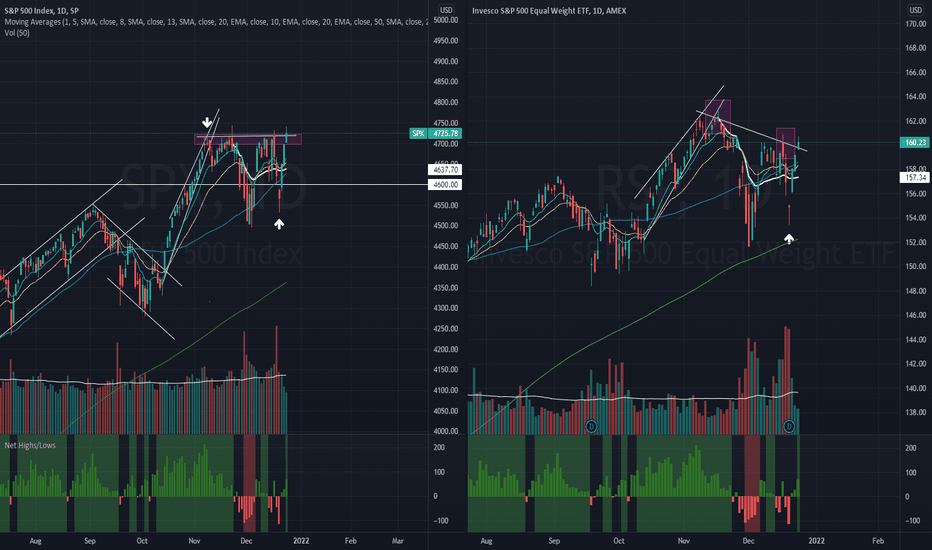

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight)

Market Technicals (Rally Cycle Count: Day 4 of 25)

$SPX (S&P 500) vs $RSP (S&P 500 Equal Weight) – (Net High/Low +70)

$SPX posted a solid gain of +2.28% (+105.13 points), erasing the losses experienced in the earlier week. With $SPX closing at 4,725 level, it remains below its all time high level that have tested four times over the past 8 weeks. $RSP broke out of its downtrend line with a pop on the last trading session, minimising the divergence reflected in both the indexes that was highlighted in the previous week.

With both $SPX and $RSP also breaking out of its Anchored VWAP (AVWAP) resistance at 4,640 level, below average trading volume is observed on the subsequent two trading session during the course of the week; as market activity thinned towards the Christmas Holiday.

The immediate support to watch for $SPX this week remains at 4,600 level, creating a box range support beneath the confluence of major Moving Averages (10D, 20D and 50D).