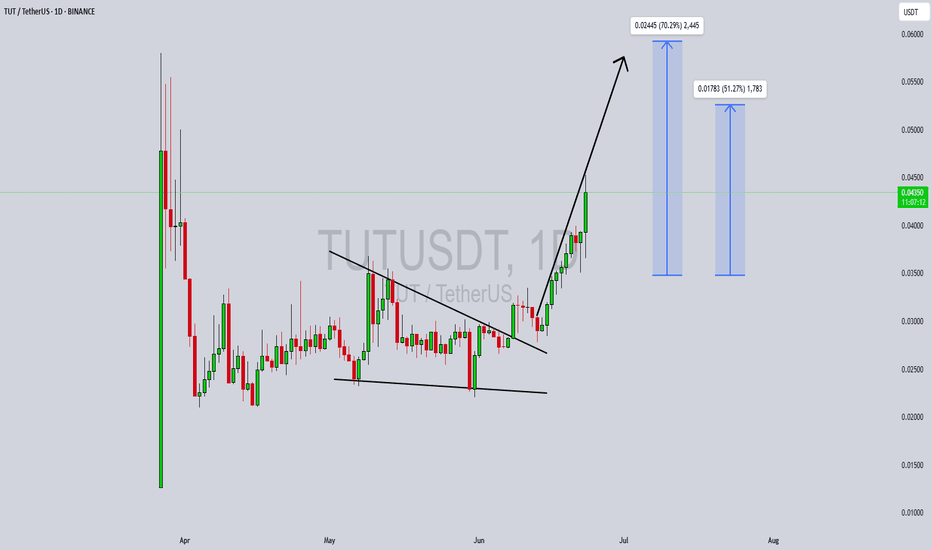

TUTUSDT Forming Bullish BreakoutTUTUSDT is currently showing a bullish breakout from a falling wedge pattern on the daily chart—a highly reliable reversal setup often signaling the end of a downtrend and the beginning of an upward move. This breakout is accompanied by a healthy increase in volume, adding further confirmation to the move. Falling wedges are generally considered powerful patterns, especially when followed by strong bullish candles as seen here. This setup is attracting both technical traders and market watchers who are closely monitoring the next leg up.

The potential for a 40% to 50% gain is clearly visible on the chart, with projection targets well-defined and aligned with recent price action. The momentum is building, and TUTUSDT seems to be gearing up for a strong continuation rally. A sustained move above the wedge resistance and current local highs could pave the way for a retest of key resistance zones from previous price spikes.

This breakout comes at a time when broader market sentiment is slowly shifting toward optimism. As the altcoin space regains traction, tokens with solid technical setups like TUTUSDT become prime candidates for short- to mid-term investment. Additionally, the relatively low market cap and increasing investor interest in this project add further fuel to its upside potential.

For traders seeking early-stage breakouts with strong technical structure and positive sentiment, TUTUSDT offers an attractive opportunity. Keep an eye on volume continuity and market-wide conditions as confirmation for a full rally toward the upper targets mentioned in this setup.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Tutbtc

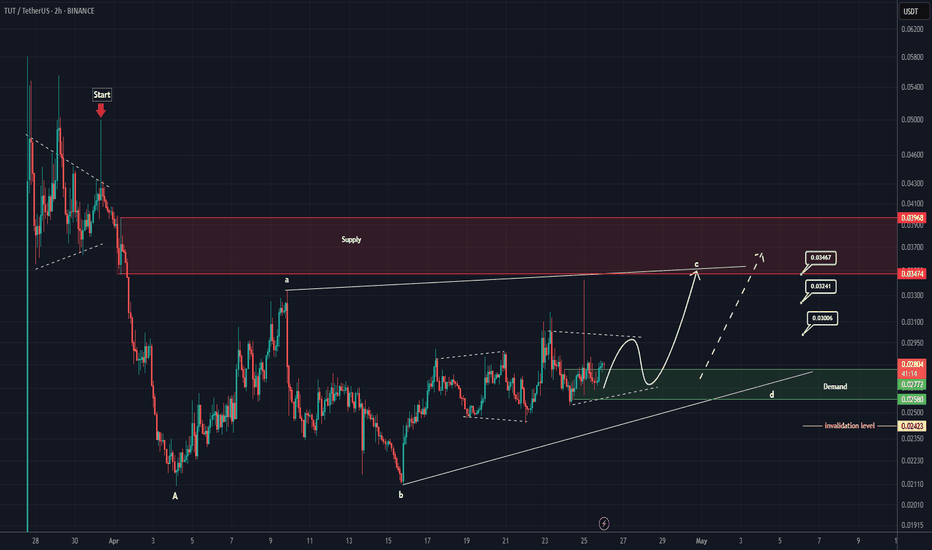

TUT Analysis (2H)From the point marked as "start" on the chart, the TUT correction has begun.

It appears to be an ABC correction, and we are currently in wave B of this ABC.

Wave B seems to be a complex correction, possibly a triangle or a diametric, and we are currently in wave c of B.

Wave c of B itself appears to be forming a symmetrical pattern.

It is expected to move toward the red box while maintaining the green zone.

The targets are indicated on the chart.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

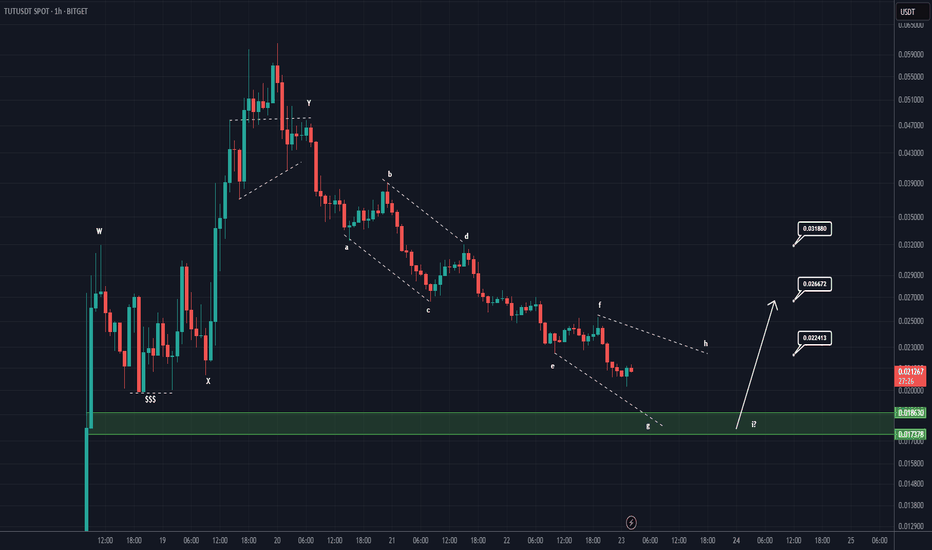

TUT ANALYSIS (1H)It seems that wave A has completed, and this token has entered wave B, which is bearish. The wave B structure appears to be symmetrical.

In the green zone, the price may sweep the liquidity pool and bounce upward.

Targets are marked on the chart. A 4-hour candle closing below the invalidation level will invalidate this analysis.

invalidation level: 0.015680$

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You