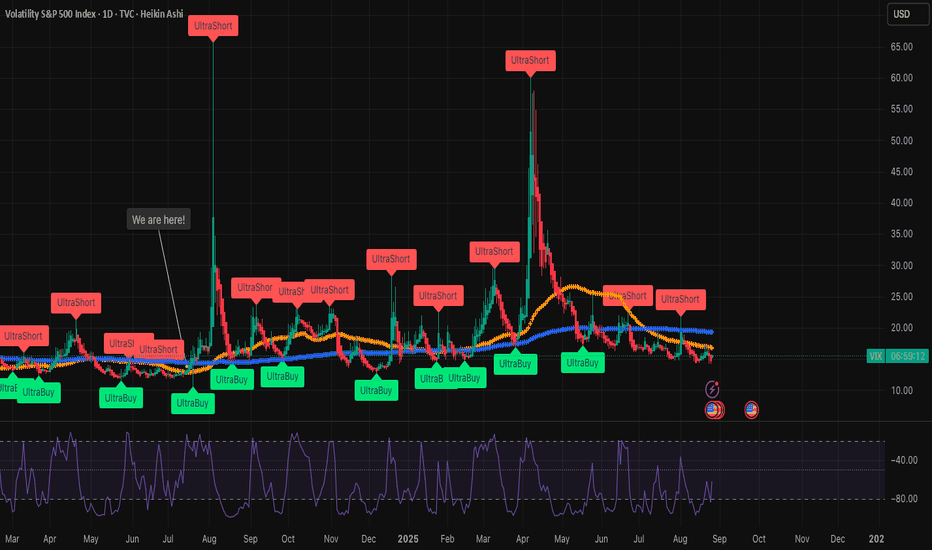

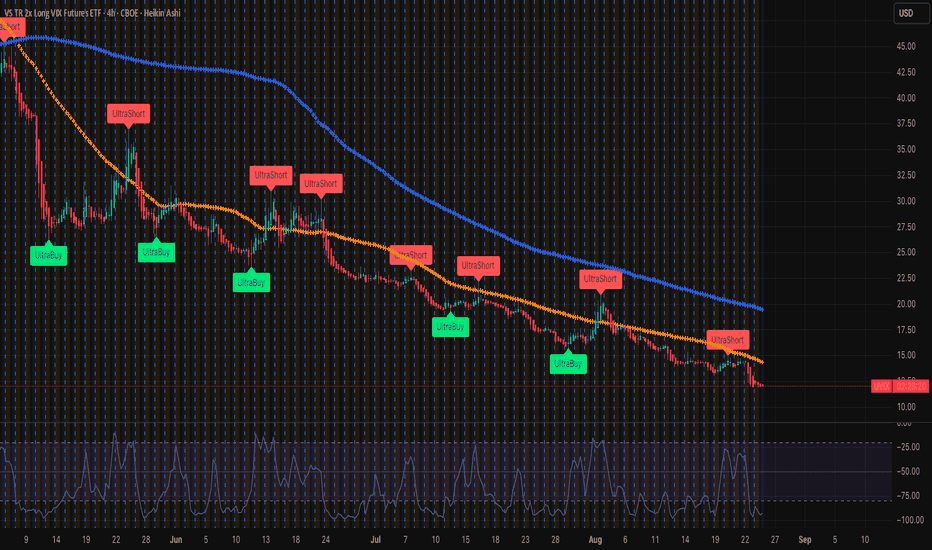

VIX looking real sweet now (use UVIX as proxy)For those tracking macros and true diversification, this is a potential nice play with a massive upside. Look at last year around July 17th. We are nearing this. Historically, the VIX bottoms out around 17-18 and it's sitting at 15. It doesn't stay in this region for too long. Most macros are looking extremely brittle and cracks are forming everywhere. I'd argue that the macros look worse now than in early 20202. Track this, put alerts on, use whatever technical you prefer, but this will spike and it's a massive upside. Some use UVIX as the proxy for the VIX :) Best of luck and always take calculated risks. If not, just go to your trusty bank and get 0.02% return annually!

Ultraalgo

Soon she will grow like a tree....UVIX (VIX proxy)Don't underestimate the VIX spike (UVIX is highly correlated), which has been sitting at a ONE YEAR low, which is extremely rare - only in times when a massive correction is about to happen! Frame this post bc historically VIX doesn't sit around 15 for too long (over 30 years). A major jump is unraveling and AI bubble will burst. Japan's long term interest rates are exploding and the Fed's short term rate cut cannot stop it since it's based on market demand / supply.