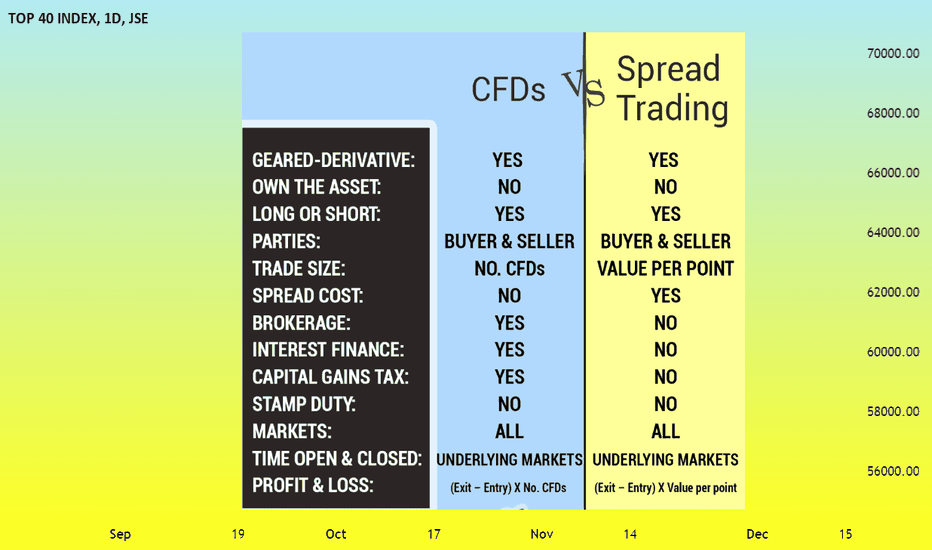

EXPLAINED: CFDs versus Spread Trading 101What are CFDs and Spread Trading?

Spread Trading (betting) and CFDs are financial instruments that allow us to do one thing.

To place a bet on whether a market will go up or down in price – without owning the underlying asset.

If we are correct, we stand a chance to make magnified profits and vice versa if wrong.

Both CFDs and Spread Trading, allow us to buy or sell a huge variety of markets including:

• Stocks

• Currencies

• Commodities

• Crypto-currencies and

• Indices.

When you have chosen a market to trade, there are two types of CFD or Spread Trading positions you can take.

You can buy (go long) a market at a lower price as you expect the price to go up where you’ll sell your position at a higher price for a profit.

You can sell (go short) a market at a higher price as you expect the price to go down where you’ll buy your position at a lower price for a profit.

EXPLAINED: CFDs for Dummies

DEFINITION:

A CFD is an unlisted over-the-counter financial derivative contract between two parties to exchange the price difference between the opening and closing price of the underlying asset.

Let’s break that down into an easy-to-understand definition.

EASIER DEFINITION:

A CFD (Contract For Difference) is an:

• Unlisted (You don’t trade through an exchange)

• Over The Counter (Via a private dealer or market maker)

• Financial derivative contract (Value from the underlying market)

• Between two parties (The buyer and seller) to

• Exchange the

• Price difference (Of the opening and closing price) of the

• Underlying asset (Instrument the CFD price is based on)

EASIEST DEFINITION

Essentially, you’ll enter into a CONTRACT at one price, close it at another price FOR a profit or a loss depending on the price DIFFERENCE (between your entry and exit).

Moving onto Spread Trading.

EXPLAINED: Spread Trading for Dummies

DEFINITION:

Spread Trading is a derivative method to place a trade with a chosen bet size per point on the movement of a market’s price.

EASIER DEFINITION:

Spread Trading is a:

Derivative method (Exposed to an underlying asset) to

Place a trade (Buy or sell) with a chosen

Bet size per point on where you expect a

Market price will

Move (Up or down)

In value

EASIEST DEFINITION:

Spread Betting allows you to place a BET size on where you expect a market to move in price.

Each point the market moves against or for you, you’ll win or lose money based on their chosen TRADING bet size (a.k.a Risk per point or cent movement).

The higher the bet size (value per point), the higher your risk and reward.

The costs you WILL pay with Spread Trading and CFDs

Both Spread Trading and CFDs are geared-based derivative financial instruments.

As their values derive from an underlying asset, when you trade using Spread Trading or CFDs, you never actually own any of the assets.

You’re just making a simple bet on whether you expect a market price to rise or fall in the future.

If you decide to go with the broker or market maker who offers CFDs or Spread Trading, there are certain costs you’ll need to pay.

Costs with Spread Trading

With Spread Trading, you’ll only have one cost to pay – which are all included in – the spread.

The spread is the price difference between the bid (buying price) and the offer (selling price).

EXAMPLE: Let’s say you enter a trade and the bid and offer prices is 5,550c – 5,610c.

The spread, in this case, is 60c (5,610c – 5,550c).

This means your trade has to move 60c to cross the spread in order for you to be in the money-making territory. Also, if the trade goes against you, the spread will also add to your losses.

Why the spread you ask?

The spread is where the brokers (market makers’) make their money.

Costs with CFDs

Brokerage

With CFDs, it can be different.

Depending on who you choose to trade CFDs with, you may need to cover both the spread as well as the brokerage fees – when you trade.

These brokerage fees can range from 0.2% – 0.60% for when you enter (leg in) and exit (leg out) a trade.

NOTE: If the minimum brokerage per trade is R100, you’ll have to pay R100 to enter your trade.

Daily Interest Finance Charge

The other (negligible) cost, you’ll need to cover is the daily financing charges.

If you buy (go long) a trade, you’ll have to pay this negligible charge (0.02% per day) to hold a trade overnight.

However, if you sell (go short) a CFD trade, you’ll then receive this negligible amount (0.009%) to hold a short trade overnight.

The costs you WON’T pay as a Spread Trader

With spread trading (betting), you don’t own anything physical.

When you take a spread bet, you’re simply making a financial bet on where you expect the price to move and nothing else.

This means, there will be no costs to pay as you would with shares including:

NO Daily Interest Finance charges

NO Stamp Duty costs

NO Capital Gains Tax

NO Securities Transfer Tax

NO Strate

NO VAT

NO Brokerage (all wrapped in the spread).

The costs you WON’T pay as a CFD trader

With CFDs, you’ll notice that there are similar costs with Spread Trading that you won’t have to pay including:

NO Stamp Duty costs

NO Securities Transfer Tax

NO Settlement and clearing fees

NO VAT

NO Strate

24-Hour Dealings

The great thing about Spread Betting or CFD trading is that, you can trade markets trade 24/5.

I’m talking about currencies, commodities and indices.

And with Crypto-currencies you can trade them 24 hours a day seven days a week.

I have left out a very important difference between CFDs and Spread Trading… Gearing and how it works in real life…

Tradingmindset

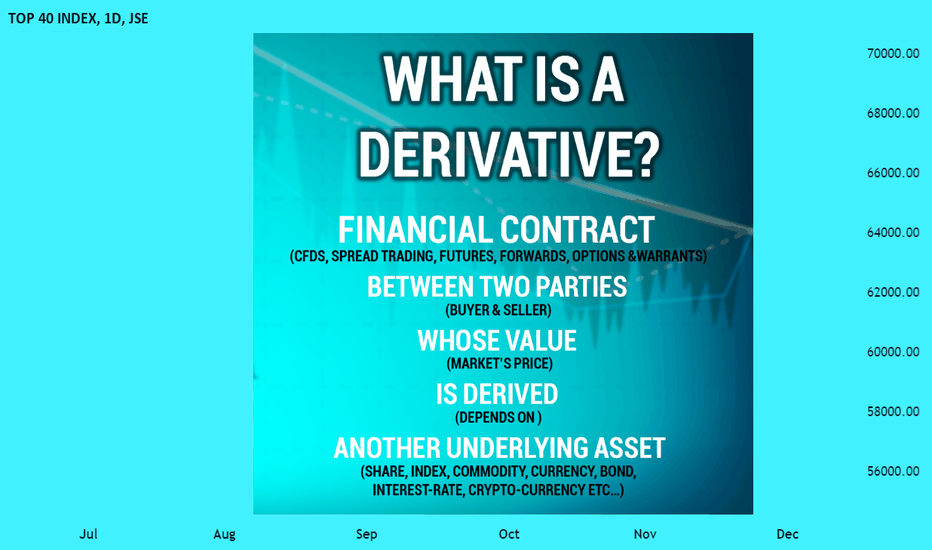

Trading 101 - What is a Derivative & why are they revolutionary?Derivatives trading!

What I believe has been the absolute market revolution since shares.

Derivatives might sound complicated and something you would hear from a professor or a know-it-all businessman – but they’re really not.

I am no academic or even remotely one of the smartest guy’s in the world. And if I can grasp the idea and understanding of derivatives, I pretty much guarantee you will too.

Also, if you want to take trading seriously and really make a living with it, you’ll need to understand derivatives trading sometime in your career.

Let’s start at the very beginning.

What is a derivative?

– Collins English Dictionary –

‘A derivative is an investment that depends on the

value of something else’

When it comes to trading, a derivative is a financial contract between two parties whose value is ‘derived’ from another (underlying) asset.

Let’s break that down more simply:

A derivative is a

financial contract (CFDs, Spread Trading, Futures, Forwards, Options &Warrants)

Between two parties (the buyer and seller)

Whose value (the market’s price)

Is derived (depends on or comes from)

Another underlying asset (Share, index, commodity, currency, bond, interest-rate, crypto-currency etc…)

You’ll find that the derivative’s market price mirrors that of the underlying asset’s price.

Why trade using derivatives?

The absolute beauty about trading derivatives is that they are a cheaper and a more profitable way to speculate on the future price movements of a market without buying the asset itself.

You don’t get all the benefits with derivatives

What’s probably important to note with derivatives, is this.

When you buy a derivative’s contract, you’re not actually buying the physical asset. You’re simply making a bet on where you expect the price to go.

EXAMPLE:

When you buy actual shares of a company, means you’ll be able to attend AGMs (Annual General Meetings), Vote and claim dividends from a company.

When you trade derivatives on the underlying share, means you’ll be exposed to the value of the shares and the price movements – and that’s it!

As a trader, when you buy or sell a derivative, you’re not actually investing in the underlying asset but rather just making a bet (speculation) on where you believe the market’s price will head.

This gives you the advantage and opportunity to:

Buy low (go long) a derivative of the underlying asset and sell it at a higher price for a profit or

Sell high (go short) a derivative of the underlying asset and buy it back at a lower price for a profit

Remember when I said it was cheaper and more profitable? You can thank margin

With derivatives, you’ll normally pay a fraction of the price of the total sum and still be exposed to the full value of the asset (share, index, currency etc…)

The fraction of the price paid is called ‘margin’.

EXAMPLE:

To buy and own 10 Anglo shares at R390 per share will cost you R3,900 (R390 per share X 10 shares).

To buy and be exposed to 10 Anglo shares using derivatives, and the margin of the contract is 10% per share, means you’ll only pay R390 (R390 per share X 10% margin per derivative X 10 shares).

I’m sure you can see that with derivatives, you’ll be exposed to more and pay less which will gear up your potential profits or losses versus when trading shares.

This is why we call derivatives, geared financial instruments.

Enjoyed the article comment below and follow for more...

Trade well, Live free

Timon

MATI Trader

Also my socials are below thanks to Trading View.

BACK TO THE FUTURE VS TRADINGI watched the Oscars recently and saw Michael J. Fox receive his humanitarian award. This brought me back to my childhood with the legendary Back to the Futures movie...

Also this year we saw The Back to the Future stars Doc Brown (Christopher Lloyd) and Marty McFly (Michael J. Fox) reunited and shared the stage at the New York Comicon 2022.

This is where they reminisced over their iconic roles in the beloved film trilogy.

There were a bunch of mixed emotions but mostly the feeling of nostalgia and childhood memories…

And so, I watched the trilogy and I found it was super interesting to watch a movie when at the time, they were trying to predict the future by making a number of predictions about 2015…

They certainly got a few spot ons such as:

• Smart watches

• Hover boards

• Virtual reality headsets (which we use Quest, PlayStation and even HTC)

• Talking from TV to TV (Instead we use tablets and smart phones, but close enough)

• Donald Trump like figure as president

They also made a few wrong predictions like:

• People wearing their pockets inside out

• Dogs having drones walk them (but we do have drones though)

• Mechanical car fuel attendants

• Pizza hydrators

But overall, there is a very big lesson we can learn from this…

If scientists, businessmen, producers, directors and actors can’t accurately predict the future, nobody can.

And trading the financial markets are similar to “Back to the Future” movies.

It’s unpredictable and normally plays out differently to what we think…

Thing about the future is… When you know what is going to happen and you act according, the future changes…

Let’s say you know what’s going to happen at a certain point in the future. If you act according to what will happen in the future, then your action will change the future.

So, if the future is so unpredictable, how can anyone ever make money from trading?

Simple.

You don’t need to know the future when you trade

When you take a trade, you should never try to predict where the market will go.

Instead, we should base the future predictions and decisions on one word.

Probability.

If the market is moving up, there is a higher chance it will continue to move up. (It’s going up for a reason).

If the market consolidates in a sideways formation and then the price breaks down, there is a higher chance the price will continue to move down.

We say, go with the trend rather than against it… Our job is not to predict every turn and bank a profit from every point move.

Our job is to anticipate a change in the market, wait for confirmation and then act accordingly to follow the MORE likely scenario… You might not get it right 30% to 40% of the time, but you can get it right 50% - 70% of the time during certain market environments…

That’s all I do when I do trades and analyses… I base probabilities on where a market is more likely to go at a certain time…

If I’m wrong, I adjust – rather than deny…

This was a short reminder of why you don’t need to predict the markets to make it as a trader.

Did you enjoy this short piece? Let me know in the comments. It's a passion to help share the knowledge I've gained over the last 20 years as a trader.

Trade well, live free.

Timon

MATI Trader

Is Trading Like Playing Poker? Is trading a form of gambling?

With hesitance, I would say yes.

However, I would rather call trading a form of strategic gambling as both require elements of risk, reward, strategy and decision making.

In the next two weeks or so, I’m planning to publish a new online FREE book called “Poker Vs Trading”.

Who knows, by the end of it all you may take up professional poker playing as well as trading…

Let’s start with the similarities.

SIMILARITY #1:

We can choose when to play (Strategy)

Traders and poker players don’t play every hand that is dealt to them.

With poker, when a hand is dealt, we can choose to either play the hand, based on how strong it is, or we can choose to fold and wait for the next hand…

With trading, we wait for a trading setup based on the criteria of our strategy i.e. MATI Trader System.

You’ll then have the exact criteria and money management rules to follow in order to take a trade or wait for the next trade.

SIMILARITY #2:

Amateur poker players and traders tend to go the ‘tilt’ (Emotional roller-coaster)

Emotions are a main driver which leads to traders losing their cash in their account or poker players losing their chips very quickly.

With poker, you get players who let their emotions take over where they start betting high with an irrational frame of mind.

These emotions lead them to losing their chips very quickly.

This is when they enter the state of what is called ‘going the tilt’.

With trading, amateur traders also tend to act on impulse and play on gut, instinct, fear and greed after they’ve undergone a losing streak or a winning streak.

This often leads them to:

~ Taking a series of losses.

~ Losing huge portions of their portfolio.

~ Holding onto losing trades longer than they should.

~ Entering a mindset of revenge trading.

SIMILARITY #3:

We know when to hold ‘em and when to fold ‘em (Cut losses quick)

We have the choice to reduce our losses when it comes to betting a hand or taking a trade.

With poker, if the players start upping the stakes and you believe you have a weaker hand in the round, you can choose to ‘fold’ and lose only the cost of playing the ‘ante’.

With trading, if you’ve taken a trade and it turns against you, you have a stop loss which will get you out at the amount of money you were willing to risk of your portfolio…

SIMILARITY #4:

We know the rake (Costs involved)

There are always costs associated with each trade we take or each hand we play, which eats into our winnings.

With poker, it’s the portion of the pot that is taken by the house i.e. the blinds and the antes. With trading, it’s the fees charged by your broker or market maker, in order to take your trade. These fees can be either the tax, spread and/or the brokerage.

SIMILARITY #5:

Aggressive trading and betting before the flop (High volatility)

There will always be a time of strong market moves and high betting.

With poker, you get times where players like to bet aggressively and blindly before the flop is revealed. It’s these times that lead to the amateur poker players losing their chips very quickly.

With trading, you get economic data i.e. Non-Farm-Payrolls, black swan events and Interest Rate decisions when big investors and traders like to drive the market up or down before the news even comes out.

NOTE: I ignore both forms of hype as it is can lead to a catastrophic situation.

SIMILARITY #6:

We bet and trade based on the unknown

Every bet and trade we take and play is based on incomplete information of the future.

With poker, we are dealt hands then bet on decisions based on not knowing what cards our opponents have and/or what is shown on the river.

We then have the options to call, bet, raise or fold during the process.With trading, we take trades based on probability predictions without knowing where the price will end up at.

This is due to new information which comes into the market including (demand, supply, news, economic indicators, micro and macro aspects).

SIMILARITY #7:

We lose A LOT! (Losses are inevitable)

Taking small losses are part of the game with both poker and trading.

With poker, it is important to wait patiently until you have a hand with a high probability of success.

Some of the best poker players in the world, fold 90% of the starting hands, they receive. Some professional poker players can go through weeks and months without a win.

With trading, we can lose over 40% to 50% of the time.

In general, I expect around two losing quarters a year. I know that when there are better market conditions, it will make up for the small losses.

SIMILARITY #8:

You must learn to earn (Education is vital)

You need to understand and gain as much knowledge as you can about poker and trading before you commit any money.

With poker, you need to understand:

• The rules of the game.

• The risk per move.

• The amount of money you should play per hand.

Once you know these points, you’ll be able to develop some kind of game plan with each hand you play.

With trading, you need to understand:

• The MARKET (What, why, where are how?)NB*

• The METHOD (What system to follow before taking a trade).

• The MONEY (Risk management rules to follow with each trade)

• The MIND (The frame of mind you must develop to succeed)

SIMILARITY #9:

Perseverance is the key ingredient to success

You need to take the time and have the determination to become a successful trader and poker player.

With poker, you’ll need to keep at it and apply strict money management rules with each hand played. With trading, you’ll need to know your trading personality, know which trading method best works you and understand your risk profile…

I’ll leave you with a quote from Vince Lombardi (American football player, coach, and executive):

“Practice does not make perfect. Only perfect practice makes perfect”

Do you think trading is like poker?

If you enjoyed this daily lesson follow fore more!

Trade well, live free.

Timon

MATI Trader

1 Rule to STOP a portfolio CRASH I guess my number one rule to prevent a portfolio going bust is my 20% Rule…

The rule is simple.

If my portfolio ever drops below 20%, due to a losing streak, I halt trading…

Notice the word halt instead of STOP.

When a portfolio is down 20%, this is where you’ll halt your trading but you’ll

KEEP following your trading strategy.

So, you’ll simply demo trade your system and continue journaling your entries and exits…

And only once the equity curve (your portfolio) goes back to all-time highs (on paper of course) then you can resume trading live…

Do you have a trading question? Ask in the comments and I'll fully answer it in one of these posts on TradingView...

Trade well, live free

Timon

MATI Trader

27 Ways to Save money to TradeSaving money to trade, or in general, can be a pain.

Either it drops your quality of life, or you find that you just can’t save a cent at the end of the month.

No matter what you’re earning, I’m going to show you exactly how to save money the easy way.

Here are my 27 favourite money savings tips with a couple of personal notes…

SAVINGS TIP #1: Stick to your shopping list

Write your shopping list down on a piece of paper or on your phone, and stick to it to avoid overspending.

When you are prepared for what you have to buy when it comes to your grocery shopping, this will more likely stop you from buying extra items you don’t need.

SAVINGS TIP #2: Pay with hard cash

Pay using real money instead of swiping your debit or credit cards.

When you pay with a card, instead of cash, you’ll find that you’ll spend more money on unnecessary items than you should or with money you don’t even have.

Personal note:

While I’ve been living and trading in Greece, I find this is the best savings tip I’ve used so far.

SAVINGS TIP #3: Pay yourself firstay yourself first

As soon as you’re paid your salary, wage or income for the month – deposit a portion of that money straight into your trading or savings account.

I like to use the 10% rule, but this all depends on what you can afford to deposit. This means, if you earn R60,000 per month deposit R6,000 into your trading account or savings account each month.

SAVINGS TIP #4: Don’t shop when ‘hangry’ or emotional

Avoid shopping when you’re feeling hungry, thirsty, angry or upset.

You’ll find you’ll spend more money than you should. In a recent study: Hungry mall shoppers who were hungry spent on average 64% MORE than non-hungry shoppers.

Make sure you have a nice meal and drink lots of water, before you go on your next shopping trip.

SAVINGS TIP #5: The ‘cookie-jar’ approach

When you empty your pockets, at the end of the day, drop them into a yearly cookie jar for your savings.

You’ll be surprised how many thousands of rands you’ll be able to save, collect and be able to deposit into your trading account for the next year.

SAVINGS TIP #6: Use the 24-Hour-Rule

Before paying money for non-essential and expensive items on clothes, cosmetics, appliances or even tools, just wait 24 hours before buying it.

You may find that you’ll lose that desire to buy them after 24 hours, which will save you tens of thousands of rands a year. Maybe when your parents said “sleep on it”, there was method behind their madness.

SAVINGS TIP #7: Go generic

Save a ton of money by buying the generic prescription medicines instead of paying a fortune for the name branded drugs.

Ask your local pharmacist or physician if you can have the generic prescription drugs instead of the brand-name drugs.

You’ll find that the generic products cost far less than the brand names, and will work equally well.

SAVINGS TIP #8: A quick breakfast that lasts a week

Breakfasts are not only the most important meal of the day, but can also be the quickest, easiest and most inexpensive meal for the day.

When you eat a full and healthy breakfast, you’ll find it will keep you from going out to eat an expensive lunch…

Personal note:

For the last two years, I have had the same breakfast which I make once and it lasts an entire week.

This has truly been life-changing as it makes my day start with one less decision to make before I get on with the rest of the day.

It’s called “Overnight Oats”. If you’d like to see my personal recipe feel free to click here…

SAVINGS TIP #9: Follow the 30-Day-Rule

Before you buy something really expensive, give it 30 days and then decide if it’s worth it.

I’m talking about items like jewellery, motorbikes, paintings, juice extractors and any other item that can cost over R3,000.

SAVINGS TIP #10: Don’t be fooled by sales

Avoid sales and don’t be duped by discounts, special offers, buy 1 get one free etc…

Remember this for every time you see a sale for 50% at the next Black Friday’s Special.

“You’re not saving 50% of your money, you’re spending 50% of your money that you weren’t planning to spend in the first place.”

SAVINGS TIP #11: Skip the alcohol and bottled water!

When you go out to a restaurant, avoid spending unnecessary money on alcohol and expensive water bottles.

A standard restaurant can mark up their cost of alcohol by three to five times.

Instead order just plain water or even a sugar free soda.

Personal note:

In Europe I have noticed that when you ask for tap water, they pour it from a bottle of expensive water (R30) anyway. This is due to the danger of drinking tap water in Europe.

SAVINGS TIP #12: Own your doggy bag

Ask your waiter to put the food that you didn’t finish in a doggy bag, so you can save money on lunch for the next day.

People are far too embarrassed about everything nowadays which I think needs to stop.

There should not be a stigma attached to taking leftover food home.

Everybody easts, drinks and sleeps. And when it comes to the food you ordered at the restaurant, you paid for it so why waste it?

This will also save you money, time and effort the next day for lunch, which will make your trip to the restaurant EVEN MORE WORTH IT.

SAVINGS TIP #13: Put three items back after shopping

When you’ve added extra items to your shopping that weren’t on the list, to avoid overspending, put back at least three items that you believe you can live without.

It’s very easy to walk through the final naughty aisle grabbing a whole bunch of crisps, chocolates, biltong, dried fruit and even a bottle of juice.

SAVINGS TIP #15: Cut down on smoking and drinking

Try to cut down your smoking and drinking by half the number per day.

This is really tricky to do but if you put your mind to it and challenge yourself, I know you can achieve this.

Personal note:

What I do with smoking is I’ve limited it to two in the morning, two in the afternoon and two at night.

This tip has saved me hundreds of rands per week from buying more boxes and I will continue to try cut it down until I’ve quit completely.

SAVINGS TIP #16: Fill up your milk with water

As soon as the milk reaches, the half way mark – fill it up with water. YOU WON’T TASTE THE DIFFERENCE.

As a parent or as a milk drinker, it can be extremely expensive to buy milk on a daily basis.

SAVINGS TIP #17: Become a vegetarian (at least once a week)

At least once a week, switch to meatless dishes which will help drop your grocery bill.

Replace it with: Chickpeas, couscous, okra, rice, sauerkraut, quinoa, beans, nuts, pasta dishes etc… You’ll be surprised what you can find at your local supermarket.

Personal note:

Inspired by my cousin, she insisted I cut meat out just once a week. I call this day “Meatless Monday”.

EXTRA MONEY SAVINGS TIPS

#18: Grow your own vegetables

#19: Sign up for loyalty cards

#20: Track your spending on your finance budget app

#21: Make meals that will last a week e.g. Lasagna, casserole, giouvetsi, gemista, soups, roasts, ratatouille etc…

#22: Buy the generic foods rather than the expensive name branded foods

#23: Pay careful attention to expiration dates

#24: Check your eggs in their boxes and your vegetables in their packets

#25: Freeze your foods in bulk

#26: Eat a meal before going to a restaurant

#27: Keep to Pay-As-You-Go with your cell phone account and use the Wi-Fi to call on WhatsAapp

This will be fun!

With these savings tips you can watch your money grow in your savings and trading account!

Why you should LOVE your losses 5 REASONSWe are brought up in society to WIN, WIN, WIN!

Throughout our upbringing we must either:

Achieve top grades

Drive the fanciest cars

Wear and own the best brands

In other words, we are raised to win with everything we do in life, until you get welcomed into the world of trading.

Today I’m going to be the contrarian and share with you why you should love, embrace and own your losses in order to ensure you grow your portfolio on a consistent basis.

Let’s start with:

What happens after a winning streak?

There will be a time during your trading career, where you’re going to endure a magical time where you end up taking sometimes 6, 8 to even 10 winning trades in a row.

Your portfolio will be smiling at a new all-time-high and, you’ll feel invincible. You may think that you’ve cracked the holy-grail of trading where you can quit your job and just make a living with the markets.

Research shows that individuals tend to invest and trade more actively when their most recent trading performance was successful. In fact, here are:

4 DANGEROUS Actions Traders Take During A Winning Streak:

They take on more trades.

They upper their trading positions.

They start to go against their trading strategy.

Their self-confidence and greed levels pick up.

Winning streaks are normal and INEVITABLE, but eventually they’ll end and the losing streak will begin.

No matter how good you believe you are as a trader or how perfect your trading execution skills are, there will be a time when the honey-moon phase for your trading strategy will be over and the markets will stop acting in your favour every time.

The reason is that due to the conditions of supply and demand, the markets environment will eventually change.

A market that was trending up or down, could enter into a 3-months sideways phase very easily. When this happens, you will enter into a drawdown (downside) phase.

The problem is not the downside for the next three months. The problem is how you’ll treat your trading going forward, based on the DANGEROUS actions you would have taken during your winning streak.

Let’s bring them back, to see what will happen to ‘invincible traders’ portfolios and minds with their unexpected losing streak…

They start to take on more trades –

THIS MEANS MORE LOSSES

They upper their trading positions –

THIS MEANS BIGGER LOSSES.

They start to go against their trading strategy –

THIS MEANS UNEXPECTED LOSSES.

Their self-confidence and greed levels pick up –

THIS MEANS DEPRESSION MAY KICK IN WHICH WILL LEAD TO QUITTING.

Now going back to what we said in the beginning.

When a winning streak ends, you should love, embrace and own your losses because of these five reasons.

5 Reasons To Love Your Trading Losses

Reason #1: Losses are part of your trading success journey

Once you have a winning and proven trading strategy, you’ll need to go back to your trading journal to remind you of the flow of winning streaks, losing streaks, average gain & loss per trade and other historical statistics.

I’ve back, forward and real-tested the MATI Trader System strategy for over two decades and so I know exactly what kind of winning and losing streaks are to come and that I’ll end up profitable in the medium to long term.

Reason #2: Losses help keep your emotions in check

Knowing there are inevitable losses to come, this should curb the ego, greed and fear emotions.

Reason #3: Losses should keep your risk low

With a losing streak that is inevitable to enter your trading results, this alone should be a reason to keep your losses low.

I personally never risk more than 2% or my portfolio in any one trade, no matter how many winning trades I take in a row. You can read more about the timeless money management rules in lesson three of the MATI Trader System programme.

Reason #4: Losses stop the “Hot Hand Fallacy”

Another reason that I love losses when trading is that it reminds me that the winning streak will come to an end.

This keeps me humbled and grounded to know that there will be a time where I’ll need to give back to the market, when the trading environment is less conducive to the trading strategy.

Reason #5: Losses don’t take me back to the drawing board

After a winning streak ends, you’ll find new traders will then quit trading and look for another system to find that will work for them during the changing market environment.

The thing is they don’t realise and accept that losses come with the trading territory and that one should never throw a profitable system away because a market enters into a drawdown phase.

Let me know what you thought about today's trading tutorial. I'm just sharing information I've learnt over the last 20 years as a trader.

Trade well, Live Free...

Timon

MATI Trader

QA WHAT is a Margin Call? QA: What is a Margin Call?

You don't want this.

It's an automatic instruction to close out your trade/s when you have insufficient funds in your portfolio.

This is a safety mechanism for both you and your broker.

It's also where either your trading platform, your broker or an automatic message via email will tell you to either deposit more funds into your account, close your trades or will warn you that your positions will be automatically closed.

*DO YOU HAVE ANY TRADING QUESTION?

Comment below or LIKE this post if you found it helpful.

I've been trading for the last 20 years and it's my hobby to help provide analyses and help traders get on the right foot.

I'm happy to have a platform like TradingView to do it :)

Trade well, live free.

Timon

MATI Trader

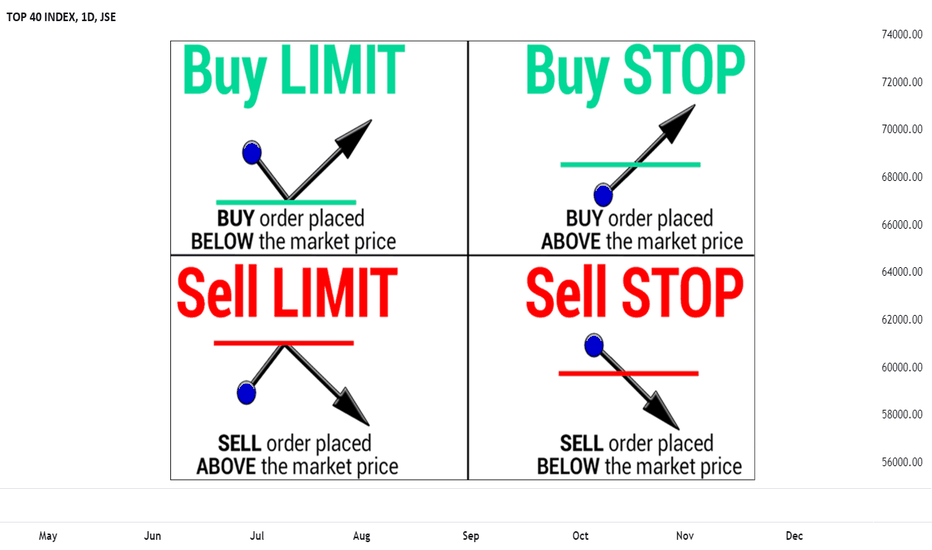

5 Market entry Orders Easily ExplainedBack in the old days, to action a trade you only had two easy options.

Buy or sell…

Fast-forward into the present day, and today you get slapped with five different options to choose from when you get into a trade.

Right now, I’m going to simplify these five trading entry orders in way that you’ll never forget.

Entry Order #1: Market Order

The first entry order is the easiest to understand.

This is where you’ll buy or sell at the most current market price.

When you choose a market order, it is the quickest, most effective and easiest way to enter into your ‘long’ or ‘short’ trade at the current bid (buy) or offer (sell).

Entry Order #2: BUY Limit

When you place a ‘Buy Limit Order’, you’ll place your long trade entry price BELOW where the current price is trading at.

Once the market price drops on or below the Buy Limit Order price, you will be automatically entered into your ‘long’ trade.

EXAMPLE: BUY Limit

If BHP Billiton’s share price is currently trading at R305 per share and you would like to buy (go long) at R300 per share, you’ll choose the Buy Limit Order.

You’ll then wait for the market price to drop to your chosen order price or below it where you’ll then be automatically entered into your ‘long’ trade.

Entry Order #3: SELL Limit

When you place a ‘Sell Limit Order’, you’ll place your short trade entry price ABOVE where the current price is trading at.

Once the market price hits this entry point or above it, you will be automatically entered into your ‘short’ trade.

EXAMPLE: SELL Limit

If BHP Billiton’s share price is currently trading at R300 per share and you would like to sell (go short) at R305 per share, you’ll choose the Sell Limit Order.

You’ll then wait for the market price to rise to or above your chosen order price, where you’ll then be automatically entered into your ‘short’ trade.

Entry Order #4: BUY Stop

When you place a ‘Buy Stop Order’, you’ll place your long trade entry price ABOVE where the current price is trading at.

Once the market price hits this entry point or above it, you will be automatically entered into your ‘long’ trade.

EXAMPLE: BUY Stop

If BHP Billiton’s share price is currently trading at R300 per share and you would like to buy (go long) at R305 per share, you’ll choose the Buy Stop Order.

You’ll then wait for the market price to rise to or above your chosen order price, where you’ll then be automatically entered into your ‘long’ trade.

Entry Order #5: SELL Stop

When you place a ‘Sell Stop Order’, you’ll place your short trade entry price BELOW where the current price is trading at.

Once the market price drops on or below the Sell Stop Order price, you will be automatically entered into your ‘short’ trade.

EXAMPLE: SELL Stop

If BHP Billiton’s share price is currently trading at R305 per share and you would like to sell (go short) at R300 per share, you’ll choose the Sell Stop Order.

You’ll then wait for the market price to drop to your chosen order price or below it where you’ll then be automatically entered into your ‘short’ trade.

I hope this helps with knowing how to place an entry order for next time!

Trade well, live free...

Timon

MATI Trader

Why you should never HOLD a boring trade - Rule I followGet in and get out in the shortest time possible.

This is the science of successful trading.

But what happens when a trade turns out to be more like a non-performing investment?

When you hold a long-term trade, there are a few issues that will follow including the:

Opportunity cost

You can find other higher probability trades, instead of having your money tied up aimlessly in a sluggish market.

Unnecessary impatience

You’ll eventually feel rather anxious and frustrated holding onto a long-term trade, when you are better off trading in a market that is moving.

The fake-out

With an ongoing trade, the breakout pattern may fizzle out into a low probability fake-out trade (a trade that turns against you).

I created a rule to avoid this situation from ever occurring again.

I call it a time stop loss...

After 7 weeks of holding a trade, exit the trade and look for a better opportunity.

Worst case you take a smaller loss than you thought.

Best case you take a smaller profit than you expected.

But you'll stop holding trades that aren't performing and stop paying daily costs with trading....

Sound good?

Trade well, live free.

Timon

MATI Trader

My Interview with US Successful Trader Peter L. BrandtThe Internet has truly made the world a smaller and a more accessible place.

In 2013, I stumbled across world-renown trader, author and owner Peter L.

Brandt, on Twitter and his blog. I sent him a request for him to

join one of the most elite South African trader groups on Skype.

We had some fantastic chats over the next couple of days. There are words

of wisdom that are far too essential to let them slip by.

I’ve collated some of the timeless lessons Peter L. Brandt shared with me.

I hope you enjoy the interview and find it useful for your trading career.

Timon: I’ve never met a trader who trades long time-frames on Forex and

commodities, do you believe technical charts can be used to predict market

movements?

Peter: I absolutely positively do NOT believe I can predict the markets. I

absolutely positively do NOT believe charts are predictive tools any more than

a MACD, COT, Moving Averages or anything else. My win rate is historically

around 38%, although I made some changes to the system in an attempt to

boost that to 45%. Generally, 100% of my profits come from 10% of my

trades. It is a matter of trying to keep the other 90% from being a net loss.

Timon: I agree with no one being able to predict the market movements,

however, I believe in probability predictions. If there is a breakout to the

upside, there is a higher probability for the market to continue moving in the

direction of the breakout. What is your take on when unfavourable markets

bring about a 15% or more drawdown on your portfolio?

Peter: Drawdowns come with the territory. The question to always ask for

discretionary traders is, whether their trading rules are out of sync with the

markets? If they are out of sync with their rules? or both? If I know the problem

are my rules being out of sync with the markets, I will never stop trading because I

cannot time my rules. I may cut back on the size during a losing period.

Timon: As my trading mentor and dear friend Igor Marinkovic

says, “Your biggest drawdown is still to come and so is your biggest

winning streak.” What are your thoughts on risk management principles?

Peter: As a general rule — very general rule — an excellent trader with a

great grasp of money management should have an average annual ROR that

is 1.5 to 2 times their worst drawdown, over the past three or five years. For

me, this is mandatory

Even daily patterns are made up of many hourly patterns that morphed, which

are made up of many 15-minute patterns that morphed etc... — I call it ‘Chart

Morphology’. The trick is to determine which patterns are real and which

patterns are more likely to morph.

Sometimes a market reveals itself by failing.

It is because of morphology that I seek patterns that are 10 to 12

weeks or longer. I’m also not worried about markets changing so drastically

that all conventional systems stop working. The reason is my belief that

markets are and have always been driven by fear, greed and money flows.

These things will always be the same.

Timon: Yes, that’s why I don’t believe in Holy Grail systems. I believe in

finding the system that suits your personality and risk profile. Along the way,

one should not feel scared about making mistakes, but be sure to avoid them

from being too costly. What would be your final feedback on trading in

general?

Peter: Sounds like you are well on your way to a long and profitable

career trading. Mistakes are the tuition charged by the markets for

learning. Unfortunately, the markets often decide the tuition rate, not

us. Hence, I only risk 0.5% per trade.

You have to develop your own style. I have never met another truly skilled trader who has copied his

or her style from another trader. This is true from a tactical standpoint,

but from a money management standpoint most skilled traders think

very much alike.

Forget about motivation and implement this insteadThere is an over-estimated word that people say. I’m talking about MOTIVATION.

“I need motivation to keep to a healthy diet.”

“I need motivation to go to gym six days a week.”

“I need motivation to see my friends.”

If I needed motivation to trade, I would have stopped trading over a decade ago. From today, I want you to remove the word motivation from your life and replace it with…

INTEGRATION

Integration is when an action becomes a habit without any effort and without any force. You make it a part of your daily life where you don’t need the motivation to do something.

To integrate something is to naturally enforce great discipline, passion and determination into your life.

I bet you already integrate certain aspects into your life such as,

Getting dressed

Brushing your teeth

Cooking food

Just like you’ve integrated a few of the above aspects into your life, so too have I done with trading.

For well over a decade, I have the same morning trading routine I’ve incorporated into my life.

I make coffee

Open my trading and chart platform

Look at the main index

Analyse charts using my MATI System

Place my trade orders

Let the market do its thing

That’s it. It’s what I do.

I don’t need the motivation or discipline from friends, family and colleagues when I follow my morning routine.

I’ve just integrated trading into my routine.

It’s time you stop the motivation and start integrating certain aspects into your life with everything that you are passionate about.

Trade well.

Timon (MATI Trader)

Secret Key to Becoming a Disciplined TraderDiscipline is the hardest trait to become good at in trading. We need it in analyzing charts and news updates as well as being aware of risk management and psychology. It's difficult to keep track of all those all at once. It can overwhelm us to become impatient and not aware of our mental and emotional states. Which results in poor performance.

I was in that phase in my life for 4 years straight. No coach was on my side guiding me through the journey. I had to teach myself everything that makes a person become a successful trader. It was tough, especially mastering the mental and emotional side of the game. Not being aware of those two and how to improve them is what led to consistent failure.

But when I began studying and applying what profitable traders do to be successful, I became one of them. It was hard though. I had to change my internal monarchy by facing my demons and tearing down old limiting beliefs. I used various techniques to make that happen. The results were astonishing. I became more mindful and self-aware. I understood my emotional nature, which allowed me to be quick to spot and tone down bad emotions.

I did the following to achieve that results:

1. Journaling.

It is a process of recording the what, why, and how behind the trade as well as your thoughts and emotions before, during, and after the trade. Doing this will keep a record for you to reflect on in the future when you want to improve your performance. That feedback will raise your self-awareness which will protect you from sabotaging your trading performance.

2. Meditating.

It is a mental exercise that trains the brain to be mindful and self-aware of your emotional triggers and behaviors that disrupt your performance. Moreover, it will allow you to improve your focus levels for a trading session. So, every day, sit quietly on your chair with your back straight and your eyes closed, then focus on your breathing pattern for 10-15 minutes.

3. Breathing.

I know you can breathe, but I bet you that your breathing is incorrect. Most people breathe through their mouths, which is wrong because the air doesn't get to the brain. The air we breathe through our nose releases certain chemicals in the brain that makes it awake and calm. It also does other things in the body that helps control it when fight/flight emotions trigger. Breathing techniques allow us to gauge those triggers during the trading session. Thus, whenever you tap into a negative state, stop and sit back on your chair, then do the following 4-7-8 breathing exercise. Inhale on the count of 4. Hold your breath on the count of 7. Then exhale on the count of 8. Do this 3-5 times.

Your OWN EXPECTATIONS are the BIGGEST thing HOLDING YOU BACK! 🤷HOW you can get control of your emotions when trading

So if trading is stressful or a rollercoaster, you're not alone. 🎢

BUT, its quite a simple fix really.🤔

You're pushing things a little too hard. Chasing an expectation that in return is causing you stress. 😢

Thing is, its actually pushing you further away from your long term goals too.

Long term hopes and dreams, short term thinking, greed and poor decision making.

A fear over your running trades constantly watching them on screen. You aren't listening or paying attention to what is going on around you.📱

It can be different though....

Think about it..🤔

If you had a £10,000 account and traded 0.01 on 1 or 2 pairs - would you be stressed? 🧘♂️

No. Thought not.😅

The fear would be gone, you wouldn't be bothered - why?

Because your risk is F all. The other upside is you would be fine letting your winners run too.💪🏻

So, instead of chasing money - focus on how you want to feel and work back from it.😳

If you have a £500 account - what risk are you truly comfortable with at any one time?

What losing run could you experience based on your strategy win rate his could you factor this in too.

If you traded 1 pair at 0.01 I am confident you would feel ok; but trading 0.1/0.2 etc on a few pairs and you won't be.

So, what am I saying?

Strip it back, get comfortable - no one likes to feel stressed and worried over their trades BUT in return you will need to realign your expectations to the long game. 🤝

Think - 2-5 years.🤔

Not how much you can make in a day/week.... you simply won't survive.👍🏻