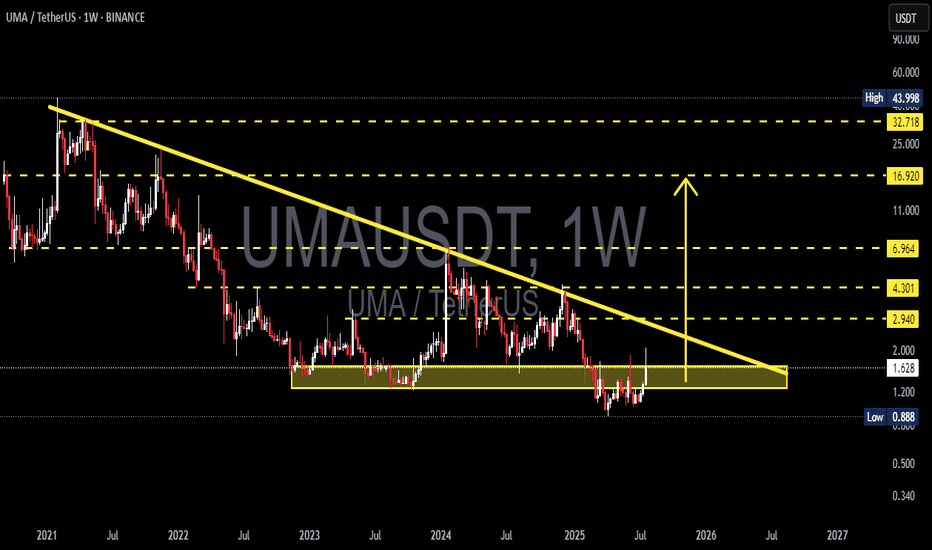

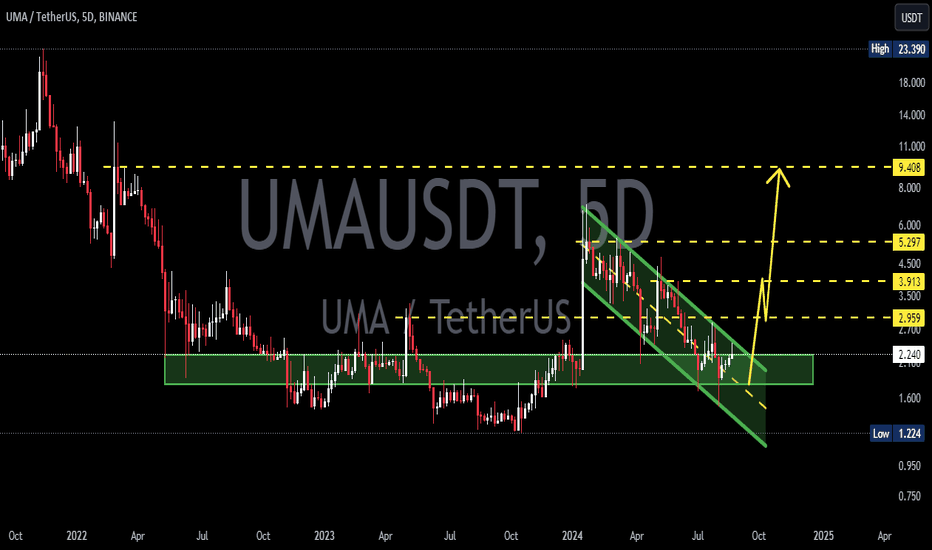

UMA/USDT Weekly Analysis – At the Edge of Compression?📉 Chart Overview:

UMA/USDT has been in a long-term downtrend since its peak in 2021. For nearly three years, price action has been trapped within a descending triangle pattern, forming consistent lower highs while holding a strong horizontal support zone around $0.88 – $1.20.

Over the last two years, UMA has been consolidating sideways, creating a massive accumulation base. Now, the price is sitting just beneath the descending trendline, putting the asset in a critical compression zone — a potential breakout could trigger a major trend shift.

🔍 Technical Pattern Breakdown:

Multi-year Descending Triangle structure with a well-defined horizontal base.

Long-term accumulation zone between $0.88 – $1.20, repeatedly tested but not broken.

UMA is currently pressing against the descending resistance line, building pressure.

Setup hints at a compression breakout, often leading to explosive moves when volume confirms.

🟢 Bullish Scenario – If Breakout Confirms:

If UMA breaks out convincingly above the descending trendline (~$1.85) with a weekly candle close and strong volume, the market could start targeting these levels:

1. ✅ $2.94 – First horizontal resistance from prior breakdown zone.

2. ✅ $4.30 – Key structure from mid-2023.

3. ✅ $6.96 – Larger swing target from historical resistance.

4. 🚀 $16.92 – Mid-to-long term target if bullish momentum sustains.

5. 🎯 $32 – $43 – Potential long-term upside under extreme bullish conditions (not base scenario).

Bullish Confirmation Signs:

Weekly candle close above trendline + high volume

RSI breaks above 50 with momentum

Bitcoin remains stable or bullish

🔴 Bearish Scenario – If Rejected Again:

If UMA fails to break the trendline:

Price could drop back into support: $1.20 → $0.88

A breakdown below $0.88 would open the door to new all-time lows

Watch for wicks and volume drop as signs of weakness

When Is Breakout Considered Failed?

Strong rejection from $1.80–$1.90

Weekly close back below $1.20

Broader market (especially BTC) turns sharply bearish

🎯 Trader Strategy Outlook:

Swing traders: Wait for breakout confirmation and retest before entering.

Long-term investors: The $0.90–$1.20 range remains a solid accumulation zone with tight risk management.

Conservative traders: Avoid entry until a clear close above the descending trendline.

📌 Final Thoughts:

> UMA is now positioned at a major inflection point after two years of sideways compression. The chart structure shows clear signs of long-term accumulation, and a breakout could mark the beginning of a new bullish trend cycle. However, patience and confirmation are crucial — this is a setup worth watching, not chasing.

#UMAUSDT #UMA #CryptoBreakout #TechnicalAnalysis #DescendingTriangle #AltcoinSetup #SwingTradeOpportunity #CryptoAccumulation #BreakoutWatch #PriceAction

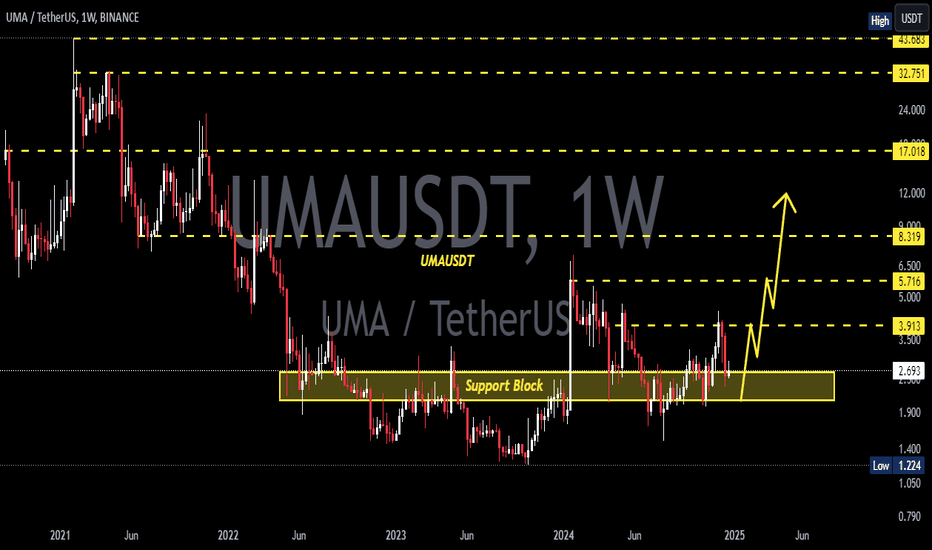

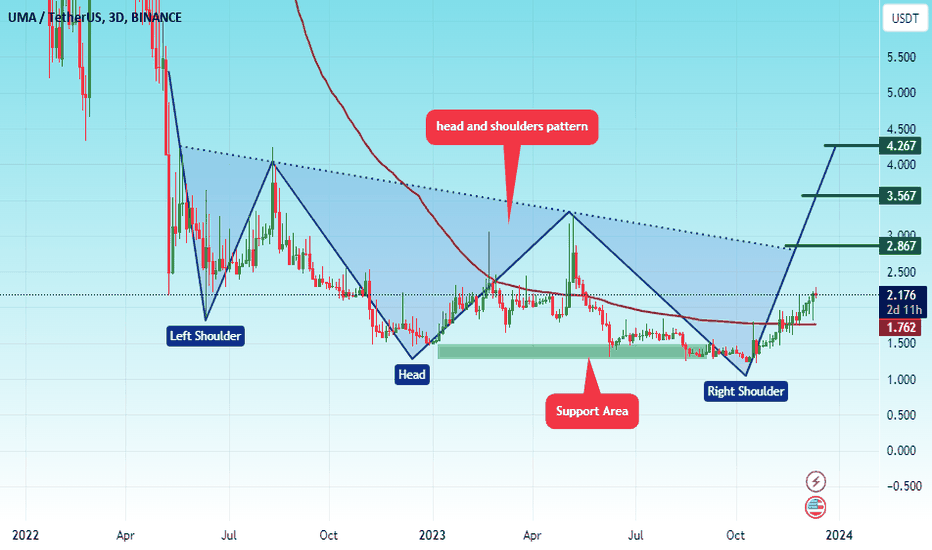

Umacoin

#UMA/USDT#UMA

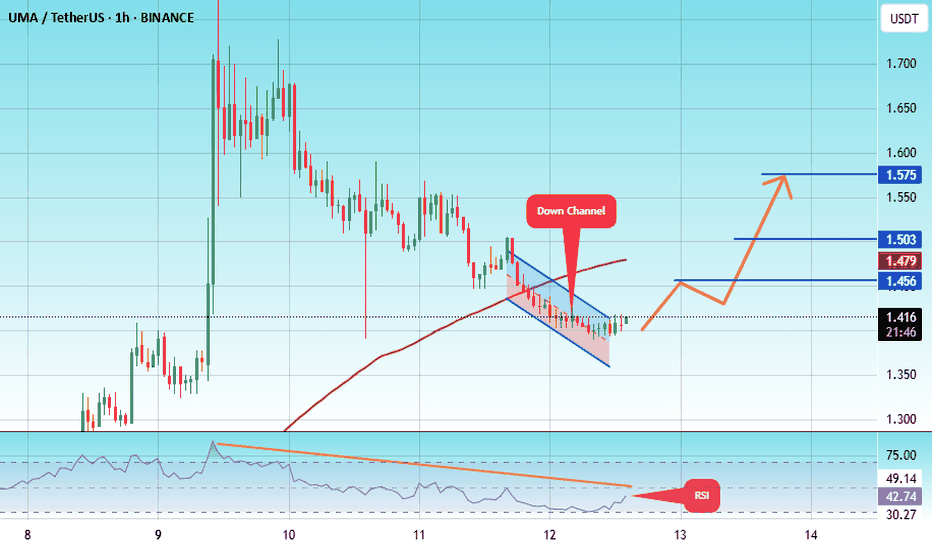

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.36.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 1.41

First target: 1.45

Second target: 1.50

Third target: 1.57

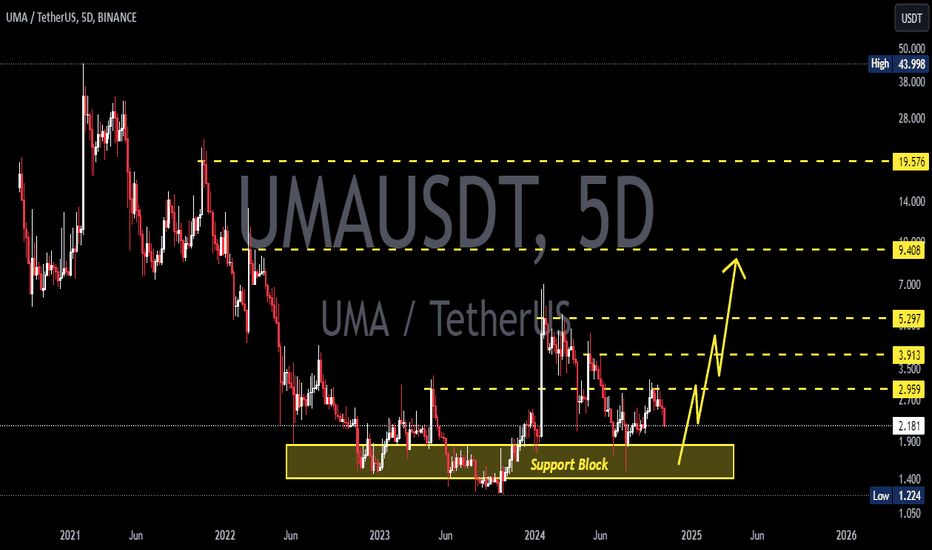

#UMA/USDT#UMA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 1.36.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.39

First target: 1.42

Second target: 1.45

Third target: 1.49