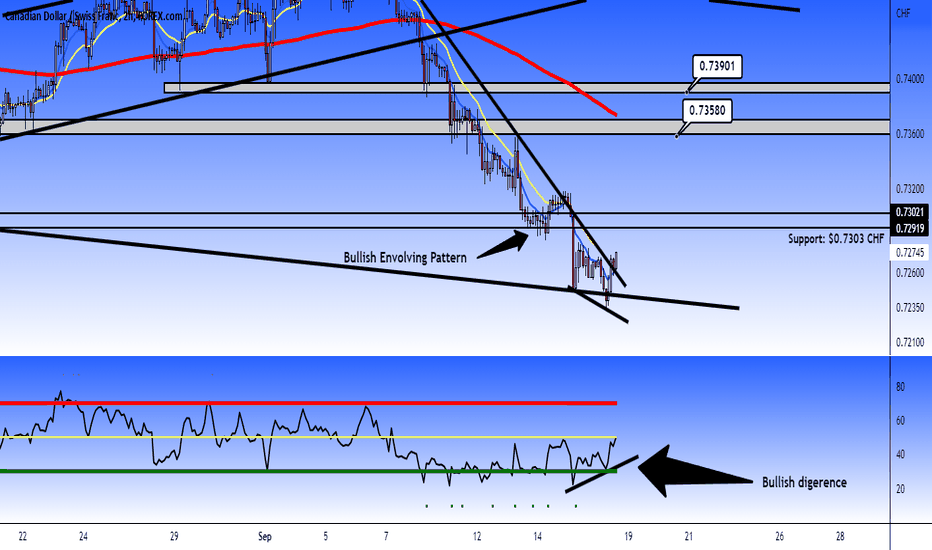

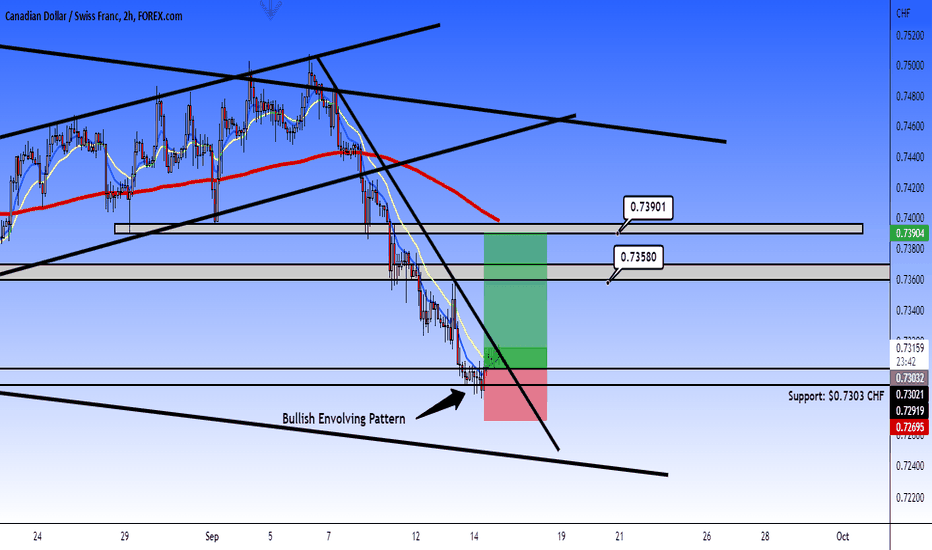

CAD/CHF: Review!!!In this review, I trade CAD/CHF to short and I was vey good when the price reach $0.7260 CHF, but I closed up this short before of it in $0.7304 CHF. What I get a earnings of 2.74% in this trade. As also, I put a long position in this black arrow in the bullish evolving but the price fell entry in$0.7303 CHF and I loss 0.76%.. So in comparison, I get more earns than loss in this trade, as only I got 1.98% in earnings. But the only to fix it's being disciplined a little more and also when we trade into this bearish channel, the best bought it's in the support of the channel.

This it's the bearish channel in H4 timeframe what CAD/CHF developed

So guys, technically we see a potential long position in these levels as we see a buliish divergence in RSI forming a lower high, and price action lower low. indicating a possible change of trend. What we could to get this opportunity to long CAD/CHF.

So, in the past week I had 12.70% in profit and plus 1.98% it's that I have 14.68% in profit during this month September

***But now, I'm in long in USD/JPY from Friday the last week as I decide to hold this long position in U.S. Dollar against Yen Japanese. So, the profit in this par could be significantly to know.. But I will make an update on USD/JPY and not a review yet until goes to my target as Stop Loss in case.

Trendanalysisexplained

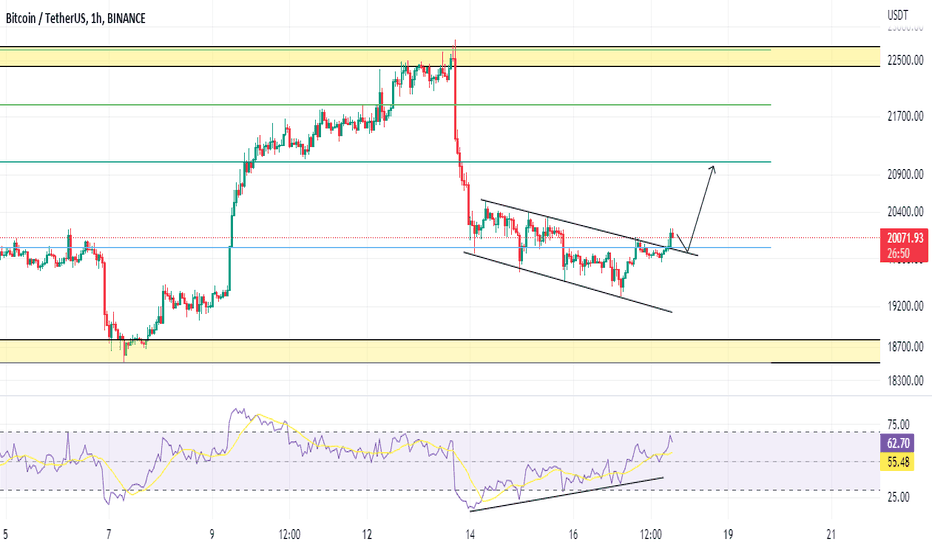

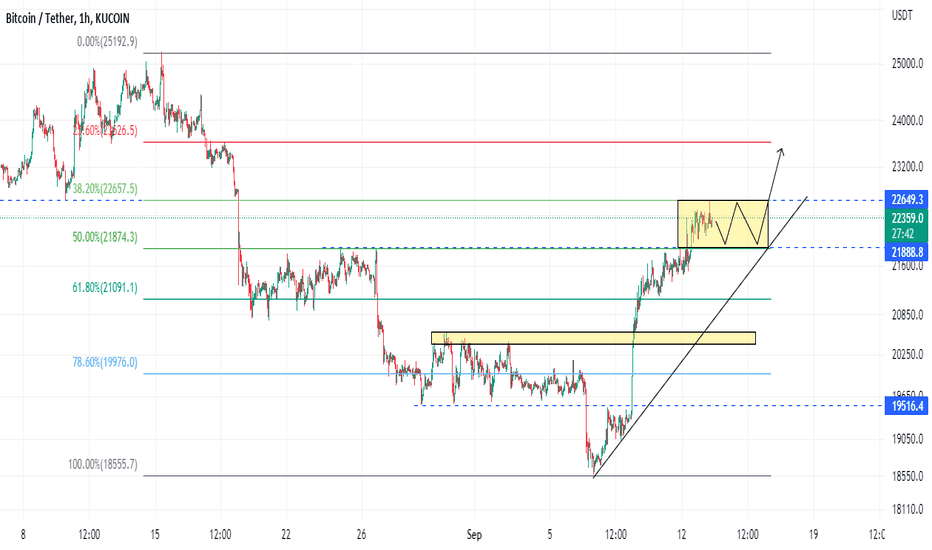

BTC/USDT (Bullish Bias)Long Call on BINANCE:BTCUSDT

BTC has been printing LHs and LLs after a parabolic move.

Now, it seems like the bearish flag formation has given a breakout to the upside.

Also, the bullish divergence formed on RSI.

Target is the coming fib. level.

Best of Luck!

Your feedback would be appreciated!

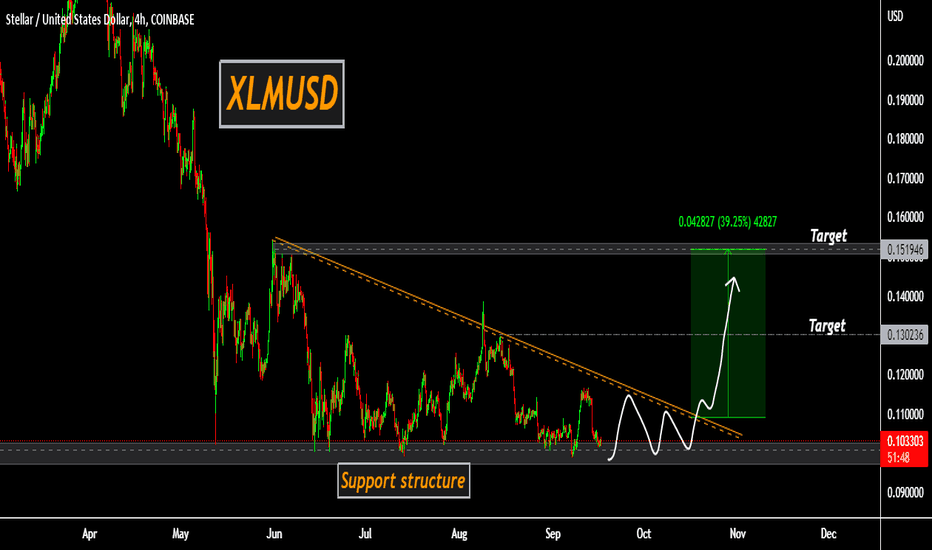

XLMUSD forming traingle pattern, wait for a breakoutXLMUSD

price is forming a triangle like structure, if price manages to break above the triangle and if price holds above the structure, I expect the price to move higher towards next resistance. if price breaks below the support area the the setup will be invalidated

Trade Wisely

*The content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

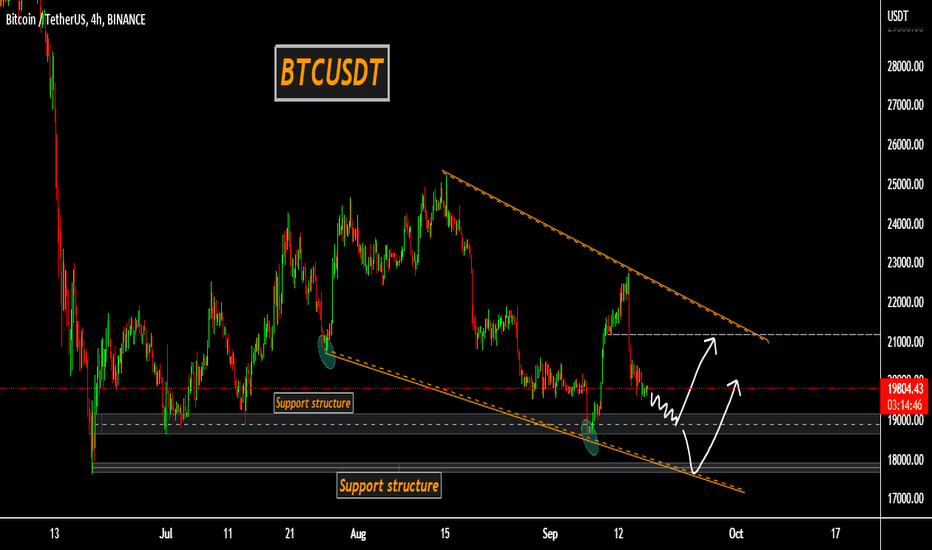

BTCUSDT approaching support structure,short term bounce expectedBTCUSDT

price is approaching support structure, after reaching the support if price holds above the support, I expect the price to move higher towards next resistance.

Trade Wisely

*The content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

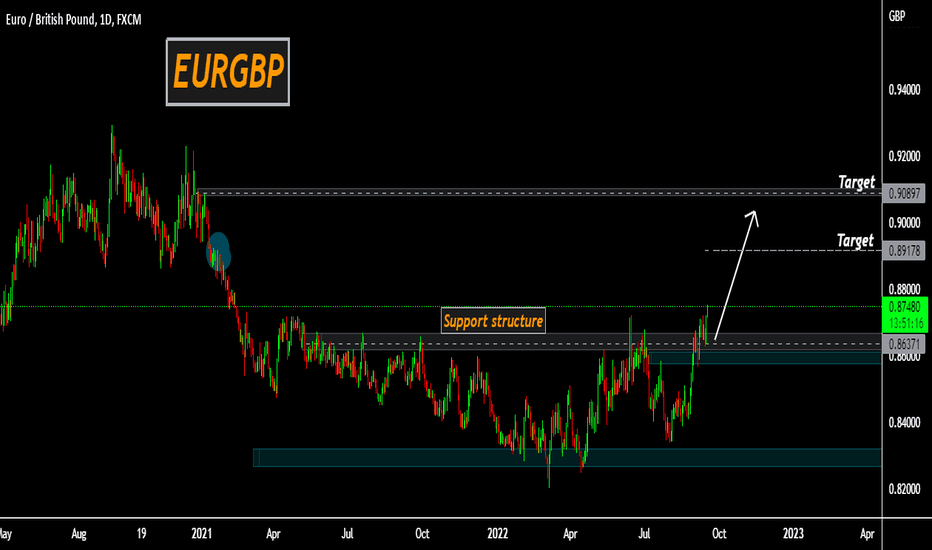

EURGBP broke above support/resistance, more growth expectedEURGBP

price broke above support/resistance structure. if price continues to hold above support I expect the price to move higher towards the next resistance..

Trade Wisely

*The content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

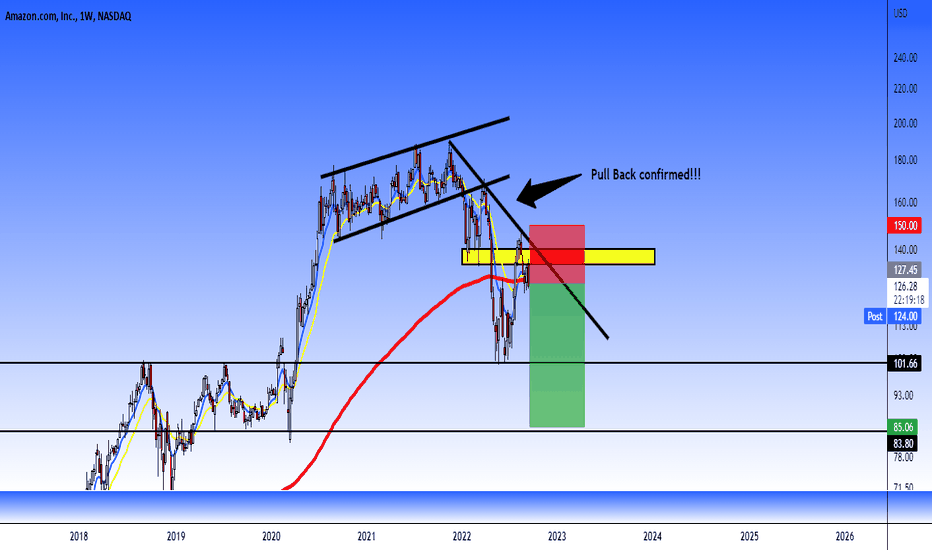

AMZN: Bearish setup!!!Amazon, Inc look very interesting to short in weekly timeframe.

So, I love to trade stocks in big timeframe as the big benefit it's the patience and trade in big timeframe we could to earn a lot money in medium to long term and being disciplined.

So, I'm analyzing that Amazon look bearish in weekly timeframe that we could to get benefit trade in bearish trend. Also if you trade in Daily, still bearish. I like to trade stock and crypto in over Day timeframe and also swing trading are the best strategy to do, for me.

So, I'm bearish in Amazon, as the same stock market and cryptocurrencies.

Good luck!!!

Remember,I have another account to trade stock and crypto market, but I have another account just to trade Forex. What we could to get good benefit for our investment.

CAD/CHF: bullish envolving patternI this update as I do in the comment box in CAD/CHF where I was shorting. My bearish movement was a good expectative, but price action show us a bullish envolving pattern that you must to be carefully, because in that point we're in the market reversal.

Also, I want to share in H4 that we're in the bearish channel, and also we forming like a descending line that in any moment as we see a bullish signal, we could to break-up this market structure in this par, and this it's look very interesting to trade in long position.

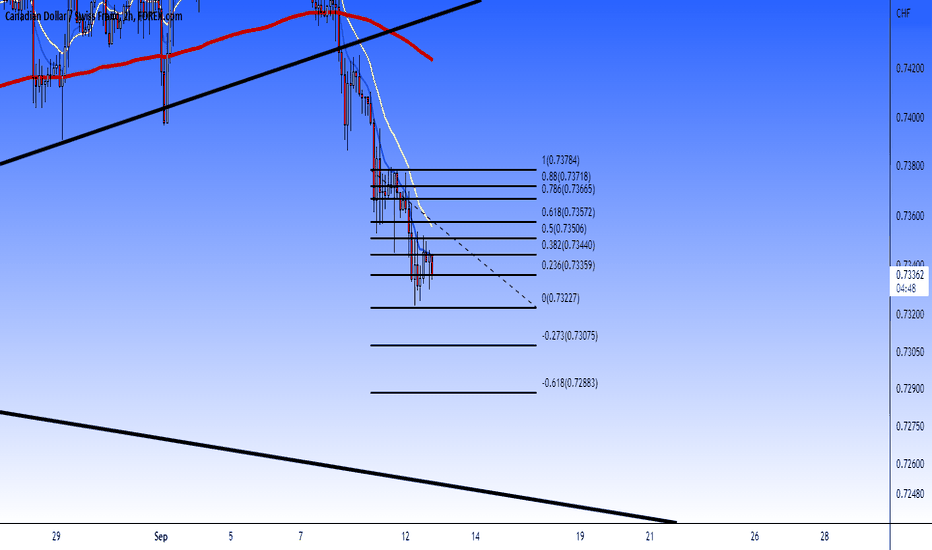

This it's the descending line that we could to see better in this zoom up.

So, at the moment, I'm in long position from this morning that I update my position in the comment box in CAD/CHF where I was shorting very good and at least I get 2.60% in profit in this trade with 27 pips in profit. But not bad, but I see that CAD can to strength now.

Technically, we see 2 point to be pending in $0.7558 CHF and $0.7390 CHF. My Stop Loss it's around $0.7269 CHF and take profit until $0.7390 CHF.

Good luck!!!

CAD/CHF: Bearish continuation trendCanadian Dollar/Swiss Franc look very bearish in H2 timeframe. So, as I made an shortly analysis, so we would need to hope in the few minutes if this live price it's a good opportunity to short now CAD/CHF and using Fibonacci retracement. If in H2 timeframe the price closed down with bearish signal, we can to entry to shorting CAD.

Now, I want to talk my improve technical analysis in CAD/CHF, what we see an interesting bearish channel, what if we see very good, it's a good time to short in the bottom of this channel until $0.7260 CHF.

So guys, I will pending in few minutes to know it it's a good time to short CAD/CHF.

Good luck!!!

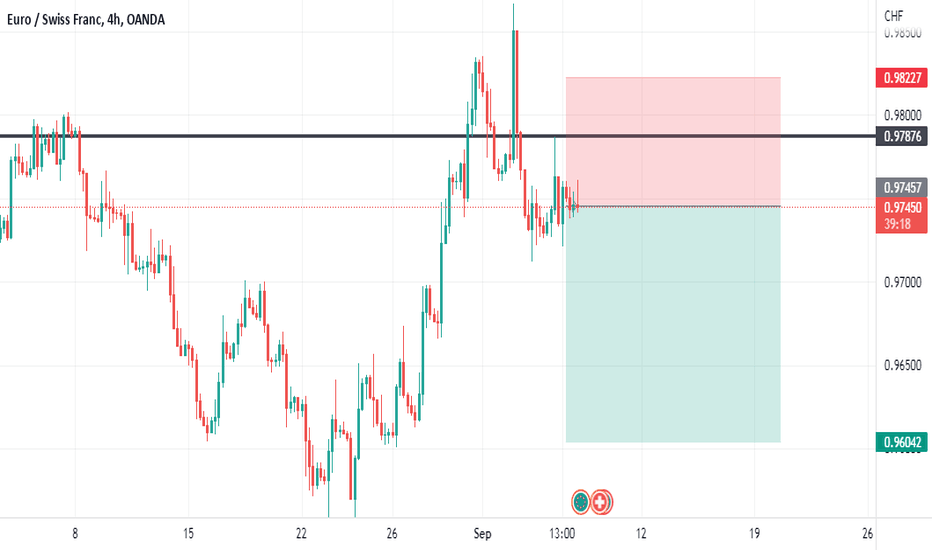

EURCHF:BEARISH POSITIONS BELLOW 0.9786OANDA:EURCHF

Hello folks, this is my analysis brought to you after deeply analyzing the EUR/CHF Forex pair from a technical and fundamental perspective:

Pivot point: 0.9786

Stop loss :0.9822

Take profit: 0.9604

Current price at the moment of generating this post: 0.9742

Risk/Reward Ratio : 1.84

If this post was useful to you, do not forget to like and comment.❤️

Trade Safely,

Best Regards,

Yasser Tavarez

BTC/USDT (MY VIEW)My view on BINANCE:BTCUSDT

BTC is moving in an upward direction for a while, although, it's not printing obvious levels and swings!

It is right now in a golden Fibonacci zone. I think it may consolidate a bit in this zone and then give a breakout to the upside or maybe to the downside.

If it gives an upside breakout then the target would be the next fib. level!

Trade the level accordingly!

Best of Luck!

Your feedback would be appreciated!

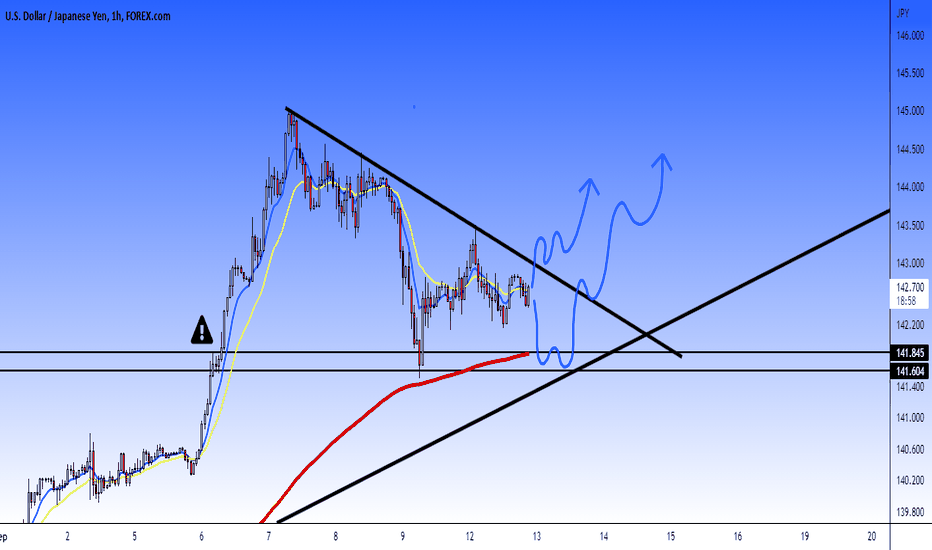

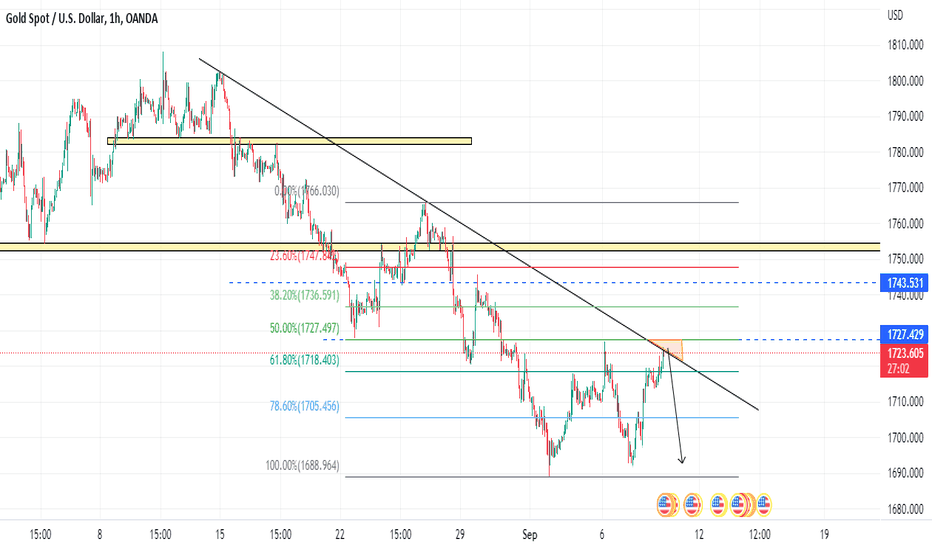

USD/JPY: Where to bought!!!In this analysis, I make an analysis in USD/JPY that I believe that in based the technical analysis. I'm still bullish in USD/JPY. What we could to find down a good level to bought like $141.76 JPY, and also if in case that make this break-out of this higher lower. What it's important to hope the next opportunity and not trade yet.

Also I want to share in H4 timeframe that we're in the 0.382% fibonacci.

Also, I study a lot this par and become the most volatile par in Forex market, what sometimes we would to develop a tolerance in this par and analyze very well to develop a successful strategy. I'm still bullish in USD.

***Tomorrow will be the U.S. Consumer Price Index, and this report it's where investor hope to know this data to trade widely.

Fundamental Analysis in U.S Dollar:

1. Dollar fell to it's lowest level in about two weeks agains a basket of currencies on Monday following recent strong gains.

2. Investor sentiment grew up into the nervous ahead of U.S inflation data as FED appeared to increase interest rates. This data show a concerned in the U.S. economy into the risk to curb like a reccesion.

***3. The U.S. Consumer Price Index report will due tomorrow to know and get clues on how aggressive the FED may need to be in hiking interest rates next week to fight high inflation in America.

4. Joe Manimbo, senior market analyst at Convera, He believe it's been a break in the dollar relentless rise, waht behind that its an improved risk sentiment.

5. U.S. Consumer Price growth is expected to decelerate slightly in August with analyst citing a moderation in soaring energy that previously contributed to driving inflation very high since 40 years ago never see in America economy

Keep update!!!

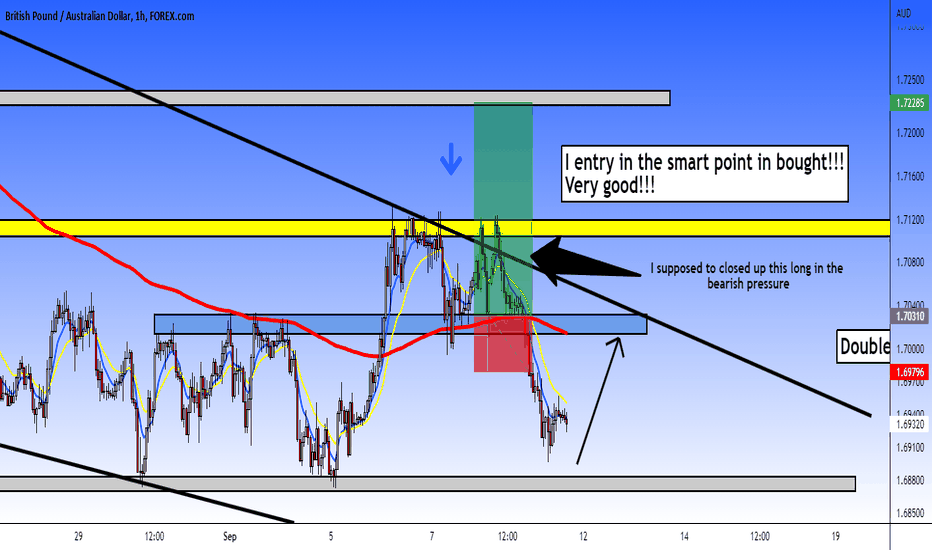

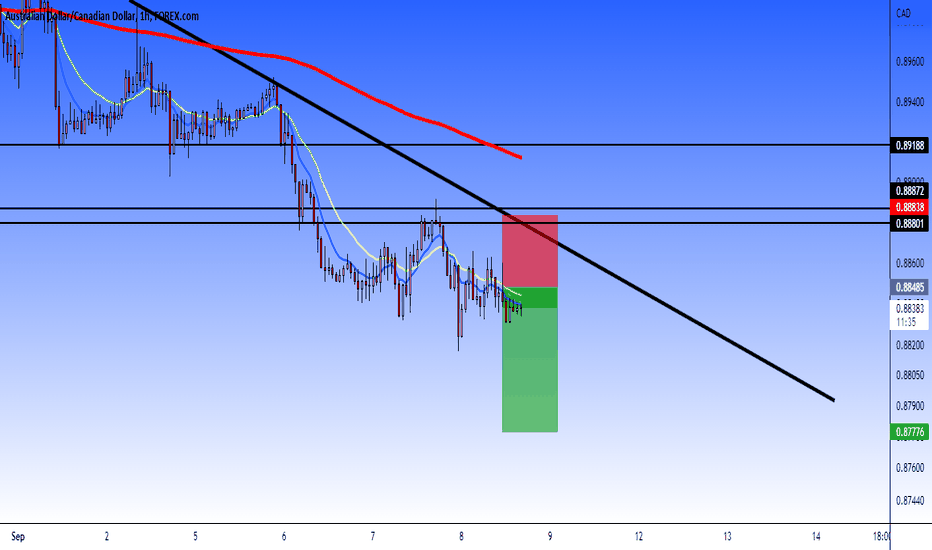

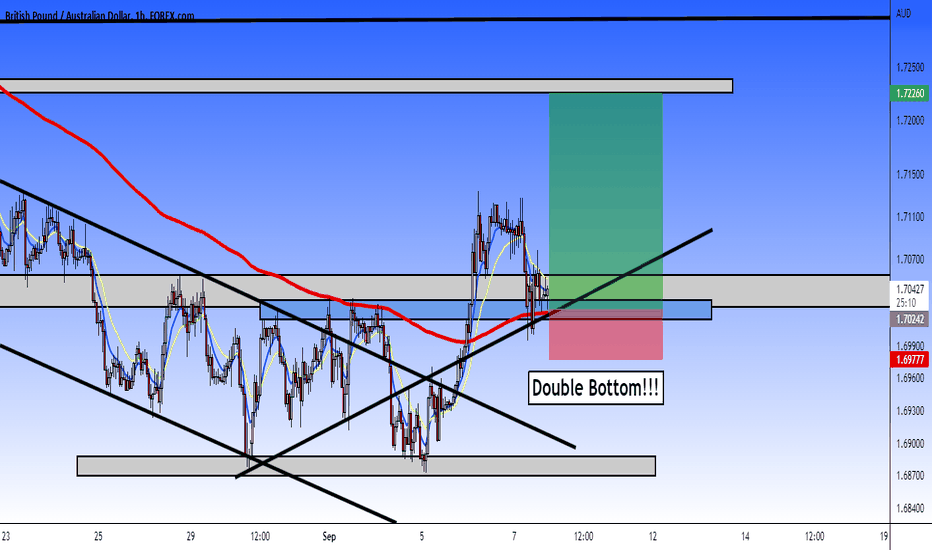

GBP/AUD: Review!!!This it's my last review that I will make now. So, during the past week I trade GBP/AUD to long position. Also, I was in profit like 99 pips equal of 5.67% in profit. But I loss 2.96% in this trade. Also to work a little more in this analysis, I found out 2 points to work in my experience.

1. When I believe that GBP/AUD forming a double bottom, and I cached very good the smart buy zone. I suppose to be pending in the formation of the price when we see a bearish pressure. in the higher point whrere I was in profit, I supposed that at least I can to get like 60 or 50 pips in profit.

2. The most important it's update our technical analysis, If I made a good entry in the smart point when I was in long. It's suppose to be a little more cautious when GBP it's in the bearish trend. And suppose to look in H4 to watch this analysis

When we see this bearish line diagonal, it's a moment to take profit from this point when I was in good, and then closed up the long position, as opportunity to short in the exact point here.

But my analysis was there, and I don't update and draw the bearish line that follow the downtrend. ]

So, it's the only mistake that I found out. Also, I was in profit in this par, but keeping the trade as look bullish by double bottom, it's necessary to work a little more this analysis to apply in my experience. What my result was a lost of 2.96%.

Now, talking about in this week. I only get an earned of 4.33% in GBP/USD and loss in 6.66% in AUD/CAD and now another loss of 2.96% in GBP/AUD. So, in this week, I get -5.29% in loss, what in my monthly progress still in 17.99% what my account decrease -5.29%. What it's mean that I hold 12.70% in profit during this month in September.

But well, my monthly goal it's to reach 20% as minimum target in my investment in Forex market. Now, we're human and we're not perfect, everyday we would to work hard in Forex market.

So guys, nothing it's everyday a good streaks, sometime we have bad streaks. Now, on this week we hope more opportunities in Forex market to view!!!

I expect a major crash in Cardano priceCardano still in this consolidation since May 2022. But, this it's not an accumulation zone, I see that bulls are trying to fight, but bears are taking control into this downtrend. And remember that FED it's very crazy to tight the interest rates and value of U.S. Dollar, what we expect a major crash in ADA.

So, I look first that this it's a re-distribution zone where we're in the bear market, and sometimes this look like the end of the bear market. But to know when the bear market ending, it's very necessary to have in mind the macroeconomic and microeconomic aspect to know what happen in the global economy. During the years I found out that cryptocurrencies make their movement what Forex market do, and sometimes as crypto-trader we could to take advantage reading everyday Forex market to take a perspective to trade cryptocurrency very well and choose some pars to trade. But I'm very interesting to learn about this correlation that crypto and forex show.

But talking about in weekly timeframe, I expect a crash that could to carry the price to $0.23 cents approx. Also I'm note that Cardano forming a symmetric triangle in Daily timeframe that it's look very interesting to check out.

I'm still bearish in weekly timeframe!!!

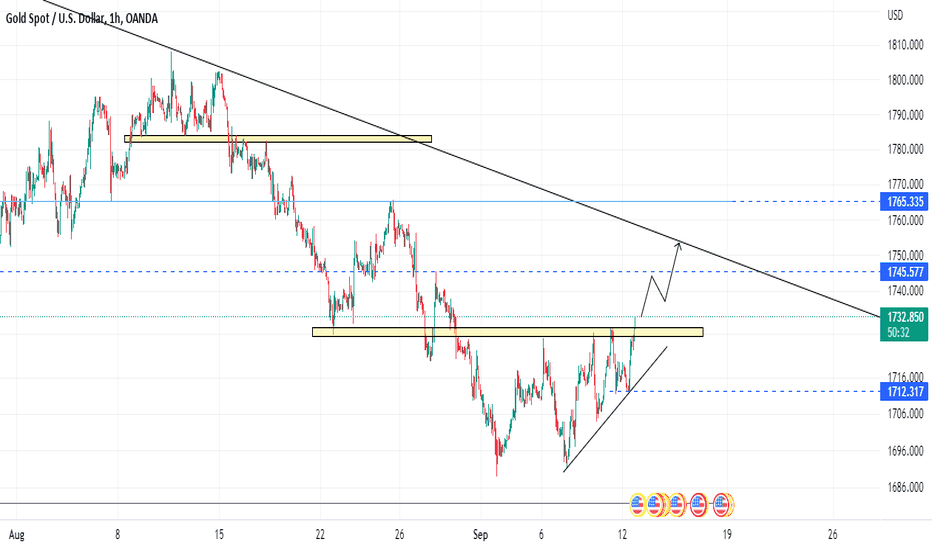

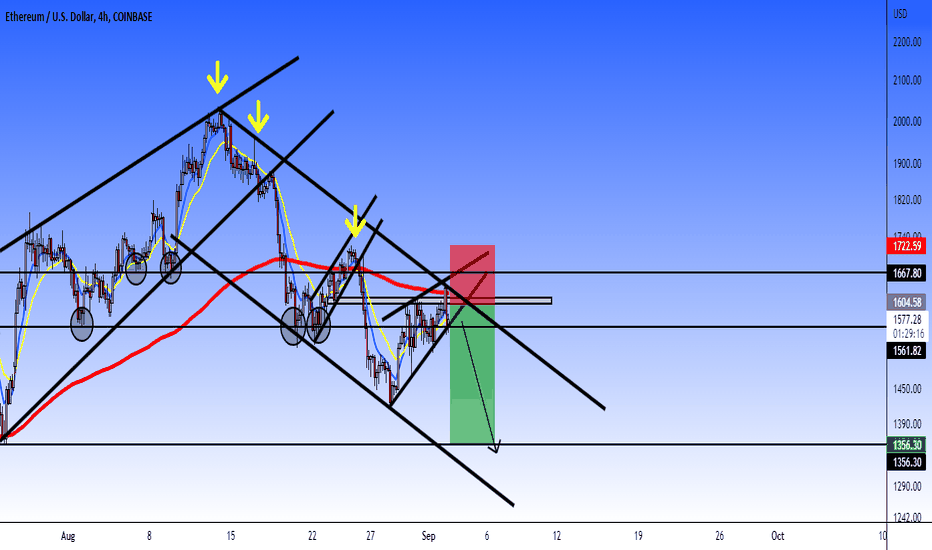

Ethereum forming a bearish channel explainedEthereum look in the exact point and very interesting to short and put a sell order place.

I like to trade cryptocurrencies in H4 timeframe or above, but based in Daily focus.

So, Ethereum formed a bearish evolving pattern, what we could to see that this will be the new higher low of the previously them. And a formation of bearish rising wedge, Ethereum could to explode this movement to the downside very soon. What I will put a sell order place to $1,600 USD, Stop Loss to $1,722 USD and take profit to $1,356 USD. So, this it's a risk/benefit of 1:2. It's a good proportion to short Ethereum from this point.

So guys, if you're interested to short cryptocurrencies, I suggested you to be very focus in Forex market first as Forex market make movement very correlated with financial market, cryptocurrencies it's an attractive world if you know how to trade crypto-assets and become a trader in cryptocurrencies could to help you if you combine your talent with Forex market and take this understanding how this market work in correlation with Forex.

I hope that this idea support you!!!

For me, Forex it's an easy market to trade, if I can to trade Forex, I must to trade cryptocurrencies. Trading it's a lot practice than theory, guys.!!!

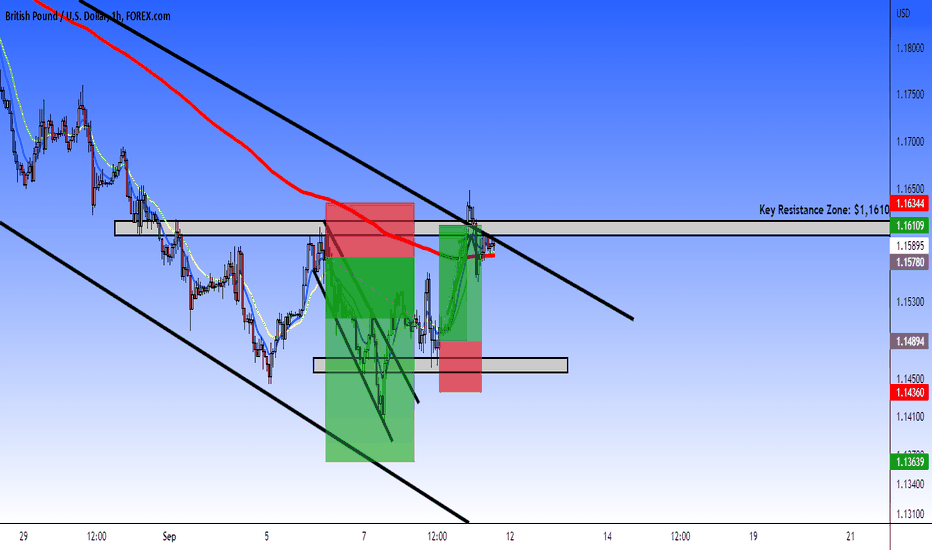

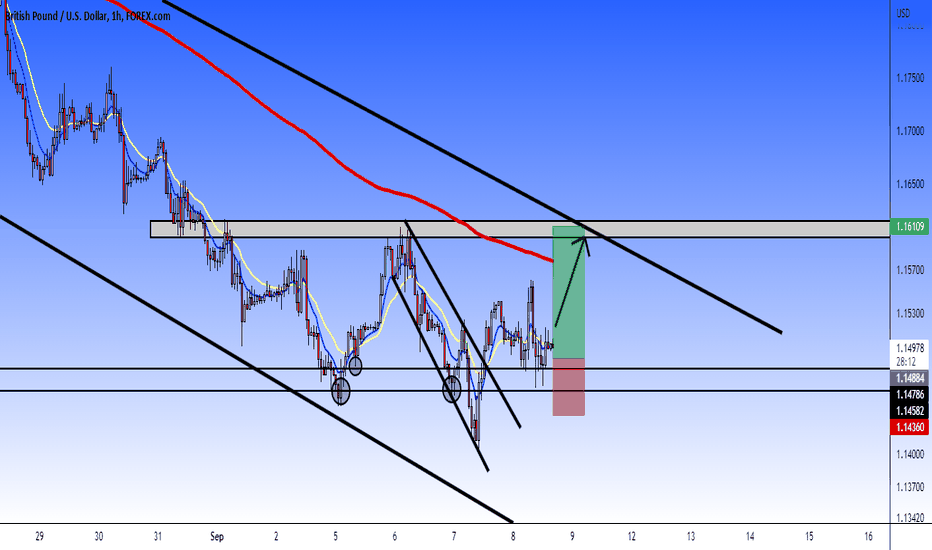

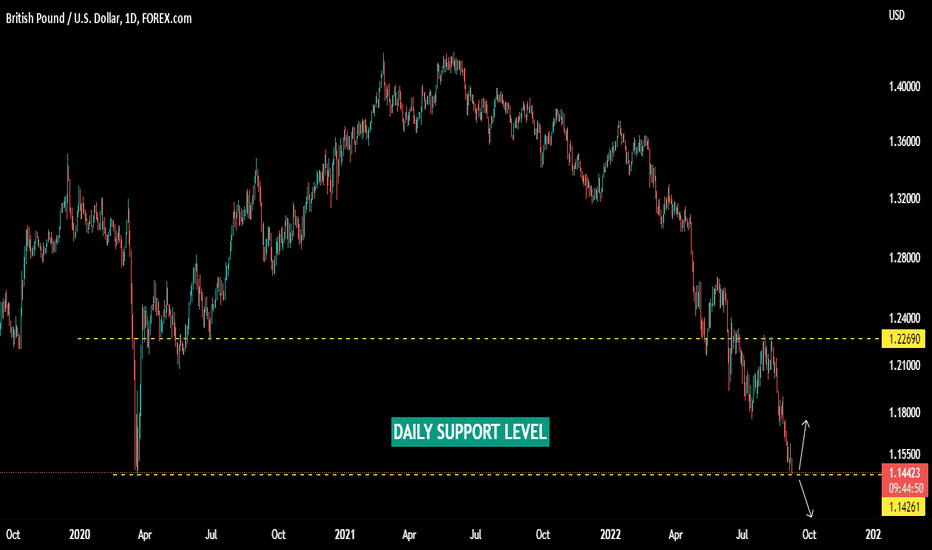

GBP/USD: Review!!!I traded GBP/USD in my first short position. And also, I made a very good entry in the smart point. And I was in profit with 173 pips. But now, GBP/USD WAS INTO THIS Bullish channel flag that I look, and break out very good, but I don't closed up in the grant bullish evolving pattern, what I closed up my short in $1.1536 USD, and my short entry price was $1.1574 UD. What in this short trade I get 43 pips in profit, equal of 4.33% in profit. Also to comment, when I closed up this short trade, I had a long perspective that GBP/USD could to up, what my prediction was very good, but never the price goes my my buy pending place in $1.1490 USD, but my direction was very good, what if I get this trade and touch my buy order place. So, my profit will be 121 pips or 12.10% in this trade. But after that GBP/USD continue climb up, so I cancelled this trade as never goes to my pending order.

But well, the only profit that I get was in my short trade, also I was very good in this trade in short, what GBP/USD was so near to take my profit for only 33 pips more down. But the only that I want to work a better it's when I see a bullish evolving, the same for the bearish trend when we see a bearish evolving, its time to take decision to closed up and keep away of this trade when price action speak me that there're a change of trend in the price fluctuation. But, well, not bad, and also my both analysis in short and long was very good in GBP/USD. And for long position, when I take this place, so I don't see any negative comment in me, but so it's very normal that somtimes the price continue up without activate the pending order at favor of the trend.

So, as my monthly ROI was in 11.33% and sum only 4.33% in profit. So my account grow to 15.66% in profit during this month on September.

Now, if I decide to trade GBP/USD, we could to see a formation of Shoulder Head Shoulder inverted, what the next movement could be bearish in GBP/USD to look a strong resistance in a key point to watch

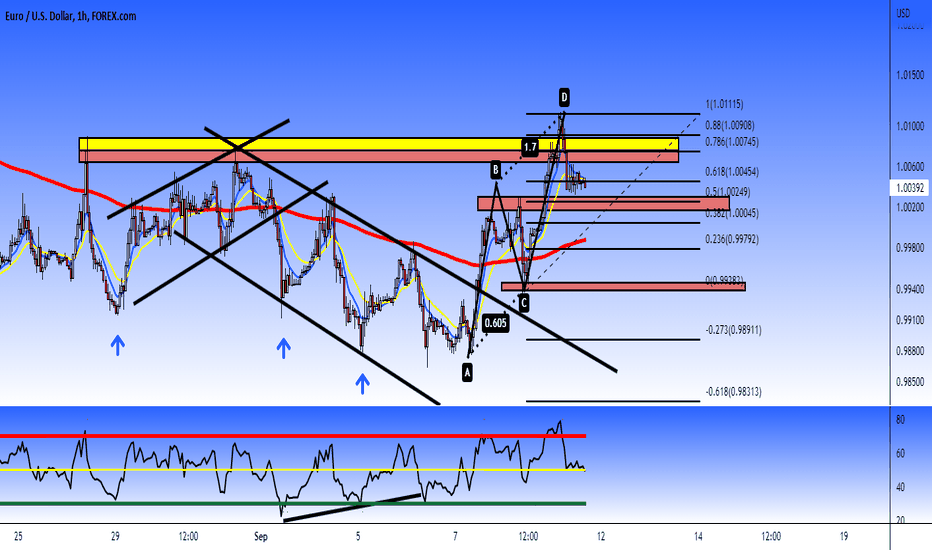

EUR/USD: Review!!!During this week, I made an analysis on Euro/Australian Dollar, when I said that Euro will climb up following my past analysis link to related idea, what I made a very good analysis. But I dont entry in this trade as I was in another. But now, at the moment, my prediction was correct when I said that Germany (The largest economy in whole Europe) do and European Union to rescue the countries they to one shield energy customer and businesses from this inflation in the energy crisis. what I found out it's that Germany Government make an investment of 65 billion (Euros) on shielding energy customers and businesses from soaring inflation and $95 billion (Euros) the amount allocated to inflation busting since the Ukraine began in February 2022. Another data show that Germany has spent over 300 billion (Euros) on propping up the economy over the past 2 years of the covid-19 pandemic.

So this movement was bullish in Euro, but I rate this trade very good analysis.

Now, to have another perspective, we see a bearish harmonic pattern ABCD formation, what it's look very interesting to short Euro in the 0.782% Fibonacci after this drop, and technical analysis identify a bullish divergence.

GBP/USD: Buy pending placeAt the moment, I don't see that from this level a drop, I look a bullish setup, so, as I was in long position in $1.1520 USD and hit my Stop Loss in $1.1475 USD where I loss 5.03%. But now, we can to see a long position from this level of bought zone. But the movement in this morning it's supposed to continue bullish, but was manipulated. Now, we see a double pull back formation in this zone what we could to find up bought.

Now, talking about H4 timeframe, the price still bullish and following the RSI bullish divergence formed.

So guys, I put a new buy order limit in $1.1490 USD, Stop Loss in $1.1436 USD and take profit to $1.1610 USD.

Good luck!!!

GBP/AUD: Double Bottom; pull backGreat Britain Pound/Australian Dollar forming an interesting Double Bottom here, and right now, the price it's making a pull back in this zone. Talking about the H1 timeframe, we see that GBP/CAD look into this bullish setup. I draw this diagonal up line that mark a psychological point that we couldto put a buy order place in the smart zone. For me, I'm very sure that GBP/CAD forming and ending this pull back confirmed to long position. I put my buy order place in $1.7024 CAD, Stop Loss to $1.6977 CAD and take profit to $1.7226 CAD, also I suggested when GBP/CAD in this way in the up trend, it's necessary to monitoring this trade if we see any rejection in the half of this way.

Based in H4 timeframe, we're in the bullish setup right now and GBP/CAD can to reach this reaction zone in $1.7236 CAD approx that I mark using block orders to analyze it.

So, that it's all for this analysis what I see.

I hope that this idea support you and trade this opportunity in Forex market for this week.