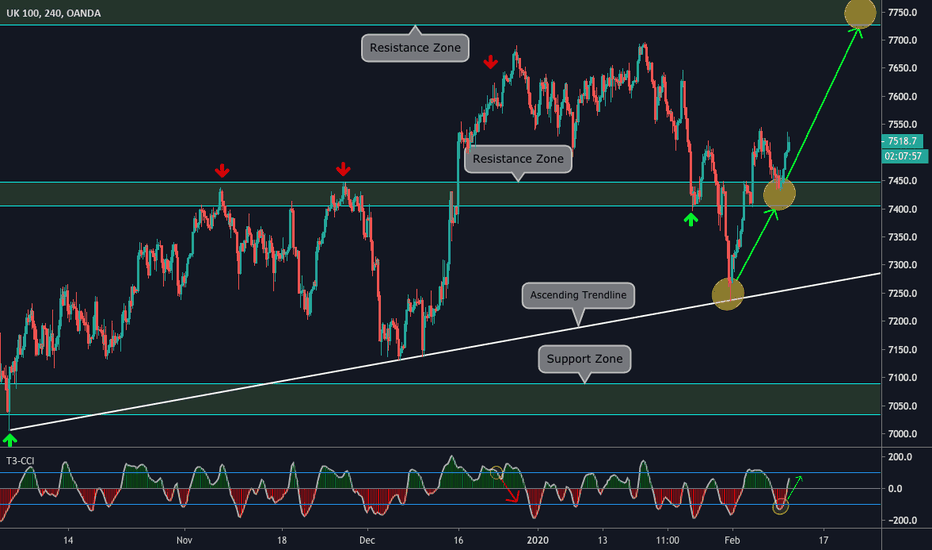

UK

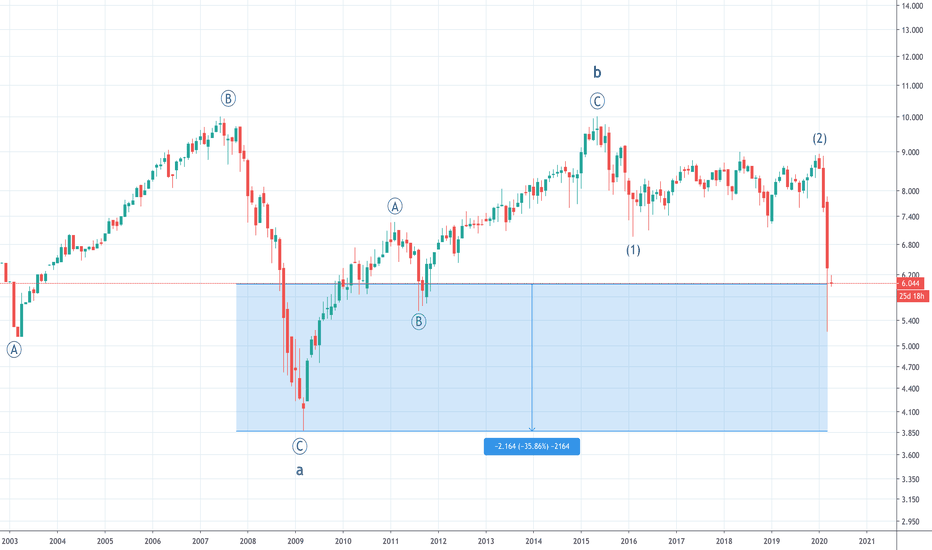

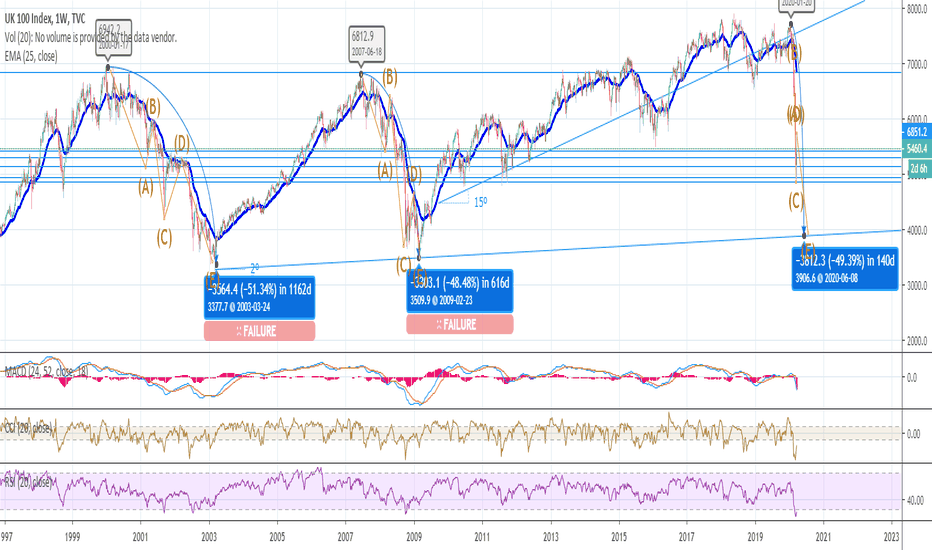

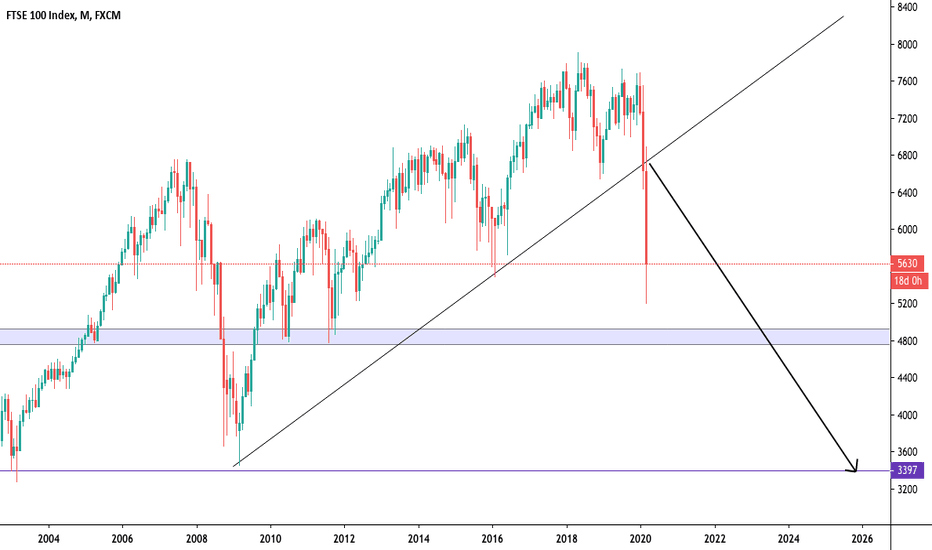

ISFA - FTSE 100 ETF - more than 35% down aheadFTSE 100 represented by its ETF is tracing down a cycle wave C that should bring prices down to around and additional 35% reaching its bottom in one to two years ahead. Retracements with opportunities for returns in the upside should occur during its path and we will be posting them here. The short term analysis is in the comments. FOLLOW SKYLINEPRO TO RECEIVE THE UPDATES.

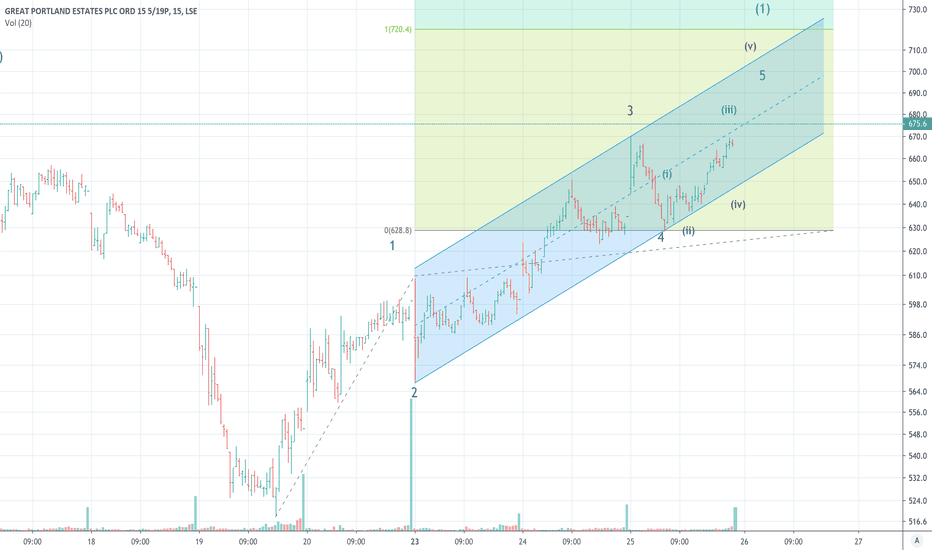

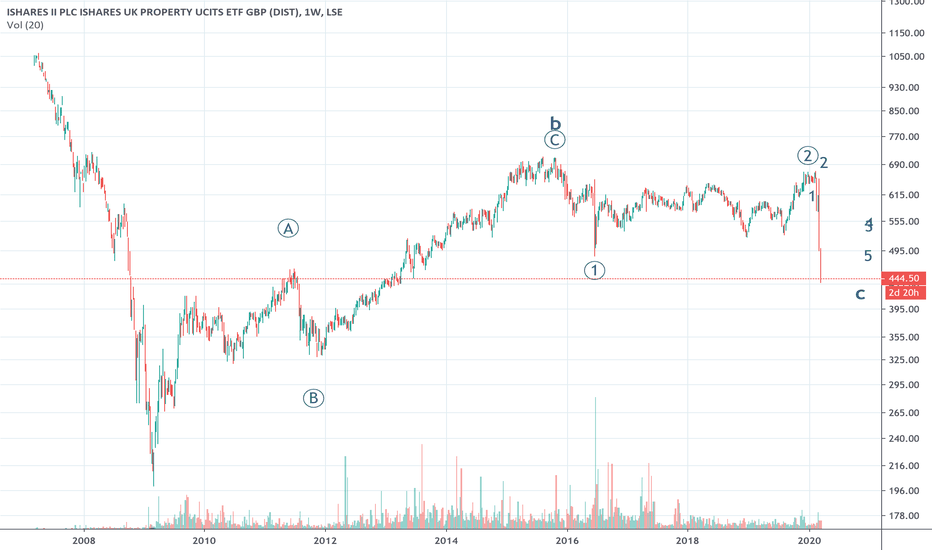

GPOR - UK REIT - possibilities of 7% gains in the next two daysGreat Portland Estates is the UK REIT that owns the best office properties in Class A cbd markets of London. The price structure suggests that it will start minute wave 4 down before going up tracing minute wave 5, the last lag that should complete Minor wave 5 of intermediate wave 1. If this scenario persists price should increase 7% in the next two days, before entering a correction of intermediate level. FOLLOW SKYLINEPRO TO GET UPTDATES.

FTSE100 - WILL LONG TERM THINKING WIN?We are currently seeing a 30-40% adjustment in the markets due tot the impact of Covid-19. After last week's crash, governments have announced economic relief bills of unprecedented sums of money that have turned the market bullish. Although such "rescue packages" are effective in the short-term, they cannot cover long-term economic damage that is expected to result from restrictions under Covid-19 and the oversupply in oil.

Most countries in Europe, and the US have not yet seen the peak in cases and deaths as the corona-virus keeps infecting and killing. Governments are imposing tighter restrictions and Italy is considering moving to a "war-economy" that will shut around 70% of the economic activities. Although other European countries seem to have a less steeper increase in corona cases and deaths, it is very likely that most economies will need to shut down more and more over the next coming weeks. Many suggest that the US will become the new "epicenter" of the disease as the virus continues to develop. Some experts say that the virus may slow down in warmer weather, and future infection-waves may be inevitable.

Now, let's back this up with some historical and chart analyses:

> CCI wave end of Mar-20 similar strength as in Jul-02 and Sep-08. In the latter two instances, both where followed by a less powerful bearish market that despite the lack of strength pushed the market down further. The time frame between the two waves is from Jul-02 to Jan-03 (+/- 6.5mo) and Sep-08 to Feb-09 (+/- 5mo), averaging around 6 months.

> The above is supported by:

- applying the Elliot-wave theory on the downward trend in the index, which have been very applicable in the past recessions as the chart shows. In 2020, we have seen two downward

impulse waves (A,C) and are currently in the second correction wave (D). Correction went back to 0.38Fib, whereas correcton D went a little over 0.38Fib and therefor may first

continue upwards to 0.50Fib (c. 5850) or even 0.62Fib (c. 6100) before continuing with the last wave.

- MACD suggest a strong bearish market that is not close to cut the base and move into a bullish market.

> Assuming the Covid-19 crisis will lead the economy into recession with similar impact on the economy as the 2003 and 2008/9 down-cycles, the index will be falling towards or just below the 4000 points around June or July when the real impact of the Covid-19 restrictions will be felt in the economy. However, the bottom may be strongest in May when Europe at the end and the US at the start of the Covid-19 peak as panic kicks in, hospital capacity is reached and economies need to be shut down almost completely. Also, most analysts are focused on emerged economies but most companies on 1st world stock exchanges have significant economic and market exposure in emerging markets where healthcare, governing and economic systems are not as sound, and where the impact of the virus may not be controllable in any front.

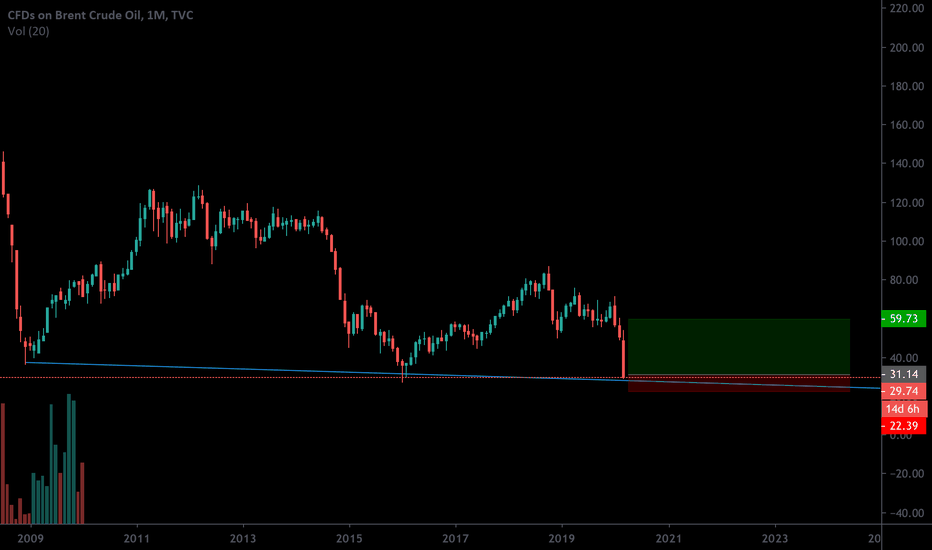

> The above is all subject to the developments of Covid-19, but also the lower oil price that is expected to remain low throughout April-20 as Saudi Arabia and Russia will not ramp down production to stabilize global prices. It will be interesting to continue monitoring all developments and see how the world reacts to a problem that we have never faced in modern times.

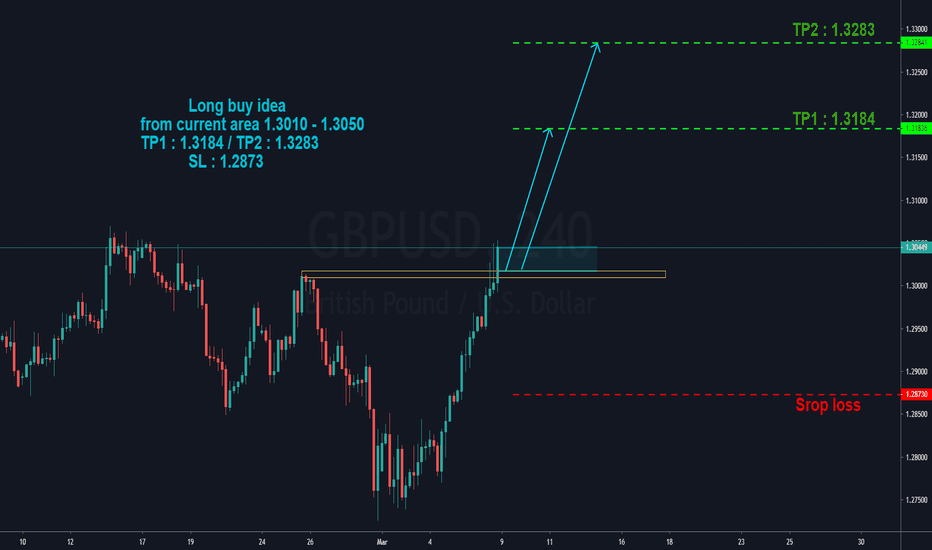

GBPUSD 4H from current area Long buy idea

from current area 1.3010 - 1.3050

TP1 : 1.3184

TP2 : 1.3283

SL : 1.2873

This is not an investment recommendation or any call to buy or sell

It is just an analysis based on a study of the history of price action

Behavior , that may not be a necessarily reason for the success of

the structure or repetition. So please make your decision based on your vision .

To protect capital and manage your deals and trading successfully

the maximum loss in each transaction for the same currency or

commodity in the same direction should not exceed ( 2% ) of the capital .

Good luck >>

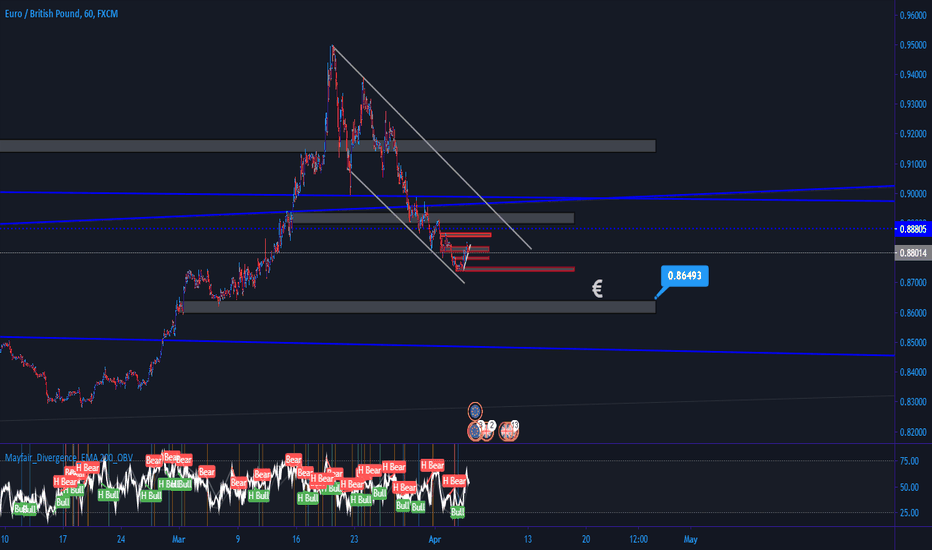

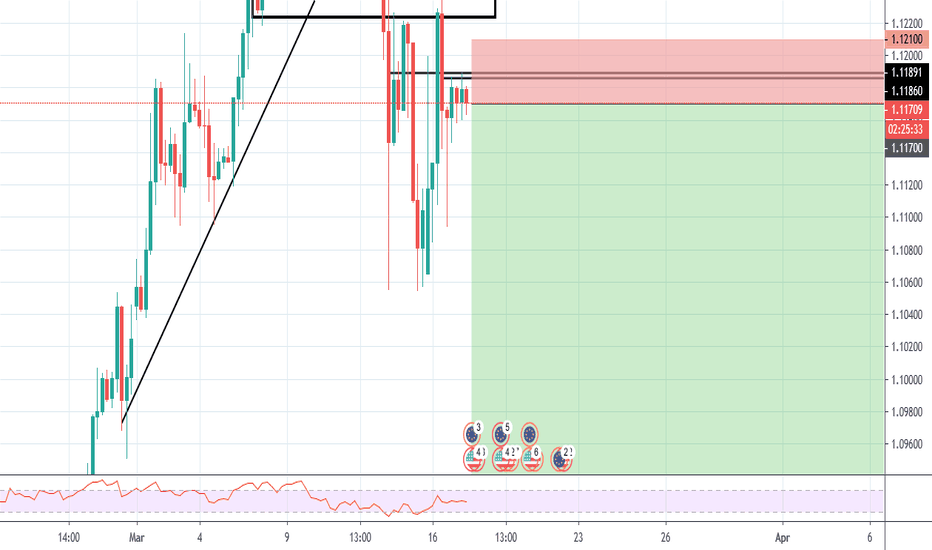

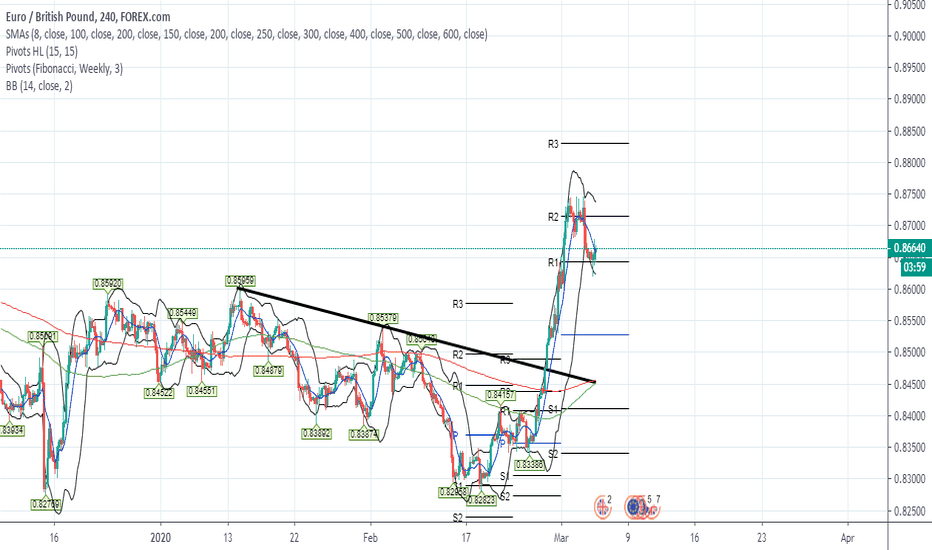

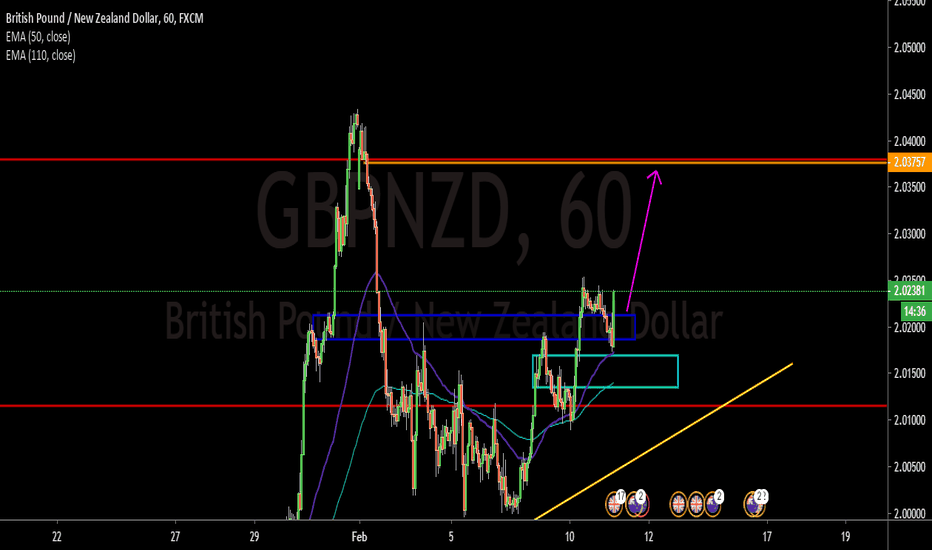

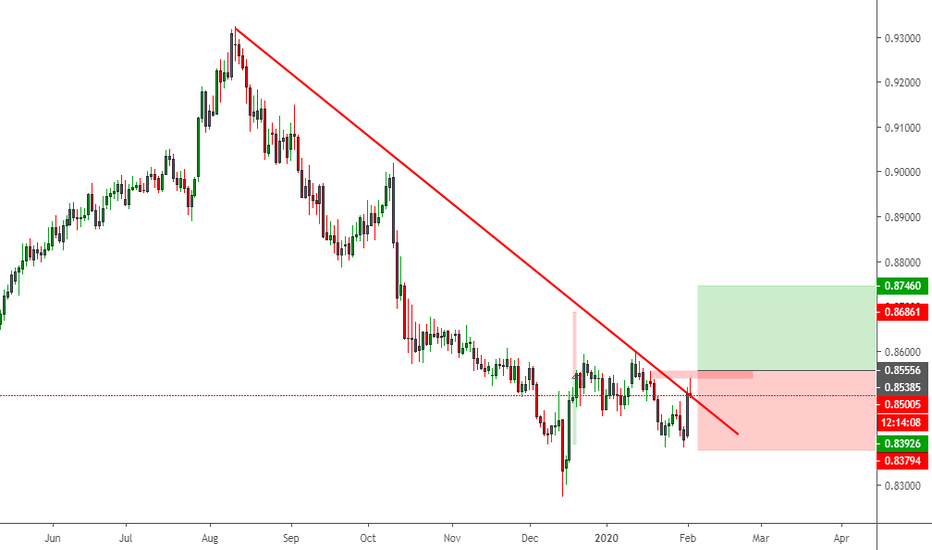

EURGBP Possible ContinuationMay have potential movement upward still even if we technically see it high fundamental euro may bang above a bit higher the way how EURUSD proved it every high no sell! I had some sentiment analysis though and I feel it has more potential upward prolly around r2 or even r3 let's see depending on the impact of BOE rate decision yet to come but pricing will occur before the event.

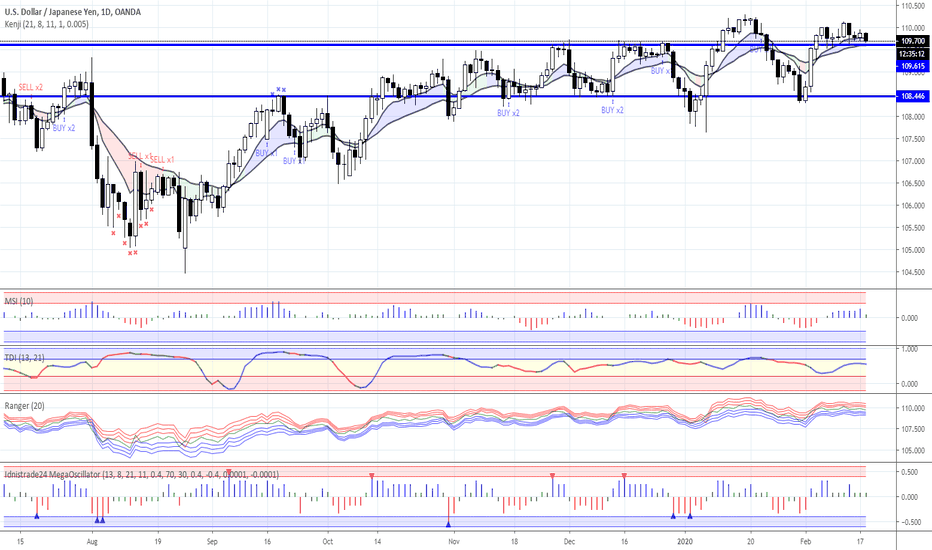

Recession in Japan, China's stimulus and UK’s dataPerhaps the main event and surprise of yesterday were the devastating data on Japan's GDP for the fourth quarter. The country's GDP fell by 1.6% (the forecast was a decline of 0.9%) in terms of q/q and 6.3% in relation to the same quarter last year (the worst result since 2014). This is a very alarming signal for the global economy because Japan is the third-largest economy in the world. And although the reasons for such a failure are generally justified - a destructive typhoon and tax increases, the picture does not become less depressing.

Given that China is Japan's largest trading partner, there is every reason to expect weak data in the first quarter of 2020 (consequences of the coronavirus epidemic). Do not forget about the loss of the tourism sector in Japan from China's ban on the travel of citizens. We are talking about hundreds of thousands of tourists from China who were supposed to visit Japan but did not visit with all the ensuing economic consequences.

The second consecutive quarter of GDP decline is already officially a recession. That is, what we have been talking about for quite some time in our reviews is beginning to take on an increasingly clear line.

What is characteristic, the Japanese yen against the background of such crushing statistics were not exposed to sales. Obviously, the demand for a safe haven asset in her person outweighs the desire to sell the yen to work out weak data. In this light, our desire to buy gold only intensified. Purchases of the Japanese yen, despite such weak data, also look good from current points.

China, meanwhile, maybe trying to generate optimism after several weeks of continuous negativity. And this is not only about the statistics on the epidemic, which is beginning to decline but also about the position of the Chinese authorities, who yesterday promised to strengthen the stimulation of the economy in order to compensate for the negative consequences of the coronavirus. It is planned to reduce corporate taxes and increase government spending.

Despite this positive, we believe that the damage has already been done and the world economy will still feel it in the first quarter. And the epidemic itself is still ongoing. According to experts, the Chinese economy will return to less or less normal functioning no earlier than in a month.

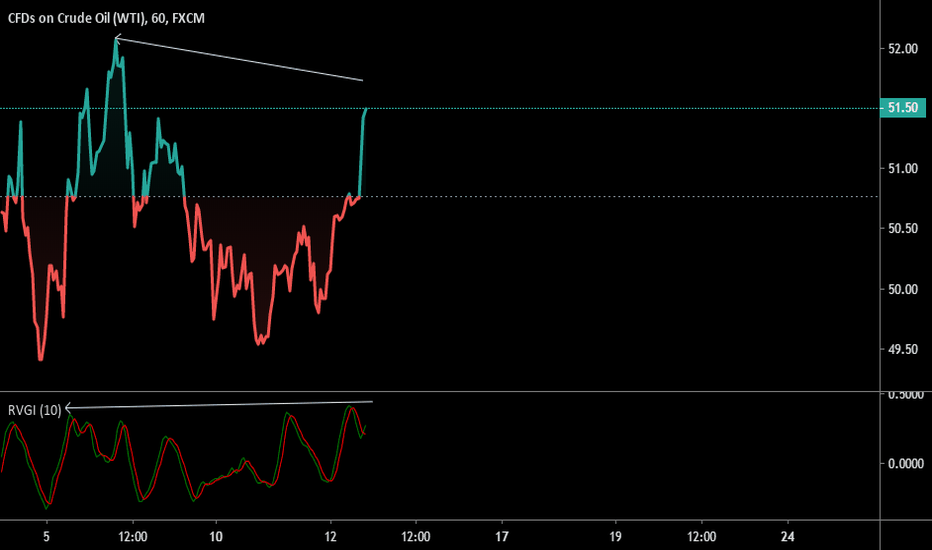

In this regard, we recall our recommendation to sell oil. Demand for oil from China continues to fall, and refinery loading drops at a gigantic pace (at some plants, the decline was 10-20%). According to Citi analysts, the total volume of oil refining in China fell by 2 million barrels per day, while oil demand in China in February may show a decrease of 3.5 million BPD. These are very serious figures for the oil market. So we use any attempts to grow the asset as an occasion for its sales.

For the British pound today is a pretty important day in terms of macroeconomic statistics - a block of data on the UK labor market will be published. In the past couple of days, the pound has somewhat lost its fuse, which was received in the form of promises to increase government spending. Today's data can either increase pressure on the pound, or give it the opportunity to return to growth. So we follow the numbers and adjust the positions depending on the nature of the data.

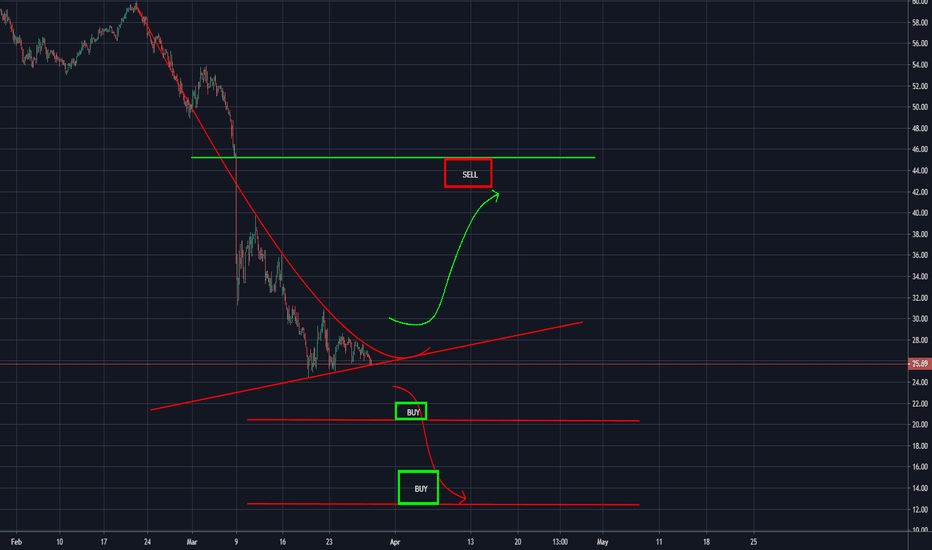

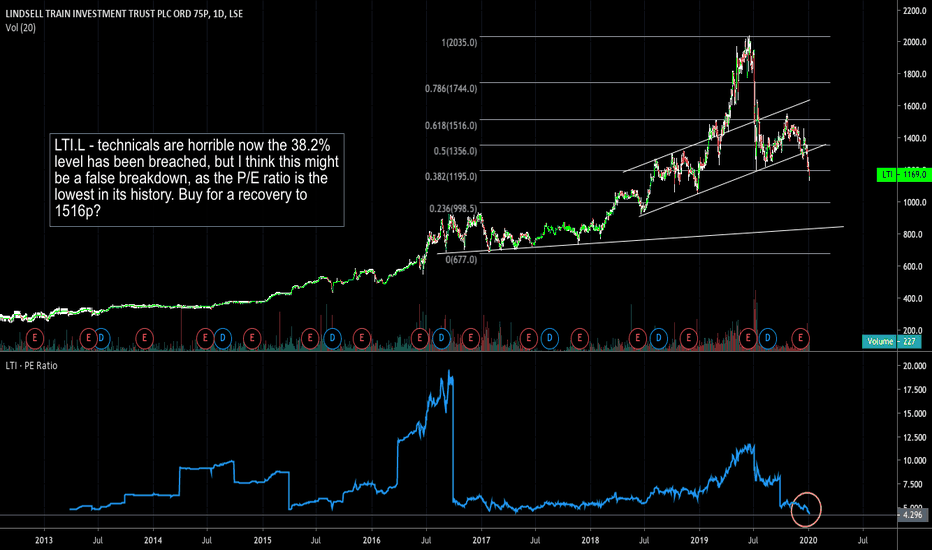

#LTI.L (UK fund) at new P/E lows.LTI.L - technicals are horrible now the 38.2% level has been breached, but I think this might be a false breakdown, as the P/E ratio is the lowest in its history. Buy for a recovery to 1516p? The drop has largely been caused by the Morningstar downgrade and the removal from HL Top funds for conflict reasons. The fund itself is fairly solid.

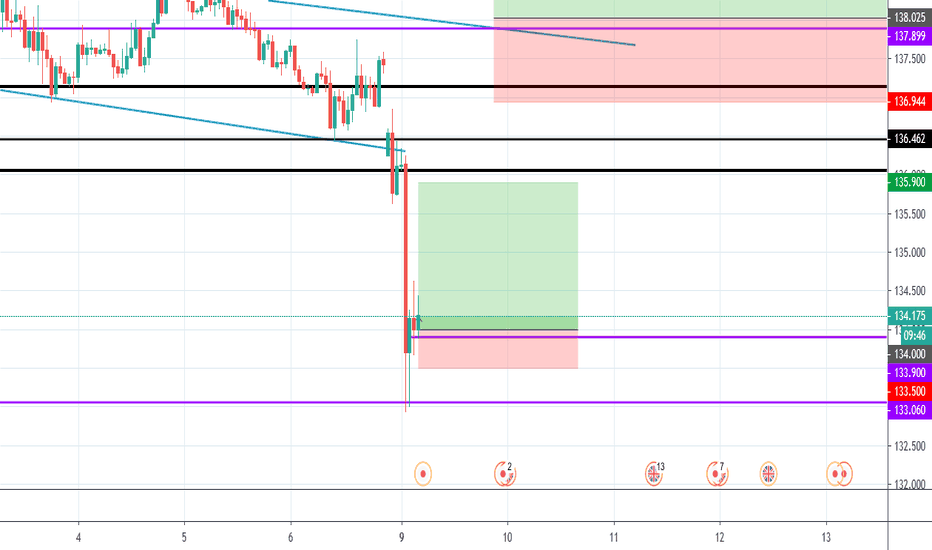

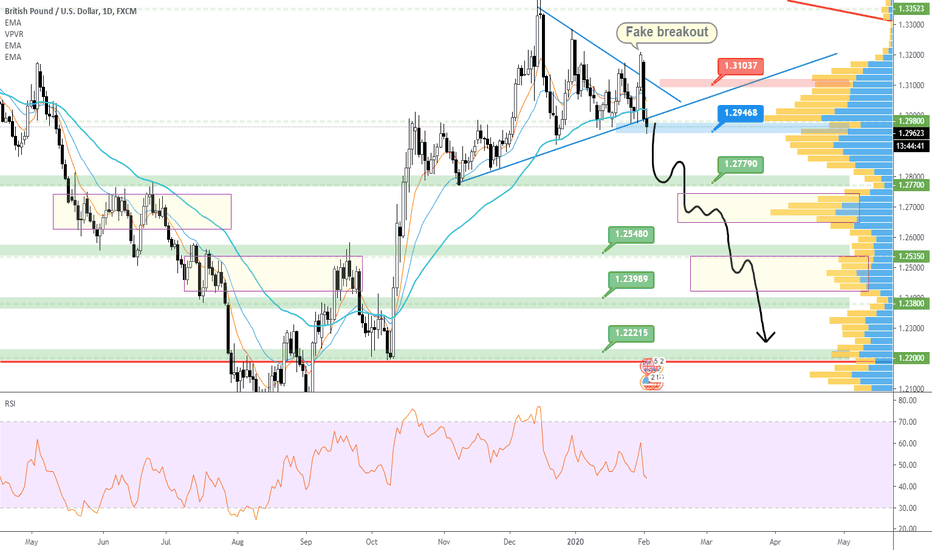

GBPUSD long short tradeGBPUSD just broke out from a local trend line ascending since Nov/2019 and will go short

my entry point will be: 1.29468

targets are

TP(1): 1.2779

TP(2): 1.2548

TP(3): 1.23989

TP(4): 1.22215

a stop-loss will be @1.31037

Take a look @ my trading Idea about GBPJPY 1000+ pips

If you agree with this Idea Please support

Don't forget to leave a LIKE

Check my idea's here: tradingview.sweetlogin.com

follow me to get the latest analysis daily

thank you

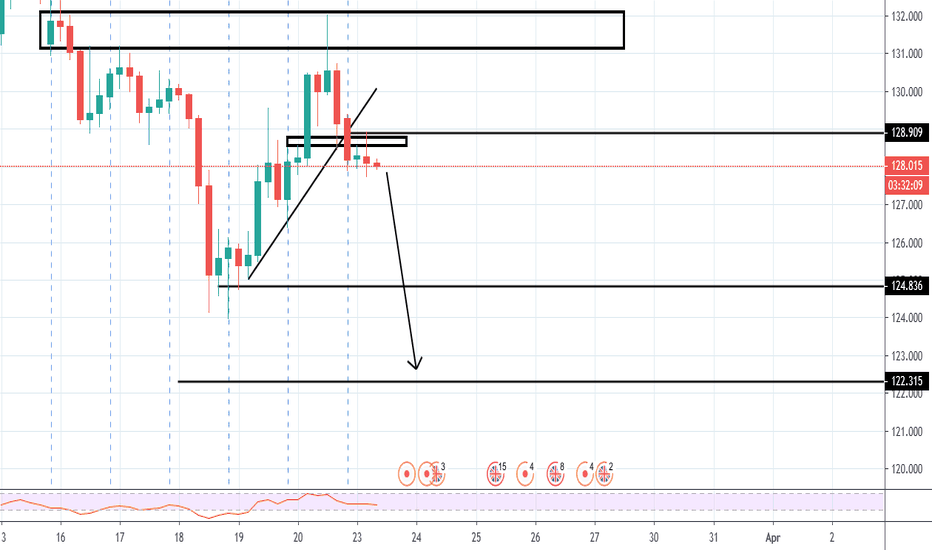

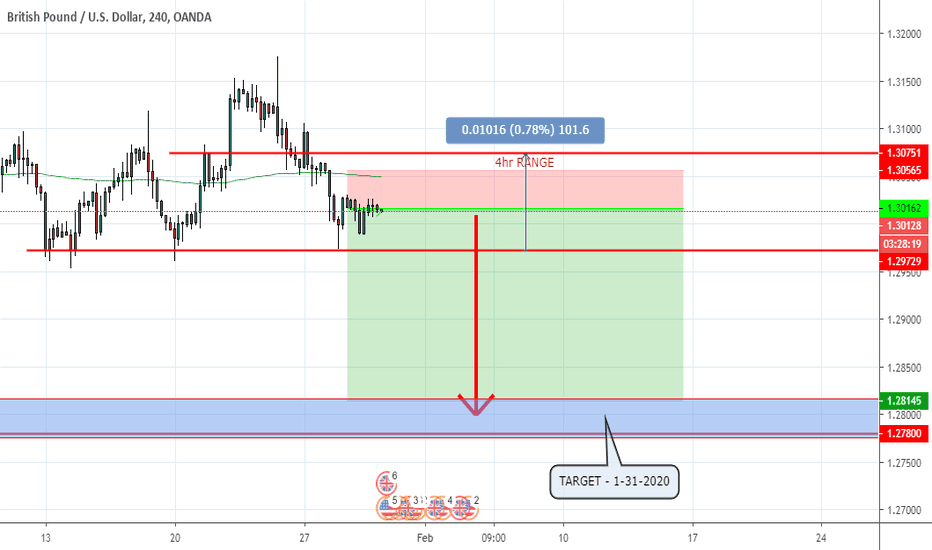

GbpUsd short opportunity!Here I have broken down the GBPUSD currency chart. I have identified a strong sell opportunity as displayed here with my technical chart work.

The GBPUSD currency pair has been in a 4hr range for the past few weeks and is now showing signs of a breakout emerging. In my opinion this breakout will be to the downside seeking to 1.295 region or below.