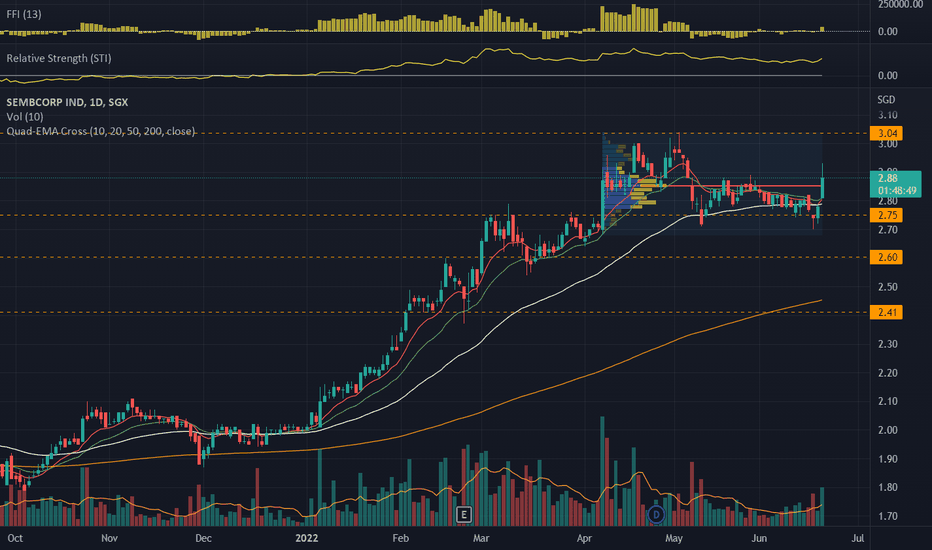

U96.SGX_Bullish Pullback Trade_LongENTRY: 2.88

SL: 2.75

TP1: 3.04

TP2: 3.20

- ADX<20. Would like to be higher.

- Daily RS +ve

- Daily FFI +ve

- Weekly RS +ve

- Weekly FFI +ve

- Moving averages are aligned.

- Stoch RSI rebounding off 30.

- Brokeout previously on 7 Apr 2022 with volume and retraced to resistance-turn-support area.

- 17 Jun 2022 hammer candle shows potential buyers coming in.

- Entry today based on >2% rebound off 10EMA with volume