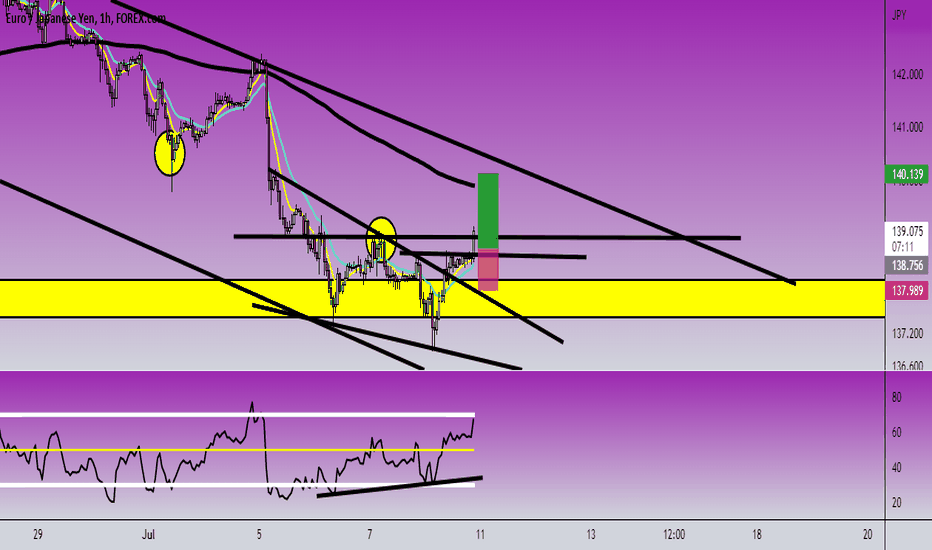

EUR/JPY: bullish divergence and break outEuro/Yen Japanese break out this structure and want to continue climb that we could to get a good trade in this par. And also we forming a bullish divergence in the RSI and price action too.

We're in this way forming a bullish divergence

In Daily timeframe it's look bullish from this key support zone above 138.50 JPY.

I put a buy order limit to $138.76 JPY, Stop Loss to $137.98 JPY and target to $140.00 JPY. This it's look a potential trade to find up 138 pips.

This it's a quickly analysis today. I hope that this idea support you

Good luck!!!

Trendanalysiseplained

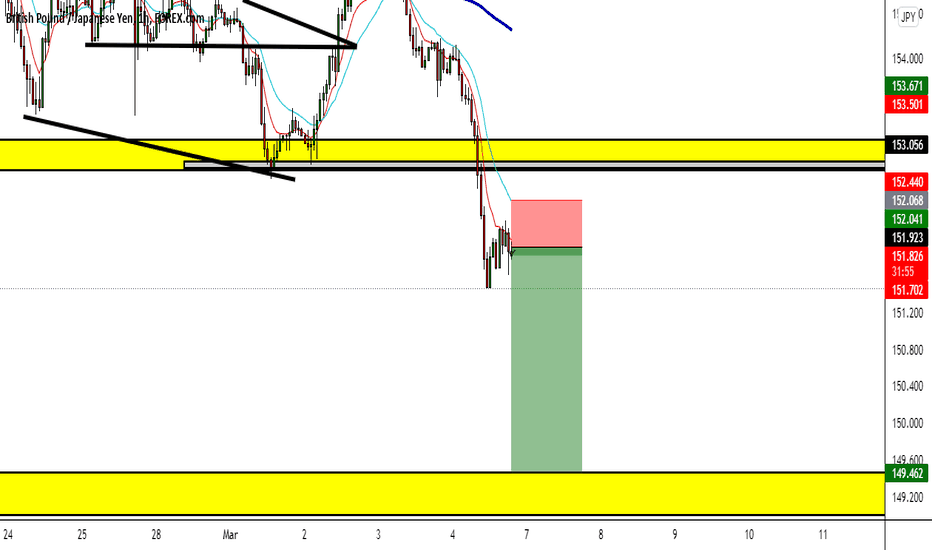

GBP/JPY: Short PosiitonGreat Britain Pound show right now sell inminent of this downtrend continuation against Yen Japanese to trade Forex

This it's the Daily chart and it's look bearish and Pound could to hit down to $149.46 JPY.

This it's the market structure, but in case that Pound make a pull back to $152.70 JPY approx. This zone it's another opportuity to sell in case that we fall this trade.

Now, in H1 I see this price action and Pound forming a bearish hammer, an indication to sell.

So guys, in our economic calendar there're nothing for tomorrow to still pending the pause of the market when that pass, but we hope to read everyday in our Forex news to know what happen in the world, specially in this conflicts of war between Ukraine and Russia.

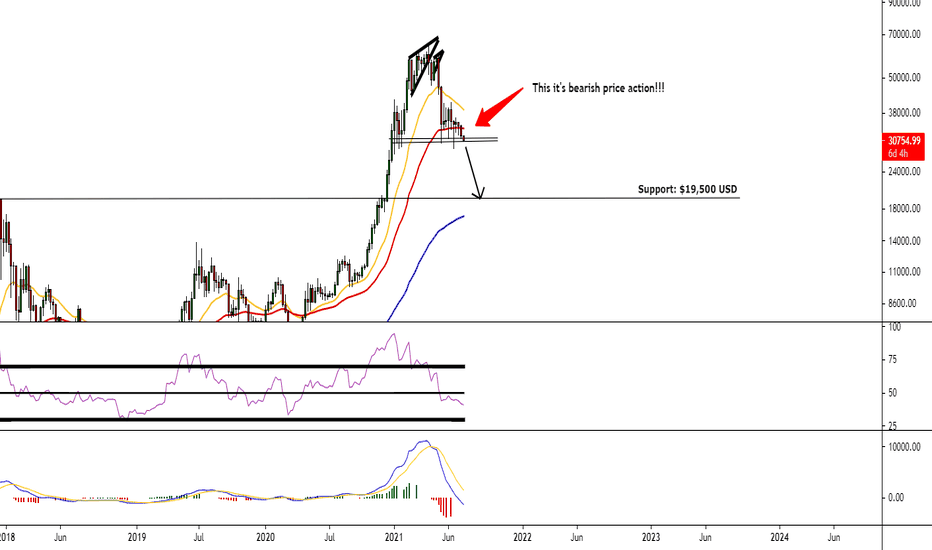

BTC/USD: Bitcoin could to leading down toward the EMA 200At the moment, anayzing the weekly timeframe, it's look extremely bearish for Bitcoin. I thinking that Bitcoin could to leading down toward the EMA 200 in the average price of $19,000 USD. That level it's a higher price when Bitcoin reached on 2017 near of $20,000 USD per coin. THE RSI and MACD are bearish together with the price action.