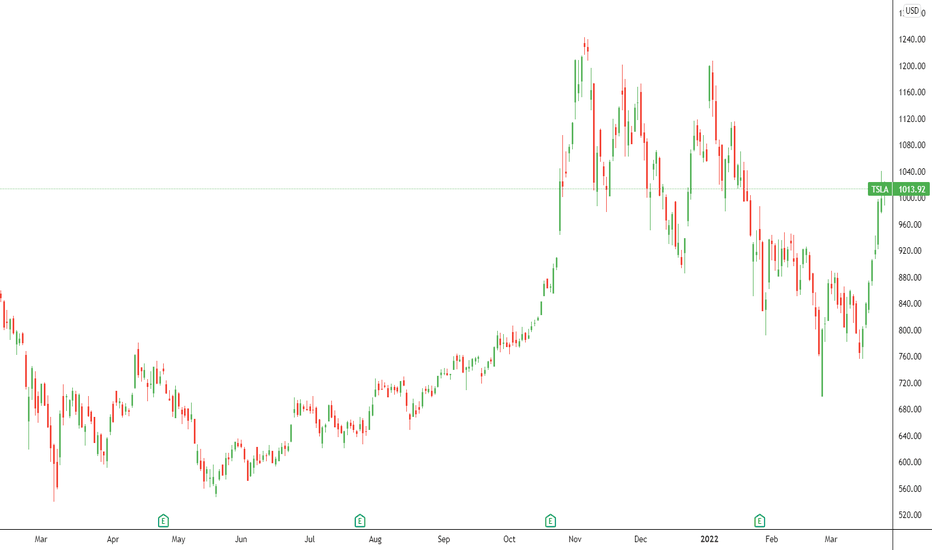

TSLA at Critical Level - Could Go Either WayTSLA is at a critical point with the volume shelf and other factors that could mean either direction.

Bull Case:

Retesting Breakout Level

Falling Wedge on Daily/65m

Bullish Divergence on 65m

Some Bollinger Band squeezing on 65m

Bear Case:

Net Premium flow favors puts heavily

Bearish Engulfing Candle on Weekly

MACD crossing down on Daily

Hidden Bearish Divergence on Daily that may not have completely played out

May be slightly below volume shelf - next shelf at $912

Diminishing Volume on Daily

So:

If Bulls Win... (price breaks $1,037)

PT1 - $1,045

PT2 - $1,065

PT3 - $1,087

If Bears Win... (price breaks $1,021)

PT1 - $1,011

PT2 - $1,000

PT3 - $1,090

Tslachart

Is Tesla still plugged into Bitcoin?The prices of cryptocurrencies including Bitcoin, the most popular of the lot, have been highly volatile in recent months due to conflicting regulatory signs and rising interest rates.

Despite the massive sell-off of digital tokens, Tesla (NASDAQ:TSLA) CEO Elon Musk is among those who are still bullish on digital currencies. As such, the recently reminted $1 trillion dollar company is caught in the crosshairs of movements in the cryptocurrency market.

Bitcoin price crash

After reaching an all-time high of $67.5K in November, the price of Bitcoin is now hovering around $40K since the start of the year. The crash is partly due to remarks from the US Federal Reserve about launching its own digital currency similar to China’s e-renminbi and US President Joe Biden’s recent order directing government agencies to coordinate on a regulatory framework for digital currencies.

While the regulatory forces mentioned above have helped to suppress any upside in digital assets, the largest contributor in the price crash of Bitcoin is the about-face that Musk, and by association Tesla, pulled for its support of Bitcoin. In a way, those cryptocurrency crosshairs are attached to the rifle wielded at times by Musk and Tesla.

Tesla’s $1.5 billion Bitcoin stash

Last year, Tesla revealed that it invested a total of $1.5 billion in Bitcoin and hinted that it may acquire and hold digital assets “from time to time or long-term.” Since that announcement in February 2021, the company has had no additional Bitcoin purchases.

Tesla disclosed in its 2021 annual report that it still held around $1.26 billion worth of digital assets and incurred $101 million of impairment losses on its digital assets.

At the same time, the EV leader also reiterated its confidence in the long-term potential of digital assets both as an investment and as a liquid alternative to cash. However, the carmaker warned, in an ambiguous statement, that it may boost or reduce its digital asset holdings based on its business needs and on its view of market conditions. However, knowing Tesla dependency on Musk as its “product architect and social media manager”, as quoted by Bloomberg, the company’s position on digital currency’s may be far closer aligned with his own personal view than the above statement suggests.

Over a month after the company’s disclosure, Musk on Twitter said he still owns and “won’t sell” his own personal Bitcoin, Ethereum or Dodge holdings, stressing that “it is generally better to own physical things like a home or stock in companies you think make good products, than dollars when inflation is high.”

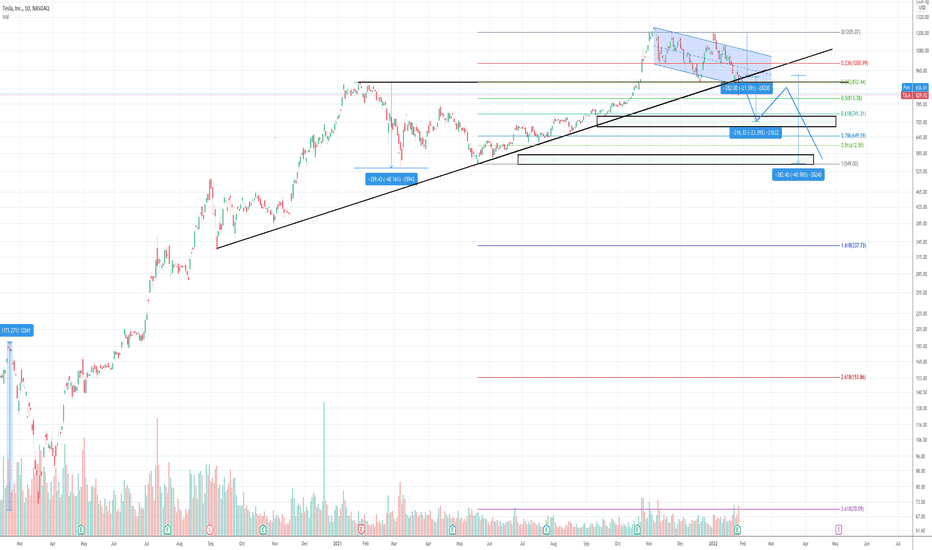

$TSLA breaking out of cup & handle pattern | Very bullish Tesla is b NASDAQ:TSLA $TSLA Breaking out of cup and handle pattern. Technicals and fundamentals both indicating new ATH imminent with potential to reach 2k per share near term.

$TSLA is breaking out of the cup and handle pattern that's been forming on the 4h chart. Confirmed bullish move as it gapped out of the handle channel today. Next area of resistance is around 1315$ where the 61.8% and trend line meet, so a new ATH in the 1300 zone seems to be an imminent target.If Tesla can break out of that strong resistance area then I think around 1559$ would be the next area of resistance since that’s where the 100% fib and the target height of the cup pattern intersect. If after that, strong fundamental momentum continues due to some strong upcoming catalysts such as ER numbers, Austin and Berlin factory updates or some other bullish news released, then reaching the 168% fib extension at 2k can happen quickly.

Either ways things are looking very bullish right now for Tesla .

Key areas of resistance and potential target zones:

Conservative target= 1315

Medium risk target= 1559

Aggressive target= 2002

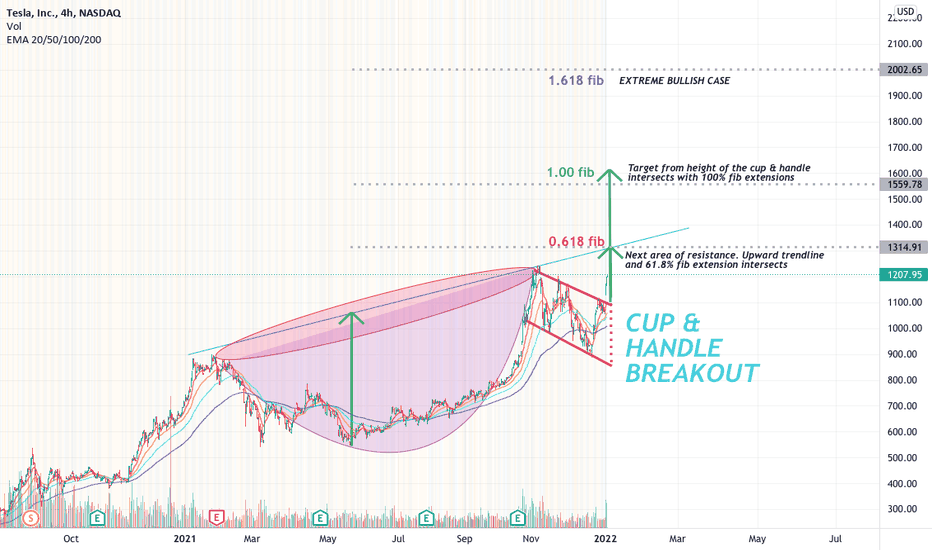

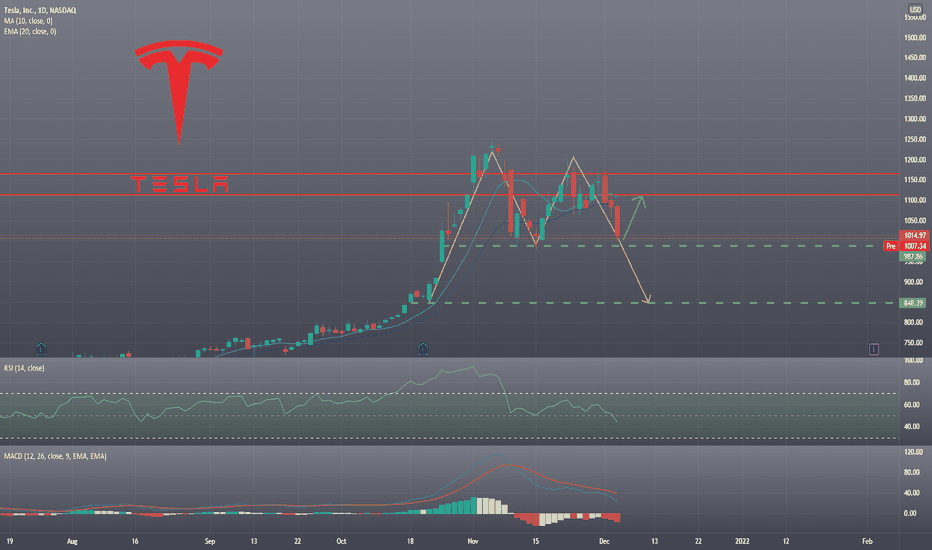

TSLA Analysis, Double Top !!Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

TSLA is currently trading in the upper part of its 52-week range. The S&P500 Index is also trading in the upper part of its 52-week range, so TSLA is performing more or less in line with the market.

The long-term trend is positive and the short-term trend is neutral. The long-term trend may just continue or reversal may be around the corner!

A double top pattern has been spotted on the daily chart which could lead the TSLA stock back to the $850 levels.

Possible Scenario for the market :

The market is trading at $1014.97 and it's nearing the neckline of the double top pattern located at the $1001 range, if a breakout happens of that line we could be seeing the TSLA stock drop to the $850 level. and a lot of the indicators are showing Bearish signs that would support the double top pattern.

In case the support line held strong then we could be seeing a Bullish movement that will lead the TSLA stock price back to the resistance level located at $1112.85

Technical indicators show :

1) The market is below the 5 10 20 MA and EMA indicating a Bearish short-term trend, But still above the 50 100 and 200 MA and EMA (Bullish long-term trend)

2) The RSI is at 44.20 showing some weakness in the market.

3) The MACD is below the 0 line indicating a bearish state in the market with a negative crossover between the Signal line and the MACD line.

Support & Resistance points :

support Resistance

1) 1029.10 1) 1168.14

2) 976.28 2) 1254.36

3) 890.06 3) 1307.18

Fundamental point of view :

Tesla Inc has asked a U.S. court to affirm an arbitrator's recent decision dismissing a former engineer's claims that the automaker fired and defamed her for raising concerns about defective floormats and contracting practices.

TSLA has a Return On Assets of 6.00%. This is better than the industry average of -1.33% and The Earnings Per Share has grown by an impressive 174.51% over the past year.

Looking at the last year, TSLA shows a very strong growth in Revenue. The Revenue has grown by 66.27% and based on estimates for the next 5 years, TSLA will show a very strong growth in Revenue. The Revenue will grow by 35.52% on average per year.

This is my personal opinion done with technical analysis of the market price and research online from Fundamental Analysts and News for The Fundamental point of view, not financial advice.

If you have any questions please ask and have a great day !!

Thank you for reading.

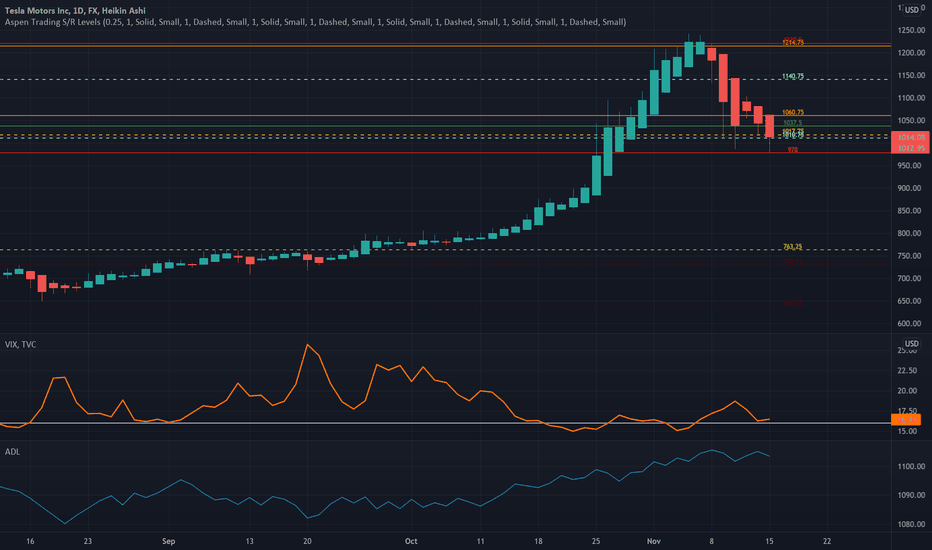

TSLA had a beautiful bounce from support Using Aspen Trading Support & Resistance Levels, TSLA has bounced from 982 support and can face the resistance at 1208.

A move above 1208 level will see further upside to TSLA.

Note - Aspen Trading S/R levels are invite only. They can be accessed through my profile information.

Disclaimer: This analysis is for information purpose only and does not constitute any investment advice.

TSLA matters a lot to the overall market Using Aspen Trading Support & Resistance Levels, a move below 978 is going to break the support and things can get ugly really quickly from that point for TSLA.

The overall market can also get impacted if the 1.2 trillion market cap of TSLA shrinks in size.

Please provide your feedback in comments if you like the analysis.

Note - Aspen Trading S/R levels are invite only. They can be accessed through my profile information.

Disclaimer: This analysis is for information purpose only and does not constitute any investment advice.

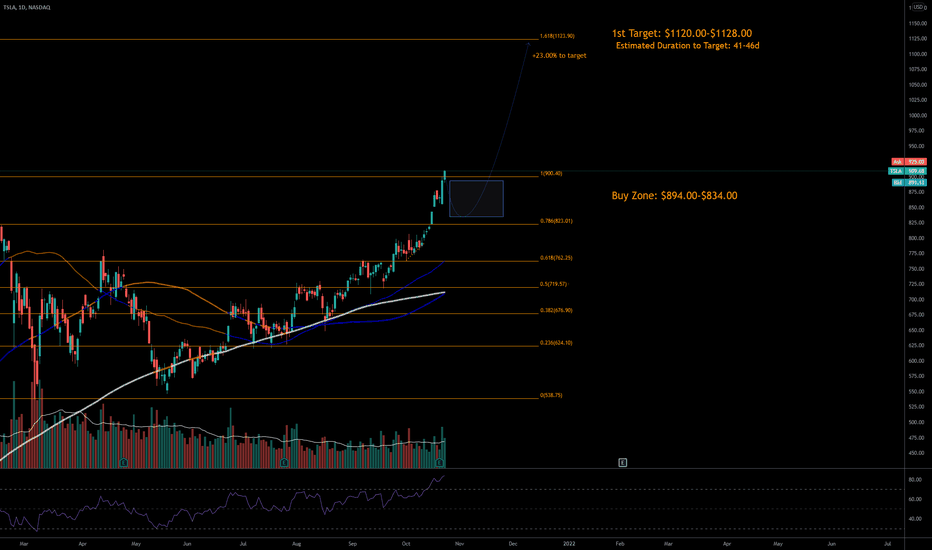

10/24/21 TSLATesla, Inc. ( NASDAQ:TSLA )

Sector: Consumer Durables (Motor Vehicles)

Current Price: $909.68

Breakout price trigger: $900.40 (hold above)

Buy Zone (Top/Bottom Range): $894.00-$834.00

Price Target: $1120.00-$1128.00

Estimated Duration to Target: 41-46d (1st)

Contract of Interest: $TSLA 12/17/21 1000c

Trade price as of publish date: $20.40/cnt

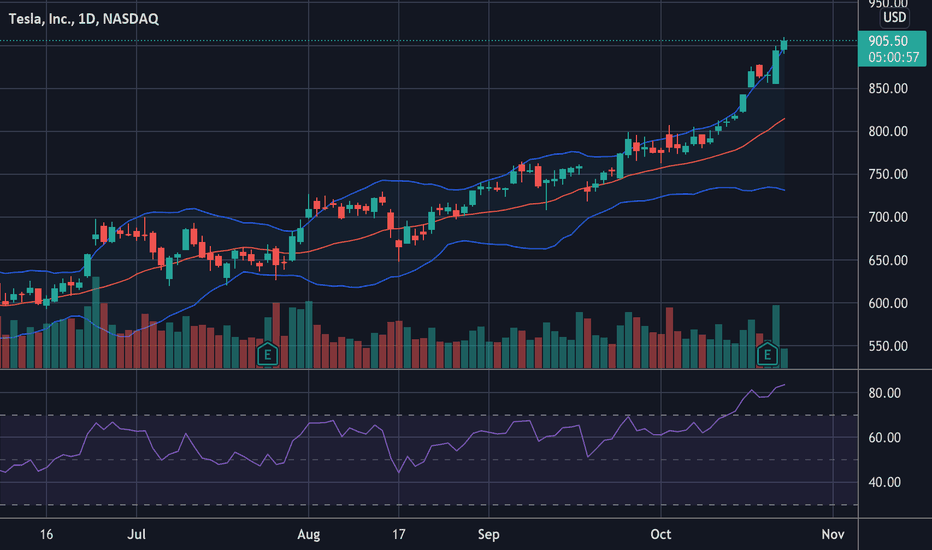

TSLA all time high$TSLA (TESLA) just reached all-time-high! Very bullish news especially for the stock that makes up the bulk of my portfolio. Congrats to those who followed me as well. My $TSLA portfolio is up by approximately 30% - with averaged price right below $700.

However, $TSLA is at $900 right now and RSI and bollinger bands is indicating that $TSLA is current very overbought right now. The rally came from their bullish earnings report that just got released recently: www.cnbc.com

Overall, i'm still very bullish on $TSLA and is holding it for the long run. Crypto gains might be hard to beat compared to equities but its very important to diversify and have both asset classes.

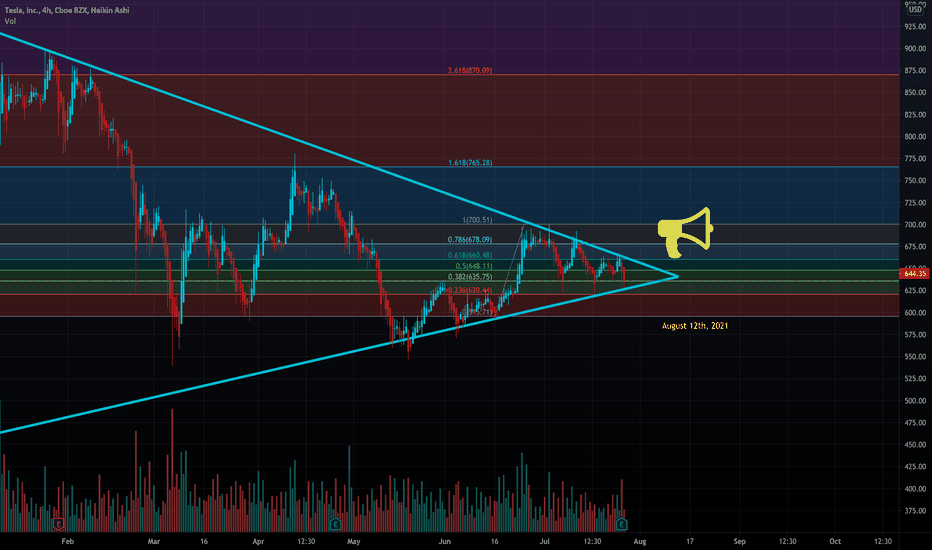

TSLA - If Price Makes The News...If price makes the news, and not the other way around - then around August 12th, 2021 seems like the right time to release some company specific breaking news.

In TSLA's case, we have a ~6 month wedge forming that converges on 8/12/21.

Price is currently coiling in a tight range, and will need to resolve itself directionally within 2 weeks.

Look for signs of accumulation and watch what price does at the lows for clues.

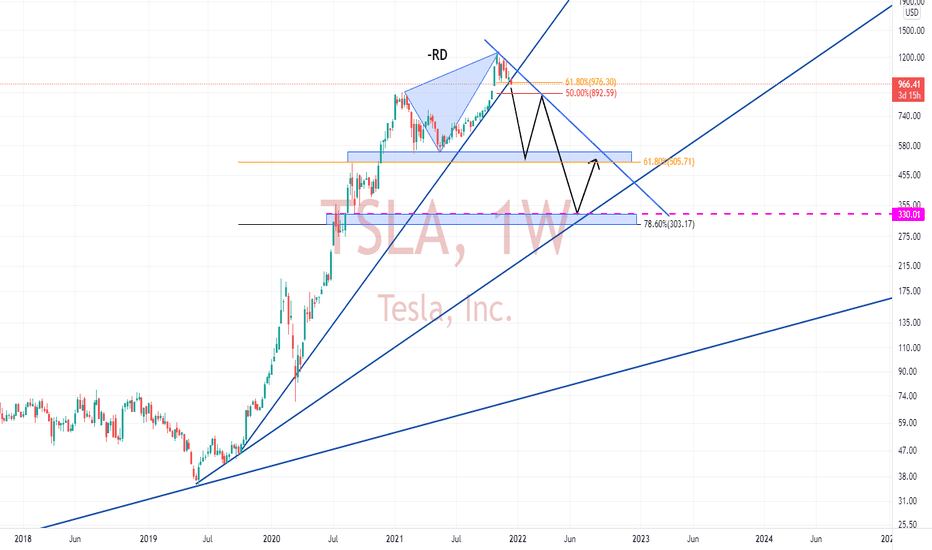

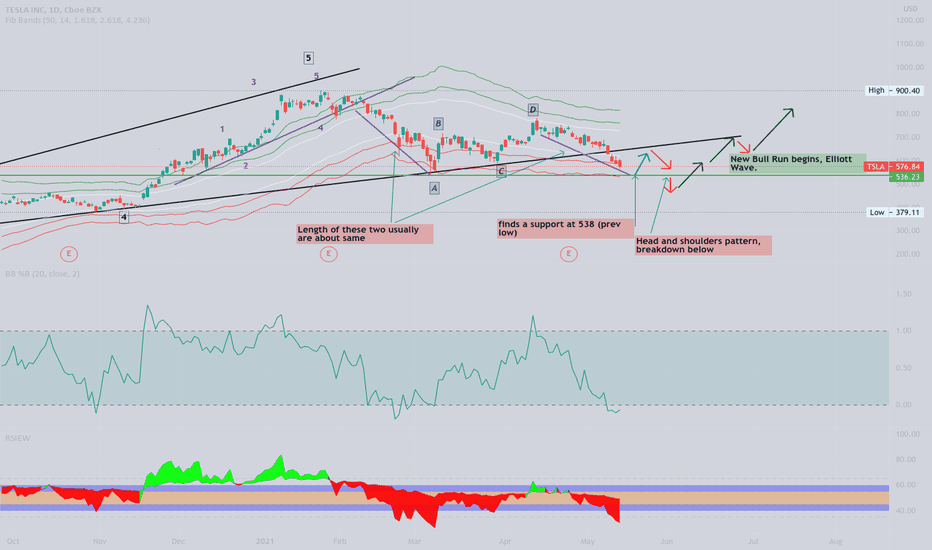

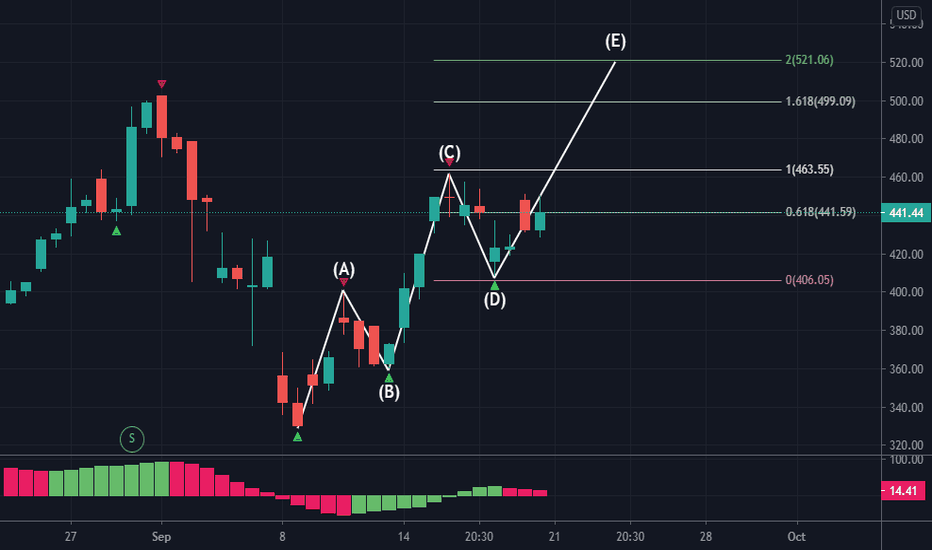

TSLA - Elliott Wave Analysis - CorrectionHi All,

I'm a long term Tesla Bull, but bearish short term, the price action suggest short term bearish price action.

Reasons

- No Catalyst until July Delivery Numbers

- No S/X Deliveries yet

- Nasdaq still in correction mode and has a room to come down, pressure on tech/growth stocks.

- Elon's tweets about FSD subscription(impacts financials) and FSD V9 release dates(impacts no financials on short term, helps perception which is good) are still in the air with no factual date of release.

- Elon's sudden move on BTC adoption, then again sudden reaction on it's rejection, creates only confusion and markets don't like it, but this will have only short term ~1 day impact on trading.

PS: This is just my opinion based on price action and macro level economics. Please be careful picking your trades.

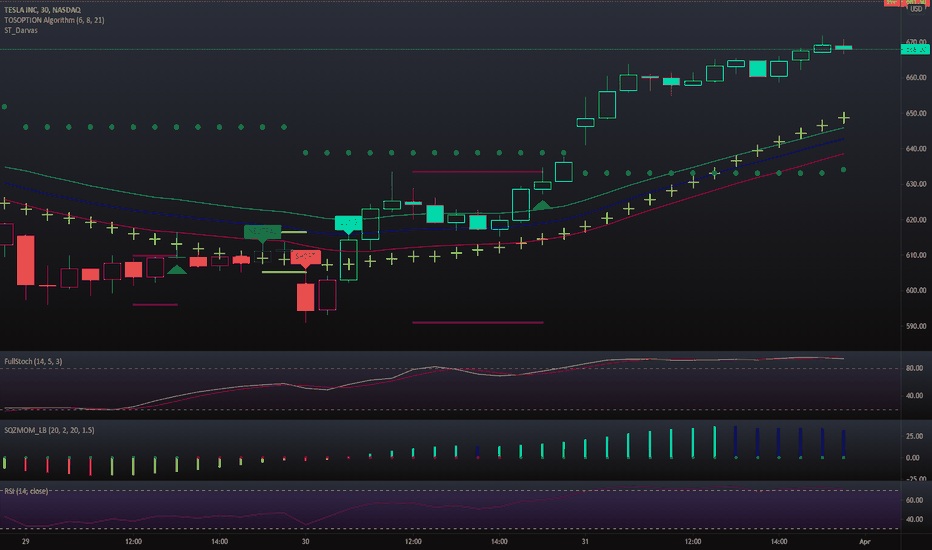

TSLA Algorithm looking to go long!TSLA algorithm went long on March 31st on the 30 min timeframe around the 613 level and ran up to 668! We were able to catch this wave and made a good profit. We are looking to build position once TSLA Algorithm signals long on the daily timeframe which could have huge move to the upside going into earnings!

The plan is to wait until the TSLA algorithm enters into a long position on the daily timeframe with TTM Squeeze setting up. RSI is also reversing back into the 50 level which is a good sign along with the MACD signaling a bullish reversal. This can be a big potential move for TSLA and could be our biggest trade for the year yet!

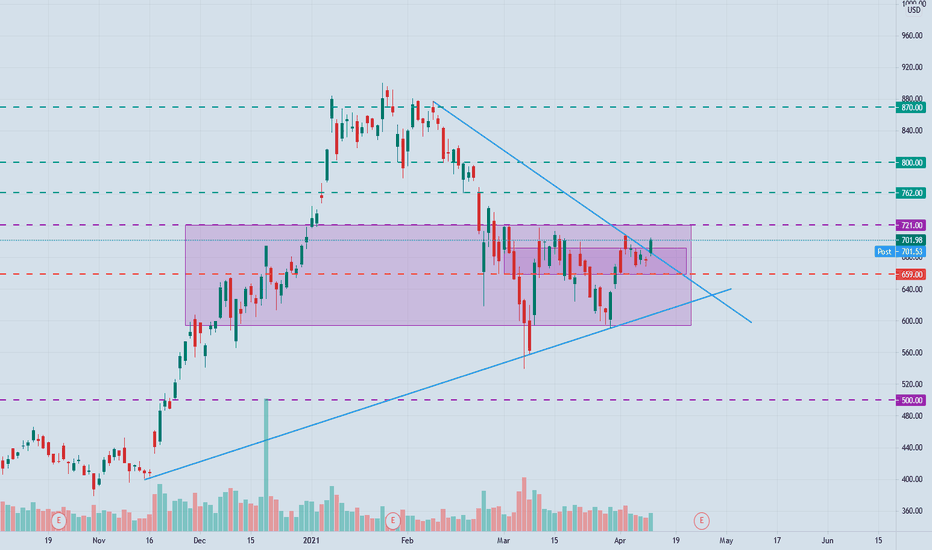

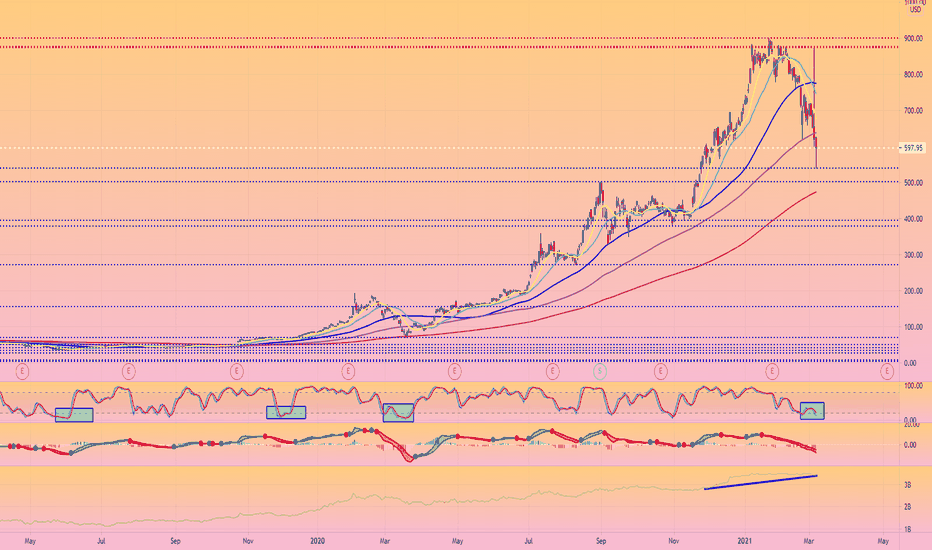

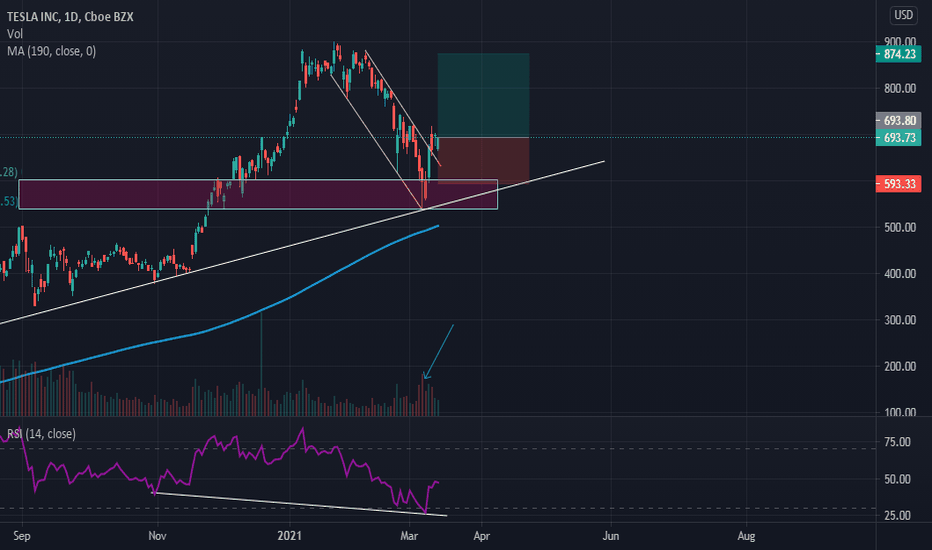

TSLAI think Tesla, Inc. (NASDAQ:TSLA) will have a relief rally next week after its dramatic fall since the January peak of $900. The RSI history of this stock speaks louder. Notice that every time the daily RSI drops below the 30% level, the stock makes a dramatic rise in the weeks after. The performance history of a stock is always an important parameter in my technical analysis. Nowadays, a lot of traders sell any stock when the daily RSI touches 70 and buy when it falls to 30, however, you must analyze the RSI history before making any trade. History does tend to repeat itself and the majority of the stocks have more than one life in them. Another interesting factor on this long-term chart is that the uptrend of the accumulation line remains practically intact after this big drop, which means the stock is still on the positive swing. These are few reasons why I think now is the time to take a long position at this one, before the stock changes its trend and heads back higher. The bottom looks to be in and the risk of more bloodshed is a lot lower than it was weeks days ago. Lets see if I am right.

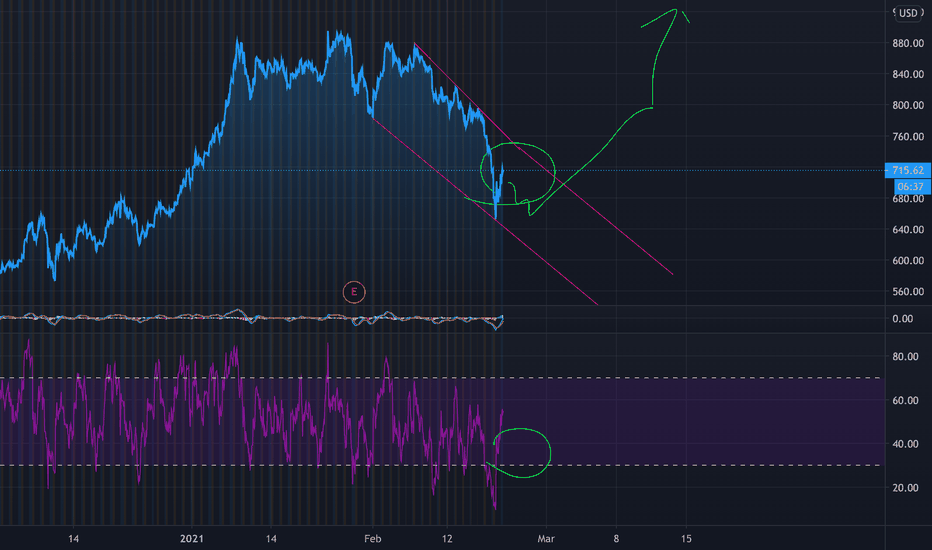

TSLA recovers!TSLA on the opening hours made a huge drop of 10 per cent down but then it recovered back from its 600 low all the way back to 700 after hours today! This is an amazing buying opportunity as it showed in times of turmoil, stocks recover back. This resembles the SPX drop of 30 per cent while not as big in magnitude, it had the same huge drop then a V-shaped recovery back to normal and this may show we are heading to all-time highs! Warning! I am not a financial adviser and take this with a grain of salt. Happy trading!

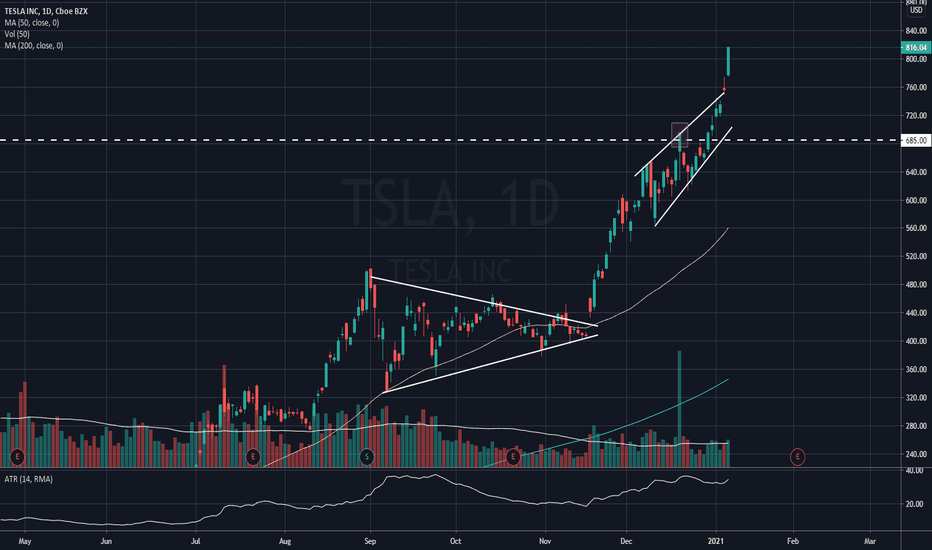

US Stock In Play: $TSLA (Tesla Inc)$TSLA was the top trending ticker symbol over at Twitter ($TWTR) in the last 12 hours, after closing with a +7.94% rally intraday. This is a new all time high attained by $TSLA at $816.04, post split. The breakout have also fully negate the Bearish Wedge chart pattern highlighted in the previous week, with $TSLA breaking above the upper boundary of the chart formation in less than 5 trading session.

Current price volatility is observed to be at a significant range of $35/day ATR-14 (an approximate 4.35%/day). A continuous follow through of momentum tonight (bullish) with pre-market trading beyond $817, is likely to see TSLA trade beyond its limit range of 4.5% to close the week at $860.

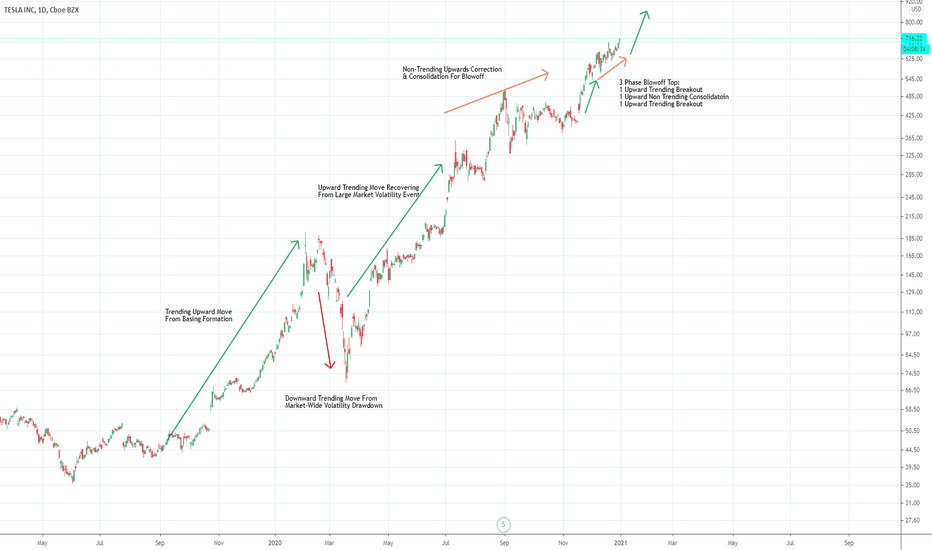

TSLA - Bubble Pattern AnalysisNote: This is just information to compare **potential** bubble formation of TSLA vs. the chart patterns of other historic Bubbles.

Of note, a classic bubble pattern follows as this:

Phase 1: Trending breakout of basing formation in a strong up-trending move

Phase 2: Trending high-volatility drawdown (usually not related to stock or index itself).

Phase 3: Trending recovery - stock or index shrugs off the high volatility event as it recovers quickly and stronger than before.

Phase 4: Upwards & & sideways non-trending consolidation. Typically choppy trading, but slightly upward move.

Phase 5: 3 Phase blowoff top - breakout of non-trending consolidation followed by a smaller upwards consolidation into final blowoff breakout top.

Note: The 5 phases above are fairly consistent across market bubbles in both indexes and assets . They're not present in the formation of every bubble, but they are nevertheless highly prevalent. One item to note is that the duration and distance of each phase can be different, but the patterns remain quite similar. This is worth noting from the perspective of trying to time a breakout on any given pattern ahead of time. You can't just follow simple analogs since the pattern can easily be of a different time or velocity.

Links to other similar bubble patterns:

Nikkei225 (Japan late 1980's bubble)

Roaring 20's Bubble (pre-depression)

3d Systems 3d Printing Stock Bubble - Post GFC

Cisco Systems Dotcom Bubble Chart Pattern