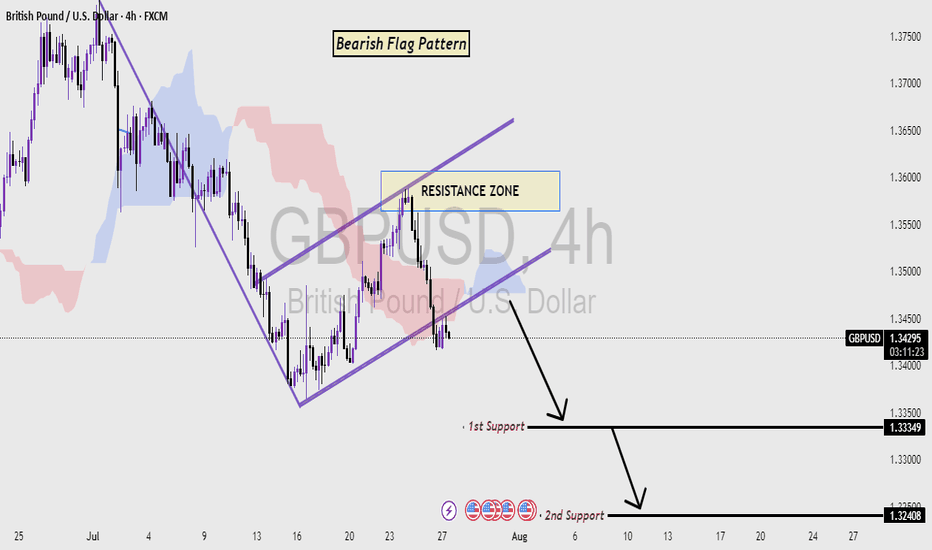

GBP/USD 4H Chart Analysis (Bearish Flag) Read the caption📉 GBP/USD 4H Chart Analysis

Pattern Identified: Bearish Flag Pattern

Timeframe: 4-Hour (4H)

Currency Pair: GBP/USD

🔍 Chart Explanation:

This chart illustrates a classic Bearish Flag Pattern, which is a continuation pattern signaling a potential further decline in price after a temporary consolidation.

Downtrend Leg (Flagpole):

The strong and sharp bearish move on the left side of the chart forms the flagpole, indicating aggressive selling pressure.

Consolidation (Flag Formation):

Price enters a rising channel (the flag) which reflects a short-term corrective phase or pullback. This consolidation occurs within the Resistance Zone, suggesting weakening bullish momentum.

Resistance Zone:

Marked in blue, this zone is where the price struggled to break above, and it acts as a ceiling. Rejection from this zone confirms bearish pressure and increases the likelihood of a breakdown.

Breakdown & Target Levels:

The chart shows that price has broken out downward from the flag pattern, triggering a continuation of the prior downtrend.

Two important support levels are highlighted:

🔸 1st Support: 1.33449 – This is the immediate target where price may pause or react.

🔸 2nd Support: 1.32408 – This is the extended target if selling pressure continues.

Ichimoku Cloud (Background):

The cloud behind the price action represents market sentiment. The red cloud suggests a bearish bias aligning with the flag pattern breakdown.

🧠 Technical Summary:

This setup favors a sell-side outlook. The rejection from resistance within a bearish flag and subsequent breakdown confirm bearish momentum. Traders may look for selling opportunities below the flag breakdown with targets at the mentioned support zones.

Trading

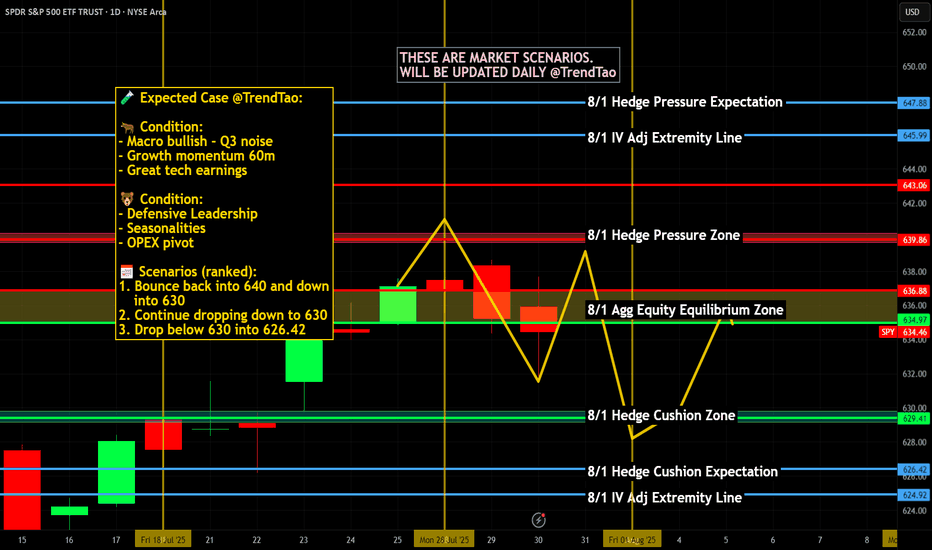

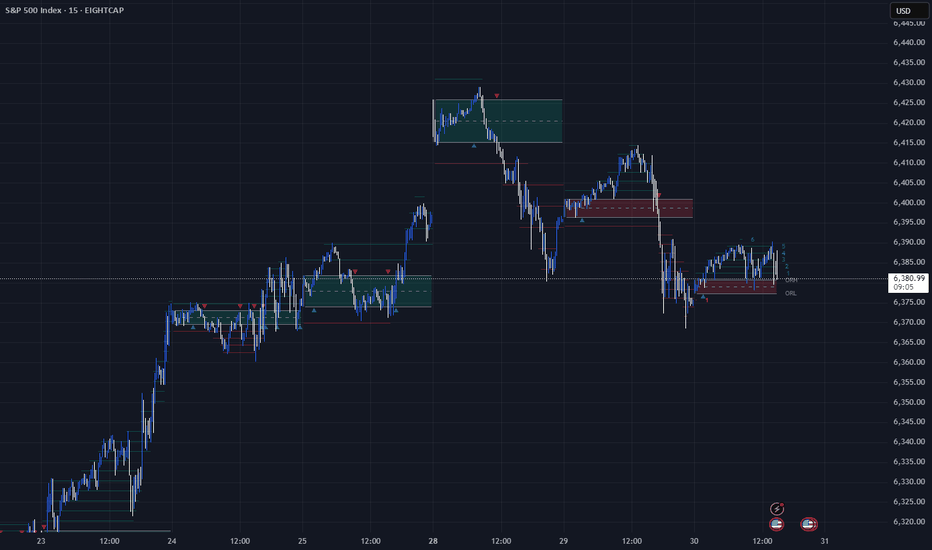

Nightly $SPY / $SPX Scenarios for July 31, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 31, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Fed Holds Rates — Dissent Indicates Division

The Federal Reserve maintained its benchmark rate at 4.25%–4.50%. Notably, two governors—Christopher Waller and Michelle Bowman—dissented in favor of a 25 bp rate cut, underscoring internal divisions amid growing political pressure

📈 Strong Q2 Growth, But No Rate-Cut Signal

U.S. GDP expanded at a 3.0% annualized rate in Q2, rebounding sharply from Q1's contraction. Despite this, Powell emphasized persistent inflation, particularly from tariffs, reinforcing the Fed’s cautious policy stance

🛢️ Oil Climbs as Tariff Tensions Rise

Brent crude rose to ~$73.51 and WTI to ~$70.37 on fears of supply disruptions tied to President Trump’s threats of new tariffs on Russian oil and new tariffs imposed on Brazil and South Korea

📊 Key Data Releases & Events 📊

📅 Thursday, July 31:

8:30 AM ET – Initial Jobless Claims (week ending July 26)

Initial claims rose to 222,000, up from 217,000 previously—an early gauge of labor-market trends

8:30 AM ET – Employment Cost Index (Q2)

Quarterly growth in labor costs edged lower to 0.8%, down from 0.9%—a signal of moderate wage pressures

8:30 AM ET – Personal Income (June)

Data released on household income and spending patterns—crucial for assessing consumer resilience heading into Q3

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #inflation #jobs #technicalanalysis

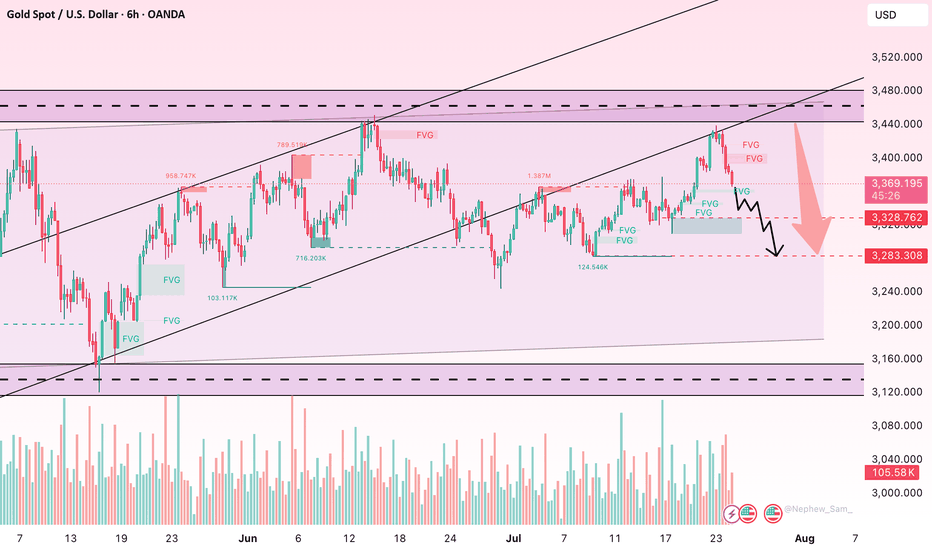

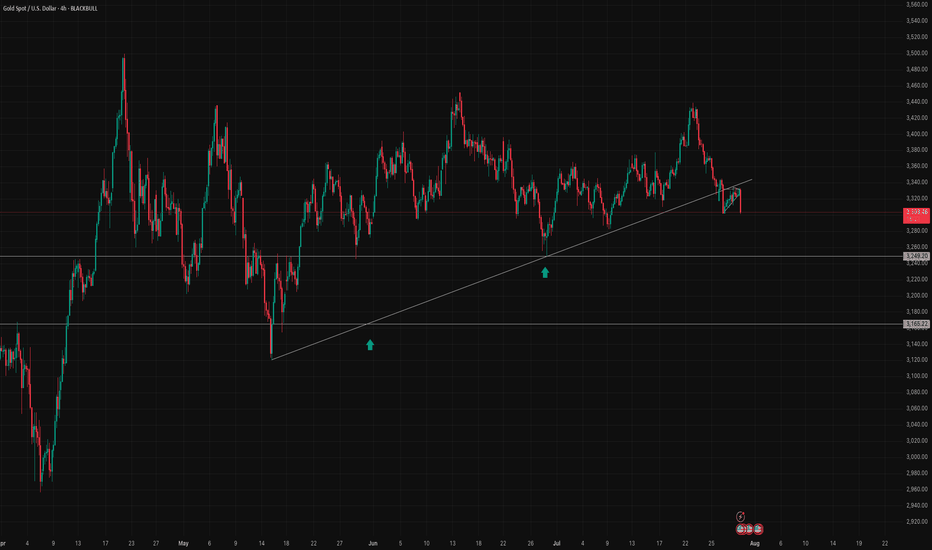

Gold’s Next Move: Bounce or Breakdown?Gold is pulling back after breaking the 3,360 USD resistance on the 6-hour chart. Price is currently testing the nearest fair value gap (3,370–3,380), but upside momentum is stalling, partly due to unfilled supply zones above.

A retest of the lower FVG near 3,340 will be key. Holding above this level could trigger renewed buying, while a break below may invalidate the bullish structure.

Traders should closely monitor whether downside gaps continue to fill and how price behaves near support zones. Lack of strong liquidity could lead to a false breakout.

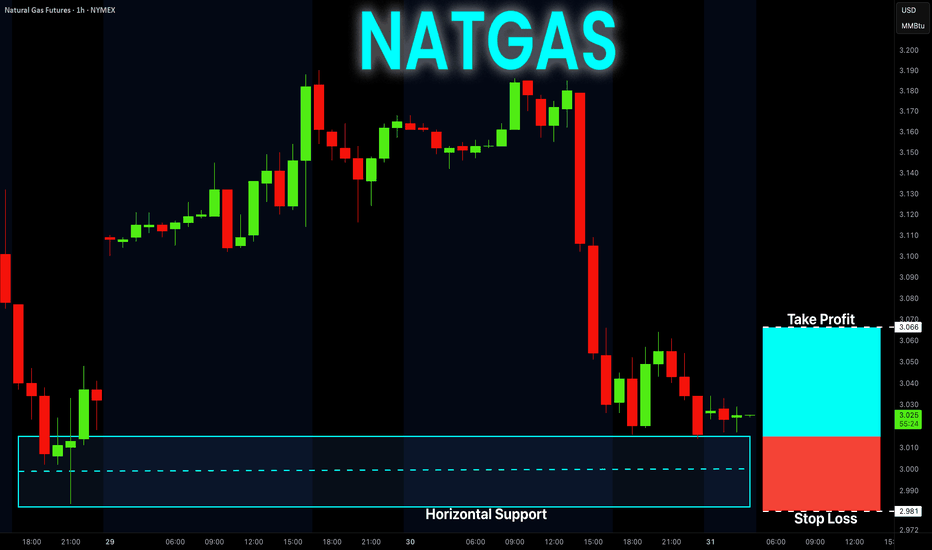

NATGAS Free Signal! Buy!

Hello,Traders!

NATGAS went down and

Almost reached the horizontal

Support of 3.014$ from where

We can enter a long trade

With the Take Profit of 3.066$

And the Stop Loss of 2.981$

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

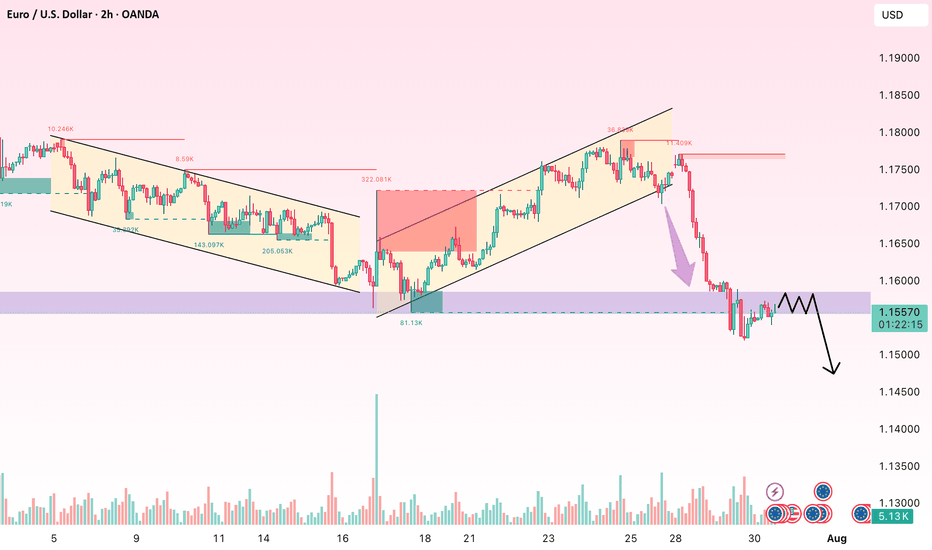

EUR/USD: A Fragile Rebound Within a Broader Bearish TrapEUR/USD has managed to stage a slight recovery after plunging through the key 1.1680 support — a level that had held firm for two weeks. The pair is now hovering just above 1.1500, but the bounce appears shallow and unconvincing. Volume remains low, momentum indicators offer little confirmation, and the broader structure still points to a prevailing downtrend.

On the H2 chart, price has rebounded from the 1.1505 area — a minor support formed during July's short-term consolidation. Yet, the EMA slope remains strongly negative, and RSI is struggling below the neutral 50 mark after exiting oversold territory. The structure continues to display classic lower highs and lower lows, with the 1.1585–1.1600 zone emerging as a potential resistance area for bears to re-enter.

From a macro perspective, the U.S. dollar remains supported by expectations that the Fed will maintain a hawkish stance, fueled by solid GDP, durable goods, and PCE data. In contrast, the Eurozone struggles with signs of stagnation, with both services and manufacturing PMIs deteriorating — most notably in Germany. This policy divergence continues to favor the greenback.

Unless bulls manage to decisively reclaim the 1.1600 zone with strong follow-through buying, any rebound risks being nothing more than a dead cat bounce. The downside target remains near 1.1460 – 1.1440 in the near term.

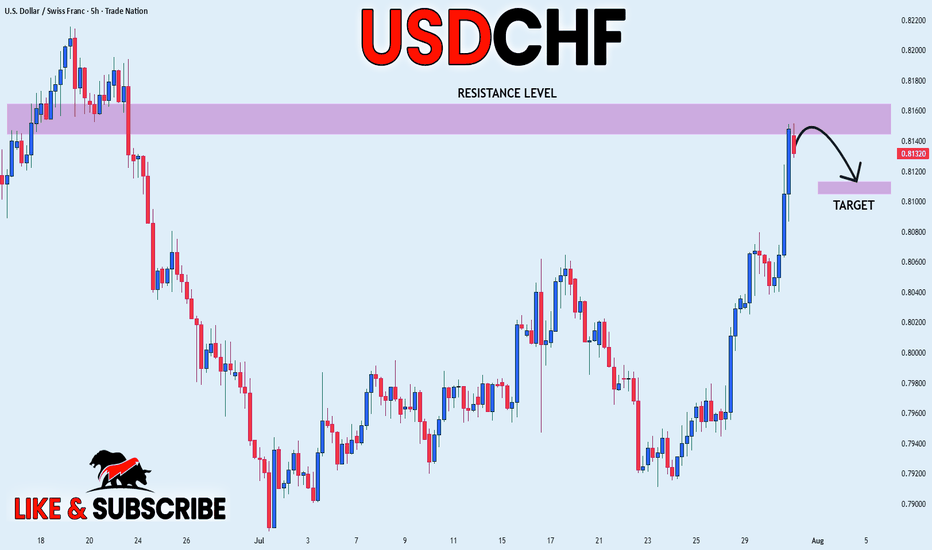

USD_CHF LOCAL SHORT|

✅USD_CHF price went up sharply

But a strong resistance level was hit at 0.8152

Thus, as a pullback is already happening

And a move down towards the

Target of 0.8113 shall follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

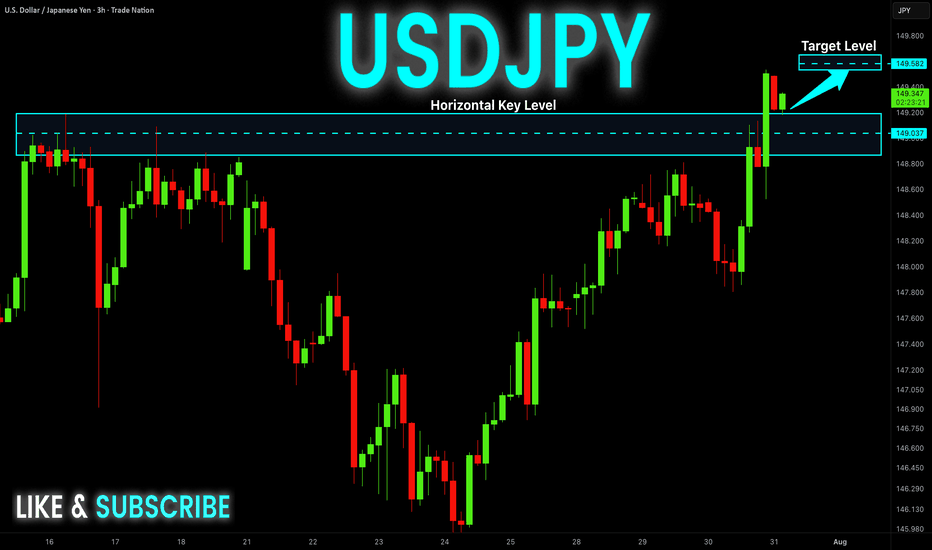

USD-JPY Will Keep Growing! Buy!

Hello,Traders!

USD-JPY keep growing and

The pair made a bullish breakout

Of the key horizontal level

Of 149.181 and the pair is

Already retesting the new

Support and we will be

Expecting a further

Bullish move up

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

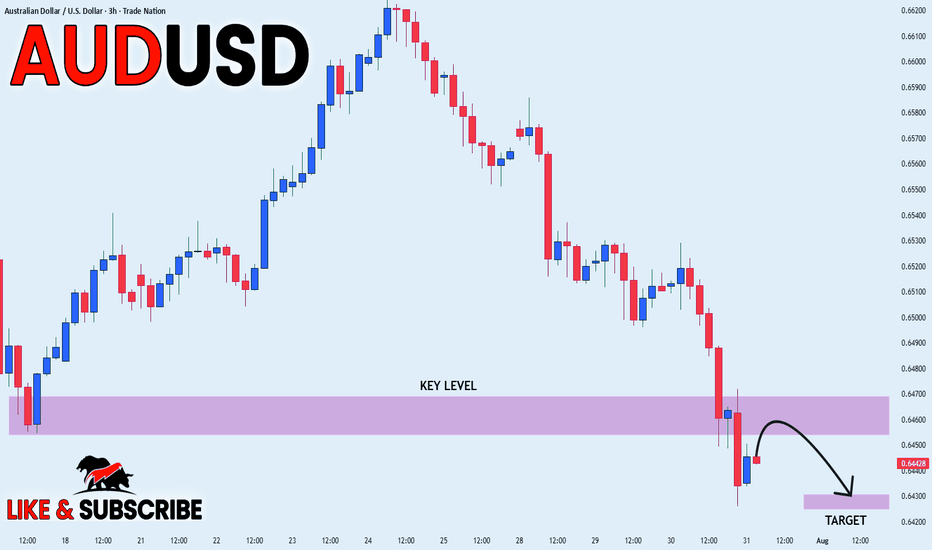

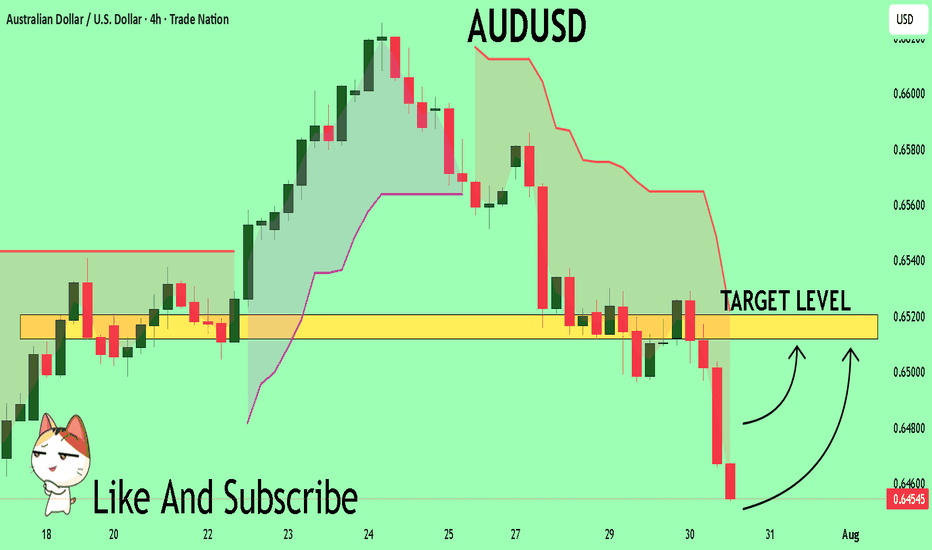

AUD_USD BEARISH BREAKOUT|SHORT|

✅AUD_USD broke the key

Structure level of 0.6460

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of

The broken level is complete

A bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

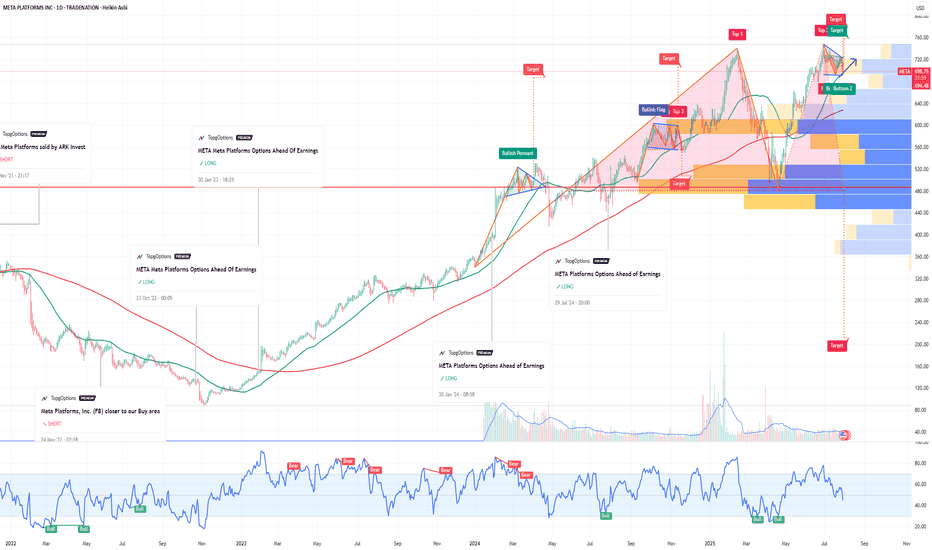

META Meta Platforms Options Ahead Of EarningsIf you haven`t bought META before the rally:

Now analyzing the options chain and the chart patterns of META Platforms prior to the earnings report this week,

I would consider purchasing the 710usd strike price in the money Calls with

an expiration date of 2026-6-18,

for a premium of approximately $89.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

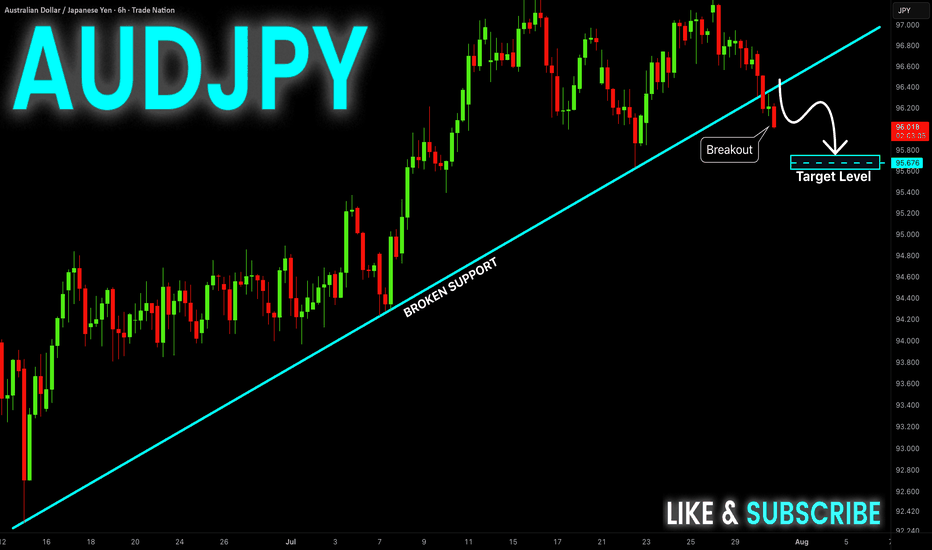

AUD-JPY Bearish Breakout! Sell!

Hello,Traders!

AUD-JPY made a bearish

Breakout of the rising support

Line and we are bearish biased

So we will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

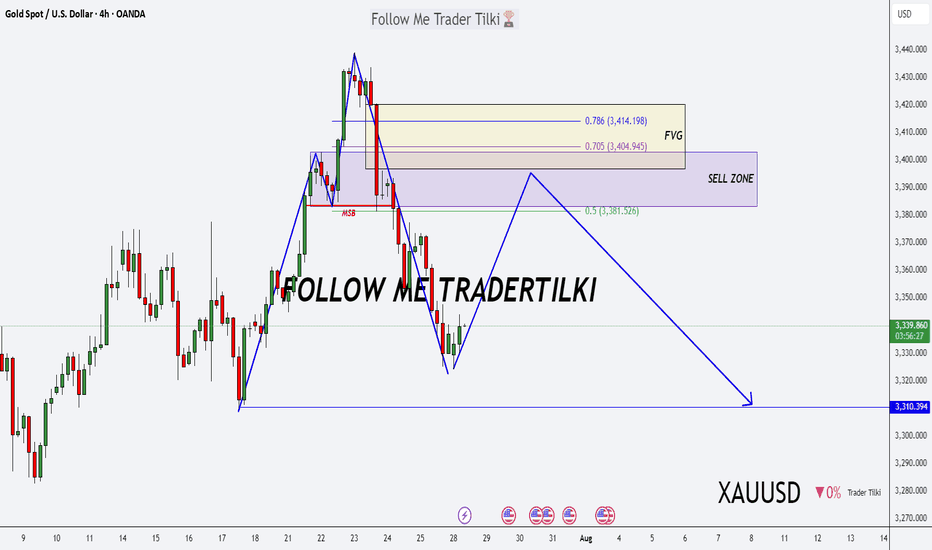

Gold Alert: Key Levels for Potential Sell Setup!Good morning, my friends 🌞

Here’s today’s gold analysis. I'm expecting a decline in gold prices, specifically from the 3,383–3,420 level.

Once a correction starts around that zone, my target will be 3,310. Gold has been riding a strong uptrend, and if we reach those levels, I’ll be expecting a pullback and opening a sell position accordingly.

Please set your stop loss based on your personal margin preferences.

Your likes and support are my biggest motivation for continuing to share these analyses. Thank you to everyone showing appreciation 🙏

ALGO Swing Trade – Waiting for Pullback to Key SupportAfter a 100%+ surge, ALGO is now retracing and approaching a critical support zone. A dip into this area could offer a strong entry for the next leg higher.

📌 Trade Setup:

• Entry Zone: $0.22 – $0.23

• Take Profit Targets:

o 🥇 $0.28 – $0.33

o 🥈 $0.45 – $0.50

• Stop Loss: Just below $0.19

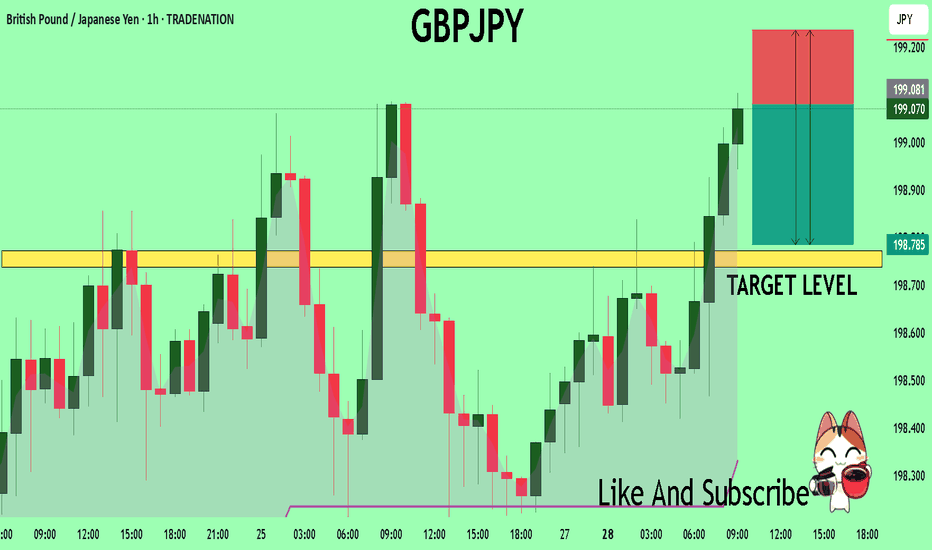

GBPJPY What Next? SELL!

My dear friends,

Please, find my technical outlook for GBPJPY below:

The price is coiling around a solid key level - 199.08

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 198.77

Safe Stop Loss - 199.23

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

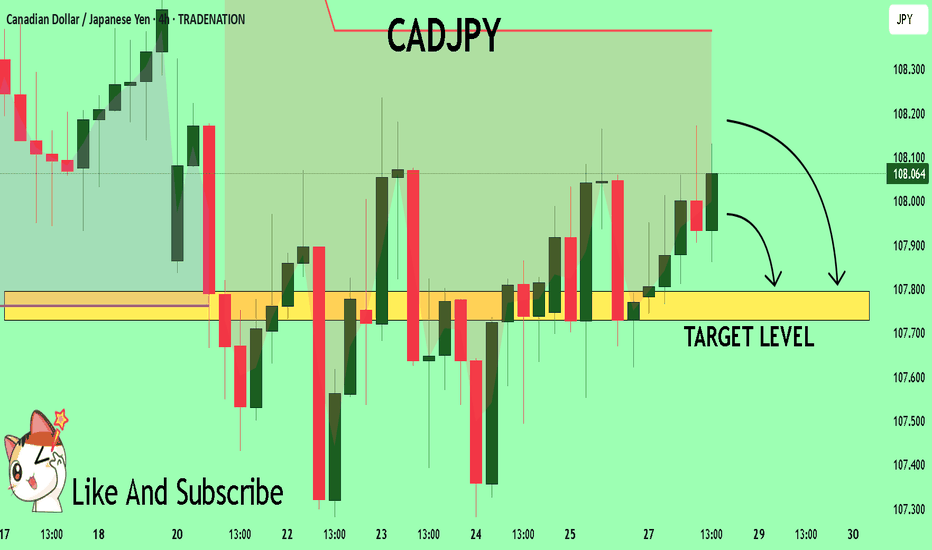

CADJPY Trading Opportunity! SELL!

My dear followers,

I analysed this chart on CADJPY and concluded the following:

The market is trading on 108.08 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 107.79

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

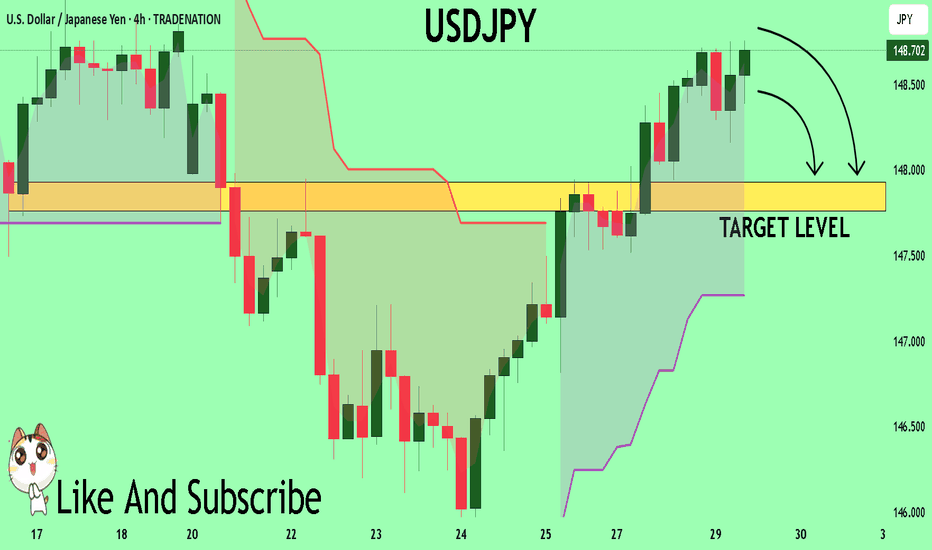

USDJPY A Fall Expected! SELL!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 148.71

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 147.93

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

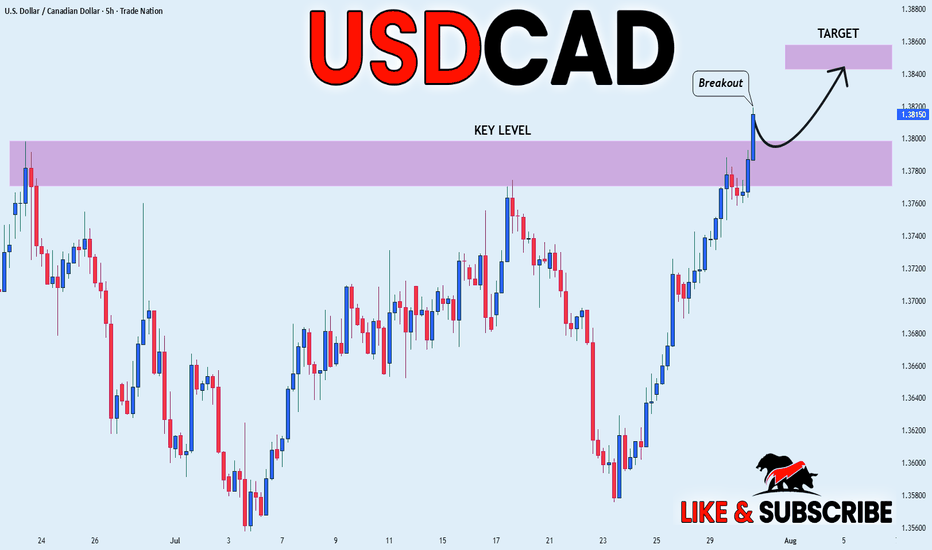

USD_CAD BULLISH BREAKOUT|LONG|

✅USD_CAD is going up

Now and the pair made a bullish

Breakout of the key horizontal

Level of 1.3800 and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

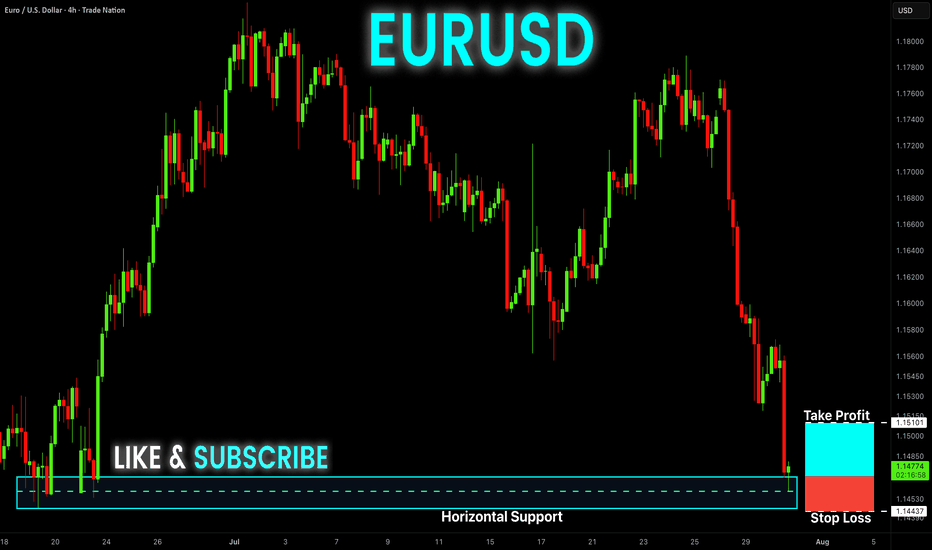

EUR-USD Free Signal! Buy!

Hello,Traders!

EUR-USD keeps falling and

The pair is locally oversold so

As the pair is retesting the

Horizontal support level

Of 1.1468 we can enter a

Long trade with Take Profit

Of 1.1510 and Stop Loss

Of 1.1443

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDUSD My Opinion! BUY!

My dear subscribers,

AUDUSD looks like it will make a good move, and here are the details:

The market is trading on 0.6455 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.6512

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

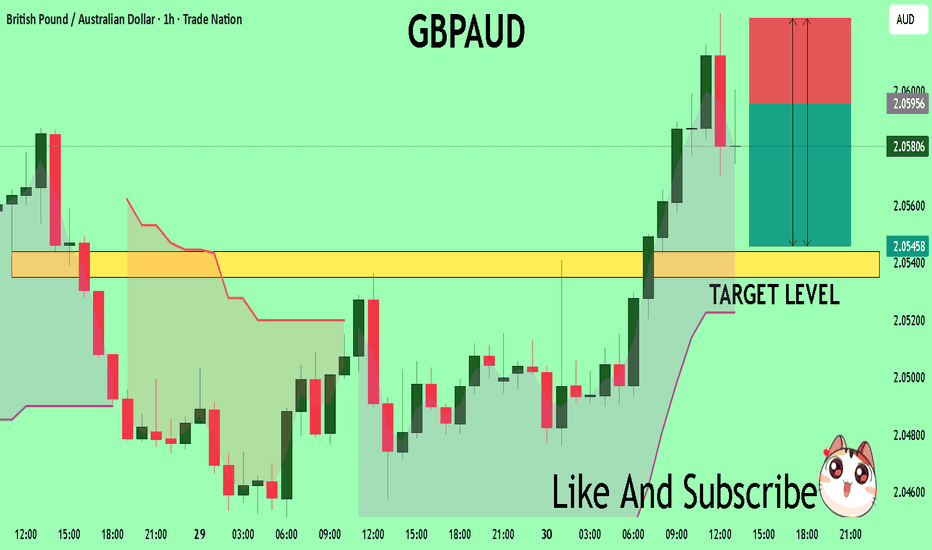

GBPAUD Massive Short! SELL!

My dear subscribers,

My technical analysis for GBPAUDis below:

The price is coiling around a solid key level - 2.0596

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 2.0543

My Stop Loss - 2.0626

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Gold (XAUUSD) Breaks Trendline – Potential Downside Ahead?Gold (XAU/USD) has officially broken below a long-term ascending trendline on the 4H chart, indicating a potential shift in market structure. The recent breakout from a bear flag pattern confirms bearish momentum, and price is now approaching a key horizontal support zone around $3,249 and $3,242.

🔹 Trendline support (now resistance) broken

🔹 Bear flag breakdown – strong bearish candle

🔹 Eyes on support levels: $3,249, $3,165, and possibly lower

🔹 Watch for a potential retest of the broken trendline for short opportunities

A clean break and close below $3,249 could open the door for further downside in the coming sessions. Trade cautiously and manage your risk!

Unlocking the Power of ORB (Opening Range Breakout)Unlocking the Power of ORB (Opening Range Breakout): A Proven Strategy for Intraday Traders

In the fast-paced world of intraday trading, simplicity and structure can often outperform complexity. One such time-tested strategy is the Opening Range Breakout (ORB) — a method favored by both discretionary and system traders for its clarity and adaptability.

📌 What is ORB (Opening Range Breakout)?

ORB refers to the price range (high and low) formed during the first few minutes (typically 5, 15, or 30) after the market opens. Traders look for a breakout above or below this range, anticipating strong momentum in that direction.

🧠 Why ORB Works

Volume Surge: The opening minutes see high institutional activity, creating genuine demand/supply signals.

Market Psychology: ORB captures trader sentiment as news digests overnight and is priced in at the open.

Defined Risk: The high/low of the range becomes a natural stop-loss area, allowing clean setups.

✅ Entry and Exit Rules for the ORB Strategy

Having a consistent framework helps you avoid emotional decisions. Here’s how you can structure your trades using ORB:

🔹 Entry Criteria:

Timeframe: Define your ORB window — e.g., first 15-minute candle.

Bullish Breakout Entry:

Enter long when price closes above the ORB high with volume confirmation.

Bearish Breakdown Entry:

Enter short when price closes below the ORB low with volume confirmation.

⚠️ Avoid entering on the first breakout candle. Wait for a close and retest, or a strong momentum candle for higher confidence.

🔹 Stop-Loss Placement:

For Long Trades: Place SL just below ORB low

For Short Trades: Place SL just above ORB high

🔹 Target/Exit Options:

Fixed RR Target: Aim for 1.5–2x your risk as initial target.

Mid/Outer Bands: Use indicator-drawn breakout bands (like those in LuxAlgo script) as profit zones.

Time-based Exit: Close position by end of session if price stalls or consolidates.

Trailing Exit: Trail your stop behind higher lows (long) or lower highs (short) after breakout.

📊 ORB in Action

You can explore this ready-to-use TradingView indicator to visualize ORB levels in real-time:

🔍 Indicator: Opening Range with Breakouts & Targets (by @LuxAlgo) Thanks to @LuxAlgo team to make this indicator available.

🛠️ Highlights:

Automatically marks the opening range

Plots breakout zones and targets

Ideal for intraday strategies

Works across indices, forex, and crypto

📓 Integrating ORB into Your Trading Journal App

If you're journaling ORB trades, consider logging:

✅ Symbol & timeframe

✅ ORB range (high/low)

✅ Breakout direction (long/short)

✅ Entry time & price

✅ Exit reason (target hit, SL hit, time-based exit)

✅ Notes: market sentiment, news drivers, volume confirmation

Over time, this data will help you:

🔍 Identify which assets respect ORB best

📈 Tune your RR ratio and stop placements

🧠 Reduce decision fatigue by automating setups

🧪 Want to Automate It?

Our trading journal app is ready with 🧠 AI-based journaling for feedback and refinement

🎯 Final Thoughts

ORB is a classic — not because it’s flashy, but because it offers structure, risk control, and repeatability. Whether you're a price action purist or using smart indicators, ORB can provide a disciplined edge — especially when integrated into a journaling and feedback loop.

📌 Start small. Track results. Tune your edge.

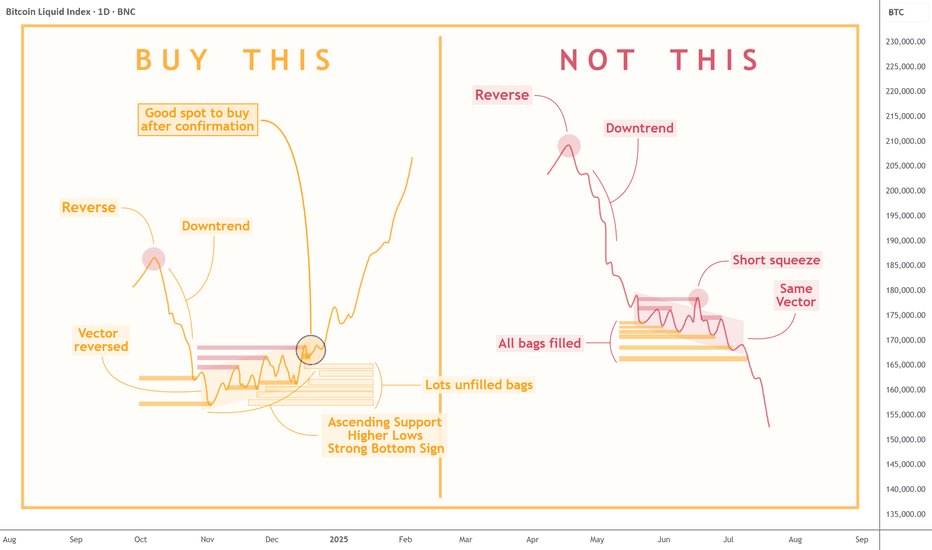

Quick Lesson: How to Identify Trend ReversalKnowing when to enter the market can mean the difference between making a profit and incurring a loss. The chart above clearly compares two similar-looking scenarios with very different outcomes: the one you should aim for and the one you should avoid.

- On the left , we see a textbook example of a bullish reversal. After a significant downtrend, the market prints higher lows and begins forming an ascending support. This signals that selling pressure is fading and buyers are stepping in. Notably, there are usually lots of unfilled bags — latecomers who show strong demand below the current price level but never get their orders filled, and who then just hit the 'market buy' button, which adds fuel to the fire of pump.

- In contrast, the right side shows a very similar pattern — a downtrend followed by consolidation, but with crucial differences. Here, all prior liquidity zones have already been filled, meaning there is less incentive for buyers to support the price. The “same vector” suggests price action hasn’t changed direction, and a common short squeeze traps late buyers before resuming the decline. This is a common bull trap , where a temporary price pump gives false hope before another leg down.

To sum up , a REAL REVERSAL builds on structure, accumulation, and higher lows—whereas a FALSE BOTTOM is often characterized by brief rallies, exhausted liquidity, and no change in vector trend. Experienced traders wait for confirmation and accumulation before entering a position, not just a temporary pause in a downtrend.

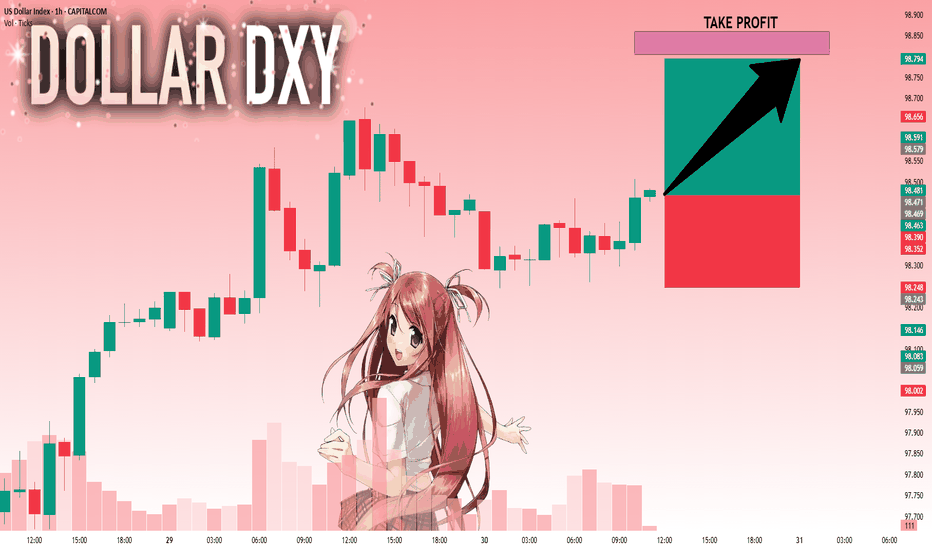

DXY: Bulls Are Winning! Long!

My dear friends,

Today we will analyse DXY together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 98.471 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️