UK100 CFD

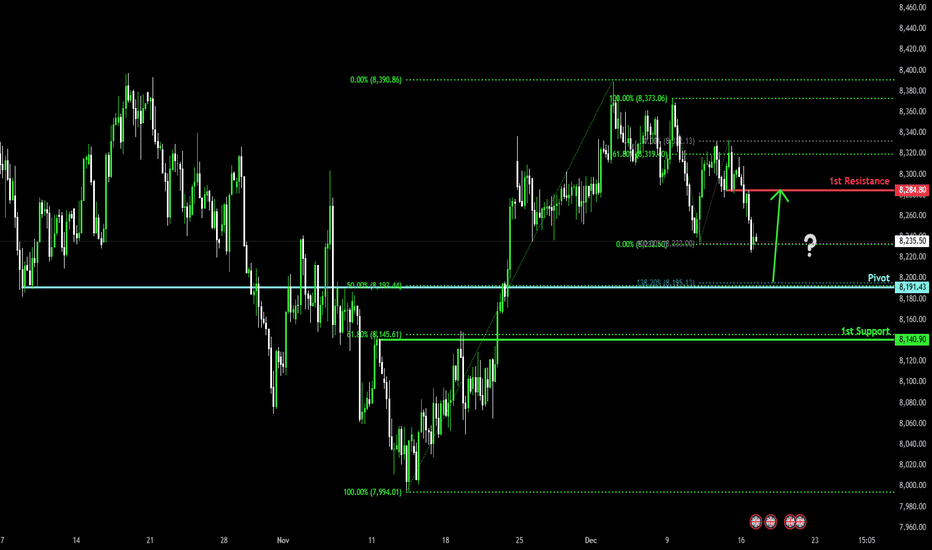

Bullish bounce?UK100 is falling towards the pivot that aligns with the 61.8% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 8,191.43

1st Support: 8,140.90

1st Resistance: 8,284.80

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

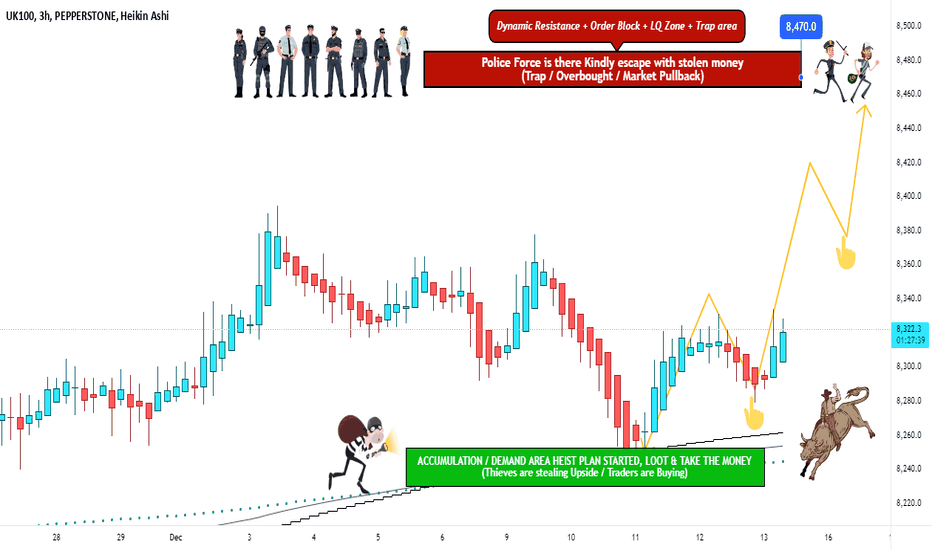

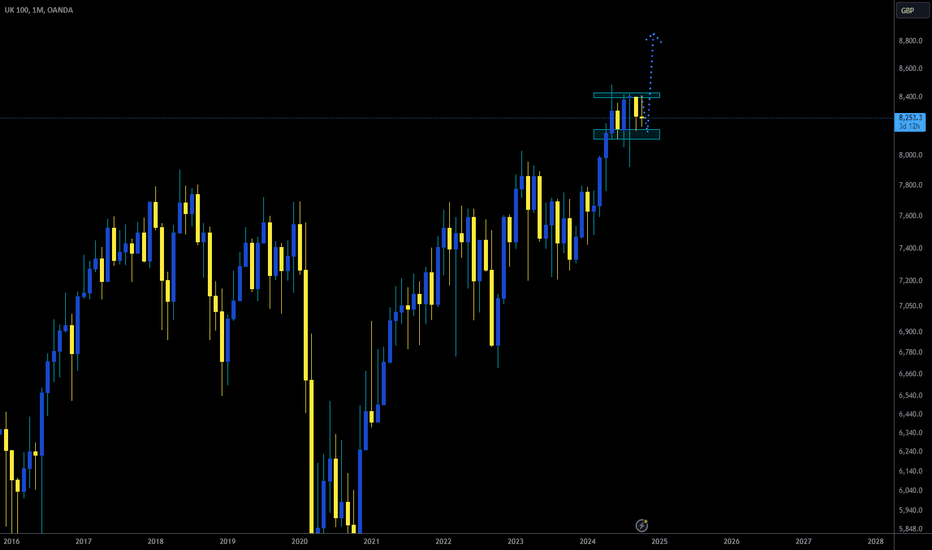

UK100 / FTSE100 Indices Market Bullish Heist PlanHi there! Dear Money Makers & Robbers, 🤑 💰

Based on Thief Trading style technical analysis, here is our master plan to heist the UK100 / FTSE100 Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. So Be Careful, wealthy and safe trade.

Entry 📈: Acceptable anywhere; I advise placing buy limit orders within a 15-minute Chart. The entry for the Recent/Nearest Low Point should be in pullback.

Stop Loss 🛑: Using the 3H period, the recent/nearest low level.

Goal 🎯: 8470.0

Scalpers, take note: only scalp on the long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.

I'll see you soon with another heist plan, so stay tuned 🫂

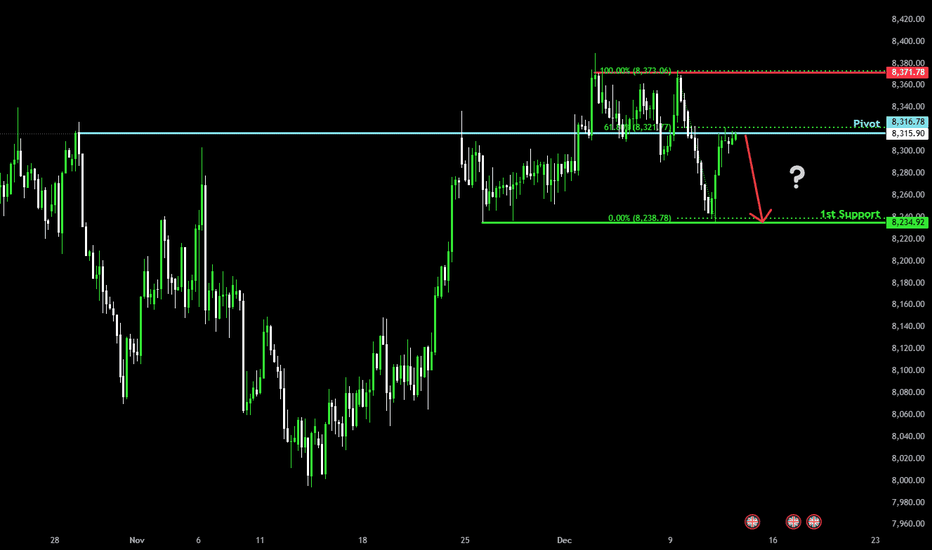

Could the price reverse from here?UK100 is reacting off the pivot which has been identified as an overlap resistance and could reverse to the 1st support level which is a pullback support.

Pivot: 8,316.78

1st Support: 8,234.92

1st Resistance: 8,371.78

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce?UK100n is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 8,197.93

1st Support: 8,137.06

1st Resistance; 8,297.98

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

FTSE 100 H4 | Approaching swing-high resistanceFTSE 100 (UK100) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 8,388.22 which is a swing-high resistance.

Stop loss is at 8,444.00 which is a level that sits above the 127.2% Fibonacci extension level and a swing-high resistance.

Take profit is at 8,305.54 which is an overlap support that aligns with the 23.6% Fibonacci retracement level.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

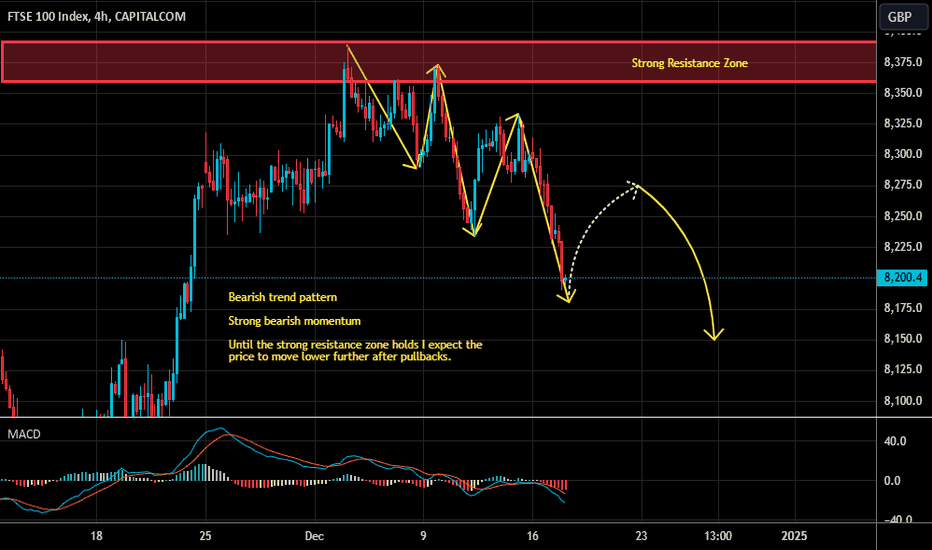

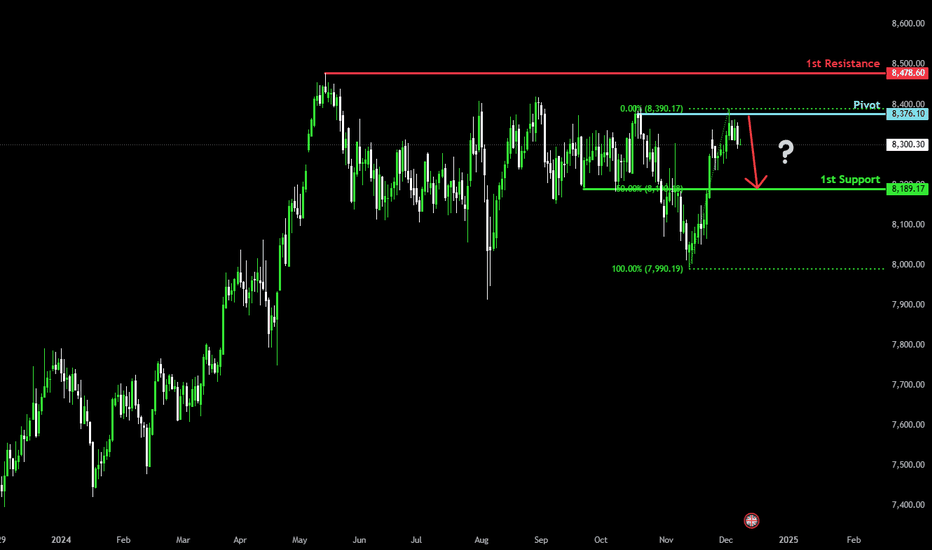

Bearish drop off pullback resistance?UK100 has reacted off the pivot and could drop to the 50% Fibonacci support.

Pivot: 8,376.10

1st Support: 8,189.17

1st Resistance: 8,478.60

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

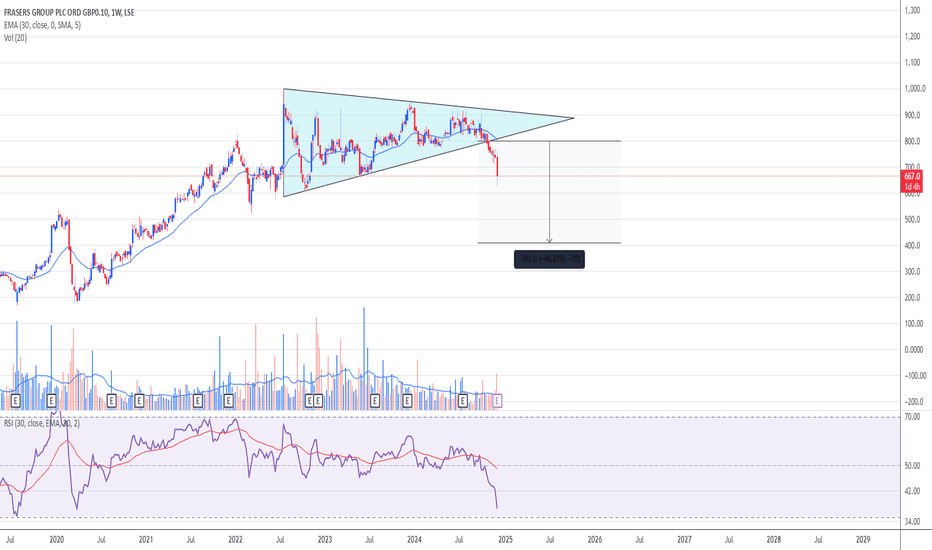

Fraser's Group - negative From the bottom of the pandemic they went from 180 to 995.

In Oct 24 they broke to the downside after forming a triangle pattern from July 22 to Oct 24.

There was no indication that the price would break out to the upside from that pattern.

In technical analysis, the target for Shorters would be 409.

GLA and DYOR. This is not a solicitation to hold or trade.

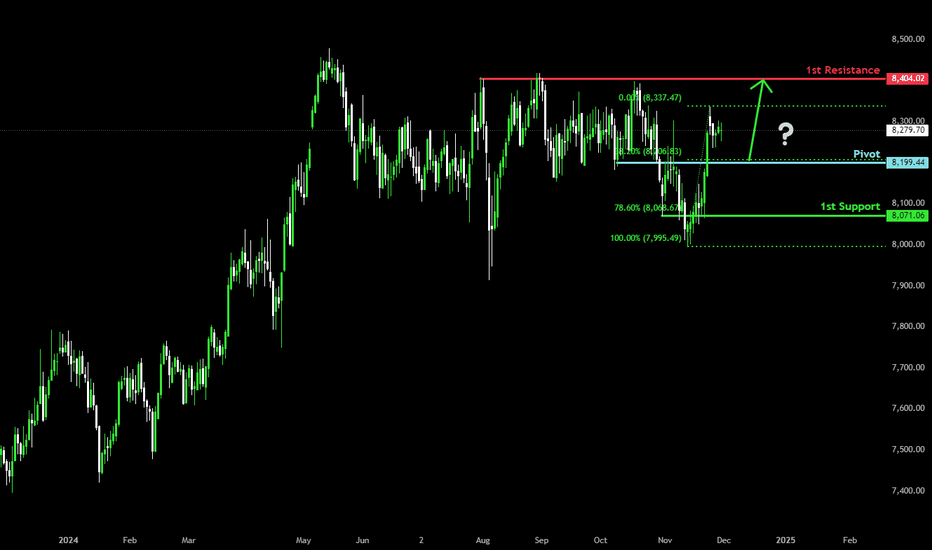

Falling towards overlap support?UK100 is falling towards the pivot and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 8,199.44

1st Support: 8,071.06

1st Resistance: 8,404.02

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

UK100 / FTSE 100 Index Bullish Robbery PlanHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist UK100 / FTSE 100 Index Market Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry in pullback.

Stop Loss 🛑 : Recent Swing Low using 1h timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

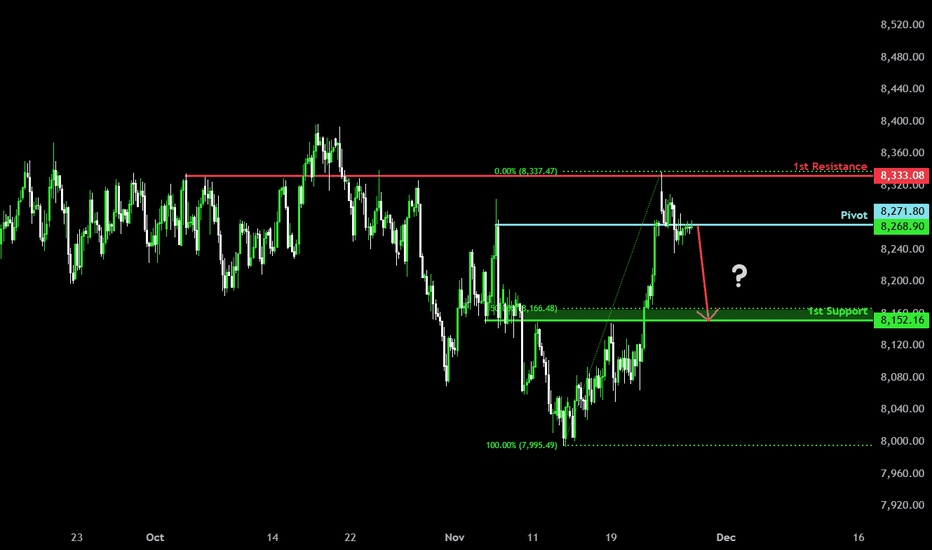

Bearish drop?UK100 is reacting off the pivot and could drop to the 1st support which is an overlap support that is slightly below the 50% Fibonacci retracement.

Pivot: 8,271.80

1st Support: 8,152.16

1st Resistance: 8,333.08

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Heading into overlap resistance?UK100 is rising towards the pivot which acts as an overlap resistance and could reverse to the pullback support.

Pivot: 8,231.90

1st Support: 8,148.65

1st Resistance: 8,319.25

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

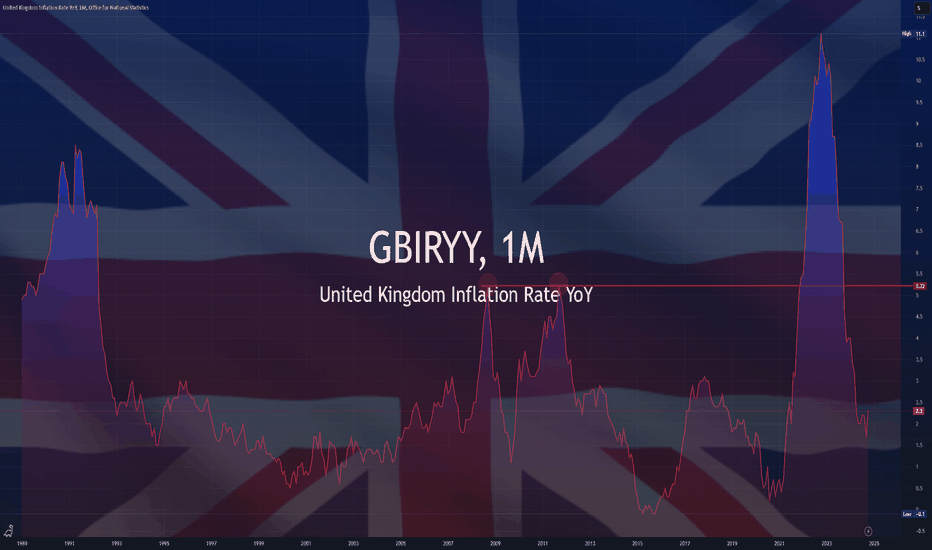

$GBIRYY -U.K Inflation Rate Above Forecasts (October/2024)ECONOMICS:GBIRYY 2.3%

October/2024

source: Office for National Statistics

- Annual inflation rate in the UK went up to 2.3% in October 2024, the highest in six months, compared to 1.7% in September.

This exceeded both the Bank of England's target and market expectations of 2.2%.

The largest upward contribution came from housing and household services (5.5% vs 3.8% in September), mainly electricity (-6.3% vs -19.5%) and gas (-7.3% vs -22.8%), reflecting the rise of the Office of Gas and Electricity Markets (Ofgem) energy price cap in October 2024.

Also, prices rose faster for restaurants and hotels (4.3% vs 4.1%) and rebounded for housing and utilities (2.9% vs -1.7%). Prices of services increased slightly more (5% vs 4.9%), matching estimates form the central bank.

On the other hand, food inflation was steady at 1.9% and the largest offsetting downward contribution came from recreation and culture (3% vs 3.8%).

Compared to the previous month, the CPI increased 0.6%. Finally, annual core inflation edged up to 3.3% from 3.2%.

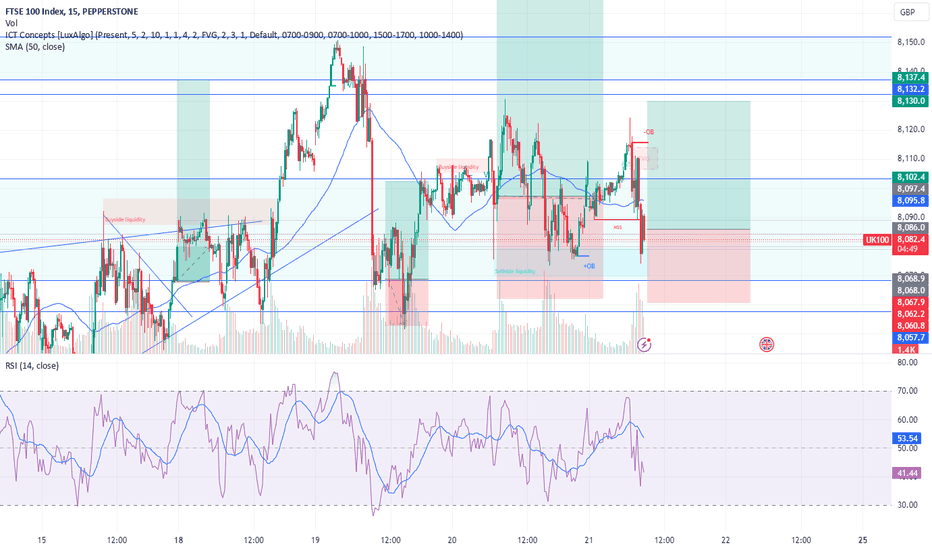

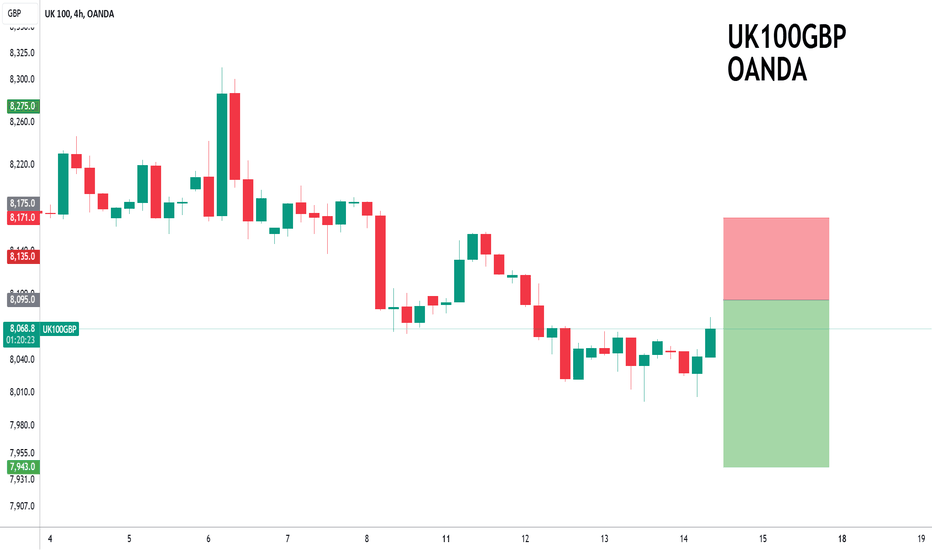

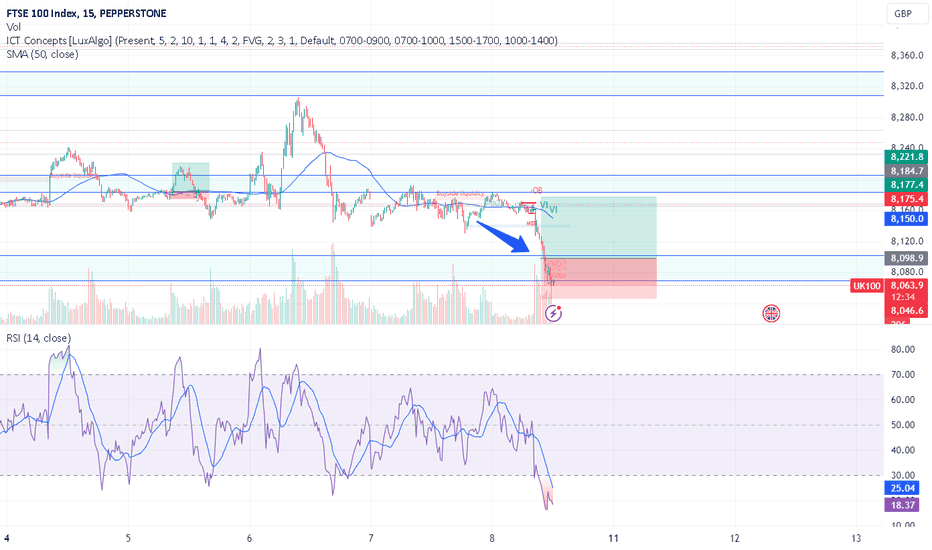

UK100 - DATA JUST COME OUTTeam, the last week and this week, we been killing the UK100 index

We are hoping to continue making the best possible outcome for everyone.

as per CPI data

the market just worry they dump a little before the data come out

but with the current price, we found a good entry at

8080-95

if you require stop loss at 8063,

We would consider adding more around 8058-65

Target 1 at 8126-32

Target 2 at 8165-78

PLEASE ENSURE BRING STOP LOSS TO BE ONCE IT REACHED FIRST TARGET

UK100GB to see a limited rally?UK100 - 24h expiry

Price action looks to be forming a bottom.

A higher correction is expected.

The bias is still for lower levels and we look for any gains to be limited.

Rallies continue to attract sellers.

Further downside is expected although we prefer to sell into rallies close to the 8095 level.

We look to Sell at 8095 (stop at 8171)

Our profit targets will be 7943 and 7780

Resistance: 8110 / 8170 / 8230

Support: 7920 / 7780 / 7710

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

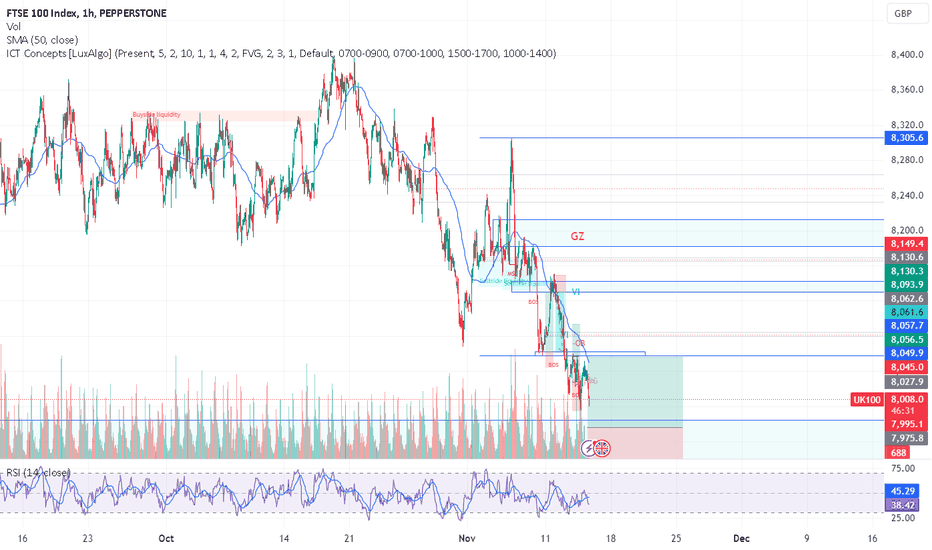

UK100 - WHAT SHOULD WE DOTeam, with the UK100, we killed 2-3 times yesterday.

let be very careful today,

we are looking to enter long UK100 at 7682-86

and would consider adding more 7960-7976 ranges,

STOP LOSS at 7920-26

Our target 1 - 8005-8015

Target 2 at 8036-45

Target 3 at 8076-84

Once it hits our first target, please take some PARTIAL and bring stop loss to BE.

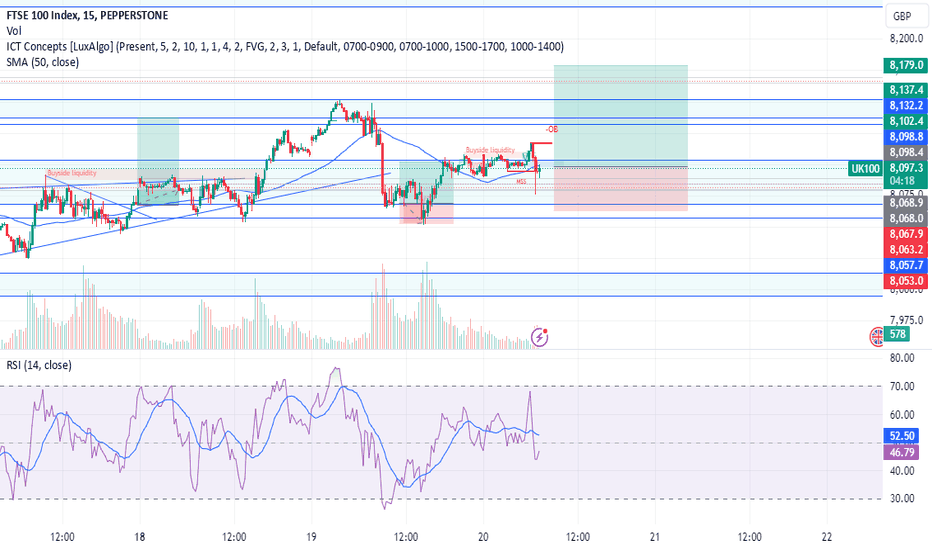

UK100 - TIME FOR ANOTHER ROUND Team, yesterday we went LONG UK and we got both target meet

today we take another long position but LESS risk since our stop loss is tight

entry price at 8068-62 with STOP LOSS at 8052-48

PLEASE NOTE, if it hit our stop loss, we will wait for next week entry at 7960 ranges

Our target at 8096-8105

target 2 at 8115-8126

Target 3 at 8136-45

Once it hit our 1ST target, please take some partial profit and bring stop loss to BE

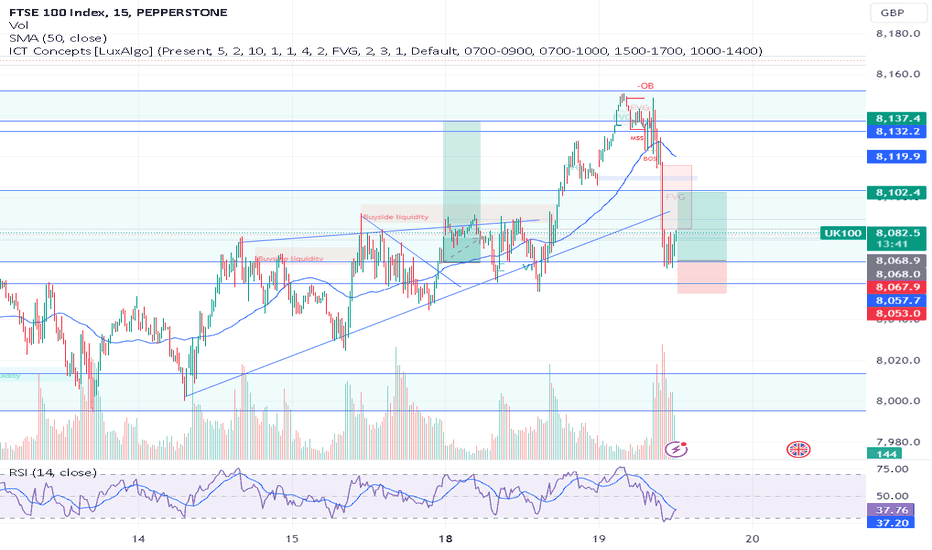

UK100 - SHOPPING TIME IS OVERTeam, yesterday we went long UK with target hit

as Today, I expect the downtrend hit toward 8080-65

So please enter slowly with RISK MANAGEMENT

Our target is 8096-8115 - TAKE SOME PARTIAL and bring stop loss to BE.

Target 2 at 8132-46

Target 3 at 8178-96

We play our STOP loss far away at 8035, if it hit stop loss RE-ENTER again. with another 30 points stop loss

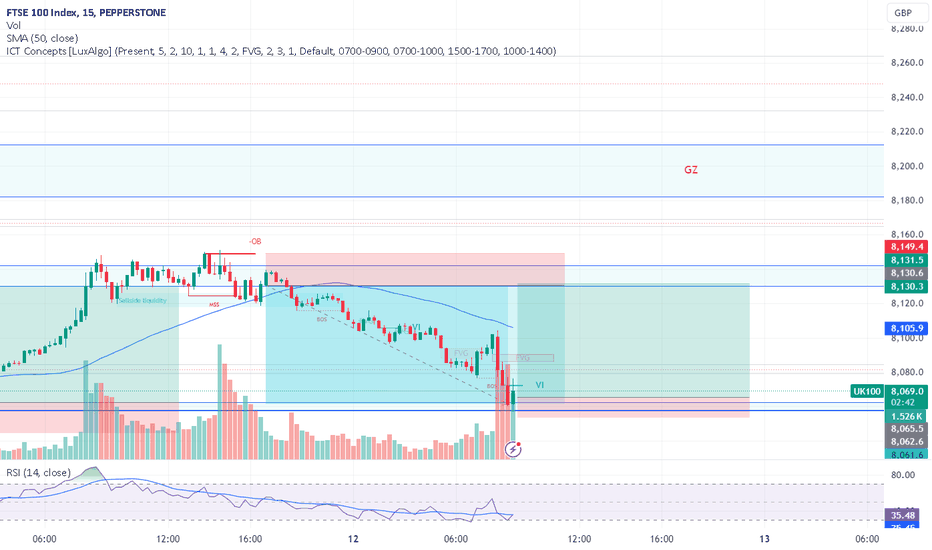

$GBINTR -B.o.E Cuts RatesECONOMICS:GBINTR

(November/2024)

source: Bank of England

-The Bank of England lowered its key interest rate by 25 bps to 4.75%, in line with expectations, following a hold in September and a quarter-point cut in August.

The U.S Fed ECONOMICS:USINTR is also expected to cut rates by 25bps today, following a larger 50bps reduction in September.

Traders are keen for signals on future policy, particularly after Trump’s re-election.

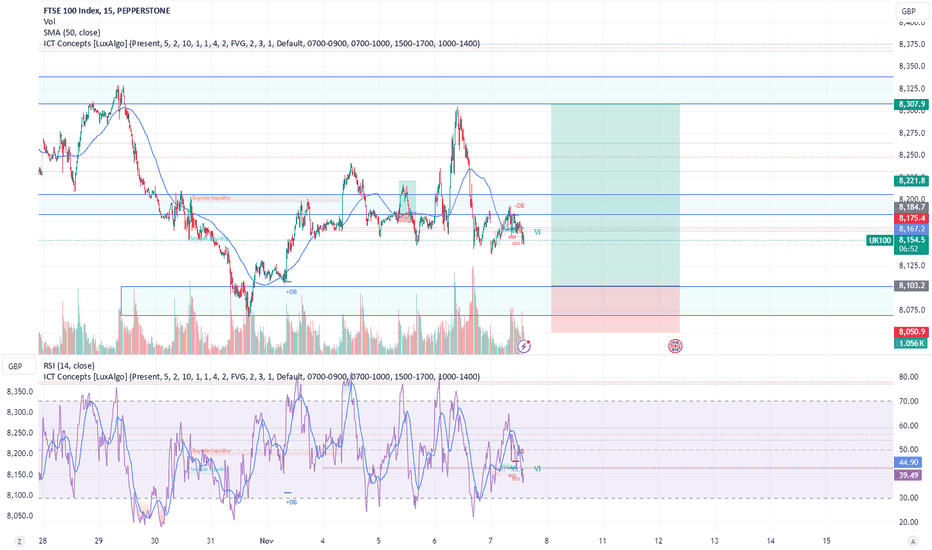

UK100 - it has been a whileTeam, with the UK100, we have not been trade since last week

we want to want for the RATE announcement

today 25% basic points is off the market

ENTER long/buy at 8150-55

We will consider add more at 8115-30

We need to move our stop loss far so we can move back once it it hit our first target like 8080-8065

Target 1 at 8180-82 - once it hit our target - take partial and bring stop loss to BE

Target 2 at 8225-40

Target 3 at 8245-65

Remember to enter slowly with RISK management.