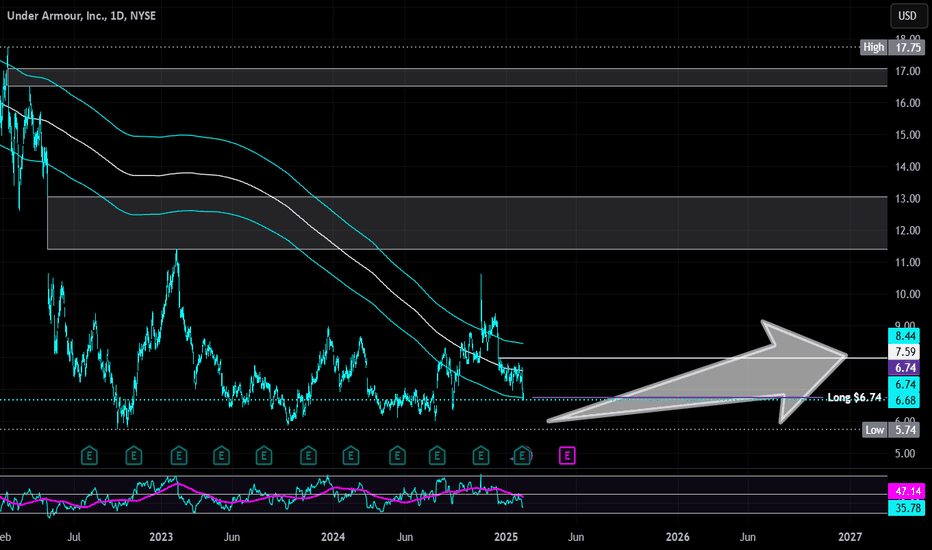

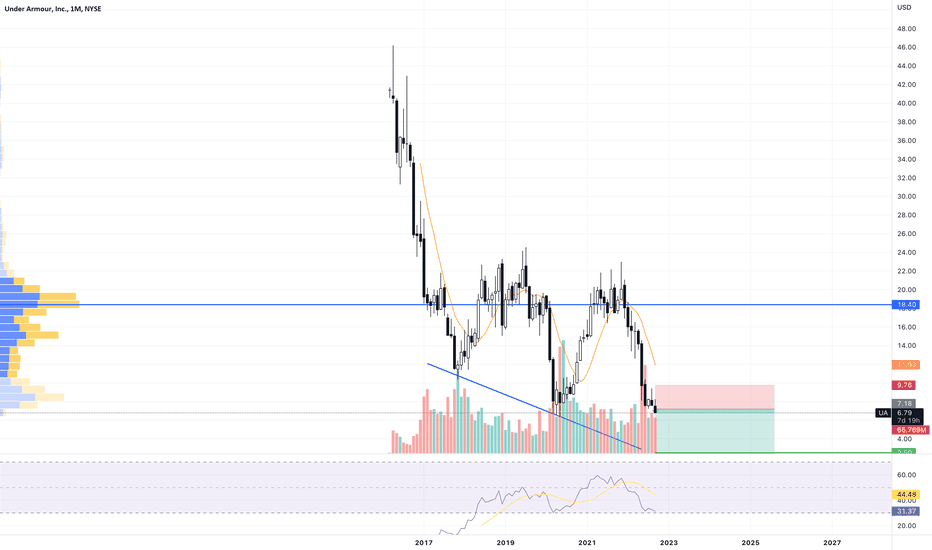

Under Armour | UA | Long at $6.74Under Armour $NYSE:UA. Price may break my historical simple moving average area/lines and dip into the low $6s, but the convergence of price with these lines often means a future price increase. Fundamentally, the stock continues to surprise with earnings beat after earnings beat. While economic headwinds are likely ahead in the retail market, global exposure may ease the likely troubles. Starter position entered at $6.74.

Targets

$7.50

$8.00

UA

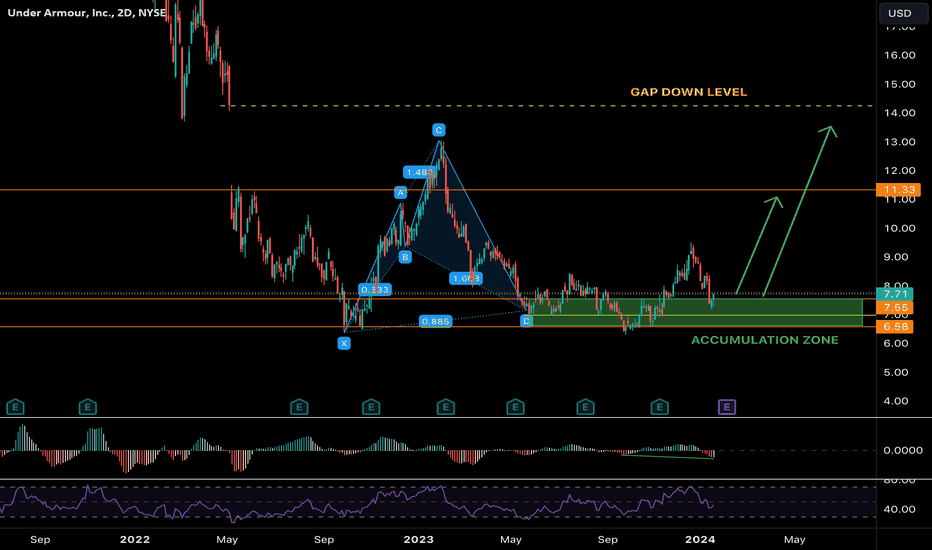

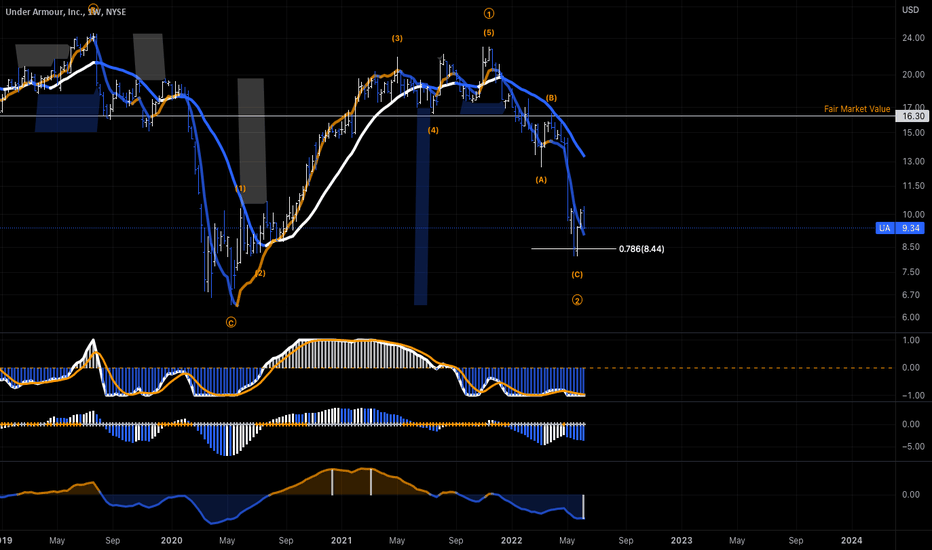

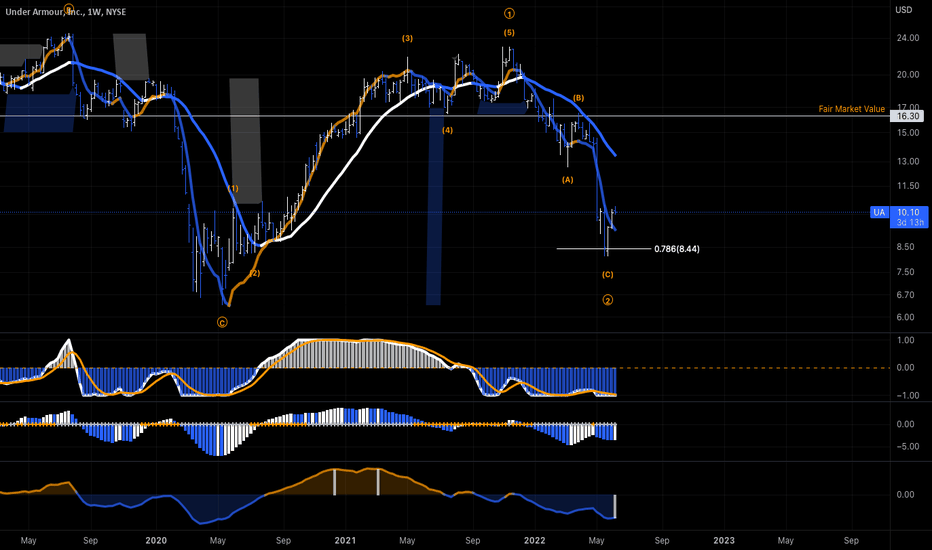

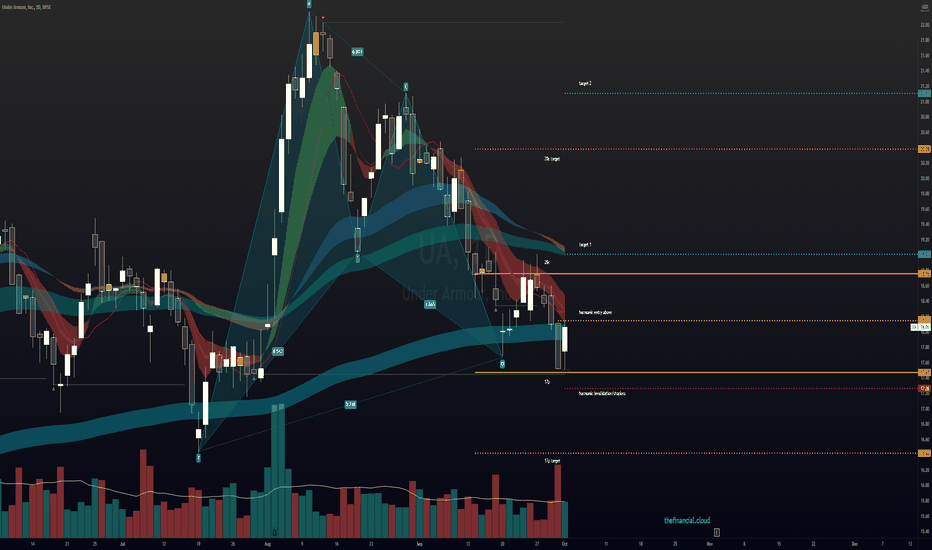

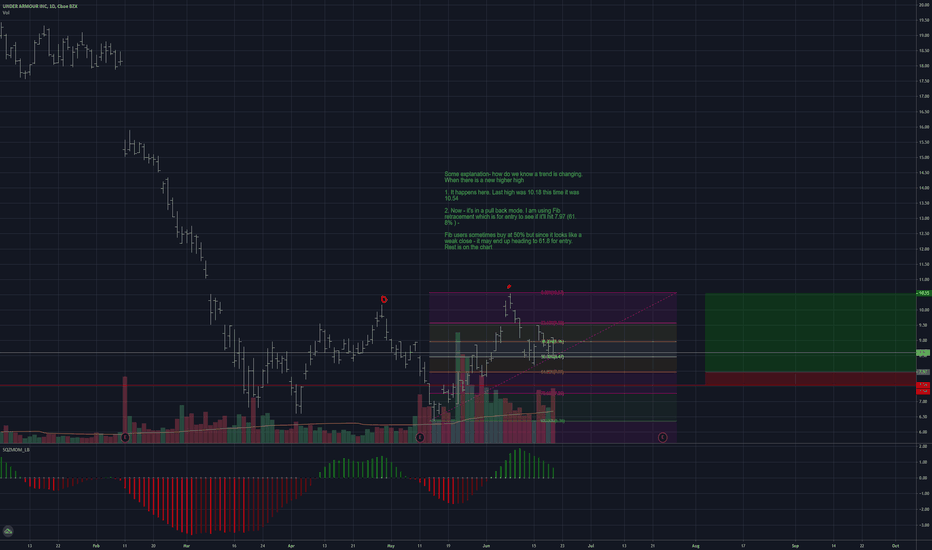

UA still an amazing pick for 2024UA completed this bullish harmonic over 8 months ago. It hit our first tp of the trade set up before falling below the key level where we were stopped out.

We do not have an open leveraged position on this asset but we are accumulating it at these levels as it has turned bullish again.

The spring back above the key level and the backtest that has occurred indicate that it is ready to go. Above 6.5 it is bullish, we are creating bullish divergence also.

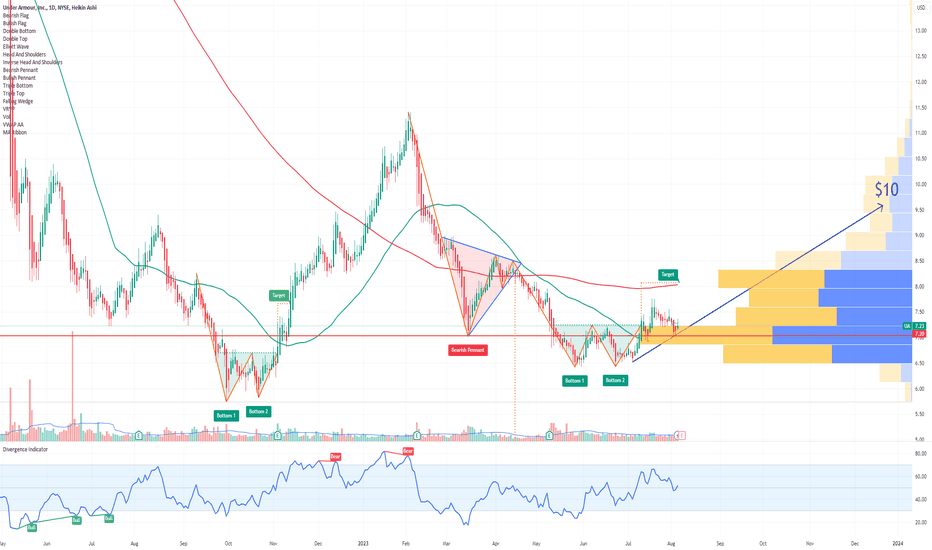

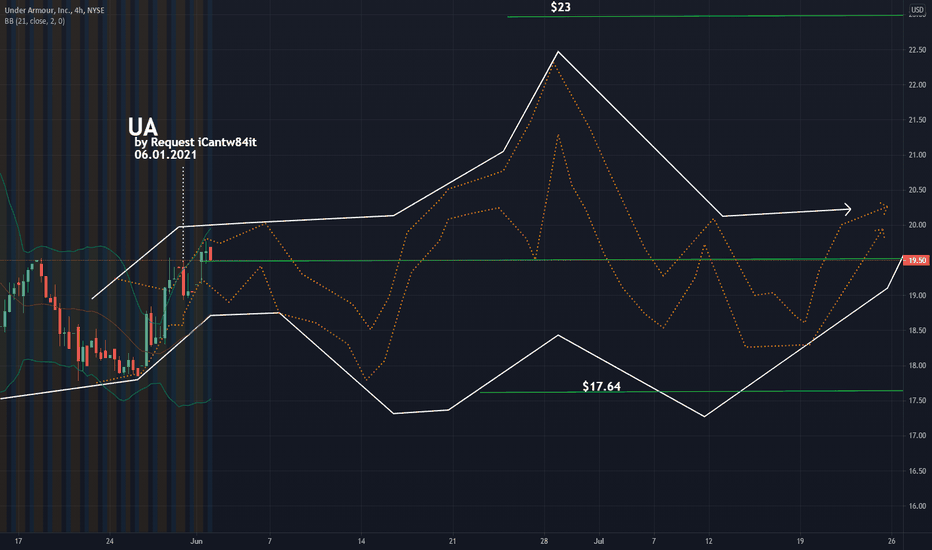

UA Under Armour Options Ahead of EarningsAnalyzing the options chain and the chart patterns of UA Under Armour prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $0.27.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

BEST STOCK PICK MEDIUM AND LONG TERMUA has the best possible set up you could ask for. I am in this from the entry point on the trade and will add if this support holds... I know I should've posted it earlier.

A double bottom at a critical level completing the typr two return of the bullish cypher. Along with this showing bullish divergence. On top of this the weekly looks AMAZING .

It might take a while to play out but you can't ask for a better set up.

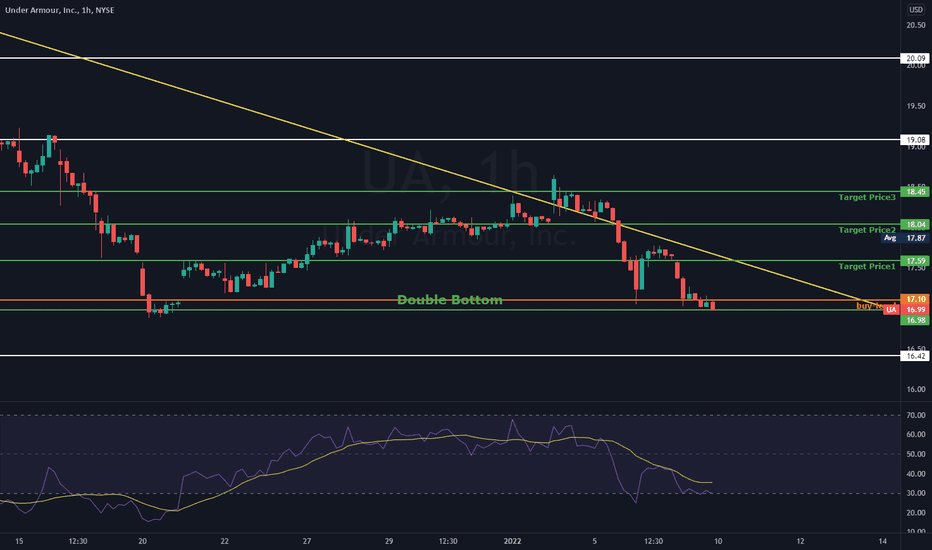

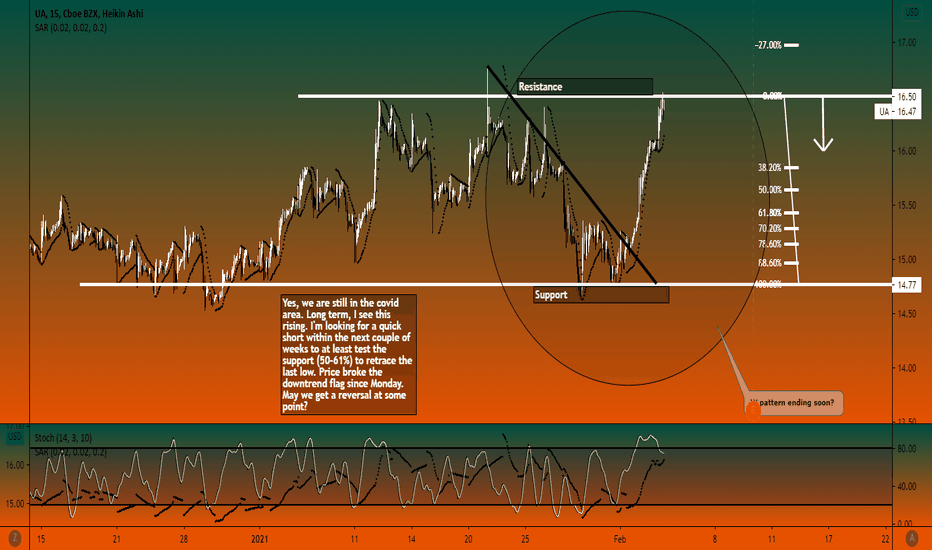

UA | LongNYSE:UA

Possible Scenario: Long

Evidence: Price action, Money-flow, Double Bottom reversal pattern, Oversold dead cat bounce scenario

Entry Point: 17.10$

TP:17.59$

TP2:18.04$

TP3: 18.45$

*This is my idea and could be wrong 100%

*I'll update this post if I open a position based on Entry point; if it doesn't hit it, the Idea is void.

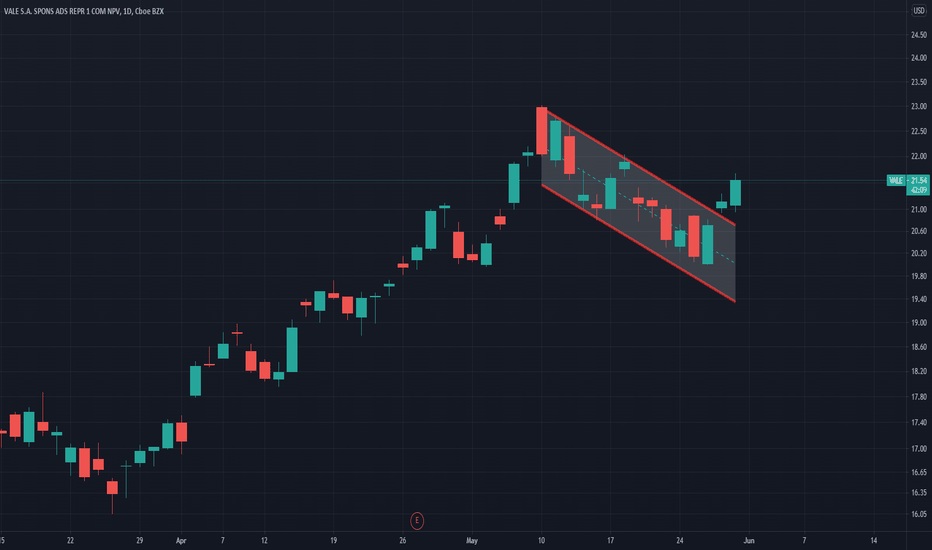

Recommended portfolio for the next 2 weeks!The ideas behind this portfolio are:

1- Benefiting from possible 6 trillion dollars infrastructure bill.

2- Being properly hedged using commodities.

3- Having exposure to the Tourism industry, apparel, and increased demand for gas in post-pandemic era.

My recommended asset allocation:

50% stock:

25% cash:

25% Gold:

0 Cryptocurrency

NYSE:VALE

NYSE:RIO

NYSE:SCCO

NYSE:CLF

NYSE:X

NYSE:FCX

NASDAQ:ABNB

NYSE:UA

NYSE:XOM

NYSE:AON

Use trailing stop loss..!

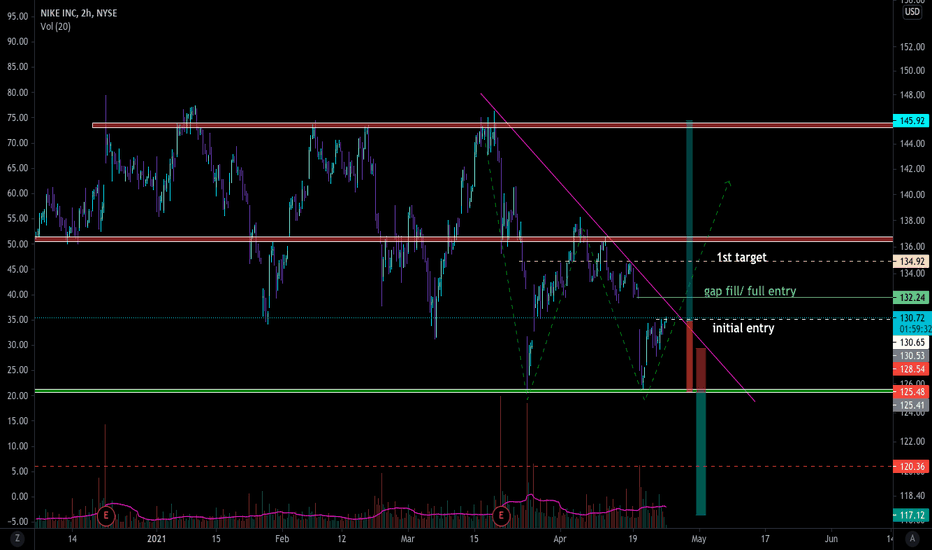

NKE time for reversal?$NKE 2HR CHART-

NKE had a nice double bottom and is currently going for that retest of the downtrend resistance (pink). Also has a nice gap fill at 132, eyeing the volume on the breakout for momentum to carry it to the next supply zone at 136. Under 125 would invalidate this idea.

Under Armour Inc 🧙Under Armour develops, markets, and distributes athletic apparel, footwear, and accessories in North America and other territories. Consumers of its apparel include professional and amateur athletes, sponsored college and professional teams, and people with active lifestyles. The company sells merchandise through wholesale and direct-to-consumer channels, including e-commerce and more than 400 total factory house and brand house stores. Under Armour also operates a digital fitness app called MapMyFitness. The Baltimore-based company was founded in 1996.

If you want more trading ideas like this one ,🎯 press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!

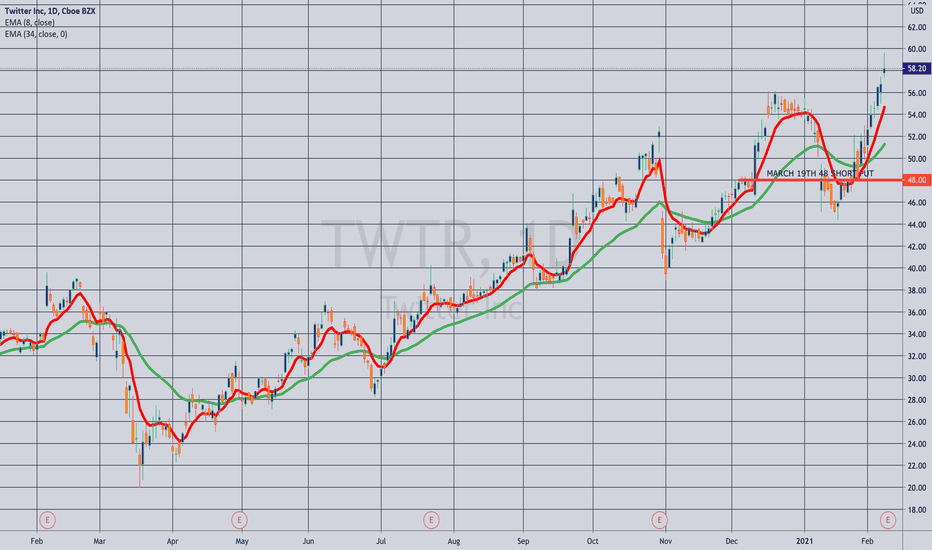

THE WEEK AHEAD: TWTR, TEVA, UA, UBER, ZNGA EARNINGS; MJ, SLVA little late to the game this week, but don't think I missed much.

EARNINGS ANNOUNCEMENTS IN UNDERLYINGS WITH HIGHLY LIQUID OPTIONS:

TWTR (53/84),* announcing Tuesday after market close.

TEVA (16/63), announcing Wednesday before market open.

UA (42/68), announcing Wednesday before market open.

UBER (11/59), announcing Wednesday after market close.

ZNGA (11/63), announcing Wednesday after market close.

Pictured here is a plain Jane 16-delta short put in TWTR in the March monthly, paying 1.48 at the mid price as of today's close with a 46.52 break even/cost basis if assigned, 3.18% ROC at max as a function of notional risk. If you're of a nondirectional bent, consider the March 19th 49/70 short strangle paying 3.00 or the 44/49/70/75 iron condor, paying 1.30.

Due to the obvious skew here, I'd also consider a double double, but it would require going ten wide on the call side due to only 5 wides being available on the call side in March at the deltas I'd want to camp out, so it's less than ideal: 2 x 42/2 x 47/70/80, paying 2.42, delta/theta 1.41/4.55.

EXCHANGE-TRADED FUNDS RANKED BY 30-DAY IMPLIED VOLATILITY:

MJ (74/89)

SLV (34/50)

ICLN (7/45)

JETS (7/43)

XRT (21/41)

EWZ (14/40)

XLE (18/38)

GDX (12/38)

BROAD MARKET RANKED BY 30-DAY IMPLIED VOLATILITY:

IWM (24/31)

QQQ (14/26)

SPY (10/21)

DIA (7/19)

EFA (13/18)

* -- The first metric is where 30-day lies relative to where it's been over the past 52 weeks; the second, 30-day implied.

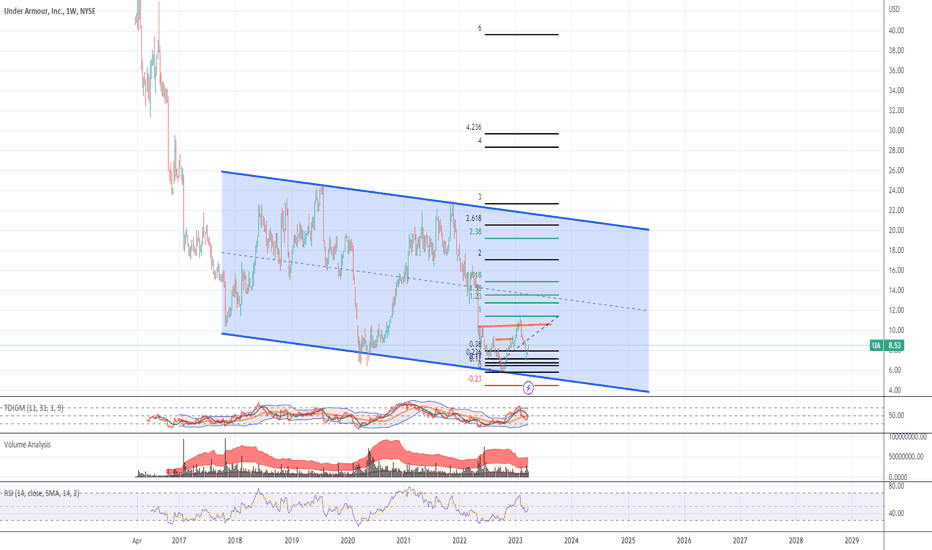

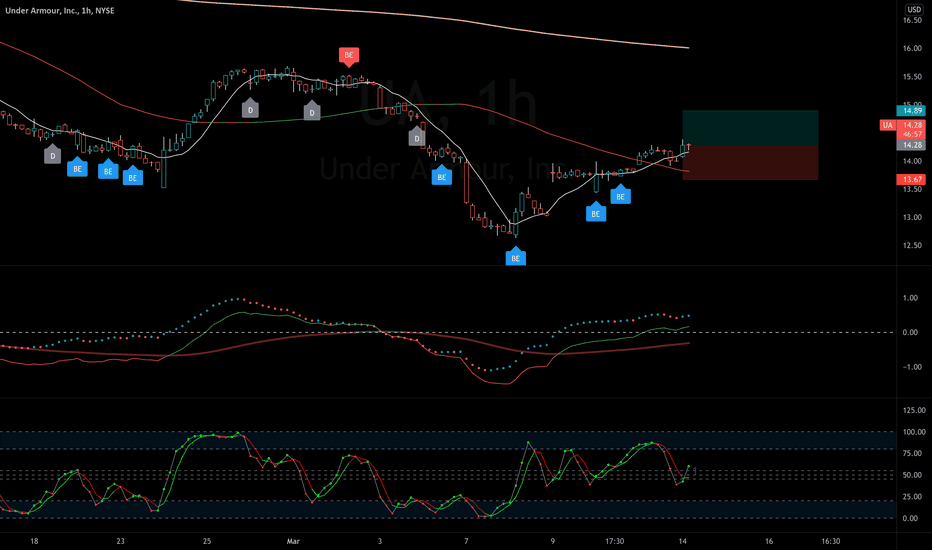

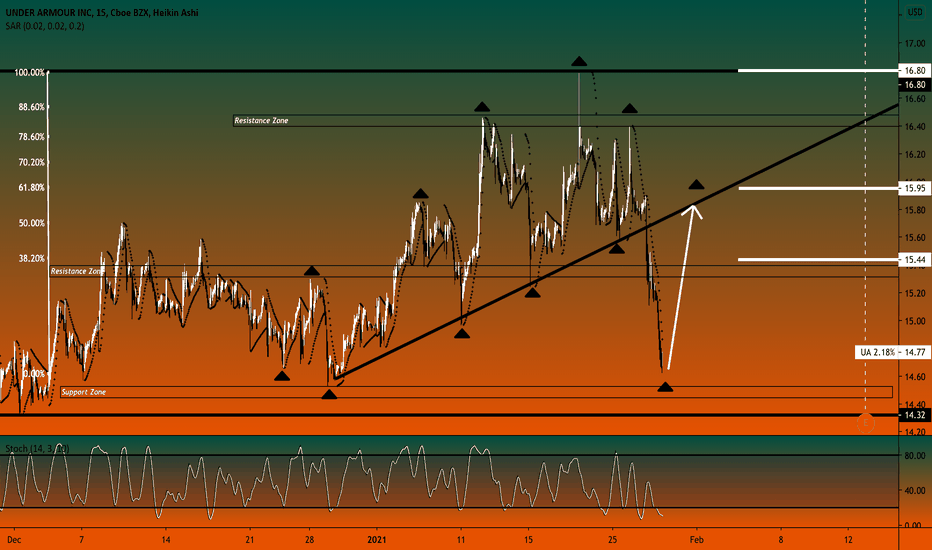

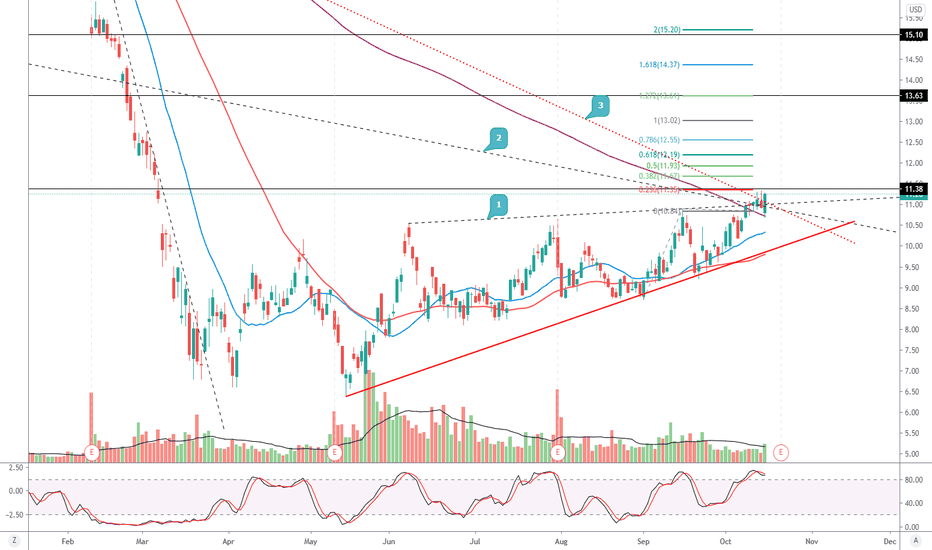

UABased on my analysis:

1. UA formed ascending triangle's chart pattern (19 May-12 Oct> 151days).

2. Yesterday, UA breakout 3rd trendline with high volume.

3. Now, UA is a above MA 200.

4. My target to TP (1) 12.55 USD, (2) 13 USD, (3) 13.60 USD & (4) 15.10-15.20 USD> invest.

*For me, UA is a great stock for long-term investment.

Syeikh Hafiz

Stock Market Analyst

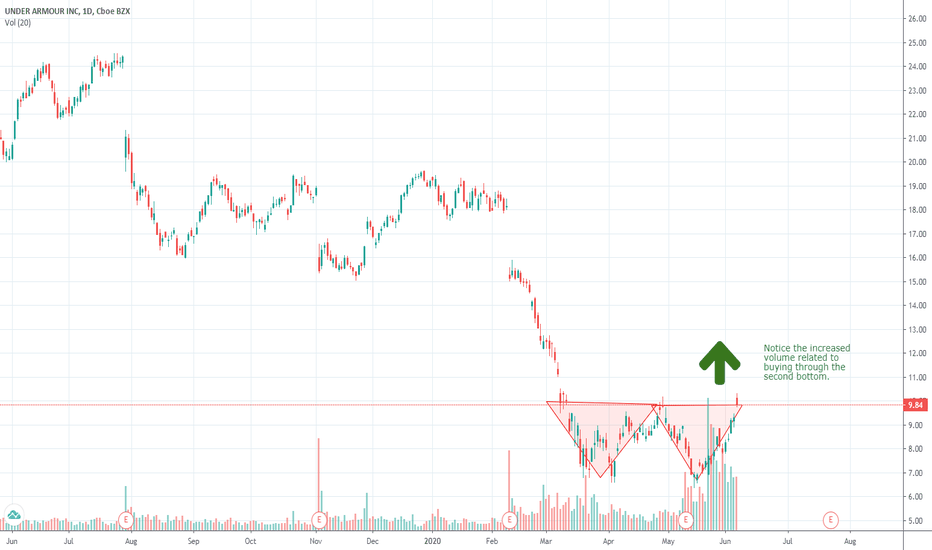

UA Double Bottom IdentifiedHi - First time publisher but have sporadically used Trading View. I have been reading up and studying on technical analysis and from what I am seeing, it looks like I identified a double bottom on a stock I was already bullish on at current levels, Under Armour.

Given a move the same size as the bottom, looks like the PT would land around $13.27 give or take a few cents. I also noticed there does not seem to be much resistence running up to around $15.

Let me know your thoughts whether you agree or disagree!

Cheers & GL

Lando