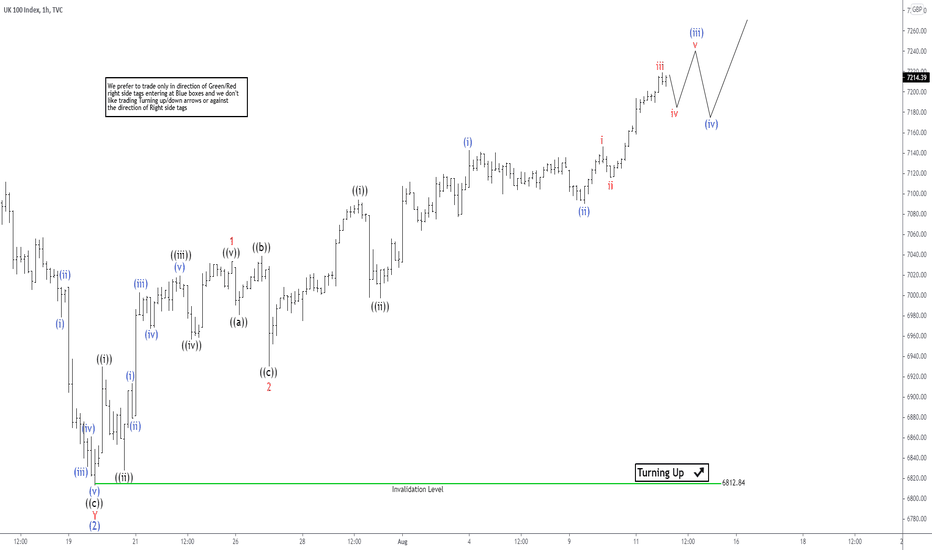

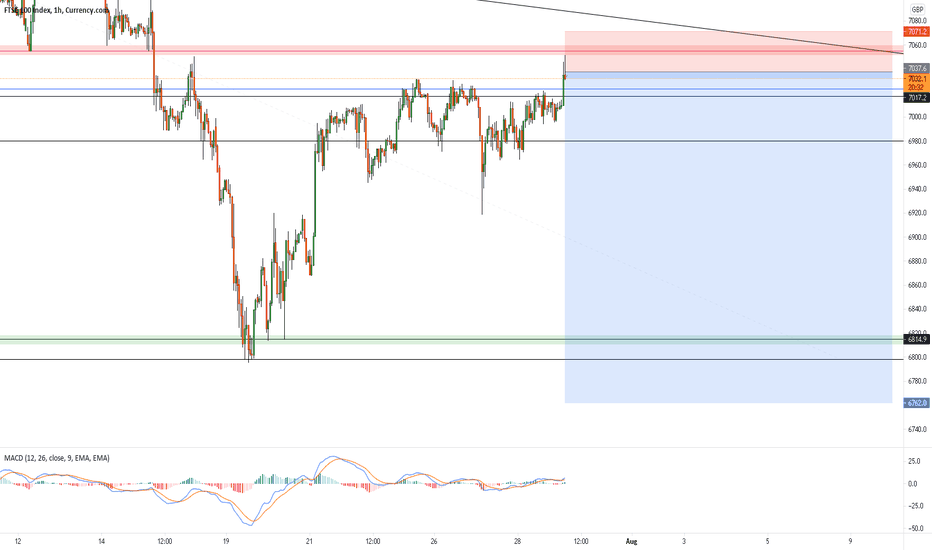

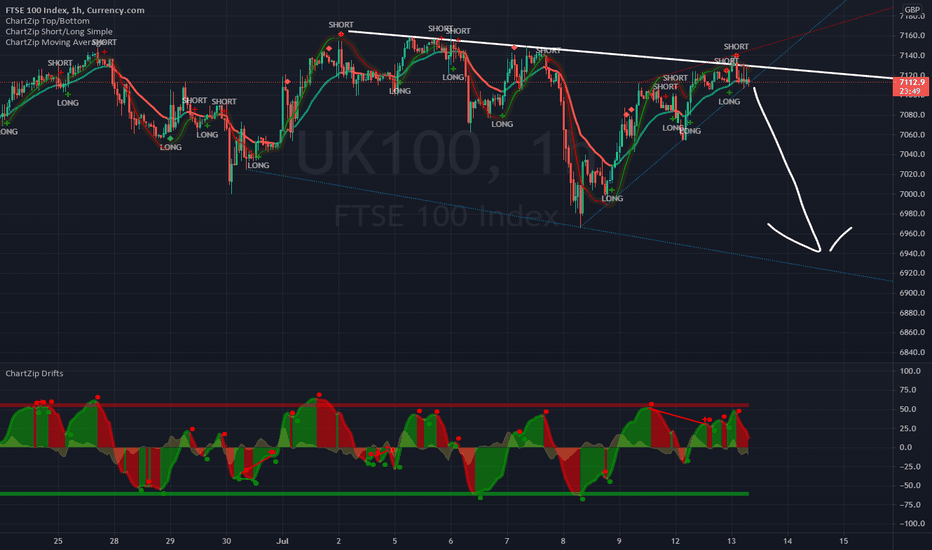

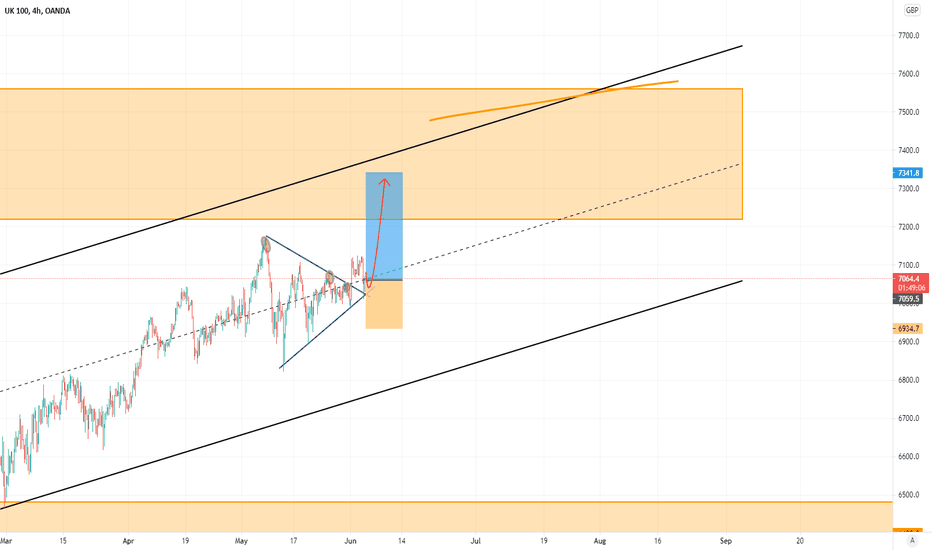

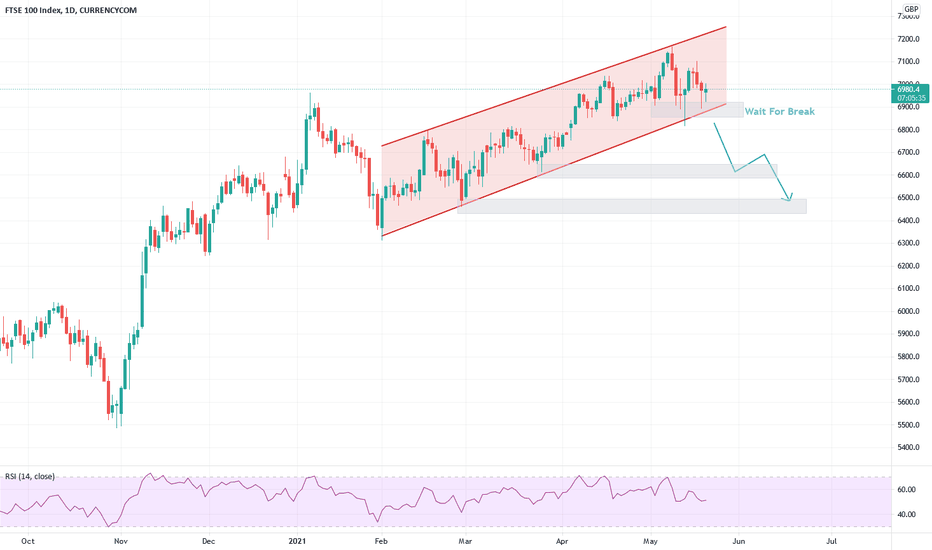

Elliott Wave View: FTSE Nesting Higher As ImpulseShort-term Elliott wave view in FTSE suggests that the pullback to 19 July 2021 low (6812.84) ended wave (4). Up from there, the index is nesting higher as an impulse sequence within wave (5) favoring more upside extension to take place. While the initial bounce to 6929.89 high ended wave ((i)), wave ((ii)) pullback ended at 6827.26 low, wave ((iii)) completed in lesser degree 5 waves at 7018.95 high. Wave ((iv)) ended at 6956.24 low, wave ((v)) ended at 7033.27 high thus completed wave 1.

Down from there, the index made a pullback in wave 2 to correct the cycle from 7/19/2021 low. The internals of that pullback unfolded as Elliott wave flat structure where wave ((a)) ended at 6980.67 low. Wave ((b)) ended at 7038.65 high and wave ((c)) ended at 6929.64 low. Above from there, the index started the next leg higher in wave 3 and ended lesser degree wave ((i)) at 7093.93 high. Then wave ((ii)) pullback ended at 6996.93 low and resume the rally higher again.

Whereas lesser degree wave (i) ended at 7142.54 low, wave (ii) ended at 7089.74 low. Near-term, as far as dips remain above 7089.74 low and more importantly above 6812.84 low then FTSE is expected to extend higher in lesser degree wave (iii) towards 7236.10- 7326.35 area higher before entering into a wave (iv) pullback. We don’t recommend selling and expect dips to find support in 3, 7, or 11 swings for further upside.

UK100 CFD

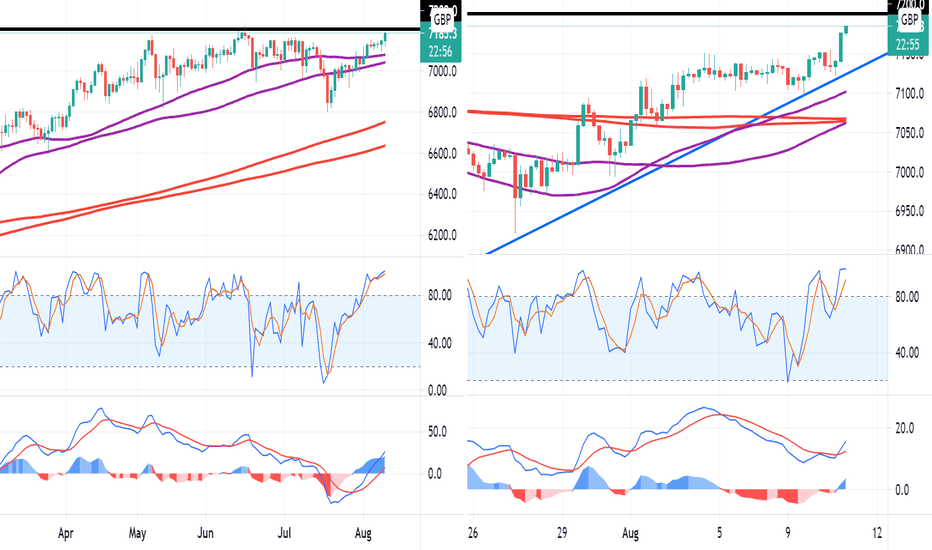

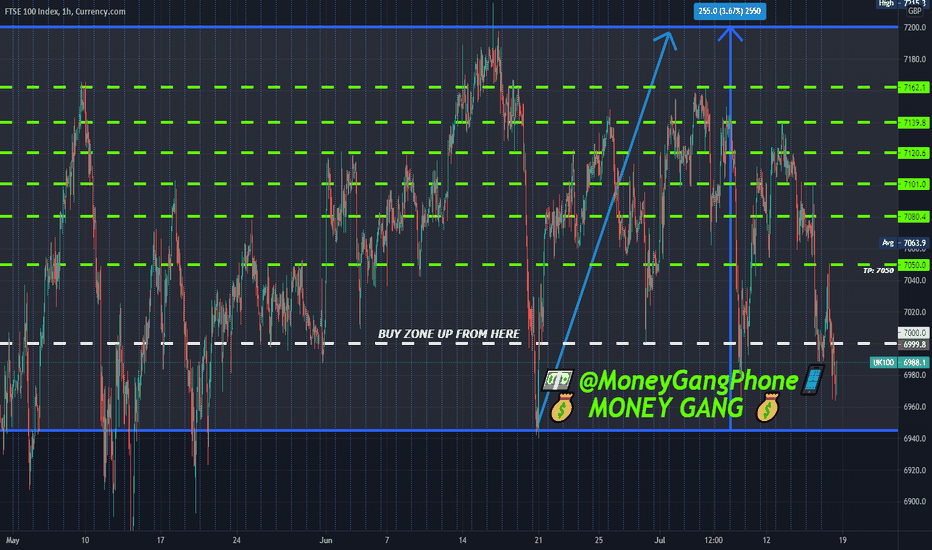

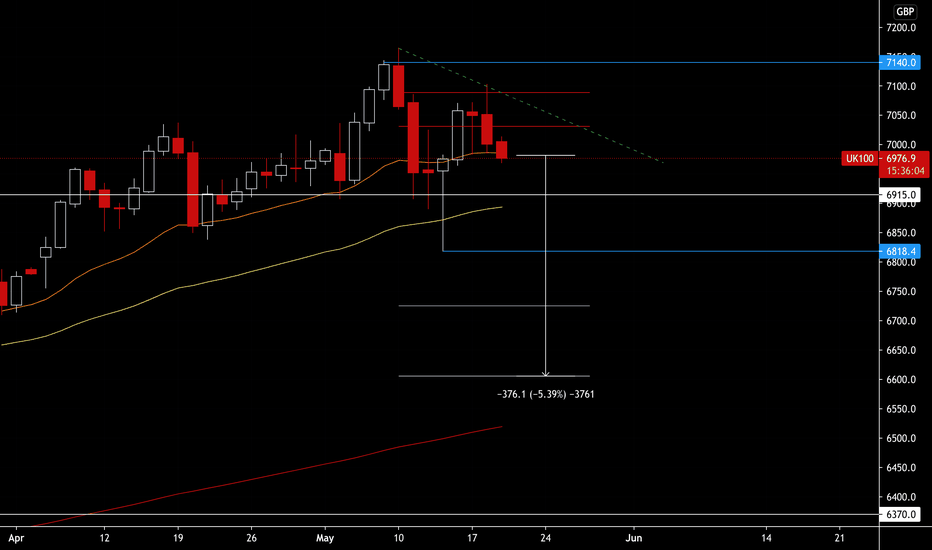

UK100 - A major breakout imminent?The UK100 is closing in on 7,200 and approaching levels not seen since the start of the pandemic.

This isn't the first time the index has eyed up this level in recent months but in the past it has failed to break through in any significant way - it briefly touched 7,217 a couple of months ago before reversing course - and each time a corrective move has followed.

This has left the FTSE trading between 6,800 and 7,200 since April but that could all be about to change.

While we may see some profit taking on approach, the MACD and stochastic suggest there's plenty of momentum still in the rally that could carry it to levels not seen in 18 months.

If we do see some profit taking, the rising trend line below could be interesting support if the rally is going to continue. A move below this would suggest a larger correction may be on the cards.

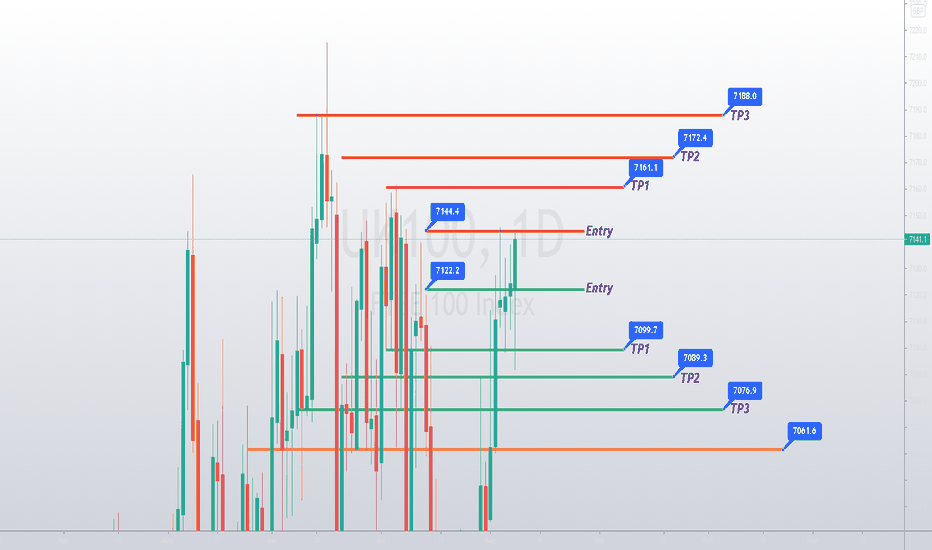

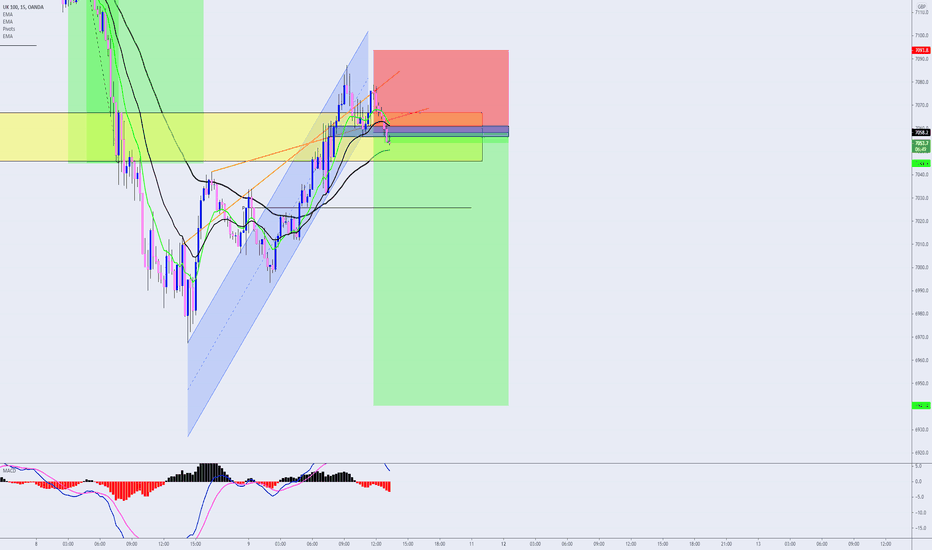

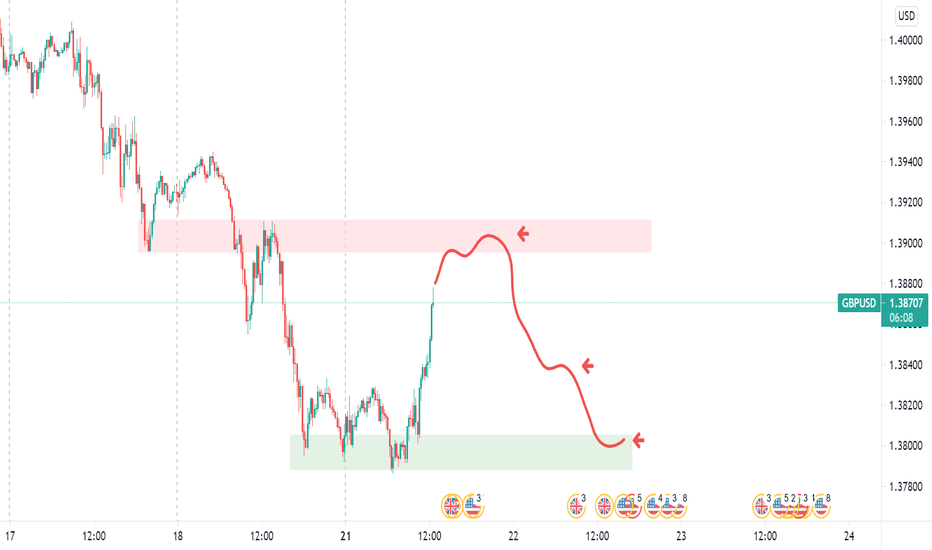

UK100 Entries + ExitsPretty clean analysis! Zones are most definitely sturdy :)

How To Play The Chart Entries/Exits:

Buy at green support entry, if it breaks by -35 pips (count it out) then enter a sell and ride to TP1, 2 and 3. Trail stop at each TP which means place your stop loss in profit but with enough room to be able to continue the sell if it continues. Same thing at resistance, sell but if broken by 30 pips then enter the buy and ride to TP1. Each TP is a support or resistance zone , so you could then even take a sell after TP1 for the buys have been hit and if it breaks out then just repeat.

Update on UK100 - 100GBPFirst position got stopped out due to premature entry without clear break of minor structure. The short position in my opinion still valid. Re entered after 1hr confirmation. Swing trade.

UK100GBP Short OpportunityPrice trigerred my sell entry. I expect price to create now a lower low on the daily time frame after this daily timeframe pullback wave of creating a lower high gets to an end.

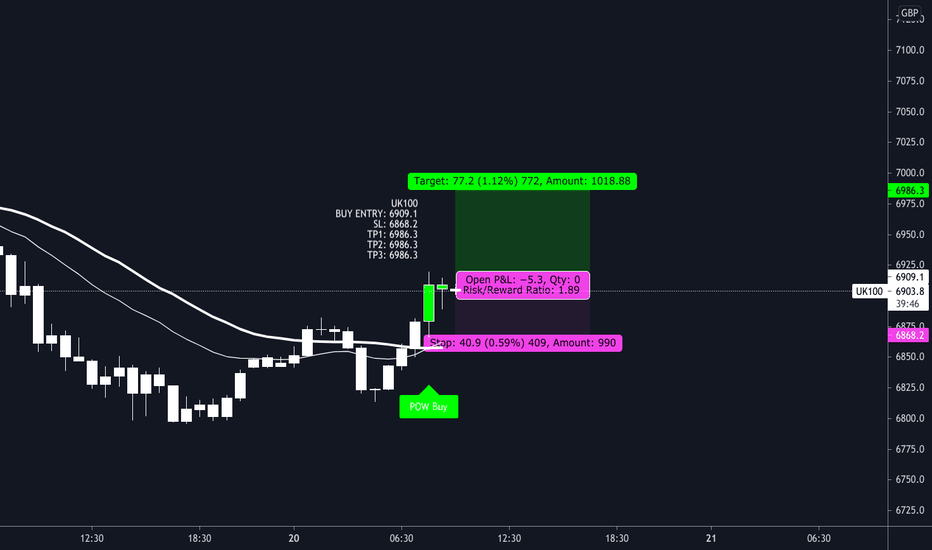

UK100 long is live 📈👍Entry details are shown on the chart.

We're only looking for TP3.

Trade history can be seen below this trade idea too for full transparency.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren.

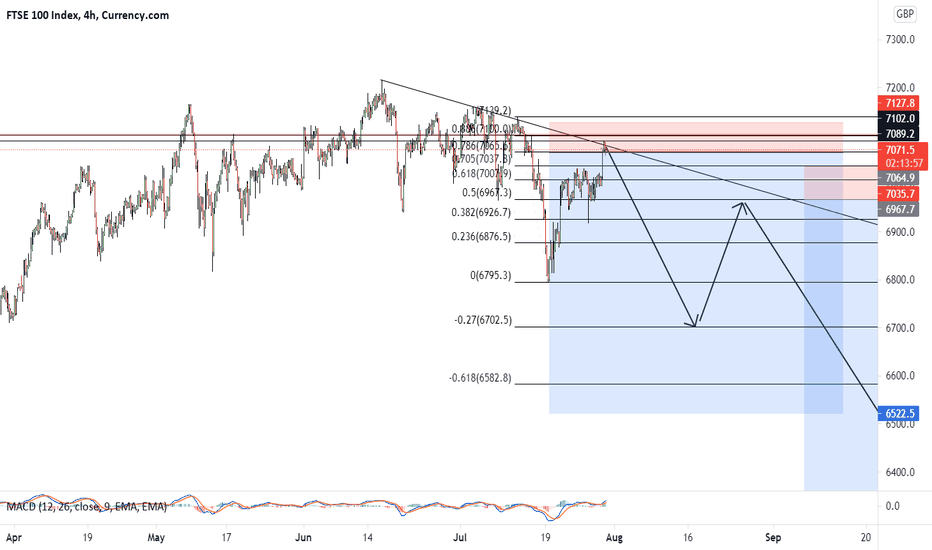

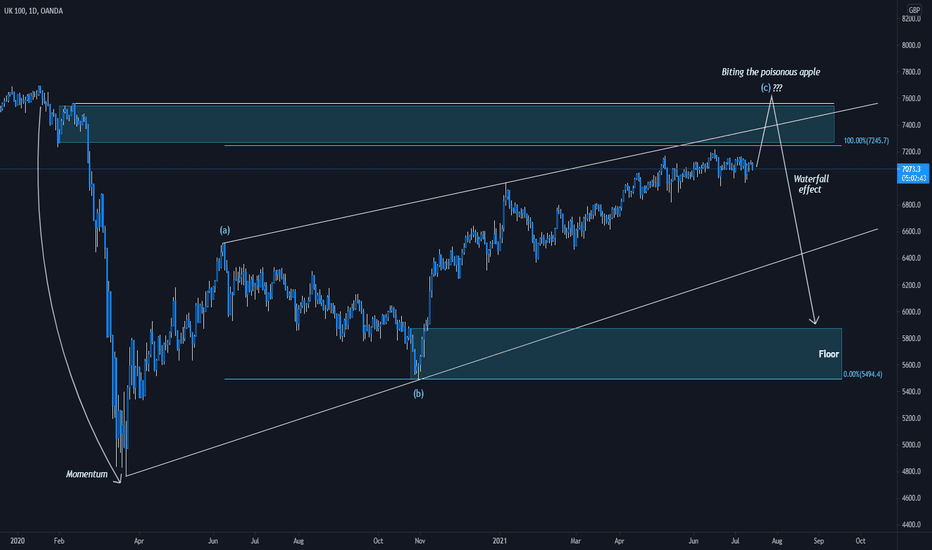

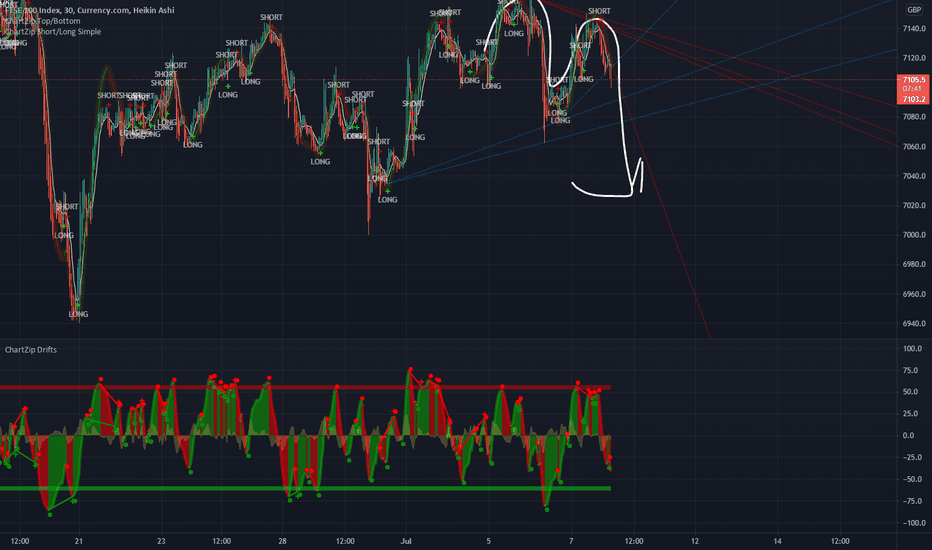

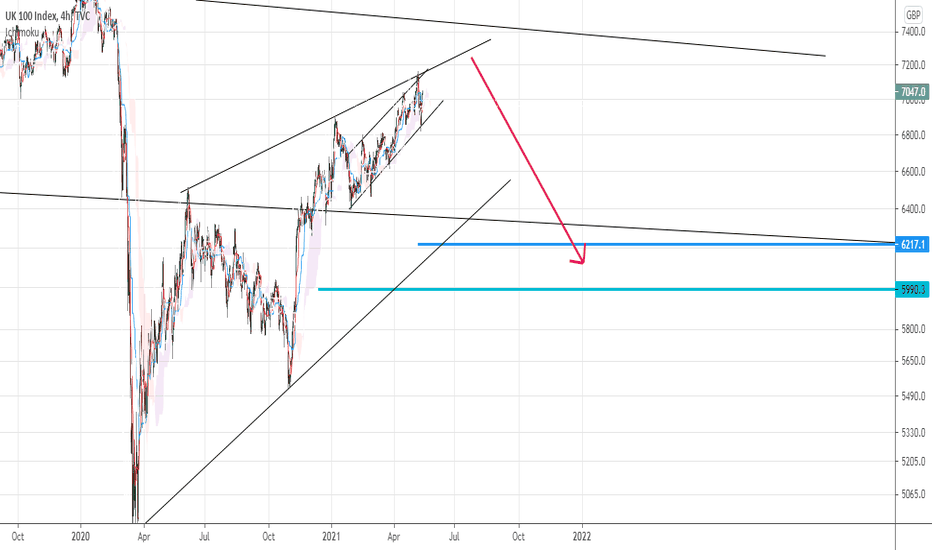

Are UK equities in danger?First things first, let's set the scenery with some backnotes:

- US equities are a ticking bomb as well

- Bitcoin is stuck in a tight range and looks for the driver to lead the next move

- Inflation keeps rising in the US while rumors for deflation are growing as people believe that 2008 is going to repeat again

- USD Index is in a global uptrend

Since we have the background, we can go into the technicals of the major UK index.

United Kingdom has yet to recover from the 2020 crash which makes it so suspicious that dark clouds are being gathered above the City. However, even if the index could just accumulate some momentum and make new 2021 highs, the timing is the worst now, as the US indices are already rocketed massively. As that said, it is really likely that a rush above the supply area would be the poisonous apple that would trigger the waterfall effect afterwards.

With the nearest floor being solid at 5400 - 5800 area, UK100 has surely a lot of room to fall before it can actually find some reliable support from the bulls.

Time will show what's next but one thing is for sure; dark clouds are being gathered and any bullish move would be psuedo-euphoric.

Take care!

6950EMA crossed over to downside on the hourly and it looks like its going to bottom of channel now at 6950

Short UK100 trade.Hello,

Last trade before the weekend can be entered right now.

Short on the UK100, nice possible catch for the weekend.

Reasons:

- Broke support horizontal.

- Broke trend-channel for the pullback.

- Pullback waves ended.

- Bear trap on 1H.

Confluences from the indicators.

Have a good weekend!

HEAD AND SHOULDERS ALERTIf this head and shoulders gets broken off the neckline it can drop to 6k levels again!

Bearish divergence on the 4 hour chart too so I think it can drop

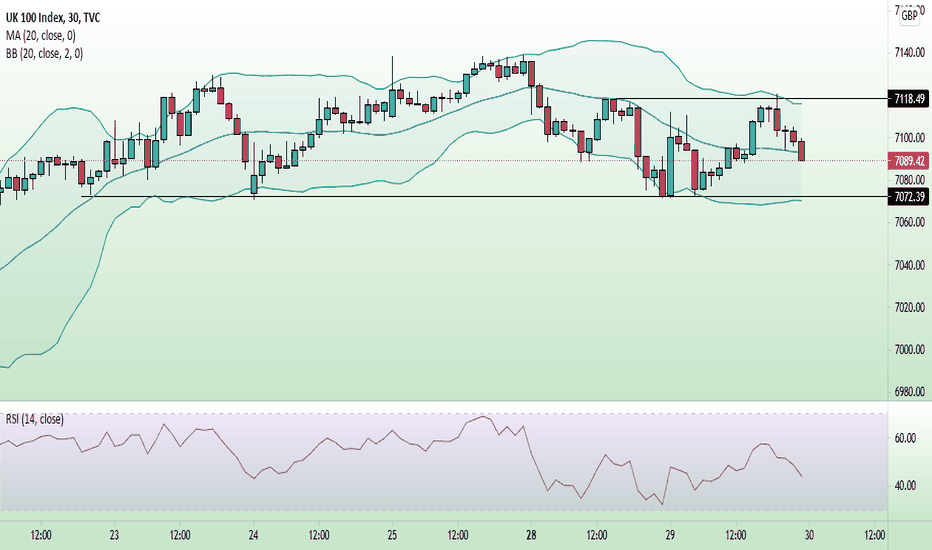

As requested, my idea about UK100!As @Traderwell requested, here’s my view about the UK100!

Short-term, the 7072 is a support that must not be lost, otherwise, we might just lose the 7k again. The breakpoint is 7118, as if UK100 breaks this point, then it’ll aim higher levels.

The danger lurking the index is the head and shoulders, a bearish pattern that has a neckline at the 7072, and the only way to avoid this scenario is by breaking the 7118.

This will make UK100 seek the next target at 7217, and cancel this bearish idea for good. I would like to see the BBs to get tighter in the 4h chart before anything else, tho.

For now, let’s focus on the 7072, as this is the most important line for us here.

If you liked this trading idea, remember to click on the “Follow” button to get more trading ideas like this, and if you agree with me, click on the “Agree” button 😉.

See you soon,

Melissa.

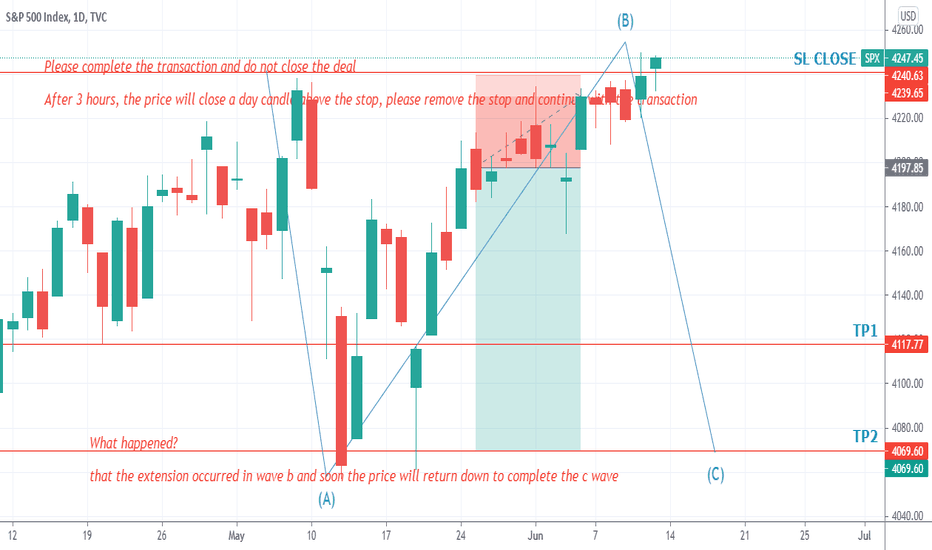

SPX Update Please complete the transaction and do not close the deal

After 3 hours, the price will close a day candle above the stop, please remove the stop and continue with the transaction

What happened?

that the extension occurred in wave b and soon the price will return down to complete the c wave

FTSE100 Moving In Up ChannelFTSE100 Moving In Up Channel.

If price closes below 6850.0 I'll consider opening sell trade with TP @6640.0

FTSE 100 SHORT OPPORTUNITYFibonacci level to be hit, to correlate to higher timeframe 78.6% retest before going higher.