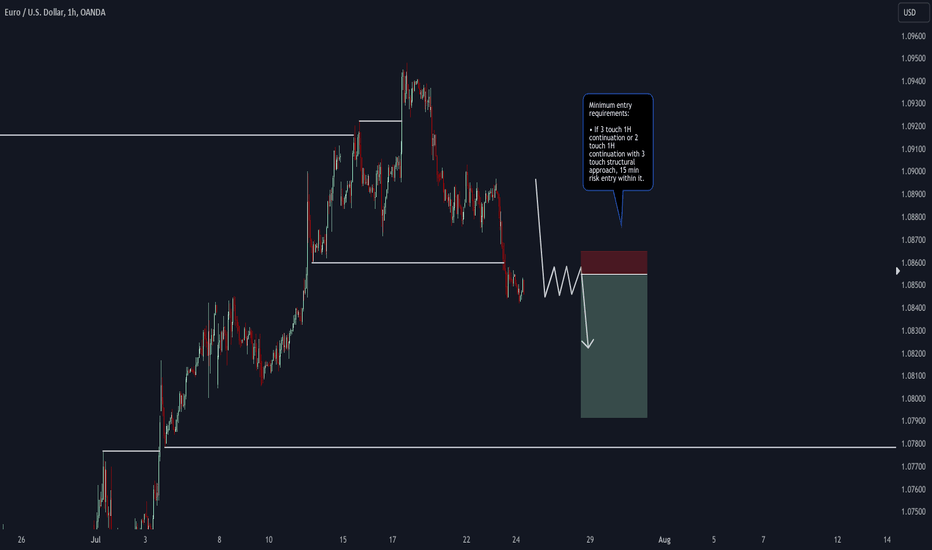

EUR/USD Short, GBP/JPY Short, AUD/NZD Short and GBP/CHF ShortEUR/USD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

GBP/JPY Short

Minimum entry requirements:

• 1H impulse down below area of value.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

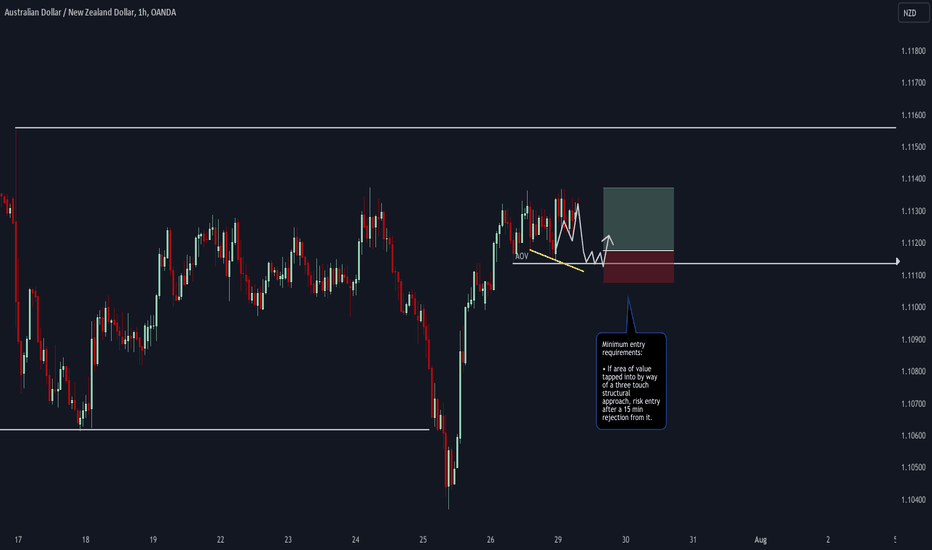

AUD/NZD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

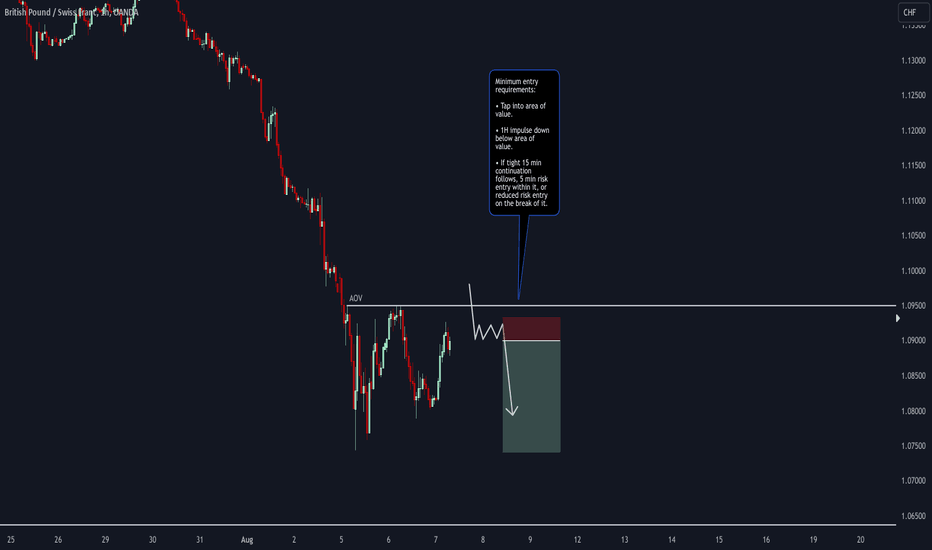

GBP/CHF Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

Tradingforex

Fed will pick up the pace, but market pricing looks aggressive

July's friendly jobs report led to market fears of a looming recession and the need for a strong Federal Reserve response. However, the latest ISM services report shows that the situation looks good with the economy growing

The ISM Service Index shows no immediate inferred threat

The ISM U.S. Manufacturing Products Index rose to 51.4 from 48.8, above the consensus of 51.0. New orders jumped to 52.4 from 47.3 while work returned to growth territory at 51.1 from 46.1.

The Fed will cut interest rates faster but the current market price looks very positive

We could see the Fed give in to some of the market demands and make at least one, maybe two 50 basis point moves

GBP/NZD Short, USD/CAD Short and EUR/USD ShortGBP/NZD Short

Minimum entry requirements:

• 1H impulse down below area of value.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

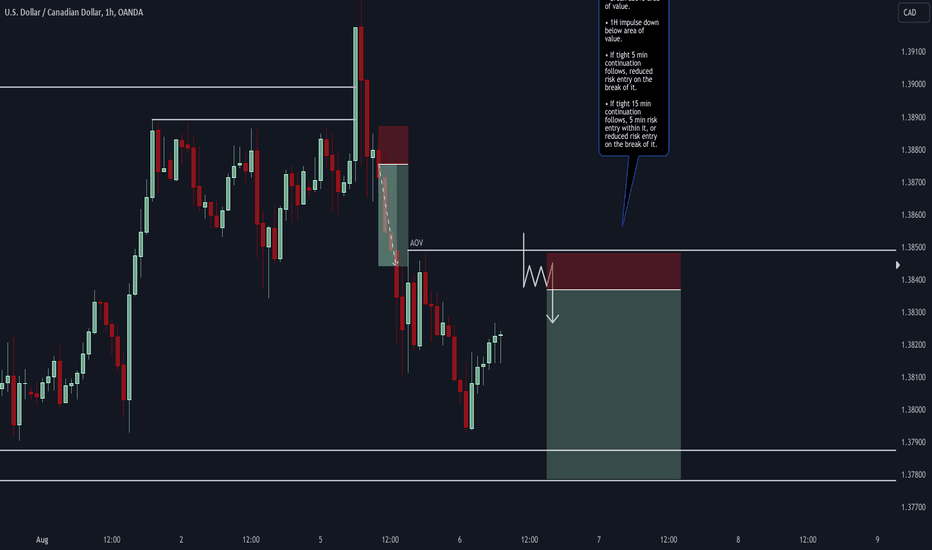

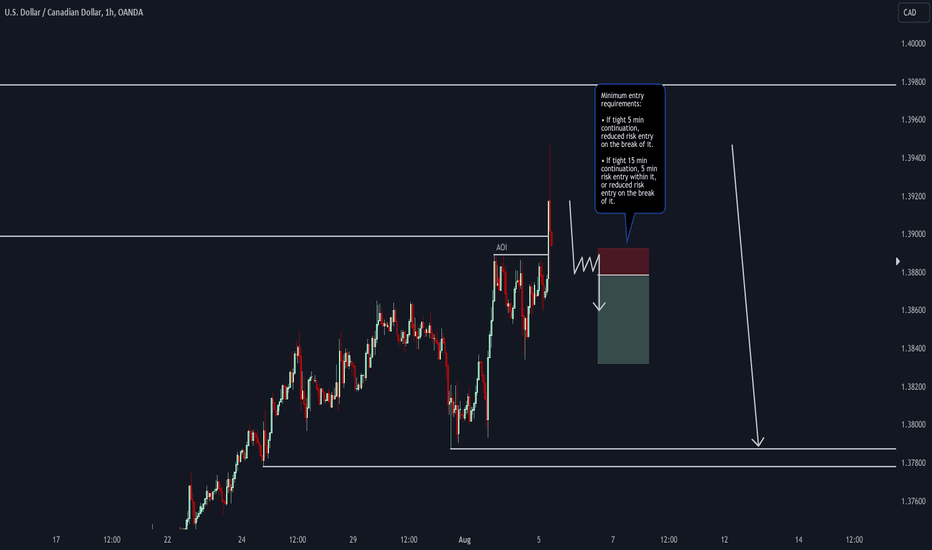

USD/CAD Short

Minimum entry requirements:

• Break above area of value.

• 1H impulse down below area of value.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

EUR/USD Short

Minimum entry requirements:

• 1H impulse down below area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach follows, 5 min risk entry within it, or reduced risk entry on the break of it.

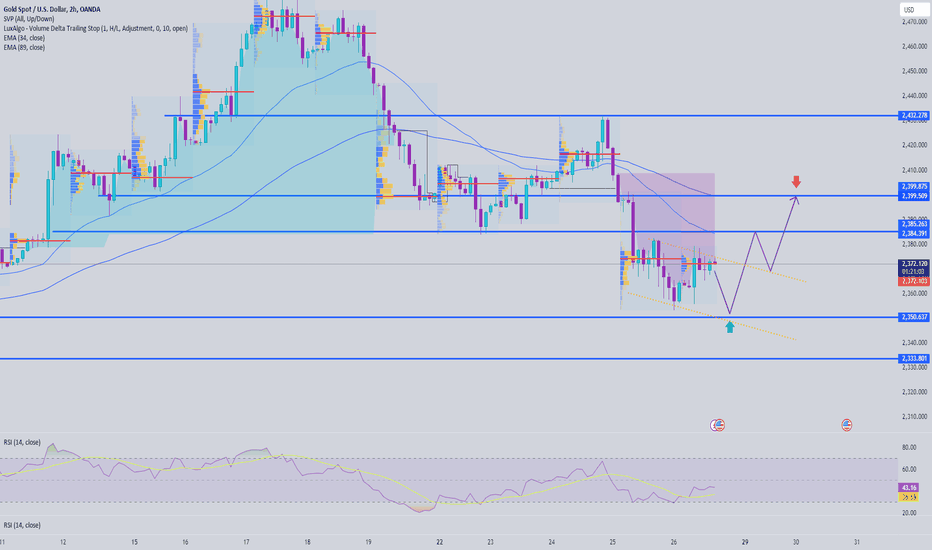

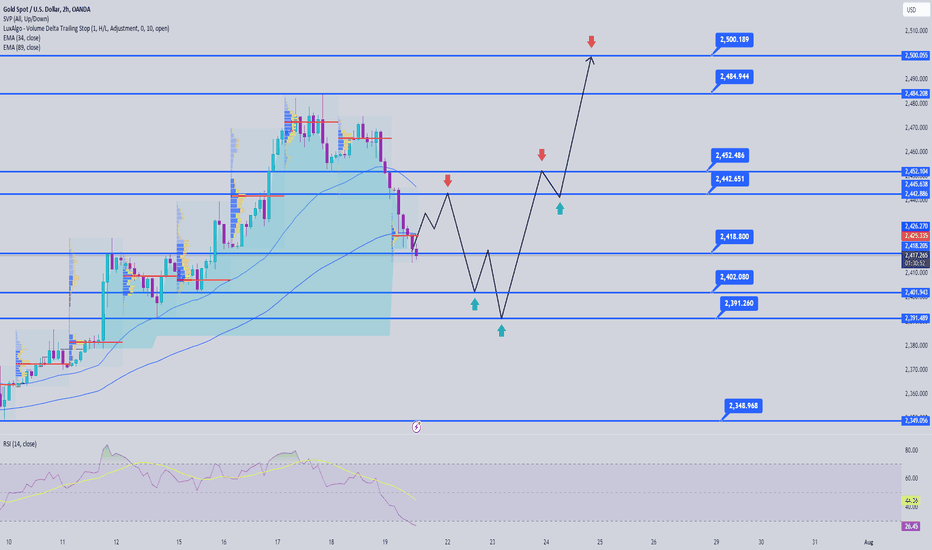

Gold fluctuations in the new weekFundamental Analysis:

Gold (XAU/USD) gained traction on Monday as the greenback weakened. The market is still digesting the dovish FOMC and a weaker US jobs report. Meanwhile, US Treasury yields and the US dollar (USD) are likely to remain under pressure, acting as a bullish driver for the yellow metal. Additionally, rising geopolitical tensions in the Middle East could continue to support traditional safe-haven assets like Gold.

Looking ahead, Gold traders will be watching the US ISM Services Purchasing Managers’ Index (PMI) on Monday for fresh catalysts. The Services PMI is estimated to improve to 51.0 in July from 48.8 in June. In case the data is stronger than expected, the USD could rise and limit the upside in the precious metal.

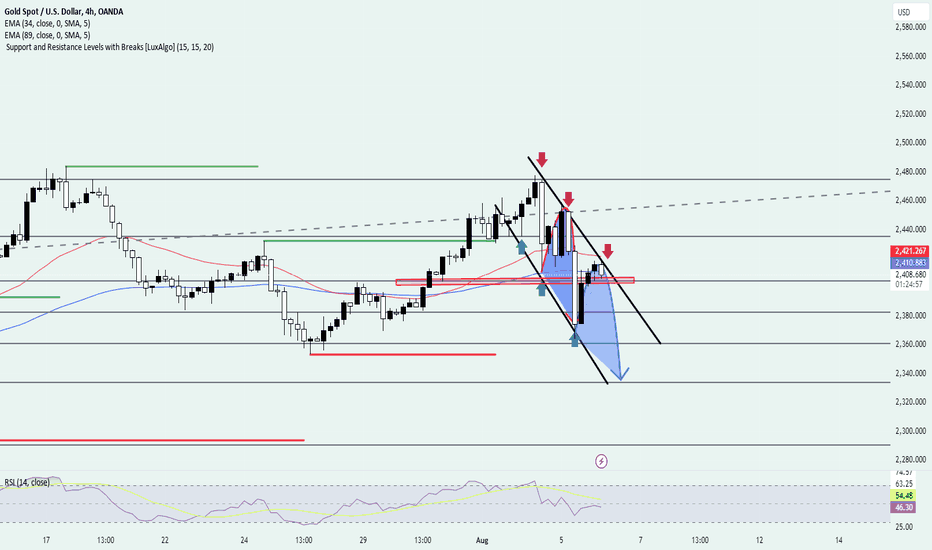

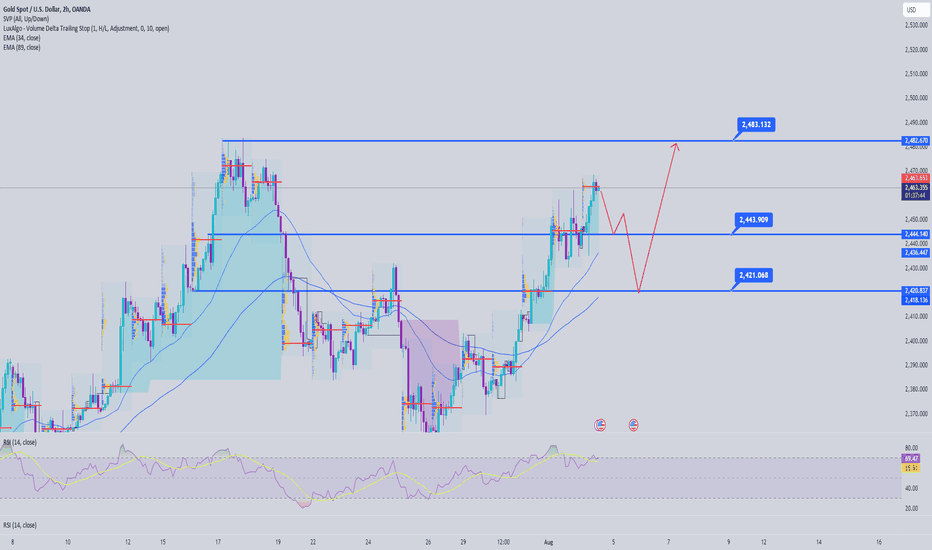

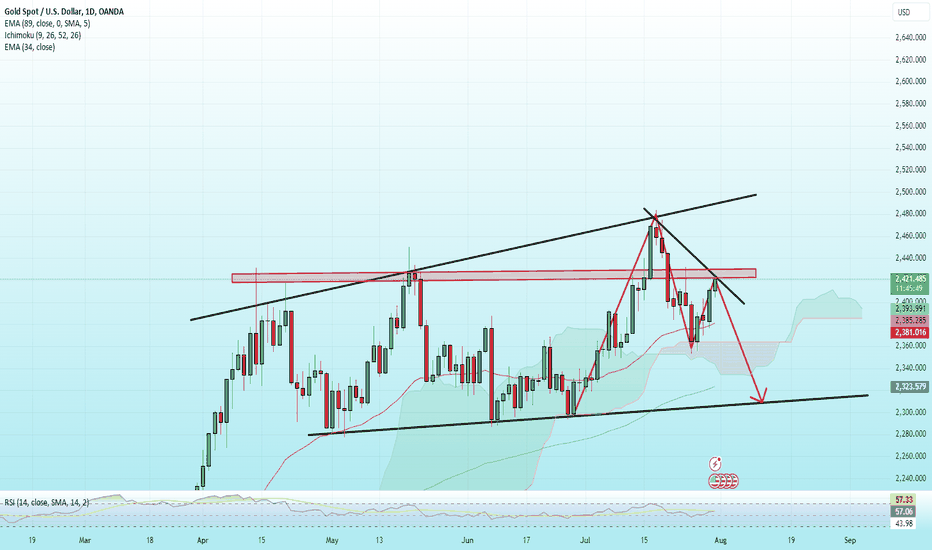

Technical Analysis:

Gold after NF formed a fairly wide trading range. An upward price range was formed with the price range of 2475 and 2420. The h2 time frame gives an overview of the short-term fluctuations of gold during the day. The 2411 area on Friday formed a critical zone around it with a reaction of 30 prices. so it became a strong reaction zone when gold broke out of the price channel.

Resistance: 2466 - 2475 - 2480 - 2491 - 2502

Support: 2423 - 2412 - 2405 - 2394 - 2385

SELL GOLD 2465 - 2467 Stoploss 2471

BUY GOLD 2415 - 2413 Stoploss 2408

EUR/NZD Short and USD/CAD ShortEUR/NZD Short

Minimum entry requirements:

• 1H impulse down below area of interest.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

USD/CAD Short

Minimum entry requirements:

• If tight 5 min continuation, reduced risk entry on the break of it.

• If tight 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

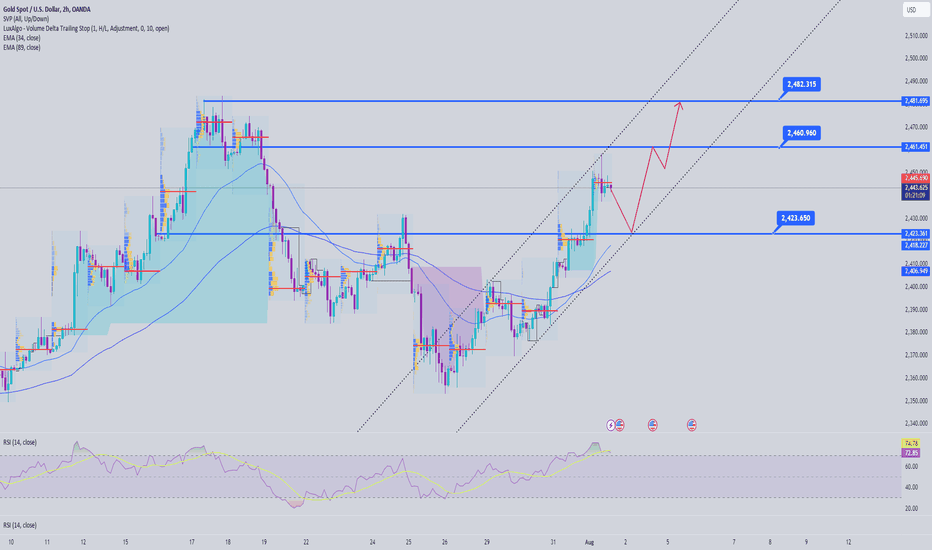

Gold August 2. Approaching all-time high🌿Fundamental Analysis

Gold prices showed absolute strength in the European session on Friday ahead of the US Non-Farm Payrolls (NFP) data for July. The official jobs data will indicate the current state of the labor market, which will influence market speculation about the US Federal Reserve (Fed) cutting interest rates in September.

Investors will also focus on Average Hourly Earnings data, a key measure of wage growth that boosts consumer spending and ultimately drives price pressures.

Meanwhile, the deepening risk of an all-out war between Iran and Israel has improved Gold’s appeal as a safe haven. Iran has vowed to retaliate for the assassination of Hamas leader Ismail Haniyeh with an Israeli airstrike in Tehran.

🌿Technical Analysis

In terms of Elliot wave, Gold may have formed wave 5 and is trading in an abc recovery wave. or a recovery could occur after Nonfarm pushing gold prices to the 2442-2430-2422 support zone to continue to return to wave 5 to break the all-time high.

The 14-day relative strength index (RSI) is rising to near 60.00. If RSI rises above that level, the momentum will continue to increase strongly.

We will wait for recovery waves to buy gold today, or look for resistance zones to catch the recovery wave.

SELL zone 2472 - 2474 SL 2478

SELL zone 2482-2484 SL 2487

BUY zone 2433 - 2431 SL 2427

BUY zone 2422 - 2420 SL 2416

Gold benefits after FOMC announcement☘️Fundamental analysis

Gold prices hovered around the $2,450 region on Thursday and are currently trading just below a two-week high. Traders were bullish amid the prospect of the Federal Reserve (Fed) rate-cutting cycle coming to a head, underpinning the yellow metal without yield.

Bets were reaffirmed by the Fed’s relatively dovish outlook on Wednesday, which sent US Treasury yields to multi-month lows and boosted the US Dollar (USD). Geopolitical tensions in the Middle East also added to the upside. Positive Outlook for Safe-haven Gold That said, the risk-on tone is generally seen as a drag and cap on XAU/USD.

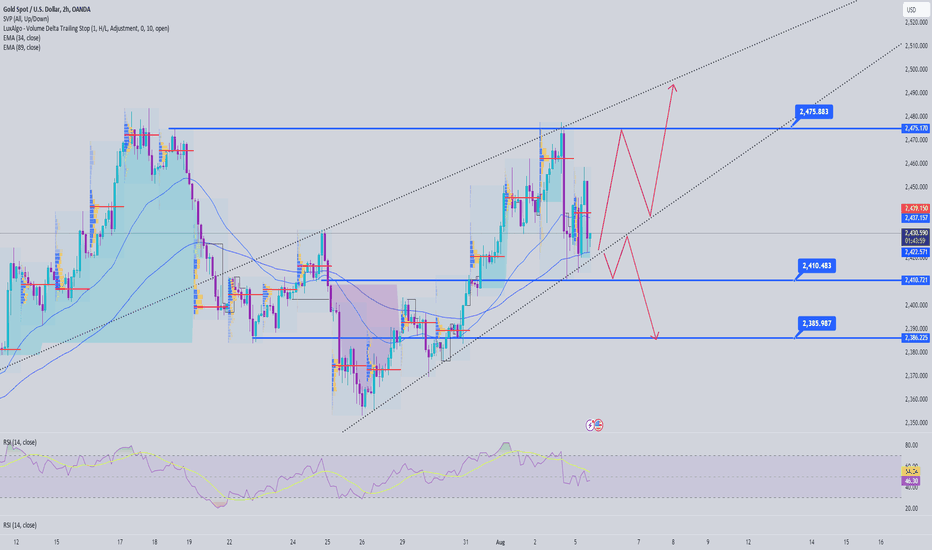

☘️Technical Analysis

From a technical perspective, the breakout above the 2430 resistance last night has officially put gold in the bullish phase of wave 3 of the Elliot Wave pattern. Furthermore, if there is a move above 2450, a return to the old highs is not far away. Hence, some further strength towards the next relevant hurdle near the $2,468-2,469 region, en route to $2,483-2,484.

On the other hand, today’s Asian low, around the $2,437 region, now seems to protect the immediate downside ahead of the $2,432 region. Any further declines can now be viewed as buying opportunities and remain capped near the resistance breakout point of $2,413-2,412.

The RSI is in the overbought zone, indicating that buying interest is still high and the possibility of a push higher for gold remains in favor. The bullish channel is still holding strong with major support around 2422. The two EMAs are expanding with EMA 34 above EMA 89. Overall the market is still in a strong uptrend and we will wait for recovery points to BUY.

Resistance: 2452 - 2459 - 2464 - 2475

Support: 2433 - 2425 - 2420 - 2412

SELL zone 2472 - 2474 stoploss 2478

BUY zone 2433 - 2431 stoploss 2427

BUY zone 2422 - 2420 stoploss 2416

AUD/NZD Short, NZD/CAD Short and WTICO/USD ShortAUD/NZD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

NZD/CAD Short

Minimum entry requirements:

• 1H impulse down below area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

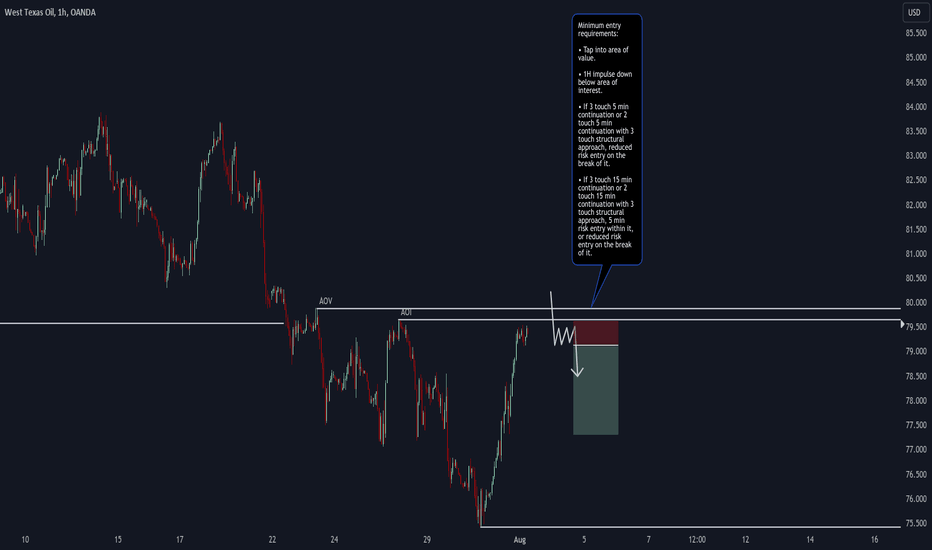

WTICO/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 3 touch 5 min continuation or 2 touch 5 min continuation with 3 touch structural approach, reduced risk entry on the break of it.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

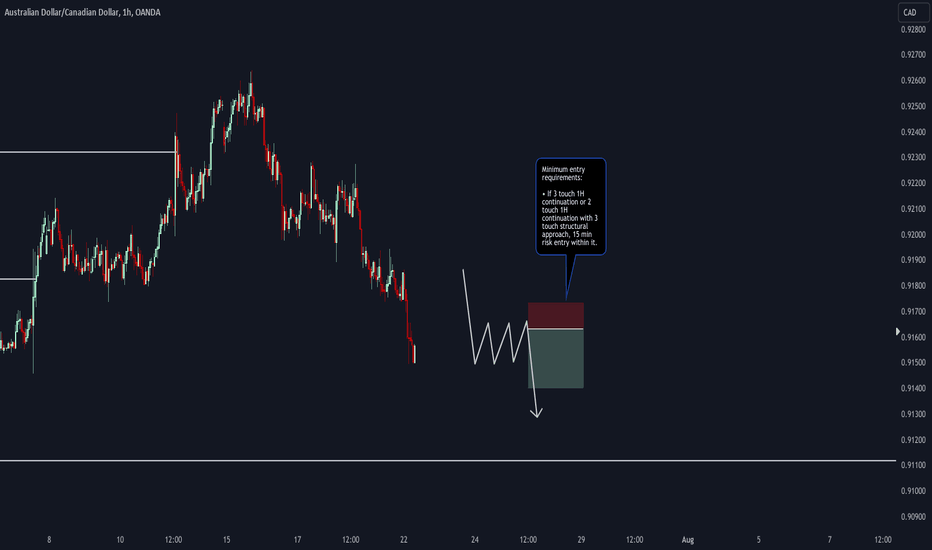

AUD/NZD Short, AUD/CAD Short, WTICO/USD Short and NZD/CAD ShortAUD/NZD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

AUD/CAD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

WTICO/USD Short

Minimum entry requirements:

• 1H impulse down below area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

NZD/CAD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

The Fed will reveal the possibility of cutting interest ratesWorld gold fees grew to become down with spot gold fees down 5.6 USD to 2,384.7 USD/ounce. Gold futures ultimate traded at $2,427.60 an ounce, down $1.70 from the brilliant spot.

The dollar`s recuperation has positioned stress at the yellow metal. Accordingly, the United States Dollar Index rose best approximately 0.3% to its maximum stage in extra than 2 weeks, making gold extra bearish for holders of different currencies.

Marex analyst Edward Meir, at the verge of recuperation for the greenback, records from China indicates that a lower in gold spending withinside the world's biggest gold customer additionally impacts the route of gold.

The state-of-the-art document indicates that gold intake in China reduced through 5.6% withinside the first 1/2 of of 2024 as call for for gold earrings reduced through 26.7% amid excessive fees. However, call for for Lis gold and cash skyrocketed.

Although gold is beneathneath stress from the greenback, specialists say that the treasured metal's decline has been "braked" way to issues approximately extended geopolitical tensions withinside the Middle East after the missile assault in Golan Heights.

AUD/USD Short, NZD/CAD Short, EUR/NZD Long and NZD/JPY ShortAUD/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

NZD/CAD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

EUR/NZD Long

Minimum entry requirements:

• Tap into area of value.

• 1H impulse up above area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

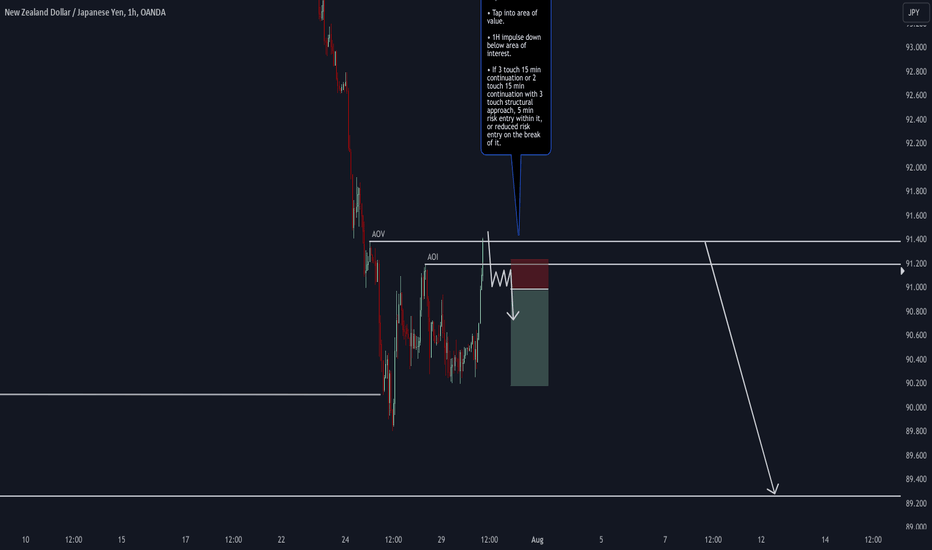

NZD/JPY Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

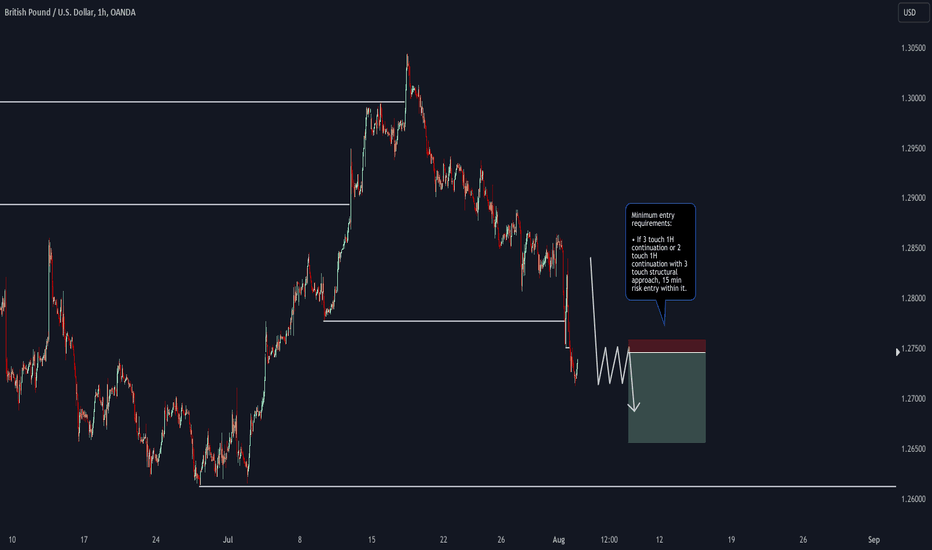

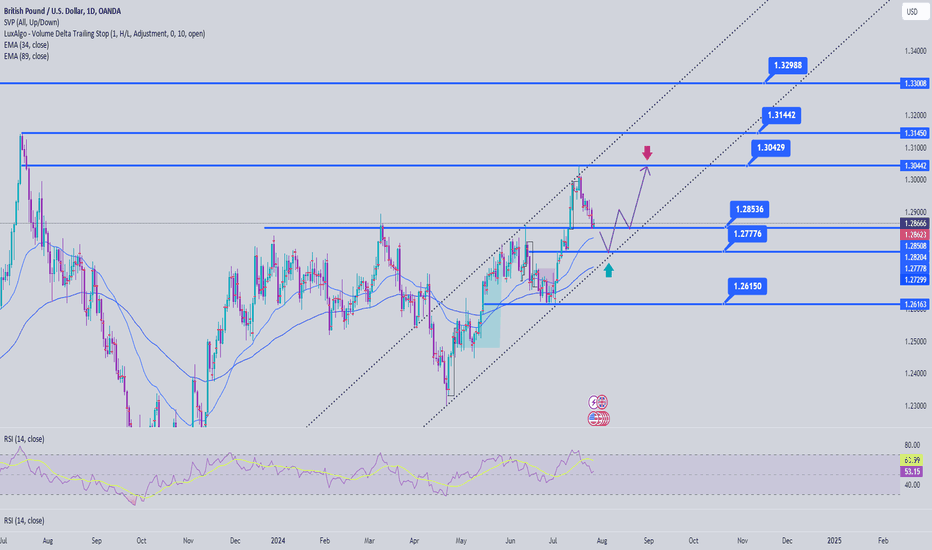

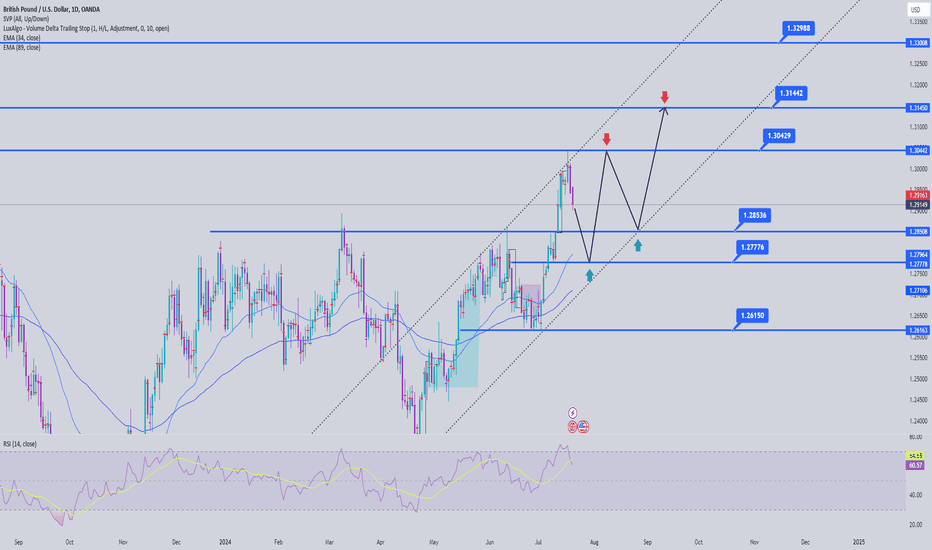

GBPUSD analysis week 31Fundamental Analysis

GBP/USD plunged on Friday, as the pound was weighed down by broad market expectations of a rate cut by the Bank of England (BoE) next week. This sent GBPUSD further lower to above 1.286.

The UK’s benchmark interest rate is expected to be cut by 25 basis points to 5.0% from the current 5.25%. The Federal Reserve (Fed) will next deliver its rate call in July, and investors are generally expecting the US central bank to leave rates unchanged at one more meeting before starting its rate-cutting cycle in September. In addition, short-term PCE inflation accelerated month-on-month in June, rising to 0.2% versus forecasts of 0.1%.

Technical Analysis

GBPUSD remains in an uptrend, The decline last week is the perfect catalyst for the uptrend to continue in the coming period. The momentum shows that buyers are still in control, as depicted by the Relative Strength Index (RSI) which is still holding above 50.

GBPUSD is supported at the 34 EMA and has responded at 1.285. The next support zone is around the EMA89 with the gap filling at 1.278. These are two important price zones that GBPUSD needs to hold to maintain the uptrend in the price channel. The bullish momentum will be reduced and could be ready for a reversal if sellers push the price to the 1.262 support zone.

On the other side of the bullish trend, GBPUSD could push back to the old high of two weeks ago around 1.305 and at the highest it could touch the upper border of the rising channel around the resistance level of 1.315.

Resistance: 1.305-1.314

Support: 1.285-1.278

Trading Signals

SELL GBPUSD zone 1.305-1.307 Stoploss 1.308

SELL GBPUSD zone 1.314-1.316 Stoploss 1.317

BUY GBPUSD zone 1.278-1.276 Stoploss 1.275

EUR/NZD Short and AUD/NZD LongEUR/NZD Short

Minimum entry requirements:

• Break above area of value.

• 1H impulse down below area of interest.

• If 3 touch 5 min continuation or 2 touch 5 min continuation with 3 touch structural approach, reduced risk entry on the break of it.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

AUD/NZD Long

Minimum entry requirements:

• If area of value tapped into by way of a three touch structural approach, risk entry after a 15 min rejection from it.

Gold Analysis July 26Fundamental Analysis:

Gold prices gained some positive momentum during the European session on Friday, seemingly snapping a two-day losing streak.

Better-than-expected US Gross Domestic Product (GDP) data released on Thursday reinforced the view that the economy is holding up well.

Gold has shown resilience below the 34-day simple moving average (EMA) on the H1, amid expectations that the Federal Reserve (Fed) will begin its rate-cutting cycle in September. However, upside momentum appears to be limited as traders await the release of the US Personal Consumption Expenditures (PCE) Price Index later on Friday for further clues on the Fed's policy path.

Technical Analysis

Gold is trading in a narrow range ahead of the PCE data. Initial resistance is at 2373-2375, created by the trendline and the falling channel formed in the morning. If this price channel is broken, the SELL zone at 2385 and 2400 is formed at strong resistance. In the opposite direction, the support zone may sweep and the liquidity zone at 2353 and we can scalp around the 2350 zone. The support zone is stronger at 2333. Pay attention to the strong ports to have a suitable news trading strategy.

SELL zone 2400-2398 Stoploss 2404

SELL zone 2384-2386 Stoploss 2390

BUY zone 2335 - 2333 Stoploss 2330

BUY zone 2350-2348 Stoploss 2345

EUR/USD Short and EUR/GBP ShortEUR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 3 touch 5 min continuation or 2 touch 5 min continuation with 3 touch structural approach, reduced risk entry on the break of it.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

EUR/GBP Short

Minimum entry requirements:

• 1H impulse down below area of value.

• If 3 touch 5 min continuation or 2 touch 5 min continuation with 3 touch structural approach, reduced risk entry on the break of it.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

EUR/USD Short and GBP/USD ShortEUR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 3 touch 5 min continuation or 2 touch 5 min continuation with 3 touch structural approach, reduced risk entry on the break of it.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

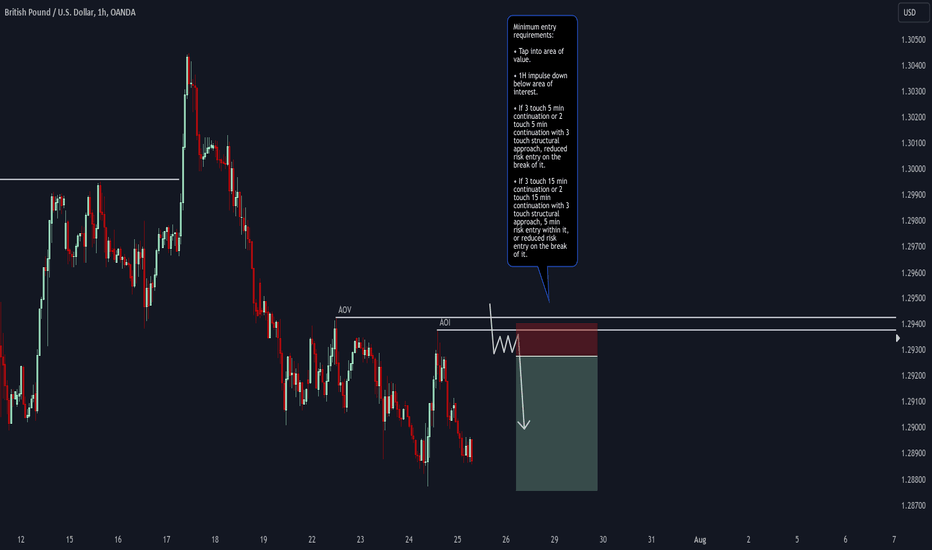

GBP/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 3 touch 5 min continuation or 2 touch 5 min continuation with 3 touch structural approach, reduced risk entry on the break of it.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

GBPUSD analysis July 22 - July 27🌐Fundamental analysis

The British Pound (GBP) extended its correction compared to most other currency pairs. The British currency continues to slide as the UK Office for National Statistics (ONS) reports weaker-than-expected June Retail Sales data.

BoE officials are hesitant to back a move to normalize policy as the US Core Consumer Price Index (CPI) remains stubborn amid persistent inflation in the services sector.

Meanwhile, an expected deceleration in Average Earnings data for the three months ended May, a key measure of wage growth that drives services inflation, failed to lift expectations. about the BoE cutting interest rates in August because the current pace is still higher than needed to maintain stability to contain price pressures.

🕯Technical analysis

The British Pound corrected sharply to near 1.2920 against the US Dollar. GBP/USD weakened as gains stalled after hitting a new yearly high of 1.3044 on Wednesday.

The upward sloping moving average (EMA) near 1.2800 suggests that the uptrend remains intact. The 14-day relative strength index (RSI) fell after turning slightly overbought and is expected to find a cushion near 60.00.

On the positive side, the two-year high near 1.3140 will be the main resistance area for GBPUSD. Last week's peak around 1,304 could also halt the pair's surge and create a double top pattern for the pair to become more stable. On the other hand, the 1.285 and 1.277 support levels become the two main support zones keeping GBPUSD in the rising price channel. If there is a sell-off that pushes the pair beyond the price channel, it could extend the price slide to the 1,262 area, the lowest bottom in two weeks.

Resistance: 1,304-1,314-1,330

Support: 1.285-1.277-1.262

SELL GBPUSD 1.314-1.316 Stoploss 1.317

BUY GBPUSD 1,280-1,278 Stoploss 1,276

USD/CAD Short and EUR/USD ShortUSD/CAD Short

Minimum entry requirements:

• 1H impulse down below area of interest.

• If 3 touch 15 min continuation or 2 touch 15 min continuation with 3 touch structural approach, 5 min risk entry within it, or reduced risk entry on the break of it.

EUR/USD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

AUD/USD Short and AUD/CAD ShortAUD/USD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

AUD/CAD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

The recovery is necessary for investors to buy long-term☘️Fundamental analysis

Gold prices extended their decline during the European session on Friday, now near multi-day lows around the $2,420 region. The US Dollar (USD) continued the previous day's solid recovery from a four-month low and became the main factor pulling Gold back more than 1% on the day. Additionally, some profit-taking , especially after the recent price increase has further contributed to the decline, although the decline appears limited.

Investors now appear confident that the Federal Reserve will begin lowering borrowing costs in September and have priced in the possibility of more rate cuts later in the year. This puts US Treasury yields on the defensive and will limit the USD. In addition, risk avoidance can support safe gold prices. Furthermore, geopolitical tensions and central bank demands will help limit any meaningful devaluation moves in the non-yielding yellow metal.

☘️Technical analysis

From a technical standpoint, any further decline is likely to find good support near the 2315 area ahead of the $2,400 round mark. Next up is a break of horizontal resistance $2,390-2,385, which has now turned into support which, if broken decisively, could prompt some technical selling.

On the other hand, the highs during the Asian session, around the $2,445 region, now appear to act as an immediate barrier, above which Gold prices could rise to the $2,469-2,470 region. With the oscillations on the h2 chart remaining firmly in the positive zone, bulls could aim to retest the all-time highs, near the $2,483-2,484 area, and conquer the psychological $2,500 mark.

Support: 2417 - 2405 - 2400 - 2391

Resistance: 2480-2465-2453-2443

SELL price range 2480-2482 stoploss 2485

SELL price range 2451 - 2453 stoploss 2456

BUY price range 2293-2291 stoploss 2288

BUY price range 2400 - 2398 stoploss 2395