ASX 200 @ 27 SEP 2021Text me if you have any questions/comments for me.

-----

27 SEP 2021 – Market Watch

As mentioned in last night’s livestream, the ASX 200 is currently trading in No Man’s Land. This is a zone where it is trading in a band that is bounded by a strong resistance (7400 levels) and strong support (7250 levels).

Usually, when an index or stock is stuck in No Man’s Land, there needs to be a strong catalyst to break either the resistance/support. With the markets still feeling the unease stemming from Evergrande’s missed interest payment last Thursday and the continued lack of clarity on the US Fed’s tapering plans, I fear we might continue to be stuck in this tight band (blue shaded zone) for at least the coming week.

The best-case scenario is if there is a successful push to 7500 levels and beyond. If it happens, I would be more bullish on the market. As it is, I am more trigger happy when deciding to trim positions. If Evergrande somehow presents a huge contagion effect at a global level similar to Lehman Brothers, the ASX 200 will likely drop to possibly even break 7150 levels.

88% of my stocks are green today. How about you?

If you find this market analysis helpful, let me know in the comments. May the markets continue to be with us!

Disclaimer:- I’m a mid-term trader and I hold my stocks between 1-3 months. I’m using Trend Following strategies and my analysis will be from a perspective as a Trend Follower. I’m sharing these analyses for learning purposes and as always, DYOR.

Trendfollowing

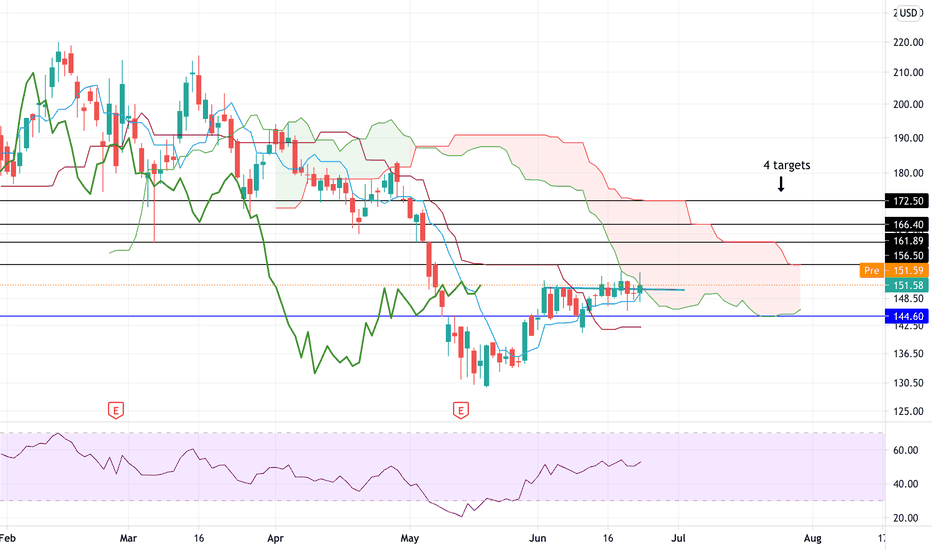

ABNB: RECOVERY PLAY, ICHIMOKU ANALYSISABNB :

Another reopening play, people looking to travel again.

Ichimoku analysis on daily:

The price is currently blocked by the cloud. Pressure is building to reintegrate the cloud.

The lagging span (green line) has broken the Tenkan (blue line) and is heading for a test of the Kinjun (dark red line), the flat zone of the Kinjun is our 1st target/resistance at 156 (providing the price can reintegrate the cloud).

This is what I'm playing now with a long trade.

The next step will be for the price to reach the top of the clouds (and maybe break out of it) and the lagging span to break the Kinjun, confirming the change of trend.

Note how Ichimoku is precise, all flat zones (of clouds and Laggin span) represent former supports and resistances (the 4 targets on the chart).

On a separate note you can see a sort of ascending triangle on the daily chart.

Trade safe!

More on Ichimoku (by Investopedia):

The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. It does this by taking multiple averages and plotting them on a chart. It also uses these figures to compute a “cloud” that attempts to forecast where the price may find support or resistance in the future.

Key takeaways:

The Ichimoku Cloud is composed of five lines or calculations, two of which comprise a cloud where the difference between the two lines is shaded in.

The lines include a nine-period average, a 26-period average, an average of those two averages, a 52-period average, and a lagging closing price line.

The cloud is a key part of the indicator. When the price is below the cloud, the trend is down. When the price is above the cloud, the trend is up.

The above trend signals are strengthened if the cloud is moving in the same direction as the price. For example, during an uptrend, the top of the cloud is moving up, or during a downtrend, the bottom of the cloud is moving down.

XRF @ 23 SEP 2021Text me if you have any questions/comments for me.

-----

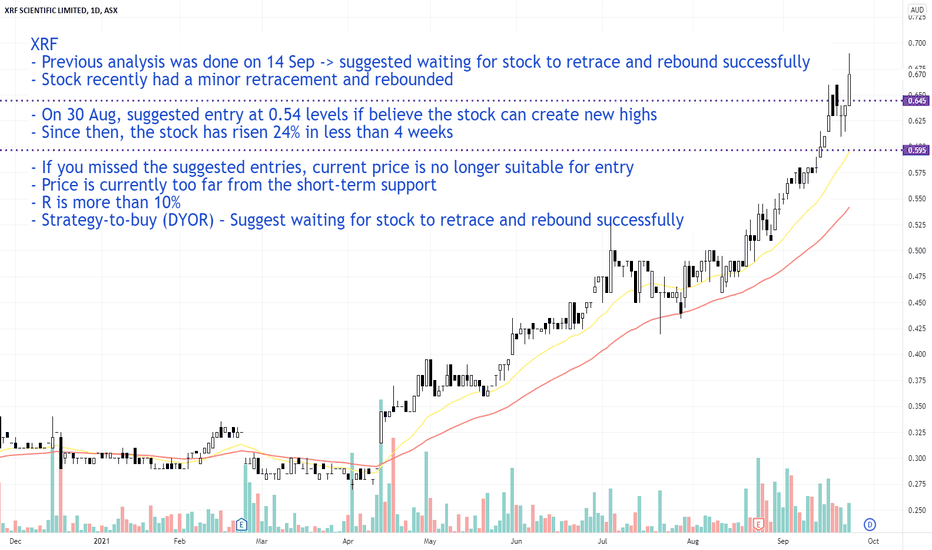

XRF

- Previous analysis was done on 14 Sep -> suggested waiting for stock to retrace and rebound successfully

- Stock recently had a minor retracement and rebounded

- On 30 Aug, suggested entry at 0.54 levels if believe the stock can create new highs

- Since then, the stock has risen 24% in less than 4 weeks

- If you missed the suggested entries, current price is no longer suitable for entry

- Price is currently too far from the short-term support

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for stock to retrace and rebound successfully

TLS @ 23 SEP 2021 Text me if you have any questions/comments for me.

-----

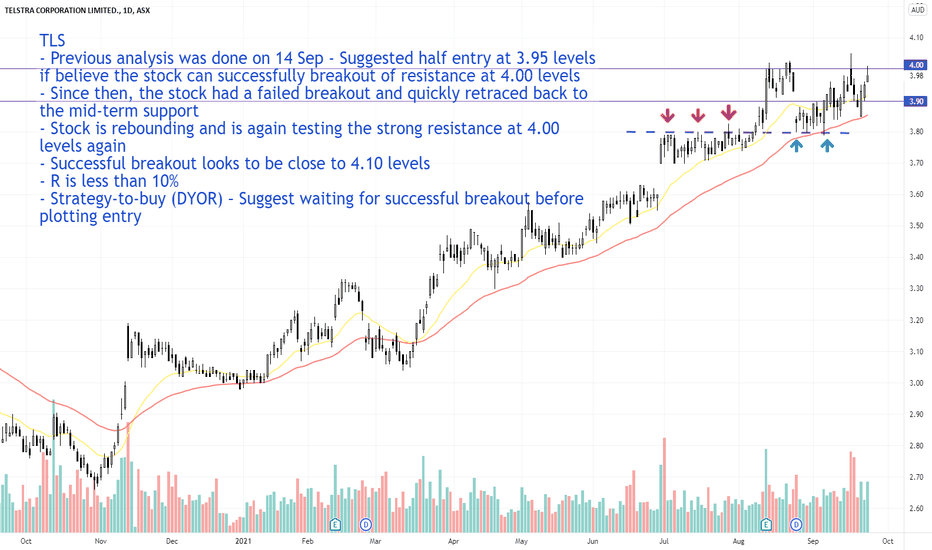

TLS

- Previous analysis was done on 14 Sep - Suggested half entry at 3.95 levels if believe the stock can successfully breakout of resistance at 4.00 levels

- Since then, the stock had a failed breakout and quickly retraced back to the mid-term support

- Stock is rebounding and is again testing the strong resistance at 4.00 levels again

- Successful breakout looks to be close to 4.10 levels

- R is less than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for successful breakout before plotting entry

REA @ 23 SEP 2021Text me if you have any questions/comments for me.

-----

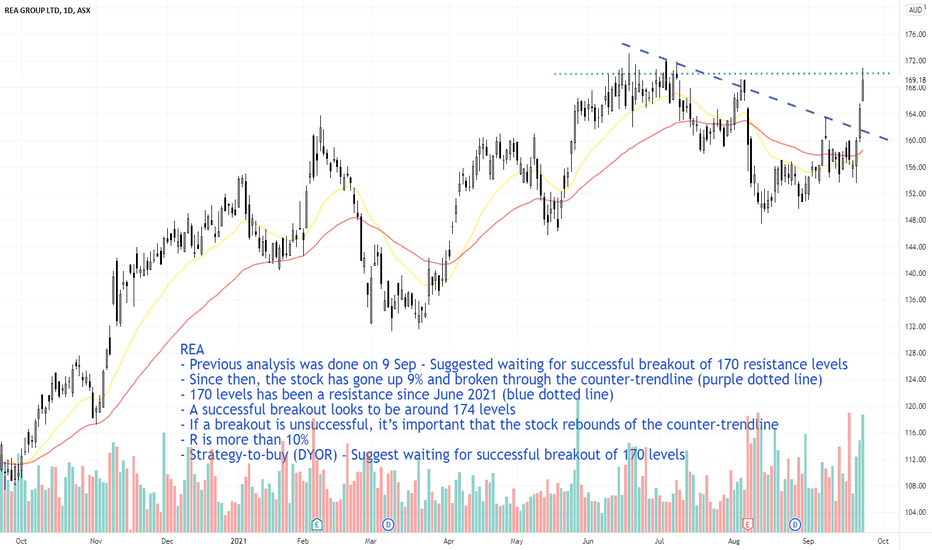

REA

- Previous analysis was done on 9 Sep - Suggested waiting for successful breakout of 170 resistance levels

- Since then, the stock has gone up 9% and broken through the counter-trendline (purple dotted line)

- 170 levels has been a resistance since June 2021 (blue dotted line)

- A successful breakout looks to be around 174 levels

- If a breakout is unsuccessful, it’s important that the stock rebounds of the counter-trendline

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for successful breakout of 170 levels

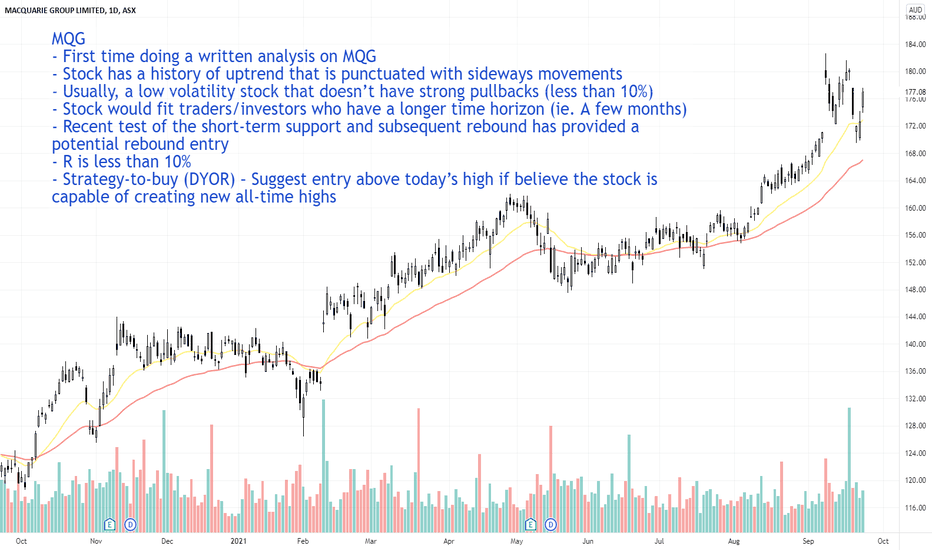

MQG @ 23 SEP 2021Text me if you have any questions/comments for me.

-----

MQG

- First time doing a written analysis on MQG

- Stock has a history of uptrend that is punctuated with sideways movements

- Usually, a low volatility stock that doesn’t have strong pullbacks (less than 10%)

- Stock would fit traders/investors who have a longer time horizon (ie. A few months)

- Recent test of the short-term support and subsequent rebound has provided a potential rebound entry

- R is less than 10%

- Strategy-to-buy (DYOR) – Suggest entry above today’s high if believe the stock is capable of creating new all-time highs

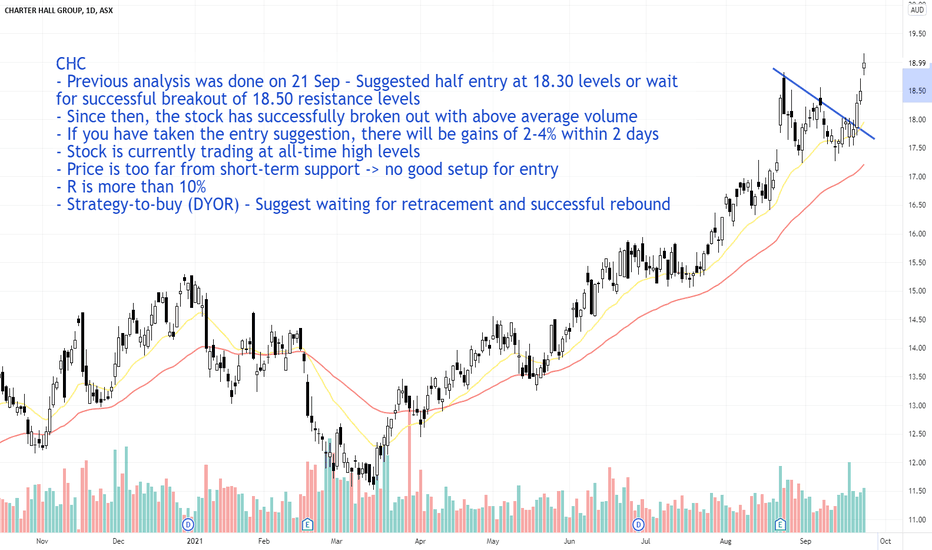

CHC @ 23 SEP 2021Text me if you have any questions/comments for me.

-----

CHC

- Previous analysis was done on 21 Sep – Suggested half entry at 18.30 levels or wait for successful breakout of 18.50 resistance levels

- Since then, the stock has successfully broken out with above average volume

- If you have taken the entry suggestion, there will be gains of 2-4% within 2 days

- Stock is currently trading at all-time high levels

- Price is too far from short-term support -> no good setup for entry

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for retracement and successful rebound

ACL @ 23 SEP 2021Text me if you have any questions/comments for me.

-----

ACL

- Previous analysis was done on 16 Sep - Suggested waiting for successful breakout of 4.60 levels before plotting entry

- Stock has been trapped in a band (moving sideways) for almost a month

- It still respects the short-term support -> good thing

- Stock has a lot of long shadows around the 4.60 resistance zone

- R is borderline 10%

- Strategy-to-buy (DYOR) – Suggest waiting for successful breakout of resistance accompanied with strong volume before plotting entry

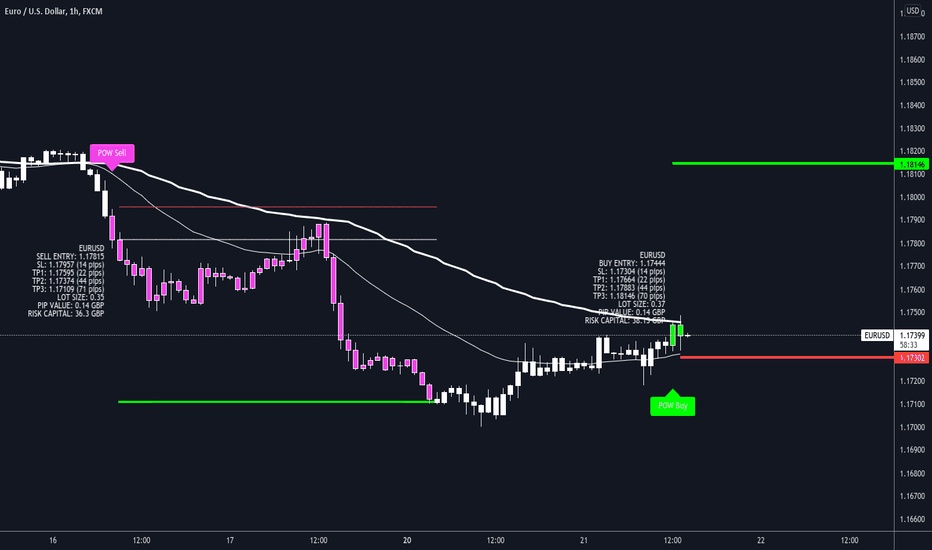

EURUSD long opportunity running ⬆️🙌We are using our trend following EDGE strategy for this trade.

Entry details are shown on the chart.

Working the H1 time frame on this strategy.

We're only looking for TP3.

Last trade can also been seen on chart which was a successful short.

Trade history can be seen below this trade idea too for full transparency.

Tight stop loss on this strategy put it's been proven in the back testing the most profitable method to trade this pair.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

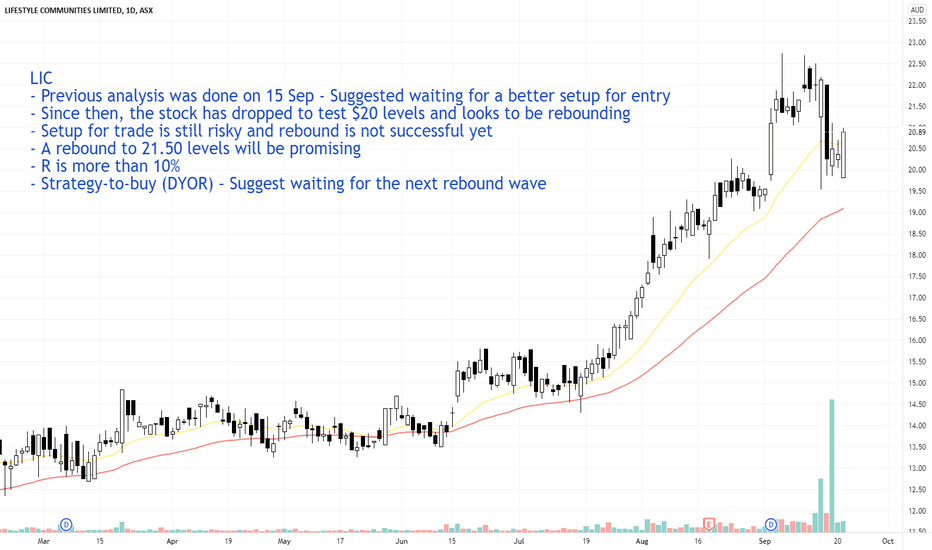

LIC @ 21 SEP 2021Text me if you have any questions/comments for me.

-----

LIC

- Previous analysis was done on 15 Sep - Suggested waiting for a better setup for entry

- Since then, the stock has dropped to test $20 levels and looks to be rebounding

- Setup for trade is still risky and rebound is not successful yet

- A rebound to 21.50 levels will be promising

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for the next rebound wave

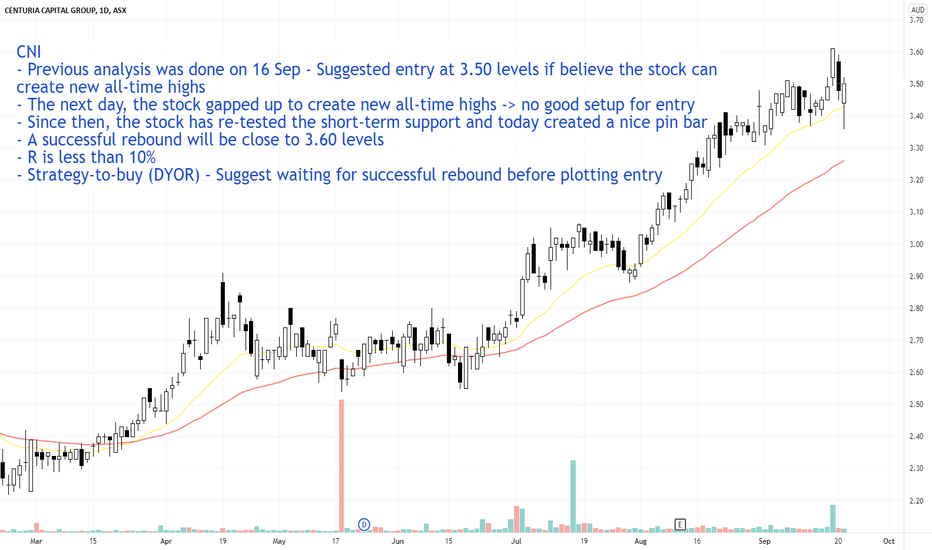

CNI @ 21 SEP 2021Text me if you have any questions/comments for me.

-----

CNI

- Previous analysis was done on 16 Sep - Suggested entry at 3.50 levels if believe the stock can create new all-time highs

- The next day, the stock gapped up to create new all-time highs -> no good setup for entry

- Since then, the stock has re-tested the short-term support and today created a nice pin bar

- A successful rebound will be close to 3.60 levels

- R is less than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for successful rebound before plotting entry

CHC @ 21 SEP 2021Text me if you have any questions/comments for me.

-----

CHC

- Previous analysis was done on 14 Sep - Suggested waiting for successful breakout of either counter-trendline or 18.50 resistance levels

- Stock today broke out of counter-trendline with slightly above average volume

- There is still an overhead resistance at 18.50 levels

- While the overall market has been weak, the stock has respected the short-term support -> good sign

- If you didn’t enter at counter-trendline breakout, entry at current price levels would be a pre-breakout strategy for the 18.50 resistance levels

- R is less than 10%

- Strategy-to-buy (DYOR) – Suggest half entry at current levels or waiting for successful breakout of 18.50 resistance levels

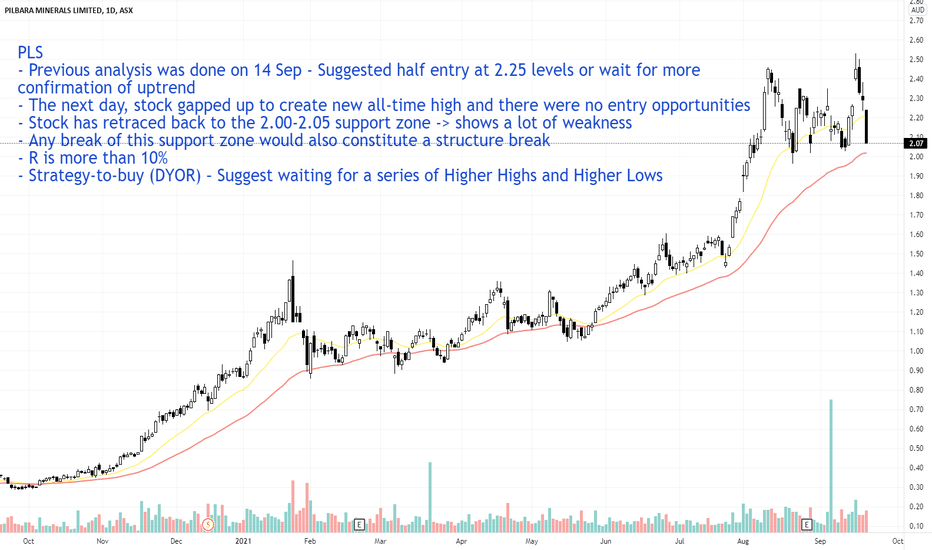

PLS @ 20 SEP 2021Text me if you have any questions/comments for me.

-----

PLS

- Previous analysis was done on 14 Sep - Suggested half entry at 2.25 levels or wait for more confirmation of uptrend

- The next day, stock gapped up to create new all-time high and there were no entry opportunities

- Stock has retraced back to the 2.00-2.05 support zone -> shows a lot of weakness

- Any break of this support zone would also constitute a structure break

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for a series of Higher Highs and Higher Lows

LYC @ 20 SEP 2021Text me if you have any questions/comments for me.

-----

LYC

- Previous analysis was done on 14 Sep - Suggested waiting for a retracement and successful rebound

- Since then, the stock tested $8 levels and today broke through the short- and mid-term supports with above average volume

- Stock is exhibiting high price volatility and may not be suitable for all types of traders

- A successful rebound looks to be close to 7.50 levels

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for a series of Higher Highs and Higher Lows

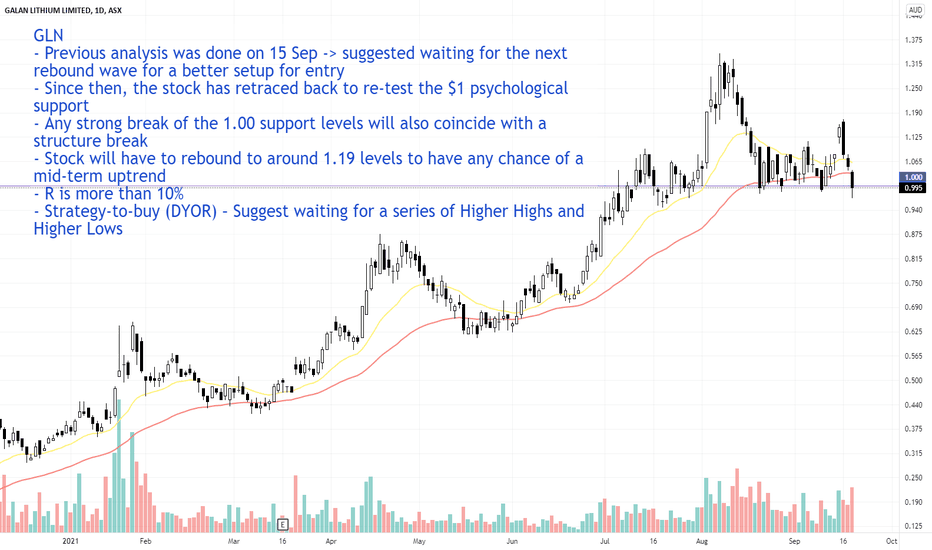

GLN @ 20 SEP 2021Text me if you have any questions/comments for me.

-----

GLN

- Previous analysis was done on 15 Sep -> suggested waiting for the next rebound wave for a better setup for entry

- Since then, the stock has retraced back to re-test the $1 psychological support

- Any strong break of the 1.00 support levels will also coincide with a structure break

- Stock will have to rebound to around 1.19 levels to have any chance of a mid-term uptrend

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for a series of Higher Highs and Higher Lows

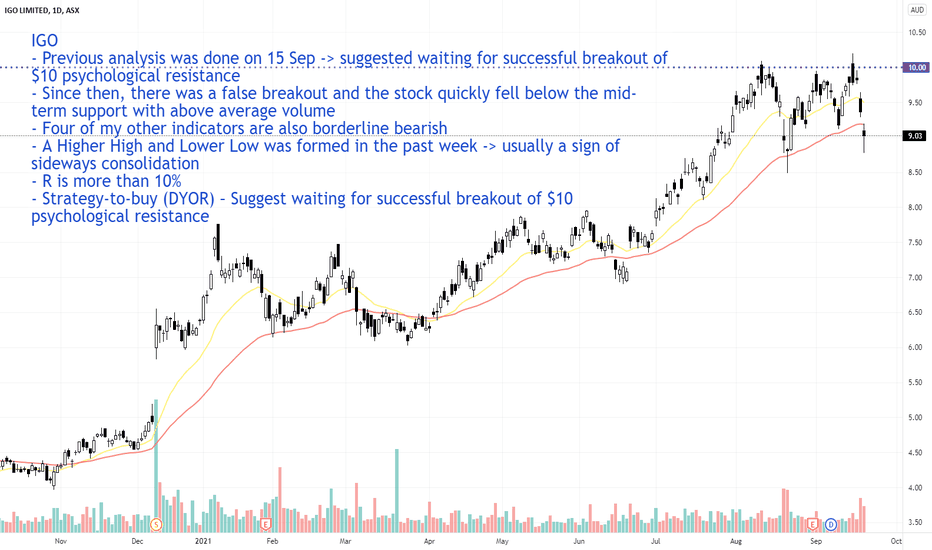

IGO @ 20 SEP 2021Text me if you have any questions/comments for me.

-----

IGO

- Previous analysis was done on 15 Sep -> suggested waiting for successful breakout of $10 psychological resistance

- Since then, there was a false breakout and the stock quickly fell below the mid-term support with above average volume

- Four of my other indicators are also borderline bearish

- A Higher High and Lower Low was formed in the past week -> usually a sign of sideways consolidation

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for successful breakout of $10 psychological resistance

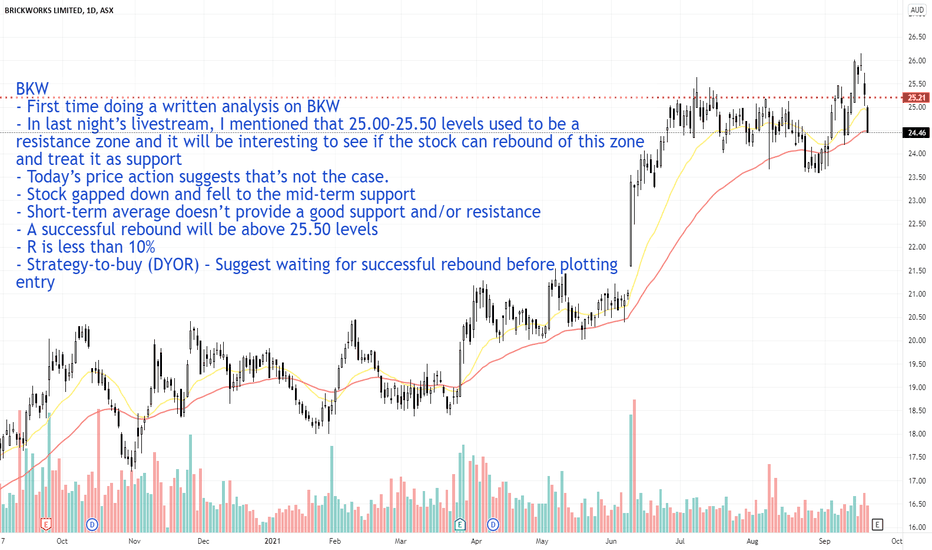

BKW @ 20 SEP 2021Text me if you have any questions/comments for me.

-----

BKW

- First time doing a written analysis on BKW

- In last night’s livestream, I mentioned that 25.00-25.50 levels used to be a resistance zone and it will be interesting to see if the stock can rebound of this zone and treat it as support

- Today’s price action suggests that’s not the case.

- Stock gapped down and fell to the mid-term support

- Short-term average doesn’t provide a good support and/or resistance

- A successful rebound will be above 25.50 levels

- R is less than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for successful rebound before plotting entry

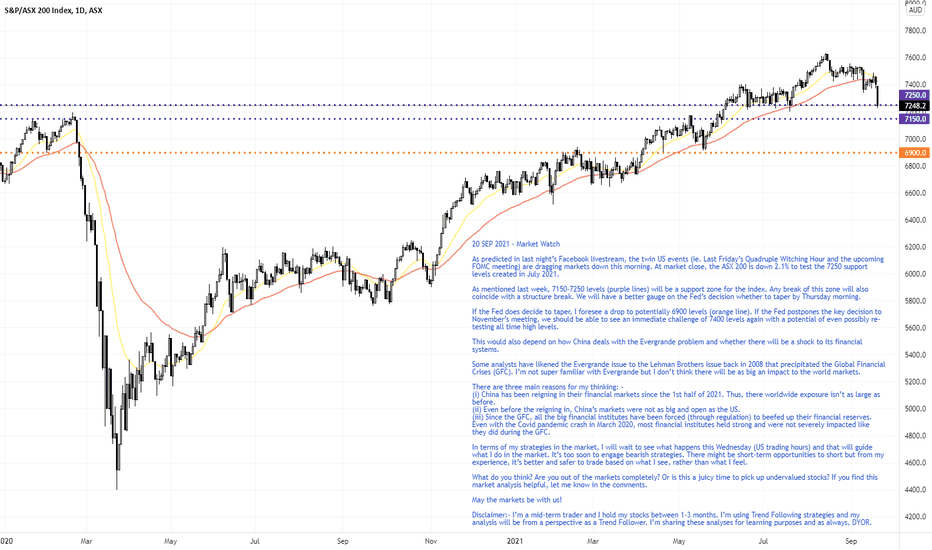

ASX 200 @ 20 SEP 202120 SEP 2021 – Market Watch

As predicted in last night’s livestream, the twin US events (ie. Last Friday’s Quadruple Witching Hour and the upcoming FOMC meeting) are dragging markets down this morning. At market close, the ASX 200 is down 2.1% to test the 7250 support levels created in July 2021.

As mentioned last week, 7150-7250 levels (purple lines) will be a support zone for the index. Any break of this zone will also coincide with a structure break. We will have a better gauge on the Fed’s decision whether to taper by Thursday morning.

If the Fed does decide to taper, I foresee a drop to potentially 6900 levels (orange line). If the Fed postpones the key decision to November’s meeting, we should be able to see an immediate challenge of 7400 levels again with a potential of even possibly re-testing all time high levels.

This would also depend on how China deals with the Evergrande problem and whether there will be a shock to its financial systems.

Some analysts have likened the Evergrande issue to the Lehman Brothers issue back in 2008 that precipitated the Global Financial Crises (GFC). I’m not super familiar with Evergrande but I don’t think there will be as big an impact to the world markets.

There are three main reasons for my thinking: -

(i) China has been reigning in their financial markets since the 1st half of 2021. Thus, there worldwide exposure isn’t as large as before.

(ii) Even before the reigning in, China’s markets were not as big and open as the US.

(iii) Since the GFC, all the big financial institutes have been forced (through regulation) to beefed up their financial reserves. Even with the Covid pandemic crash in March 2020, most financial institutes held strong and were not severely impacted like they did during the GFC.

In terms of my strategies in the market, I will wait to see what happens this Wednesday (US trading hours) and that will guide what I do in the market. It’s too soon to engage bearish strategies. There might be short-term opportunities to short but from my experience, it’s better and safer to trade based on what I see, rather than what I feel.

What do you think? Are you out of the markets completely? Or is this a juicy time to pick up undervalued stocks? If you find this market analysis helpful, let me know in the comments.

May the markets be with us!

Disclaimer:- I’m a mid-term trader and I hold my stocks between 1-3 months. I’m using Trend Following strategies and my analysis will be from a perspective as a Trend Follower. I’m sharing these analyses for learning purposes and as always, DYOR.

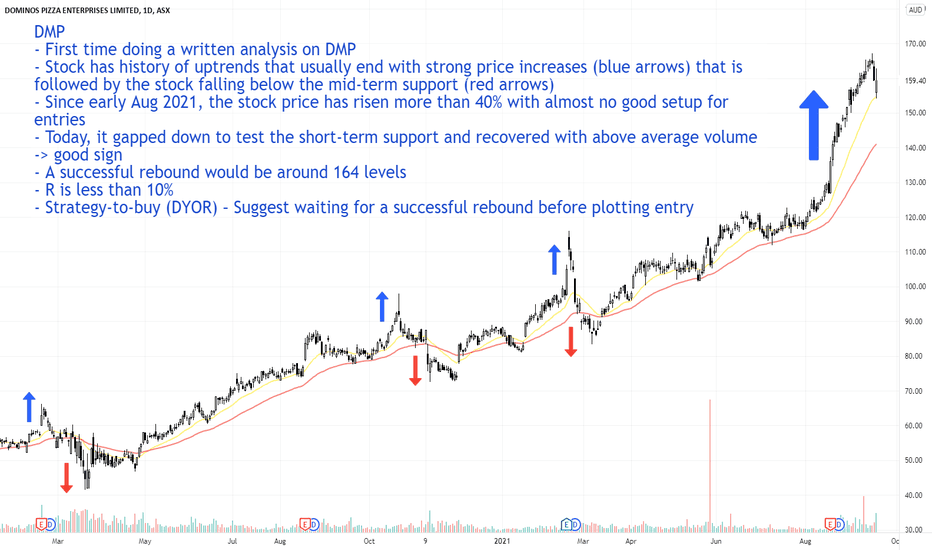

DMP @ 17 SEP 2021Text me if you have any questions/comments for me.

-----

DMP

- First time doing a written analysis on DMP

- Stock has history of uptrends that usually end with strong price increases (blue arrows) that is followed by the stock falling below the mid-term support (red arrows)

- Since early Aug 2021, the stock price has risen more than 40% with almost no good setup for entries

- Today, it gapped down to test the short-term support and recovered with above average volume -> good sign

- A successful rebound would be around 164 levels

- R is less than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for a successful rebound before plotting entry

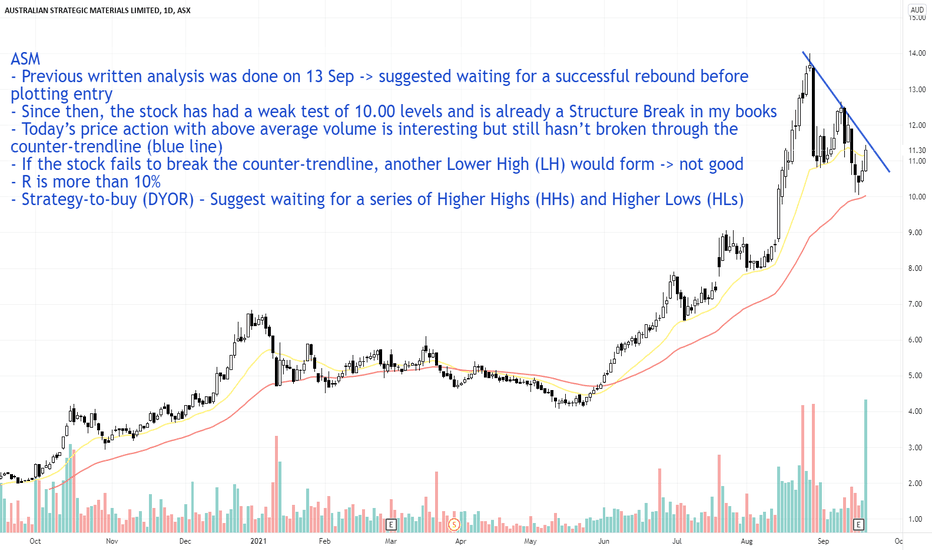

ASM @ 17 SEP 2021Text me if you have any questions/comments for me.

-----

ASM

- Previous written analysis was done on 13 Sep -> suggested waiting for a successful rebound before plotting entry

- Since then, the stock has had a weak test of 10.00 levels and is already a Structure Break in my books

- Today’s price action with above average volume is interesting but still hasn’t broken through the counter-trendline (blue line)

- If the stock fails to break the counter-trendline, another Lower High (LH) would form -> not good

- R is more than 10%

- Strategy-to-buy (DYOR) – Suggest waiting for a series of Higher Highs (HHs) and Higher Lows (HLs)

ILU @ 17 SEP 2021Text me if you have any questions/comments for me.

-----

ILU

- Previous analysis was done on 14 Sep - Suggested half entry at 10.40 levels (to manage risk) or wait for a retracement and successful rebound

- Since then, the stock has dropped more than 9% to rest at the mid-term support

- As mentioned previously, the stock has a history of strong retracements back to the mid-term support -> Today’s price action should not be a surprise

- Technically not a structure break yet -> A close around 9.00 levels would be a structure break for me

- A successful rebound would be a price recovery above 10.20 levels accompanied with good volume

- R is borderline 10%

- Strategy-to-buy (DYOR) – Suggest waiting for a successful rebound

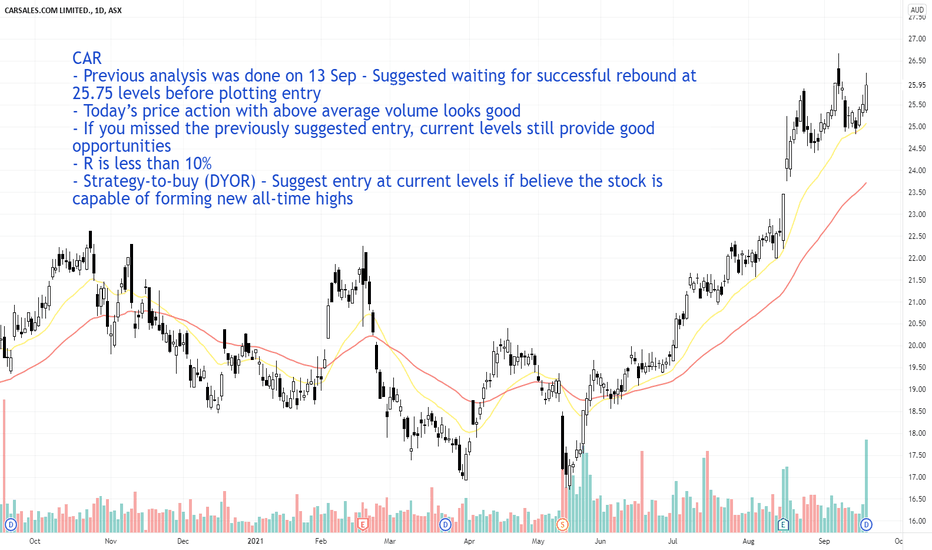

CAR @ 17 SEP 2021Text me if you have any questions/comments for me.

-----

CAR

- Previous analysis was done on 13 Sep - Suggested waiting for successful rebound at 25.75 levels before plotting entry

- Today’s price action with above average volume looks good

- If you missed the previously suggested entry, current levels still provide good opportunities

- R is less than 10%

- Strategy-to-buy (DYOR) – Suggest entry at current levels if believe the stock is capable of forming new all-time highs

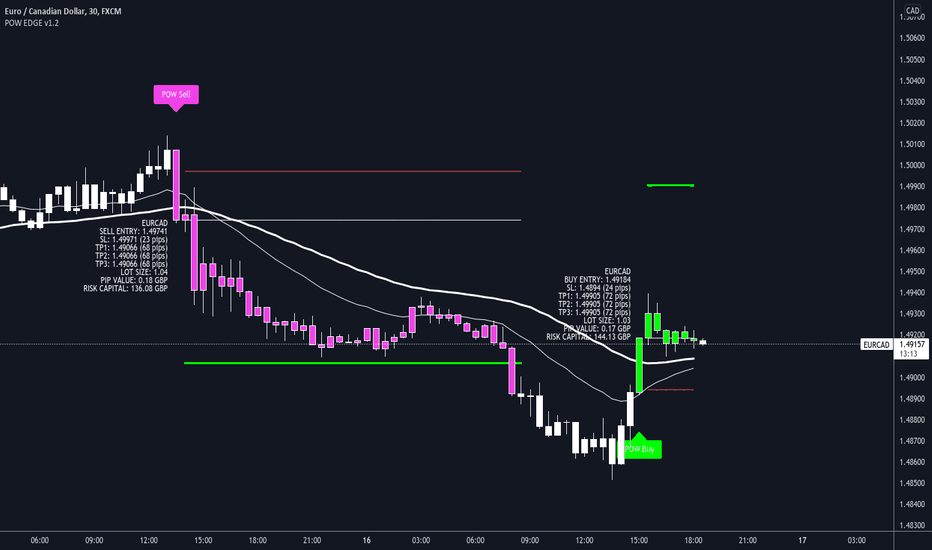

I'm in a EURCAD buy 📈💪We are using our trend following EDGE strategy for this trade.

Entry details are shown on the chart.

Working the M30 time frame on this strategy.

We're only looking for TP3.

Previous short trade can be seen on chart.

Also trade history can be seen below this trade idea too for full transparency.

In the back test report chart every trade is logged and can be viewed by clicking the tabs in the box.

You as the viewer of this idea can also do that so go ahead and have a play.

I'll follow this trade now until TP is achieved, a new signal presents or stop loss is hit.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren.