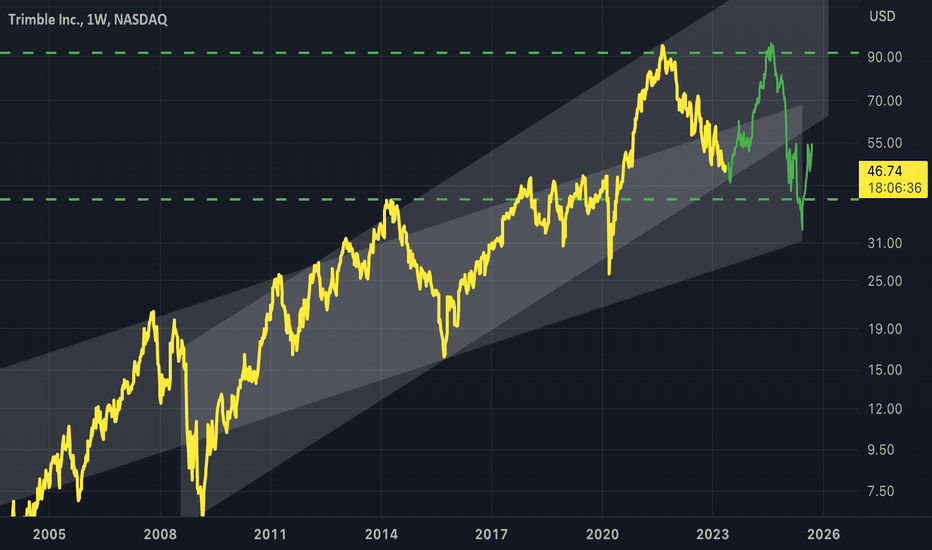

🔁 Are Trimble Stocks Ready For Rebound To Pre-Inflation Highs Trimble is a company that specializes in software for navigation, guidance, and control of equipment for various industries, including construction and agriculture, trades at $54 per share, about 37% below the level seen two years ago in December 2021.

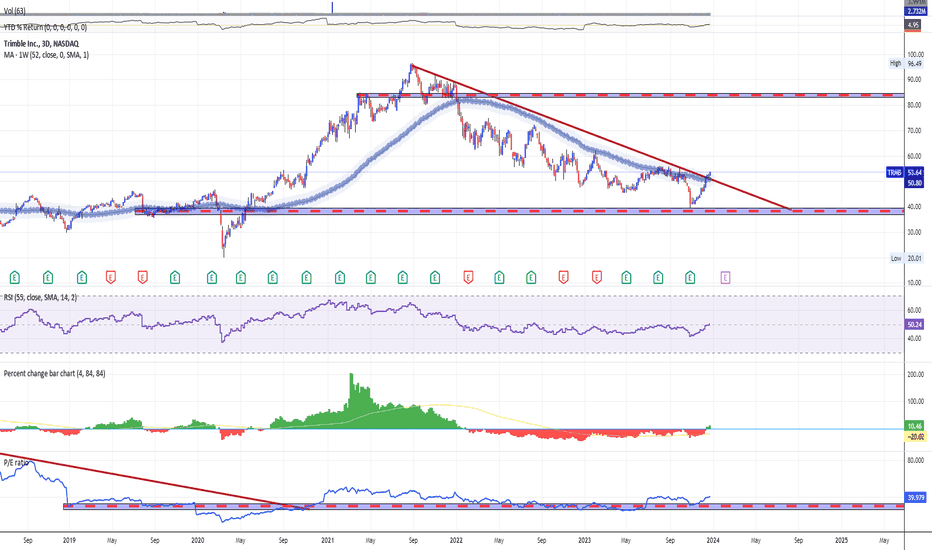

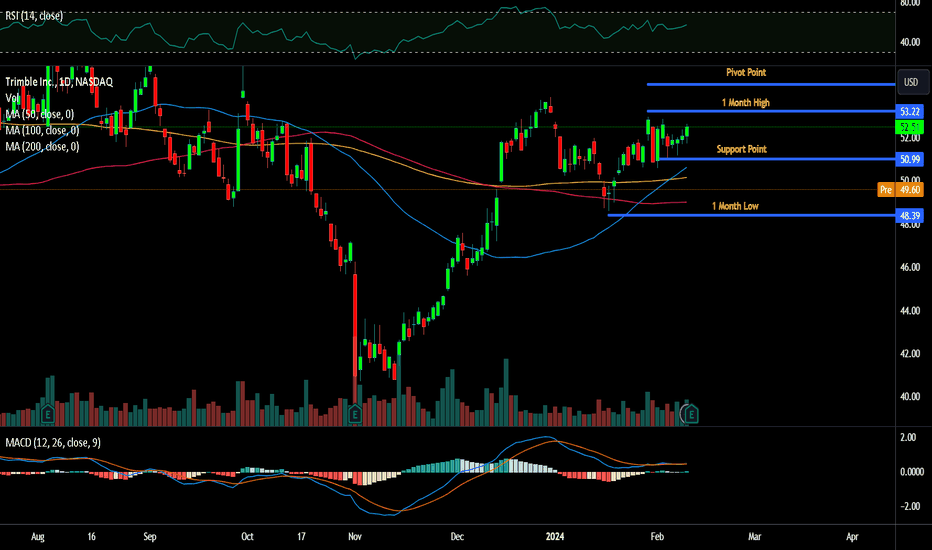

Looking at a slightly longer term, NASDAQ:TRMB stock has faced a notable decline of 25% from levels of $65 in early January 2021 to around $50 now, vs. an increase of about 25% for the S&P 500 over this roughly 3-year period. However, the decrease in NASDAQ:TRMB stock has been far from consistent. Returns for the stock were 31% in 2021, -42% in 2022, and about 5% in 2023.

In comparison, returns for the SP:SPX have been 27% in 2021, -19% in 2022, and 25% in 2023 - indicating that NASDAQ:TRMB underperformed the S&P in 2022 and 2023.

In fact, consistently beating the S&P 500 - equally in good times and in bad - has been quite difficult over recent years for individual stocks.

Given the current uncertain macroeconomic environment with high oil prices that still above its 5 years SMA, and elevated interest rates, lets take a look could NASDAQ:TRMB face a similar situation as it did in 2022 and 2023 and underperform the S&P over the next 12 months - or will it see a recovery?

Returning to almost pre-inflation shock high of around $80 means that NASDAQ:TRMB stock will have to gain about 50% from here, so potentially that will not materialize anytime in extremely fast mode.

Meanwhile the main technical graph says NASDAQ:TRMB stock getting a support around $40 level and breaks out its major 52-weeks SMA resistance first time over the past 5 years. Following this, it can takes the time while potentially NASDAQ:TRMB stock is ok to recover the next one pre-inflation $80-85 level.

Trimble

Trimble Inc. Surges Ahead with Record Revenue and Strategic MoveTrimble Inc. (NASDAQ: NASDAQ:TRMB ) has just released its fourth-quarter and full-year 2023 financial results, showcasing remarkable growth and strategic initiatives that position the company for continued success in 2024. With record annualized recurring revenue (ARR), impressive margins, and robust earnings, Trimble's ( NASDAQ:TRMB ) performance underscores its resilience and strategic foresight in navigating dynamic market conditions. Let's delve into the key highlights of Trimble's financial performance and its forward-looking guidance, offering insights into what lies ahead for this technology powerhouse.

Record Financial Performance:

In 2023, Trimble ( NASDAQ:TRMB ) achieved record-breaking financial milestones, signaling its strength and agility in a competitive landscape. Annualized recurring revenue soared to $1.98 billion, marking a substantial 24% year-over-year increase. This growth, bolstered by a 13% rise on an organic basis, underscores Trimble's ability to consistently deliver value to its clients and capitalize on market opportunities. Moreover, the company reported robust GAAP and non-GAAP gross margins, with GAAP operating income reaching $448.8 million and non-GAAP operating income hitting $934.7 million, equivalent to 11.8% and 24.6% of revenue, respectively.

Strategic Moves and Operational Excellence:

Beyond financial achievements, Trimble's strategic moves and operational excellence have played a pivotal role in driving its success. Throughout 2023, Trimble prioritized executing its strategic vision while returning capital to shareholders. The company's president and CEO, Rob Painter, highlighted this commitment, emphasizing Trimble's resolve to navigate macroeconomic uncertainties while advancing its long-term goals. Notably, Trimble's prudent capital allocation strategy included the repurchase of approximately 2.4 million shares for $100.0 million, reflecting confidence in its future prospects and commitment to enhancing shareholder value.

Forward-Looking Guidance and Growth Prospects:

Looking ahead to 2024, Trimble remains optimistic about its growth trajectory and market position. The company's forward-looking guidance sets ambitious targets, with projected revenue between $3,570 million and $3,670 million for the full year, accompanied by non-GAAP EPS expectations of $2.60 to $2.80. These projections, underpinned by a tax rate of 17.5% and approximately 243 million shares outstanding, demonstrate Trimble's confidence in its ability to sustain momentum and capitalize on emerging opportunities.

Moreover, Trimble's guidance for the first quarter of 2024 anticipates revenue between $905 million and $935 million, with non-GAAP EPS forecasted at $0.57 to $0.62. These projections, based on similar tax assumptions and shares outstanding, reflect Trimble's robust start to the fiscal year and its proactive approach to achieving sustainable growth.

Key Catalyst: Joint Venture with AGCO:

A key catalyst for Trimble's future growth is its joint venture with AGCO, slated to close at the beginning of the second quarter of 2024. While Trimble ( NASDAQ:TRMB ) refrains from providing a quantitative reconciliation of certain measures to GAAP due to the pending joint venture, the strategic significance of this collaboration cannot be understated. By leveraging synergies and expertise, Trimble ( NASDAQ:TRMB ) and AGCO aim to unlock new opportunities in the agriculture sector, further solidifying Trimble's position as a leader in innovative solutions for precision agriculture.

Conclusion:

Trimble Inc.'s stellar performance in 2023, coupled with its strategic initiatives and forward-looking guidance, underscore its resilience and growth potential in an evolving market landscape. With record revenue, strong margins, and strategic partnerships on the horizon, Trimble ( NASDAQ:TRMB ) is well-positioned to capitalize on emerging opportunities and drive value for shareholders in 2024 and beyond. As the company continues to execute its vision and navigate macroeconomic dynamics, investors can remain confident in Trimble's ability to deliver sustainable growth and innovation in the years to come.

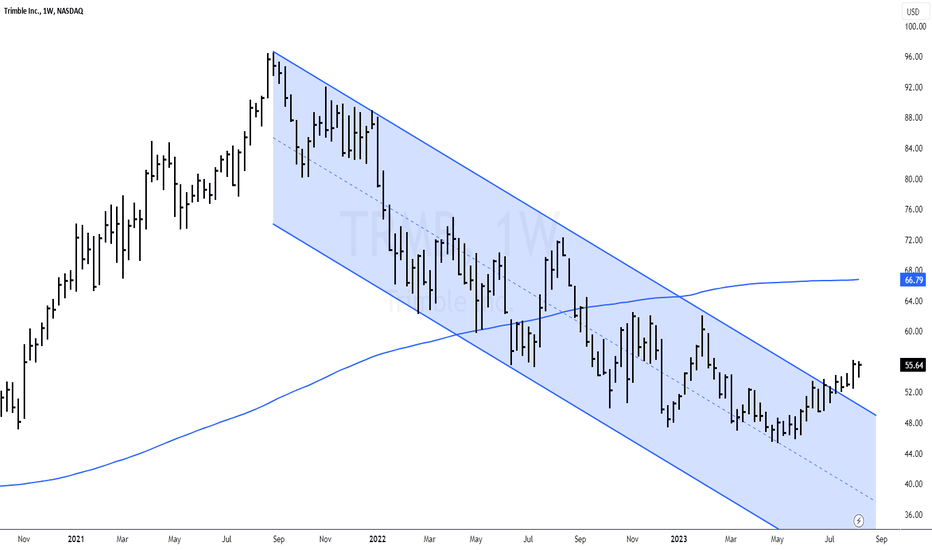

$TRMB Bearish to Bullish ReversalNASDAQ:TRMB Trimble Stock Breaks Bearish Trend, Initiates Bullish Reversal A bearish parallel trend is characterized by a consistent downward trajectory in a stock's price over time. Investors often regard this pattern as a sign of declining market sentiment, prompting caution and reevaluation of investment strategies. Trimble, a well-known player in the technology and solutions domain, had been navigating such a bearish trend until recently.

The Breakout: A Bullish Reversal

Investor sentiment took a positive turn as Trimble's stock exhibited a remarkable shift in its trend pattern. Breaking away from the downward trajectory, Trimble's stock embarked on a bullish reversal. This noteworthy development is a testament to changing market dynamics, potentially signaling renewed interest and optimism surrounding the company's prospects.