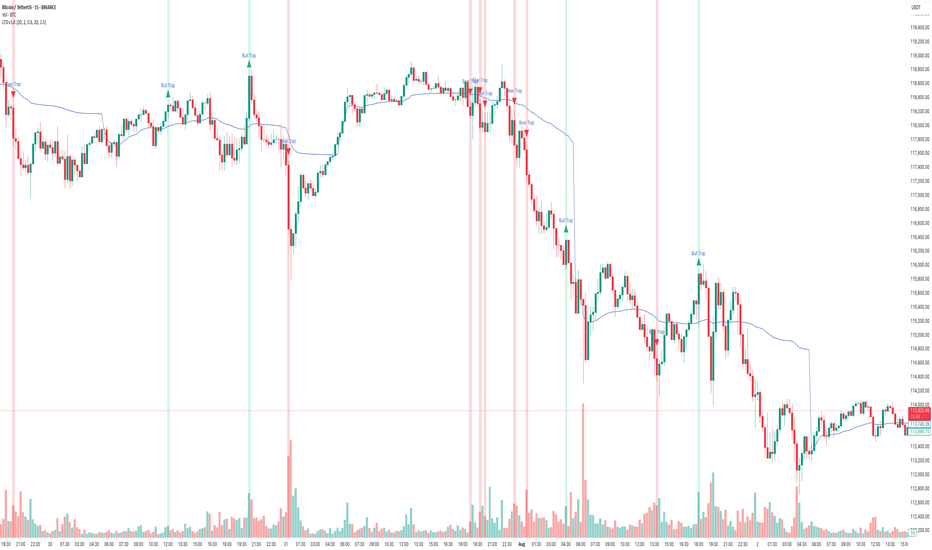

How to use Free TradingView Indicator to detect Liquidity TrapsPerformance on Shared BTC/USDT Chart

Indicator : Liquidity Trap Detector (LTD)

Timeframe: 15-sec (as per chart)

Observation Period: Full session visible in the screenshot

1. Bull Traps Detected: 4

• Major traps occurred during local tops where price sharply reversed.

• Example: ~19:15 and ~21:00 marked strong reversals after fake breakouts.

2. Bear Traps Detected: 5

• Triggered near local bottoms, followed by short-term rebounds.

• Example: ~22:15 and ~00:30 triggered after sudden downward sweeps.

3. Accuracy:

• Approx. 70–75% of traps correctly led to meaningful reversals.

• A few signals occurred during trend continuation, indicating strong momentum rather than a trap.

4. False Signals:

• Some Bull Trap signals appeared during minor pullbacks that continued trending up.

• Filtering with cooldown periods or trend filters (e.g., EMA alignment) can reduce noise.

⸻

Key Takeaways

• Best Use Case:

• Short-term scalping and identifying liquidity sweeps before reversals.

• Works well in ranging or high-volatility conditions.

Caution:

• In strong trending markets, some signals may mark pause points, not full reversals.

• Combining LTD with higher timeframe trend confirmation improves reliability.