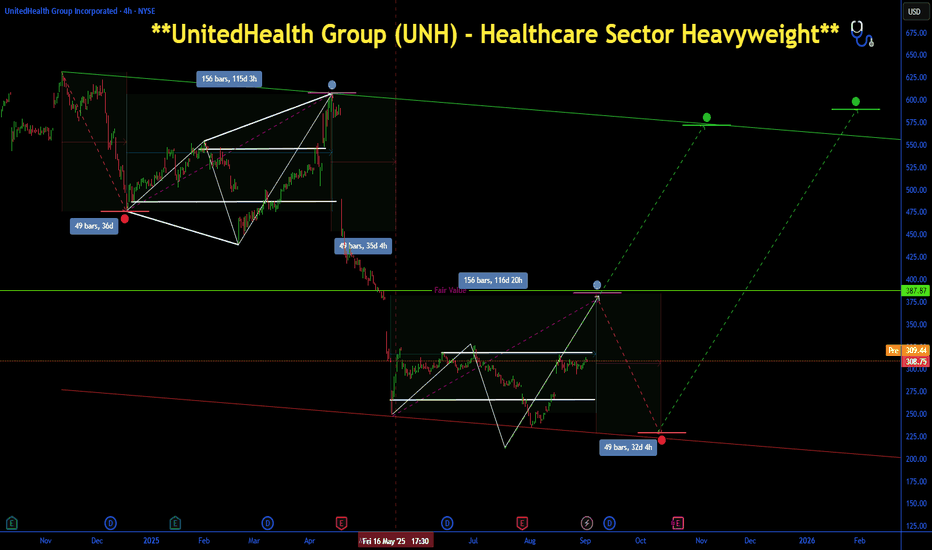

UnitedHealth Group (UNH) - Healthcare Sector Heavyweight**UnitedHealth Group (UNH) - Healthcare Sector Heavyweight** 🩺

Managed care leader trading cheap post-regulatory noise, straight from Graham's discount playbook—evoking Buffett's healthcare forays like his DaVita stake, leveraging moats for enduring value.

- **Key Metrics Showing Why It's Undervalued 💹**: At **$308.80**, trailing P/E **13.37** (below industry ~18), forward P/E **17.54**, P/B **2.95**, juicy yield **2.86%**. Market cap: **$279.67B**, ROE **21.65%** screams efficiency.

- **Potential Upside 🚀**: Analyst targets **$327.71** eye ~6% quick gain, but aging demographics could fuel 15-25% over 12 months—defensive sector moat buffers volatility.

- **How dcalpha.net Strategies Help 📈**: Leverage our portfolio tools with "Warren Buffett tips" on ROE filters—allocate 10-20% to healthcare, blending UNH for balanced growth and dividends, echoing value legends' resilience.