TRNS

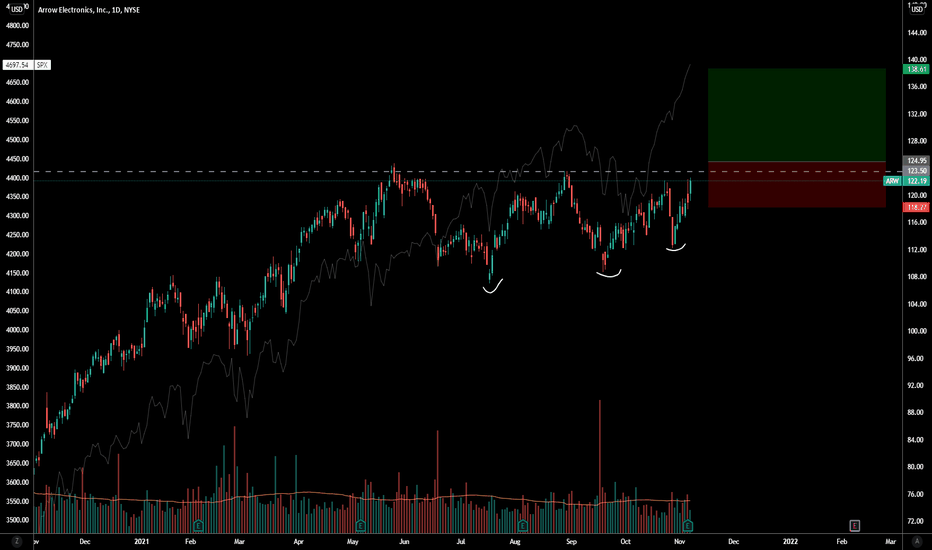

Arrow Electronics $ARW could follow $TRNS and make the breakoutIn the IBD ranking, NYSE:ARW is number 9 in its industry. While NASDAQ:TRNS is number one, which already made the breakout and has a +20%. Since I missed that move I´m focusing on SET:ARROW .

The electronics parts distributor has made 3 higher lows and shows a pivot buy above $123.50. With a stop loss at $118.27, my target sell will be above $138. I´ll be waiting for the breakout to take a position.

I´d like to add that the some of the biggest ETFs holders have momentum and alpha seeking strategies. Like AMEX:LSAT , $ AMEX:MTUM , AMEX:QVAL and AMEX:BOUT .