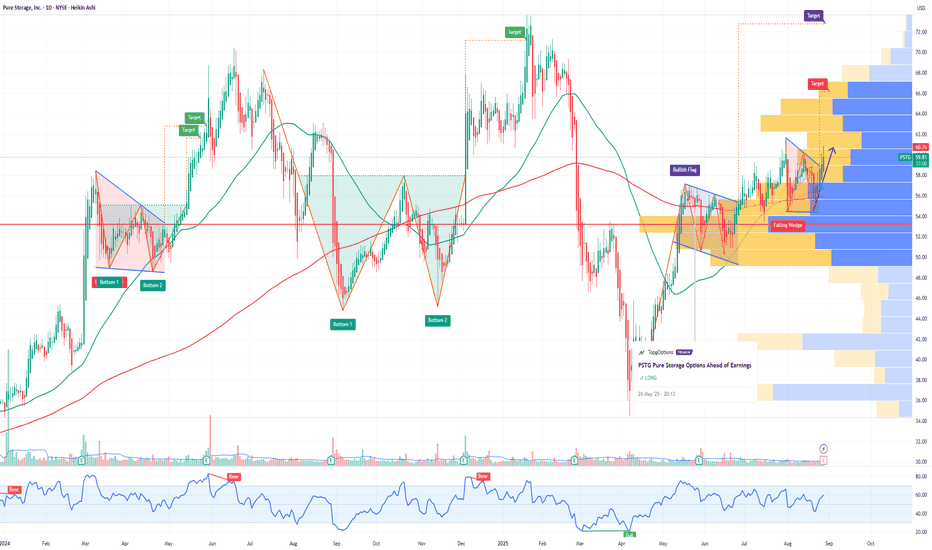

PSTG Pure Storage Options Ahead of EarningsIf you haven`t bought PSTG before the previous earnings:

Now analyzing the options chain and the chart patterns of PSTG Pure Storage prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $6.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Tradingcourses

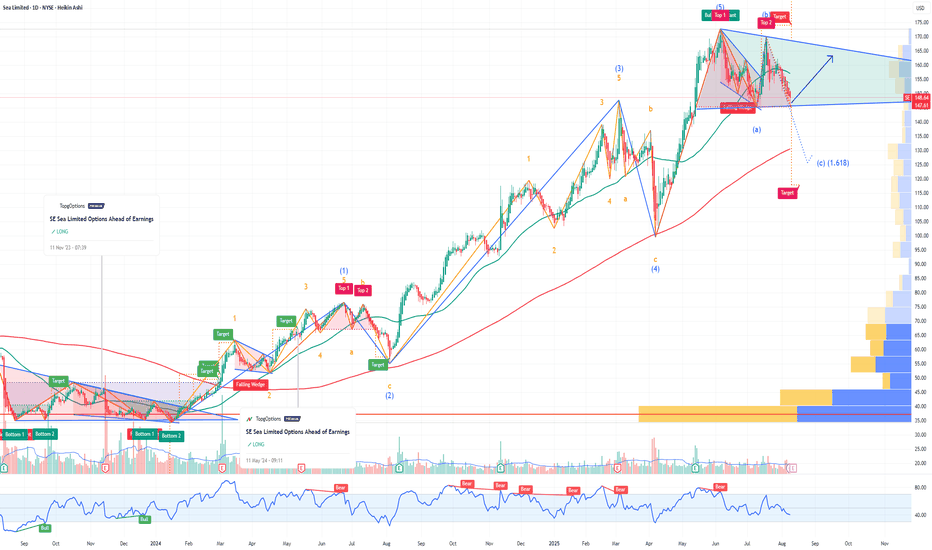

SE Sea Limited Options Ahead of EarningsIf you haven`t bought SE before the rally:

Now analyzing the options chain and the chart patterns of SE Sea Limited prior to the earnings report this week,

I would consider purchasing the 150usd strike price at the money Calls with

an expiration date of 2025-9-12,

for a premium of approximately $9.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

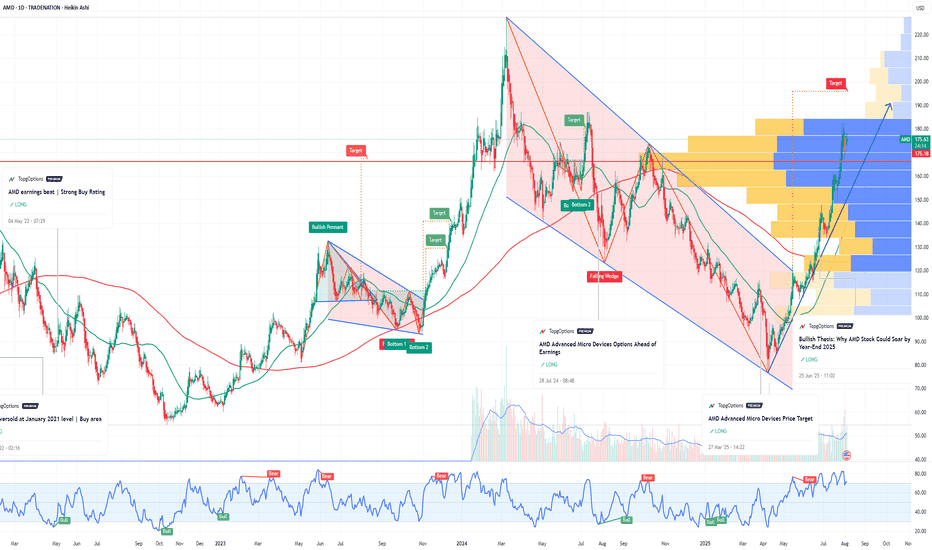

AMD Advanced Micro Devices Options Ahead of EarningsIf you haven`t bought AMD before the previous earnings:

Now analyzing the options chain and the chart patterns of AMD Advanced Micro Devices prior to the earnings report this week,

I would consider purchasing the 220usd strike price Calls with

an expiration date of 2026-9-18,

for a premium of approximately $22.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

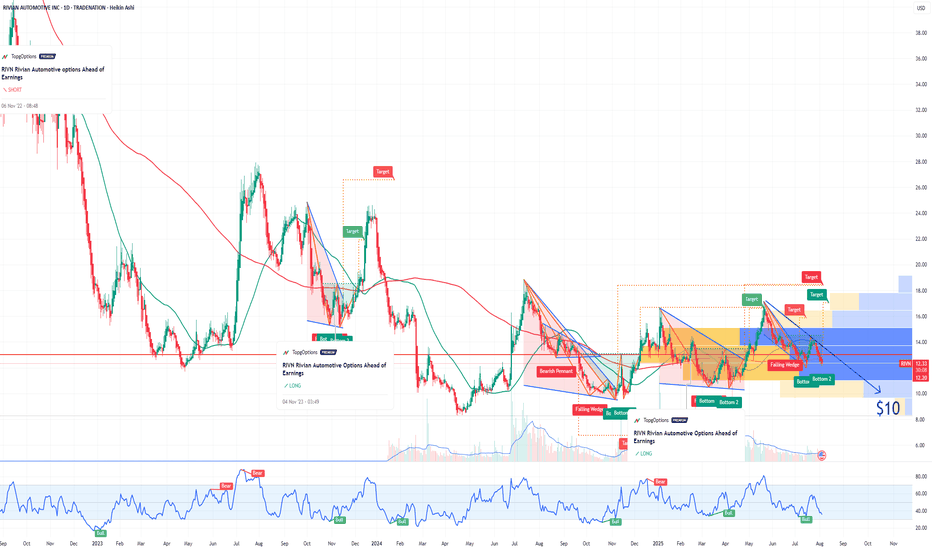

RIVN Rivian Automotive Options Ahead of EarningsIf you haven`t bought RIVN before the previous earnings:

Now analyzing the options chain and the chart patterns of RIVN Rivian Automotive prior to the earnings report this week,

I would consider purchasing the 10usd strike price Puts with

an expiration date of 2025-10-17,

for a premium of approximately $0.39.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

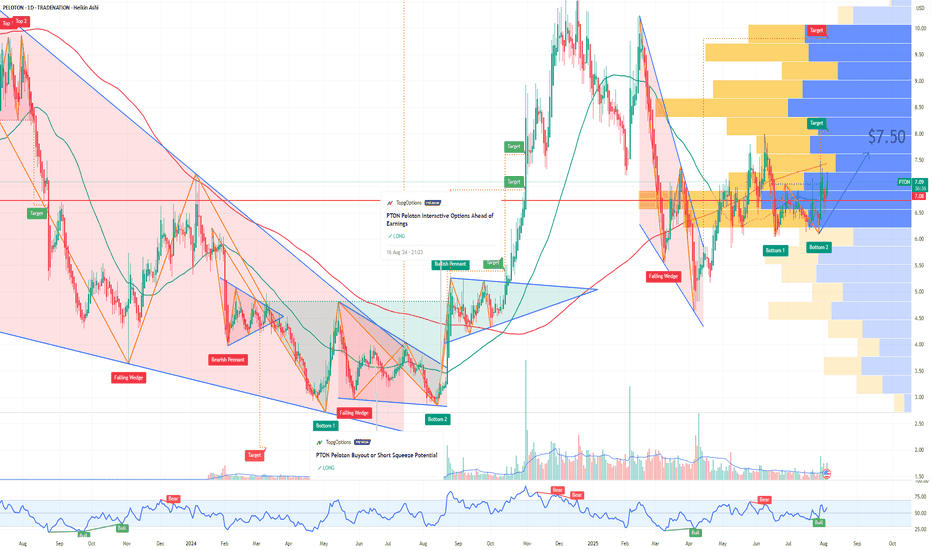

PTON Peloton Interactive Options Ahead of EarningsIf you haven`t bought the dip on PTON:

Now analyzing the options chain and the chart patterns of PTON Peloton Interactive prior to the earnings report this week,

I would consider purchasing the 7.50usd strike price Calls with

an expiration date of 2025-8-8,

for a premium of approximately $0.46.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

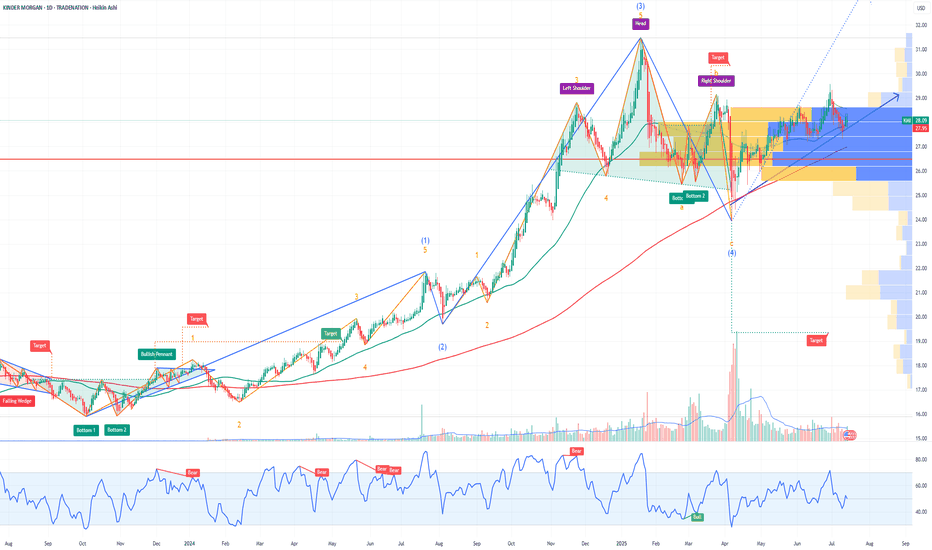

KMI Kinder Morgan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KMI Kinder Morgan prior to the earnings report this week,

I would consider purchasing the 28.5usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

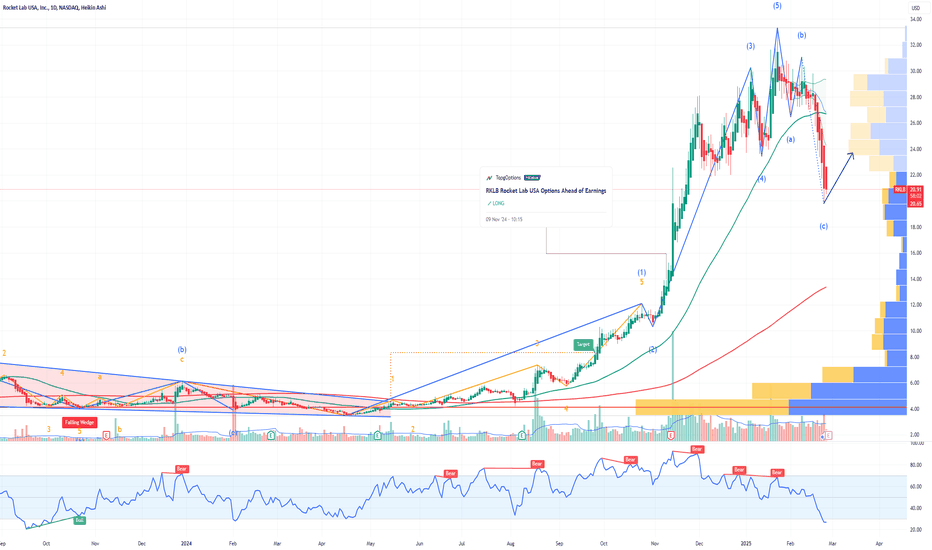

RKLB Rocket Lab USA Options Ahead of EarningsIf you haven`t bought RKLB before the previous earnings:

Now analyzing the options chain and the chart patterns of RKLB Rocket Lab USA prior to the earnings report this week,

I would consider purchasing the 21.5usd strike price Calls with

an expiration date of 2025-3-7,

for a premium of approximately $1.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

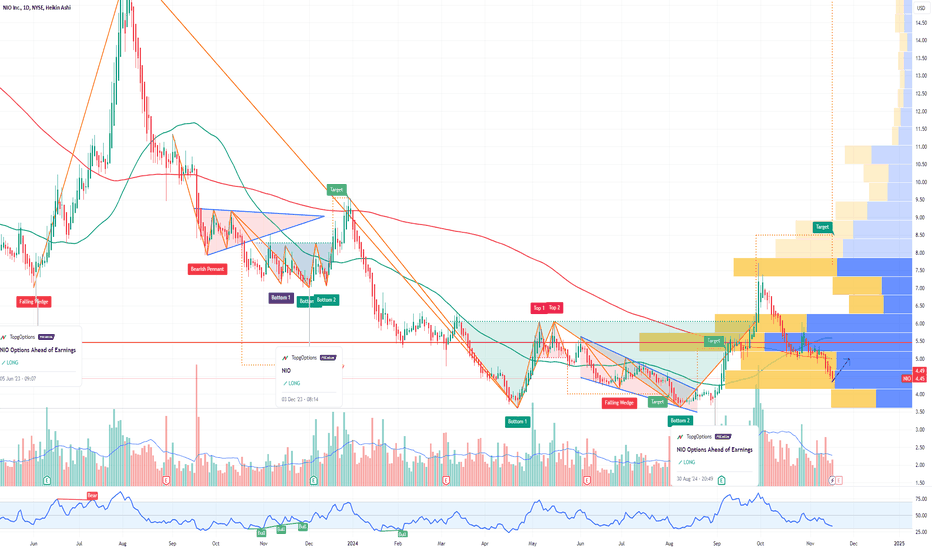

NIO Options Ahead of EarningsIf you haven`t bought NIO before the previous breakout:

Now analyzing the options chain and the chart patterns of NIO prior to the earnings report this week,

I would consider purchasing the 4usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.86.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

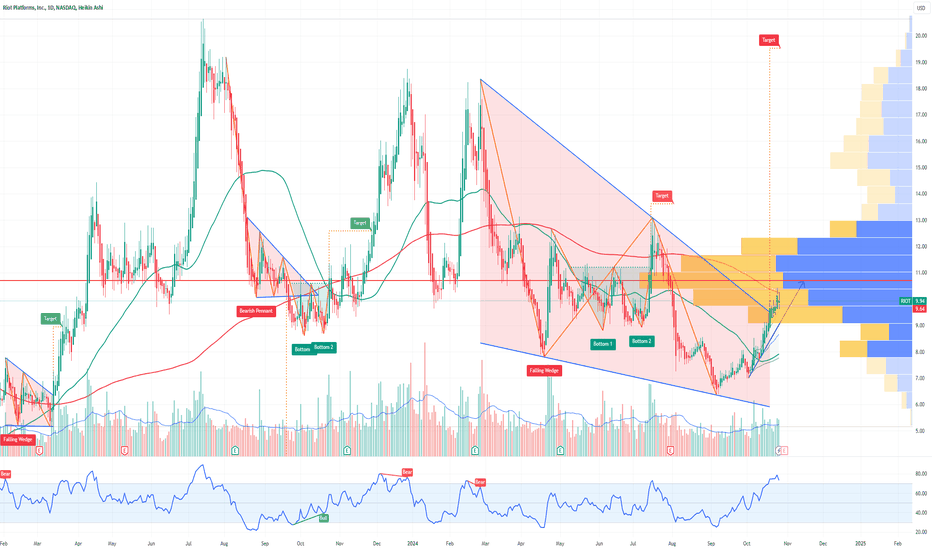

RIOT Platforms Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RIOT Platforms prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2024-11-1,

for a premium of approximately $0.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMAT Applied Materials Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AMAT Applied Materials prior to the earnings report this week,

I would consider purchasing the 195usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $15.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GILD Gilead Sciences Options Ahead of EarningsIf you haven`t bought GILD on the Remdesivir approval:

Then analyzing the options chain and the chart patterns of GILD Gilead Sciences prior to the earnings report this week,

I would consider purchasing the 80usd strike price in the money Calls with

an expiration date of 2024-1-19,

for a premium of approximately $4.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

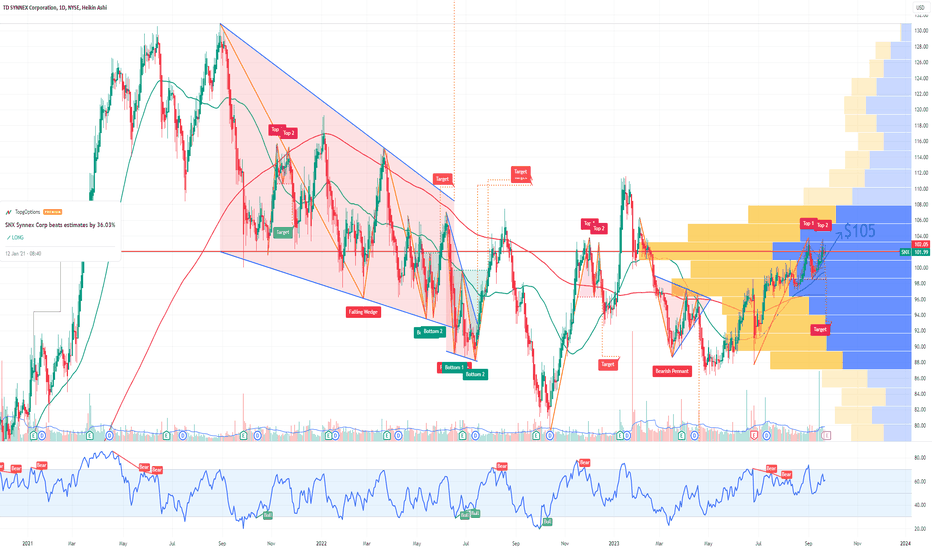

SNX TD SYNNEX Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SNX TD SYNNEX Corporation prior to the earnings report this week,

I would consider purchasing the 105usd strike price Calls with

an expiration date of 2023-11-17,

for a premium of approximately $2.97.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

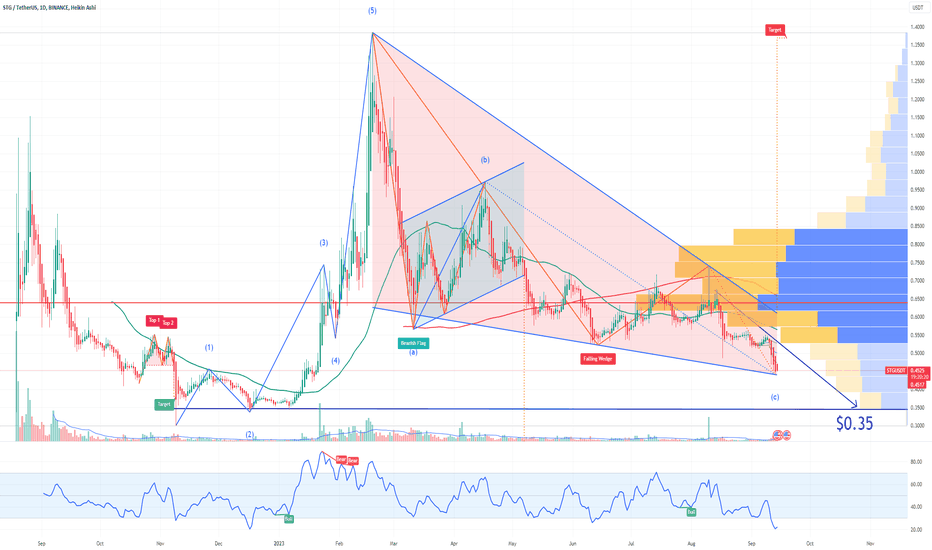

STG Stargate Finance PriceT after Court approves FTX LiquidationGiven the recent developments in the crypto space, there are several factors that point towards a bearish outlook:

FTX Liquidation of $3.4 Billion in Crypto Assets: The approval by the Delaware Bankruptcy Court for FTX to liquidate $3.4 billion in crypto assets is a significant event. This influx of a substantial amount of cryptocurrency into the market could potentially lead to an oversupply situation. When a large amount of assets is dumped into the market at once, it can put downward pressure on prices.

Limited Sales in the First Week: The imposed limit of $50 million for the first week indicates a controlled release of these assets. This may imply that FTX anticipates potential market disruption if a large volume is sold at once. However, even with controlled release, the market could still experience downward pressure.

Potential for Increased Limits: The provision for increasing the limit with the approval of the creditors’ committee and ad hoc committee, or potentially even up to $200 million weekly with court approval, shows that there's room for further selling pressure in the coming weeks.

Binance US CEO Resignation: The resignation of Binance US President and CEO, Brian Shroder, could potentially signal internal challenges within the exchange. Leadership changes in major crypto exchanges can lead to uncertainty and can impact market sentiment.

Asset List: The assets listed for liquidation include some of the major cryptocurrencies in the market such as Bitcoin, Ethereum, WBTC, WETH, USDT, SOL, XRP, STG, APT, BIT, DOGE, MATIC, FTT, TON and more. If a significant portion of these assets are sold off, it could have a widespread impact on the market.

Market Sentiment and Confidence: These events combined might lead to a loss of confidence in the crypto market, especially if investors perceive them as signs of instability or potential oversupply.

Regulatory Considerations: The fact that a bankruptcy court is involved in this process highlights the regulatory environment surrounding cryptocurrencies. Heightened regulatory scrutiny or intervention can have a dampening effect on the market.

Considering the above, my Price Target for STG Stargate Finance is $0.35.

Looking forward to read your opinion about it.

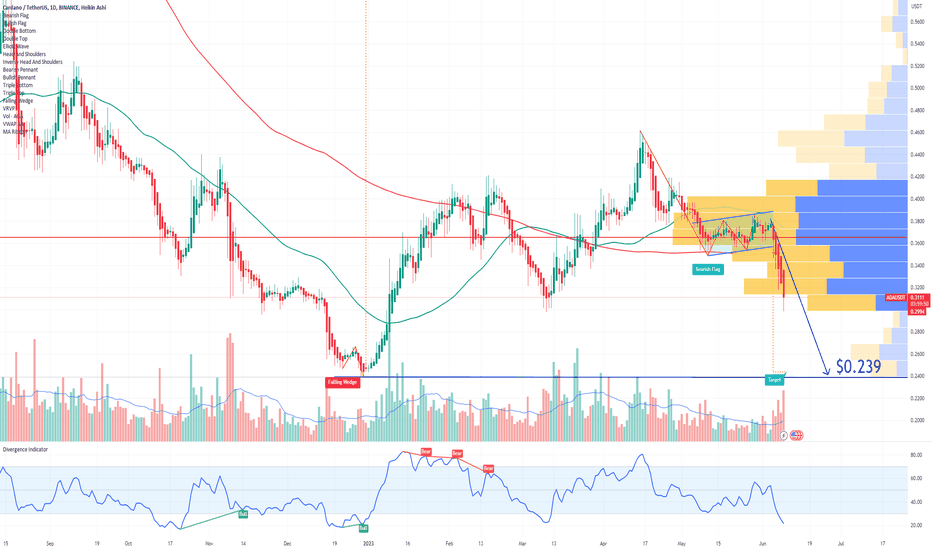

Robinhood to delist ADA Cardano If you haven`t sold ADA here:

Then you should know that Robinhood, the well-known trading platform, will discontinue its support for three cryptocurrencies implicated in SEC lawsuits against Binance and Coinbase.

Effective from June 27, 2023, Robinhood will no longer provide support for Cardano (ADA), Polygon (MATIC), and Solana (SOL).

In My opinion ADA will test the support of $0.239.

Looking forward to read your opinion about it.