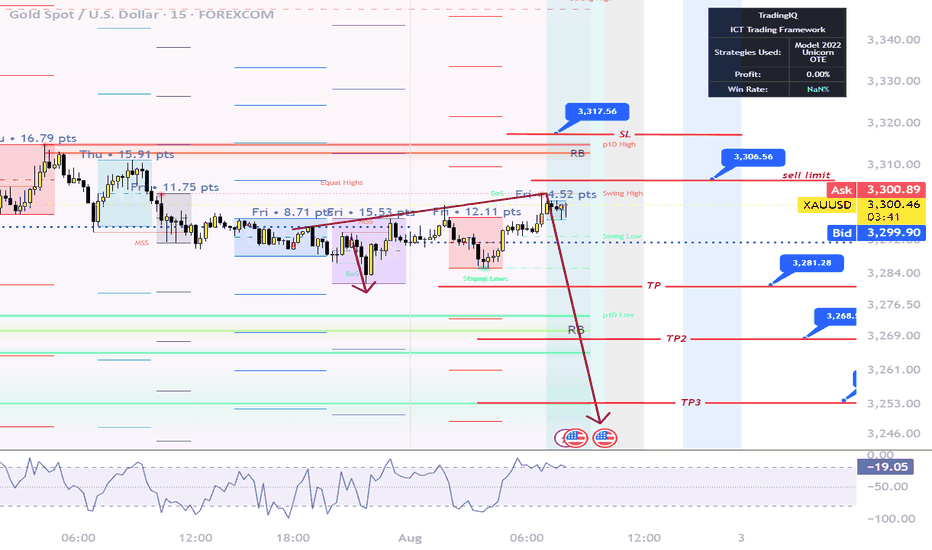

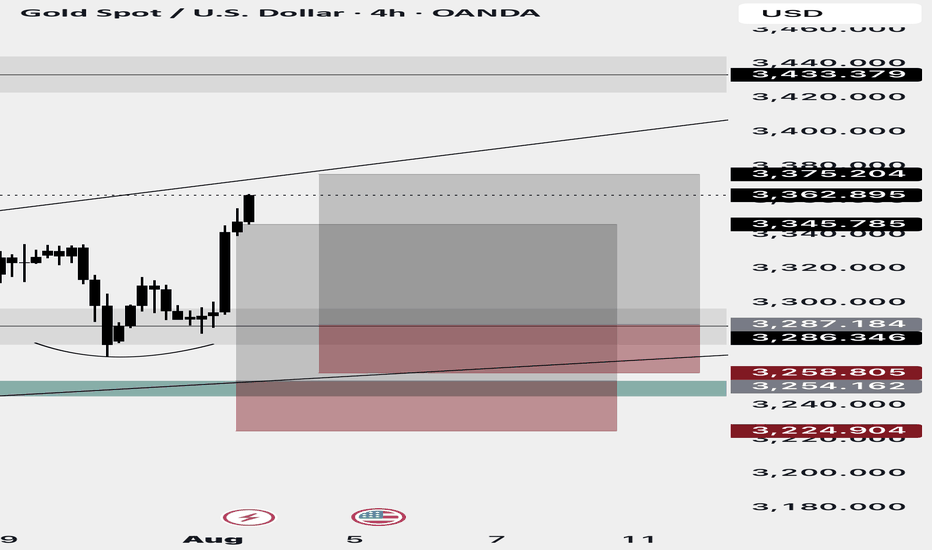

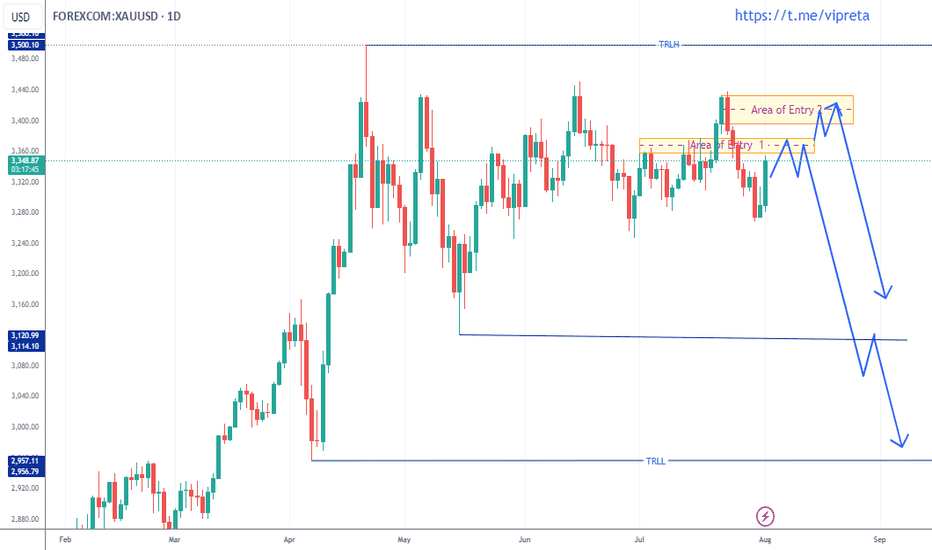

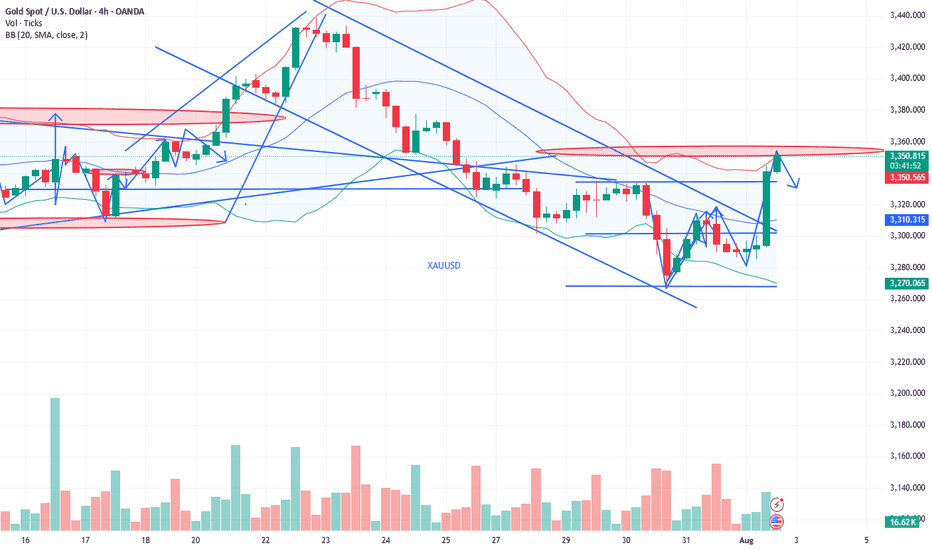

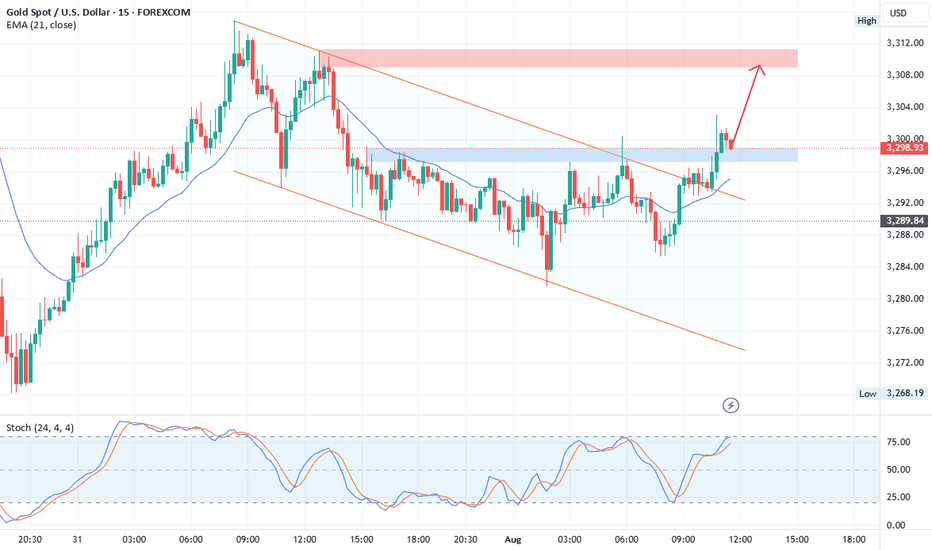

XAUUSD – Smart Money Sell Setup during New York Session | ICT St

Gold (XAUUSD) has just completed a classic liquidity grab above the London session highs, forming a potential Judas Swing as New York begins.

On the 4H timeframe, we clearly have a bearish BOS (Break of Structure), and price has returned to a Premium zone within a bearish FVG and OB (Order Block).

Today is NFP Friday, and after the Fed kept rates steady mid-week, we’re expecting high volatility.

Current price action has swept the overnight liquidity and is now reacting inside a Repricing Block, aligning perfectly with the NY Midnight Open level.

🎯 My Sell Plan (Live Execution):

Sell Limit: 3306.50

SL: 3317.50 (Above OB high)

TP1: 3281.20

TP2: 3268.50

TP3: 3253.90

🧠 Bias: Bearish

🕒 Session: New York

🧮 ADR: 43 pts

📉 Market Structure: Bearish

This setup follows the ICT methodology using time, liquidity, structure, and displacement.

If we break above 3317.50 with strong displacement, the idea becomes invalid.

Let's see if Smart Money takes it down into Friday’s close.

Trend Analysis

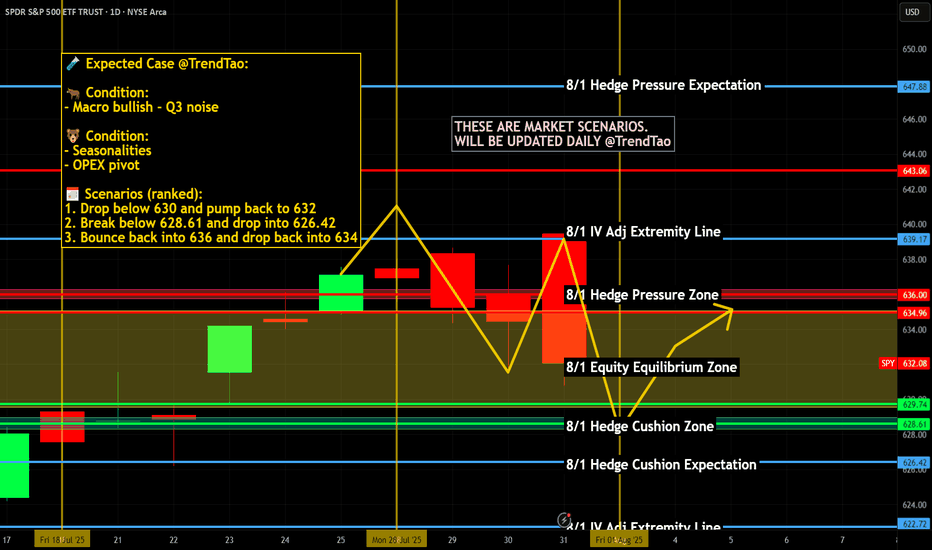

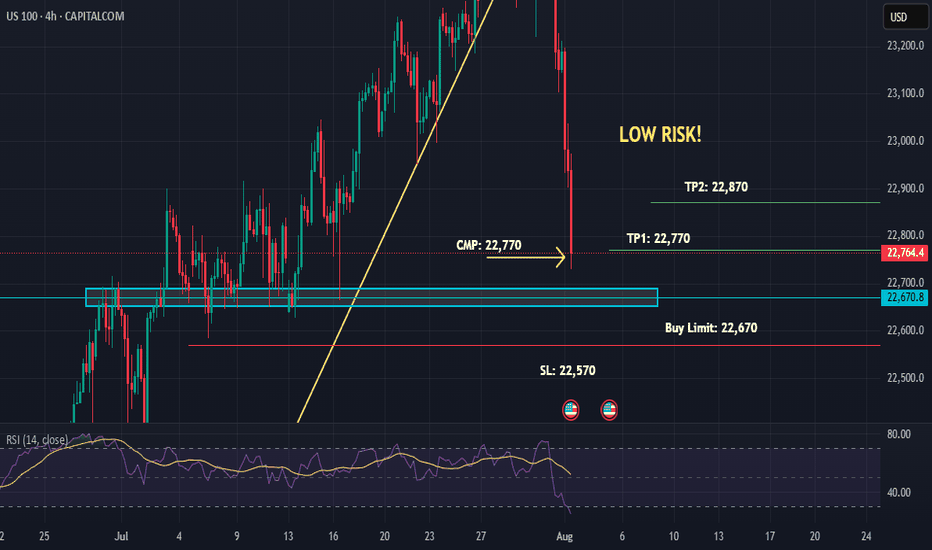

Nightly $SPY / $SPX Scenarios for August 1, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 1, 2025 🔮

🌍 Market-Moving News 🌍

📦 U.S. Imposes New Tariffs as Deadline Passes

Fresh tariffs rolled out on August 1 hitting major exporters: 25% on Indian goods, 20% on Taiwan, 19% on Thailand, and 15% on South Korea. Canadas tariff elevated to 35%, though Mexico got extra negotiation time. Global equity markets slipped modestly, led by declines in Asia-Pacific regions. AMEX:SPY futures also eased on mounting geopolitical and trade pressures.

🏦 Fed Uncertainty Mounts Despite Calm GDP

Despite robust Q2 GDP growth and a hold on interest rates this week, Fed Chair Jerome Powell faced growing unrest. Comments acknowledged downside labor risk amid trade uncertainty—investors are now assigning just a 39% chance of a rate cut in September.

📊 Key Data Releases & Events 📊

📅 Friday, August 1:

8:30 AM ET – Nonfarm Payrolls (July):

Payrolls rose by 106,000, less than June’s 147,000 but still positive. Wage growth slowed, easing inflation concerns slightly.

8:30 AM ET – Unemployment Rate:

Unemployment ticked up to 4.2%, from 4.1% in June—reflecting modest labor softness.

8:30 AM ET – Average Hourly Earnings (MoM):

Wages rose +0.2%, down from +0.4% in June, signaling wage pressure easing.

⚠️ Disclaimer:

This information is provided for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #jobs #Fed #tariffs #inflation #technicalanalysis

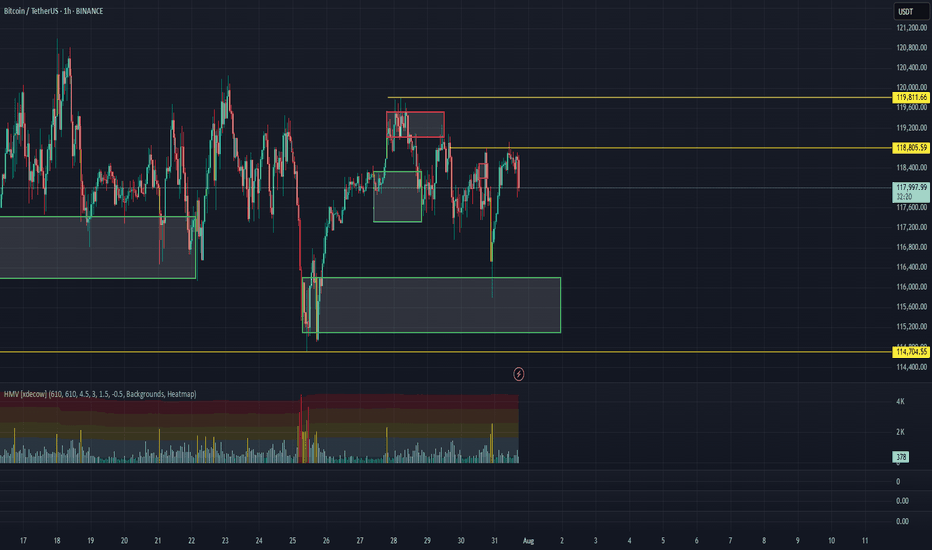

BTC/USDT Analysis: Testing Strong Support

Hello everyone! This is the daily analysis from CryptoRobotics' trader-analyst.

Yesterday, we tested the local support zones previously marked and moved into a decline. At 21:00 (GMT+3), the U.S. Federal Reserve released its monetary policy statement, which included hawkish comments regarding inflation risks. The interest rate remained unchanged. The market reacted negatively to this news, and Bitcoin accelerated its drop.

At one point, a key buyer zone at $116,200–$115,000 (volume anomalies) was tested. Then, between 21:30 and 22:00 (GMT+3), a report from the White House on digital assets was released, shifting focus toward a more positive regulatory outlook. Bitcoin bounced from the mentioned zone and has since fully recovered the drop.

Currently, there are no immediate resistance levels, so in the near term, we’re likely to see a test of the ~$120,000 level. There, it's important to watch for any signs of selling pressure.

Buy Zones:

• $116,200–$115,000 (volume anomalies)

• $110,000–$107,000 (accumulated volume)

This publication does not constitute financial advice.

XAUUSD TRADE UPDATE MISSED TRADE Hey everyone here’s a trade recap of the week at first we were interested to take buys at 3254 zone as first entry and scale in at 3287 zone but price pulled down slightly missed the first entry and I didn’t execute & the second entry didn’t execute that too and market skyrocket if price activated the first entry we would’ve caught a huge trade today,the first one didn’t activated so I didn’t execute the second entry which is the 3287 zone that buyers came in so we move on and I will keep on sharing potential good setups and have a beautiful weekend guys….

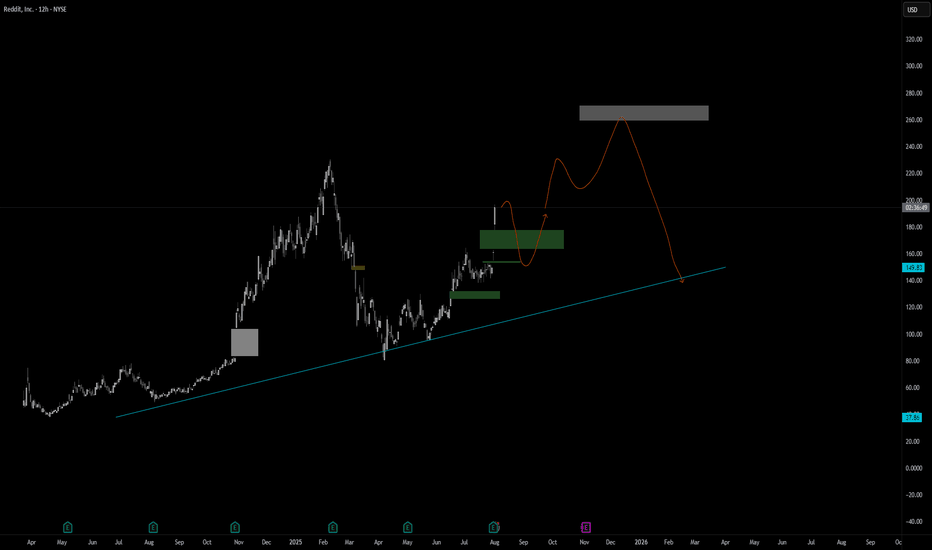

New targets for Reddit RDDT In this video I recap the previous reddit analysis where we looked for the long which is playing out really well .

I also look at the current price action and simulate what I think could be a target for the stock moving forward using Fib expansion tools as well as levels below for price to draw back too.

Welcome any questions below the chart . Thanks for viewing

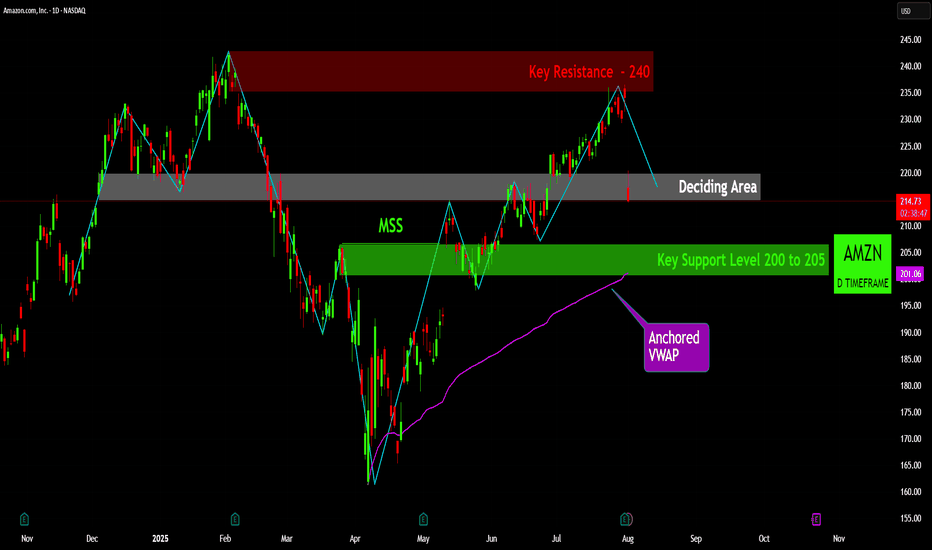

AMZN: The Battle for Direction at a Critical JunctureThe recent price action for Amazon (AMZN) is currently navigating a critical juncture, having pulled back from a significant resistance level and now consolidating within a pivotal "Deciding Area." A detailed review of the key technical levels reveals the following insights:

Key Resistance ($240): A formidable resistance zone is established around the $240 price point. This level represents a major overhead supply area, where prior selling pressure has been strong enough to halt upward price movements on multiple occasions. A decisive breach of this level on strong volume would be a highly bullish development, signaling a potential move to new highs.

Key Support Level ($200 to $205): A robust support zone is identified between $200 and $205. This level has historically served as a strong price floor, absorbing selling pressure and providing a foundation for subsequent rallies. The integrity of the current uptrend is heavily dependent on the price holding above this critical area.

Market Structure Shift (MSS): The formation of a "Market Structure Shift" earlier in the year was a pivotal technical event. This change in market dynamics marked a significant transition, signaling a potential reversal from a prevailing downtrend to the current bullish phase. The subsequent rally from the lows validates this structural change.

Anchored VWAP: The Anchored Volume-Weighted Average Price (VWAP), anchored from the most recent major low, is serving as a dynamic and trend-defining support level. This indicator reflects the average price paid by investors since the start of the current trend. A sustained close below this line would be an early warning sign of weakening momentum.

Deciding Area: The stock is presently trading within a "Deciding Area" situated just below a previous swing high. This zone represents a period of consolidation and indecision as the market digests the recent pullback from resistance. The outcome of this consolidation will likely dictate the short-term directional bias. A break to the upside would suggest a renewed attempt to challenge the $240 resistance, while a breakdown would likely lead to a retest of the primary support level at $200-$205.

Summary of Outlook: The overall technical picture for AMZN indicates that the stock is at a critical inflection point. The health of the underlying uptrend remains intact as long as the price holds above the key support levels and the Anchored VWAP. A definitive move out of the "Deciding Area" will provide the next clear signal for either a renewed push toward resistance or a deeper pullback to test established support.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

Gold is significantly bullish, where can we short?The positive non-farm payroll report pushed the market from 3300 directly above 3330, demonstrating overall bullish momentum. Congratulations again, everyone. Real-time strategies are like a beacon guiding your investment journey. The market will never disappoint those who persevere and explore wisely. Charlie advises against blindly chasing highs. Trading advice (first hit is valid): Focus on key support levels: 3300 and 3310. Go long if these levels are reached.

~For those who want to go short above 3350-55, only use a stop-loss and feel free to try~ PEPPERSTONE:XAUUSD FXOPEN:XAUUSD ACTIVTRADES:GOLD FXOPEN:XAUUSD CMCMARKETS:GOLD VANTAGE:XAUUSD VELOCITY:GOLD

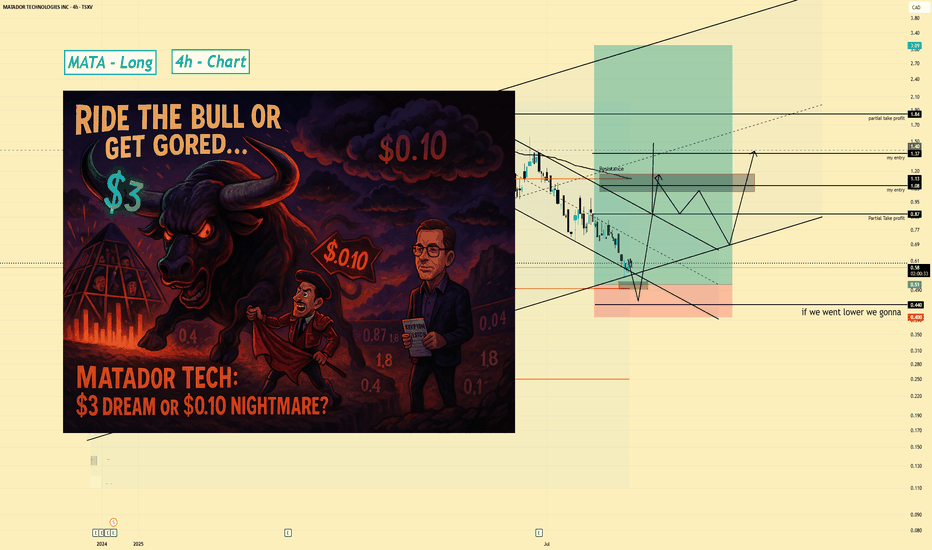

MATA | Long Swing Setup | Trapped Sellers (Aug 2025Matador Technology Inc. (Canada) | Long Swing Setup | Accumulation & Trapped Sellers (Aug 2025)

1️⃣ Short Insight Summary:

Matador Technology is an interesting small-cap play led by Mark Morris, who has a strong vision for tech innovation and market trends. Right now, price action shows signs of flushing out trapped traders, which could set up a big upside opportunity if we manage risk carefully.

2️⃣ Trade Parameters:

Bias: Long (Swing)

Entry: Watching accumulation zones between $0.50

Stop Loss: Below $0.40 (invalidates structure and opens downside risk)

TP1: $0.87 (initial target, partial exits recommended)

TP2: $1.80 (mid-term target)

Final TP: $3.00 (long-term aggressive target)

3️⃣ Key Notes:

Right now, the stock is extremely volatile. The goal is to buy where others are trapped and forced to sell. A clear break below $0.20 would be very dangerous and could push price as low as $0.10.

On the upside, we want to see the stock reclaim the $0.50 zone convincingly. This could build momentum towards $0.87 and beyond. Patience is key—this is a swing trade, not a quick scalp.

4️⃣ Follow-up:

I’ll monitor the price action around $0.40–$0.50 and update if we get a breakout from the current downtrend channel.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

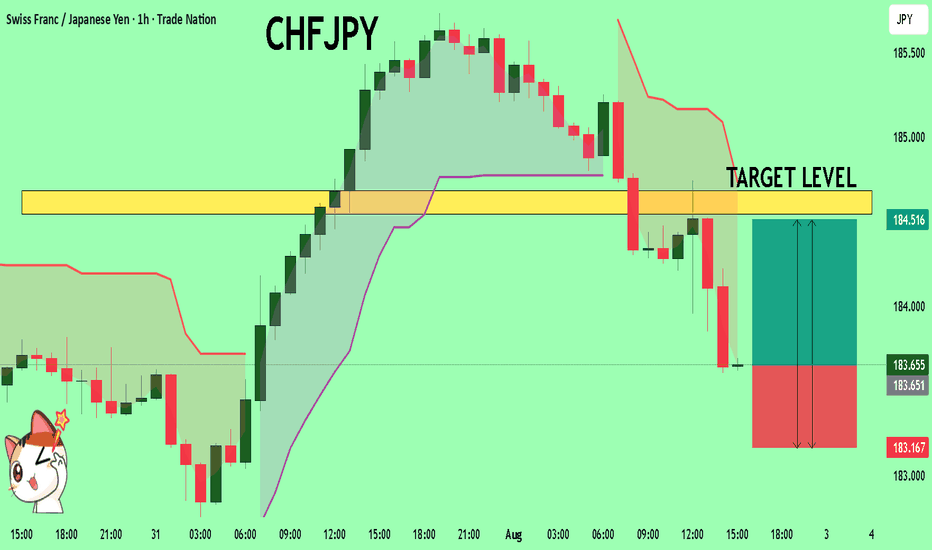

CHFJPY On The Rise! BUY!

My dear friends,

My technical analysis for CHFJPY is below:

The market is trading on 183.63 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 184.54

Recommended Stop Loss - 183.16

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

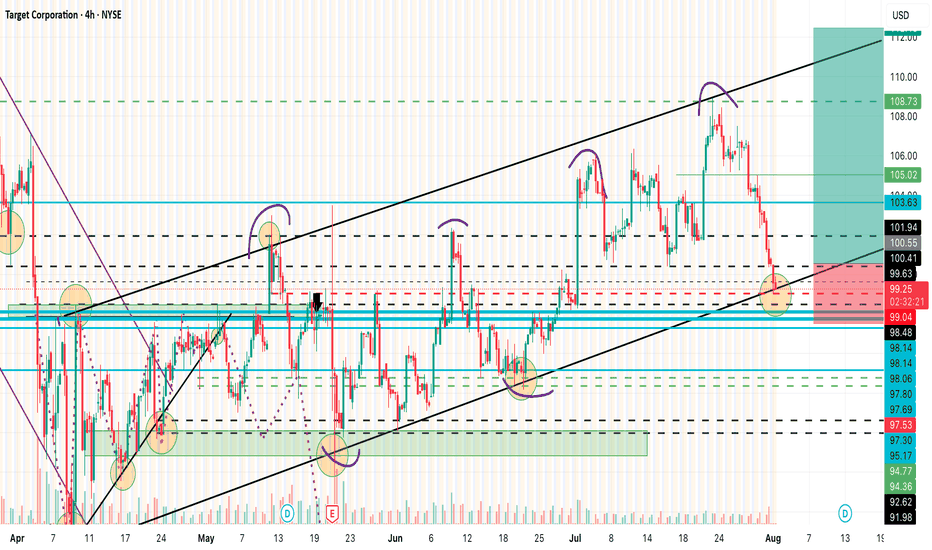

Target Calls $100 CallsTGT Technical Breakdown — August 1st

Target (TGT) remains within a well-defined ascending channel that began forming around April 9th, showing a consistent pattern of higher highs and higher lows. Today, price action has touched the lower trendline support of this channel near $99.50, which also coincides with a key psychological level.

While this area has historically attracted buyers, yesterday’s post-earnings reaction, which saw the stock fall several points, raises major concern about potential bearish sentiment in the short term. This makes the next move crucial.

Trade Plan & Critical Levels

🔎 Entry Trigger: I’m not entering yet. My entry will only be considered at $100.55, and even then, only if the price breaks this level with conviction — specifically, I want to see a strong bullish "power candle" to validate buyer momentum.

🛑 Stop Loss: $97.50 — just below the current trendline and a key invalidation point for this bullish structure.

📈 Targets Upon Confirmation:

$103.63

$105.00

$107.00

$108.73

Summary

The structure is still bullish, but yesterday’s earnings-driven drop introduces caution. $100.41–$100.55 remains the "must-break" zone. If bulls can clear this level with strength, momentum could carry the stock to the above targets. Otherwise, failure to hold the $99.50 support could see a breakdown toward the $97.50 area or lower.

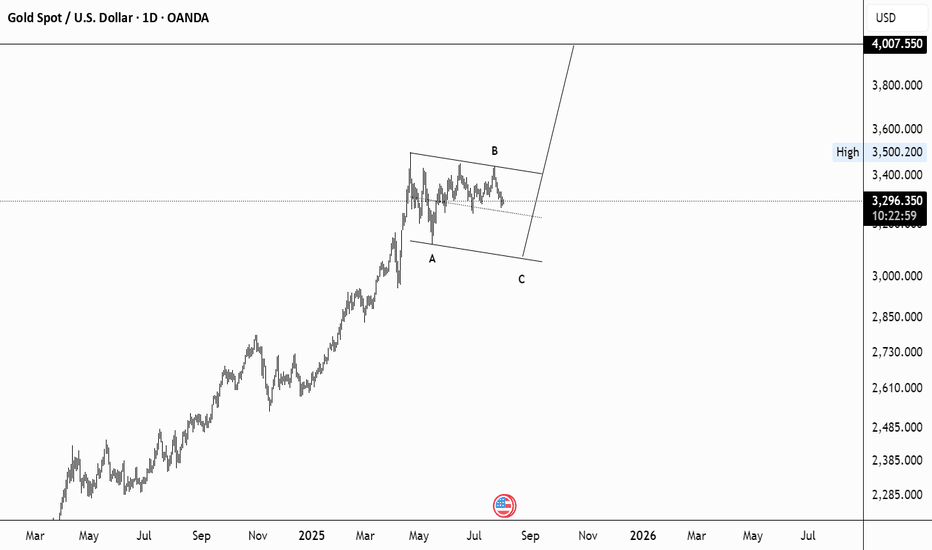

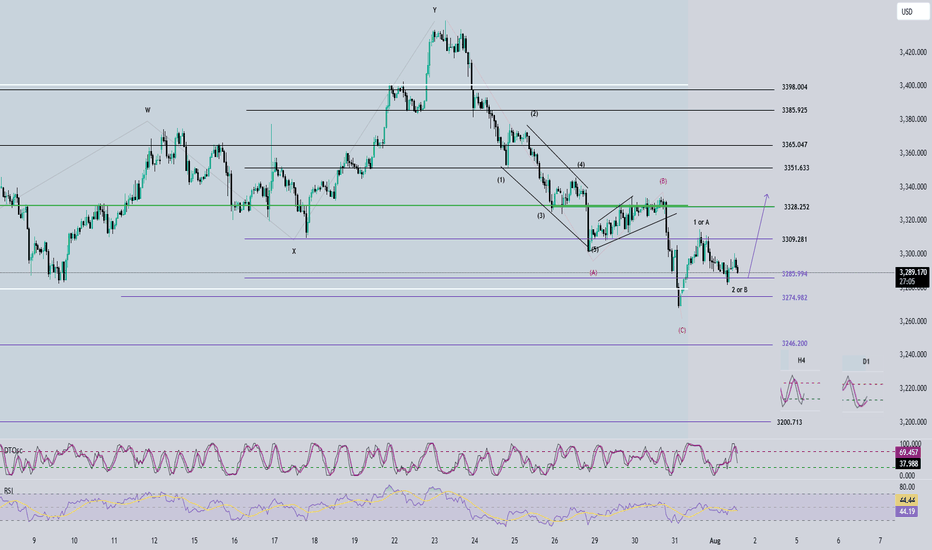

Elliott Wave Analysis – XAUUSD August 1, 2025📊

________________________________________

🔍 Momentum Analysis:

• D1 Timeframe:

Momentum has reversed to the upside. Based on this signal, we expect a bullish trend to continue for the next 5 daily candles — likely until mid-next week.

• H4 Timeframe:

Momentum has also turned upward → This suggests that from now until the U.S. session, the price will likely continue to rise or consolidate with an upward bias.

• H1 Timeframe:

Momentum is currently turning down → We anticipate a short-term corrective move. We should wait for H1 to enter the oversold zone and give a bullish reversal signal before looking for long entries.

________________________________________

🌀 Wave Structure Analysis:

The current wave structure remains complex and lacks clear confirmation. Thus, the current wave labeling should be considered provisional. However, the wave count has not been invalidated, and D1 momentum supports a bullish outlook — so we continue to maintain our wave structure bias.

Important Note:

Wave (C) in red appears relatively short. This leaves open the possibility that the price may continue lower, targeting:

• ⚠️ 3246

• ⚠️ 3200

→ This scenario will be triggered if price breaks below 3268, especially given today's Nonfarm Payroll (NFP) report.

________________________________________

📌 Two Possible Wave Scenarios:

1. Scenario 1: Black Waves 1 – 2 – 3

o Wave 1 (black) is complete.

o We are now in Wave 2 (black) → Preparing for Wave 3.

o Wave 3 tends to be strong, impulsive, and sharp with large candle bodies.

o Target: 3351

2. Scenario 2: Black ABC Correction

o The market is currently in Wave B (black).

o Potential target for Wave C: 3328

________________________________________

🛡 Support Zones & Trade Strategy:

• Support Zone 1: 3290 → A good area for potential buying, but we must wait for H1 to enter the oversold region and show a bullish reversal.

• Support Zone 2: 3275 → Deeper buy zone if the price corrects further.

________________________________________

💡 Trade Plan:

📍 Option 1 – Buy Limit:

• Buy Zone: 3290 – 3289

• Stop Loss: 3280

• Take Profit 1: 3309

• Take Profit 2: 3328

• Take Profit 3: 3351

📍 Option 2 – Buy Limit:

• Buy Zone: 3275 – 3273

• Stop Loss: 3265

• Take Profit 1: 3309

• Take Profit 2: 3328

• Take Profit 3: 3351

________________________________________

📎 Notes:

• Experienced traders should wait for clear confirmation signals on H1 before entering trades.

• New traders may consider using limit orders in the proposed buy zones.

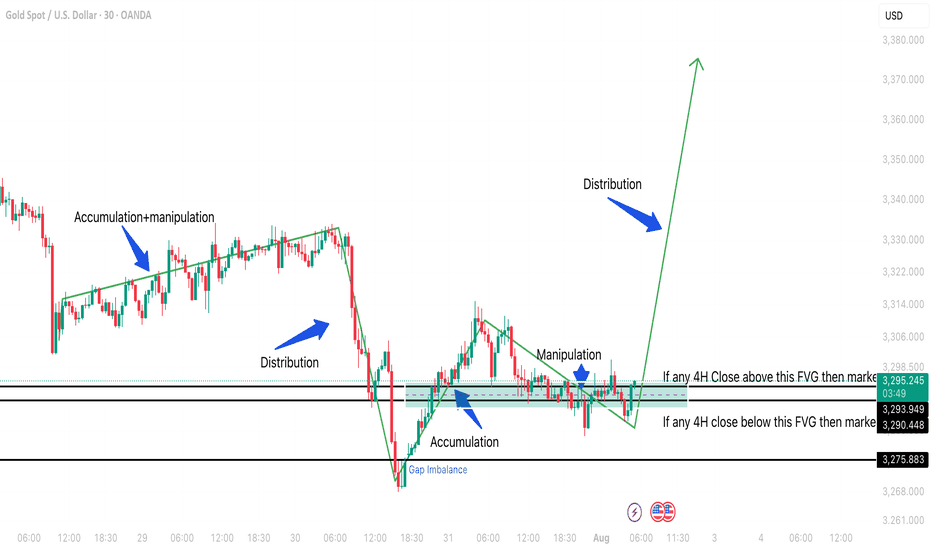

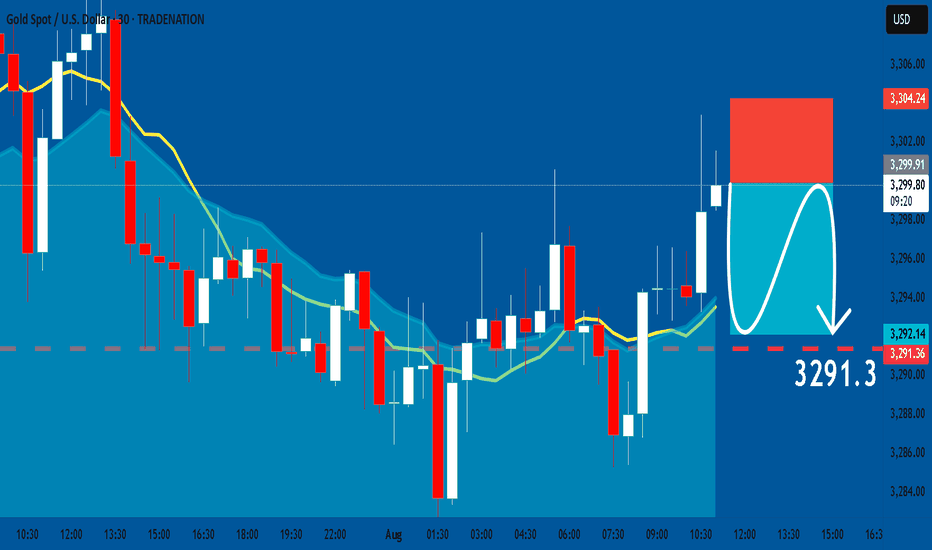

GOLD: Short Trading Opportunity

GOLD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry Level - 3299.9

Sl - 3304.2

Tp - 3291.3

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

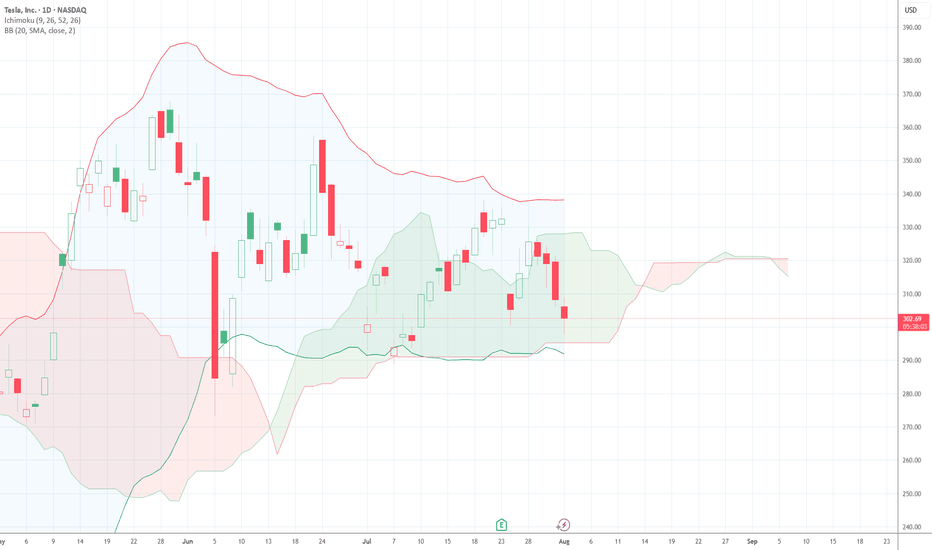

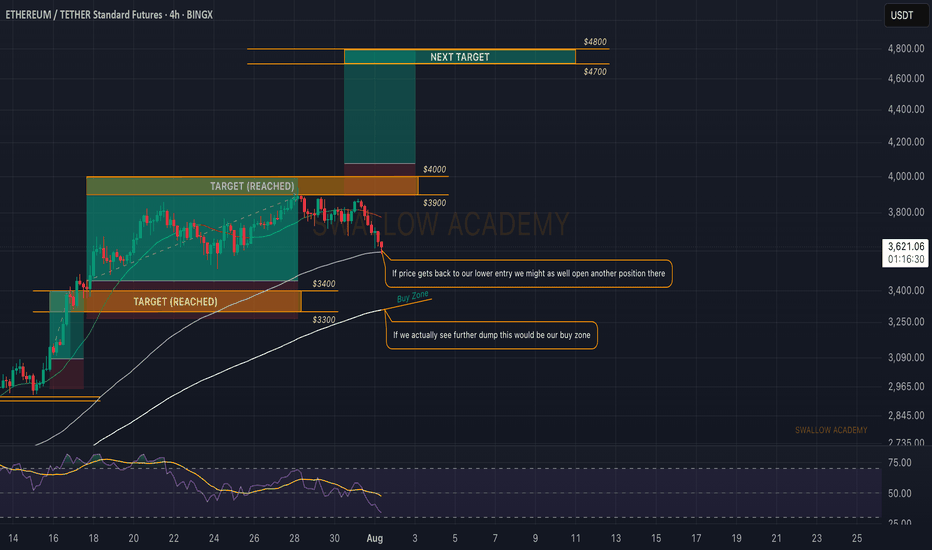

Ethereum (ETH): Bloody End of Week & Start of Month | We Wait!Well, we were close to breaking out of the $4000 area and now we are back on the lower side of the area, where sellers are showing strong pressure to coin.

As we approached the 100 EMA, we waited. Waiting is the worst part of trading, but that's what we do here. The 200 EMA is one key zone for us for another buying opportunity so if we keep on falling, that's the zone we are aiming for.

The second point of interest is the current 100 EMA, where if we see MSB to form, there might be a smaller scalp opportunity.

And last but not least, the zone above $4000.

Swallow Academy