Trendpattern

ADAUSDT ShortTime Frame: 4H

Symbol: ADAUSDT

Entry: 0.3480

TP: 0.3386

SL: 0.3556

Bias: Short

The cost has begun moving from its zone and building up important speed to lay out its own heading. The wavering between two limits is very critical as we see the ongoing cost is going down setting out a freedom for a potential short trade.

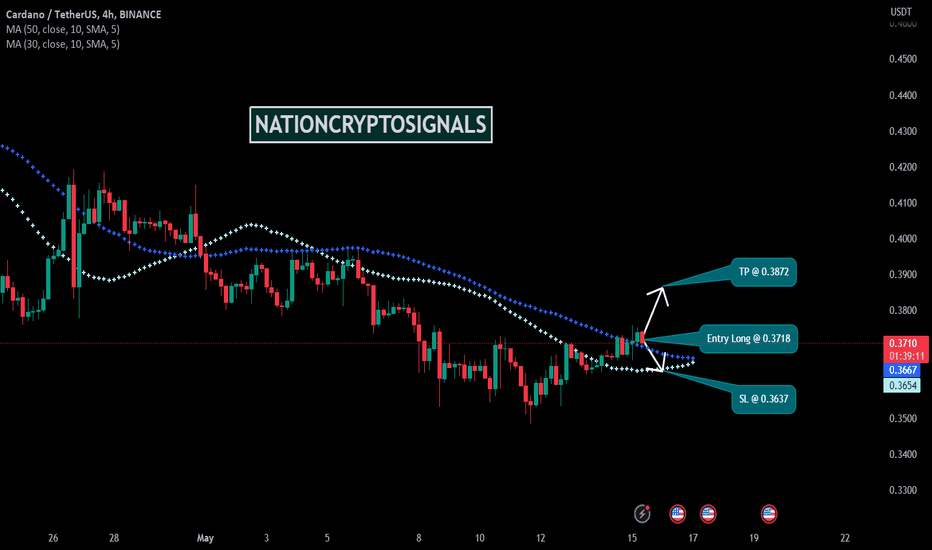

ADAUSDT LongTime Frame: 4H

Symbol: ADAUSDT

Entry: 0.3766

TP: 0.3885

SL: 0.3668

Bias: Long

We are searching for a long opportunity in this pair. The pair is going for quite a while. The expectation of solid cost motions or directional development got reduced most recent couple of weeks. Yet we are confident about a superior time and we are searching for a long open door that might be a consequence of crossing the momentum transient obstruction.

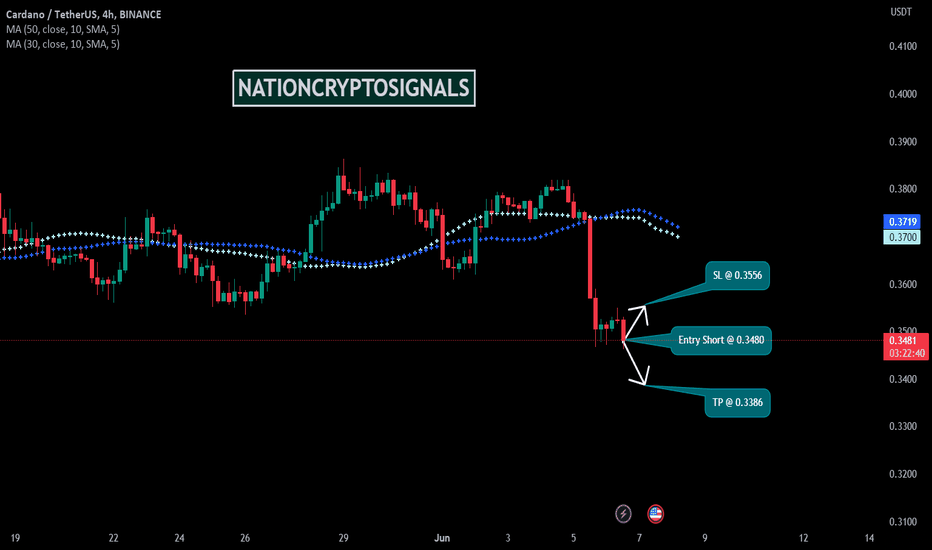

ADAUSDT ShortTime Frame: 4H

Symbol: ADAUSDT

Entry: 0.3745

TP: 0.3652

SL: 0.3819

Bias: Short

As we see the pair is moving lower for quite a while . It is a sort of descending development or cost drop binge. The inclination of the pattern to drop will keep setting out some lovely shorting opportunities.

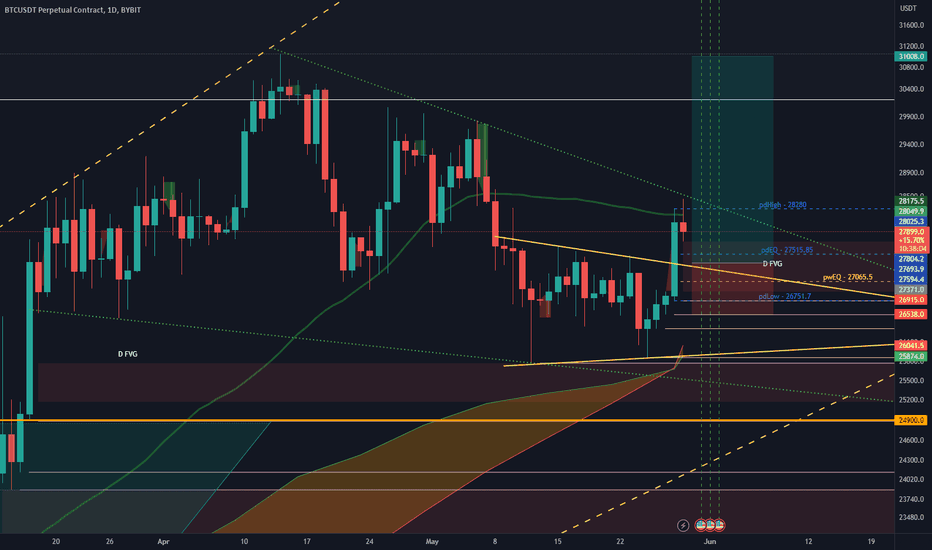

bitcoin long setup Hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied. Please also refer to the Important Risk Notice linked below.

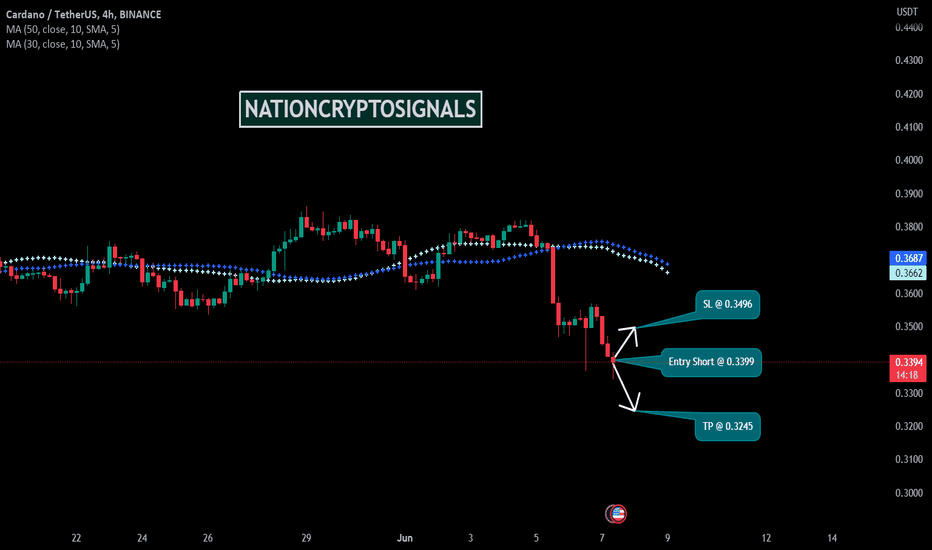

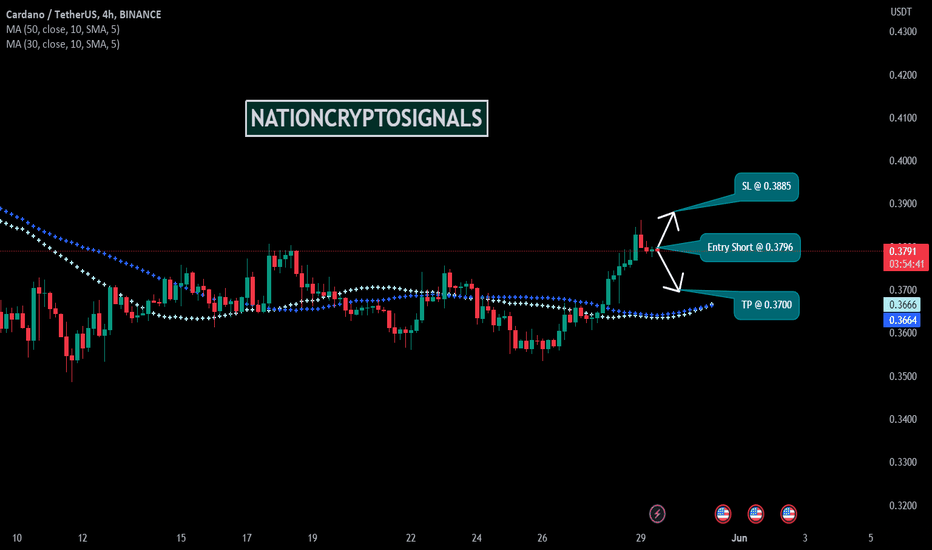

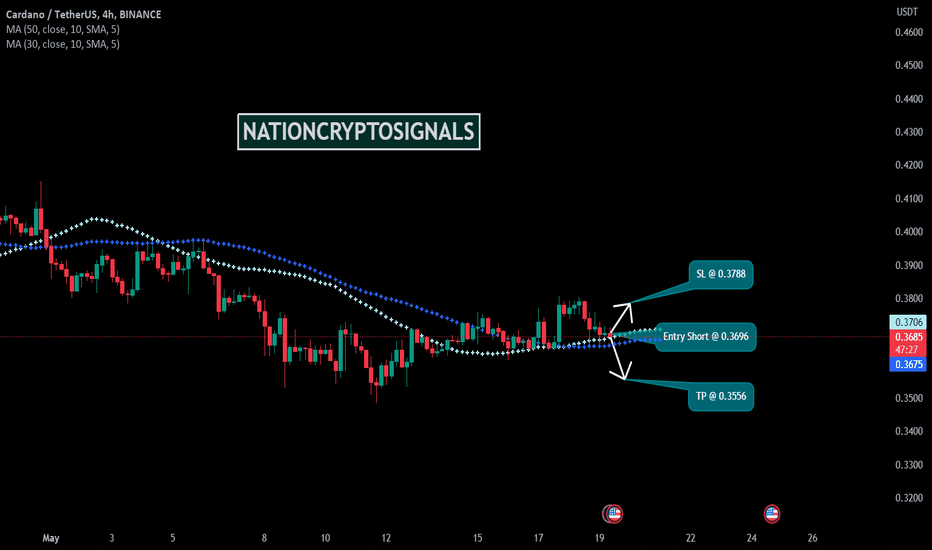

ADAUSDT ShortTime Frame: 4H

Symbol: ADAUSDT

Entry: 0.3796

TP: 0.3700

SL: 0.3885

Bias: Short

The ongoing value example of this pair shows a decent sell position. Assuming we take a gander at the long and brief time frame backing and protections of this pair it becomes obvious that the pair will give a decent short entry .

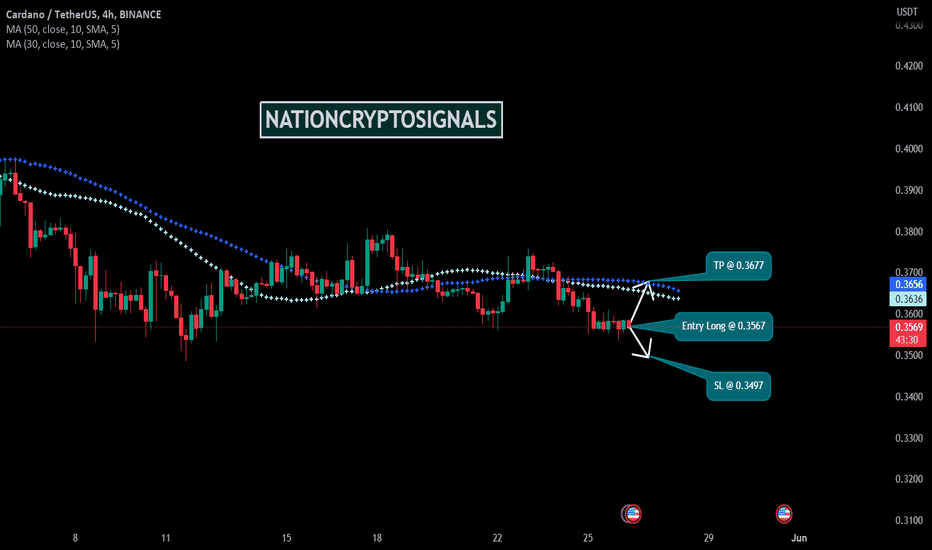

ADAUSDT LongTime Frame: 4H

Symbol: ADAUSDT

Entry: 0.3567

TP: 0.3677

SL: 0.3497

Bias: Long

Current value activity of this instrument is exhibiting a bullish predisposition. As we see the cost is blocked in a spot and sitting tight for a delivery with an eruption. The most ideal decision as of now is to go for a long exchange. However insurance should be taken to oversee exchanges appropriately with legitimate gamble reward proportion.

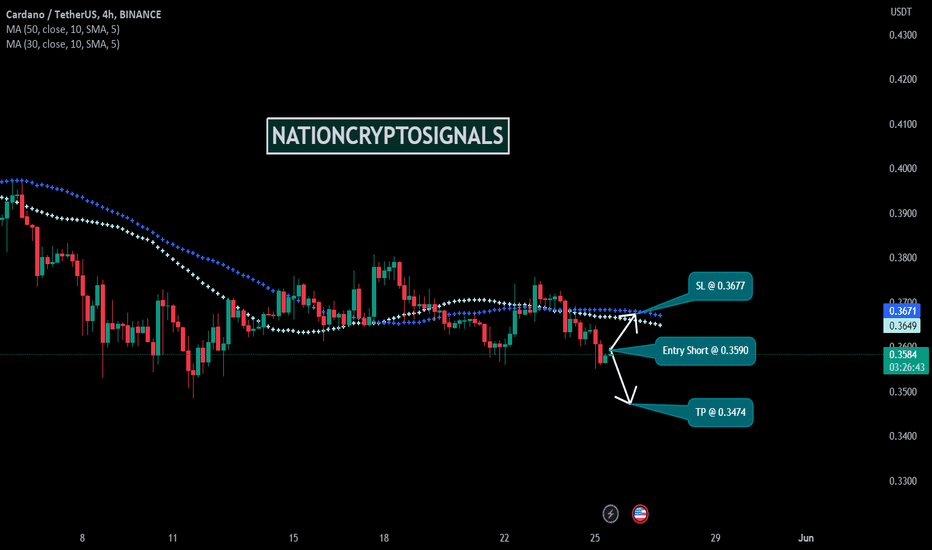

ADAUSDT ShortTime Frame: 4H

Symbol: ADAUSDT

Entry: 0.3590

TP: 0.3474

SL: 0.3677

Bias: Short

The pattern of cost development for this pair is plainly showing a short inclination. The general course is short and the ongoing cost design is likewise uncovering a short exchange set up. Allow us to expect a sell exchange from the ongoing time and cost projection.

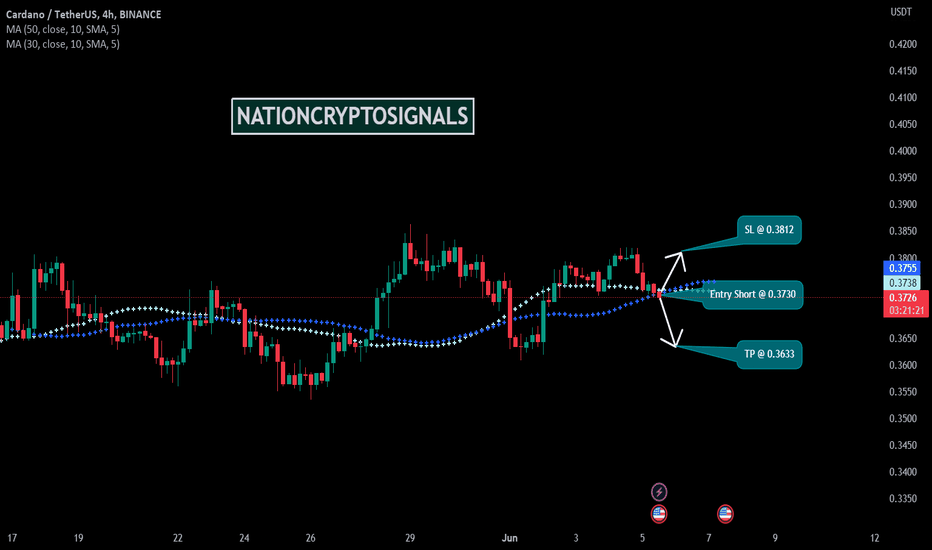

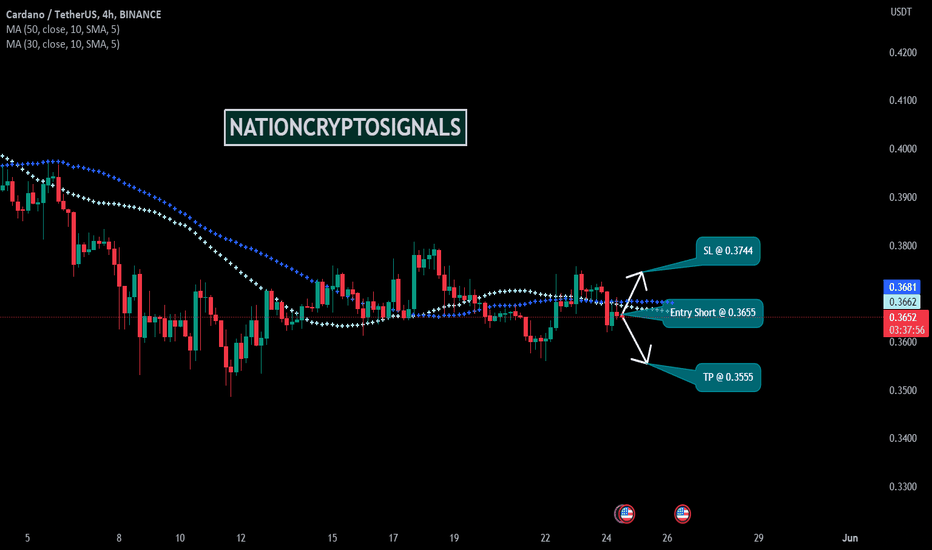

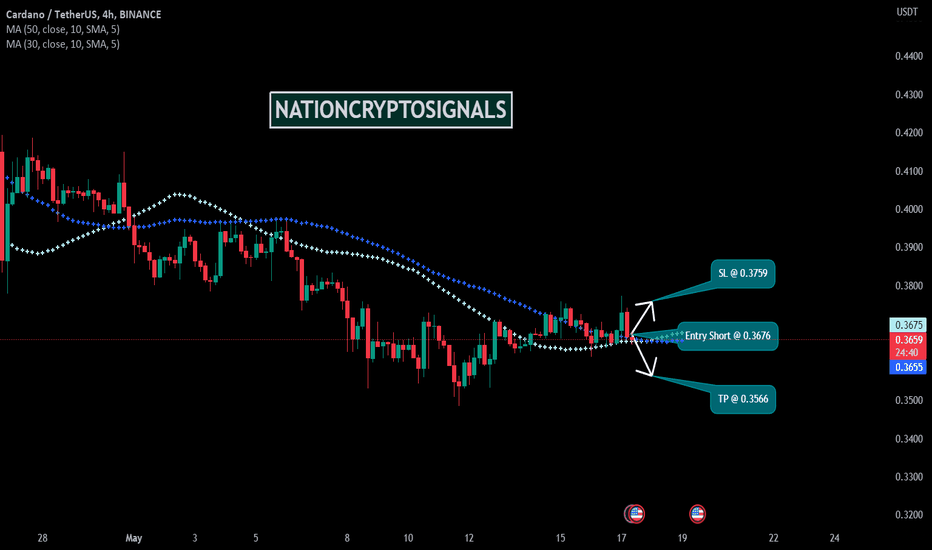

ADAUSDT ShortTime Frame: 4H

Symbol: ADAUSDT

Entry: 0.3655

TP: 0.3555

SL: 0.3744

Bias: Short

For ADAUSDT we will in any case go short and trust a little move descending. On account of the occasional impact we expect no sharp move except for the motions will essentially be inside help and protections.

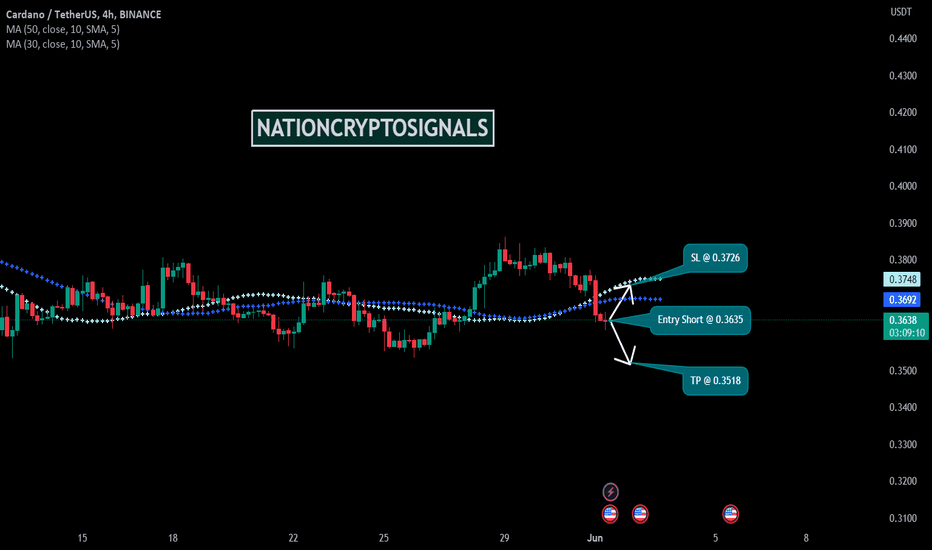

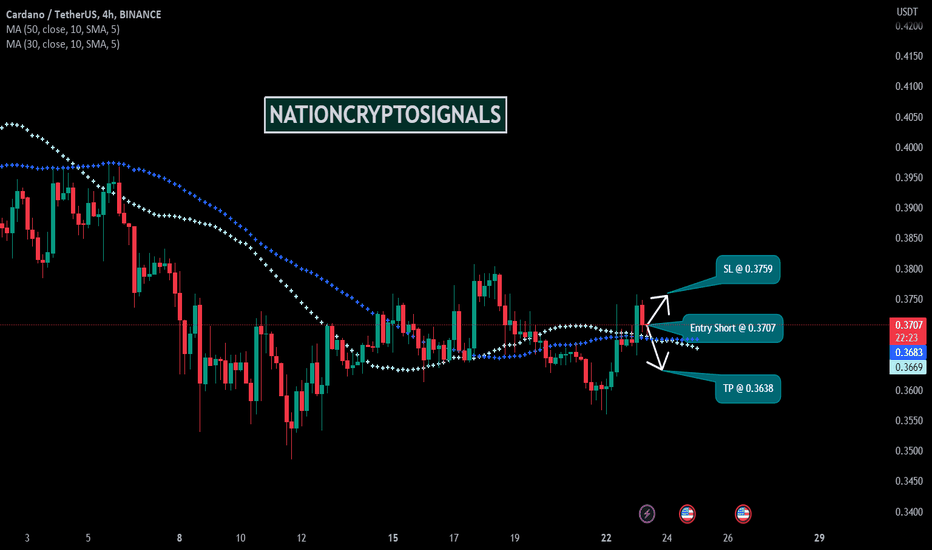

ADAUSDT ShortTime Frame: 4H

Symbol: ADAUSDT

Entry: 0.3707

TP: 0.3638

SL: 0.3759

Bias: Short

At present the market design of the significant matches don't show major areas of strength for an inclination. We can anticipate a few momentary maneuvers to a great extent . Taking into account the changes and the energy driven open doors accessible on the lookout, our attention is on the edge in light of organic market.

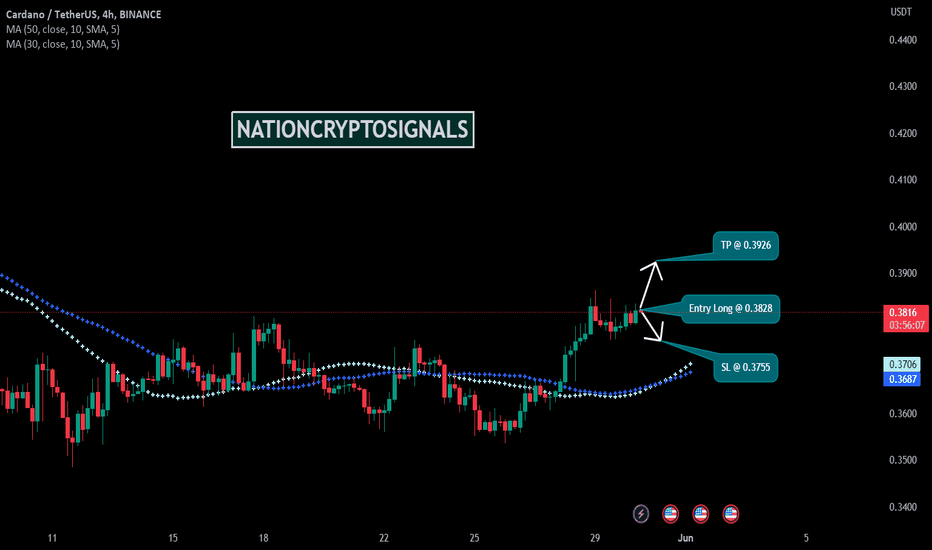

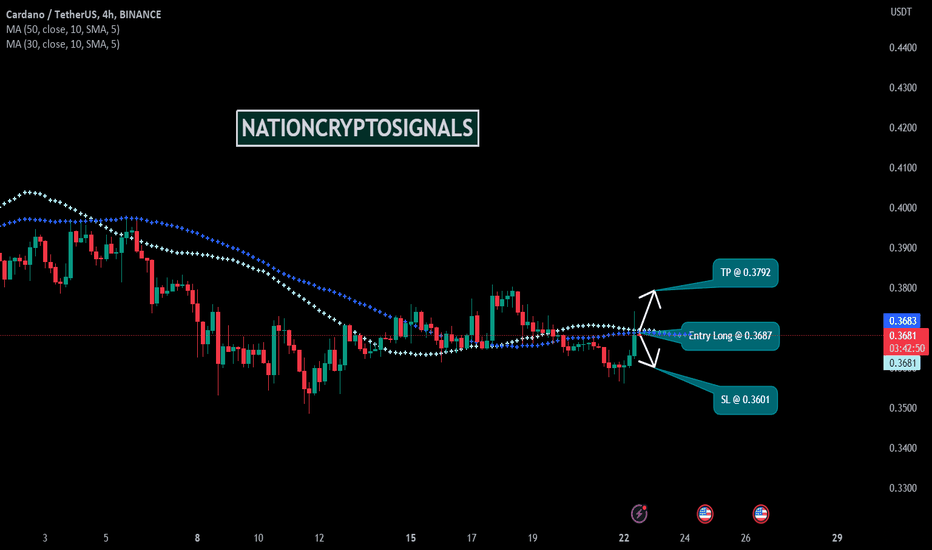

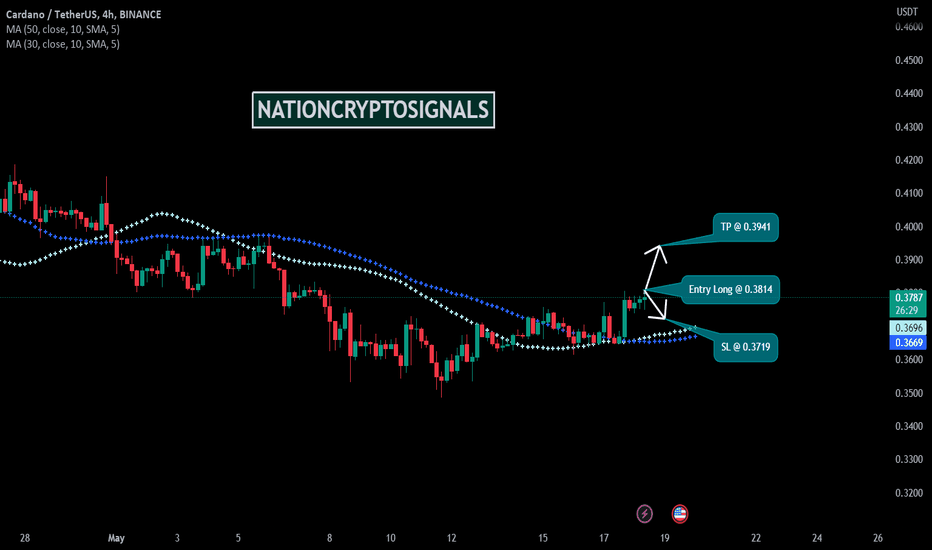

ADAUSDT LongTime Frame: 4H

Symbol: ADAUSDT

Entry: 0.3814

TP: 0.3941

SL: 0.3719

Bias: Long

The value projection of this pair for momentary shows a positive long predisposition. However most of markers like moving midpoints and oscillators are showing short signals , the qualities of the signs are extremely powerless. We can anticipate a long exchange from the ongoing setting.

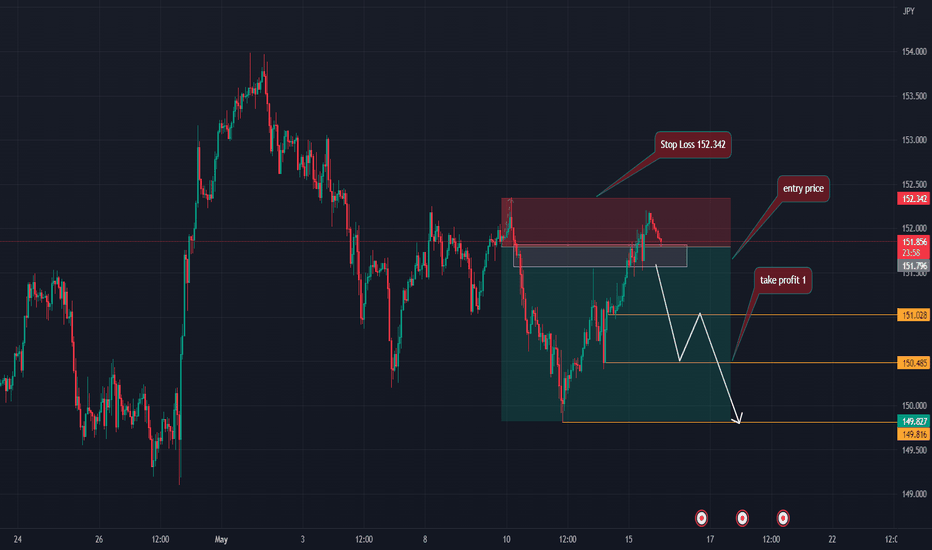

HIL moving/consolidating in a channelNSE:HIL is moving sideways from last week. It takes support at the same price taken last time and resist at the same price taken at last time in 15 minutes timeframe.It is moving in a channel. The 50 and 200 moving average is aslo sideways. Wait for a good breakout with volume. It is good for taking trade for intrady trade. If it gives breakout we are going to get enter in the trade as per the situation.

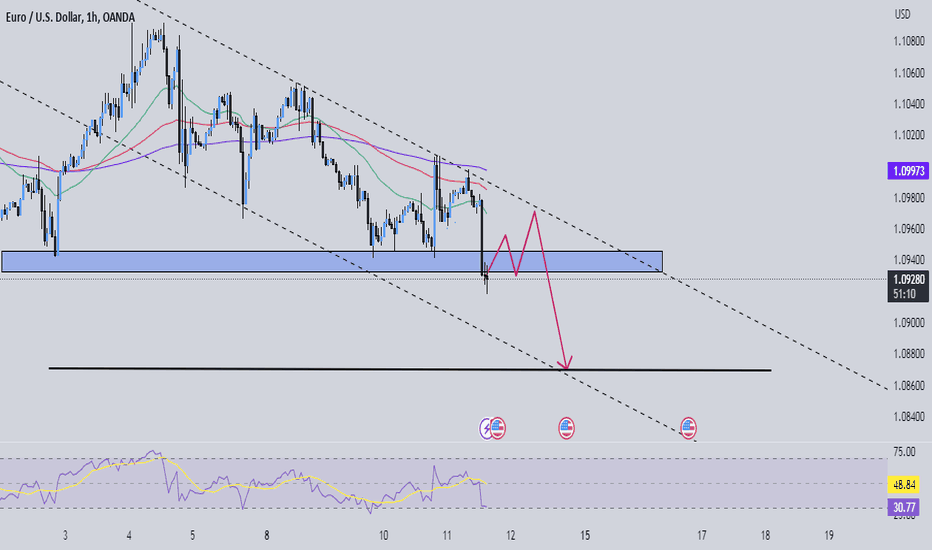

EUR/USD: 11/05. BREAK THE TREND TO BUY DOWN BEFORE PPI NEWSEUR/USD seems to be seeing more clear signs of rejection of the resistance that formed the top of the shallow uptrend channel from early January, with strong daily and weekly downside momentum.

The support below at 1.0945 has established a near-term top and we look for a test of the 55-DMA at 1.0835, ideally holding on a close. Even so, below will warn of a more significant potential downturn and test support at 1.0545/1.0488.

However, above 1.1098 would suggest we could see a final leg above our 1.1187/1.1273 core target – 61.9% retracement and March high. 2022. Our bias remains to look for an important top here.