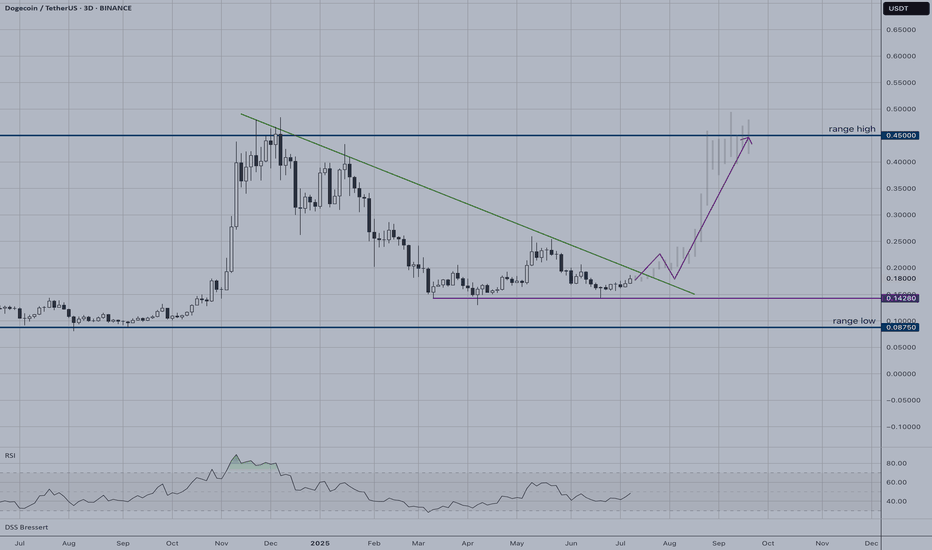

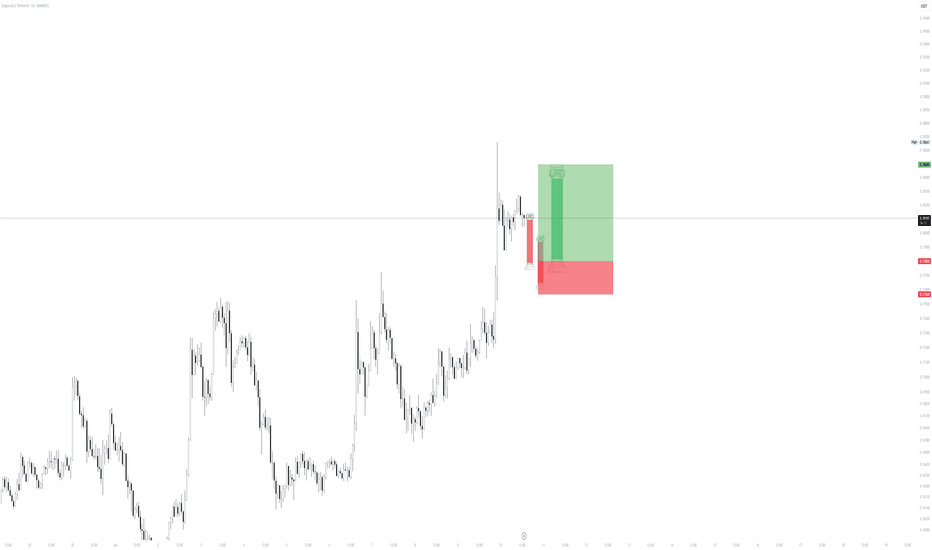

DOGE | Preparing for Breakout Dogecoin appears to be setting up for a potential breakout from a long consolidation phase.

Key Technical Signals:

- Price has been consolidating near the range low around $0.14260 for months

- Recent price action shows higher lows formation

- RSI is showing signs of life after extended oversold conditions

Potential Long Setup:

- Entry: Current levels around $0.18025 or on any dip to support

- Target: Range high at $0.45000 (150%+ potential gain)

- Stop Loss: Below $0.14260 support level

Risk Factors:

- Crypto markets remain volatile

- Bitcoin correlation could impact movement

The technical setup suggests accumulation at these levels, with the potential for a significant move if the diagonal resistance is broken. However, failure to hold current support could lead to further downside.

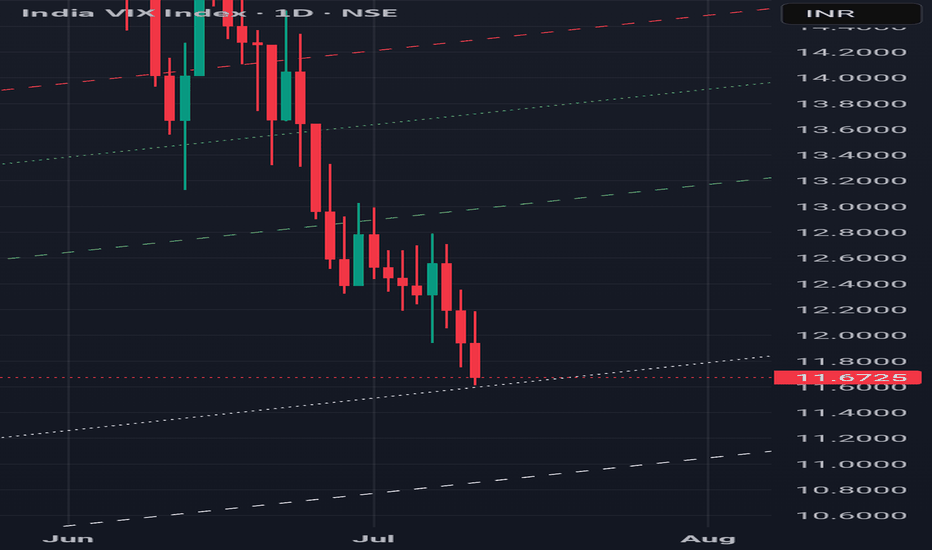

Trend Lines

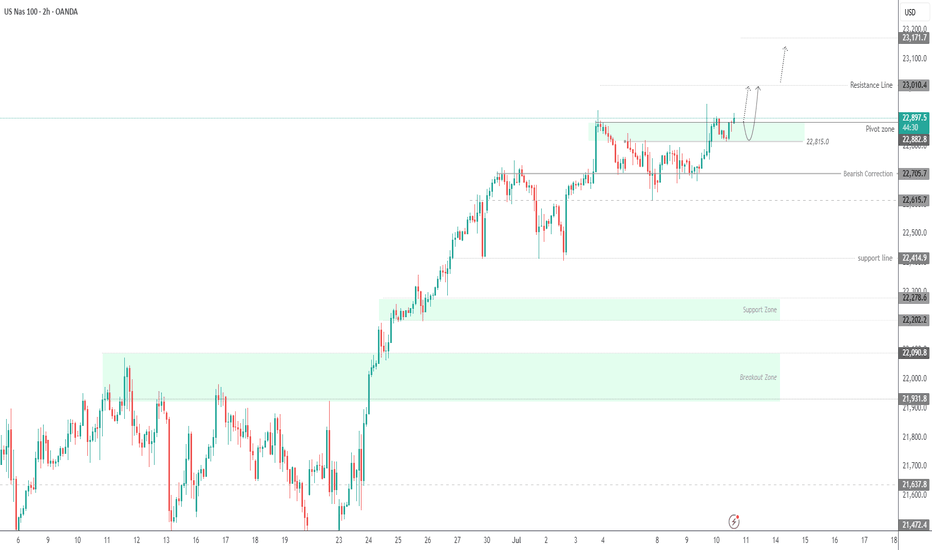

USNAS100 Bullish Ahead of NVIDIA Milestone – 23010 in SightUSNAS100 – Outlook

The index continues its bullish momentum, supported by strong tech performance — notably NVIDIA surpassing a $4 trillion market cap.

As long as the price holds above 22880, the trend remains bullish toward:

23010 Then extended targets near 23170

However, a 1H close below 22815 would signal weakness, potentially opening the way for a retracement toward: 22705 And 22615, especially if tariff tensions escalate.

Resistance: 23010, 23170

Support: 22815, 22705, 22615

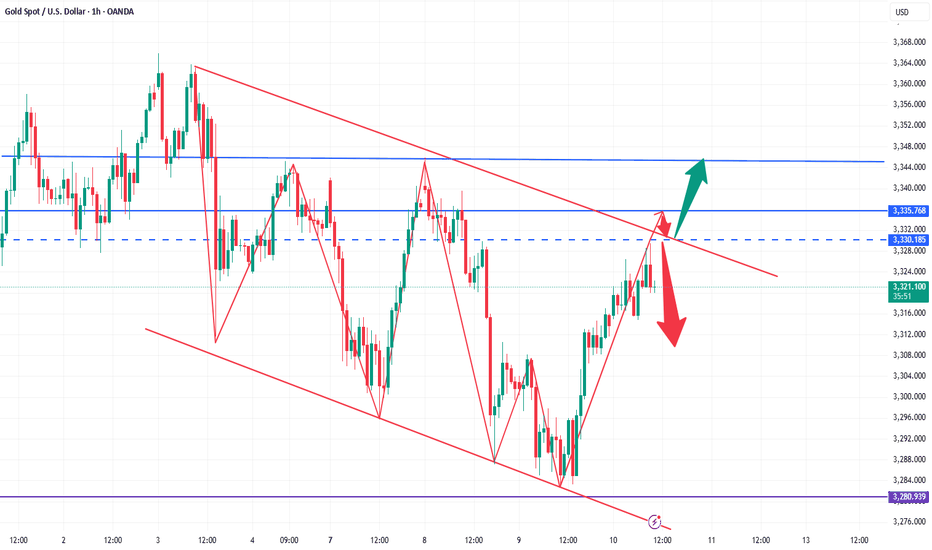

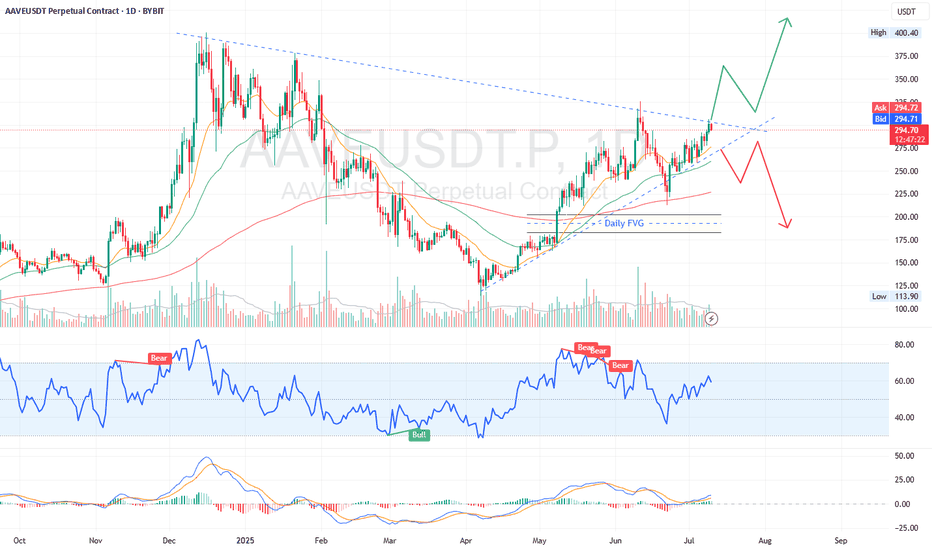

Gold shows signs of slowing down, are the bears ready?This wave of bullish pull-up is a complete rebound. With the help of the timeliness of fundamentals, the highest rebound only reached around 3330 and then began to fall. At this time, many people probably think that the short-term trend has begun to change. I still stick to my bearish thinking. The important target pressure is definitely around 3330. As long as this position is under pressure and falls back to 3280 again, it will be shaky. At present, the stop loss is based on the break of 3335. If it really breaks, it will be similar to the break of 3280. Even if 3340-3345 is short, it is also a short-term bull correction. If the falling channel is broken, I can't convince myself to continue to be short and stick to it. Once 3335 breaks, I can really confirm the reversal of the short-term trend. Then 3280 will also be the bottom of the medium term. In short, since I am shorting near 3320-3330 in the direction of the band and the short-term negative, I think that the stop loss will be given to 3335. The stop profit target is uncertain. The channel has not been broken. Now the short-term long and short conversions are frequent. It is definitely the best choice in my own trading system. No one will win all the time. It is too fake to win all the time. Make your moves according to your own ideas without regrets. If this wave of strategy verification fails, everyone is welcome to supervise. We dare to take responsibility and review every judgment.

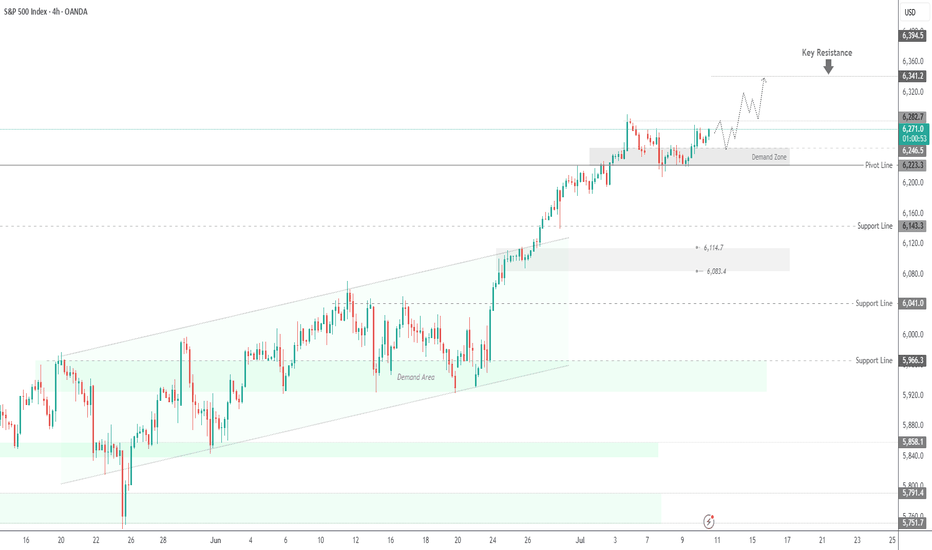

SPX500 Eyes New ATH – Key Levels in PlaySPX500 – Overview

The index remains under bullish pressure, with potential to record a new all-time high (ATH).

As long as the price holds above 6246, the bullish trend is likely to continue toward 6282.

A confirmed 1H close above 6287 could trigger further upside toward 6310 and 6341.

However, a break below 6223 would signal bearish momentum, opening the path toward 6195 and 6143.

Pivot Line: 6282

Resistance: 6310, 6341

Support: 6246, 6223, 6195

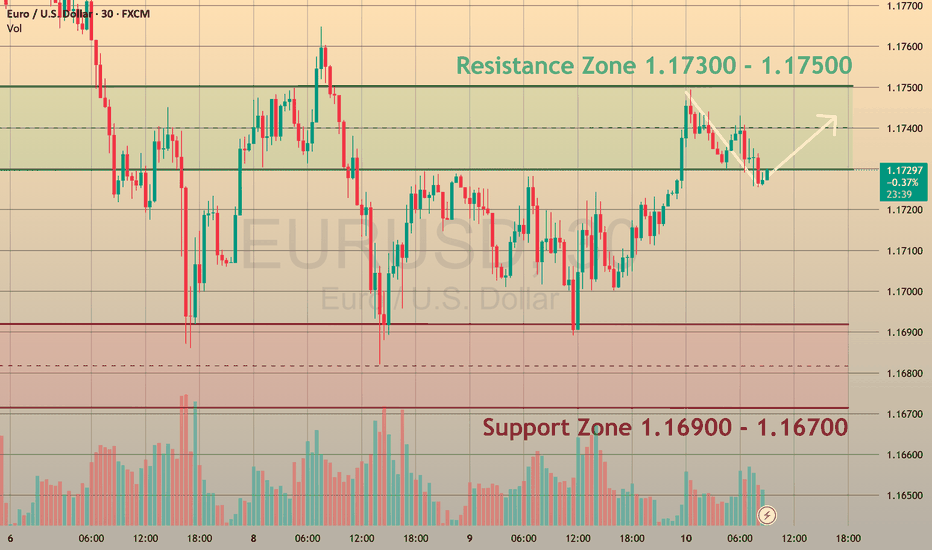

EURUSDSentiment: Bullish Bias

Institutions are holding a strong net long position on the Euro, with +107,537 contracts. This reflects continued bullish sentiment toward EUR, suggesting strength against the USD. With DXY showing net shorts and EUR net longs, EUR/USD may favor upside moves, especially from key daily demand zones. Swing traders should watch for bullish confirmations and structure shifts on 4H.

DOGE/USDT – Breakout Retest Long SetupDOGE has broken out of local consolidation with momentum and is now retesting the breakout zone, offering a clean long entry with defined invalidation.

Setup Thesis:

After a strong impulse move, price pulled back with low aggression, signaling profit-taking rather than reversal. The current candle structure suggests demand is stepping in at prior resistance-turned-support. This is a textbook breakout-retest continuation setup.

Trade Plan:

Entry: ~$0.1810

Stop Loss: Below ~$0.1764 (beneath breakout zone and structure)

Target: ~$0.1940

R/R: Favorable risk profile with strong reward potential

Confirmation Factors:

Impulsive breakout

Controlled pullback with no aggressive selling

Retest occurring at structural pivot

Still aligned with broader uptrend context

Execution Note:

This setup works best with strong follow-through in the next couple of candles. If price stalls or closes below the stop zone, it's invalidated.

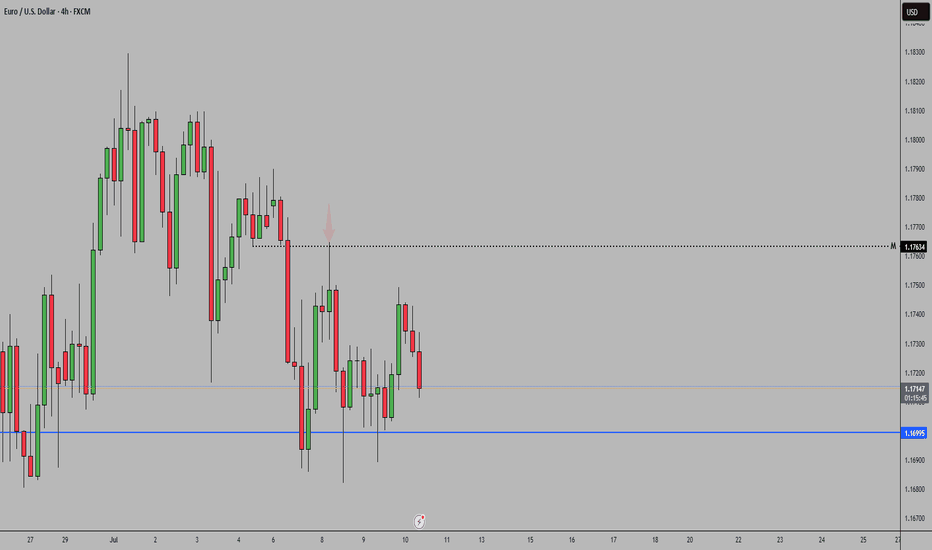

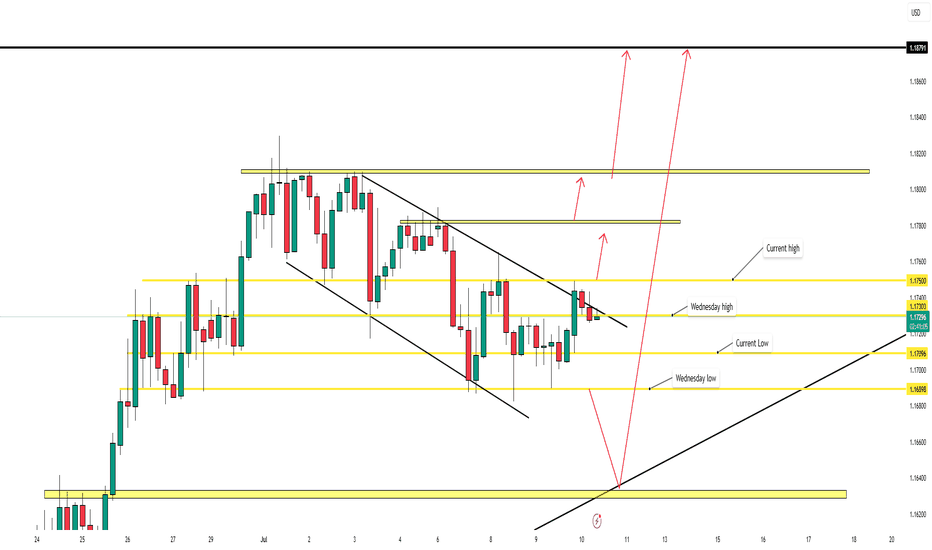

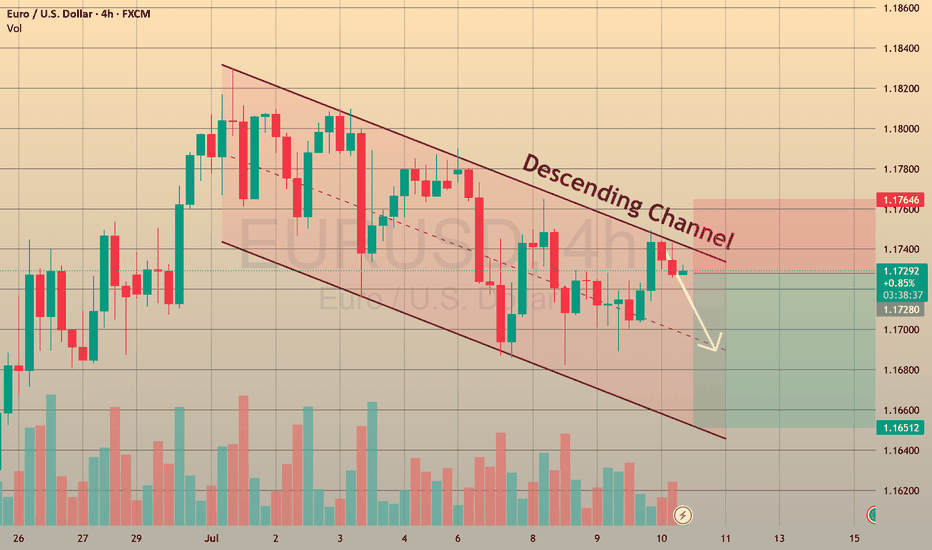

Thursday July 10th – EURUSDEURUSD didn’t give us any trade setups yesterday and is still respecting the short-term bearish trendline. Price has remained below 1.17500, acting as resistance, and hasn’t given confirmation for buys.

We’re still watching the same key zones:

✅ Safe buys: Above 1.17500 if we get a solid break and bullish close.

✅ HRHR buys: Retest of 1.16898 (Wednesday's low) showing rejection or support.

Until either of those levels are tapped, I’m not taking trades on this pair. Current structure still offers no low-risk opportunities. Let it come to us.

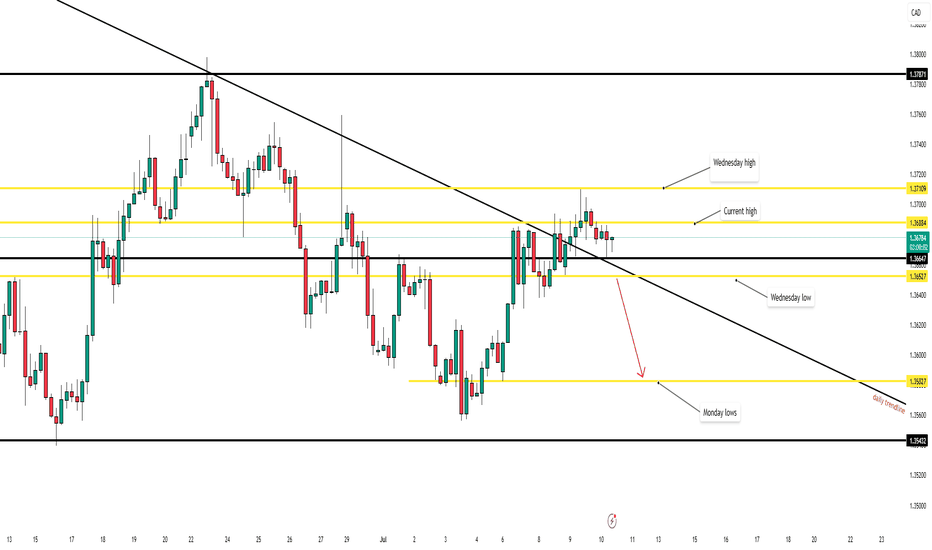

USDCAD – July 10 OutlookUSDCAD’s high-risk, high-reward (HRHR) sells from Wednesday are still in play with price currently up 35 pips. Price action remains within the structure as we continue to respect the March trendline, but are now stalling in a tight 4H range.

📍 Key Observations:

1.36647 is acting as strong intraday support

Possible retest of yesterday’s or Wednesday’s high could provide another HRHR sell opportunity

Break below 1.36527 could open the door for a clean 70-pip move toward 1.35827

🔔 Summary: Patience is essential—watching for either another short-term rejection at resistance or a clean structural break to continue the broader bearish bias.

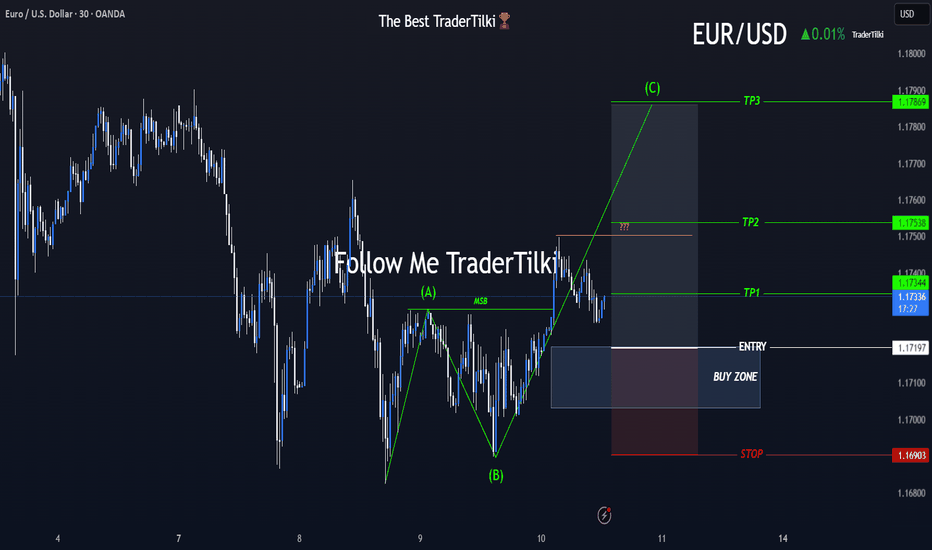

A New Chapter Begins with EURUSD’s ABC Wave Formation!🎯 Hey Guys,

I’ve prepared a fresh EURUSD analysis for you.

The market has shifted direction, and an ABC wave structure has emerged.

I’ve placed a Buy Limit order based on my entry level.

Below, you’ll find my detailed target zones and entry specifics:

🟩 Buy Limit Order: 1.17197

🟥 Stop Loss: 1.16903

📌 Targets:

🔹 TP1: 1.17344

🔹 TP2: 1.17538

🔹 TP3: 1.17869

📊 Risk/Reward Ratio: 2.27

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

US Jobless Claims: Why They Matter for EURUSD 🇺🇸FOREXCOM:EURUSD

📈 US Jobless Claims: Why They Matter for EURUSD 🇺🇸💼

While Trump’s tariff policies ⚔️ remain in focus, it’s important not to overlook today’s economic calendar 🗓️, with Initial Jobless Claims taking the spotlight.

🧐 What are Jobless Claims?

Initial Jobless Claims 📑 measure the number of people filing for state unemployment insurance for the first time. Released weekly by the US Department of Labor 🏛️, it’s a key indicator of the health of the US labor market 💪.

Why does it matter?

A strong labor market typically supports the US dollar 💵, as it reduces the likelihood of immediate Fed rate cuts 🕰️, while higher claims suggest a weakening economy, which could pressure the dollar lower.

📊 Latest Figures:

🔹 Previous: 233K

🔹 Forecast: 235K

Last week, claims fell from 237K to 233K, highlighting continued labor market resilience. If today’s data beats expectations (lower claims), the USD may strengthen 🛡️, potentially pushing EURUSD below 1.1700. Conversely, higher claims could weaken the USD ⚠️, lifting EURUSD above 1.1800.

💡 Trade Idea:

BUY EURUSD at 1.17300

❌ Stop Loss: 1.17600

✅ Take Profit: 1.16500

While the US labor market remains strong, technical factors and broader fundamentals can confirm a strong EURUSD reversal, keeping bearish opportunities in play.

🚀 Stay tuned for live reactions after the data drops!

💬 Support this post if you find it useful! 🔔

EURUSD Eyes Key Levels Ahead of DataFOREXCOM:EURUSD

EURUSD is trading within the 1.1680 – 1.1810 range 📊, continuing its upward momentum during the Asian and early European sessions 🌏⬆️.

⚡️ Markets are now focusing on potential trade negotiations with India and the EU 🤝, which could shape near-term currency moves and risk sentiment 🌐.

📈 Today at 12:30 p.m. UTC 🕧, the U.S. Jobless Claims report 📑 may trigger volatility across all USD pairs ⚠️. Stronger-than-expected data could delay Fed rate cuts 🕰️🔻 and push EURUSD below 1.1700 🩻, while weaker figures may weigh on the U.S. dollar 💵⬇️ and lift EURUSD above 1.1800 🚀.

👀 We will monitor these levels closely for potential breakout opportunities. Stay tuned for live updates!