Uberforecast

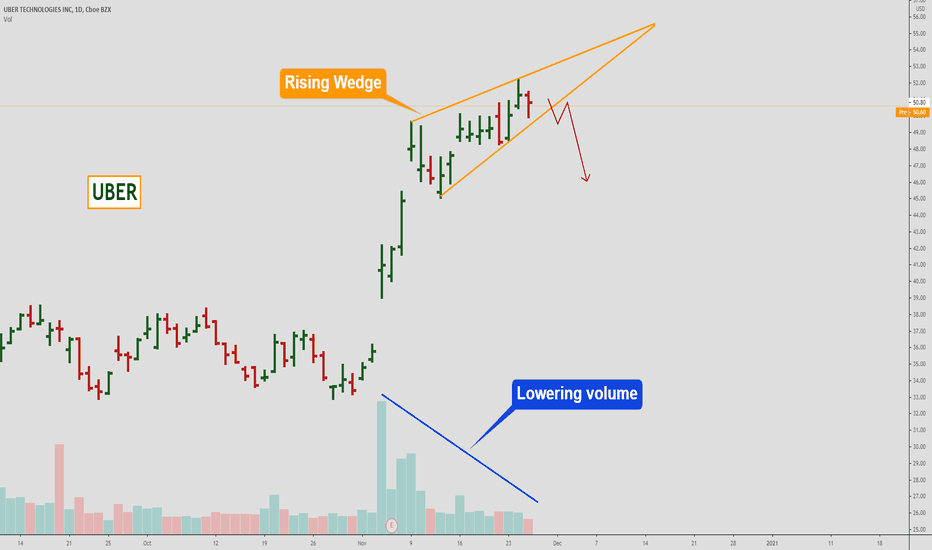

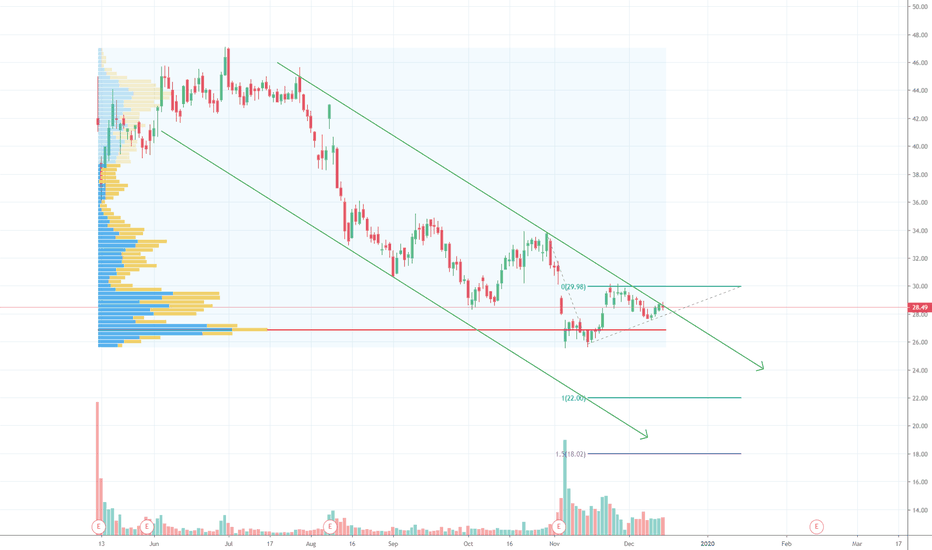

UBER - Rising WedgeThis usually occurs when a security’s price has been rising over time

The trend lines drawn above and below the price chart pattern can converge to help a trader or analyst anticipate a breakout reversal. While price can be out of either trend line, wedge patterns have a tendency to break in the opposite direction from the trend lines.

Therefore, rising wedge patterns indicate the more likely potential of falling prices after a breakout of the lower trend line. Traders can make bearish trades after the breakout by selling the security short or using derivatives such as futures or options, depending on the security being charted. These trades would seek to profit on the potential that prices will fall.

You will learn the best place where we can trade this instrument at low risk.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

😭 Sorry Guys... Kind Of Late On (UBER)💰 LET'S GET INTO SOME UBER ANALYSIS!💰

1️⃣ First off SMASH that LIKE BUTTON & Give us a FOLLOW for DAILY ANALYSIS! ❤❤❤

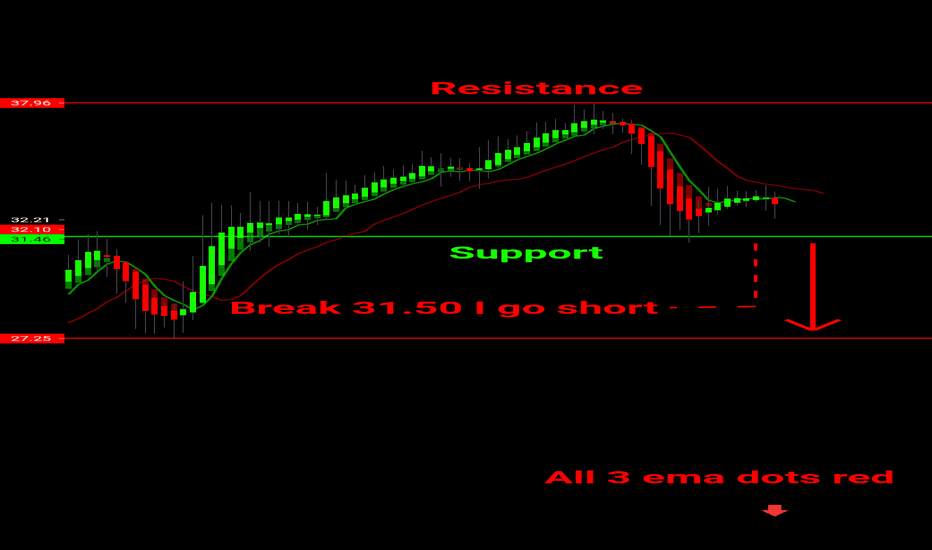

(Overall Market Sentiment) 🐻 Bearish

- Man I wish I would of had checked this one on the daily chart about a week ago. Beautiful crossover Crossover ema dots played out. No worries, let's catch the new wave!

- We are getting a red Crossover with an engulfing candle, this would good be a good short but we need to consider how close we are to support. I would rather look for the breakout on the 31.50 support to go short for most likely a 10-13% play to the next low.

- We so have one previous touch at 31.50 and rebounded but not by much! Let's see how it holds up. If it did hold and compressing with a green Crossover we will go long based off of the fact we did have that recent support.

- All 3 ema dots are firing red.

Drop your chart below in the comments section and share with us what you think will happen next! ❤❤❤

Thanks for checking out our analysis! ✌😁✌

🥇MLT | MAJOR LEAGUE TRADER

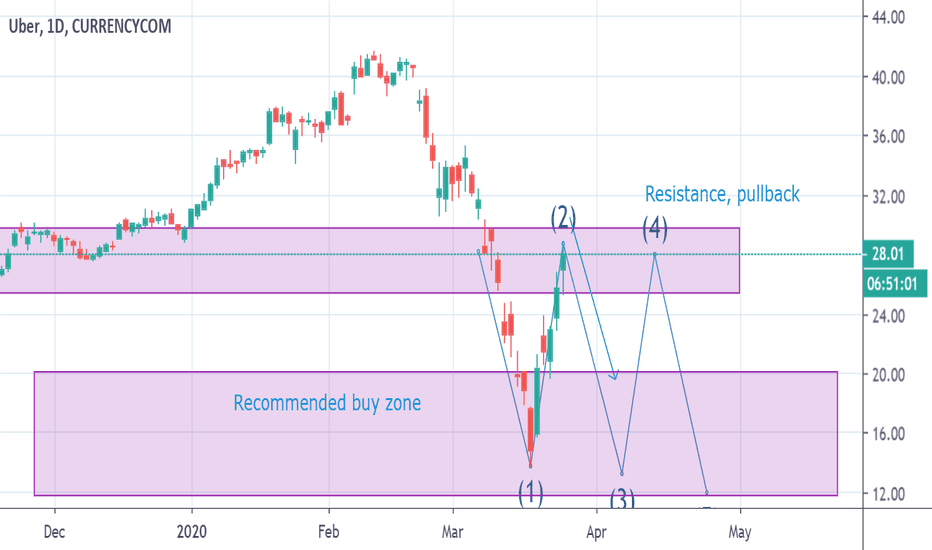

UBER - Pullback coming soonHello,

I made this graphic showing you the top support that when uber hit it will pullback to the bottom.

I recommend you to buy on the indicated zones.

Thanks.

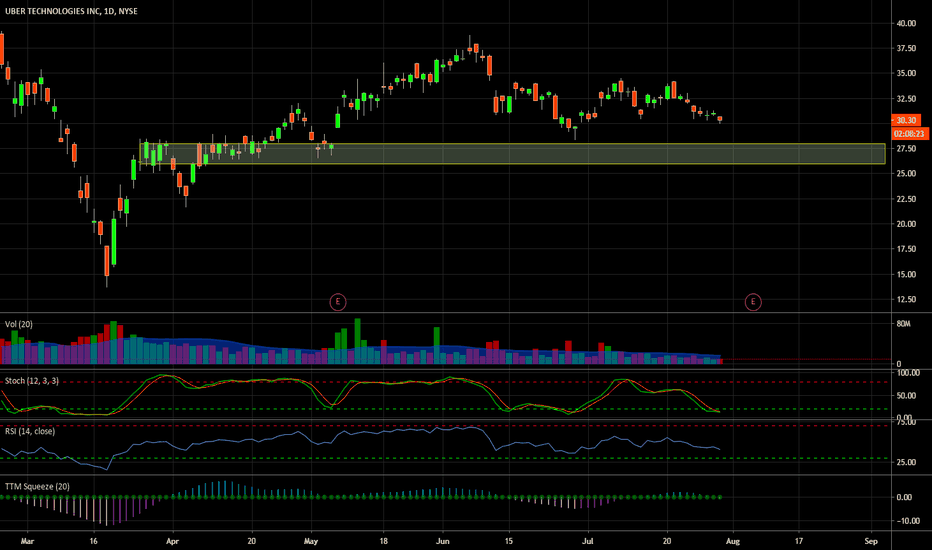

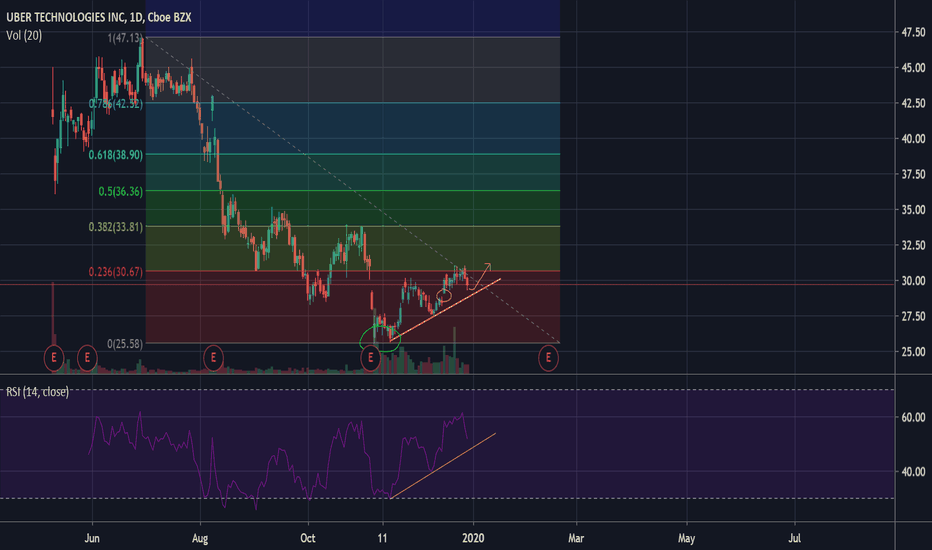

Uber has bottomedCapitulation followed by massive volume at around $25.50.

Double bottom circled in green.

Gap to be filled around $41.

Small gap to be filled circled in yellow.

Yellow trend-line with confluent are at the gap fill.

RSI has some room before it hits the yellow RSI trend-line reinforcing the idea of a gap fill n' go.

Fundamentally speaking, news co-founder has been liquidating all his shares but price has not tanked on this news.

Just like Facebook and alot of early tech stocks we saw a selloff after the IPO hype and rally after the haircut.

Like Facebook, UBER is already ingrained in much of our lives and it is hard to believe it will be gone so soon.

Tell me what you think.

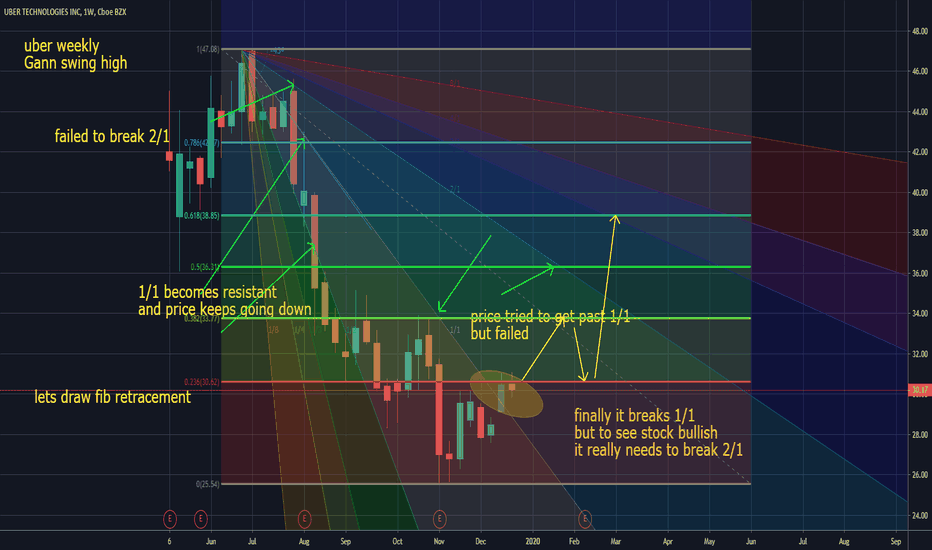

UBER SHORT to $20, former CEO dumps shares! UBER has been on a strong downtrend since the IPO, the company has not yet turned a profit and expenses are through the roof with little hope to switch to the long side in the near future. To add to that the co-founder and previous CEO Kalanick continues to dump shares, another +$160 Million worth and the stock continues to trend lower while volume to the sell side increases.

The previous broken low at around $30.00 held as resistance on a retrace and the rotations indicated a continued short where price fell from, price is not at an all-time low anymore where support lies. The IPO to date POC is at $26.85 which is going to be strong support but there is a strong chance it break and price moves into the expansion level at $22.00. We just need to break through the support barrier. The price is at the top of the downward channel which is holding resistance.

Disclaimer: This idea is for educational purposes only, this does not constitute as trading or investment advice. TRADEPRO Academy is not liable for any market activity.