TradeCityPro | Bitcoin Daily Analysis #141👋 Welcome to TradeCity Pro!

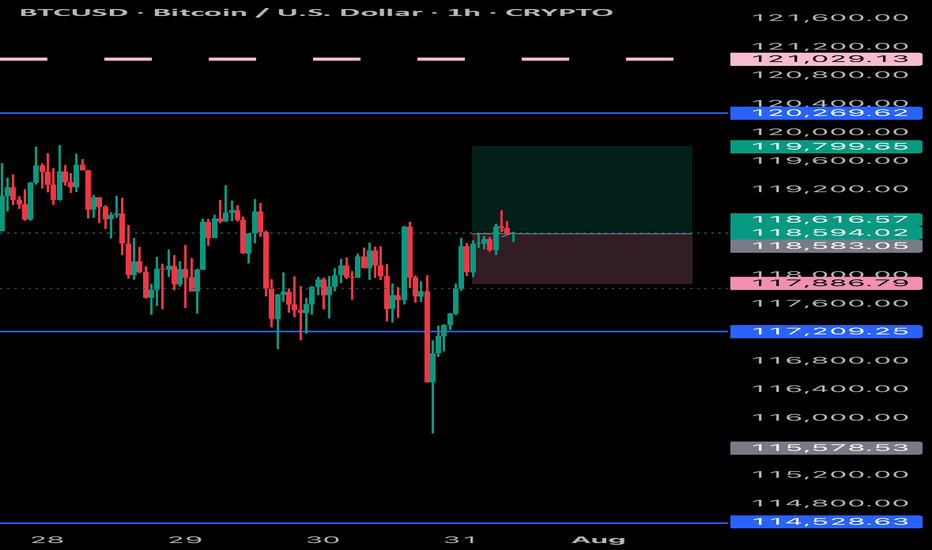

Let’s dive into Bitcoin analysis. Yesterday, the exact bearish scenario I told you about happened. Let’s see what opportunities the market is offering us today.

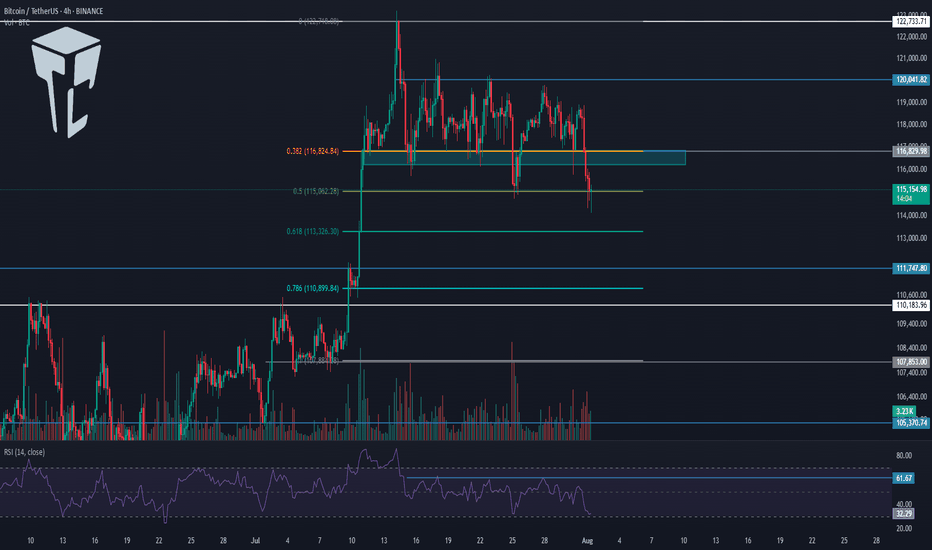

⏳ 4-Hour Timeframe

Yesterday, I mentioned that the price had tested the 116829 zone too many times and that this area had become very weak. I also said that if the price made a lower high than 120041, deeper corrections would be likely.

✔️ Another perspective I have on the market is that sometimes certain support and resistance levels simply aren’t strong enough to continue the trend.

🔑 For example, in this case — despite Bitcoin being in an uptrend across all cycles — the 116829 support couldn’t hold, and the price broke it to reach a stronger support zone, one that might be capable of continuing the trend.

📊 Right now, this is what might be happening again. Support levels like 0.5, 0.618, and 0.786 Fibonacci retracement zones could be where the next bullish leg begins.

✅ At the moment, price has reached the 0.5 Fibonacci level, and the previous strong bearish momentum has slightly weakened. If you look at the volume, momentum is still in favor of sellers, but based on the long lower wicks on the candles, we can say the bearish trend is showing signs of weakness.

💥 On the other hand, RSI is approaching 30, and in an uptrend, when RSI nears the Oversold zone, it can often be a good entry point for a long. However, we’re not acting on this yet — we’ll wait for more confirmations before opening any positions.

⭐ For now, there’s no trigger for a long position on this timeframe. A break below 115000 could act as a short trigger, but given the trend Bitcoin is in, I’m not opening any short positions at the moment.

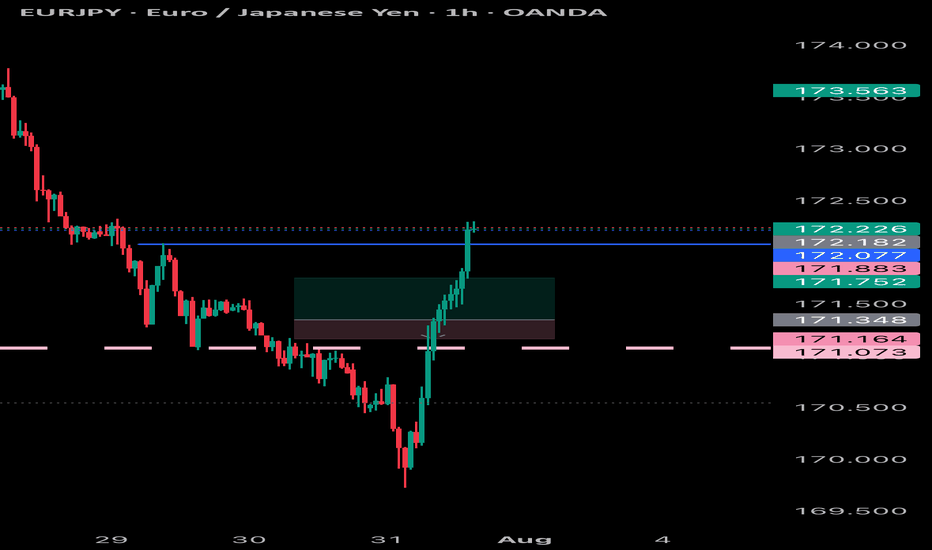

⏳ 1-Hour Timeframe

The price has dropped down to 114560, and I believe today we might enter a corrective phase. However, if the price stabilizes below 114560, the correction could continue. The next targets would be the Fibonacci levels from the 4-hour timeframe.

🔽 I won’t open a short position with the break of 114560, and I suggest you don’t take that short either.

📈 If this move turns out to be a fakeout, the first trigger we have now is at 118736, which is quite far from the current price. For this trigger to activate, we’d need to see a V-pattern form.

🔍 There are no other triggers right now. But if more range structure forms, we might consider opening a risky long on the breakout of the range top.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Tradingview

TradeCityPro | Bitcoin Daily Analysis #140👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis. Yesterday, the interest rate decision by the US Federal Reserve was announced, and once again, just like the past few months, it remained unchanged. Let’s see what impact it had on Bitcoin.

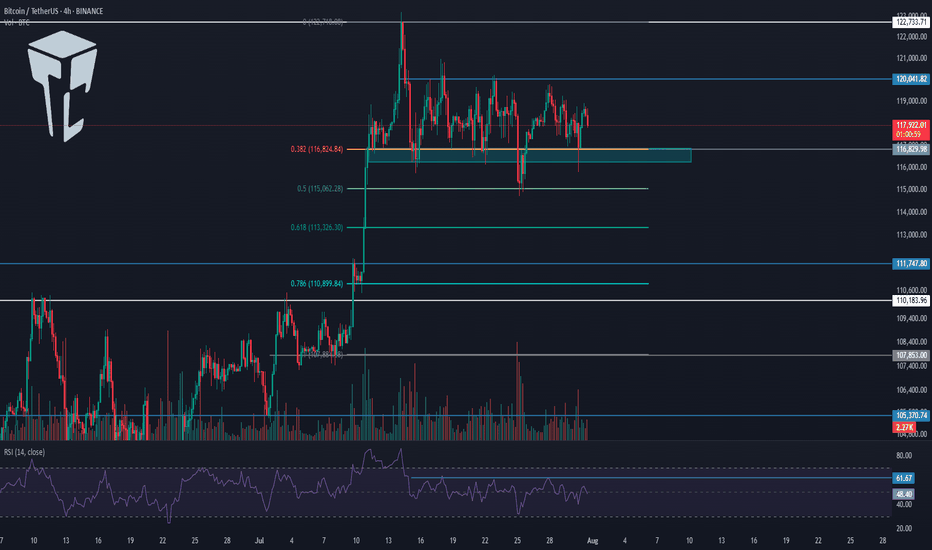

⏳ 4-Hour Timeframe

In the 4-hour timeframe, after the announcement of the unchanged interest rate and Powell’s speech, Bitcoin printed a red candle on the support zone and even wicked lower, but then recovered and the price returned back into the box.

✔️ Basically, we can say that this month’s rate decision had no real impact on the market, and Bitcoin is still moving inside its range box. The fact that the support zone wasn’t lost is a positive sign for the continuation of the trend.

⭐ But the important point is this: if the uptrend is going to continue, the price must print a higher high or at least a level equal to 120041, and in my opinion, if for any reason a lower high gets printed, the chances of breaking below 116829 significantly increase.

📊 I currently have no new position on Bitcoin, and all my entries are below 110000. But if 120041 breaks, I’ll open a long position for the next bullish wave that Bitcoin might start.

💥 A major trigger for starting a new leg is the 61.67 level on the RSI. As long as RSI remains below this level, there’s no bullish momentum in the market — and considering that the number of touches to 116829 has increased, the probability of a correction is also rising.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

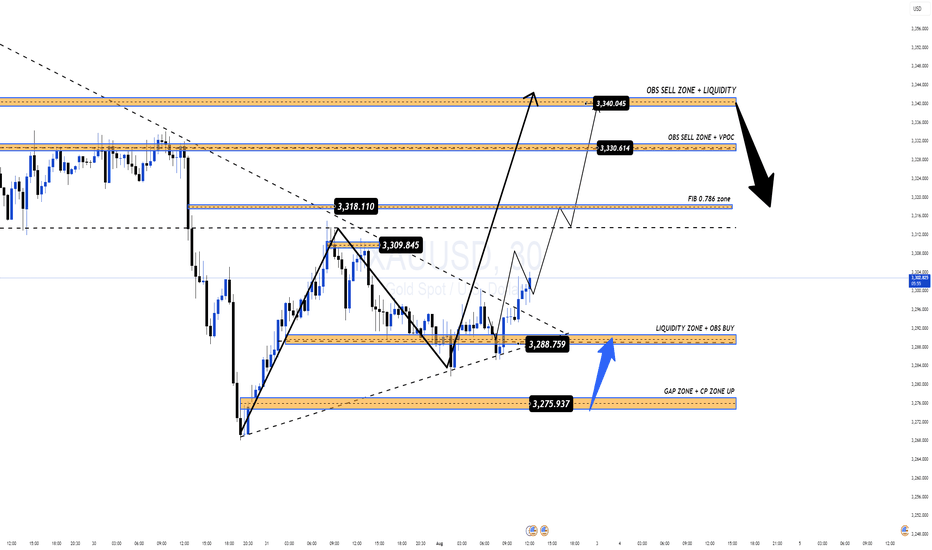

GOLD TRADING PLAN – Triangle Squeeze, All Eyes on NFP【XAU/USD】GOLD TRADING PLAN – Triangle Squeeze, All Eyes on NFP

Gold continues to trade within a large symmetrical triangle, tightening toward the end of its range. However, current candle structure shows clear bullish momentum, indicating the potential for a strong upside breakout.

🔍 Today’s Key Focus: Non-Farm Payrolls (NFP)

Market expectations are pointing to weaker-than-expected US economic data, which could trigger strong FOMO-buying for gold if confirmed. A poor NFP report would likely weaken the USD, supporting bullish continuation.

🔑 Strategy and Key Technical Levels:

Watch for a confirmed breakout above the descending trendline to trigger Wave 3 of the bullish structure.

CP ZONE + OBS BUY ZONE triggered yesterday already yielded 160+ pips profit.

Strategy: Prefer buy-the-dip entries. SELL setups only valid on strong resistance rejection. Avoid counter-trend trades near breakout zones.

🟩 BUY ZONE:

Entry: 3276 – 3274

Stop Loss: 3270

Take Profits:

3280, 3284, 3290, 3294, 3300, 3305, 3310, 3320, 3330, 3340, 3350

🟥 SELL ZONE:

Entry: 3339 – 3341

Stop Loss: 3345

Take Profits:

3335, 3330, 3325, 3320, 3315, 3310, 3305

TradeCityPro | ONDO Builds Strength Beneath Key Supply Barrier👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ONDO coin for you — one of the RWA projects, currently ranked 37th on CoinMarketCap with a market cap of $2.93 billion.

📅 Daily Timeframe

In the daily timeframe, as you can see, this coin has formed a range box between the levels of 0.7354 and 1.1933, and the price is currently sitting in the upper half of this box.

✔️ At the moment, the price is hovering around 0.9037, and it’s forming a higher low above 0.7354. If this low gets confirmed, the probability of breaking above 1.1933 increases.

⭐ The 1.1933 zone is a very significant supply level that was previously acting as support in late 2024, and after being broken, has since acted multiple times as resistance.

📊 If this area breaks, we can open a long position, or even buy this coin in spot. Personally, if this trigger is broken, I’ll open a long-term long position.

✨ The target for this position is 2.0565, and once the price reaches this level, we can take profits and consider a spot buy.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

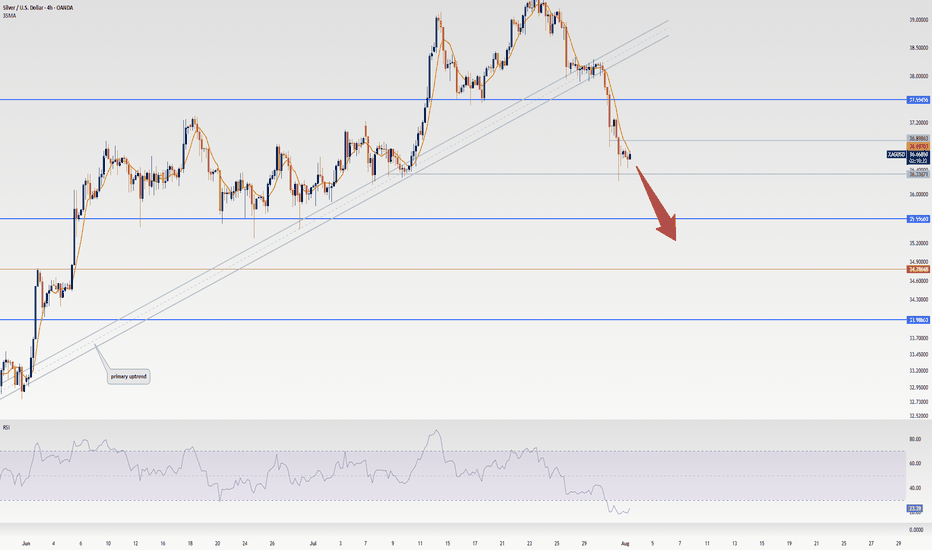

Market Stuck in Limbo? XAGUSD Update & Likely Range AheadLet’s talk silver.

The market's clearly undecided — no real momentum, just hesitation.

We’re approaching overextended RSI levels, so don’t expect fireworks just yet.

Im Skeptic from Skeptic Lab and In this quick update, I’ll show you what I’m watching for both long and short triggers …

and why a range might dominate the next few days.

👉 Watch till the end to avoid getting trapped by fake breakouts.

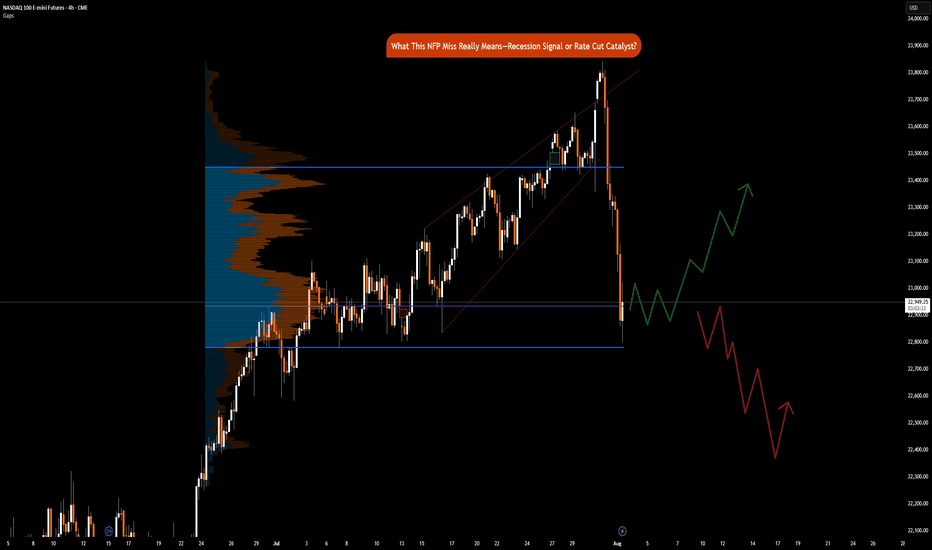

NFP Miss Implications: Recession Signal or Rate Cut CatalystCME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1!

Happy Friday, folks!

Today is the first Friday of August, and that means the highly anticipated Non-Farm Payroll (NFP) numbers came in at 7.30 am CT.

US Non-Farm Payrolls (Jul) 73.0k vs. Exp. 110.0k (Prev. 147.0k, Rev. 14k); two-month net revisions: -258k (prev. +16k).

Other key labor market indicators were as follows:

• US Unemployment Rate (Jul) 4.2% vs. Exp. 4.2% (Prev. 4.1%)

• US Average Earnings MM (Jul) 0.3% vs. Exp. 0.3% (Prev. 0.2%)

• US Average Earnings YY (Jul) 3.9% vs. Exp. 3.8% (Prev. 3.7%, Rev. 3.8%)

• US Labor Force Particle (Jul) 62.2% (Prev. 62.3%)

Data and Key Events Recap:

What a year this week has been! It's been packed with high-impact economic data and pivotal central bank decisions, especially from the Federal Reserve. On top of that, trade and tariff announcements have dominated the headline.

U.S. economic data this week was broadly strong. Second-quarter GDP came in at 3.0%, beating expectations and signaling solid growth. The ADP employment report also surprised to the upside, printing 104K vs. the 77K forecast. Consumer confidence showed resilience as well, with the Conference Board’s reading rising to 97.2.

Inflation data was mixed but mostly in line. Core PCE for June rose 0.3% MoM, while the YoY reading ticked up to 2.8%, slightly above the expected 2.7%. The broader PCE Price Index also came in at 0.3% MoM, with a YoY print of 2.6%, slightly higher than forecast.

The Federal Open Market Committee (FOMC) voted to keep the federal funds rate target range unchanged at 4.25% – 4.50%. Notably, Governors Waller and Bowman dissented, favoring a 25-basis-point rate cut as expected, however, marking the first dual dissent by governors since 1993.

Changes to the FOMC Statement included a downgraded assessment of economic growth, reflecting slower real consumer spending. The Committee reiterated that uncertainty around the economic outlook remains elevated. It maintained its view of the labor market as "solid" and inflation as "somewhat elevated." Forward guidance remained unchanged, emphasizing the Fed’s readiness to adjust policy as necessary while continuing to monitor risks to both sides of its dual mandate.

Here’s a summary of key points from the FOMC press conference:

• On current policy stance:

“We decided to leave our policy rate where it’s been, which I would characterize as modestly restrictive. Inflation is running a bit above 2%... even excluding tariff effects. The labor market is solid, financial conditions are accommodative, and the economy is not performing as if restrictive policy is holding it back.”

Chair Powell commented on the need to see more data to help inform Fed’s assessment of the balance of risks and appropriate Fed Funds rate.

• On labor market risks:

“By many statistics, the labor market is still in balance... You do see a slowing in job creation, but also a slowing in the supply of workers. That’s why the unemployment rate has remained roughly stable.”

• On inflation and tariffs:

“It’s possible that tariff-related inflationary effects could be short-lived, but they may also prove persistent. We’re seeing substantial tariff revenue—around $30 billion a month—starting to show up in consumer prices. Companies intend to pass it on to consumers, but many may not be able to. We’ll need to watch and learn how this unfolds over time.”

Trade Headlines:

US President Trump announced tariffs on countries ranging from 10%-41%. Average US tariff rate now at 15.2% (prev. 13.3%; 2.3% pre-Trump), according to Bloomberg. US officials said that if the US has a surplus with a country, the tariff rate is 10% and small deficit nations have a 15% tariff, US officials said they are still working out technicalities of rules of origin terms for transshipment and will implement rules of origin details in the coming weeks. No details on Russian oil import penalty. Sectoral Tariffs White House said new reciprocal tariff rates take effect on Friday. Although Canada’s tariffs were increased to 35%, excluding USMCA goods, the effective rate is only 5%.

The economic data is showing strength, on the contrary, tariffs announcements for most countries have now been announced. Investors need to consider that tariffs are not just a tool to reduce trade deficit, it is also a geopolitical tool presently being used to shape alliances. The US wants to soften BRICS, China and Russian influence on the world stage.

Key to note is that these tariffs are substantially lower than what was announced on April 2nd, 2025.

The key question now remains, do participants buy the dip or ‘sell the fact’ is the current playbook?

Market Implications

Given the prior revisions in NFP data of -258K, July’s payroll came in at 73K, missing forecasts of 110K. What does this mean for markets? Markets are now pricing in 75% chance of a September rate cut. Prior revisions along with the current job market slowing down imply that risks to the downside are substantially increasing. Fed’s current policy is not just moderately restrictive but rather it may likely tip the US into a recession if Fed Funds rates remain elevated. The Chair asked to see more data, and here it is but I do wonder why they did not take this data into account for the July meeting. Surely, it would have been available to them.

Another question to ask would be, is it due to defiance of rate cut calls by the US administration? Is the Fed already behind the curve?

Fed’s dual mandate targets inflation and maximum employment. While inflation is sticky, the Fed may need to abandon their 2% mandate in favor of average inflation of 2.5% to 3%. A less restrictive policy will provide needed stimulus along with the fiscal stimulus provided via the BBB bill.

This drastically changes, in our analysis, how investors position themselves heading into the remainder of the year.

Markets (equities) may retrace slightly but the dip in our opinion will still be the play given weaker labor market data and increased rate cut bets. The bad news here means that the Fed has the data it wants to see to start cutting. Market pricing in 2 cuts seems to be the way forward for now.

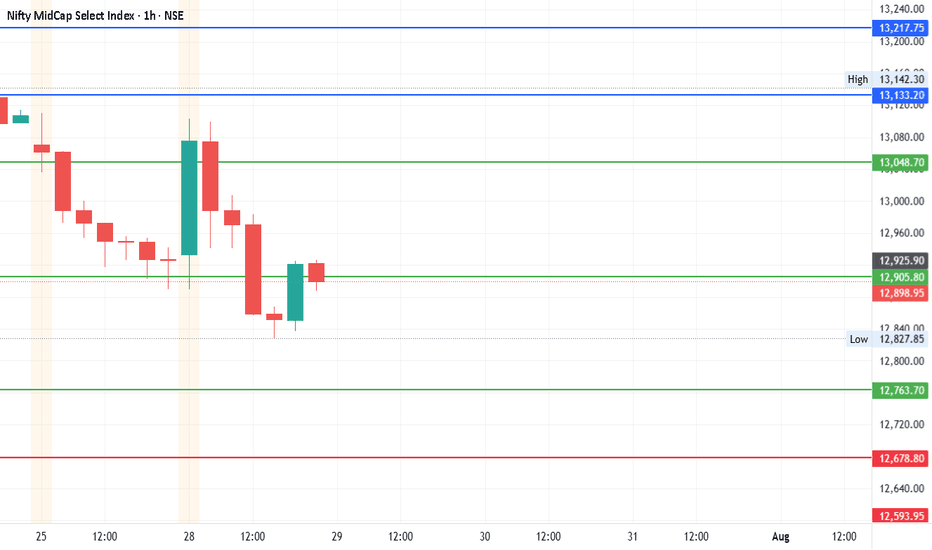

#NIFTY_MID_SELECT - 400 POINTS SWING ON CARDS?Date: 28-07-2025

#Midcap - Current Price: 12898.95

Pivot Point: 12905.825 Support: 12763.711 Resistance: 13048.719

Upside Targets:

Target 1: 13133.222

Target 2: 13217.725

Target 3: 13334.688

Target 4: 13451.650

Downside Targets:

Target 1: 12678.818

Target 2: 12593.925

Target 3: 12476.963

Target 4: 12360.000

#TradingView #Stocks #Equities #StockMarket #Investing #Trading #NiftyMIDCAP

#TechnicalAnalysis #StockCharts #Finance

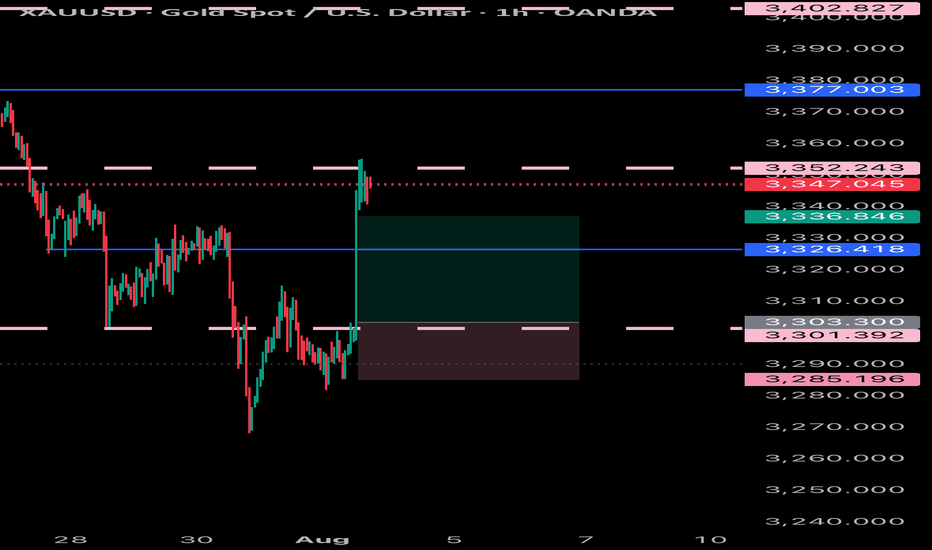

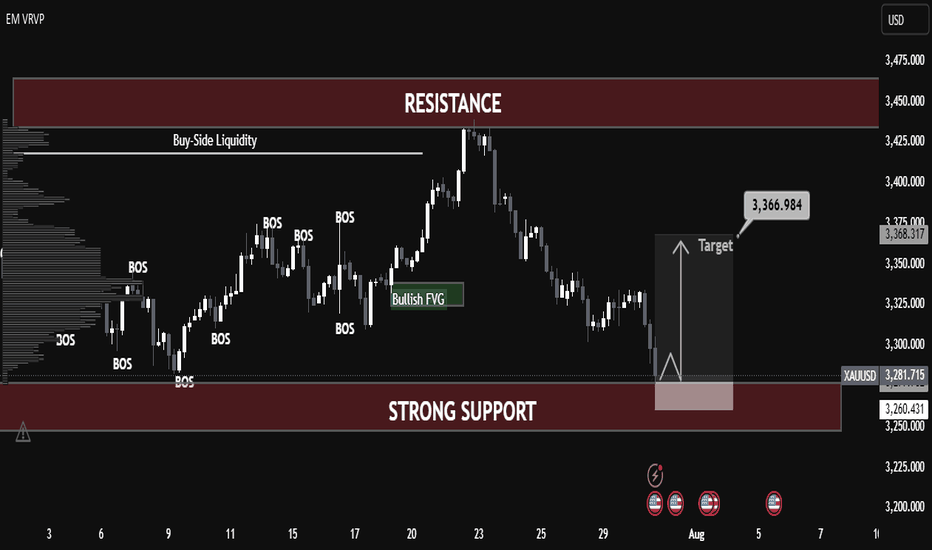

XAUUSD – Strong Bullish Reversal from Key Support XAUUSD – Strong Bullish Reversal from Key Support

Chart Summary:

Gold (XAUUSD) has shown a clear reaction from a strong support zone near 3260, suggesting bullish momentum is gaining strength. The chart highlights multiple key market structure elements and confirms the potential for a bullish move.

Technical Highlights:

🔻 Strong Support Zone (3260–3280):

Price tapped into a well-defined demand zone with historical significance, initiating a bullish response.

🔺 Resistance Zone (3460+):

A strong resistance level lies ahead. This area may act as a potential target for bulls.

🔁 Break of Structure (BOS):

Multiple BOS marks on the chart indicate trend shifts and liquidity grabs. Most recent BOS aligns with potential reversal.

💹 Bullish Fair Value Gap (FVG):

A bullish FVG near mid-structure confirms institutional interest and adds confluence to the upside move.

📈 Target: 3,366.984 USD

Marked as the next probable short-term liquidity target. If momentum sustains, price may approach resistance above this.

Price Expectation:

If the current bullish momentum holds above the strong support zone, we may see a rally towards 3,366–3,400 USD.

This move could be driven by:

Buy-side liquidity grab above prior highs

Breakout traders entering above BOS

Reaction to macroeconomic calendar (highlighted on the chart)

✅ Educational Takeaway:

This is a textbook example of:

Support-resistance flip

Liquidity concepts (Buy-Side Liquidity)

Fair Value Gaps usage

Volume Profile confluence

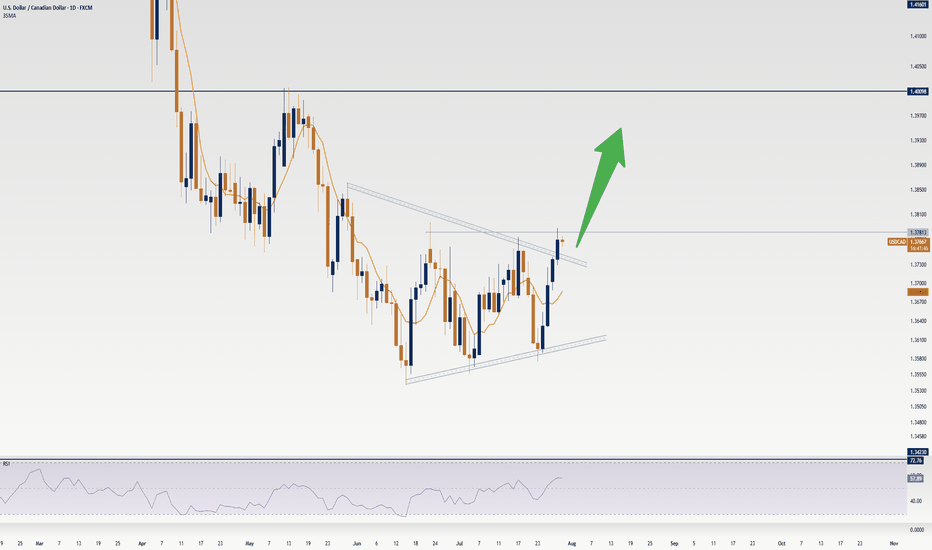

USDCAD Update: Don’t Sleep on This Uptrend’s First LegYo traders, Skeptic from Skeptic Lab here! 🚀 USDCAD’s serving a hot long trigger for pattern traders chasing the first leg of a big uptrend! We’ve got an ascending triangle breakout on the daily, with bullish candles stacking up, hinting at a return to the weekly bullish trend. Too early to confirm, but the momentum’s fire.

📈 Today’s FOMC meeting’s got everyone buzzing—will Powell cut, hold, or drop resignation hints? Check the full setup in the video, but with crazy news like Federal Funds Rate

, s tick to high-probability trades, keep risk low, and no FOMO or revenge trading! Drop your thoughts, boost if it vibes <3

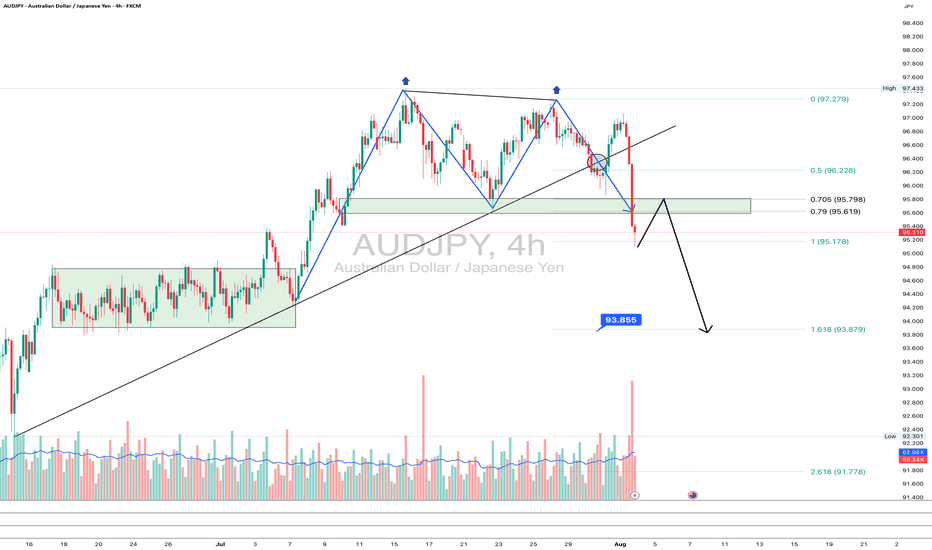

AUDJPY: goodbye uptrend?On the 4H chart, AUDJPY has printed a textbook double top pattern, breaking the rising trendline and diving below the 95.6–95.78 support zone - now acting as resistance. The pair is currently retesting this zone from below, which often provides a clean re-entry point for bears.

This area also aligns with the 0.705–0.79 Fibonacci retracement, reinforcing it as a key resistance. If the price rejects this zone, the next target is 93.85 (1.618 Fibo projection), followed by 93.25 and potentially 91.71 if momentum strengthens.

Fundamentally, the yen gains strength on risk-off flows and diverging rate expectations, while the Australian dollar is pressured by falling commodity prices and a likely pause from the RBA. This widens the rate differential and weakens AUD.

As long as price remains below 95.78, sellers are in control. Watch for a rejection from this retest zone.

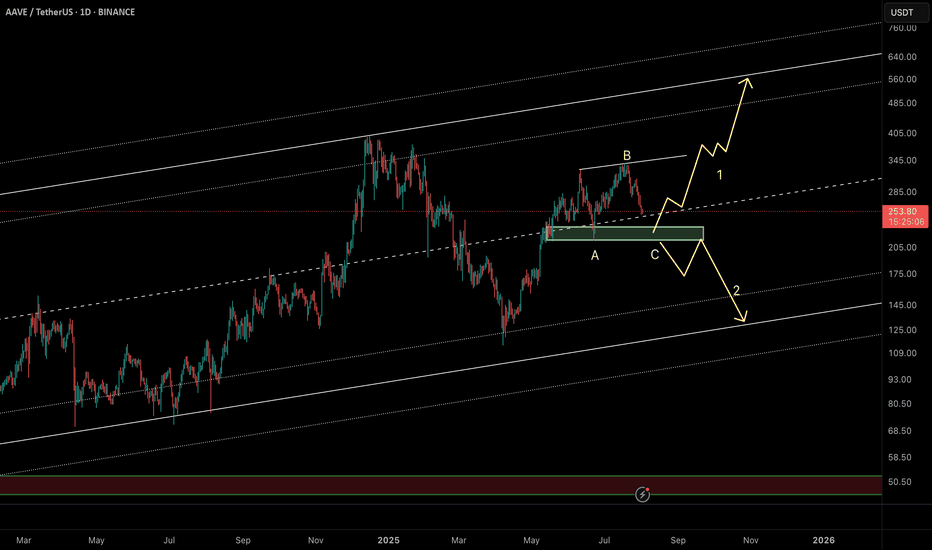

AAVE Daily Chart – Key Buy Zone & Two ScenariosAAVE is currently moving within a well-defined ascending channel on the daily timeframe. The last major bullish leg began from the $120 support and surged nearly +180% to a local high near $330.

Now, after a 25% pullback, price is consolidating around the midline of the channel near $250. More importantly, there’s a strong bullish order block sitting between $220–230, making this a low-risk buy zone with a stop below the order block.

🔸 Scenario 1 (bullish preferred):

Price dips into the $220 OB zone, completes a possible ABC correction, and launches a new bullish leg targeting the channel top above $500.

🔸 Scenario 2 (bearish alternate):

If the $220 order block fails, deeper correction could follow toward the channel bottom near $135.

⏳ This is a critical area to watch for reaction – Smart Money will likely show its hand soon.

🔗 Analysis by CryptoPilot

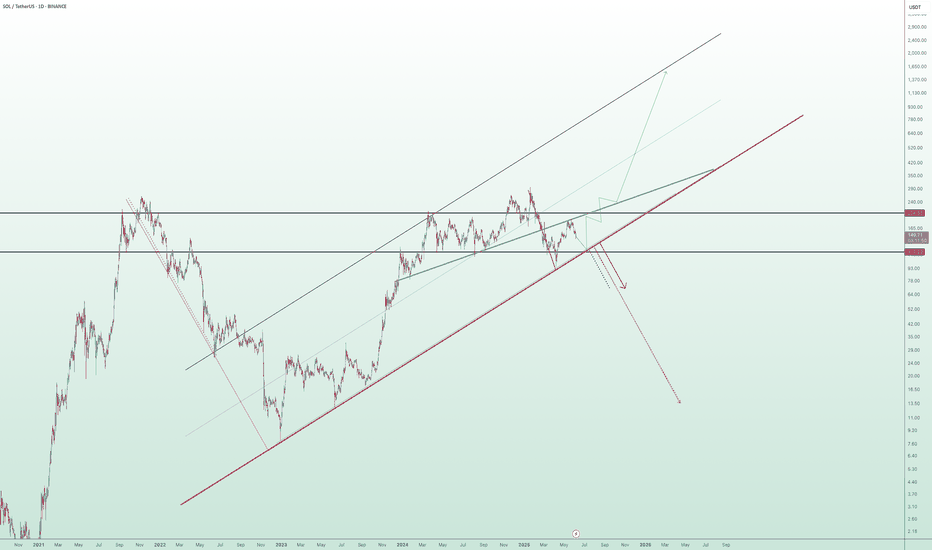

Long-Term Technical Outlook: Critical Decision Point Approaching

The chart illustrates a long-term technical structure where the price has been following an ascending channel after a prolonged bearish trend. However, recent price action indicates a breakdown below the green ascending trendline, raising concerns about a potential shift in market sentiment.

Currently, the $117 level is acting as a pivotal support zone. A sustained breakdown below this level — and more critically, below the red lower trendline — would validate the bearish scenario. This could trigger a deeper correction phase, with downside targets aligned along the red projection path. Such a move may lead to significantly lower price levels in the medium to long term.

🔽 Bearish Scenario:

If the price fails to hold above $117 and breaks below the red trendline, this would confirm the start of a bearish leg. Based on historical structure and projected trajectories, this could result in a descent toward the $93 level initially, with the possibility of extending further downward depending on market conditions.

🔼 Bullish Scenario:

On the other hand, if the price manages to reclaim the green trendline and more importantly, stabilize above the $204 resistance zone, it would signal renewed bullish strength. Such a move would open the path toward higher highs, potentially re-entering the previous upward channel and continuing the macro uptrend.

🧭 The price structure is now approaching a decisive zone, where either a confirmation of bearish continuation or a bullish recovery will likely unfold. Both scenarios have been visually outlined — green lines indicating bullish continuation, and red lines representing bearish momentum.

📌 Note: This analysis is for educational purposes only and should not be interpreted as financial advice.

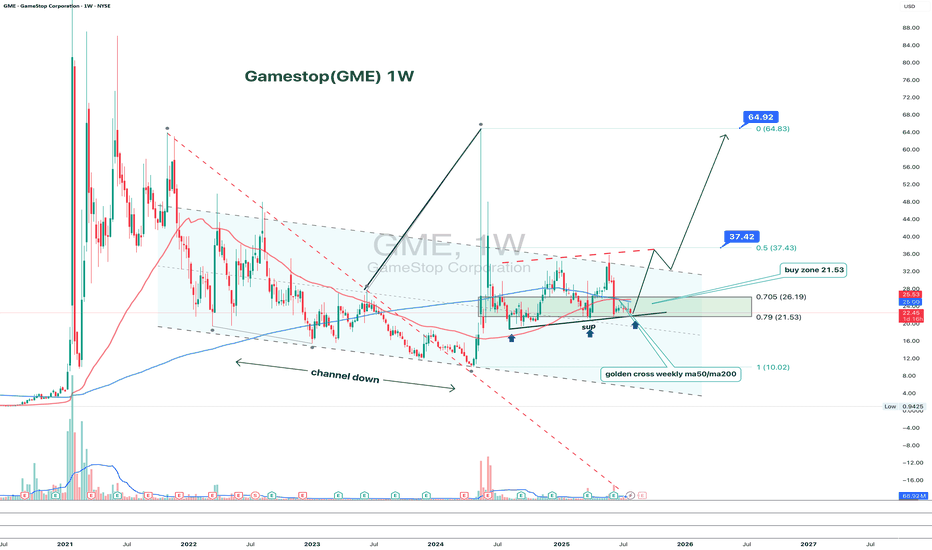

GME 1W: when the memes fade, the structure speaksGameStop is once again testing the lower boundary of its long-term consolidation, bouncing off the 21.53 zone - a level that aligns with the 0.79 Fib retracement and historical support. This zone also intersects with a key trendline on the weekly chart, and just recently, a golden cross (MA50 crossing MA200 weekly) printed - a rare but technically significant signal. The stock continues to trade inside a broad descending channel, and if this support holds, the natural next step is a move back toward the mid-range at 37.42 (0.5 Fib), followed by a possible push toward 64.92. The tactical setup favors a confirmation entry near current levels, with a stop under 21.00. Risk/reward here is among the cleanest GME has offered in months.

On the fundamental side, GameStop remains in a transitional phase. The company is shutting down unprofitable segments, reducing costs, and doubling down on e-commerce and digital distribution. Financial results are still slow to recover, but the latest Q2 2025 report showed positive operating cash flow and narrowing losses. This isn't a value play in the traditional sense - it's more about the potential for renewed retail-driven momentum if technical conditions align.

If there’s still power behind the crowd - this might be one of the most technically compelling entry zones of 2025.

Still Losing After Backtesting? This Fixed It.Let’s get straight to it.

If you’ve gone through the "nerd arc" and the "backtesting arc" but still aren’t profitable...

What’s the fix?

In this short write-up, I’ll walk you through 3 brutal truths that made me finally see green.

Is it hard?

UH—Damn right.

But let’s go 👇

1. Market Understanding

This isn’t something you "learn" from a course.

It’s something that clicks after dozens of stop losses and live trades.

Here are a few ways I got more comfortable with it:

1. Don’t fear opening trades or hitting stop loss.

Each trade gives you data. More trades = more experience = better market feel.

What’s the requirement? Capital and risk management. Without that, you won’t even survive long enough to "get" it.

2. Journaling every single trade.

Write everything: your thoughts, screenshots, feelings — before and after.

Too lazy to do it? Left trading. Simple.

3. Be the detective.

Read the chart like a story. No, seriously.

Think of Bitcoin as a character with real moods.

Every candle tells you something.

That 5% pump? Buyers pushing up. Then bears smacked it down — candle closed red.

Now price is bleeding again.

Why?

🔍 Be the detective.

4. Analyze the market every day — even without trading.

The more you observe, the more you see. Structures. Patterns. Behavior.

Easy? Nah.

It takes discipline — like posting one story text to Insta for 1,000 days straight. Still wanna try?

2. Personal Trading Plan

Remember how I said "don’t fear opening trades"?

Well — after you’ve opened a bunch, you can start tailoring your own trading plan based on you.

This isn’t a PDF you can steal off Google.

Only after seeing how you behave in trades, you’ll know what rules make sense.

Maybe:

"I don’t trade when I’m emotionally off."

"This setup gave me the best results over 100 trades."

Just don’t copy-paste someone else’s rules.

Make a flexible structure, then let the details emerge from the market and your own experience.

Now —

Take a deep breath.

When was the last time you enjoyed your coffee?

More than a day ago?

Go make one now.

Might not get to taste it tomorrow.

Not everything in life is trading :)

3. Psychology

Ah, the final boss.

Still my weakest area, honestly.

But here are a few real things that helped:

Tip 1: WRITE.

Just write whatever you feel.

Telegram saved messages? Notebook?

Or if you're like me (🧠nerd), Notion.

Do it for 60 days straight — then feed that journal to ChatGPT and analyze yourself.

Takes time, but the patterns you'll see are... magical.

Tip 2: Money & Risk Management.

When you know your stop loss means only -0.25% of your capital…

why should you panic?

For me:

I place the SL, set a TP alert, and leave the screen.

No emotions, no fear.

Why? Because when capital is protected, so is my psychology.

Truth is, trading emotions aren’t just during the trade — they live in your head all day.

When your mental energy’s drained?

You’ll miss A+ setups.

Fall for BS ones.

Lose focus.

It’s complicated.

Because humans are complicated.

Our brains are the most tangled system known.

And somehow, out of all that noise, consciousness emerges.

A miracle.

So don’t expect to always feel calm.

Just aim to get better.

That’s it.

Thanks for sticking around.

These are just my thoughts, from one tired trader to another 🧠

I’m no expert—just sharing what’s worked (and what hasn’t).

If it helped, a boost would mean a lot.

🚫 Don’t FOMO

✅ Manage your capital

Until tomorrow —

Peace out. ✌️

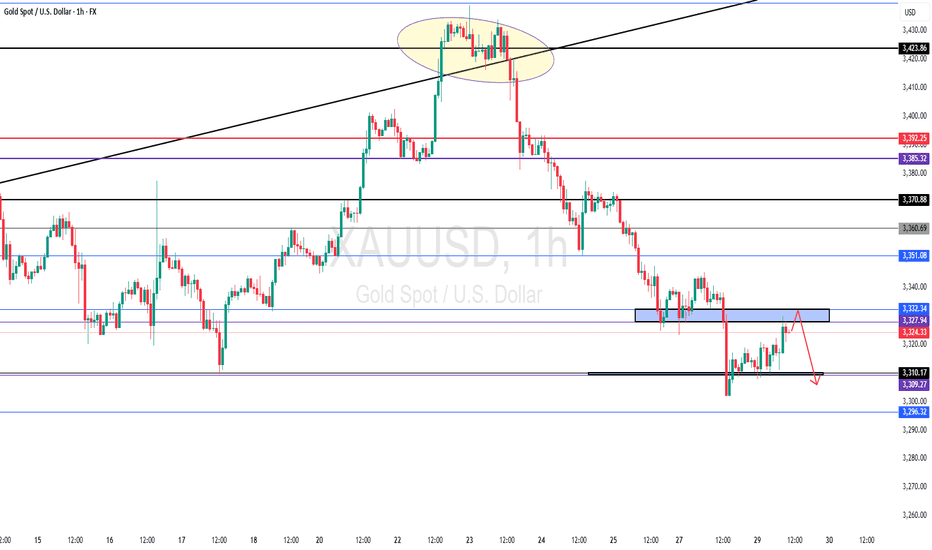

GOLD - Near Current Resistance? holding or not??#GOLD... so market perfectly holds our expected bottom and bounced back and now market just near to his current Resistance region.

that is around 3328 to 3332

keep close that region because if market hold it in that case we can see again drop towards our ultimate support 3310

NOTE: we will go for cut n reverse above 3332 on confirmation.

good luck

trade wisely

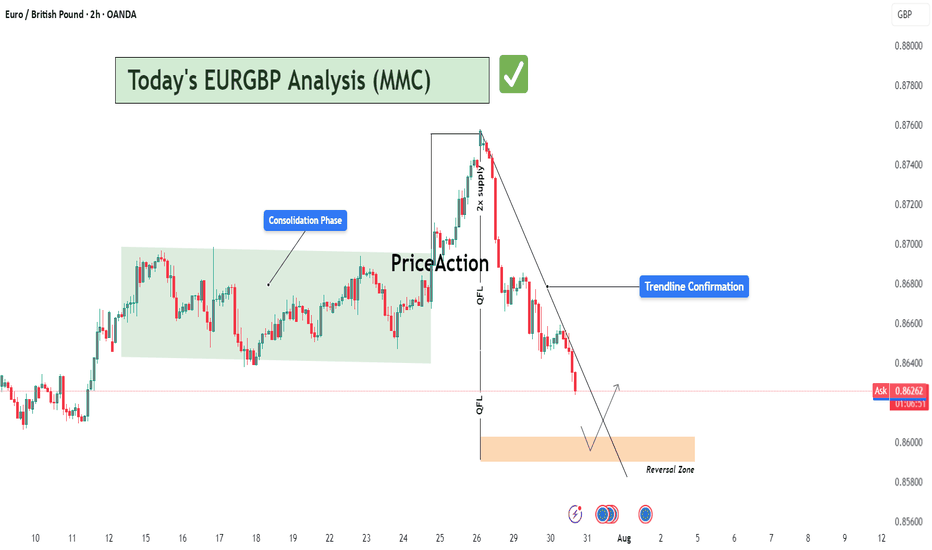

EURGBP Analysis : Bearish Leg Nearing Completion + Target Zone📍 Overview:

The EURGBP pair has recently provided significant price action signals that suggest a high-probability reversal setup is unfolding. This analysis dives deep into market structure, supply and demand dynamics, and institutional price behavior using MMC principles.

The current focus lies in identifying a potential trend reversal opportunity after a sharp decline from a key supply level, as price nears a well-marked Reversal Zone. This detailed breakdown covers each phase to provide clarity and trade planning.

🧩 Phase 1: Consolidation Phase (Accumulation)

From July 11th to July 24th, EURGBP moved sideways within a clearly defined range-bound structure (highlighted in green).

This consolidation indicates a battle of control between bulls and bears, typically signaling accumulation or distribution depending on breakout direction.

The tight price action and wicks on both sides suggest market makers accumulating positions before a breakout.

Price eventually broke out to the upside, confirming bullish accumulation rather than distribution.

🚀 Phase 2: Impulse Move & 2x Supply Rejection

Following the breakout from the consolidation, price experienced a strong impulsive rally, catching breakout traders and pushing into a major supply zone.

The area where price reversed is marked as a 2x supply rejection zone, suggesting heavy institutional sell orders were triggered.

This zone aligns with a historical resistance level and is critical in the current structure.

Price failed to sustain the bullish momentum, forming a sharp drop right after tapping into supply, indicating strong selling pressure.

🔄 Phase 3: Market Structure Shift via QFL (Quick Flip Levels)

As the price dropped from the supply zone, two significant QFL levels were printed in quick succession.

QFL (Quick Flip Levels) represent a break in internal structure, showing that buyers were no longer defending the previous support zones.

These quick flips signal an aggressive shift in momentum from buyers to sellers.

Each QFL breakdown was followed by a new lower low, confirming the start of a bearish sequence or trend leg.

📉 Phase 4: Descending Trendline & Dynamic Resistance

After the QFL shifts, a clear downtrend channel formed, respected by multiple lower highs.

The descending trendline drawn from the supply zone peak has acted as dynamic resistance, rejecting every bullish pullback attempt.

This trendline provides technical confluence for intraday traders to manage risk and timing entries.

🟠 Current Market Context: Entering the Reversal Zone

Price is now approaching a marked Reversal Zone (highlighted in orange).

This zone represents a high-probability demand area, previously respected as a base before the rally to supply.

If price reaches this area and shows signs of exhaustion (e.g., bullish engulfing, long wick rejection, volume divergence), it may serve as a reversal point.

This zone aligns with MMC logic — market makers tend to react at zones of trapped liquidity, especially after stop hunts.

📈 Projected Scenario & Trade Setup:

Price drops into the Reversal Zone

A bullish rejection pattern appears (e.g., pin bar, engulfing candle)

Price retests and breaks the descending trendline to confirm a momentum shift

Entry can be taken post-breakout or with aggressive confirmation inside the zone

Stops placed below the zone; targets aligned with the previous QFL or trendline retest

⚠️ Key Notes for Traders:

Don't chase the move. Wait for reversal confirmation before entering.

QFLs offer strong structure-based levels to identify where the market flipped.

Use trendline confluence and volume confirmation for precise entries.

Monitor price action in the Reversal Zone — if invalidated, the downtrend may extend toward the next macro support.

Apply proper risk management and stay patient for the setup to fully develop.

📊 Summary:

🧭 Bias: Short-term bearish → possible reversal bullish

🎯 Entry Area: Reversal Zone (0.85800 – 0.86000 approx.)

⛔ Invalidation: Clean break and close below 0.85700

🏁 Potential Target: First TP near 0.86750; extended TP near 0.87050 (previous QFL level)

🔄 MMC Approach Recap:

This analysis follows the Market Maker Cycle (MMC) method, which involves:

Consolidation (Accumulation)

Manipulation (False Breakouts or Stop Hunts)

Distribution (Rapid Expansion & Flip Levels)

Re-Accumulation or Reversal

Each step is clearly defined in this chart, offering a blueprint for both trend traders and reversal specialists.

💬 Let's Talk:

What do you think about this setup? Are you seeing similar MMC patterns on other EUR or GBP crosses?

Drop your thoughts, charts, and questions below!

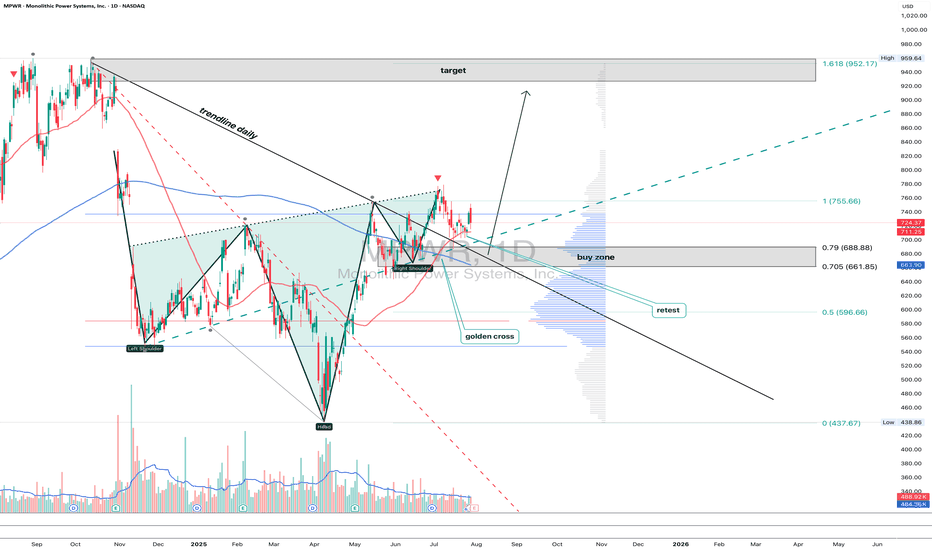

MPWR 1D: shoulders are squared and the battery's still fullMonolithic Power Systems broke out of a long-term descending trendline after completing a clean inverse head and shoulders. Now the price is pulling back into the 705–688 zone — a textbook retest area that combines the neckline, the 0.705–0.79 Fib levels, and a major volume shelf. Add to that a golden cross (EMA50 crossing EMA200 from below) and we have a solid technical foundation for continuation. Volume on the pullback is low, indicating no panic, just rotation. If 688 holds, the next levels to watch are 755.66 and 952.17 — the latter being the 1.618 Fib extension. Tactical setup: look for a reversal signal between 705–688, with a stop just below 661. As long as price holds this zone, the bullish structure remains intact.

Fundamentally, MPWR remains one of the strongest names in the semiconductor space. With over $1.5B in annual revenue and industry-leading margins, the company continues to see strong demand from data center and EV sectors. In its latest report, management highlighted accelerating orders from Tier‑1 manufacturers. The balance sheet is clean, with zero debt, and ongoing buybacks provide downside support. In a sector full of volatility, MPWR stands out with both structural reliability and technical clarity - making it a strong candidate for long-term positioning.

If this textbook pattern plays out, the train’s just leaving the station. The best seat is usually the one taken before the doors close.

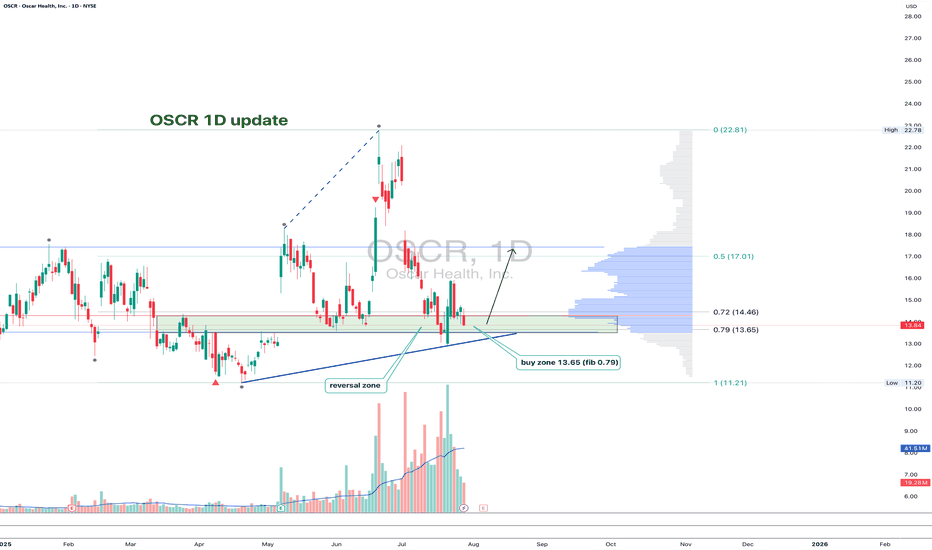

OSCR: back to support and now it’s decision timeAfter the recent impulse move, OSCR has pulled back to a key support zone around 13.65. That area aligns with the 0.79 Fib retracement, a horizontal level from spring, and a rising trendline that has already triggered reversals in the past. The structure is still intact, and buyers are testing the level again. If support holds and we get a bullish confirmation, the next target is 17.01, followed by a potential breakout toward the high at 22.81.

Volume remains elevated, the overall structure is healthy, and the correction is controlled. A break below 13.00 would invalidate the setup - until then, it’s a clean, high-reward zone with tight risk.

Fundamentally, Oscar Health has revised its 2025 guidance: revenue is expected in the $12–12.2B range, with operating losses projected between $200M and $300M. Despite softening topline growth, earnings per share are improving, and investor sentiment has been shifting. Technical strength is also reflected in the recent rise in RS Rating to 93, confirming that the stock is showing relative leadership even as the market cools.

This is one of those setups where both technicals and narrative are aligning - now we just need confirmation from the chart.