Tradingview

TradeCityPro | JUP Eyes Breakout as Altseason Momentum Builds👋 Welcome to TradeCity Pro!

In this analysis, I want to review the JUP coin for you. It’s one of the projects in the Solana ecosystem, currently ranked 59 on CoinMarketCap with a market cap of $1.65 billion.

📅 Daily Timeframe

On the daily timeframe, this coin is currently sitting below a very important resistance zone at 0.6312. This is a strong resistance area and serves as the main trigger for a trend reversal in this coin.

✔️ The main support floor for JUP is located at 0.3409, a level price has tested twice before. Now it has returned to 0.6312, and we can see increased market volume at this level, which indicates tension between buyers and sellers.

✨ A breakout of 0.6312 would be a good trigger for a long position, and I plan to open a long if this level breaks. This could potentially be a long-term position with a high risk-to-reward ratio.

🔔 The next major resistance zones are at 0.7858 and 1.1435, which we can use as targets for this position.

🔽 If the price gets rejected from the top and moves down, breaking 0.4186 and 0.3409, we can look to open a short position.

🧩 The break of 0.3409 would confirm the start of a downtrend, and it's one of the key zones where I’ll definitely look to hold a short position if it breaks.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

5 Lessons from My First 100 TradesAfter executing and reviewing over 100 real trades in crypto, forex, and gold — I found patterns. Bad patterns. Repeating mistakes. And lessons I wish someone had told me earlier.

So I broke them down into 5 key insights that changed how I trade — and might just save you thousands.

📘 Here’s what’s inside:

1️⃣ Smart Profit-Taking:

How I turned 10 R/R into 32 R/R using a dynamic exit plan.

📘Further resource:

Cycle Mastery (HWC/MWC/LWC)

---

Multi-Timeframe Mastery

2️⃣ The Sleep Edge:

70% of my losing trades happened after bad sleep. Here’s why that matters more than emotions.

3️⃣ No More Blind Stop Orders:

Why I stopped using buy/sell stops without real candle confirmation — and what I do instead.

📘 Further reading:

Breakout Trading Mastery

---

Indecision Candle Strategy

4️⃣ Multi-Layered Setups Win:

How structure, S/R, patterns, and timing stack into high-probability entries.

5️⃣ News Trading? Just Don’t.

The data behind why most of my SLs were hit near news time — and how I avoid the trap.

💡 These aren’t theories. These are real lessons from real trades.

If this video helped you or sparked an “aha” moment, give it a boost, commenting your takeaway, and sharing it with a fellow trader.

lets grow together :)

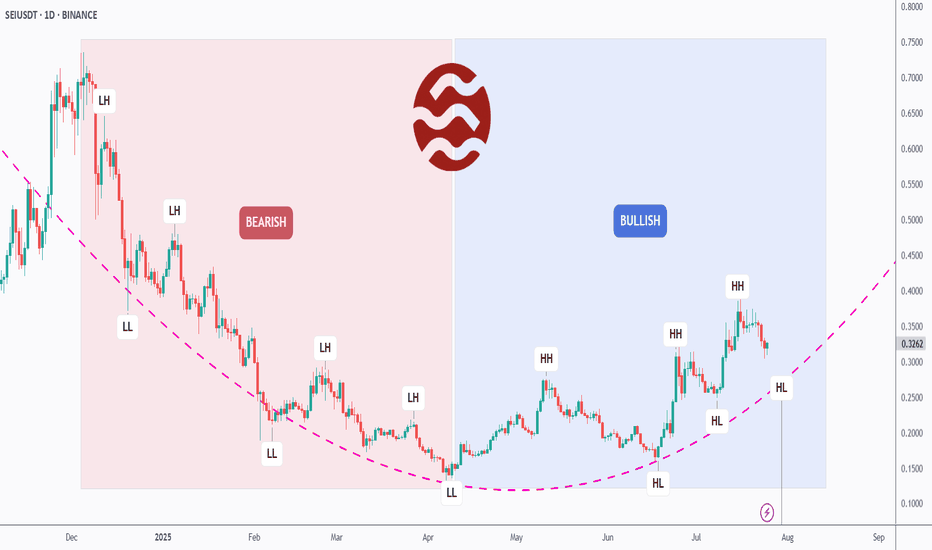

[Deep Dive] SEI – Edition 2: From Pain to Power: A Bull Cycle?SEIUSDT may have just flipped the script.

After months of consistent lower highs and lower lows, SEI has officially broken its bearish structure and is now printing clear higher highs (HH) and higher lows (HL) — a textbook sign of a trend reversal.

📉 Left Side: Bearish Breakdown

From late 2023 to Q2 2025, SEI was stuck in a painful macro downtrend. The structure was brutally clean: LH → LL → LH → LL. Each bounce was weaker than the last, reflecting exhausted buyers and relentless supply.

But something changed in late Q2…

📈 Right Side: Bullish Rebuild

Since its final low around April, SEI began to carve a new path. What started as a subtle accumulation quickly morphed into a solid structure of higher highs and higher lows.

The arc-shaped pink trendline tracks this momentum shift — and we’re now watching a potential continuation of the bullish cycle.

The most recent HL is forming exactly on that curve — a critical moment where bulls may step in for the next impulsive move.

🔥 What’s Fueling the Shift?

SEI is gaining traction as a high-performance Layer 1 designed for trading apps, with native parallelization and a focus on speed and throughput.

Its recent ecosystem growth — including projects in DeFi, gaming, and infrastructure — has started to attract both retail and VC attention.

On-chain metrics are showing increased activity, and whispers of upcoming protocol incentives could be the spark that pushes SEI toward the $0.45–$0.50 range.

🧠 What We’re Watching

- The current HL zone — will bulls defend this level?

- If SEI can break above the previous HH, the bullish structure strengthens.

- A failure to hold this HL would suggest a range or even deeper correction — so risk management is key.

Let’s recap:

- Structure has flipped bullish ✅

- SEI is riding a fresh higher low ✅

- Fundamental momentum is building behind the scenes ✅

It’s now up to the market to decide if this was just a bounce — or the beginning of a much bigger move.

💬 What do YOU think: Is SEI building steam for a breakout, or just teasing us with a fakeout?

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

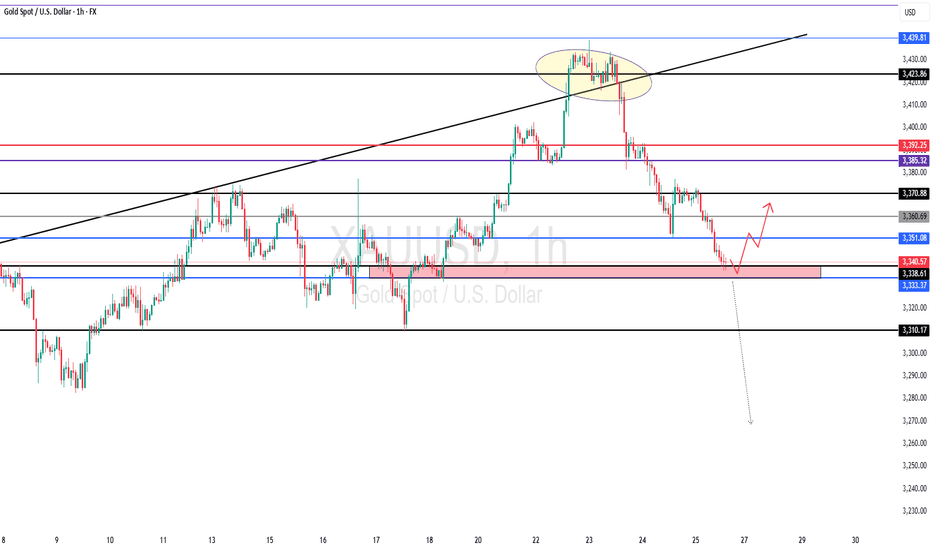

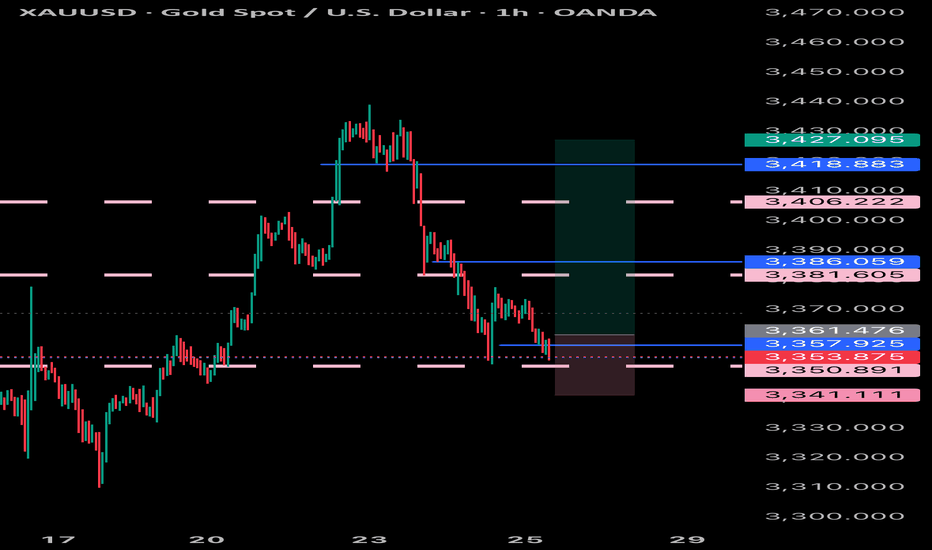

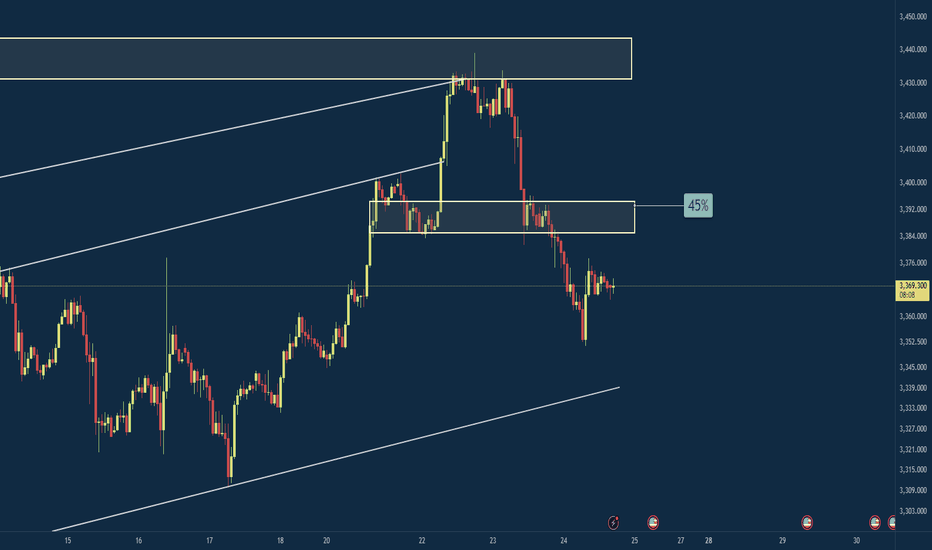

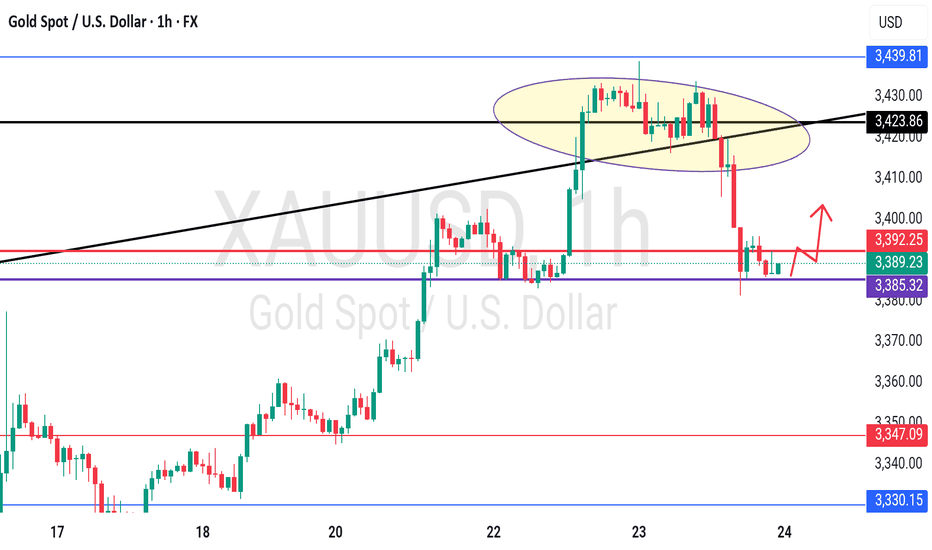

Gold at Key Support – Will Bulls Step In or Drop Continue?🌐 Market Overview

Gold has struggled to recover after yesterday's sharp drop, driven by macro-political concerns and profit-taking at recent highs.

🔻 On July 24, former President Trump made an unexpected visit to the US Federal Reserve, sparking speculation that he's pressuring the Fed to cut interest rates soon.

While the Fed has yet to make any dovish moves, short-term bond yields dipped slightly, showing growing market expectations for policy easing.

The US dollar remains strong, reflecting some skepticism around the Fed’s possible shift despite recent economic strength.

📉 Technical Outlook

On the H2 chart, gold still maintains an overall bullish structure. However, it's approaching a critical support level near 3338, which aligns with the VPOC and the ascending trendline.

📌 If this zone breaks, price may rapidly fall toward deeper liquidity zones in the 332x – 329x range.

🎯 Trade Setups

🔽 BUY SCALP (Quick Reaction Play)

Entry: 3338 – 3336

Stop Loss: 3332

Take Profit: 3342 – 3346 – 3350 – 3354 – 3360 – 3365 – 3370 – 3380

🟢 BUY ZONE (Deep Buy Area – Long-Term Potential)

Entry: 3312 – 3310

Stop Loss: 3305

Take Profit: 3316 – 3320 – 3325 – 3330 – 3340 – 3350 – 3360 – 3370 – 3380

🔻 SELL ZONE (if market retests)

Entry: 3374 – 3376

Stop Loss: 3380

Take Profit: 3370 – 3366 – 3360 – 3355 – 3350 – 3340 – 3330

🔍 Key Levels to Watch

Support: 3350 – 3338 – 3325 – 3310 – 3294

Resistance: 3374 – 3390 – 3400 – 3421

⚠️ Risk Note

As we head into the weekend, liquidity sweeps are common – especially on Fridays. Be cautious of sharp moves.

Focus mainly on scalp setups today. Avoid early long entries unless strong confirmation appears at lower liquidity zones.

Always follow your TP/SL strategy to protect your capital.

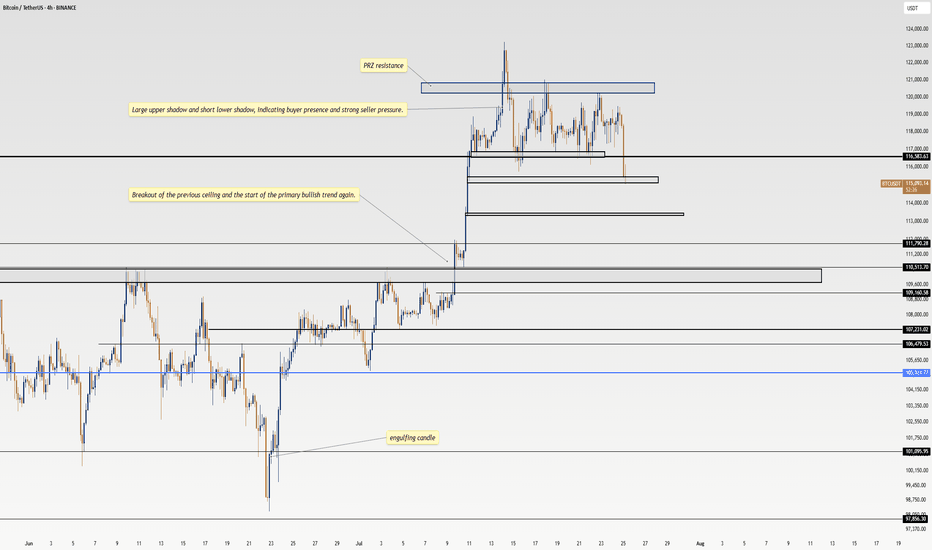

Bitcoin’s Epic Run from 80K to 120K: What’s Next for BTC?Yo traders, it’s Skeptic from Skeptic Lab! 🩵 Diving into Bitcoin’s wild ride from 80K to 120K—breaking down the key supports, resistances, and what’s next for BTC.

From the $76k bounce to smashing $110K, we’re eyeing the $120K PRZ. Will it correct or keep soaring? Check the video for the full scoop! Drop your thoughts or coin requests in the comments, boost if it vibes & Let’s grow together!

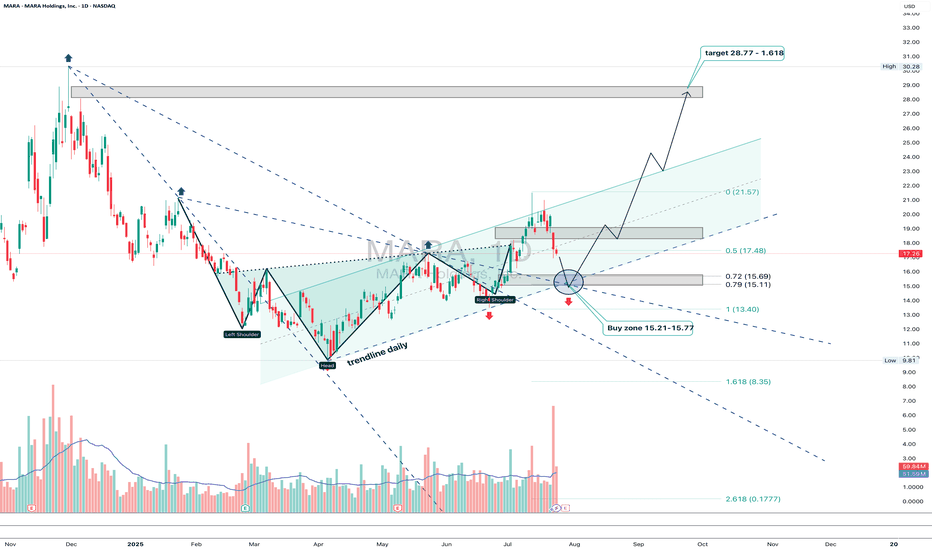

MARA: shoulders done, now walk toward the targetOn the daily chart, MARA completed a textbook inverse Head & Shoulders reversal with a clear breakout above the descending trendline. A corrective pullback followed, and the price is now heading into the key buy zone at 15.21–15.77 - aligning with the 0.72 and 0.79 Fibonacci retracements, and the upper boundary of the broken channel. This is the area to watch for a potential continuation of the bullish impulse.

Volume on the breakout was above average, confirming strong buyer interest. The EMAs are trending below the price, supporting the upward structure. The first target is located at 21.57 (previous resistance), with a potential extension to 28.77 (Fibonacci 1.618).

Fundamentally, MARA remains highly correlated with BTC and crypto sentiment. As interest returns to crypto-related assets due to ETF flows and possible Fed easing, mining stocks like MARA gain attention. Recent reports also show improved production efficiency and lowered costs - a tailwind for bulls.

Tactically, the best setup would be a confirmed reaction from the buy zone — whether a strong candlestick formation, volume surge, or reclaim of a key level. If that happens, aiming for 21.57 and 28.77 becomes a solid plan.

The pattern played out - now it's time for the market to walk the talk.

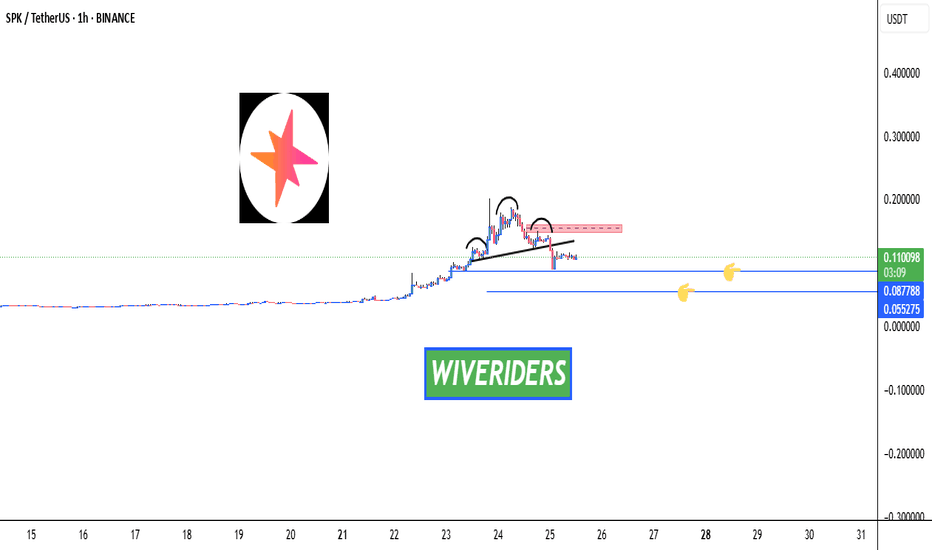

SPK Market Update – Key Levels Ahead 🚨 SPK Market Update – Key Levels Ahead 🔄📉📈

SPK previously formed a bearish Head and Shoulders pattern, which was confirmed by a breakdown. So, what’s next?

🔹 Option 1:

Price could move down to the two blue support levels — these zones may offer potential long entries, as buyers were active here before. Watch for confirmation! 👀

🔺 Option 2:

We also have a red resistance zone, located around the right shoulder of the H&S.

If INDEX:SPK breaks above this zone, it may signal the return of buyers and a potential bullish reversal.

Welcome Back! Gold Trading Strategy & Key Zones to WatchIn this week’s welcome back video, I’m breaking down my updated approach to XAU/USD and how I plan to tackle the Gold markets in the coming days. After taking a short break, I’m back with fresh eyes and refined focus.

We’ll review current market structure, identify key liquidity zones, and outline the scenarios I’m watching for potential entries. Whether you’re day trading or swing trading gold, this breakdown will help you frame your week with clarity and confidence.

📌 Covered in this video:

My refreshed trading mindset after a break

Key support/resistance and liquidity zones

Market structure insights and setup conditions

What I’ll personally avoid this week

The “trap zones” that might catch retail traders off guard

🧠 Let’s focus on process over profits — welcome back, and let’s get to work.

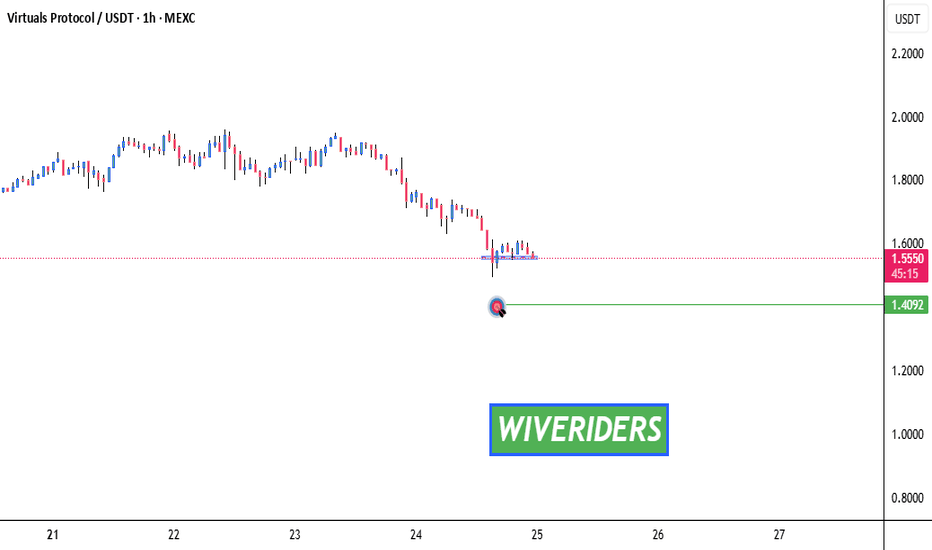

Testing Blue Support – Key Level Ahead!🚨 SPARKS:VIRTUAL Testing Blue Support – Key Level Ahead! 📉🔵

SPARKS:VIRTUAL is currently testing the blue support zone.

📊 If a breakdown occurs, we could see a move toward the green line level as the next target.

🛑 Watch for confirmation — this could signal further downside if sellers take control.

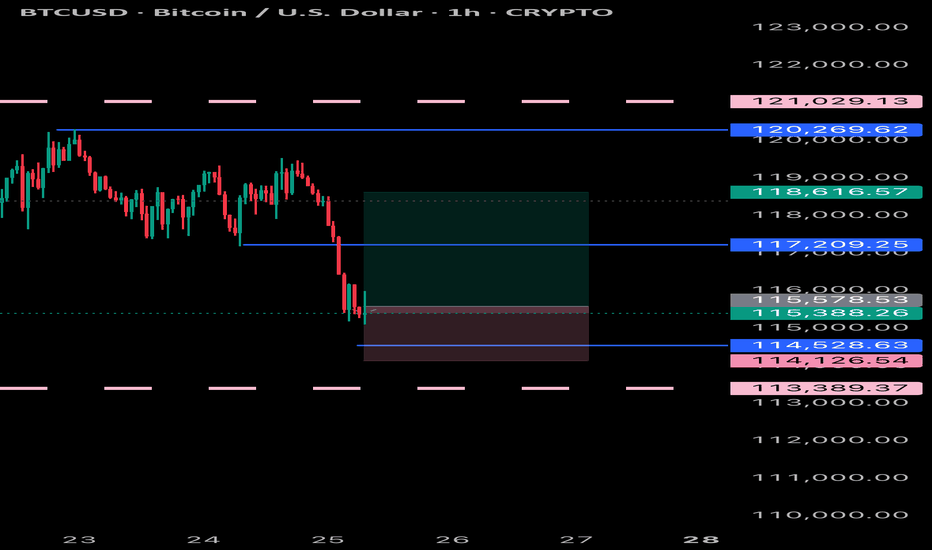

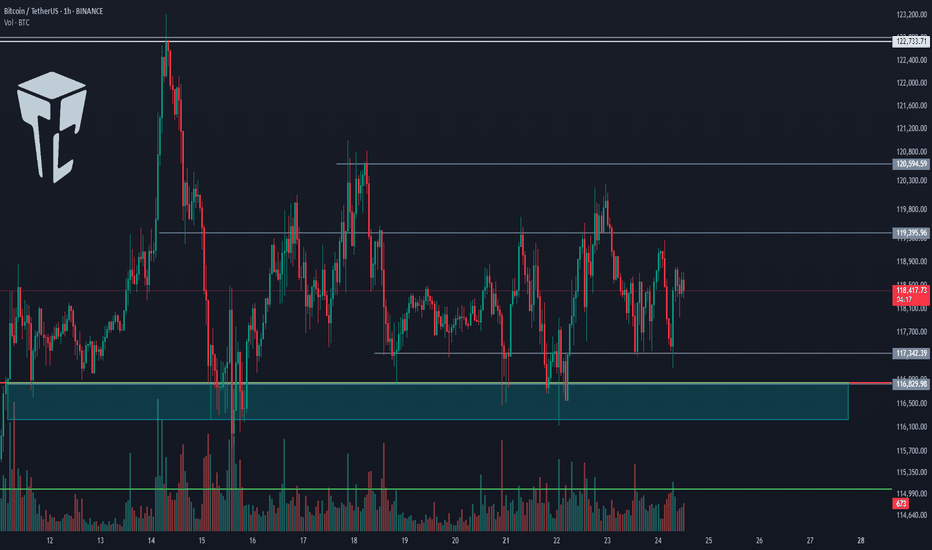

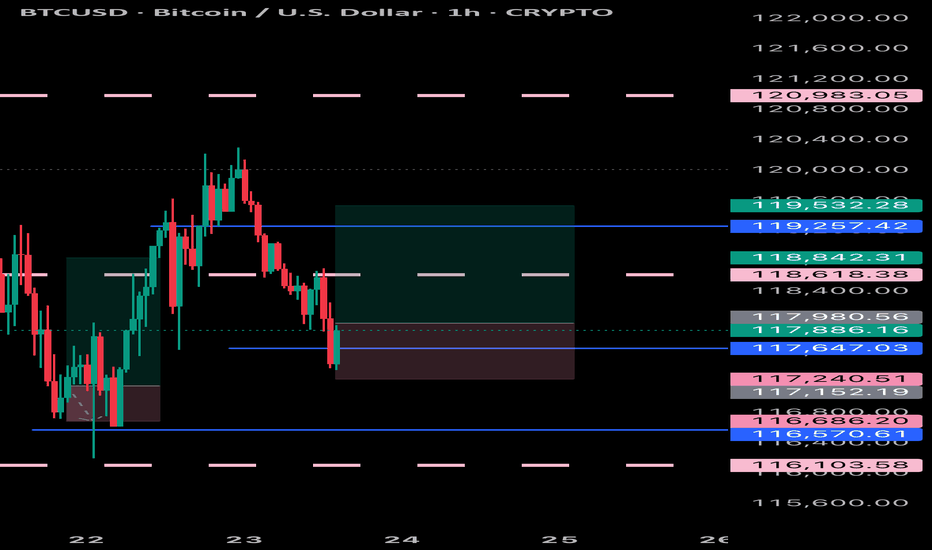

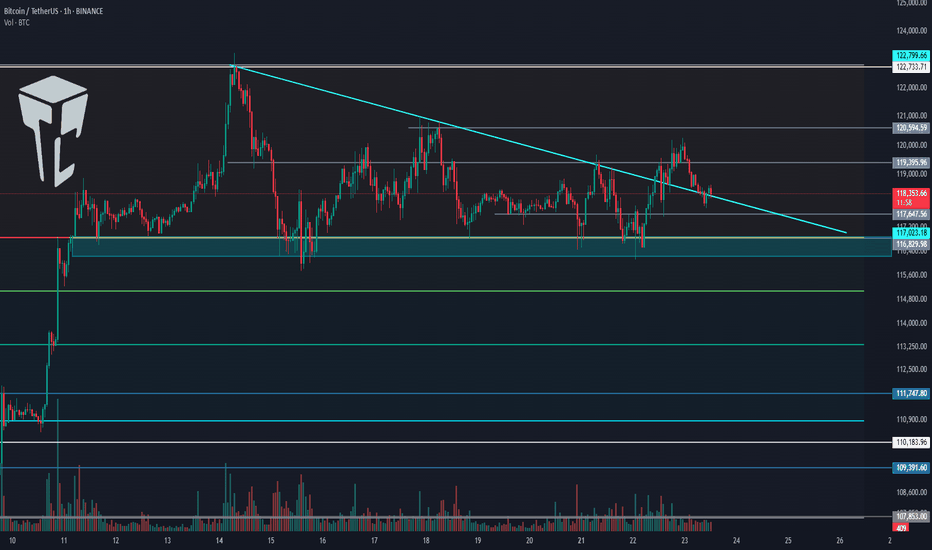

TradeCityPro | Bitcoin Daily Analysis #136👋 Welcome to TradeCity Pro!

Let’s get into the analysis of Bitcoin and major crypto indices. As usual in this analysis, I’m going to review the futures triggers for the New York session.

⏳ 1-Hour Timeframe

On the 1-hour timeframe, price is still ranging inside the box, and none of its triggers were activated yesterday.

✔️ The support floor is at 117,342, and another key support zone is around 116,000.

✨ If these zones break, Bitcoin may begin a deep correction. In that case, we can open short positions or close long-term long positions that we’re already holding.

⭐ For long positions, we still have the 119,395 and 120,594 triggers. A breakout of either zone could provide a very good entry point for the next bullish leg of Bitcoin.

👑 BTC.D Analysis

Let’s move on to Bitcoin Dominance. Yesterday, dominance stabilized above the 61.20 zone, and as I mentioned before, breaking this zone led to a bullish leg, which continued up to 62.41, and currently, it has more bullish momentum.

💥 If 62.41 breaks, the bullish momentum will intensify. However, I still believe the overall trend is bearish, and if 60.46 breaks to the downside, the decline could continue.

📅 Total2 Analysis

Let’s go over Total2. This index has continued to correct and has now dropped to the 1.41 zone, which corresponds to the 0.5 Fibonacci level. It has now created a trigger around 1.47.

⚡️ If 1.47 breaks, we can open a long position. Our next trigger will be 1.53.

A breakout of 1.53 would signal the start of the next bullish wave.

📅 USDT.D Analysis

Now to Tether Dominance. This index has finally exited its range box and has broken the 4.25 level.

The current resistance stopping price is 4.36.

🔔 If dominance drops back below 4.25, strong bearish momentum could hit, increasing the likelihood of a breakdown of 4.13.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

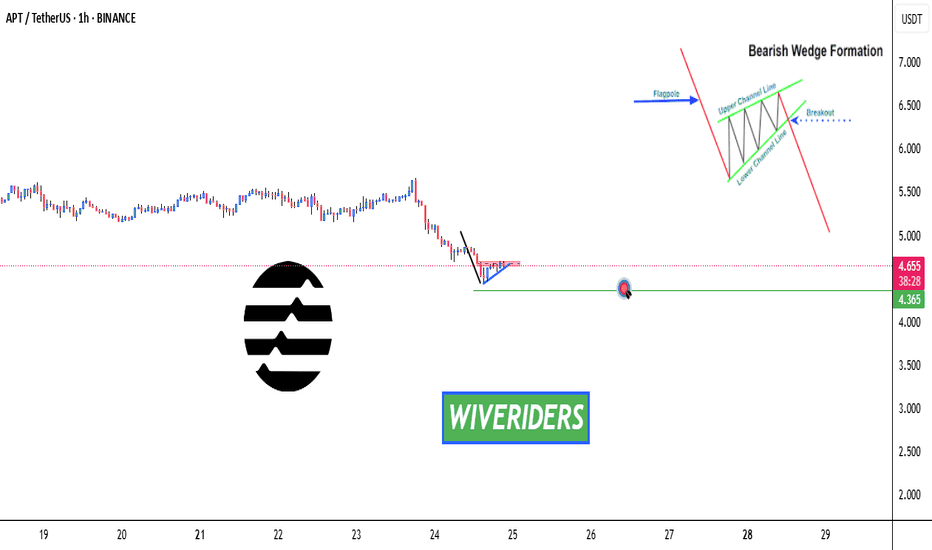

APT Forming Bearish Wedge Pattern – Watch the Support! APT Forming Bearish Wedge Pattern – Watch the Support! ⚠️📉

APT is forming a bearish wedge pattern and is now testing the blue support trendline.

🔻 If the support breaks, we could see a move down to the first green line level.

📊 Stay alert — this setup could trigger soon. Wait for confirmation before reacting.

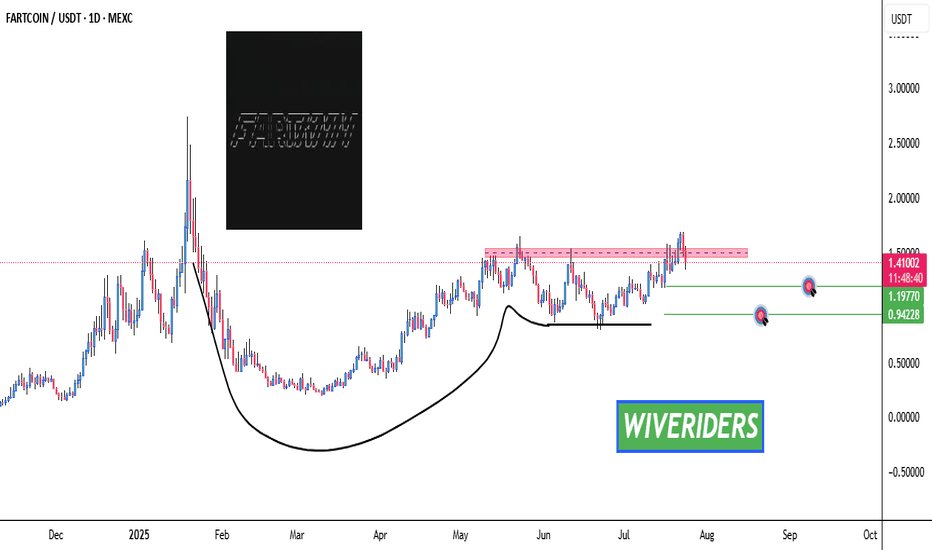

What’s Next? 🚨 $FARTCOIN Cup & Handle Pattern Forming – What’s Next? 📈

$FARTCOIN has formed a bullish Cup & Handle pattern — but is it over?

❌ Not yet. $FARTCOIN hasn’t shown any strong bearish signals for now.

🔍 We’re watching two key green line levels below.

📉 If the price drops toward these zones, we may see buyers step back in — creating a potential entry, but only with confirmation.

✅ Stay patient — no rush to jump in without a setup. Let the chart guide us.

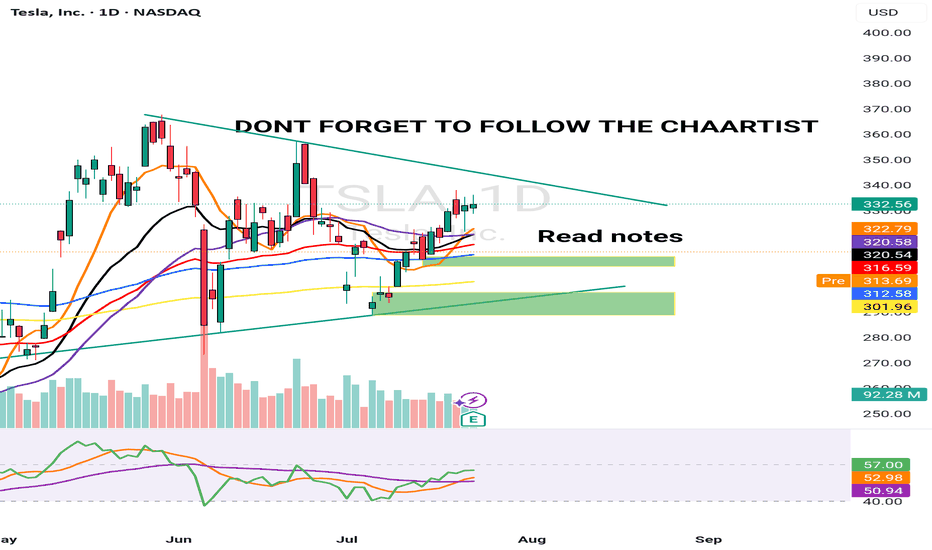

TSLA 24 JULY 2025I have marked 2 levels in green boxes. Price is inside this box pre market and TSLA is down -8.5% from the highs of $338 post market till $310 & -7.5% down from yesterday's close

A better level is the lower demand zone but its not the best. Price has not hit any major resistance.

My job is to read the data & trade. I am still bullish & 10% up down move is normal for Tesla &

This could be a "BEAR TRAP".

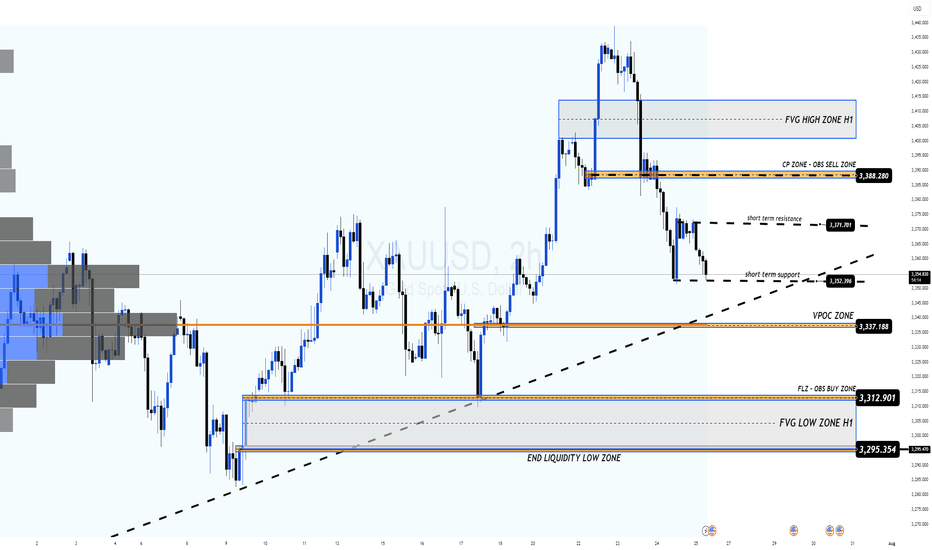

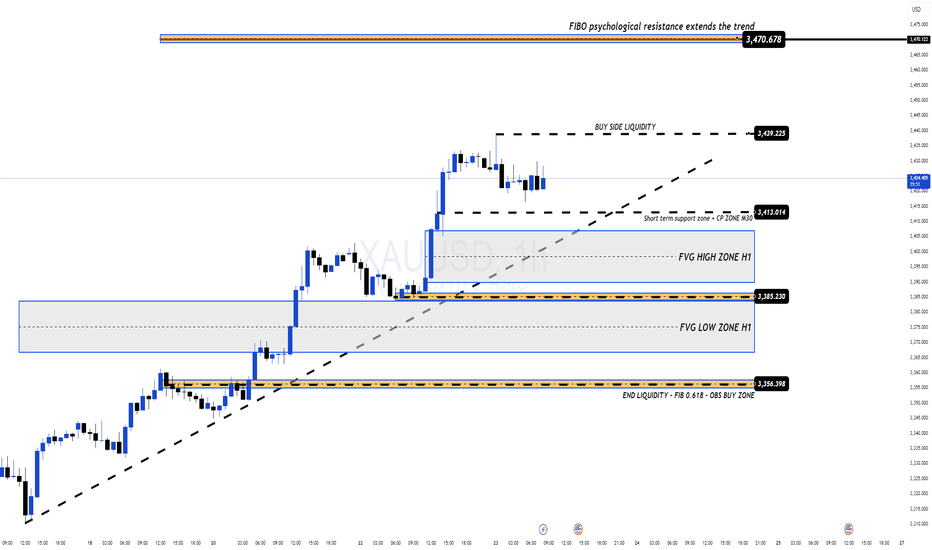

Bullish Momentum Fading? Key Correction Levels Ahead XAUUSD – Bullish Momentum Fading? Key Correction Levels Ahead (23 July)

📰 Market Overview

Gold surged strongly overnight, driven by:

A speech from Fed Chair Jerome Powell, with no hints of resignation or major policy shift.

Rising geopolitical tensions between the US, China, and the EU — with the 1st of August marked as a key deadline.

A notable drop in US bond yields and the US Dollar, triggering increased demand for safe-haven assets like gold.

While today’s economic calendar is quiet, the market remains sensitive to sudden volatility.

📉 Technical Analysis

On the H4 chart, the recent bullish wave shows signs of exhaustion. Reversal candles are now forming on the H1 and M30 timeframes — suggesting a potential correction in the short term.

The 3412 – 3410 support zone will be critical. If price breaks below and invalidates the ascending trendline, we may see a deeper pullback toward lower liquidity zones (FVGs).

Below that, the 335x region offers strong confluence (Fibonacci 0.618 + previous demand zone), making it a prime area for potential long entries if price action confirms a bounce.

📌 Trade Setups to Watch

🔻 SELL ZONE: 3469 – 3471

Stop Loss: 3475

Take Profit Targets: 3465, 3460, 3455, 3450, 3445, 3440, 3430, 3420

→ Wait for a breakout and retest before shorting.

🔸 BUY SCALP: 3385 – 3383

Stop Loss: 3379

TP Targets: 3390, 3394, 3398, 3402, 3406, 3410

→ Ideal for intraday pullback entries with clear structure.

🔹 STRONG BUY ZONE: 3356 – 3354

Stop Loss: 3350

TP Targets: 3360, 3364, 3368, 3372, 3376, 3380, 3390, 3400

→ Great long-term entry zone with technical alignment (liquidity + fib levels).

⚠️ Risk Management Reminder

Even in low-news sessions, markets may spike unexpectedly due to political statements or liquidity sweeps.

Always respect your TP/SL levels — smart trading is protected trading.

💬 Patience breeds precision. Wait for the zone, trust the plan, and manage the trade.

GOLD - One n Single Support, holding or not??#GOLD.. market just reached at his current ultimate supporting area and that is 3385

Keep close it and if market hold it in that case we can see again bounce otherwise not..

Note: we will go for cut n reverse below 3385 on confirmation.

Good luck

Trade wisely

TradeCityPro | Bitcoin Daily Analysis #135👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and major crypto indices. In this analysis, as usual, I’m going to review the futures triggers for the New York session.

⏳ 1-Hour Timeframe

Yesterday, Bitcoin broke the 119,395 level but couldn’t hold above it and has now returned below this level, currently sitting on its previous trendline.

✔️ Today, the market will probably try to form more structure, and I think Bitcoin will range.

⭐ However, if it wants to move, we can enter a long position with the trigger at 120,594.

🔽 For a short position, we can enter if the 116,000 support area breaks.

👑 BTC.D Analysis

Let’s move on to Bitcoin Dominance. Yesterday, dominance had a bullish move, and finally, a support floor managed to prevent further drop in dominance.

🧩 A retracement to 61.20 has occurred. If this retracement continues, the upper levels are 61.53 and 62.

A break of 60.46 will start the next bearish leg.

📅 Total2 Analysis

Let’s go to Total2. This index has formed a range box between 1.48 and 1.55 and is still oscillating within it.

🎲 If 1.55 breaks, we can open a long position, and on the other hand, if 1.48 breaks, the price could correct to lower support levels.

📅 USDT.D Analysis

Let’s move on to Tether Dominance. This index also has a range box and is still moving inside it.

🔑 Breaking 4.13 is very important for the future market trend and could lead to a drop in dominance.