NZD/CAD Short, NZD/CHF Short and SUGAR/USD ShortNZD/CAD Short

Minimum entry requirements:

• 1H impulse down below area of interest.

• If 2 touch 5 min continuation, reduced risk entry on the break of it.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

NZD/CHF Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 5 min continuation, reduced risk entry on the break of it.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

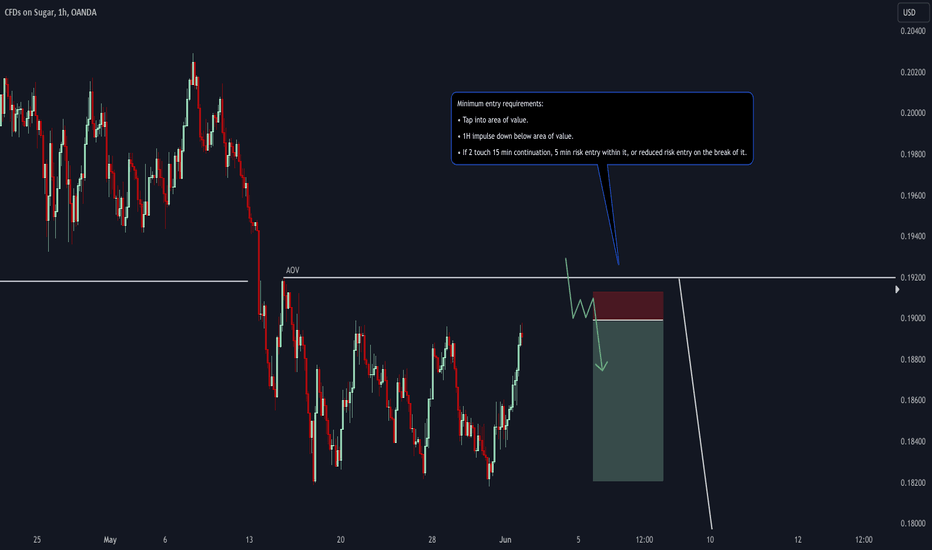

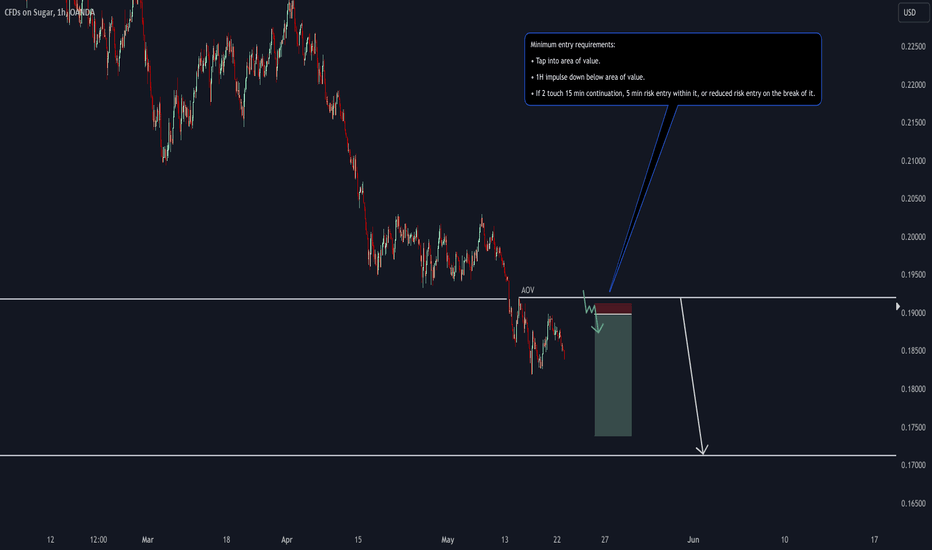

SUGAR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

Tradingforex

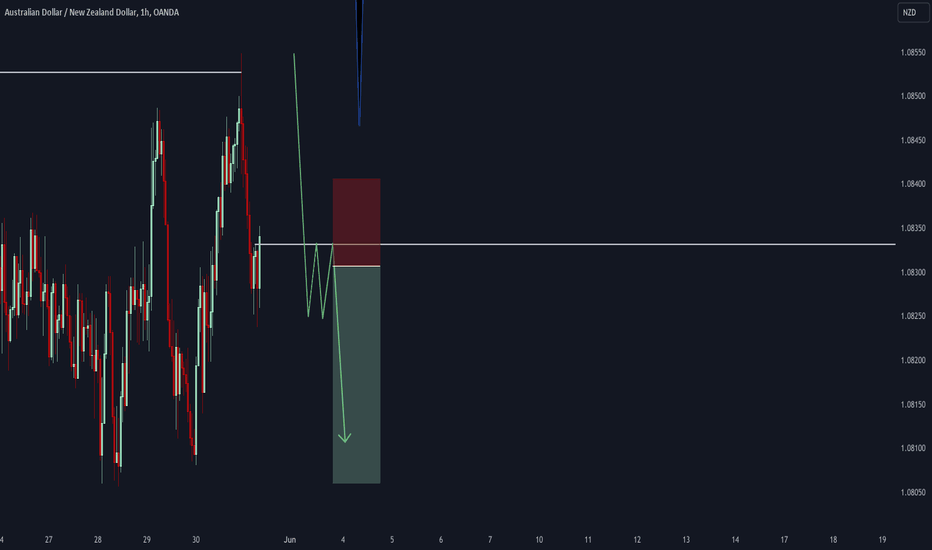

AUD/NZD Short and WTICO/USD ShortAUD/NZD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

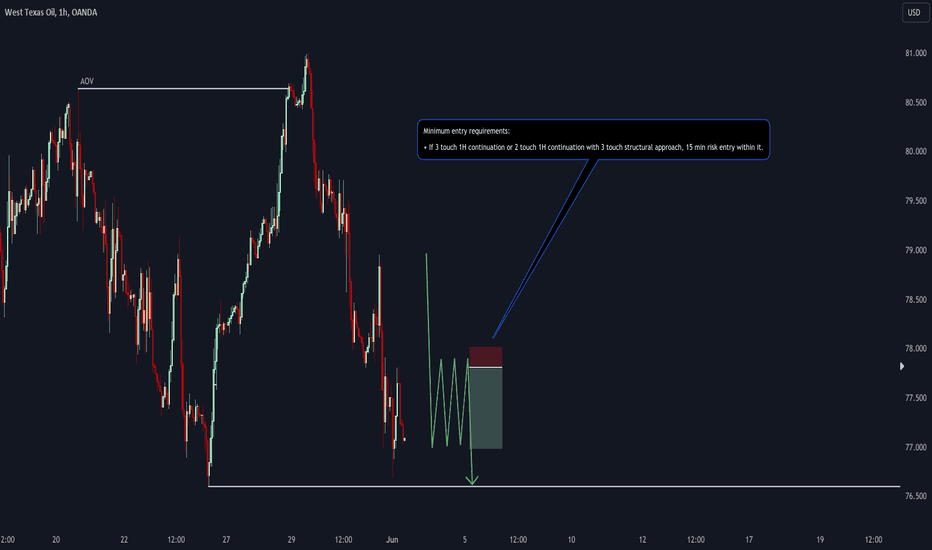

WTICO/USD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

GBP/CAD Long, AUD/NZD Short, USD/CHF Short and GBP/AUD LongGBP/CAD Long

Minimum entry requirements:

• Break below area of value.

• 1H impulse up above area of value.

• If 2 touch 5 min continuation, reduced risk entry on the break of it.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

AUD/NZD Short

Minimum entry requirements:

• If 2 touch 15 min continuation, 5 min risk entry within it.

USD/CHF Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

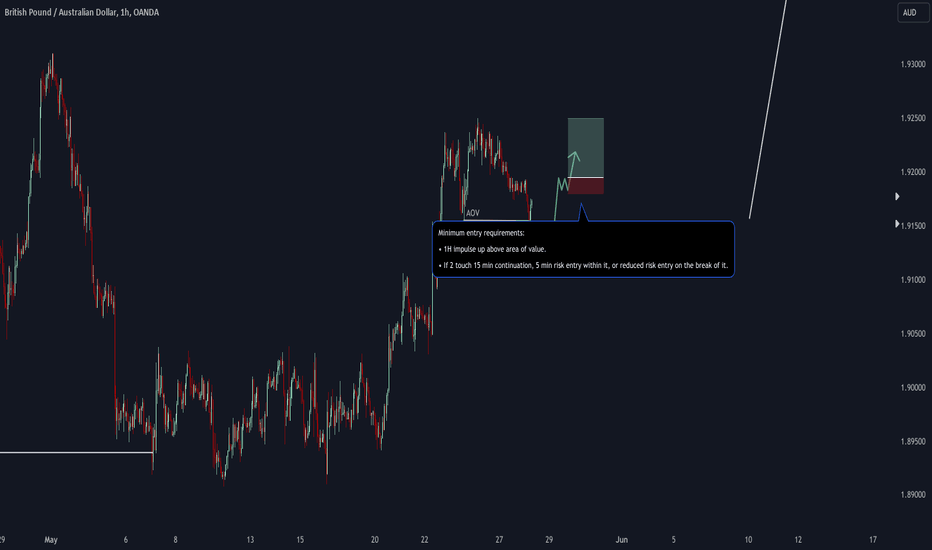

GBP/AUD Long

Minimum entry requirements:

• Tap into area of value.

• 1H impulse up above area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

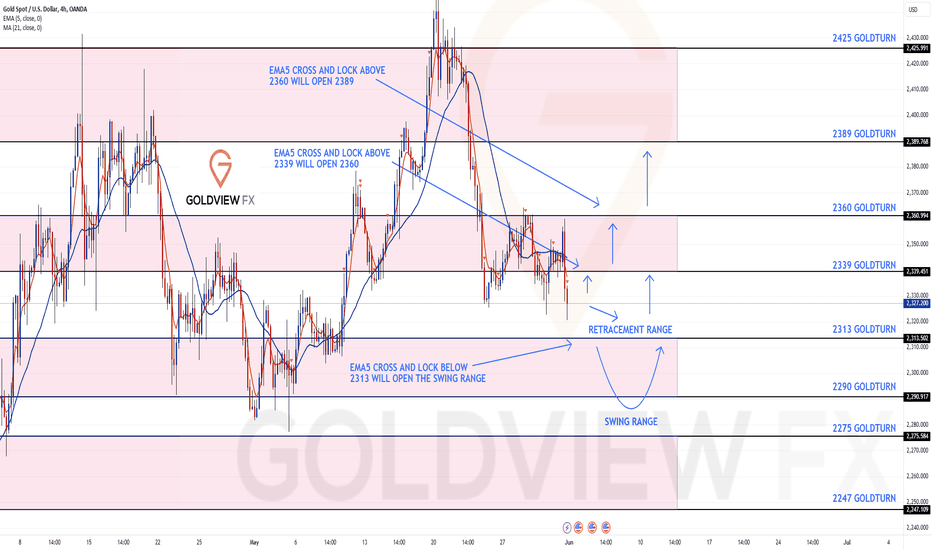

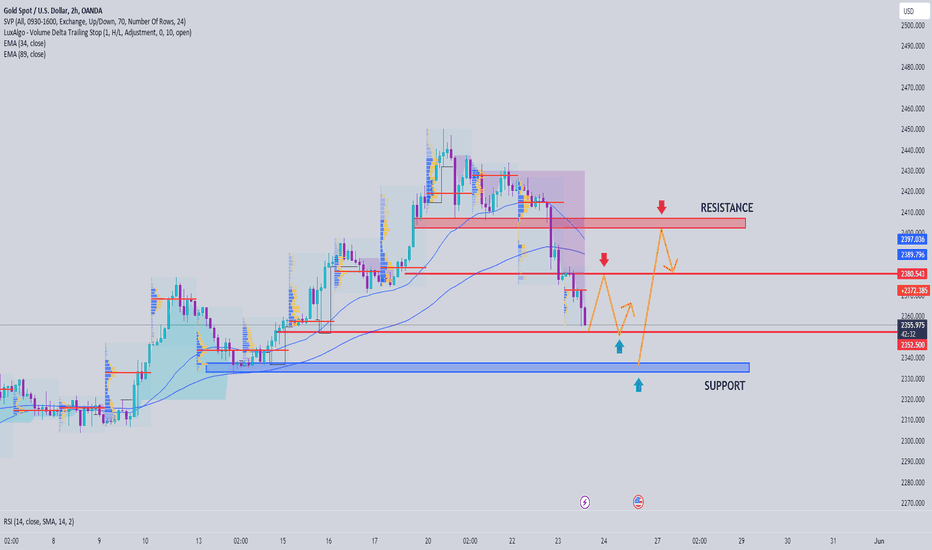

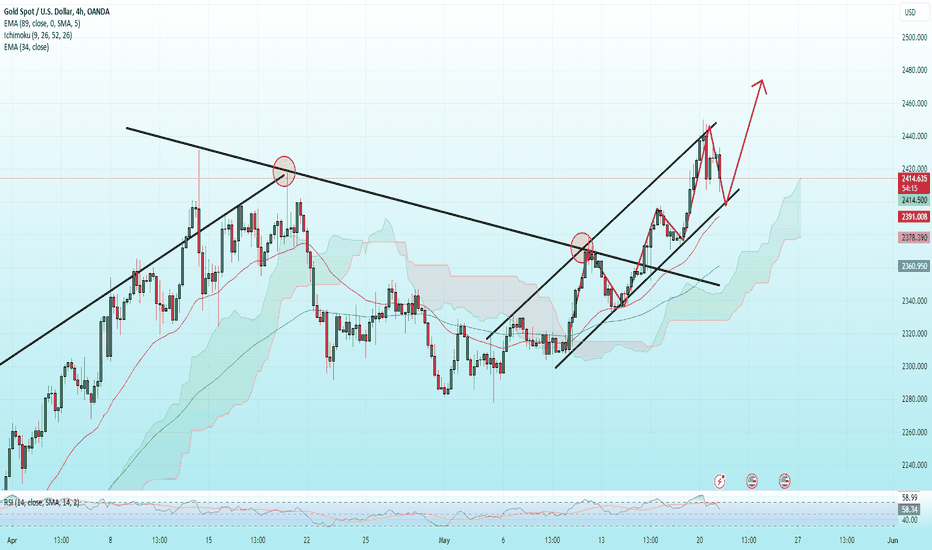

GOLD 4H CHART ROUTE MAP & TRADING PLANS FOR THE WEEK AHEADHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels 2339 resistance and 2313 is the weighted support for this range. We will need to see either weighted level break and lock to confirm the next range.

We will need to see ema5 lock above 2339 to open the range above or a rejection will follow to find support in the retracement range. A cross and lock below 2313 will open the swing range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we share every week in the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGETS

2339

EMA5 CROSS AND LOCK ABOVE 2339 WILL OPEN THE FOLLOWING BULLISH TARGET

2360

EMA5 CROSS AND LOCK ABOVE 2360 WILL OPEN THE FOLLOWING BULLISH TARGET

2389

BEARISH TARGETS

2313

EMA5 CROSS AND LOCK BELOW 2313 WILL OPEN THE FOLLOWING SWING RANGE

SWING RANGE

2290 - 2275

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

Mr Gold

GoldViewFX

Gold price decreases temporarily or long term💥Gold prices extended their decline on Wednesday. The yellow metal's potential for further upside may be limited as the FOMC minutes are understood to be significantly more hawkish than previous releases.

💥The future direction of gold may depend on the results of the FOMC Minutes. Technical indicators in the daily chart suggest an extension of the ongoing correction, as indicators retreat sharply from indexes near overbought levels, maintaining a solid bearish slope at positive levels. pole. The potential downside target and key support zone is around $2,338, where the pair has its lowest level in the last three weeks. Meanwhile, the EMA 34 and EMA 89 are showing a downward slope in the h2 time frame, and the price is trading below the two EMA lines, showing that the downtrend will last at least until next week.

💥PLAN trading May 23

Support: 2352 - 2337 - 2321

Resistance: 2383 - 2400 - 2413

SELL price range 2380 - 2382 stop 2385

BUY price range 2338 - 2336 stop 2333

USD/CHF Long, SUGAR/USD Short, EUR/AUD Short and GBP/AUD LongUSD/CHF Long

Minimum entry requirements:

• 1H impulse up above area of value.

• If 2 touch 5 min continuation, reduced risk entry on the break of it.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

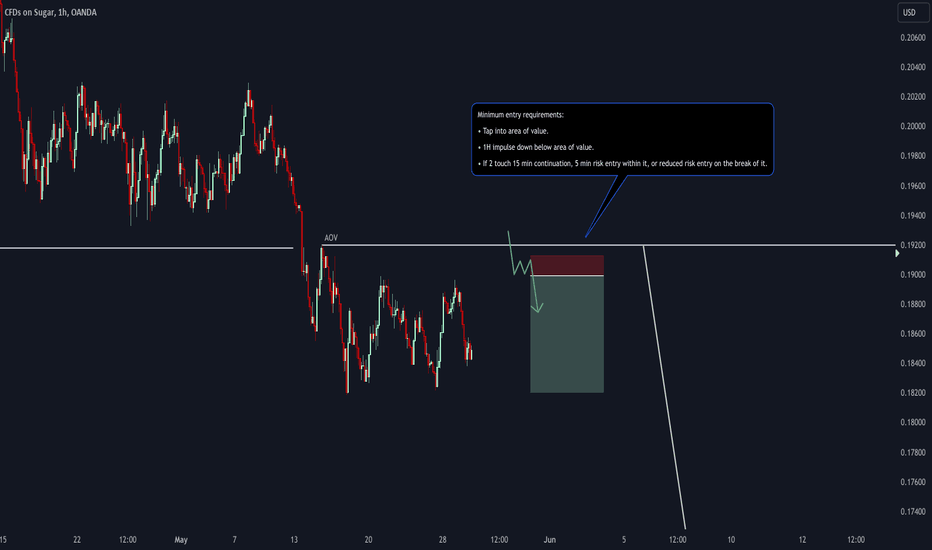

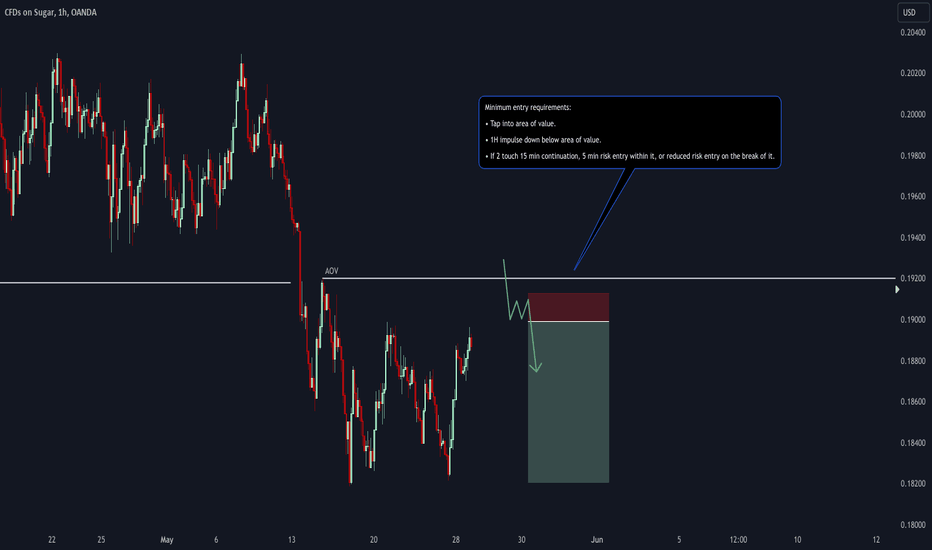

SUGAR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

EUR/AUD Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

GBP/AUD Long

Minimum entry requirements:

• 1H impulse up above area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

AUD/USD Long, SUGAR/USD Short and EUR/USD LongAUD/USD Long

Minimum entry requirements:

• Tap into area of value.

• 1H impulse up above area of interest.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

SUGAR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

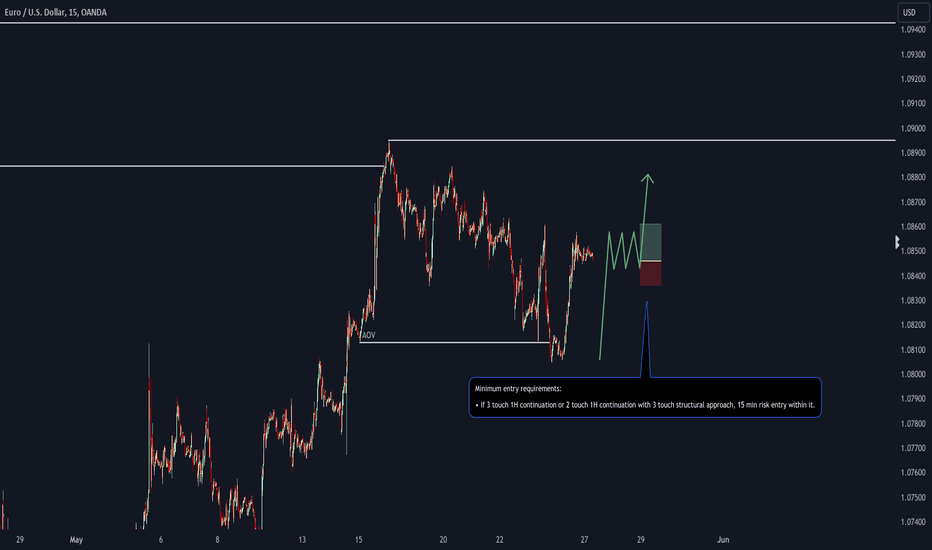

EUR/USD Long

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

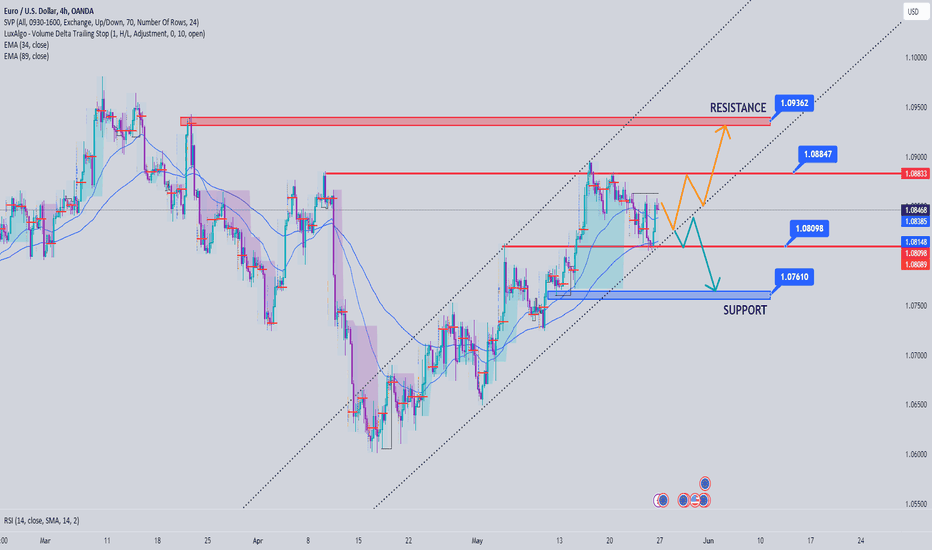

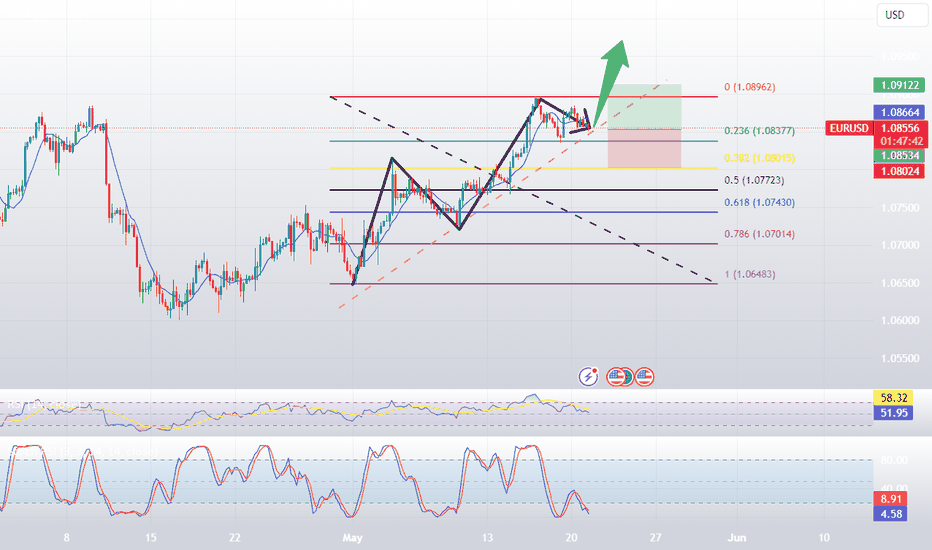

EURUSD price analysis week 22📌After the surprise data on US services PMI skyrocketed, there was concern that the FED would cut interest rates less than expected. This caused investors to rush into the USD and pushed the Euro down despite the EUR PMI data. better than previously announced expectations.

📌EUR/USD recovers to 1.0850 as risk mood improvesEUR/USD gains traction and rises to 1.0850 on Friday. The improvement seen in the risk mood made it difficult for the US Dollar (USD) to maintain its strength and helped the pair erase some of its weekly losses.

📌EURUSD does not break the EMA 89 and continues to maintain its long-term uptrend. After bouncing up to 1.0850 EUR, it created a new, more stable and solid trendline. This 1.0850 area is currently a resistance area saved by the trendline and the old peak in the h4 time frame, so there is a high possibility that the pair will have a slight recovery. The highest increase that the pair can achieve next week is around the price range of 1.0930 after breaking the peak around 1.0890. On the opposite side, if the rising trendline is broken, the next support level is around 1.0770, at which point a short-term downtrend will begin to form if this support is broken.

🕯Trading signals

BUY EURUSD zone 1.07700-1.07500 SL 1.07200

SELL EURUSD zone 1.09300-1.09500 SL 1.09800

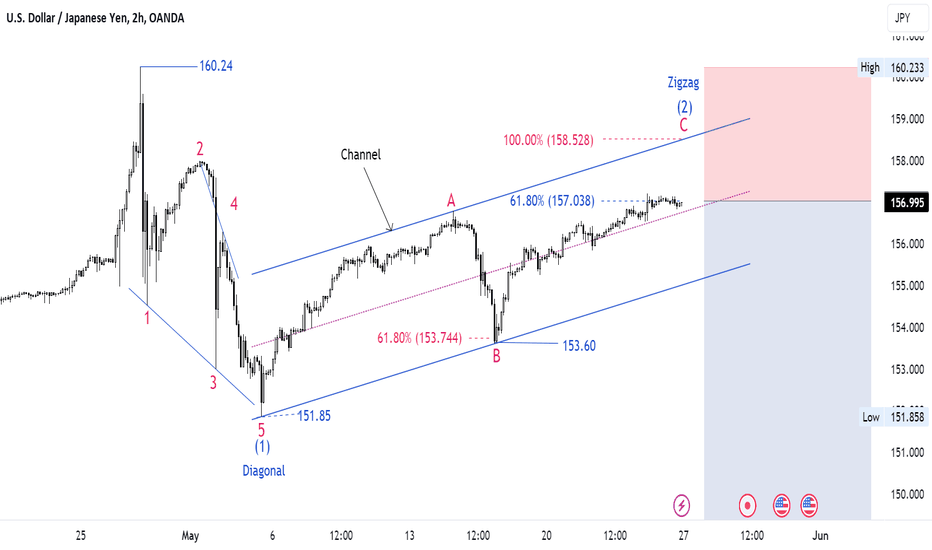

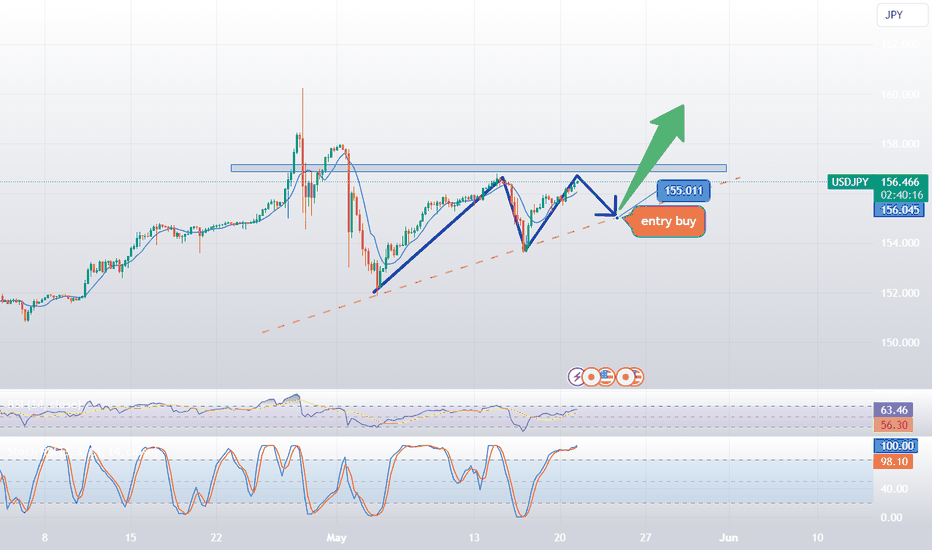

USD/JPY: Ride this Third wave Decline.The decline from 160.24 high subdivides into five waves. This move is significant as it identifies the dominant trend as down. The technical name for this pattern is a leading diagonal.

The subsequent three-wave price action unfolding in USD/JPY supports this bearish conviction. Countertrend price action commonly subdivides into a three. It is often slow, choppy and typically contained within a parallel channel. The technical name for this rally is a Zigzag pullback.

As illustrated earlier in my education ideas, in zigzag formations, the upper boundary of a parallel channel often projects the end of wave C with dramatic precision.

Moreover at 158.52, wave C would equal the length of wave A which is a common Fibonacci relationship in zigzag formations.

It is also the case that when a leading diagonal occurs in wave (1) position of an impulse, it is sharply retraced by a zigzag correction with 61.8% and 78.6% levels common targets. Although not shown,the 78.6% retracement level corresponds to the upper boundary of the trend channel and wave C equality target.

So in anticipation of wave (3) decline; a trader's bread and butter, the recommendation is to short at or near the 61.8% retracement level. The Protective Stop will be placed at 160.24; the origin of this decline. Why? Wave (2) of an impulse can NOT retrace more than 100% of wave (1).

The target for this trade is a drop of at least 13.58 as in (160.24 - 151.83) X 1.618. Why? As a guideline, wave (3) of an impulse often extends and commonly travels 1.618 times the length of the (1). A Risk: Reward of 1:3

Working with 153.60 as our key level. A break below this level would hint that wave (2) is over and wave (3) to the downside is underway.

Have a profitable trading week!

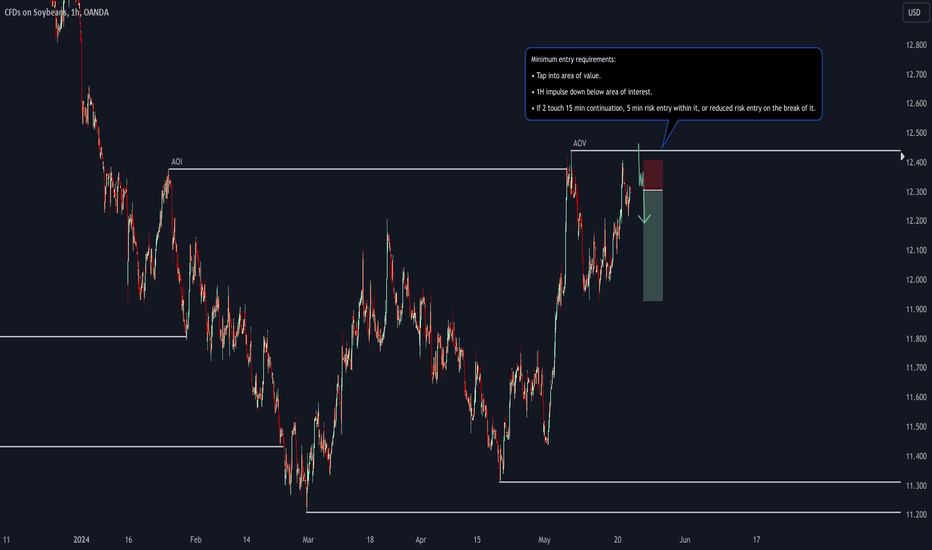

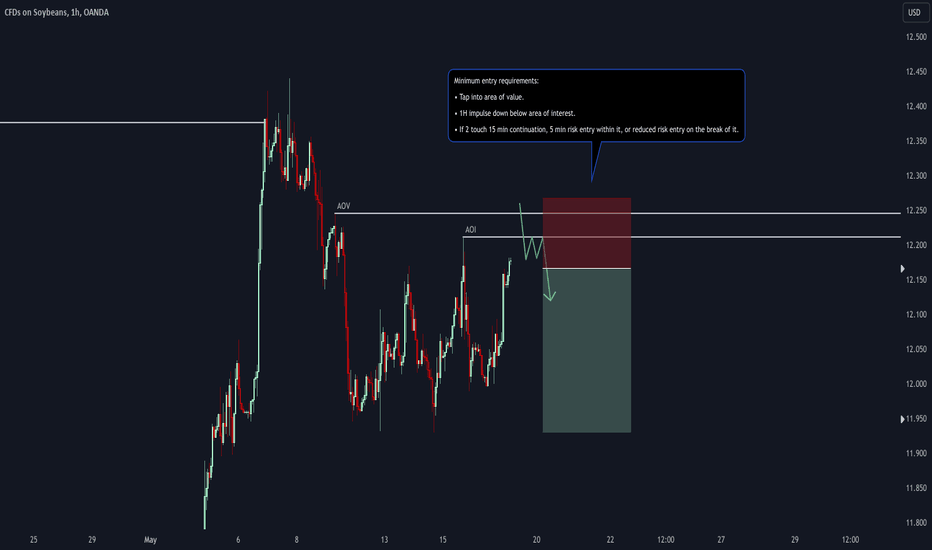

SOYBN/USD Short and SUGAR/USD ShortSOYBN/USD Short

Minimum entry requirements:

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

SUGAR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

SOYBN/USD Short and SUGAR/USD ShortSOYBN/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

SUGAR/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

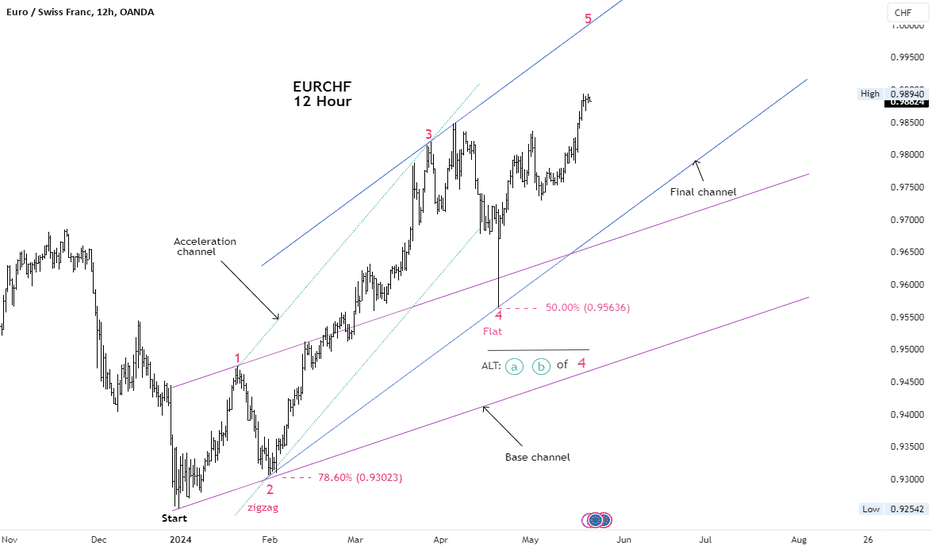

How to Confirm an Elliott Wave Count.Hello fellow traders, today I would like to show you how to apply a Kennedy Channeling technique (by Jeffrey Kennedy) to identify and confirm Elliott waves with more confidence.

1. Base Channel:- Wave 3 identification

When wave 2 is complete, connect the origin of wave 1 and the end of wave 2. Draw a parallel line along the top of wave 1. As long as price action stays within this channel, you can consider price action corrective, probably wave C of a Zigzag. In a bullish trend, prices ought to break above the upper boundary line of this channel for wave 3 count to be acceptable.

2. Acceleration Channel:-Wave 4 identification.

Connect the extreme of wave 1 and the top of wave 3. Draw a parallel line starting at the bottom of wave 2. Only after prices break through the lower boundary line of the acceleration channel, could you be convinced that wave 3 is over and wave 4 is unfolding.

3. Final Channel:- Wave 5 identification

Connect the end of waves 2 and 4. Draw a parallel line along the top of wave 3 to project wave 5 target. It is quite common for wave 5 to terminate upon reaching the upper trendline of the final channel.

That's all for today. Trade wisely!

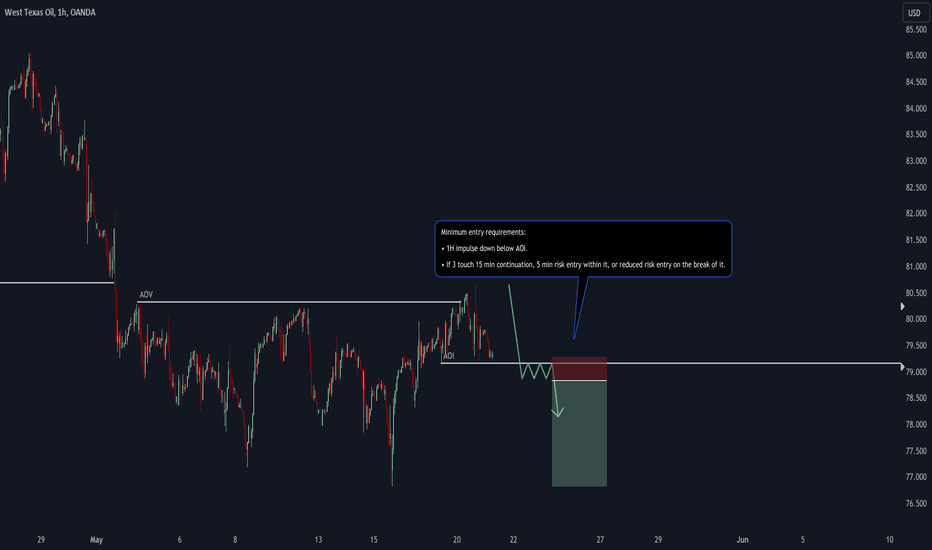

EUR/NZD Short, SOYBN/USD Short and WTICO/USD ShortEUR/NZD Short

Minimum entry requirements:

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

SOYBN/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

WTICO/USD Short

Minimum entry requirements:

• 1H impulse down below AOI.

• If 3 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

Gold technical analysis: 21/5/2024The left chart suggests an equally-weighted gold basket of spot gold towards FX majors. It objectives to expose the underlying of energy of gold in general, and dilute the inverse dating among gold and americaA greenback – that is the maximum extensively observed gold market. On the proper we are able to see the gold futures (gold/USD) reached a document excessive on Monday along better buying and selling volume, even though it didn't keep onto profits above $2450 or the earlier document excessive and retraced lower.

It is likewise exciting to notice that the gold basket has stalled round $2800, simply below its very own document excessive set in April. A bearish divergence has additionally shaped at the gold basket and gold futures contract, each of that are withinside the overbought zone.

It can be tough to assemble a direct bearish case aside from gold stalling round key resistance levels. But that may be true sufficient for gold bulls to take notice and err at the facet of caution.

We`ve already visible as soon as fake damage of the April excessive for gold futures, so possibly bulls may also need to at the least see the gold basket damage to a brand new document excessive earlier than assuming gold futures will keep directly to profits. Of course, what ought to assist with the latter case is to look americaA greenback index damage and keep under 104. Otherwise, some other method is for bulls to await a retracement earlier than looking for proof of a better low for bullish swing change at a extra beneficial price, in anticipation of a damage to a brand new document excessive.

EURUSD: EURUSD analysis todayRecent information confirmed that US client charges fell in April, main to marketplace expectancies of a 50 foundation factor hobby fee reduce this year. However, warning from diverse Fed officers has tempered those expectancies, with buyers now predicting round forty six foundation factors of easing, merely factoring in fee cuts for November.

In early buying and selling on Monday, the euro rose barely to $1.087525, drawing close a almost two-month excessive of $1.0895 reached final week. The greenback index, a gauge towards six important currencies, confirmed little change, status at 104.forty six.

USDJPY: The USD holds steady as markets look for interest rate dThe US dollar remained broadly stable today as market participants await additional indicators to determine US interest rate developments. This period of anticipation follows recent cautious comments from US Federal Reserve (Fed) officials and signs that inflation may be easing.

The Japanese yen fell slightly at the start of the week, trading at 155.80 against the dollar. Investors are closely watching for any signs of potential government intervention, with the yen showing minimal volatility in recent days.

AUDUSD: AUDUSD analysis todayING predicts balance in USD forex pairs as buyers look ahead to the discharge of the April center non-public intake expenditures (PCE) rate index, predicted on May 31. The corporation believes that cross-asset volatility is in all likelihood to stay subdued withinside the coming weeks, that may spur the look for convey trades.

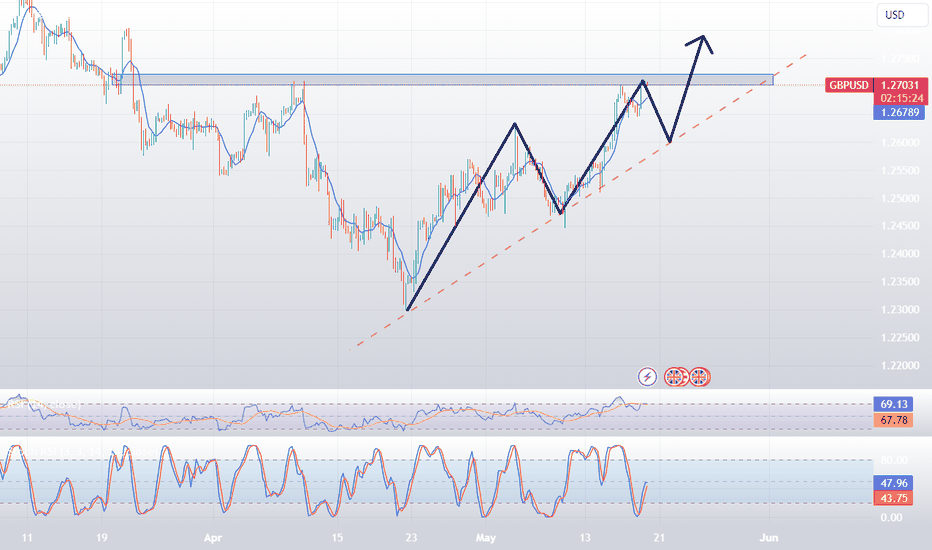

GBPUSD: USD pauses, market pays attention to April core PCE dataUSD pauses, market pays attention to April core PCE data

ING predicts stability in USD currency pairs as investors await the release of the April core personal consumption expenditures (PCE) price index, expected on May 31. The firm believes that cross-asset volatility is likely to remain subdued in the coming weeks, which could spur the search for carry trades.

EUR/NZD Short, WTICO/USD Short and SOYBN/USD ShortEUR/NZD Short

Minimum entry requirements:

• Tap into area of value.

• 15 min rejection or phase line break.

WTICO/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.

SOYBN/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If 2 touch 15 min continuation, 5 min risk entry within it, or reduced risk entry on the break of it.