the markets are a very emotional cry babyIf you've ever asked, “Why is the market going up on bad news?” or “Why did it dump after great earnings?”, you're not alone.

Markets may seem logical—economic data in, price action out—but in reality, they’re driven by human emotion, crowd psychology, and reflexive feedback loops. The charts don’t lie, but the reasons behind the moves? Often irrational.

Let’s break down why markets are emotional—and how traders can use that to their advantage.

🧠 1. Markets Are Made of People (and People Aren’t Rational)

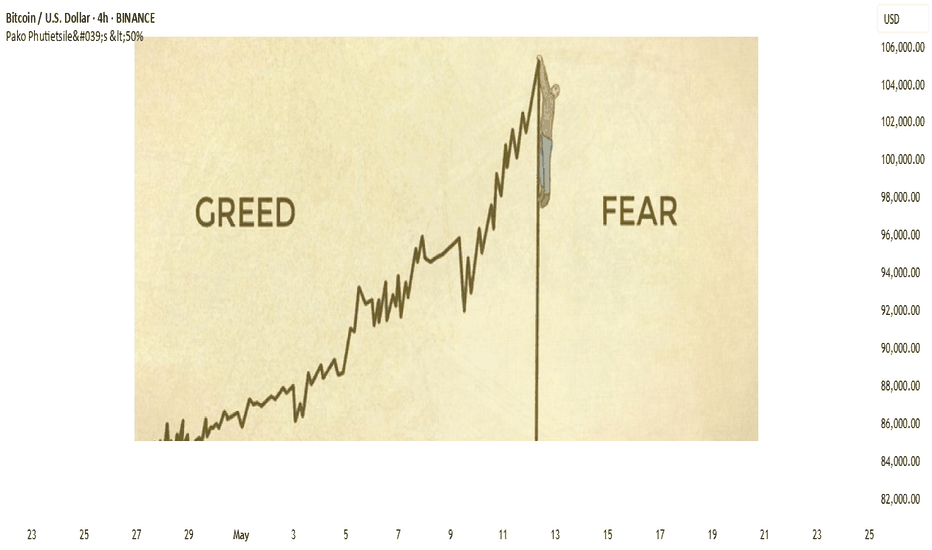

Even in the age of algorithms, human behaviour sets the tone. Fear, greed, FOMO, panic—all of it shows up on charts.

Fear leads to irrational selling

Greed fuels bubbles and euphoria

Uncertainty causes volatility spikes—even with no new information

📉 Example: The 2020 COVID crash saw massive capitulation. Then came one of the fastest bull markets ever—driven by stimulus and FOMO.

another example

📊 S&P 500 in 2020 with VIX, the S&P 500 crashed and the VIX went up, When the VIX (CBOE Volatility Index) goes up, it means that traders/investors expect a greater likelihood of price fluctuations in the S&P 500 over the next 30 days. This generally indicates increased fear as shown on the chart below

📈 2. Price Doesn’t Reflect Facts—It Reflects Belief

The market is not a thermometer. It’s a barometer of expectations.

When traders believe something will happen—whether true or not—price adjusts. If the Fed is expected to cut rates, assets may rally before it actually happens.

💡 Nerd Tip: Reality matters less than consensus expectations.

Chart Idea to visit:

💬 USD Index vs. Fed rate expectations (2Y yield or futures pricing)

🪞 3. Reflexivity: Belief Becomes Reality

Coined by George Soros, reflexivity explains how beliefs can influence the system itself.

Traders bid up assets, creating bullish momentum

That momentum attracts more buyers, reinforcing the trend

Eventually, fundamentals “catch up” (or the bubble bursts)

📌 Insight: The market creates its own logic—until it doesn’t.

😬 4. Emotional Extremes Create Opportunity

When markets overreact, they offer setups for rational traders.

Capitulation = Bottom Fishing

Euphoria = Caution

Disbelief = Strongest rallies

🧠 Pro Tip: Watch sentiment indicators, not just price. Fear & Greed Index, put/call ratios, or COT data reveal what the crowd is feeling.

Chart Example:

📊 Bitcoin 2022 bottom vs. Fear & Greed Index.. on the chart above the index score close to zero (RED) indicating extreme fear this was because in november 2022 crypto cybercrimes grew new level and investors lost confidence, these cyber crimes included the bankruptcy of FTX as the owners were allegedly misusing customer funds.

💡 5. How to Trade Rationally in an Irrational Market

a. Have a plan. Pre-define entries, exits, and invalidation levels.

b. Expect overreaction. Markets often go further than they “should.”

c. Use sentiment tools. Divergences between price and emotion are gold.

d. Don’t fight the crowd—until it peaks. Fade extremes, not momentum.

e. Zoom out. 5-minute panic means nothing on a weekly trendline.

🎯Nerd Takeaway:

Markets aren’t efficient—they’re emotional.

But that emotion creates mispricing, and mispricing = opportunity.

You don’t need to predict emotion—you just need to recognize it, and trade on the reversion to reason.

💬 Have you ever traded against the crowd and nailed it? Or got caught up in the hype? Drop your chart and your story—let’s learn from each other.

put together by : @currencynerd as Pako Phutietsile

Tumimokgosi

stock clusterization.there are various significant classes of stocks that help investors/traders to make more insightful and informed decisions when choosing the right stocks of choice here are my most important and favorite.

1.MARKET CAPITILIZATION

this is the size/ total value of a company's outstanding shares of stock,

which can be calculated with a simple formula of :

outstanding shares X share price of stock = market cap value

MEGA CAP = capitalization of over $200 Billion.

LARGE CAP = $10 Billion - $200 Billion

MID CAP = $2 Billion - $10 Billion

SMALL CAP = $300 Million - $2 Billion

MICRO CAP = $50 Million - $300 Million

NANO CAP = under $50 Million.

- the larger the market cap the more stable and safer the stock, even though they are less liquid and more risky smaller cap companies provide more room for growth.

2. LIQUIDITY

this is how fast and easy stock shares can be sold and bought without significant impact on stock price or simply transaction speed and easiness.

HIGHLY LIQUID = Volume (OVER 1,000,000 shares traded daily) - LOW SPREAD

LIQUID = Volume (100,000 - 1,000,000 shares traded daily) - MEDIUM SPREAD

ILLIQUID = Volume (Under 100,000 shares traded daily) - HIGH SPREAD

3. BUSINESS LIFECYCLE

these are the most crucial stages of a business from the very beginning to the end product which tracks it's growth, maturity and decline. this is highly significant as it aids investors identify potential business growth or downsides.

the main 5 lifecycle stages are :

1. Starp-up - the development stage of business showcasing projection of future business dealings and events.

2. Growth - this phase is when operations are ongoing and business expands and cashflow increases, its key on how business survives and grows

3. Maturity - a company reaches maturity when it stands firm on its feet showcasing recurring revenue which is the stage where crucial management of resources ensuring continued growth.

4.Decline - this is stage for companies that didn't have a prolonged revenue and growth due to external and market conditions and capital and market expertise is necessary to safe and keep business afloat in this phase.

5. Exit - this is when a business is in a stage where original investors choose to exit company either by Initial Public Offering / executive buyout.

4. DIVIDEND POLICY

this is a policy that a business/company uses to structure dividend payout to common stock sharesholders.

this is crucial also when stock-picking or classification as no dividend companies don't pay dividend on stocks and usually reinvest the profits back in business this may increase expansion and growth and stock price guaranteeing higher returns when investor may choose to sell stocks.

put together by : Pako Phutietsile as @currencynerd

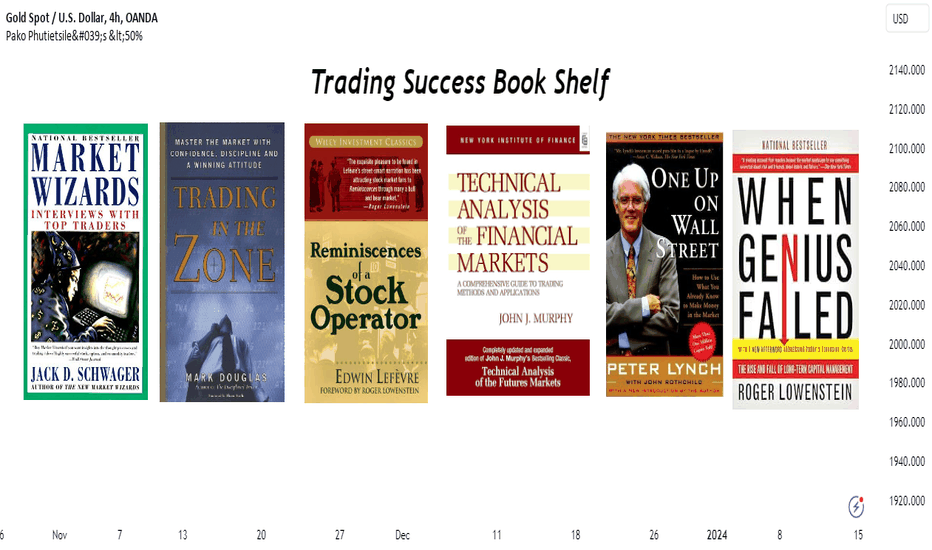

Top Trading BooksLiterature is one of the best ways to share and spread knowledge and information around the world, here are my top picks of the most informative, knowledge packed trading books that can help improve and transform your trading approach for the better.

1. Market Wizards - by Jack Schwager, 1989.

this consists of a series of interviews from a couple of the world's renowned traders including Paul Tudor James, Bruce Kovner, Richard Dennis and several others as they share tips and insights on what makes them the best from the rest. It reveals to traders/investors some of the traits it takes to become a successful trader.

"the elements of good trading are (i) cutting losses, (ii) cutting losses, (iii) cutting losses.

2. Trading In The Zone : master the markets with confidence, discipline and a winning attitude - by Mark Douglas, 2000.

this is mostly a trading psychology book that explores the significance of the right mindset when pursuing trading success as well as ways to maintain and gain emotional intelligence in the fast-paced trading environment and how emotional control is an essential part in any trading plan.

"do not let past loses influence your future"

3. Reminiscence Of A Stock Operator - by Edwin Lefèvre, 1923.

published almost 100 years ago, inspired by the life of stock trader Jesse Livermore. This book highlights tons of experience he gained in the stock market from the failures to success that even present day traders face.

"there is nothing like losing all you have in the world for teaching you what not to do, and when you know what not to do in order not to lose money, you begin to learn what to do in order to win"

4. Technical Analysis Of The Financial Markets : a comprehensive guide to trading methods and applications - by John Murphy, 1999.

given the name "the bible of technical analysis" updated from his landmark best seller "technical analysis of the future markets" if you want to learn how to track market behavior this is the book for you. if also offers from basic trading concepts to advanced trading concepts covering also different technical indicators and over 400 chart illustrating different market techniques. after reading i am sure you will be able to create a trading system that fits oneself.

"it should be stressed here again, however that basic trend analysis is still the overriding consideration"

5. One Up On Wall Street - by Peter Lynch, John Rothchild, 1989.

this book focuses more on the importance of research, study and analysis to go from beginner to expert trader as well as the different investment opportunities in our everyday life's that expert investors are not even aware of. Most importantly the effective investment techniques, strategies and guidelines that aided Peter to become one of the best fund mangers of all time.

"the trick is not to learn to trust your gut feeling, but rather to discipline yourself to ignore them"

6. When Genius Failed - by Roger Lowenstein, 2000.

this book tells the story of the rise and fall of one of the most impressive hedge funds Long-Term Capital Management which has more than $120 Billion under management before its downfall in 1998. The book is written in 2 sections, the first focuses on the 'genius' business model of the hedge fund that delivered more than 40% between 1994 and 1998 and the second segment explores the firm's downfall.

"investors long for steady waters, but paradoxically the opportunities are richest when the markets turn turbulent"

but together by : Pako Phutietsile ( @currencynerd )

new year, new trader Happy new year to all @TradingView users

A new year is often regarded as new and fresh beginning, the start of something new, i hope this is the year we excel and reach the kind of success and profitability we all long for and if you have reached it i hope to get the wisdom to maintain and improve on it.

here are some things to leave behind in 2023 that can help on your trading journey to being a successful trader:

-Fear of being stopped out or fear of taking a loss

- Getting out of trades too early

- Adding on to a losing position

- Wishing and hoping instead of having a sound approach to the markets

- Not trusting your trading system

- keep a trading journal

-overtrading ( random trades)

and here are the things you should consider doing to improve your trading in 2024:

-Educate Yourself

-Create a comprehensive trading plan

-Practice with a Demo Account

-Start Small: When transitioning to live trading

-Use Proper Risk Management always

-Stay disciplined

-learn from past mistakes

i hope this information helps you a lot. To a whole lot more trading knowledge sharing.

put together by : Pako Phutiestile ( @currencynerd )

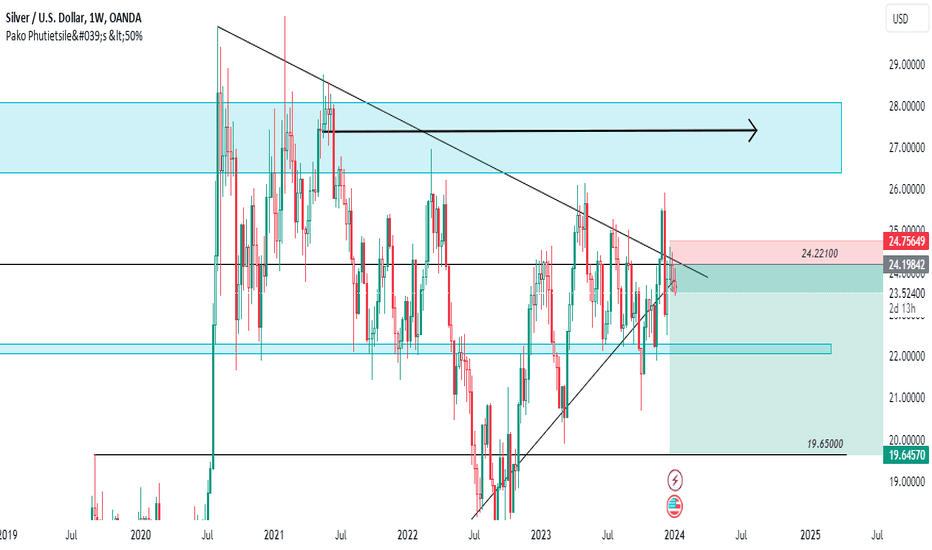

swing traders are going to love this!the trade bias on this idea is strictly based on technical analysis.

going straight to the monthly price chart liquidity pool ranging from 28.08800 to 26.39800 has been the current significant price area in control of price since a rejection from the area in 01 march 2022.

price has been also showing signs of bearish rejection from price levels @ 25.40550 failing multiple times to close above, price continues to indicate increasing bearish momentum with bearish trendline (acting as dynamic support & resistance) still intact with no full OHLC candlestick closing above and MONTHLY candlestick currently trading below bullish trendline which closes in 28days a close above is extra confirmation for a continued move to the downside.

i have targets at previous high @ 19.6500 with just below it resting fresh demand zone, but the next bearish price of interest is liquidity pool ranging from 22.00100 to 22.25650 if we clear it then all aboard the TP cruise ship.

put together by : Pako Phutietsile ( @currencynerd )

SUPPLY AND DEMAND RULES ALL MARKETS