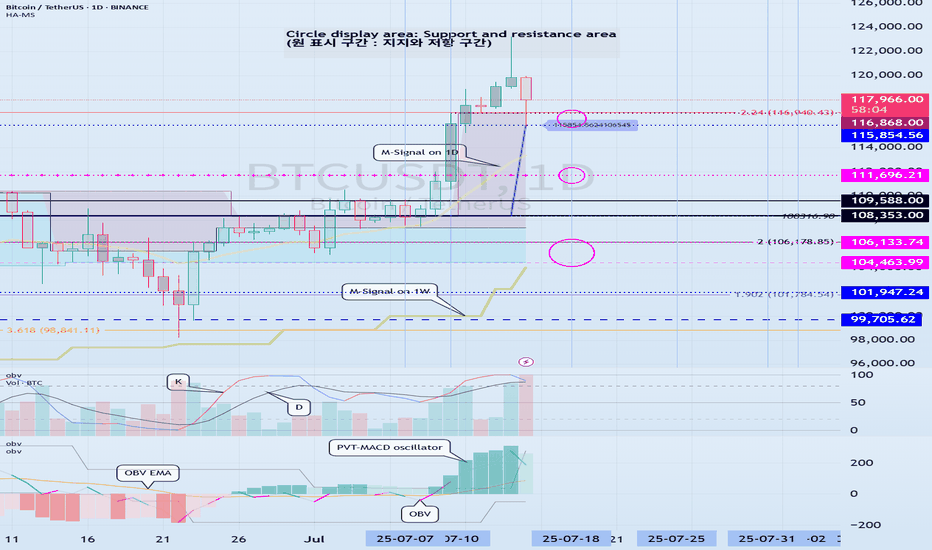

Support and resistance zones: 115854.56-116868.0

Hello, traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

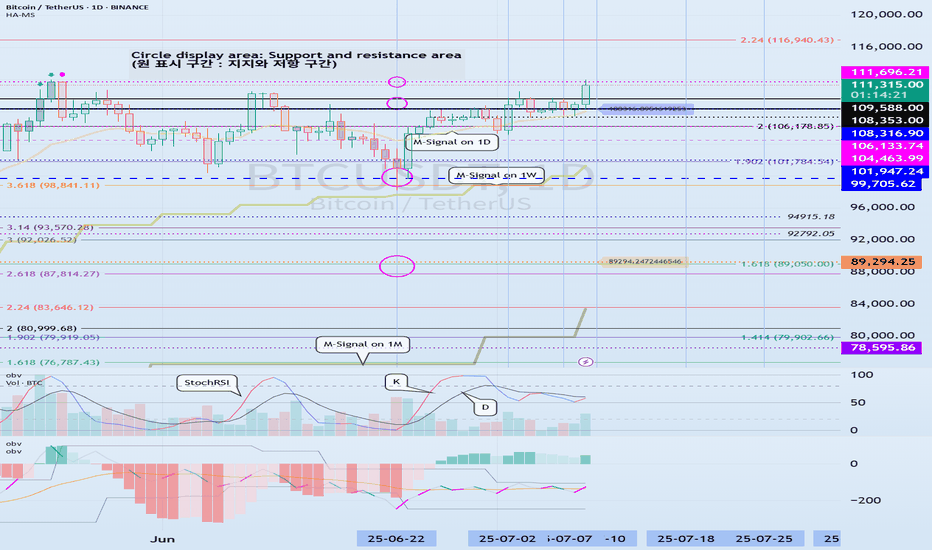

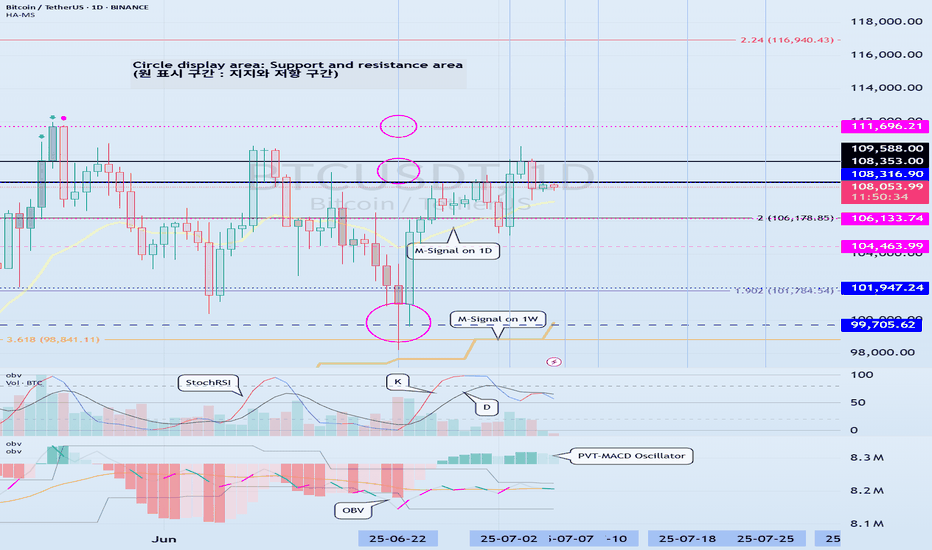

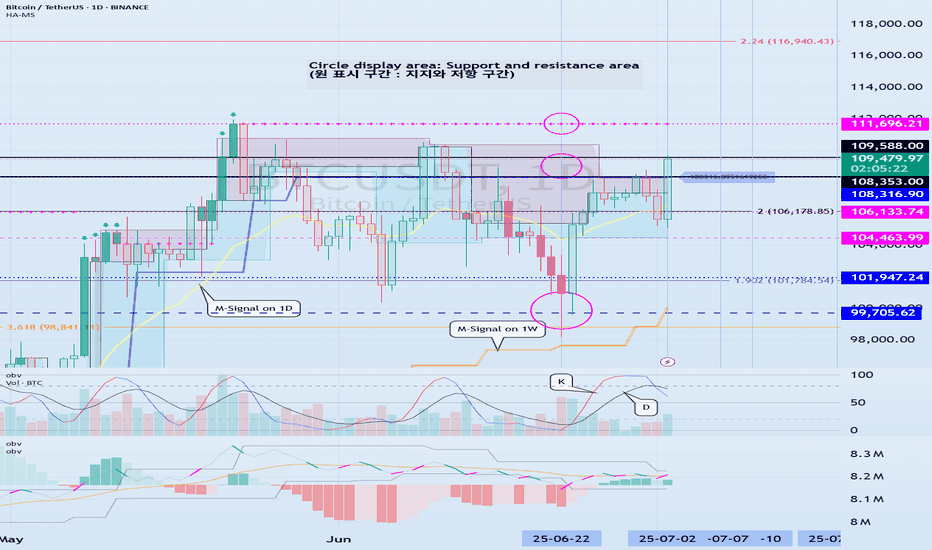

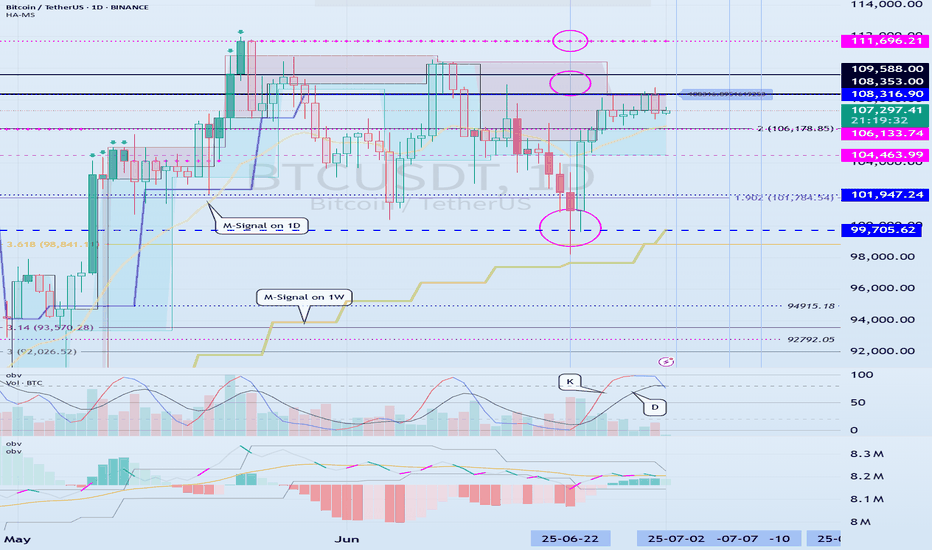

(BTCUSDT 1D chart)

This decline created a new trend line.

This added a period of volatility around July 31st.

If the HA-High indicator is generated at the 115854.56 point, the key is whether it can be supported and rise around that point.

If it falls below the HA-High indicator, there is a possibility of a downward trend.

Therefore, it is necessary to look at which support and resistance points the price is maintained at as it passes the volatility period around July 18 (July 17-19).

-

Since the StochRSI 80 indicator is formed at the 116868.0 point, it is important to be able to maintain the price above 116868.0 if possible.

Therefore, assuming that the HA-High indicator will be generated at the 115854.56 point, the key is whether there is support around 115854.56-116868.0.

Next, since the M-Signal indicator on the 1D chart is rising above 116696.20, we need to check if it is supported by the M-Signal indicator on the 1D chart or around 116696.21.

-

So far, we have talked about how to maintain an upward trend by breaking through a certain point or section.

That is,

- The K of the StochRSI indicator should be below the overbought section and should show an upward trend with K > D.

- The PVT-MACD oscillator indicator should show an upward trend. (If possible, it should be above the 0 point.)

- The OBV indicator of the Low Line ~ High Line channel should show an upward trend. (If possible, it should be maintained by rising above the High Line.)

I said that when the above conditions are met, there is a high possibility that the upward trend will continue.

On the other hand, in order to change to a downward trend,

- The DOM (60) indicator should be created and show resistance near the DOM (60) indicator.

- When the HA-High indicator is generated, it should show resistance near the HA-High indicator.

- When the K of the StochRSI indicator falls from the overbought zone, it should switch to a state where K < D and show a downward trend. (However, caution is required as volatility may occur when K reaches around the 50 point.)

- The PVT-MACD oscillator indicator should show a downward trend. (If possible, it is better if it is located below the 0 point.)

- The OBV indicator of the Low Line ~ High Line channel should show a downward trend. (However, it should show a downward trend in the state where OBV < OBV EMA is present.)

When the above conditions are satisfied, there is a high possibility of a downward trend.

Among these, the most intuitive thing to know is whether the DOM (60) indicator and the HA-High indicator are generated.

This is because, in order to first switch to a downward trend, a signal that the current price position is a high point must appear.

The DOM(60) indicator is an indicator that indicates the end of the high point.

Therefore, if the DOM(60) indicator is generated, it is likely to be a high point.

However, since it can be supported and rise near the HA-High indicator, you should check whether there is support in the HA-High ~ DOM(60) section and respond accordingly.

The HA-High indicator is an indicator created for trading on the Heikin-Ashi chart, and if it falls below the HA-High indicator, it is likely to be a point where a downtrend will begin.

-

Since the same principle applies to any time frame chart you trade, it is easier to understand the chart and determine the timing of the start and end of the transaction.

However, the basic trading method must be a split trading method.

The reason is that if it rises in the HA-High ~ DOM(60) section, it is likely to show a stepwise upward trend, and if it falls in the DOM(-60) ~ HA-Low section, it is likely to show a stepwise downward trend.

This basic trading method, that is, buying near the HA-Low indicator and selling near the HA-High indicator, will eventually make you familiar with day trading, which will have an effective influence on finding a buying point when making mid- to long-term investments.

It is wrong to say that you are good at mid- to long-term investments when you are not good at day trading.

You were just lucky.

Unfortunately, this kind of luck cannot last.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Tradingstrategy

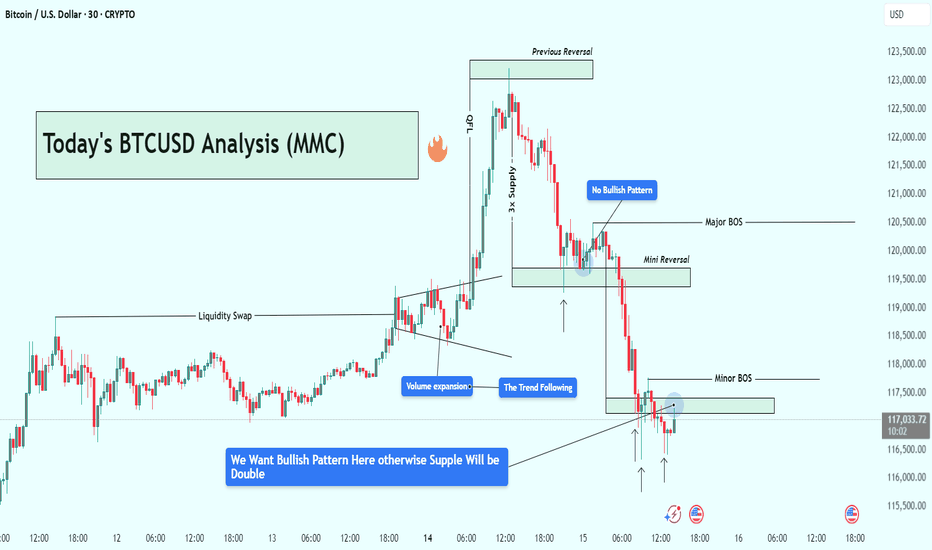

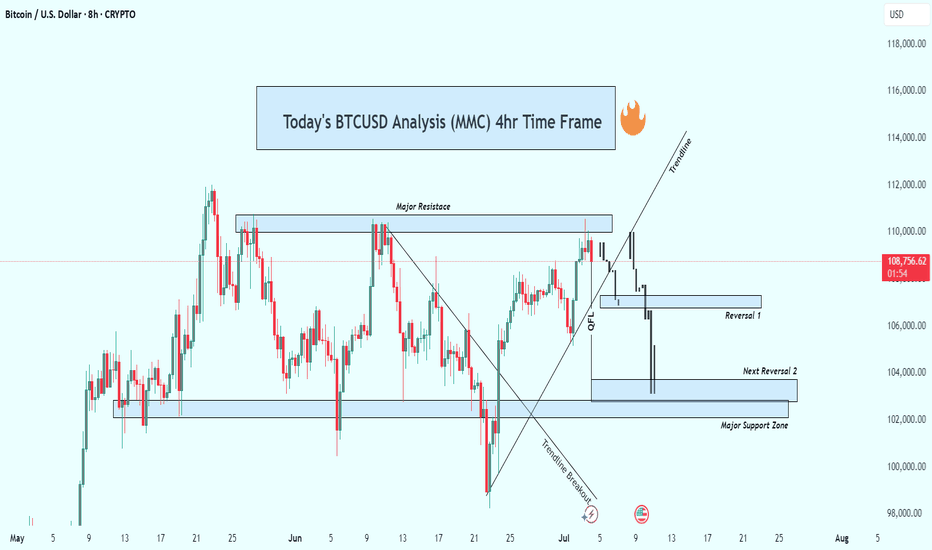

BTCUSD Analysis : Bitcoin Trend Shifted/Bullish Pattern + Target🧭 Overview:

Bitcoin’s recent price action has delivered a textbook sequence of institutional liquidity play, volume-driven breakout, and supply zone rejection. After rallying on increasing volume, BTC tapped into a significant 3x Supply Zone—which also served as a previous reversal point—and was swiftly rejected. The market is now trading around a key decision zone where traders must stay alert for a confirmed bullish reversal, or risk getting caught in further downside.

🔍 Step-by-Step Technical Breakdown:

🔸 Liquidity Grab + Volume Expansion

The move began with a liquidity sweep, as BTC pushed above recent highs, hunting stop-losses and inducing breakout traders. This kind of price manipulation is typical of smart money accumulation/distribution zones.

Immediately following that, we observed a volume expansion—a strong signal that institutional players had stepped in, propelling BTC upward with conviction. This expansion pushed price sharply into the 3x Supply Zone, a critical zone of interest from a previous bearish reversal.

🔸 3x Supply Zone – The Turning Point

Once price entered the 3x Supply Zone, bearish pressure resumed. No bullish continuation pattern appeared on the second attempt into this zone—confirming that sellers were defending it aggressively. This area has now been validated as a strong supply barrier, capable of initiating trend reversals.

🔸 Major BOS – Structural Shift Confirmed

Price broke below key support around $120,500, which marked a Major Break of Structure (BOS). This BOS is crucial—it represents a shift from a bullish to bearish market structure and is often the signal that retail longs are trapped.

This BOS was followed by a mini reversal zone, but again, no bullish confirmation appeared there—highlighting market weakness.

🔸 Minor BOS & Trendline Breakdown

Further downside action led to a Minor BOS near $117,800, reinforcing the bearish sentiment. Additionally, the ascending trendline—which had supported BTC’s rally—was decisively broken and retested from below. This confirms a shift in momentum, now favoring sellers.

📍 Current Price Action – Critical Decision Zone

BTC is currently hovering around $117,000, right at a potential demand zone. While there was a brief bullish reaction, the market hasn’t formed a valid bullish reversal pattern yet.

There’s a clear message from the chart:

“We want a bullish pattern here—otherwise, support will break and supply will double.”

In simple terms, unless bulls step in with structure (higher low, engulfing candle, etc.), sellers will likely take over, and price may test deeper support levels.

🎯 What to Watch Next:

✅ Bullish Case:

If BTC forms a strong reversal pattern (e.g., double bottom, bullish engulfing, or inverse head & shoulders), we can expect a short-term recovery back to:

Target 1: $118,500

Target 2: $120,000–$120,500

❌ Bearish Case:

Failure to hold this zone and no clear bullish pattern = likely continuation to the downside, potentially targeting:

$116,000

Even $114,500 in extended moves

🧠 Trading Insights (Educational):

Volume + Structure = Edge

Don’t rely solely on candlestick signals—combine them with structural breaks and volume to get confluence.

Supply Zones Aren’t Just Rectangles

The 3x Supply Zone was powerful because it had historical context, volume convergence, and psychological resistance. These layered factors make zones more reliable.

BOS Isn’t a Trendline Break

BOS means real structural shift. In this case, lower highs and lower lows confirmed the change.

💡 Final Thoughts:

BTC is at a make-or-break level. The recent rejection at the 3x supply zone has shifted the momentum, and buyers must prove their strength now—or risk watching the price unravel further.

Stay patient, wait for structure, and never fight momentum.

Space and Time: Trading Strategy · 1 BTC = 2.5 BTC (PP: 150%)Are you interested in a double-up?

Let's use round numbers to keep it simple.

Trade: Buy 1 BTC STXUSDT = Get 2.5 BTC (150% profits).

Time duration: 20-40 days.

Risk: Very low (time).

The risk can be calculated in time. Since this is a spot trade, you cannot get liquidated. In the worst case scenario, you wait. This is the only risk if the chart breaks down. If it works as planned, you can get 150% profits (250% earnings) by selling on target.

Time duration is "short-term." Which is within 30 days. Here I set 20-40 days to allow for any unexpected variations.

The trade is any amount you want. $1,000 USDT bought at current price, say 0.0890, would result in $2,500 USDT if selling happens at 0.2229. This is just an example of course for illustration purposes.

The trick is to be ready to wait. If waiting is hard, one can be use diversification to be entertained. Say, $250 USDT on four different pairs that have good potential for growth. Can be $2,500 USDT by 4 if the capital is $10,000. Or $10,000 USDT by 10 if the capital is $100,000. There are many different ways to approach the market.

A different approach: $10,000 in. The market (pair in question) grows 25%. Close position (sell). Result = $12,500. Find new pair and repeat.

The stop-loss can be a tight one at 5%. If prices drop 5% close position. Result = $9,500. Try again with a different pair. The stop-loss can be set at 10%, 15%, 20%, based on the chart, etc.

There is also a trailing stop. Adjust the stop below a certain level as prices rise, after you catch the rising trend. This is a bit more advanced and it is mainly used by profitable traders.

Patience is key. If you can wait, you can win.

Space and Time (SXT) is set to grow. How you approach this market is up to you. Remember to do your own research and planning. This is not financial advice. I am sharing for learning and entertainment purposes only.

Thank you for reading.

Namaste.

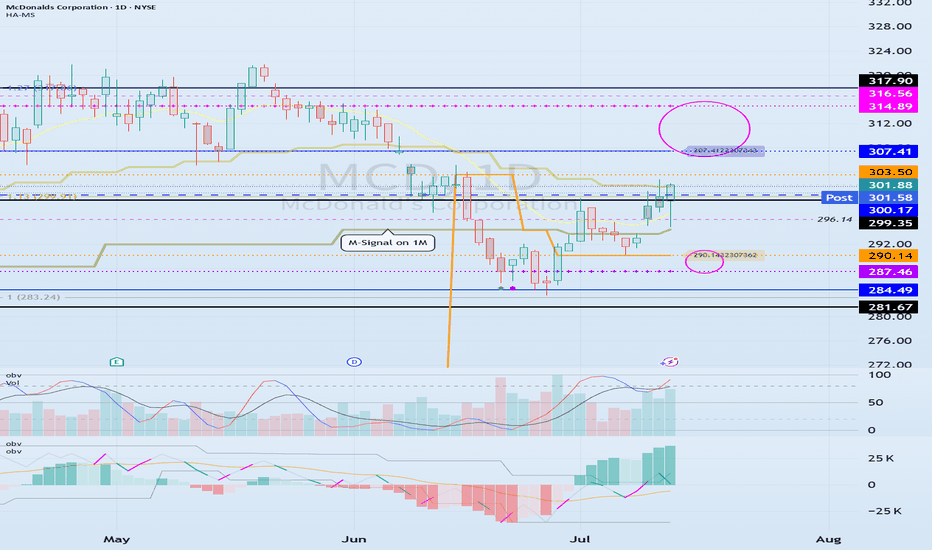

The key is whether it can be supported and rise near 300.17

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(MCD 1D chart)

Before following the basic trading strategy, the first thing to check is whether the current price is above or below the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, there is a possibility that it will turn into a medium- to long-term downtrend.

Therefore, if possible, it is recommended to trade stocks whose prices are above the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, you should respond quickly and briefly using the short-term trading (day trading) method.

-

The support and resistance zones can be seen as the 287.46-290.14 zone and the 307.41-314.89 zone.

The 287.46-290.14 zone is the DOM(-60) ~ HA-Low zone, and the 307.41-314.89 zone is the HA-High ~ DOM(60) zone.

These two zones are likely to form a trend depending on how they break through, so they can be seen as support and resistance zones.

-

The 300.17-316.56 zone is the HA-High ~ DOM(60) zone on the 1W chart.

Therefore, we need to check whether it can receive support and rise in the 300.17-316.56 zone.

Therefore, if it falls near the 307.41-314.89 range, you should check for support near 300.17.

-

If it rises above the HA-High ~ DOM(60) range, it is likely to show a step-up trend, and if it falls in the DOM(-60) ~ HA-Low range, it is likely to show a step-down trend.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

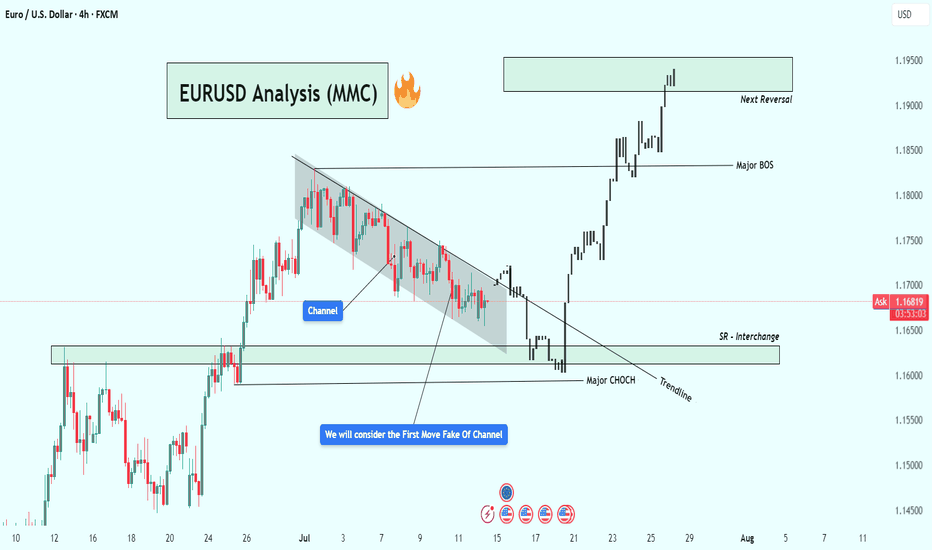

EURUSD Analysis – Smart Money Breakout + Reversal Zone in Play🔹 1. Bearish Channel & Liquidity Trap Setup

Price action from late June into mid-July formed a clearly defined descending channel, with consistent lower highs and lower lows. This structure likely attracted retail traders into short positions, expecting continued downside.

💡 Key Insight: The initial breakout of the channel was a fake move — often referred to as a liquidity grab or inducement. This is typical in smart money models where institutions trap early traders before the real move begins.

🔹 2. Major CHoCH (Change of Character)

Shortly after the fakeout, price sharply reversed and broke a major internal structure level, giving us our first CHoCH confirmation. This is a critical event in SMC, signaling a possible trend reversal from bearish to bullish.

Why it matters: A CHoCH after a channel + fakeout combo is a strong reversal signal, especially when supported by volume and aggression.

Visual cue: Look at the bullish engulfing momentum candle post-fakeout — this was the moment smart money entered.

🔹 3. Trendline Break + SR Interchange (Support/Resistance Flip)

Following the CHoCH, price broke the trendline and came back down to test a high-probability SR Interchange Zone — an area where previous resistance turned into fresh support.

This zone also aligns with the order block and inefficiency area, making it a premium entry for institutions.

Notice how price respected the zone before launching aggressively upward.

🧠 Note: This was the cleanest entry point in this setup — combining structure break, liquidity, and a demand zone.

🔹 4. Major BOS (Break of Structure)

After the retest, EURUSD broke the last major lower high, confirming a Bullish BOS (Break of Structure). This is where many traders realized the trend had shifted.

Market sentiment flipped from bearish to bullish.

Momentum increased, indicating institutional buying pressure.

🔹 5. Next Target: Reversal Zone (Supply Area)

Price has now reached a critical supply zone (1.1930 – 1.1970) where the next major reaction is likely to occur. This area was previously a strong rejection point, and it aligns with a potential higher timeframe supply zone.

⚠️ Watch for:

Bearish rejection wicks

Liquidity sweeps above highs

Bearish engulfing or mitigation patterns

CHoCH on lower timeframes (1H, 15m)

✅ Key Trading Takeaways:

Liquidity Trap: Retail was trapped inside a clean channel.

Fakeout Move: Induced shorts were wiped out.

CHoCH & BOS: Clear reversal pattern with momentum.

Perfect Retest Entry: Price retested demand and launched.

Current Area = Supply/Distribution: Great place to look for shorts or take profits.

📌 Possible Trading Plans:

🔸 Plan A: Reversal Short (Countertrend)

Entry: Inside 1.1930–1.1970 zone

Confirmation: Bearish PA + LTF CHoCH

TP1: Previous BOS (~1.1830)

TP2: Demand zone retest (~1.1650)

SL: Above 1.1980–1.2000

🔸 Plan B: Continuation Long (Breakout Bias)

Entry: Break + Retest above 1.2000 psychological level

SL: Below breakout wick

TP1: 1.2100

TP2: 1.2200+

🔖 Concepts Applied:

Smart Money Concepts (CHoCH, BOS, liquidity sweep)

Price Action Structure

Trendline break and retest

Supply & Demand Zones

Support/Resistance Flip (SR Interchange)

Volume + Momentum Confirmation

🔄 Conclusion:

This chart demonstrates a classic Smart Money narrative:

“Trap the retail, shift the structure, drive price into premium, then reverse.”

We're now at a make-or-break supply zone. Watch price behavior carefully — this is where smart traders either secure profits or prepare for the next leg.

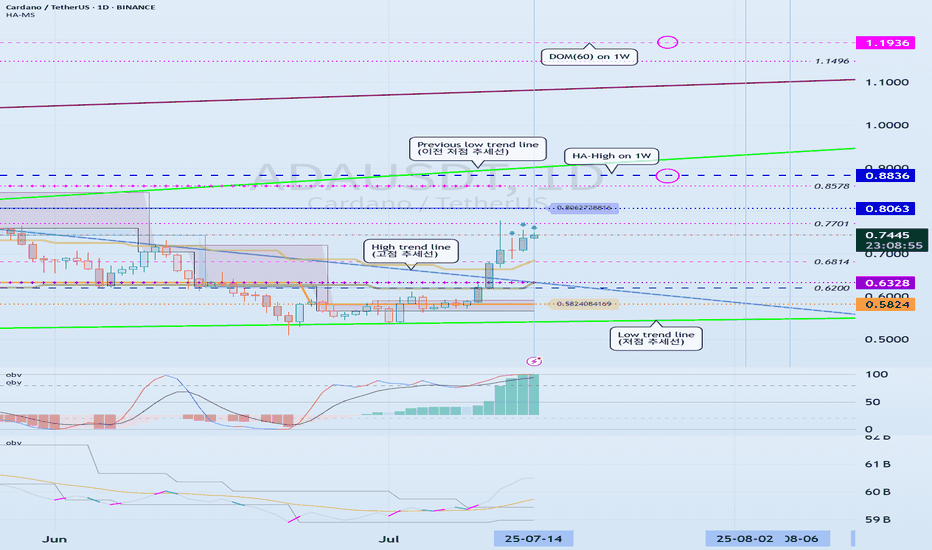

Can we break above the 0.8063-0.8836 range?

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ADAEUSDT 1D chart)

ADA is forming a long-term rising channel and is showing an upward trend as it breaks above the mid-term high downtrend line.

We need to see if it can rise above 0.8836 and maintain the price to rise above the previous mid-term low trend line.

-

The DOM(60) indicator is showing signs of being newly created.

Accordingly, we need to see where the DOM(60) indicator is formed.

Since the HA-High indicator is formed at 0.8063, in order to continue the upward trend, it must rise at least above 0.8063 to maintain the price.

Accordingly, the key is whether the price can be maintained above 0.6328.

-

It is possible to show a mid- to long-term upward trend only if it breaks through the HA-High ~ DOM(60) section of the 1W chart upward.

Therefore, the 0.8836-1.1936 section is likely to be the resistance section.

-

Based on the current price position, the support section is the 0.5824-0.6328 section.

However, since the positions of the HA-Low indicator and the DOM(-60) indicator are switched, if it shows a downward trend, there is a possibility that a new HA-Low indicator will be created.

If a new HA-Low indicator is created, it is important to determine whether there is support near it.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

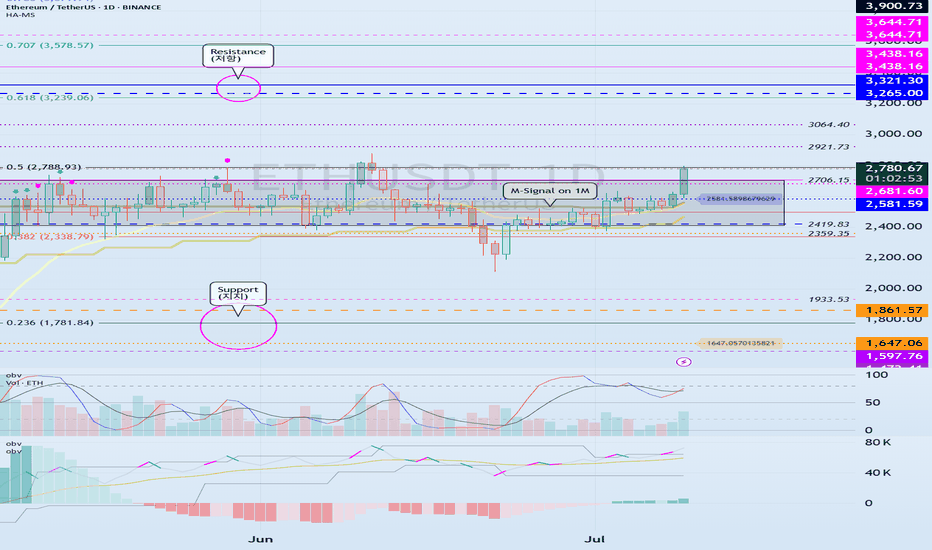

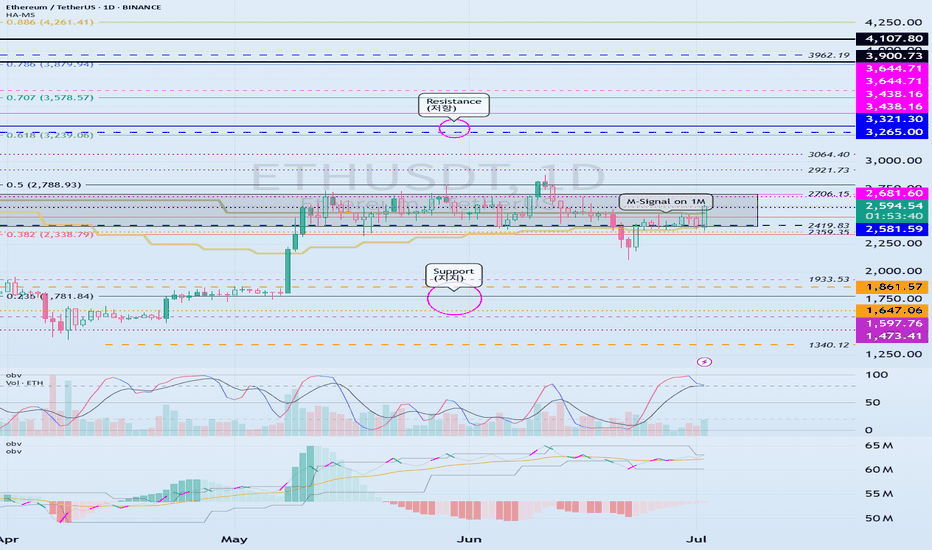

Resistance zone: 3265.0-3321.30

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

It is showing an upward breakout of the important zone of 2419.83-2706.15.

We need to see if the price can be maintained by rising above the Fibonacci ratio of 0.5 (2788.93).

If so, it is expected to rise to the resistance zone of 3265.0-3321.30.

The important zone of 2419.83-2706.15 is the support and resistance zone that can lead to a full-fledged uptrend.

Therefore, if it falls below this zone, we should stop trading and watch the situation.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

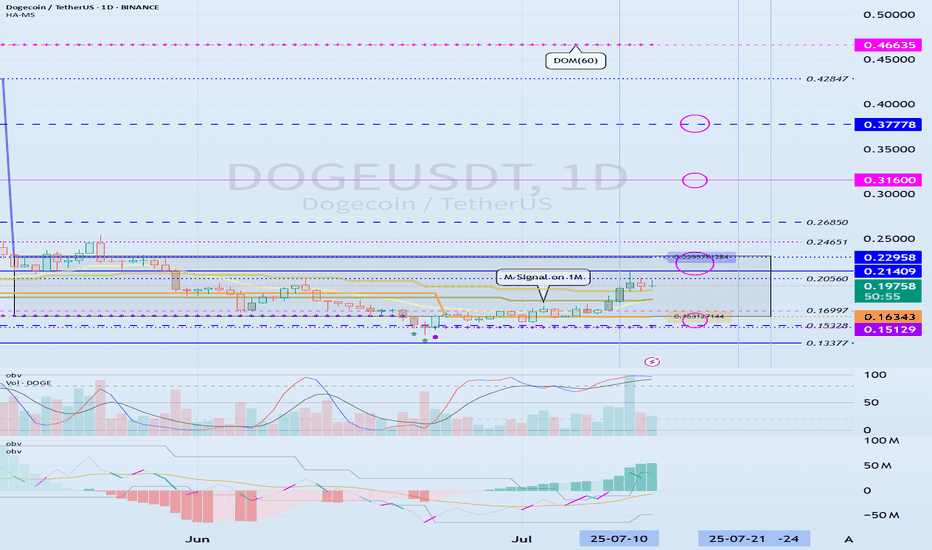

Check if there is an upward breakout of 0.21409-0.22958

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(DOGEUSDT 1D chart)

HA-High and HA-Low indicators are converging.

Accordingly, if it breaks through the 0.21409-0.22958 section, it is expected to surge.

However, since the DOM(60) indicator is formed at the 0.46635 point, we need to look at how the DOM(60) indicator is newly created.

It seems possible that the DOM(60) indicator will be newly created while shaking up and down in the 0.21409-0.31600 section, which is the HA-High indicator ~ DOM(60) indicator section of the 1M chart.

If the DOM(60) indicator is newly created, we need to check whether it is supported in the HA-High ~ DOM(60) section.

If it rises above the HA-High ~ DOM(60) section, it is likely to show a stepwise upward trend.

-

To summarize the above, it is as follows. - Buy range: 0.16343-0.22958

- Resistance range: 0.31600-0.37778

If the price breaks through the resistance range upward and maintains, there is a high possibility that the upward trend will continue in the medium to long term.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

Overtrading – The Silent Threat to Consistent PerformanceTrader Psychology | Part 1: Overtrading – The Silent Threat to Consistent Performance

In trading, more does not mean better. One of the most common and damaging psychological pitfalls traders fall into is overtrading — executing too many trades, often without clear setups, simply to stay active in the market.

It’s subtle, it feels productive… but it quietly erodes both your capital and your discipline.

💡 What Is Overtrading?

Overtrading occurs when a trader opens excessive positions, often outside of their strategy or plan. It’s driven by emotions rather than logic, and usually shows up in one of the following forms:

Taking trades without confirmation

Trying to "make back" previous losses (revenge trading)

Forcing trades during low-volume market conditions

Trading simply out of boredom or anxiety about missing out

It’s not just about the number of trades — it’s about why you’re taking them.

⚠️ How to Know You're Overtrading

You're entering trades that don’t meet your criteria

You feel uncomfortable not having an active position

You trade aggressively after a loss

You switch strategies frequently

Your trading feels more like activity than decision-making

You’re losing more in fees/spread than on price movement

🧠 Why Overtrading Happens

🔹 The Need to Be "Active"

Traders often equate activity with productivity. But the truth is, patience is a trading skill — doing nothing is sometimes the most profitable move.

🔹 Pressure to Perform Daily

Some traders feel they must generate daily profits. This mindset leads to forcing trades during uncertain or low-probability conditions.

🔹 Overconfidence After Wins

A short winning streak can create the illusion of control, pushing traders to increase frequency and risk — usually without real setups to back it up.

🔻 The Cost of Overtrading

Rapid Drawdowns: Frequent small losses and transaction costs add up quickly

Emotional Fatigue: Decision-making becomes reactive instead of rational

Loss of Trust in Your System: Not because the system failed — but because it wasn’t followed

Increased Costs: Spreads, commissions, and swaps eat into your margin

Overtrading doesn’t just hurt your balance. It damages your confidence, focus, and mental capital.

✅ How to Stop Overtrading – Practical Fixes

1. Set a Daily Trade Limit

Commit to a maximum number of trades per session (e.g., 2–3 trades). This forces you to wait for the best opportunities.

2. Track Your Trades in a Journal

Log each trade: the setup, your reasoning, emotions, and outcome. Over time, this reveals emotional patterns and helps you regain discipline.

3. Trade Only During Key Market Hours

Avoid trading during illiquid sessions. Focus on London and New York overlaps, where structure and volatility are present.

4. Accept That Flat Is a Position

Not being in a trade is often a smart decision. Staying out preserves capital and prepares you for higher-probability setups.

🎯 Final Thoughts

Overtrading is not a technical flaw — it’s a psychological leak.

If you want longevity in this game, you must master more than charts — you must master yourself.

“The market doesn’t reward activity. It rewards patience, precision, and emotional control.”

Next time you feel the urge to trade "just because" — pause, breathe, and ask yourself: Is this trade part of my edge?

📌 Coming Up Next:

Trader Psychology | Part 2: FOMO – Why Fear of Missing Out Can Destroy Good Traders

🔔 Follow this profile to be notified when the next chapter is live.

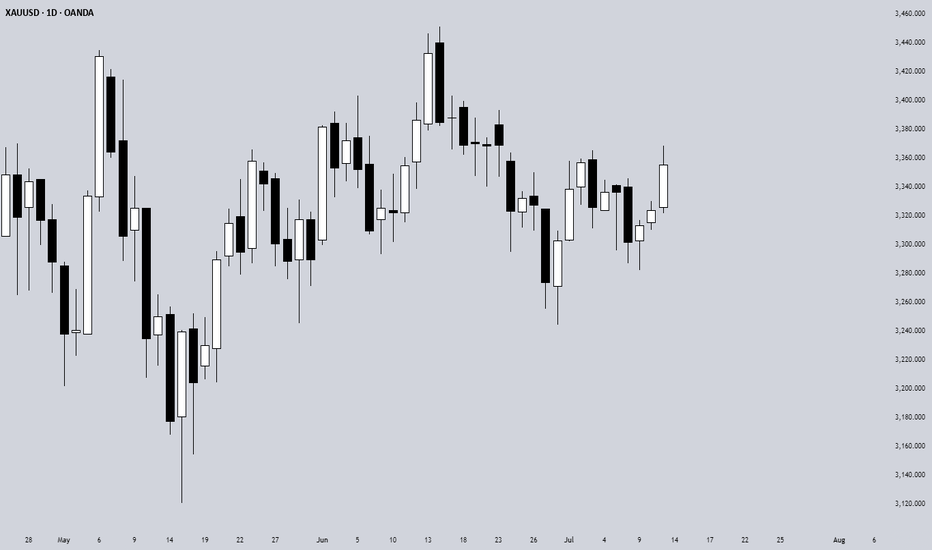

The 3-Method Framework: Simplifying Technical AnalysisMost traders get caught up in complex indicator setups, thinking that more tools equal better results. We rely on moving averages to tell us if prices are trending up or down, and we depend on support and resistance levels to predict market movement. But what if I told you there's a simpler, more powerful way to read the market using pure price action?

Today, I want to share my experience and understanding of bias and expectations for the next candle formation. This approach is refreshingly simple because we don't need to understand every single price movement - we just need to focus on what matters most.

Method 1: Opening Price Comparison

The first method is beautifully straightforward. For a bullish bias, the current opening price should be above the previous opening price. That's it. Sounds almost too simple, right? But simplicity often holds the greatest power in trading.

For Gold yesterday, we simply needed to compare the latest opening price on the Daily timeframe with the previous opening price. It's that simple.

Method 2: Mid-Level Analysis

The second approach involves comparing mid-levels between candles. We compare the mid-level of the previous candle with the mid-level of the candle before that. I know it might sound a bit complicated when explained this way, but once you visualize it on your chart, the concept becomes crystal clear.

Still on Gold, we just compare the 50% or mid-level of the previous candle with the candle two periods back from the latest candle on the daily chart.

Method 3: Expansion Expectations

The third method helps us anticipate expansion in price. Traditional complex methods require analyzing numerous factors, but this simplified approach only needs two candles before the current one. Here's how it works: we use the high and low of the candle two periods back, and the open and close (body) of the previous candle. If the previous candle's body sits within the high-low range of the two-candle-back formation, we can expect price expansion.

The beauty of this method is that we don't care whether the price is bullish or bearish - we simply expect expansion to occur. Think of it like a compressed spring: when price gets squeezed within a previous range, it often seeks to break out in either direction. We're not predicting the direction, just the likelihood of significant movement.

Still on Gold, I randomly selected all inside candles on the Daily timeframe. Remember, the purpose is only to expect expansion, not direction. If you want to use this for directional bias, make sure you apply the additional analysis required.

Remember, there are no guarantees in trading, but this method provides valuable insight into potential market expansion.

Advanced Combinations for Enhanced Analysis

Combining Methods 1 and 2 creates our most accessible approach since you only need two candles. When both the opening price and mid-point from two candles ago indicate bullish conditions, we can expect the current candle to follow an OLHC bullish pattern.

You can see the 3 examples I've provided in the image, and all of these are applicable across all timeframes, both daily and 4-hour.

Combining all three methods offers a more sophisticated analysis, particularly useful for anticipating market reversals. This involves marking the current and previous opening prices, comparing mid-levels from the last two candles, and identifying the high/low range from two to three candles back.

Now I'm adding Inside Candles from 2-3 periods back (My personal rule is maximum 3 candles before the current candle, or this analysis will lead to analysis paralysis).

The Bullish and Bearish Rules

Bullish Rule 1:

Opening price above the previous opening price

Mid-level of the previous candle above the mid-level of the previous candle before that.

Inside candle formation (optional)

Bearish Rule 1:

Opening price below the previous opening price

Mid-level of the previous candle below the mid-level of the previous candle before that.

Inside candle formation (optional)

The Secret Sauce: Timeframe Harmony

Here's where the "devil is in the details" comes into play. You might find perfect bullish conditions on your chart, but the market still reverses. The secret lies in using this method on Daily and 4-hour timeframes simultaneously.

Simply understand it from the chart.

Simply understand it from the chart.

If Rule 1 conditions are met on the daily chart, they must also align on the 4-hour chart. When the 4-hour contradicts the daily, follow the 4-hour signal as it might indicate a "sell on strength" or "buy on weakness" scenario.

The formula is simple: must align with

I've never tested this on 1-hour charts because the Daily and 4-hour combination provides sufficient accuracy for my trading approach.

Enhanced Rules for Precision

Rule 2 makes the inside candle formation mandatory rather than optional. Sometimes you'll encounter mixed signals where the mid-level suggests one direction while the opening price suggests another. The solution? Drop down to a lower timeframe for additional confirmation.

I don't recommend using this method below the 4-hour timeframe, but you can certainly apply it to Monthly or Weekly charts for long-term bias determination. The key is analyzing both Daily AND 4-hour timeframes together, not just one or the other.

When timeframes conflict, often just one key level provides the confirmation you need - typically a previous Monthly or Weekly high or low.

Final Thoughts

Pure price action mastery isn't about having the most sophisticated setup or the most indicators on your chart. It's about understanding the fundamental relationship between opening prices, mid-levels, and candle formations across meaningful timeframes.

This approach has served me well because it cuts through market noise and focuses on what price is actually telling us. Start with these three methods, practice identifying the patterns, and gradually build your confidence in reading pure price action.

Remember, consistent profitability comes from mastering simple, reliable methods rather than chasing complex strategies. Keep practicing, stay disciplined, and let price action guide your trading decisions.

Good Luck! :)

CoinMarketCap chart and correlation with BTC

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(USDT.D 1D chart)

USDT dominance is showing a downward trend along the medium- to long-term downtrend line.

The decline in USDT dominance can be interpreted as an upward trend in the coin market.

Therefore, if it remains below 4.91 or continues to decline, the coin market is likely to enter a bull market.

The coin market is expected to show a major bull market until 2025.

At this time, the USDT dominance is expected to fall to around 3.42 and then rise, causing the coin market to enter a bear market.

Therefore, a major bear market is expected in 2026.

-----------------------------------------------

(BTCUSDT 1M chart)

You might think that it would be good if it continued to rise in a bull market, but in reality, that is not the case.

The reason is that if the price continues to rise, you have to buy more money.

Therefore, it will show a pattern of falling when appropriate and rising again when appropriate.

As I mentioned earlier, 2025 is a major bull market, so it will eventually show a rising pattern.

So, when should we buy and when should we sell?

It would be nice if we could know this a little bit faster, but we can never know.

Currently, BTC is renewing its ATH, so it is even more difficult to predict the movement.

Therefore, we can only predict it through predictable chart analysis techniques.

Among them, the method I use is to predict and respond to the high point using the HA-Low, HA-High indicators and the DOM (DMI + OBV + MOMENTUM) indicator using the Heikin-Ashi chart.

The DOM indicator indicates the end of the high and low points, and the HA-Low and HA-High indicators are used to establish a basic trading strategy.

The sky blue (#00bcd4) arrow is generated, indicating that the DOM (60) indicator is likely to be generated soon.

In other words, it means that the end of the high point is becoming more likely.

When the DOM(60) indicator is created, there is a high possibility of resistance, so the price is likely to fall.

Therefore, you should think about a countermeasure for the decline.

However, as I mentioned earlier, since 2025 is expected to show a major uptrend, it is recommended to sell in installments at an appropriate level to preserve profits.

The reason is that we cannot know how far it will fall.

The start of a full-scale decline is likely to begin when it falls below the HA-High indicator.

Therefore, if it falls after the DOM(60) indicator is created, we should observe whether a new HA-High indicator is created.

If a new HA-High indicator is created, the key point is whether there is support in the vicinity.

If a new HA-High indicator is not created, it is likely to fall to the current HA-High indicator location of 73499.86.

-

A trend line has been formed between highs, but a trend line between lows has not yet been formed.

Therefore, it is difficult to predict how far it will fall once the decline begins.

In the 2025 bull market, BTC is expected to rise to around the Fibonacci ratio of 2.618 (133889.92).

Therefore, we should also consider countermeasures for this.

------------------------------------------------

(BTC.D 1M chart)

When will the altcoin bull market start?

I think the timing is when BTC dominance falls below 55.01 and is maintained or continues to decline.

I think the rising BTC dominance means that the funds flowing into the coin market are concentrated toward BTC.

Therefore, we should consider that a market for trading BTC has been formed.

If BTC dominance fails to fall below the 55.01-62.47 range, BTC dominance is expected to rise to around 73.63-77.07.

At this time, it is highly likely that it will encounter strong resistance and begin to decline.

Since it has not fallen below the mid- to long-term trend line, it seems likely that it will continue to rise.

In order to eventually turn into a downtrend, BTC dominance must fall below 60.

If not, I think it will be difficult to expect an uptrend in altcoins.

----------------------------------------------------------------------

(BTCUSDT 1D chart)

This period of volatility is expected to continue until July 11.

Therefore, the key issue is whether there is support near 111696.21.

If there is support at the 111696.21 point, it is expected to rise to the right Fibonacci ratio 2.24 (116940.43).

If not, we need to check whether there is support near 108316.90.

As I mentioned in the previous idea, three conditions must be met to break through the 111696.21 point upward.

- The StochRSI indicator is showing an upward trend with K>D,

- The PVT-MACD oscillator is showing an upward trend (if possible, above the 0 point),

- The OBV indicator of the Low Line ~ High Line channel is maintained above the High Line,

If the above conditions are met, I said that there is a high possibility of a stepwise upward trend from the 111696.21 point.

-

The next volatility period is expected to occur around July 18 (July 17-19).

Therefore, we need to see if it can be maintained above 111696.21 until the next volatility period.

If it fails, we need to check if it is supported above the M-Signal indicator on the 1D chart, near 108316.90.

If not, it is likely to fall to the M-Signal indicator on the 1W chart or near 99705.62.

-

The basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, if the HA-High indicator rises, there is a possibility of a stepwise uptrend, and if the HA-Low indicator falls, there is a possibility of a stepwise downtrend.

The end of the stepwise uptrend is a downtrend, and the end of the stepwise downtrend is an uptrend.

That is, we can see that the support around the HA-High ~ DOM(60) section and the DOM(-60) ~ HA-Low section will be important turning points for the future trend.

----------------------------------------------------

On the USDT dominance chart, it seems likely that August 3rd will be the volatility period.

Looking at the BTC chart, it seems likely that August 2nd to 5th (August 1st to 6th) will be the pre-movement for the volatility period of August 1st to 6th.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

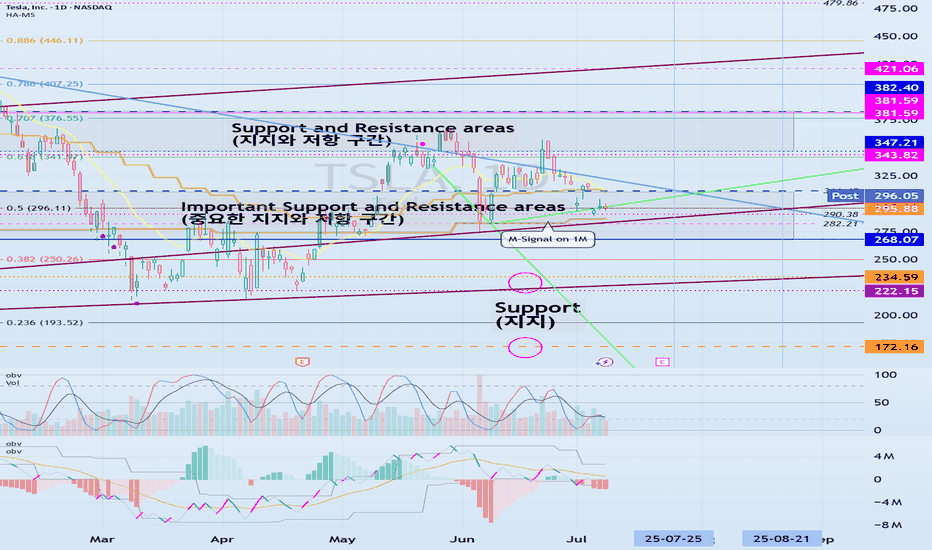

Important Volatility Period: Around August 21

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(TSLA 1D chart)

The medium-term trend is maintaining an uptrend.

However, if the price falls below the M-Signal indicator on the 1M chart and maintains, there is a possibility of a downtrend, so caution is required.

The support zone is

1st: 222.15-235.59

2nd: 172.16

Around the 1st and 2nd above.

The 268.07-311.48 zone is an important support and resistance zone.

If the price is maintained above this zone, there is a high possibility that a full-scale upward trend will continue.

However, since a resistance zone is formed in the 347.21-382.40 zone, we need to look at how this zone is broken upward.

-

When it falls to the 172.16-234.59 zone, we need to find a time to buy.

If not, we need to buy when it shows support in the 268.07-311.48 zone.

It would be better to buy at a lower price, but since the investment period will inevitably be longer, I think it is better to buy when an upward trend is detected.

-

The important volatility period is around August 21st, but before that, we need to check the movement around July 25th.

If it falls below 268.07 after August 21st, it could lead to further decline.

If it rises above 311.48 and maintains the price during the movement around July 25th, it could lead to further increase and it seems likely to create a trend after the volatility period around August 21st.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

What is the key that makes you start trading?

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

HA-Low, HA-High indicators are indicators created for trading on Heikin-Ashi charts.

Therefore, they are determined by Heikin-Ashi's Open, Close, and RSI values.

If the RSI indicator value is above 70 when the candle starts to rise and then falls on the Heikin-Ashi chart, the HA-High indicator is generated.

If the RSI indicator value is below 30 when the candle starts to rise and then falls on the Heikin-Ashi chart, the HA-Low indicator is generated.

Therefore, rather than judging the rise and fall with your eyes, you can judge the rise and fall transitions with more specific criteria.

If you look at a regular chart, you can see that there are many rise and fall transition points, unlike the Heikin-Ashi chart.

The Heikin-Ashi chart has the effect of reducing fakes.

Therefore, it has a higher reliability than judging with a regular chart.

The biggest disadvantage of the Heikin-Ashi chart is that it is difficult to know the exact values of the Open and Close values.

Therefore, the HA-Low, HA-High indicators are used to accurately and quickly identify the Open and Close values by indicating the rising and falling transition points of the Heikin-Ashi chart on a general chart.

-

The Heikin-Ashi chart uses the median.

Therefore, the HA-Low indicator corresponds to the median when it leaves the low range, and the HA-High indicator corresponds to the median when it leaves the high range.

If the HA-Low indicator is generated and then receives support, there is a high possibility that an upward trend will begin, and if the HA-High indicator is generated and then receives resistance, there is a high possibility that a downward trend will begin.

Therefore, the HA-Low, HA-High indicators are used in basic trading strategies.

However, since the HA-Low and HA-High indicators are intermediate values, if the HA-Low indicator resists and falls, there is a possibility of a stepwise decline, and if the HA-High indicator supports and rises, there is a possibility of a stepwise rise.

Therefore, to compensate for this, the DOM (60) and DOM (-60) indicators were used.

The DOM indicator is an indicator that comprehensively evaluates the DMI + OBV + MOMENTUM indicators.

When these indicators are above 60 or below -60, the DOM (60) and DOM (-60) indicators are created.

In other words, the DOM (60) indicator corresponds to the overbought range and indicates the end of the high point.

The DOM (-60) indicator corresponds to the oversold range and indicates the end of the low point.

Therefore, when the HA-Low indicator resists and falls, the actual stepwise decline is likely to start when it falls below DOM (-60).

On the other hand, when the HA-High indicator is supported and rises, the actual step-up trend is likely to start by rising above DOM (60).

This compensates for the shortcomings of the HA-Low and HA-High indicators.

-

There is no way to be 100% sure in all transactions.

Therefore, if the motivation to start a transaction is clear, it is only worth challenging the transaction.

Finding that motivation and deciding how to start a transaction that suits your investment style is the trading strategy and the core of trading.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

Volatility period likely to continue until July 11th

Hello, traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

This volatility period is expected to last until July 11th.

The first volatility period, July 1-7, 3 days passed, and the second volatility period began on July 6.

It is important to explain it in words, but I think it would be better if you could intuitively understand the flow by looking at the chart.

For that reason, I divided the chart into a chart with a trend line drawn and a chart with indicators.

Since the trend line is used as a tool to calculate the volatility period, it is not necessary to show it after the volatility period is displayed.

What we need to look at is the support and resistance points drawn on the 1M, 1W, and 1D charts after the calculated volatility period, or the support in the indicator to find the trading point.

-

It seems that support is being checked around 108316.90, which is the HA-High indicator point of the 1D chart.

Therefore, we need to see if it can rise after receiving support near 108316.90 during this volatility period.

If not, it will eventually show a downward trend.

As a basic trading strategy, we use buying near the HA-Low indicator and selling near the HA-High indicator.

Therefore, considering the current price position, it can be said that it is a section where we should sell to make a profit.

However, since the HA-Low and HA-High indicators are intermediate values, if it falls from the HA-Low indicator, it is possible to show a stepwise downward trend, and if it rises from the HA-High indicator, it is possible to show a stepwise upward trend.

Therefore, we need to respond with a split transaction.

Conditions for continuing the uptrend include:

1. When OBV is above the High Line and shows an upward trend,

2. When PVT-MACD oscillator is above the High Line,

3. When StochRSI is above K > D, showing an upward trend,

If the above conditions are met, there is a high possibility that the uptrend will continue.

-

If it falls below the M-Signal indicator on the 1D chart, it is highly likely that it will select the trend again when it meets the M-Signal indicator on the 1W chart.

At this time, whether there is support near 99705.62 is important.

If it rises, you should check whether it is supported near 111696.21.

If it is not supported, it means that it has not broken through the high point section, so you should prepare for a decline.

The high point boundary section is the 108316.90-111696.21 section.

Therefore, if the price is maintained within this section, there is a possibility that it will continue to attempt to break through upward.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

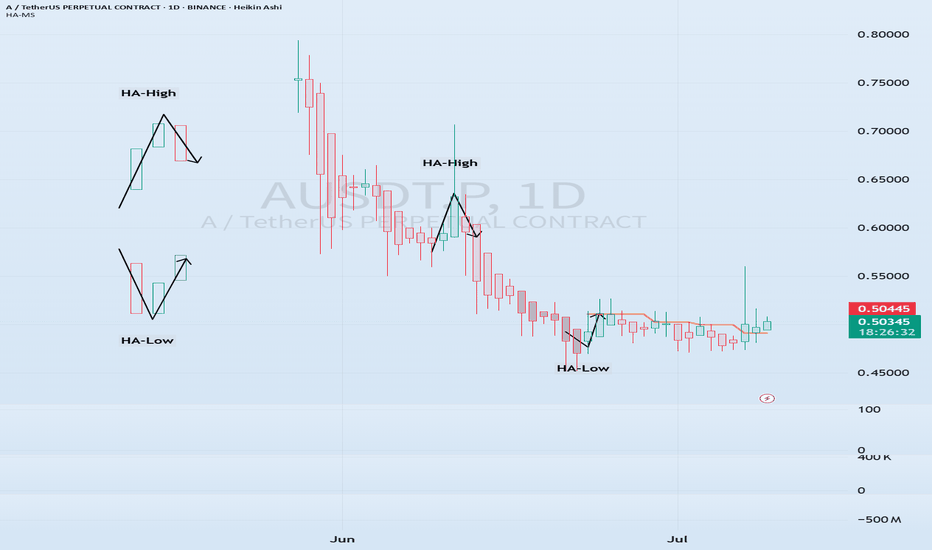

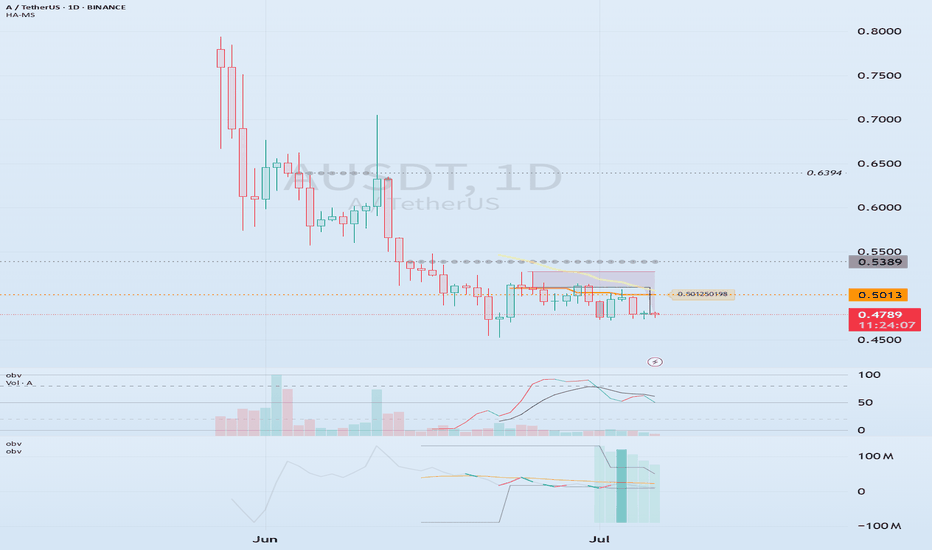

EOS -> Vaulta : (0.5013 support is the key)

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

EOS switched from banking to blockchain during the network reorganization.

(AUSDT 1D chart)

The key is whether it can rise to around 0.5013 and receive support.

If not, it is likely to show a step-down trend.

-

(4h chart)

In terms of day trading,

Support range: 0.4942-0.4822

Resistance range: 0.5959-0.6394

We need to see whether it can receive support and rise in the above range.

However, since the M-Signal indicator of the 1D chart is passing around 0.5013, it is important to see how the volume profile formed around this area and 0.5389 will rise.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

See if we can hold the price above 0.05709

Hello traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

(AWEUSDT 1D chart)

The total supply of 2 billion has been unlocked.

Therefore, it seems that temporary profit taking will occur.

We will have to wait and see what kind of flow it will show in the future, but I think the key is whether there is support around 0.05709, which is the HA-Low indicator point.

Since the volume profile section formed on the current 1D chart is formed at 0.06367, we need to check whether there is support around this area.

The 0.06981-0.07188 section corresponds to the previous high point of the 1M chart.

Therefore, the start of the uptrend is expected to begin when the price breaks through the 0.06981-0.07188 section upward and is maintained.

-

In summary of the above,

- The time to buy is when support is confirmed around 0.05709.

- The resistance section is likely to be around 0.06367 and the 0.06981-0.07188 section.

Therefore, you should create a response strategy depending on whether there is support at the points or sections mentioned above, that is, 0.05709, 0.06367, 0.06981-0.07188.

If the price falls below 0.05709, you should stop all trading and wait and see.

The reason is that it is likely to lead to a step-down trend.

Even if it rises, it is expected that there will be a limit to the rise due to profit taking for the time being because all tokens have been unlocked.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

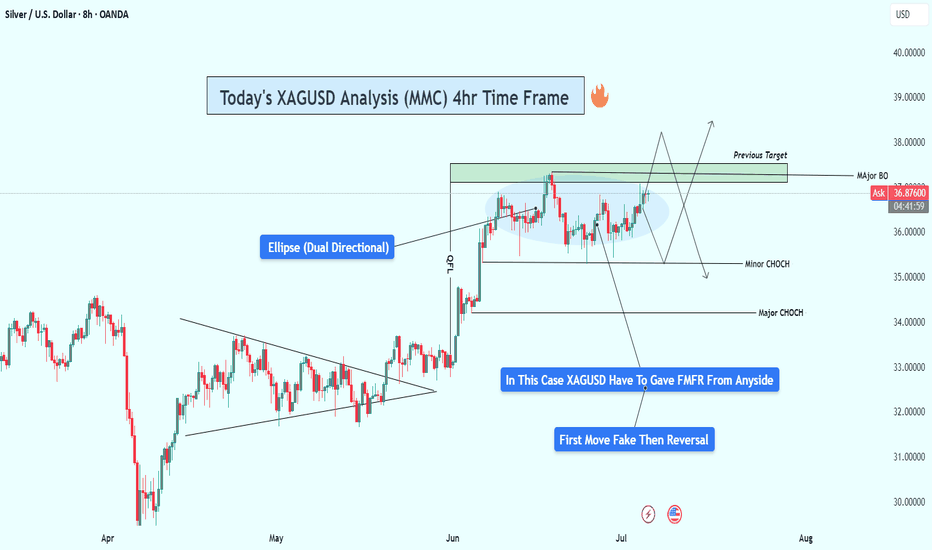

XAGUSD Analysis : Consolidation & FMFR Setup + Target🧭 Technical Overview:

Silver has had a strong bullish rally that started after the breakout of a long-term symmetrical triangle pattern. This breakout marked a Major Break of Structure (BOS) and shifted the overall market sentiment toward the bulls. Since then, price has been consolidating under a major resistance zone, forming a compression range, which is now shown as a blue elliptical zone in the chart.

This ellipse is not just a consolidation area — it represents a neutral compression zone where price can explode in either direction. The price action inside this area has been choppy and manipulative, sweeping both local highs and lows without real follow-through — a perfect environment for a Fake Move – then Reversal (FMFR) strategy.

🔍 Key Chart Components:

🔹 1. Ellipse (Dual Directional Zone)

This region shows indecision. Price is coiling inside, creating higher lows and lower highs — a volatility squeeze. A breakout from this ellipse is likely, but the first breakout move may be fake, followed by a quick reversal.

🔹 2. Major BOS (Break of Structure)

Price broke out of a long-term descending structure and pushed strongly upward, which marked a significant bullish shift. The pullback after that BOS was shallow — a sign of continued strength — but now we’re at a decision point.

🔹 3. Resistance Zone (Previous Target Area)

The price is now retesting a strong historical resistance around $37.00–$38.00, where we’ve seen rejections before. This is the liquidity zone where breakout traders enter long, but institutions may sweep them for liquidity before reversing.

🔹 4. Minor and Major CHoCH Levels

Minor CHoCH: Around $35.00–$35.50

Major CHoCH: Near $33.80–$34.00

These are reversal zones to watch if a fake move to the upside occurs and price rolls over.

📉 FMFR Setup Explained:

FMFR (First Move Fake Reversal) is a market behavior pattern where:

Price fakes a breakout in one direction (e.g., above resistance).

Attracts liquidity (traders’ orders).

Reverses rapidly in the opposite direction, trapping those who entered late.

In your chart, the blue notes say:

“In This Case, XAGUSD Have to Gave FMFR From Anyside”

“First Move Fake Then Reversal”

This highlights that no matter which direction the market initially breaks, it’s likely to reverse shortly afterward. This pattern is often seen before major moves when the market seeks to clear liquidity.

🔄 Scenarios to Watch:

🅰️ Bull Trap (Fake Breakout)

Price spikes above $37.80–$38.00.

Sweeps the highs and rejects sharply.

Reversal triggers below the ellipse, heading toward minor/major CHoCH.

🅱️ Bear Trap (Fake Breakdown)

Price dips below $35.00 (minor CHoCH).

Triggers panic sells.

Then rebounds quickly into the previous high zone or beyond.

⚙️ Trading Strategy Ideas:

Wait for Confirmation: Enter only after a confirmed breakout and retest OR a fakeout with reversal candles (e.g., engulfing, pin bar).

Use Tight Risk Management: Place stops outside sweep zones. This setup is volatile and can trap undisciplined trades.

Watch Volume & Wicks: Spikes with wicks and no close beyond the level usually confirm FMFR setups.

🔐 Key Levels to Watch:

Zone Price Level Action

Major Resistance $37.00–$38.00 Watch for fakeouts

Minor CHoCH ~$35.00–$35.50 Reversal entry zone

Major CHoCH ~$33.80 Last line of bullish defense

📝 Final Thoughts:

This is a textbook FMFR compression setup, where volatility is building inside a symmetrical price zone. The first aggressive move from this region is likely to be deceptive. Smart money traders look for trap setups, not the obvious direction. Silver is approaching a high-risk, high-reward decision zone, and staying patient will be key.

📊 Wait. Observe. React — don’t predict blindly.

BTCUSD 4hr Technical Analysis : Rejects $110K - Next TargetsOverview:

Bitcoin is currently undergoing a significant technical correction after rejecting a strong resistance level. The 4-hour chart shows a decisive bearish breakdown, suggesting that the bulls are losing control and sellers are gaining momentum. As the price continues to fall, all eyes are now on the major support levels that could trigger a potential reversal—or further acceleration to the downside.

📊 Technical Breakdown:

1. Major Resistance Zone (~$110,000 – $111,000):

This zone has acted as a strong supply area, where price has repeatedly failed to break through. Multiple rejections from this zone confirm it as a key distribution area, where large sellers are stepping in. The repeated failure to close above it shows market exhaustion at the highs.

Multiple candle wicks and strong bearish closes around this area.

Bull traps occurred after brief moves above this resistance, followed by sharp sell-offs.

2. Trendline Breakout:

Previously, BTC had been respecting a rising ascending trendline, which served as dynamic support throughout the last rally. Recently, price broke below this trendline with strong bearish momentum.

This marks a break in market structure.

The trendline retest acted as resistance—textbook confirmation of the trend shift.

3. QFL (Quantity Following Line) Breakdown:

The QFL zone, typically a bullish defense level, has failed to hold. This breakdown confirmed that bulls lost a critical level of control.

Price briefly retested the QFL from below before continuing downward.

This zone now acts as resistance, reinforcing the bearish outlook.

🔻 Downside Targets & Reversal Zones:

✅ Reversal Zone 1 (~$106,000):

This minor support level provided minimal reaction and was quickly breached.

Lack of volume or candle confirmation suggests weak buying interest here.

✅ Next Reversal Zone 2 (~$104,000):

This zone has historical importance as a short-term demand area.

Monitor closely for bullish candlestick patterns, volume spikes, or bullish divergences to assess potential bounce scenarios.

✅ Major Support Zone (~$102,000 – $100,000):

This is the most critical level in the near term.

Historically, price has reversed strongly from this zone, indicating strong buyer interest.

If price breaks and closes below this level, expect a high-probability continuation towards the $98,000 psychological level or lower.

🧠 Market Psychology:

The breakdown from the trendline and QFL indicates panic or profit-taking.

Many late long positions are likely being liquidated.

Smart money may be waiting at the $100K zone to accumulate, depending on market conditions and macro factors.

🎯 Trading Strategy Ideas:

🛑 For Bears (Shorts):

Stay short below $110K resistance.

Trail stop-loss above QFL zone or trendline breakdown.

Look to take profit at $104K and $102K zones.

Add to positions on confirmed bearish retests of broken supports.

📈 For Bulls (Longs):

Wait for clear confirmation (e.g., bullish engulfing, double bottom, RSI divergence) near $104K or $102K before entering.

Avoid catching falling knives—patience is key.

Consider scaling in with smaller position sizes and tight stops.

Watch for a reclaim of the QFL zone or a strong bounce from the $100K psychological level.

🧭 Bias: Bearish

Structure: Lower highs & lower lows.

Momentum: Selling volume increasing, bulls losing steam.

Invalidation: A strong daily close above $111K would flip bias back to neutral/bullish.

🧩 Final Thoughts:

Bitcoin is currently in a fragile state as it retraces from a failed breakout. With multiple key support zones ahead, the next few sessions will be critical in determining whether bulls can reclaim control or if we see deeper downside movement. Watch for signs of exhaustion from sellers or fresh accumulation zones to position accordingly.

Important Support and Resistance Areas: 2419.83-2706.15

Hello, traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

The key is whether ETH can find support in the 2419.83-2706.15 area and rise.

This is because this section is the section that needs to be supported in order for a full-fledged uptrend to begin.

Therefore, if you are trading ETH, you can proceed with a purchase when support is confirmed in the 2419.83-2706.15 section.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

Check support at 108316.90-111696.21

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

Among the many trend lines, the one marked 1W is the important one.

Therefore, we need to look at whether it can rise above the 1W trend line or rise along the trend line.

If not, and it falls below 108316.90, it may lead to further decline, so we need to think about a countermeasure for this.

This volatility period is expected to continue until July 3, but it is expected to last until July 11, so caution is required when trading.

-

Indicators that indicate high points are DOM(60), HA-High, and StochRSI 80.

HA-High and StochRSI 80 are formed around 108316.90, and DOM(60) is formed at 111696.21.

Therefore, the 108316.90-111696.21 section is a high point boundary section, and if it is supported and rises in this section, it is highly likely that a stepwise uptrend will begin.

The conditions for a stepwise uptrend to begin are:

- The K of the StochRSI indicator must show an upward trend below 80,

- The PVT-MACD oscillator indicator must show an upward trend above the 0 point,

- The OBV of the Low Line ~ High Line channel must show an upward trend. If possible, it is better for the Low Line ~ High Line channel to form an upward channel.

When the above conditions are met, I think that if it is supported and rises in the 108316.90-111696.21 section, it is highly likely that a stepwise uptrend will continue.

If the above conditions are not met, it is likely that it will show a downward trend again while pretending to rise.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

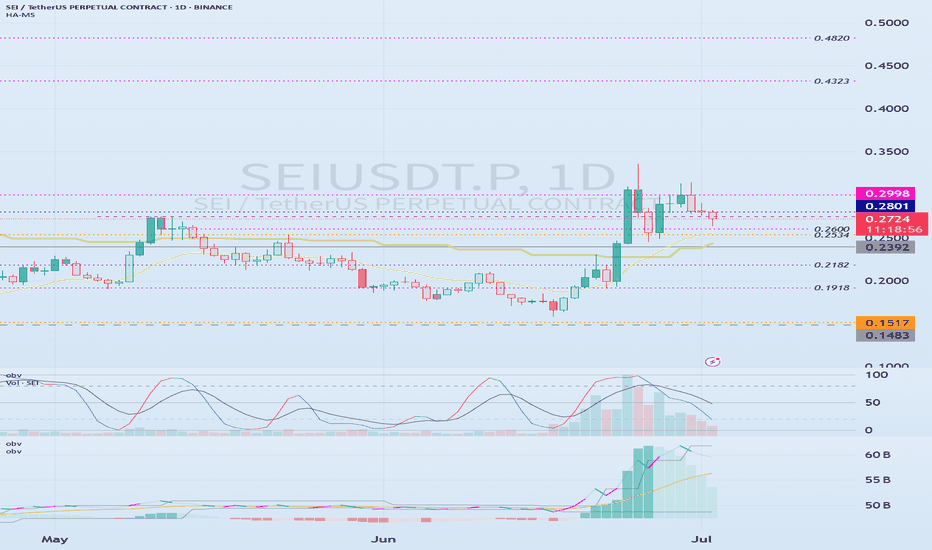

Important volume profile area: 0.2392

Hello, traders.

If you "follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(SEIUSDT.P 1M chart)

I wonder what the 1M chart means on the futures chart, but if you know the current big picture trend, I think you can trade according to your main and secondary positions.

Currently, the volume profile section is formed at 0.2392 on the 1M chart, so it is expected that the major trend will be determined based on this point.

In other words, if the price is maintained above 0.2392, I think it is highly likely to turn into an uptrend.

-

(1W chart)

Currently, on the 1W chart, we are checking for support near the 0.2750 point, which is the StochRSI 80 indicator point.

The StochRSI 80 indicator is one of the indicators that indicates the high point section.

Therefore, if it is supported near the StochRSI 80 indicator, it is highly likely to rise.

On the other hand, if it is not supported, it is important to check for support because it corresponds to the resistance point.

Once the rise begins, it is basically likely to rise until it meets the HA-High indicator.

The HA-High indicator is currently formed at 0.7406.

However, when rising, there is a possibility of receiving resistance near the area where the arrow is pointing, so you should think about a countermeasure.

-

(1D chart)

In order to rise, the price must rise above the 0.2801-0.2998 range and maintain it.

If not, there is a possibility of falling until the HA-Low indicator is met.

However, since an important volume profile range is formed at the 0.2392 range, whether there is support near this area is an important issue.

Therefore, if it falls below 0.2392, it is recommended to stop trading and check the situation if possible.

If it rises above 0.2998, it seems likely to surge to the 0.4323-0.4820 range because the resistance range is weak.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

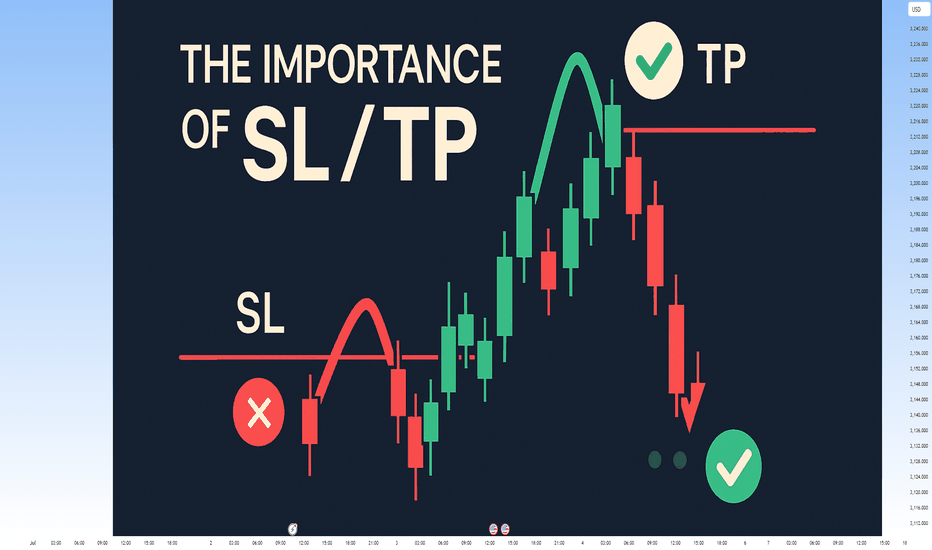

The Power of Setting SL and TP: Secret to Mastering Your TradeThe Power of Setting SL and TP: The Secret to Mastering Your Trade

Hey there, traders! 👋 Let’s talk about something that can make a world of difference in your trading journey – Stop Loss (SL) and Take Profit (TP). These simple tools may look basic, but they are essential for every trader to stay consistent and profitable in the long run.

In today’s post, we’ll dive into the importance of setting SL and TP for each trade and how these two tools can change your trading game. Whether you’re new to trading or have been in the game for a while, understanding and applying SL and TP correctly is key to building a solid and profitable trading strategy. Let’s get started!

1. What Exactly Are SL and TP?

Stop Loss (SL):

A Stop Loss is the level where you decide to cut your losses if the market moves against your trade. It's your safety net, ensuring that your losses stay manageable. For example, if you’re trading XAU/USD at $1800 and don’t want to lose more than $50, you’d set your SL at $1750.

Take Profit (TP):

Take Profit is the level at which you’ll close your trade once the price reaches your desired profit. This helps you lock in profits automatically, without the temptation to stay in the market too long. For example, if you think gold will rise to $1850, you’d set your TP at that level to secure the profit.

2. Why Are SL and TP Crucial?

A. Eliminating Emotion from Your Trades

One of the hardest challenges in trading is keeping emotions out of the equation. Fear and greed can cause you to hold onto losing positions for too long or exit too soon. SL and TP automate your exits, allowing you to trade with a clear plan and reduce emotional decision-making.

B. Managing Risk Like a Pro

Risk management is the backbone of any successful trading strategy. SL limits your losses by setting a predefined level where your trade will automatically close. Without SLs, you could risk losing more than you intended, which can damage your trading account.

C. Securing Consistent Profits

TP helps you to capture profits at the right time. Without it, you might let your profits slip away as the market moves against you. A TP ensures you don’t miss out on locking in gains when the market reaches your target.

D. Building Consistency

By setting SL and TP, you create a consistent and structured approach to your trading. If you trade with a 1:2 risk-to-reward ratio, where you risk $1 to make $2, you can build long-term profitability, even if you lose some trades along the way. Consistency is the key to success in trading.

3. How to Set SL and TP Like a Pro

A. Start with Proper Analysis

Before entering any trade, always analyze the market context. Use technical analysis (like support and resistance levels, Fibonacci, and trendlines) to place your SL and TP at logical levels. For example, set your SL slightly below support for a buy trade, or slightly above resistance for a sell trade.

B. Risk-to-Reward Ratio

A good rule of thumb is to have a 1:2 risk-to-reward ratio. This means if you risk $50 on a trade, you aim to make at least $100. This allows you to lose half of your trades but still come out ahead in the long run. Always set your TP in relation to your risk tolerance.

C. Use Indicators to Help

Use indicators like EMA, RSI, Fibonacci retracements, and pivot points to determine the best levels for your SL and TP. For example, if you see a strong bullish trend and are entering a buy position, placing your TP near the next Fibonacci extension level is a great strategy.

D. Keep Volatility in Mind

Market volatility plays a big role in where you place your SL and TP. In highly volatile markets, tight SL might get hit too early. Adjust your SL to reflect the market’s movement. Similarly, your TP should be flexible enough to account for volatility.

4. Benefits of Setting SL and TP

A. Reducing Emotional Trading

Emotional trading is the quickest way to lose money. SL and TP take emotion out of the equation, making trading more objective and disciplined. You know exactly when you’re getting in, and when to get out – no guessing!

B. Avoiding Overtrading

Without clear SL and TP levels, you might overtrade, holding positions for too long or exiting too early. This lack of structure leads to emotional decisions and bad habits. Having SL and TP in place ensures that you trade only when it makes sense.

C. Gaining Confidence

By setting clear SL and TP levels, you gain confidence in your trading strategy. You know that your risk is limited and your profits are protected. This allows you to trade with a calm mindset, focusing on quality trades instead of rushing into everything.

5. Conclusion

Setting SL and TP is one of the most important skills for any trader, whether you're new to the market or experienced. They help you manage risk, capture profits, and build a disciplined approach to trading. By incorporating SL and TP into your trading plan, you can protect your capital, lock in profits, and ensure consistent growth in your trading journey.

So remember, Plan your trade and trade your plan – and always set your SL and TP before entering any trade.

Happy Trading! Stay disciplined, stay profitable! 💰🚀

Check if price can hold above M-Signal indicator on 1D chart

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

I failed to register a modified indicator of StochRSI indicator on TradingView alone, so I added it to the existing OBV by readCrypto indicator.

From the top of the indicator setting window to the bottom

1. OBV indicator of Low Line ~ High Line channel

2. PVT-MACD oscillator indicator

3. StochRSI indicator

They are registered in the order above.

Since the values used are all different, you should activate and use one indicator.

Please check the chart above.

------------------------------------------

(BTCUSDT 1D chart)

It is showing a downward trend as it failed to rise above the HA-High indicator (108316.90) on the 1D chart.

It is currently checking whether there is support near 107340.58, which is the StochRSI 50 indicator point.

If it fails to receive support and falls, it is expected to fall to around 104463.99.

The 104463.99 point is the DOM (60) indicator point of the 1W chart, which corresponds to the end of the high point on the 1W chart.

Since the StochRSI 20 indicator point is formed near the 104463.99 point, its importance can be considered high.

-

Since the M-Signal indicator of the 1D chart is passing near 106133.74, there is a possibility of volatility when touching this area.

Since the volatility period begins around July 2 (July 1-3), it is necessary to keep an eye on the current movement.

-

However, the key is to buy near the HA-Low indicator and sell near the HA-High indicator, so the current movement may be natural.

This volatility period is expected to last until around July 10 (July 9-11), so be careful when trading to avoid being fooled by fakes.

----------------------------------------

- The StochRSI indicator is showing signs of transitioning to a state where K < D.

- The PVT-MACD oscillator indicator is showing signs of decline.

- The OBV indicator of the Low Line ~ High Line channel is showing signs of decline in the High Line.

Therefore, if you look at the indicators, they are showing signs of decline overall.

However, if the OBV rises above the High Line, the price will show signs of rise.

Therefore, we need to observe the movements of the indicators while checking whether there is support at the StochRSI 50 indicator point.

Basically, the time to make a purchase is when it shows support near the DOM (-60) ~ HA-Low indicator.

If you want to make a purchase outside of that, you should not forget that a short and quick response is required.

The indicators that tell you the high point are HA-High, DOM(60) indicators.

In addition, there are StochRSI 80 and StochRSI 20 indicators that require quick response.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------