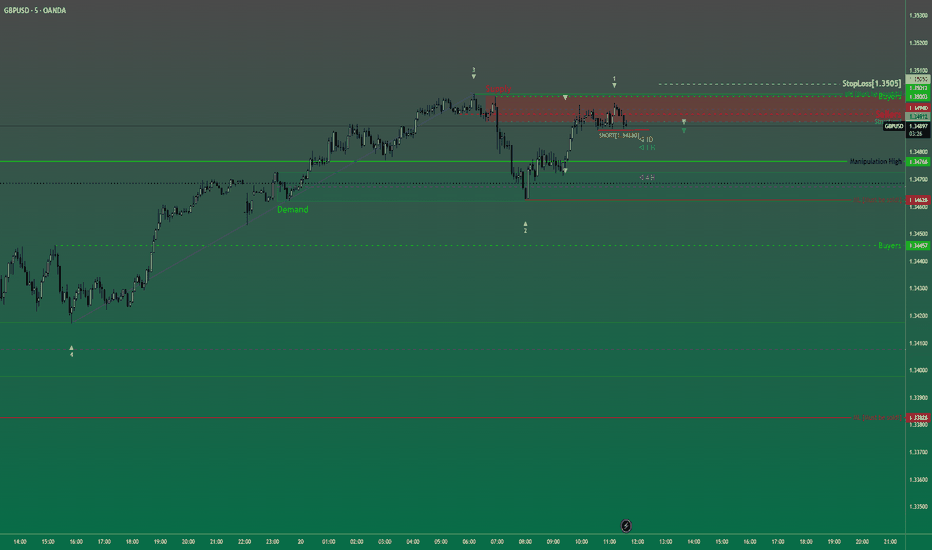

GBPUSD London Session | Live Forex Analysis & Trade ideasIn today’s London session, we conducted a detailed intraday analysis on the GBPUSD currency pair using wave structure analysis on the 5-minute (M5) timeframe.

Price action confirmed a break below bullish market structure that had previously formed the Asian session high, signalling a potential shift in market sentiment to the downside. This breakdown confirmed short-term bearish momentum shift.

Following the completion of the bearish wave, the price retraced to form a structural pullback (trend reset), providing a discounted price zone for new short positions and offering profit-taking opportunities for earlier sellers.

Our trading plan for this session is to sell GBPUSD at 1.3488, anticipating a move below the midline (ML) support at 1.3462. The technical target for this trade, based on our London-New York session projection, is set at 1.3417.

The stop-loss for this setup is placed above MH of the bearish structure at 1.3505, maintaining proper risk management.

This trade idea aligns with our trend-following strategy and is supported by real-time price action analysis.

📉 Short Bias Confirmed

🎯 Entry: 1.3488

🛑 Stop Loss: 1.3505

✅ Take Profit: 1.3417

Trade safe, manage your risk, and stay blessed.