Recap – Week 27 (30 Jun – 04 Jul)🟡 XAUUSD | MJTrading

Overview

Gold (XAUUSD) staged a significant recovery this week after retesting a critical support zone. Price action reflected strong buying interest at lower levels, followed by consolidation near mid-range resistance.

🔹 Key Levels:

Strong Support Zone: 3,246 – 3,250

Weekly Low: 3,246.35 (30 June)

Weekly High: 3,365.77 (3 July)

Closing Price: ~3,343

🔹 Price Action Summary:

✅ Early Week Retest & Reversal

After the prior week’s decline, gold opened the week near the major support area around 3,246. This zone acted as a strong demand pocket, triggering a swift rejection and initiating a bullish reversal.

✅ Sustained Rally to Resistance

Price climbed steadily, riding the 15-period EMA to reach the weekly high of 3,365.77 on 3 July. This move represented a nearly 4% recovery off the lows, fueled by renewed safe-haven flows and short covering.

✅ Midweek Consolidation

Following the rally, gold entered a sideways consolidation phase between 3,340 and 3,365. EMA flattening reflected a pause in momentum as traders assessed the next directional catalyst.

✅ Late-Week Pullback

Toward the end of the week, price tested the 3,310–3,320 area before modestly bouncing into the Friday close. Overall, the market maintained a cautiously bullish tone while holding above the prior support.

🔹 Technical Perspective:

🔸 Bias: Cautiously Bullish

Price defended the strong support and printed a higher low structure.

Sustained closes above 3,300 maintain the bullish outlook.

🔸 Near-Term Resistance:

3,365–3,390 remains the immediate supply zone to monitor for breakout attempts.

🔸 Key Support:

The 3,246–3,250 area continues to be the primary downside line in the sand.

🔹 Special Note – 4th July US Bank Holiday

Trading volumes were notably lighter on Thursday, 4th July, due to the US Independence Day holiday. This contributed to reduced liquidity and muted volatility, with many traders and institutions off desks. The thinner market conditions likely influenced the late-week pullback and consolidation, as participation was limited heading into the weekend.

🔹 Sentiment & Outlook

The decisive rebound from support suggests that buyers are defending value zones aggressively. However, failure to close the week above 3,365 leaves gold vulnerable to another retest of mid-range levels if fresh catalysts don’t emerge.

Traders should watch for:

A clean breakout above 3,365 to confirm continuation higher.

Any sustained weakness below 3,300 as a signal of fading bullish momentum.

🧭 Next Week’s Focus:

Monitoring whether the consolidation evolves into accumulation or distribution.

Watching for a breakout or deeper pullback

Reactions to upcoming economic data

EMA alignment: If the 15 EMA continues to track above the 60 EMA, it supports a bullish bias.

Chart Notes:

The main chart highlights this week’s action, while the inset provides a fortnight overview of the broader decline and recovery for context.

Thank you for your time and your support...

🚀🚀Boost it if you like it (Thanks)🚀🚀

#Gold #XAUUSD #GoldTrading #Forex #Commodities #TechnicalAnalysis #PriceAction #TradingRecap #MJTrading #GoldForecast #MarketReview #WeeklyRecap #TradingView

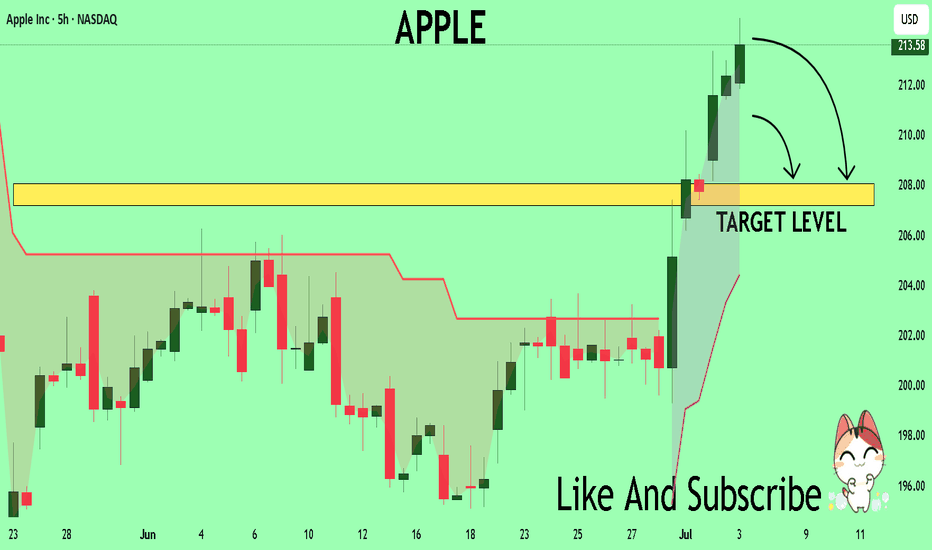

APPLE Massive Short! SELL!

My dear friends,

Please, find my technical outlook for APPLE below:

The instrument tests an important psychological level 213.58

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 208.03

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

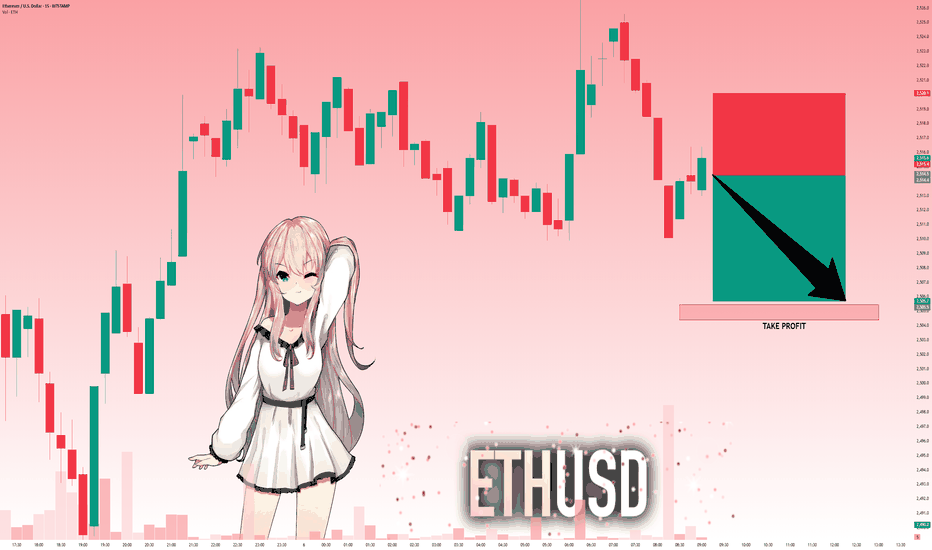

ETHUSD: Next Move Is Down! Short!

My dear friends,

Today we will analyse ETHUSD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 2,514.4 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

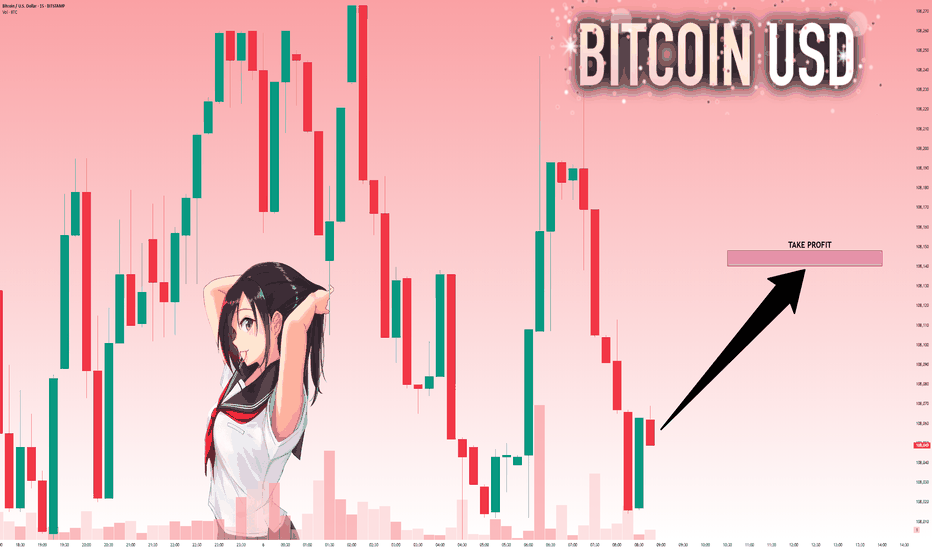

BTCUSD: Target Is Up! Long!

My dear friends,

Today we will analyse BTCUSD together☺️

The market is at an inflection zone and price has now reached an area around 108,067 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 108,140. Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

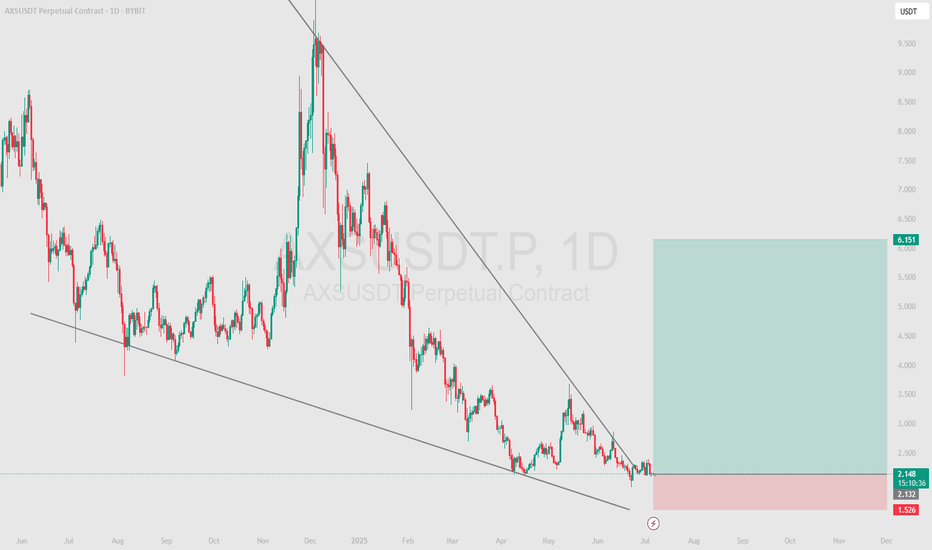

AXS - We are on support, next rocket 180%At the moment, the price is in the testing zone of the lower boundary of the descending channel. This is a critical level that will determine the further direction of movement. If the price bounces off the support, we can expect an upward correction. If the price breaks through the support, we should expect a further fall.

Recommended signal: Waiting for confirmation of the breakout of the lower boundary of the channel to enter shorts or a rebound from support to enter longs.

Price range forecast for the next 3 days: 1.50–2.30 USDT.

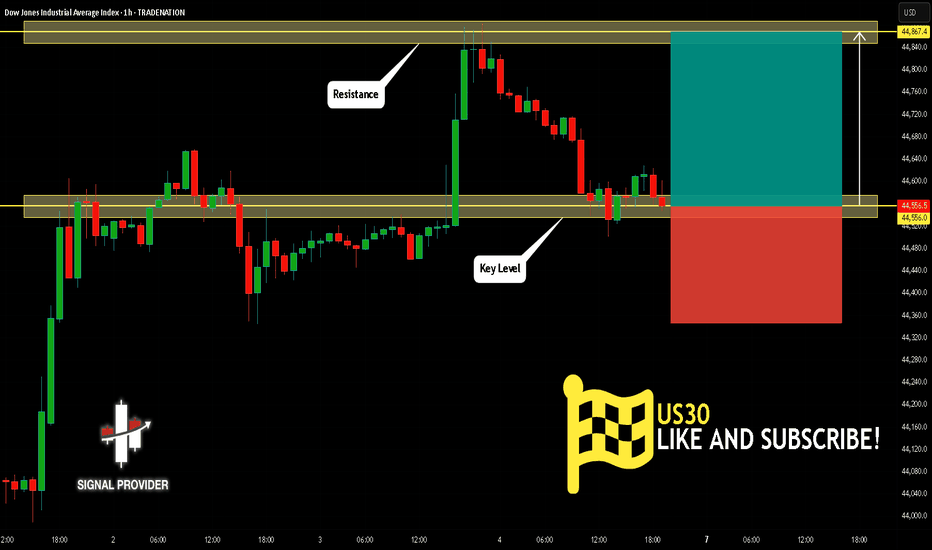

US30 Will Move Higher! Buy!

Take a look at our analysis for US30.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 44,556.0.

Taking into consideration the structure & trend analysis, I believe that the market will reach 44,867.4 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

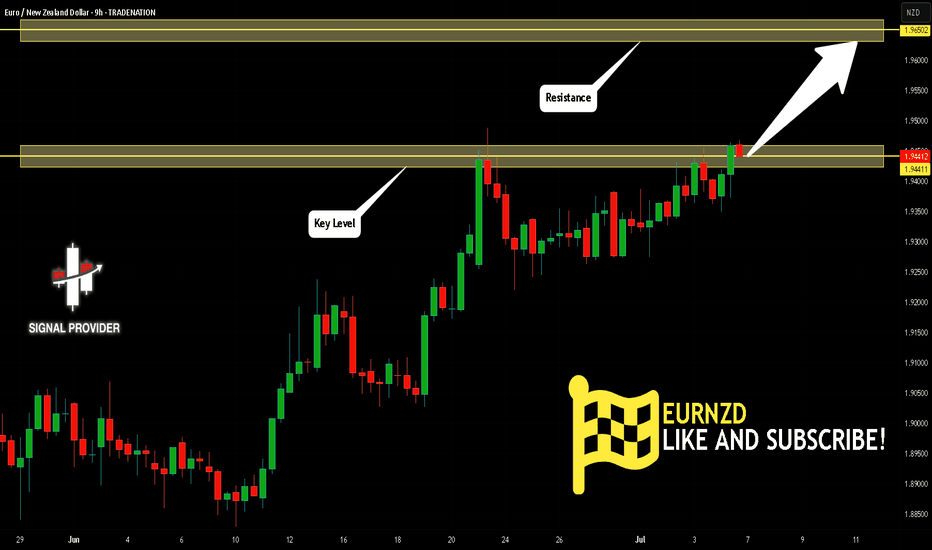

EURNZD Is Bullish! Long!

Please, check our technical outlook for EURNZD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1.944.

Considering the today's price action, probabilities will be high to see a movement to 1.965.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!