Tron (TRX) Price Prediction: Nasdaq Deal Fuels Bullish ForecastThe $210 Million Nasdaq Rumor: Deconstructing the Hype for a Realistic Tron (TRX) Price Prediction

In the volatile theater of cryptocurrency, headlines can ignite market-moving frenzies, and few have been as potent as the recent whirlwind of news surrounding Tron (TRX). The prospect of a planned Nasdaq listing via a $210 million reverse merger, intertwined with the enigmatic presence of the Trump family, sent shockwaves through the community, promising a new era of mainstream legitimacy and sparking wildly bullish price predictions. However, as the dust settles, a clearer, more nuanced picture emerges—one that separates explosive rumors from the fundamental drivers that will truly dictate the future of Tron's price.

The core of the excitement stemmed from a strategic deal involving SRM Entertainment, a Nasdaq-listed company specializing in theme park merchandise. In a stunning pivot, SRM announced it would rebrand as Tron Inc., initiate a substantial TRX treasury funded by a $100 million private equity investment, and appoint Tron's founder, Justin Sun, as an adviser. This "reverse merger" was widely interpreted as a backdoor for the Tron blockchain to gain a coveted spot on a major U.S. stock exchange, a move that would grant it unprecedented access to traditional capital and validation. Adding a layer of political intrigue, the deal was facilitated by an investment bank where Eric Trump and Donald Trump Jr. serve on the advisory board.

This confluence of high finance, crypto ambition, and political association created a perfect storm for speculation. The stock price of SRM Entertainment skyrocketed over 500%, and the price of TRX saw a notable jump. However, the narrative quickly became more complex. Eric Trump clarified his position, denying any direct "public involvement" in the new company, despite expressing his admiration for Justin Sun and their established business connections.

While the deal with SRM Entertainment is very real, its direct implications for the TRX token are more complex than a simple "Nasdaq listing." The transaction is for the corporate entity, which will hold TRX in its treasury, not for the decentralized TRX asset itself to be traded on Nasdaq like a stock. This distinction is critical. The move provides Tron with a publicly-traded vehicle and significant capital, but the ultimate value of TRX still hinges on the utility and adoption of the Tron network itself. Therefore, a realistic price prediction must look beyond the initial hype and analyze the bedrock of Tron's fundamentals.

Deconstructing the Hype: The Nasdaq Deal and Trump Connection

The plan for SRM Entertainment, a Florida-based supplier of toys and souvenirs, to morph into Tron Inc. is a masterclass in financial engineering. Through a reverse merger, a private company (in spirit, Tron) can go public by merging with an existing publicly-traded company (SRM), bypassing the rigorous and lengthy process of a traditional Initial Public Offering (IPO).

The deal, valued at up to $210 million upon full exercise of warrants, involves SRM receiving a $100 million equity investment from a private investor to initiate a "TRX Treasury Strategy." This strategy mirrors the approach of companies like MicroStrategy with Bitcoin, where the public company's assets are heavily invested in a specific cryptocurrency, making its stock a proxy for that asset. With Justin Sun serving as an adviser, the new Tron Inc. plans to implement a TRX staking program and even a dividend policy for its shareholders, further intertwining its fate with the Tron ecosystem.

The involvement of the investment bank brokering the deal brought the Trump name into the headlines. Eric Trump and Donald Trump Jr.'s roles on the bank's advisory board led to speculation about their involvement in the new Tron Inc. However, Eric Trump later clarified his position, separating his personal and business relationships from a formal executive role in the public venture, though the connection undeniably added to the initial media frenzy.

Beyond the Rumors: Tron's True Fundamental Strengths

With the Nasdaq hype contextualized, the real question for investors is: what is the intrinsic value of the Tron network? The answer lies in its undeniable dominance in one of the most crucial sectors of the digital economy: stablecoins.

The Undisputed King of USDT

The Tron network has become the world's primary settlement layer for Tether (USDT), the largest stablecoin by market capitalization. The network hosts over $78 billion in USDT, a figure that has surpassed the amount on its main rival, Ethereum. This dominance is not accidental. Tron's architecture, which allows for high throughput and extremely low transaction fees, makes it the preferred network for USDT transfers, especially for retail users and in emerging markets.

During a single month in mid-2025, the Tron network processed over $694 billion in USDT transfers through nearly 90 million contract interactions. The vast majority of USDT holders on Tron are retail users with balances under $1,000, highlighting the network's deep penetration into everyday peer-to-peer and remittance use cases. This immense and consistent utility generates real, sustained demand for the network, forming the most solid pillar of its valuation.

A Growing DeFi and dApp Ecosystem

While stablecoins are its main draw, Tron's Decentralized Finance (DeFi) ecosystem is also substantial. The network holds a Total Value Locked (TVL) of over $8 billion, placing it among the top layer-1 blockchains. Platforms like the lending protocol JustLend and the decentralized exchange SunSwap are key contributors to this activity.

The network has processed over 10.5 billion transactions from more than 313 million user accounts, demonstrating a vibrant and active user base. Although a recent decline in TVL from its peak and slowing DEX volume has been observed, the sheer number of daily active users and transactions suggests a pivot towards non-DeFi dApps and peer-to-peer transfers, reinforcing its utility beyond pure financial speculation.

Tron (TRX) Price Prediction: Technical Analysis and Future Outlook

Given the strong fundamentals, particularly its role as the leading stablecoin platform, what can be expected from the TRX price?

Technical Indicators

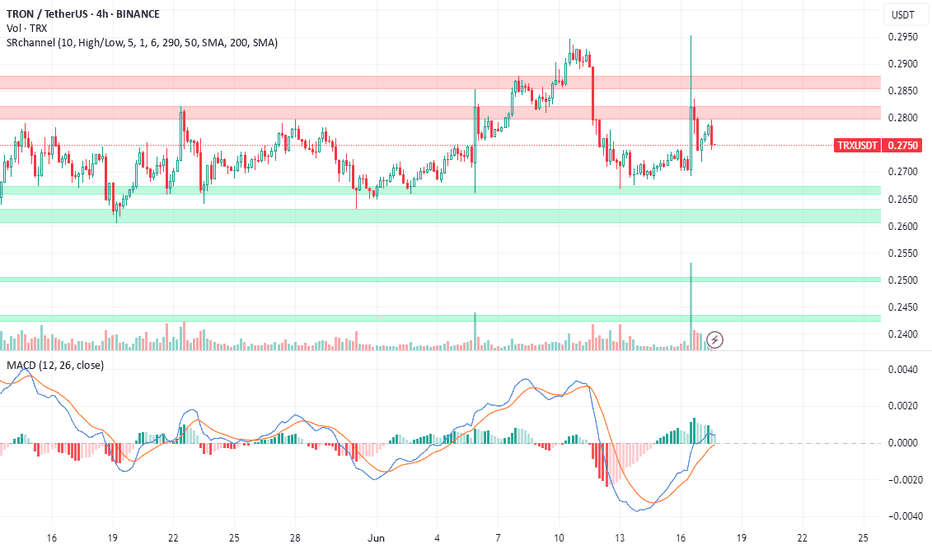

As of mid-2025, TRX has shown resilience. Technical analysis reveals a generally neutral to bullish sentiment. The price has been consolidating in a horizontal channel, with key resistance and support levels being closely watched. Bullish signals, such as a "golden cross" and a bullish MACD crossover, suggest potential for upward momentum. A key indicator of its potential is its market-cap-to-TVL ratio, which, at 0.26, suggests the coin may be significantly undervalued compared to the value of the assets secured on its network.

Price Forecasts for 2025 and Beyond

Price forecasts for the end of 2025 vary but are generally optimistic, contingent on broader market conditions.

• Conservative Outlook: A conservative forecast places the potential price of TRX in a range between $0.18 and $0.35 for 2025. A move toward the upper end of this range would depend on a sustained crypto bull market and continued growth in Tron's user base.

• Bullish Scenario: An optimistic forecast suggests that if a full-blown "altseason" takes hold, TRX could surpass its previous highs and target levels between $0.45 and $0.70. Some long-term models even project a path toward $1.00 or higher by 2030, assuming Tron maintains its competitive edge and expands its use cases.

• Bearish Scenario: Risks remain. A regulatory crackdown on stablecoins, particularly Tether, could disproportionately impact Tron. Furthermore, a recent $2 billion drop in its DeFi TVL, despite user growth, suggests a potential weakness in its financial ecosystem that warrants monitoring. In a bearish turn, TRX could fall back to support levels around $0.21 or lower.

The "100x Gem" Fallacy

The headlines promoting Tron's Nasdaq deal were often accompanied by mentions of speculative new tokens like "BTC Bull Token," promising astronomical 100x returns. It is crucial for investors to recognize this as a common marketing tactic that leeches onto legitimate news to promote highly speculative and often worthless assets. The future success of Tron will not be found in chasing such gambles, but in the sustained growth of its core network. The real "alpha" is in understanding the fundamental utility that drives billions of dollars in transactions daily, not in lottery-ticket tokens.

Conclusion: A Bullish Continuation Built on Reality, Not Rumor

The story of Tron's Nasdaq listing is a potent reminder of the crypto market's susceptibility to hype. While the reverse merger with SRM Entertainment is a significant strategic maneuver that provides Justin Sun's ecosystem with a public-facing entity and a war chest, it is not the magic bullet that guarantees a higher TRX price.

The true bullish case for Tron is more mundane but far more powerful. It is the network's unparalleled dominance as the world's preferred highway for stablecoin transactions. This utility provides a constant, powerful demand for the network's resources. As long as Tron remains the fastest, cheapest, and most accessible platform for billions of dollars in daily USDT transfers, its intrinsic value will continue to grow.

The Nasdaq deal is a catalyst, but the engine is the ecosystem. Investors looking for a bullish continuation should focus on the steady hum of that engine—the growth in active wallets, transaction counts, and stablecoin volume—rather than the fleeting roar of market rumors. Based on these fundamentals, a steady, upward trajectory for TRX seems not only possible but probable, with the potential to retest and surpass previous highs as the digital asset market matures.

Tronbreakout

$0.268: Tron TRX Last Stand?Tron is currently trading below the resistance at $0.297, the area characterised by slow and choppy price action.

1. A bounce from the nearby support level at $0.268 could suggest renewed buying interest, setting the stage for a potential move toward $0.297 (Dashed Green Projection).

2. A break and close above this level would indicate bullish strength, opening the path toward the next resistance at $0.339, followed by $0.377, providing room for a broader recovery (Solid Green Projection).

3. Conversely, if TRX fails to hold $0.268, it would indicate increasing bearish momentum, likely triggering a decline toward the key support zone at $0.226 (Red Projection).

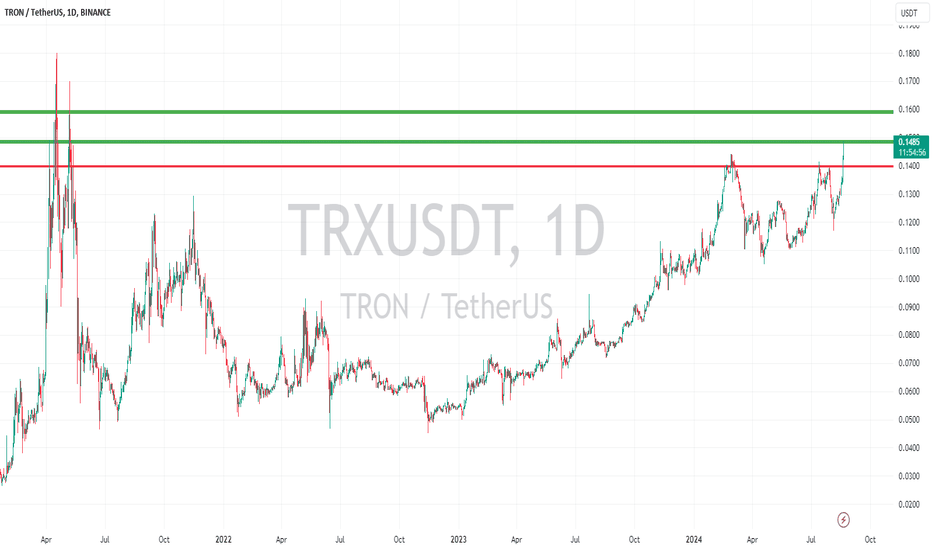

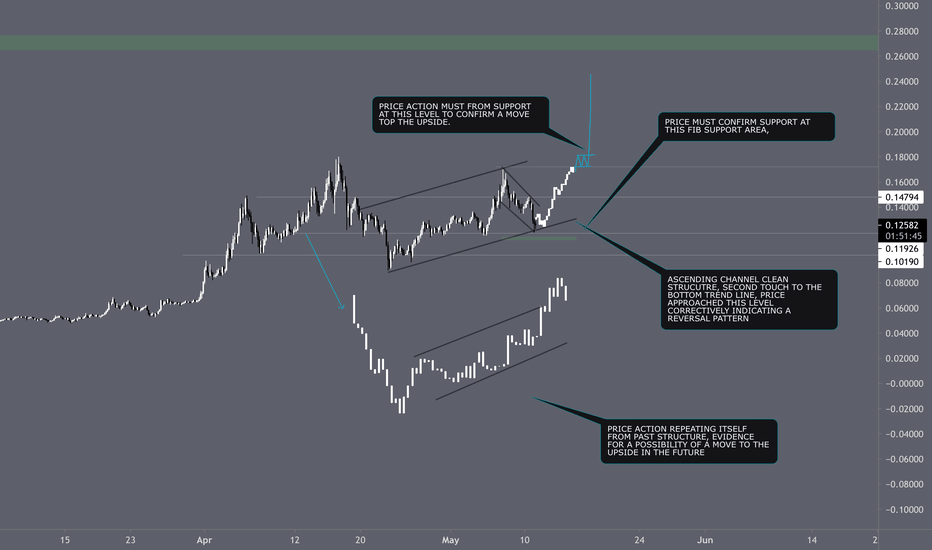

Cryptolean Tron TRX UpdateTron is trading in the wide daily range zone between $0.112 and $0.126.

A bullish move from the current price location reclaiming$0.126 will result in a slow upward move to $0.138.

As long as TRX in the daily chart is trading below $0.126, the bears are in control and will try to push price to the key daily support zone of $0.106-$0.112.

A bearsih break-out of this support zone will make TRX very bearish.

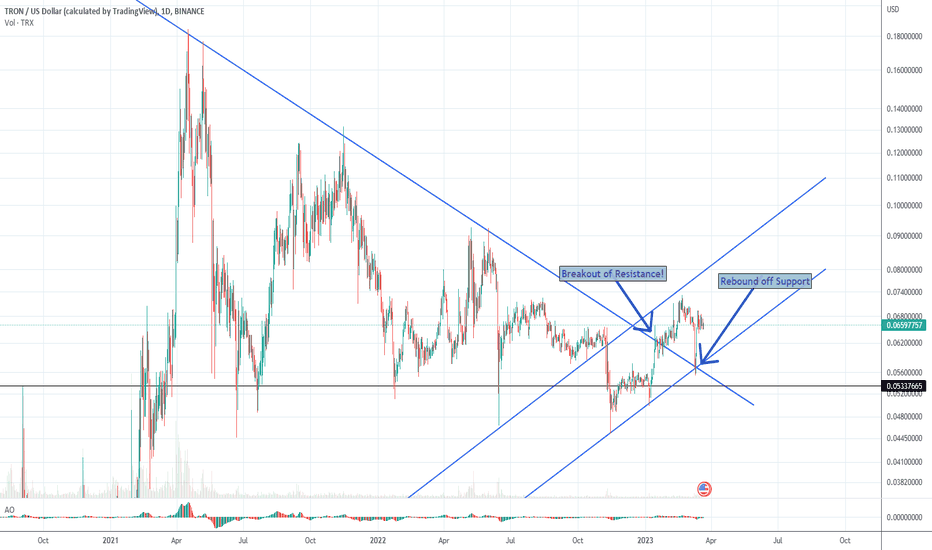

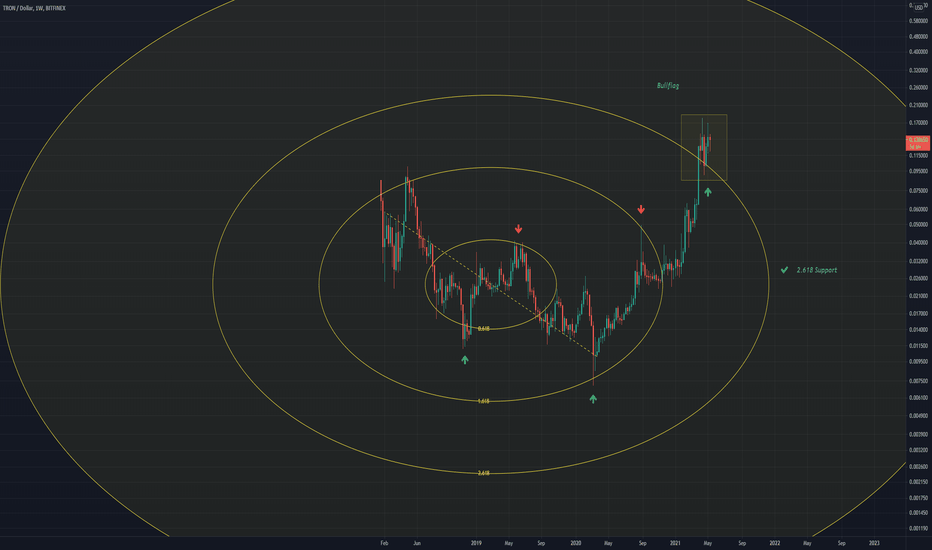

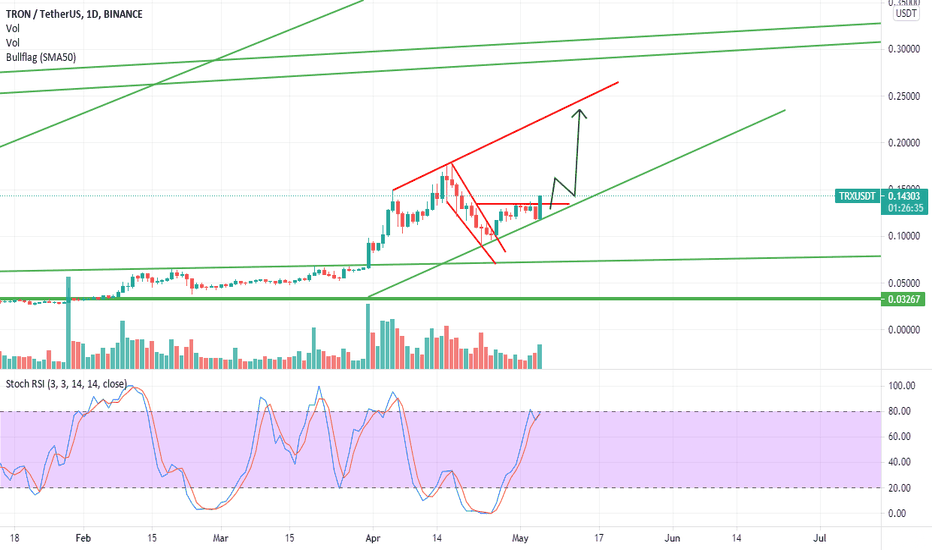

Resistance becomes Support!We've waited such a long time for this moment with Tron. Seems to be the narrative with a lot of altcoins right now. Huge falling wedges that are now starting to breakout.. eg. Xrp.. Vechain etc! Utility tokens! Although Trx seems to be a bit further ahead in the charts, so I expect Tron to start moving first! Get ready!

Tron to start breaking upwards exactly February 6th it appears!Analysis of the the majority of charts in crypto at the moment, the sentiments have come down lower than expected in the market. Most crypto are undervalued. Not only that but it appears we have hit rock bottom of the trendline upwards. This is showing on multiples of cryptocurrencies so expect Tron to begin it's ascent February 6th until finally breaking out up mid February.

It's coming!! 📈

Trx still trading in the Zone!It's amazing how accurate these signals are pushing upwards along the trend line based on previous signals. Still a danger Trx can fall downward, but it would be a temporary setback that I believe would recover in quick time if we see that scenario.

So therefore I'm still bullish for Tron! We have so much upside potentiality that it's long overdue.

I'm surprised not many people talking about Tron when it has such a large Asian and worldwide market! This is already Eth 2.0.

TRX Going to Down??Yesterday the news of TRX gained so much attention about the USDD that it shoot for more than 17%. Right now it is in the cooling phase , but Tron is know for doing something opposite in the market so I have a neutral view, but if the price breaks in either direction I will open a trade.

Please Like, Share and Comment.

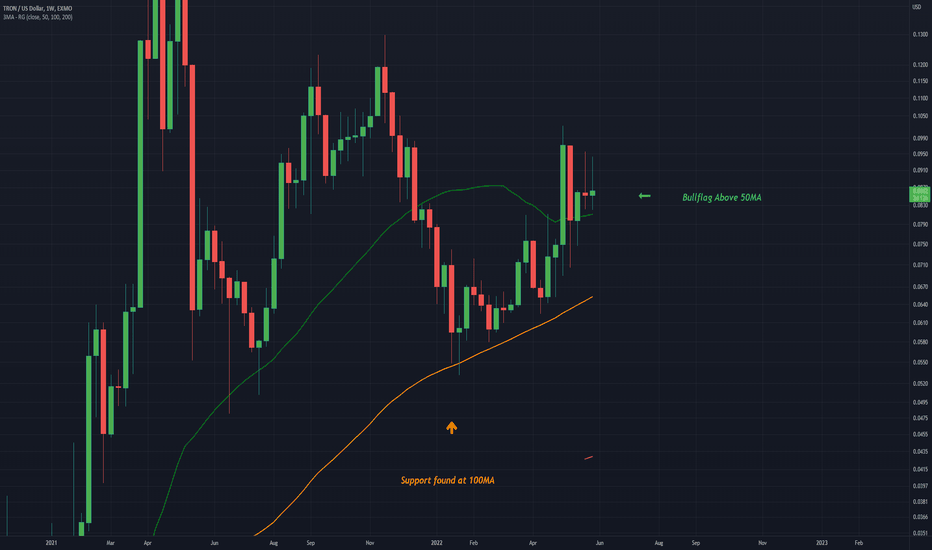

TRON Weekly View 3/6/22TRXUSD Can be seen to have moved above the 50MA in a bullish fashion on this Weekly timeframe

Prior this support for the bulls was found at the 100MA

A breakout to upside may follow

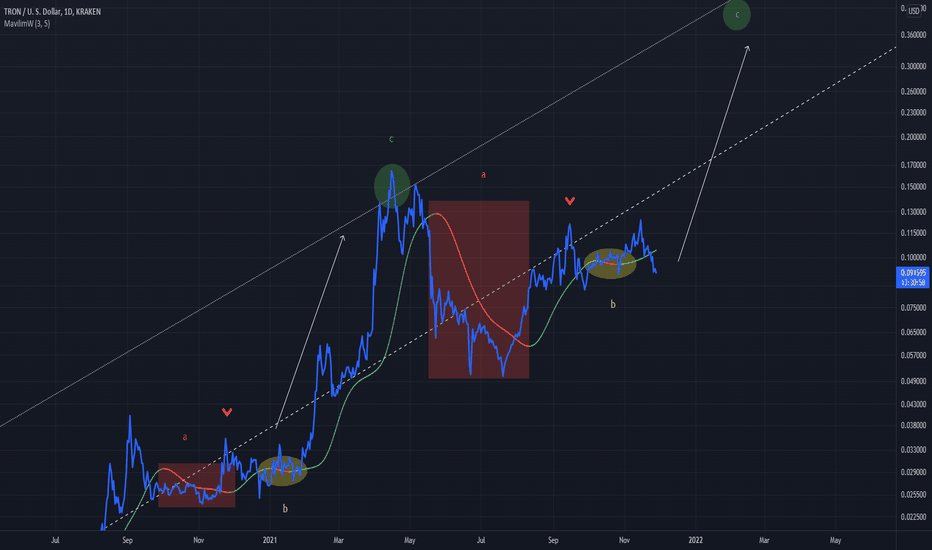

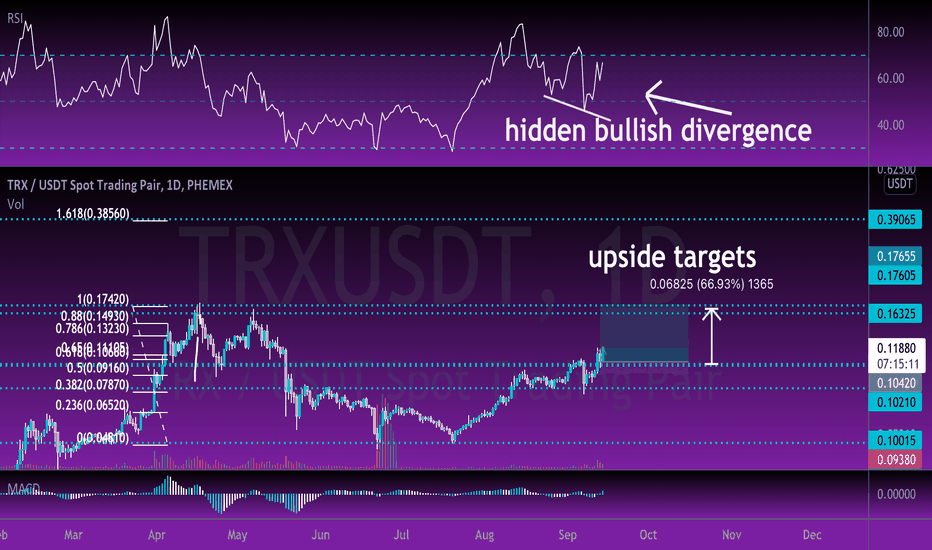

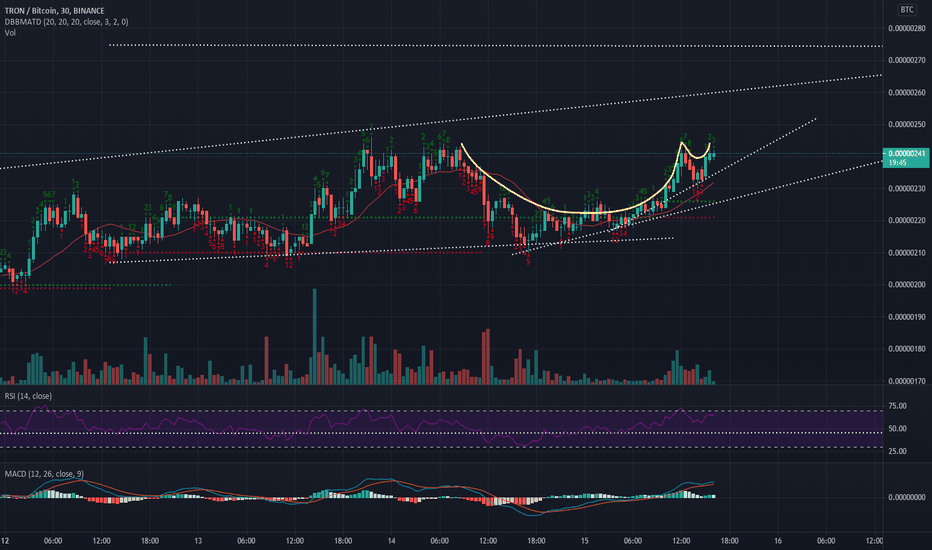

Tron TRX Ready to MOON LONG NOW !!??? TRON TRXTaking a look at price action you can see that the most recent pullback was a retest of key support and resistance and on top of that we formed hidden bullish divergence on the daily time frame !!

A short term break and rest of our most recent high which lines up with an area of support is holding strong

In my view holding this level could allow us to run up to the next level of resistance

If we execeed that level expect TRX to ATH 30 cents !!!!!

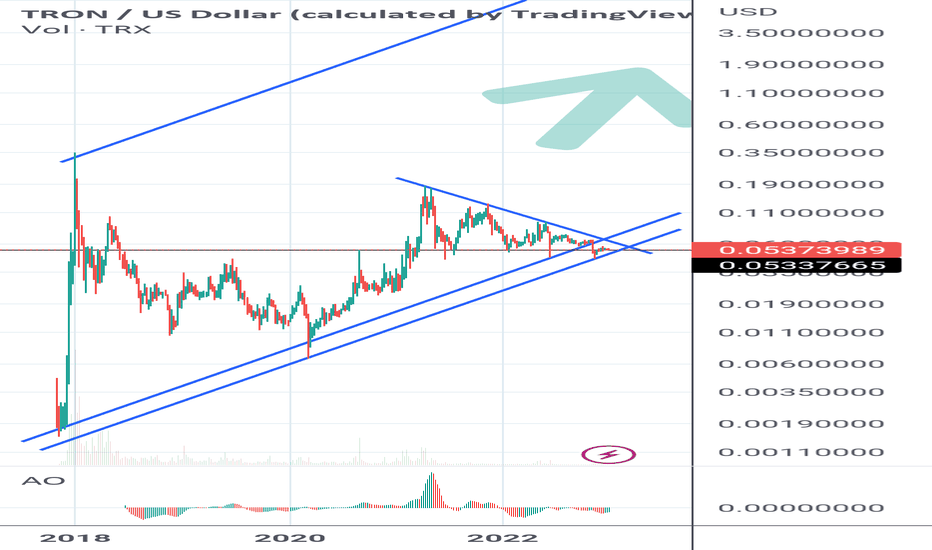

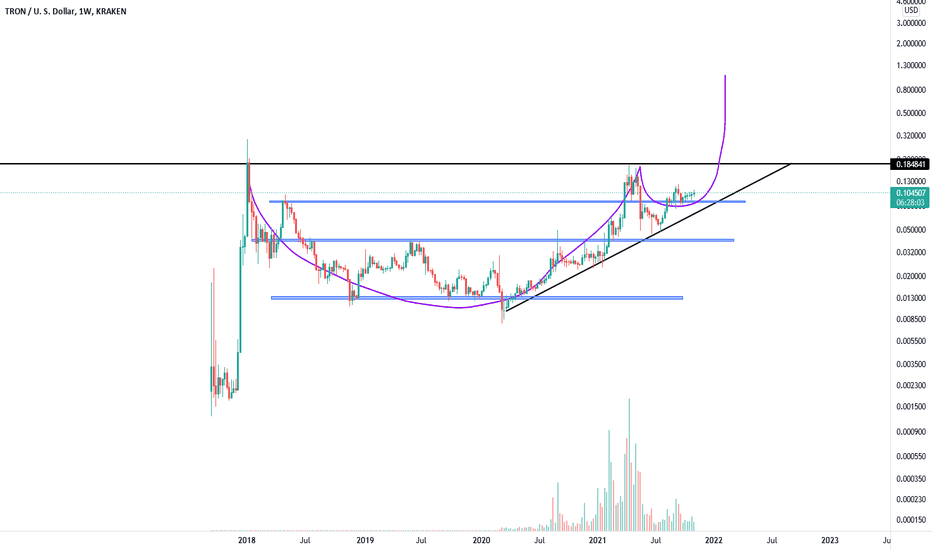

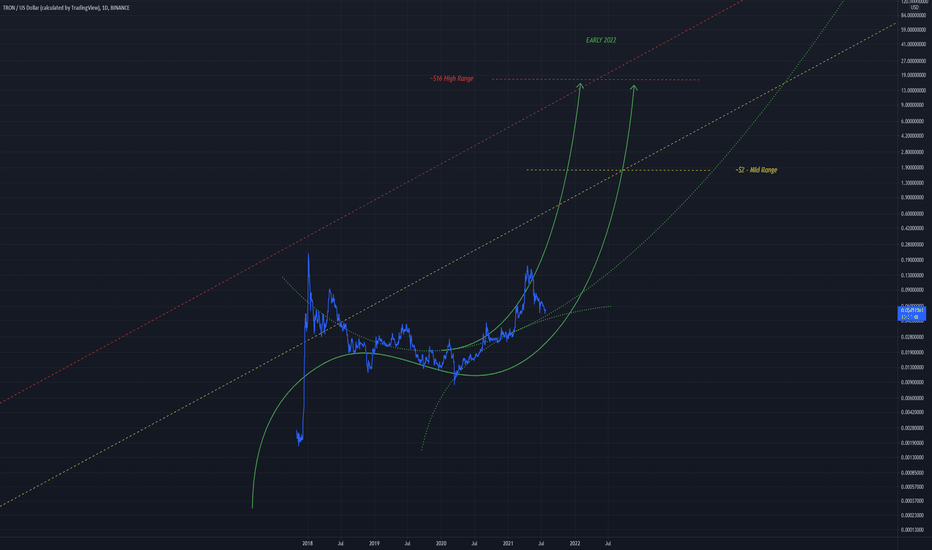

TRON Price Range Targets for Early 2022An idea for TRON

Top channel band suggests $16 which is a massive increase from the current 0.05

Middle channel band suggests $2 which is also a huge increase

Both of these scenarios make sense, the top band was where price hit in 2017

Time will tell if it repeats

I have used a sort of 'quasi' channel to identify these ranges

Also some funky trend lines included to support this channel idea !

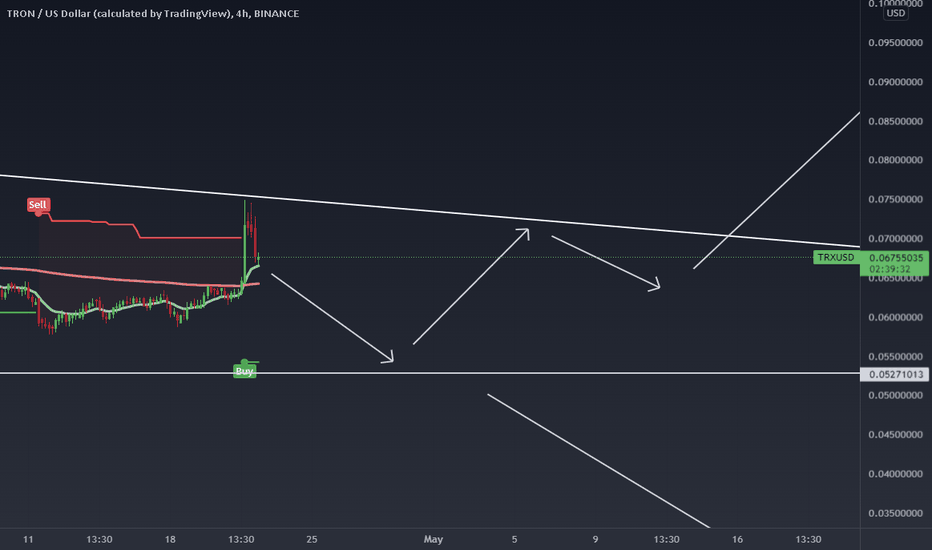

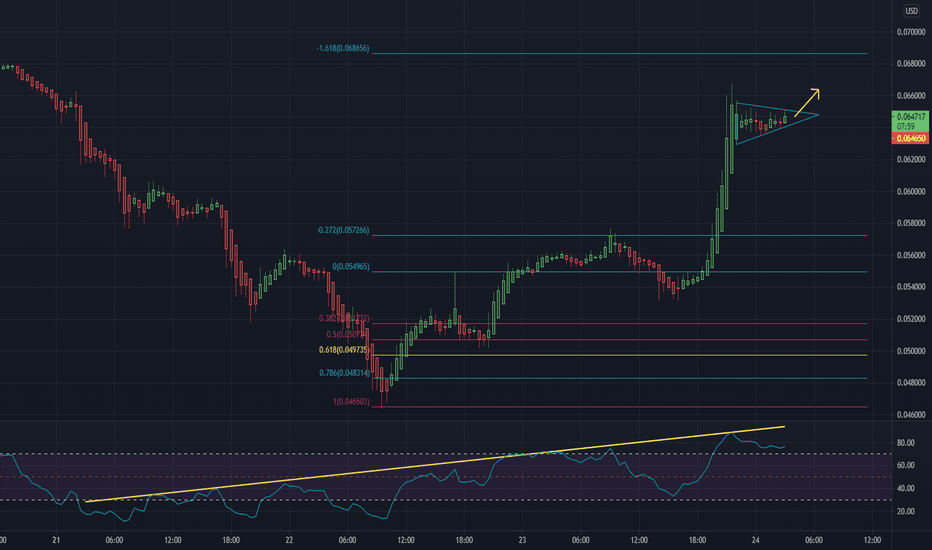

#TRX on it's way too .07?The RSI indicates we have been building bullish momentum & still continuing to rise. We may hit our .07 target around 4 am est but we very well could see a fall back too .057 so let's see how this plays out.

Looking at BTC we may be in for a very bullish day, but we all know it depends on which direction it (Bitcoin) goes for the market to follow suit.

*NFA

Tron(TRXUSD) LONG $0.2Tron price holding in this channel from March, the correction wave is getting completed and going on a next impulse wave after it breaks out of this channel

1) Looks like the bulls are going to take over

2) place your positions accordingly after it comes out of the channel

Happy trading, feedback is always appreciated

THE GAME OF TRON Hello Tron holders,

Finally the moment expected from all you came, yes TRX is moving up steady in a bullish channel.

The relative strength index need to catch up with the volume but hey this is THE GAME OF TRON not whatever.

I will try to update entry.

MMM (Make Motherf.ckin Money)

Invest your money wisely, be patient.