IBKR – Scaling Globally with Automation, Innovation, and InflowsCompany Snapshot:

Interactive Brokers NASDAQ:IBKR is delivering explosive growth, driven by unmatched automation, deep market access, and strong global demand for low-cost, self-directed investing.

Key Catalysts:

Account Growth Surge 🚀

Q2 saw 250,000 new accounts, pushing 2024’s total to 528,000+—already surpassing all of 2023. This signals powerful user acquisition at scale, especially in volatile and rate-sensitive environments.

Global Expansion 🌐

Rising momentum from international clients and introducing brokers positions IBKR as a top gateway for U.S. equity and options access worldwide.

Product Innovation 🧠

Thousands of platform upgrades in Q2 alone, including:

IBKR InvestMentor app for educational engagement

“Investment Themes” tool, simplifying access to trend-driven strategies

These add stickiness and improve the user experience.

Strong Financial Engine 💵

Record net interest income of $860M (+9% YoY), driven by:

Elevated client cash balances

Robust securities lending revenue

IBKR’s business model thrives on rate volatility and market churn, offering powerful operating leverage.

Investment Outlook:

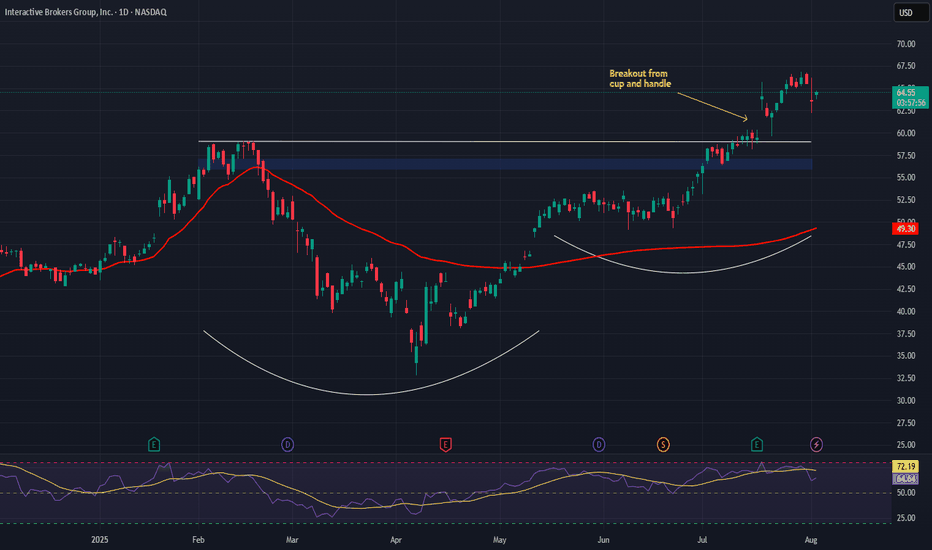

Bullish Entry Zone: Above $56.00–$57.00

Upside Target: $80.00–$82.00, supported by client growth, global reach, and rate-sensitive earnings strength.

📈 IBKR is a rare fintech that’s both profitable and rapidly scaling—making it a top pick for exposure to the next wave of digital brokerage adoption.

#Fintech #IBKR #InteractiveBrokers #SelfDirectedInvesting #TradingPlatforms #BrokerageGrowth #InterestIncome #GlobalMarkets #TechInFinance #RetailInvesting #InvestMentor #OptionsTrading #ScalableFinance