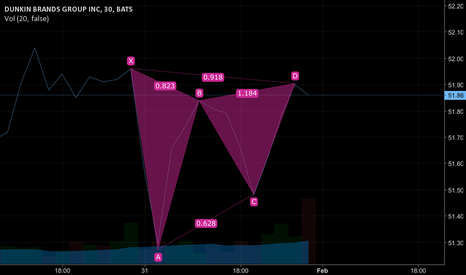

$DNKN Bearish Cypher$DNKN clear bearish cypher on today's chart. Slightly stretched, but recommend shorting and picking up again later this week.

Trend-trading

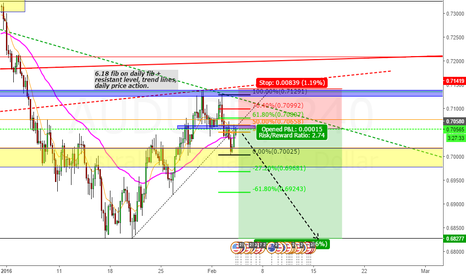

GBPUSD Watching the channel and inner channel trendPretty self explanatory chart setup here, if channel trend breaks, shorting to bottom of channel to see if support holds for a long position or a break to the downside. A short trade will be entered after a break of the channel and a rejection back into the channel

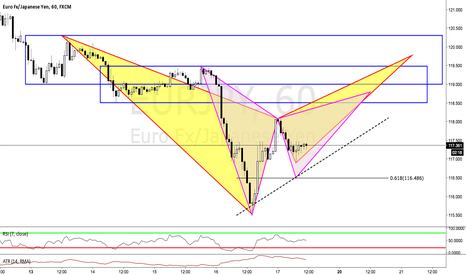

One step ahead of the market: Follow up on EURJPYI am looking for two different structure zones on this pair. The lower one gives us first chances to look for valid shorting opportunities. To this point we failed to retest the 61,8 % retracement, therefore the shown gartley pattern isn't activ right now.

So, if we see the lower retracement I will place my limit orders to short via the lower gartley pattern. If we move straight up I will short the higher bat pattern which comfirmed all my rules by now.

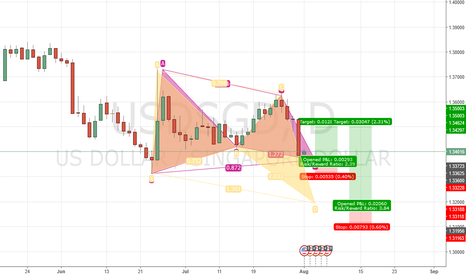

GBPAUD Short Resistance levelon the 4H chart the long term resistance line has just been touched. this has been followed by a nice engulfing candle setup. the recent uptrend support line has also been broken. the 1H chart also shows what looks to me like a head and shoulders setup. all of this is telling me that i believe it will go short.

Bearish Bat on GOLD, Nice RRWe have a bearish Bat forming at previous support/resistance level, so we expect a re-test of resistance an then fall to previous support

Hope you enjoy!

PS: I'm not 100% trader, i dont know anyone that is, and because of this, i maybe fail in my prediction, but that is ok

CHFJPY - Identifying the main trend for Sell OpportuntiesI am writing a blog post to give more details to the attenders of my last Private Webinar on http://profiting.me, to explain how to identify the main trend and take advantage from it. To make this I just used CHFJPY as example.

This image explain very well the importance to have clear the main trend and what is prevailing in the market.

In this scenario the Supply Willing is prevailing and the trend is bearish inside the channel.

The bounce back visible on chart can give a good opportunity to sell running a trade in the trend continuation.

What do you think?

Thank You

girolamoaloe.com

Bat Pattern, Aud/Nzd , 1hrHere I found a bat pattern developed and completed in the negative deviation range of the AUD NZD chart. my strategy suggests that the market will rally up into positive deviation before correcting for trend continuation.

I have place my entry at point B to Verify reversal after point D

I have placed my Stop at point X for the break below close below bust

! have placed my limit at the 1.618 extension of the BC leg , for consistency and risk reward ratios

USDCHF Getting Ready to Head South AgainI like these kind of setups very much: clear downtrend, confluence of support, key moving average level, at a Fibonacci retracement level, with confirming candlesticks. I'm not in this trade because I'm at max risk capacity already, but I'd be short at 8840, stop at 8872, target profit at 8697. This would setup a reward/risk ratio of over 4:1.

www.informedtrades.com