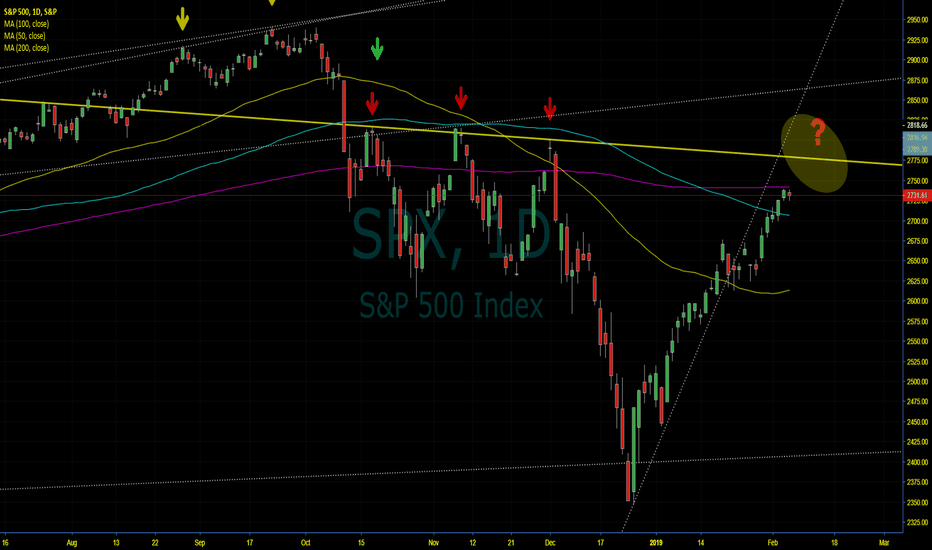

The Quad Tops Signal Steep Declines AheadThere have been 5 occurrences of quad tops in the S&P 500 since 2000. Each top bounced off a resistance trend line four times. The fourth bounce resulted in steep declines for the index. The index is about to test this theory within the next 3-7 trading days as it nears the trend line on the chart above. Could it be a coincidence? Sure, but what is keeping this market from pushing through it now that earnings are over, the Fed is sitting on their hands, Congress is yet to pass the USMCA (NAFTA 2.0), and a China deal is most likely months away (if it happens at all)?

On the positive side for technicals, we finally moved above the 100 DMA which has not happen in months, but the 200 DMA is the next test (also likely to occur within next 1-3 trading days). The break of the 100 DMA could be the real deal or a Bull Trap and a break of the 200 could be the same. The technicals are not encouraging until we move clearly above the 100, 200 and the quad top trend line for the bulls.

This is the quad tops between 2000 and 2015. The first is in Red and the second is in Orange.

The next one is below with the green arrows between 2010 and 2018.

The final two are in Blue and Yellow below from 2016 to the present. The red on here is the same as the red on the main chart above.