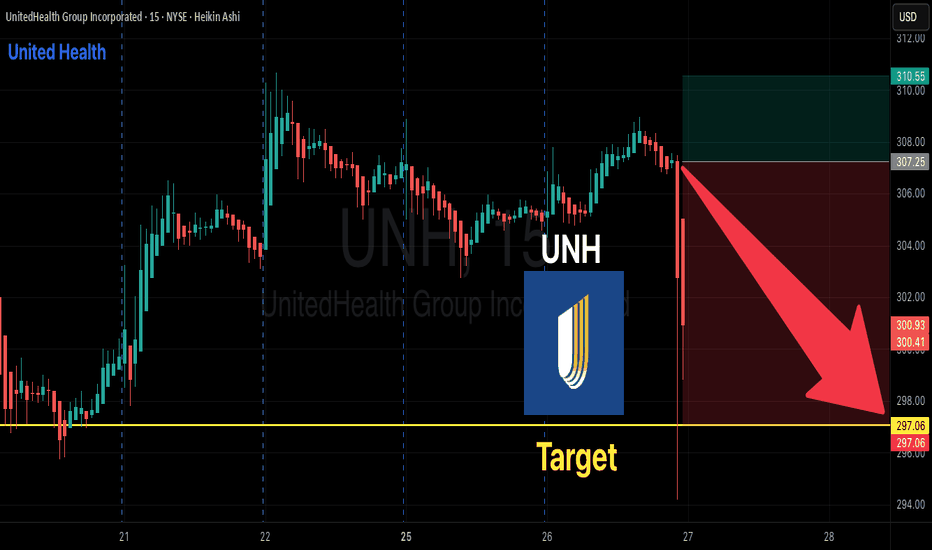

UNH Breakdown Ahead?= 297.5 PUT Jackpot

# 🚨 UNH Weekly Options Alert (2025-08-26) 🚨

🔥 Tactical Bearish Play or Sit Out? 🔥

### 📊 Key Takeaways

* ⚖️ Multi-timeframe conflict: Daily RSI \~61.7 (neutral-bullish) vs Weekly RSI 36.5 (bearish).

* 📉 Weekly trend = bearish, weak volume (0.4x).

* 📈 Options flow mildly bullish (C/P \~1.21) but no strong conviction.

* 📰 DOJ probe news = extra downside risk.

* 🤔 Most models say **NO TRADE** → but DeepSeek signals a tactical bearish PUT.

---

### 🎯 Trade Idea (High Risk / Tactical)

* 🏦 **Instrument**: \ NYSE:UNH

* ⬇️ **Direction**: PUT (short bias)

* 🎯 **Strike**: 297.50

* 💵 **Entry Price**: \$3.10 (midpoint)

* 💰 **Profit Target**: \$4.96 (+60%)

* 🛑 **Stop Loss**: \$1.86 (-40%)

* 📅 **Expiry**: 2025-08-29 (weekly)

* 📏 **Size**: 1 contract (conservative)

* ⏰ **Entry Timing**: At open

---

### ⚠️ Risks

* 📰 News volatility → DOJ probe can cause sharp reversals.

* ⌛ 3 DTE = **fast time decay** & gamma risk.

* 📉 Low volume = lack of institutional conviction.

---

### 🧭 Conclusion

* Majority: 🚫 No trade → wait for RSI alignment + stronger volume.

* Tactical bears: ✅ Take small PUT at 297.5 for downside skew.

---

### 📌 TRADE JSON (for algos/automation)

```json

{

"instrument": "UNH",

"direction": "put",

"strike": 297.5,

"expiry": "2025-08-29",

"confidence": 0.55,

"profit_target": 4.96,

"stop_loss": 1.86,

"size": 1,

"entry_price": 3.10,

"entry_timing": "open",

"signal_publish_time": "2025-08-26 18:42:52 EDT"

}

```

---

🔥 Suggested **title for TradingView post**:

**“🚨 UNH Weekly Options Play – DOJ Probe Sets Up Tactical Bearish PUT (297.5 Strike)”**

Unhinsurance

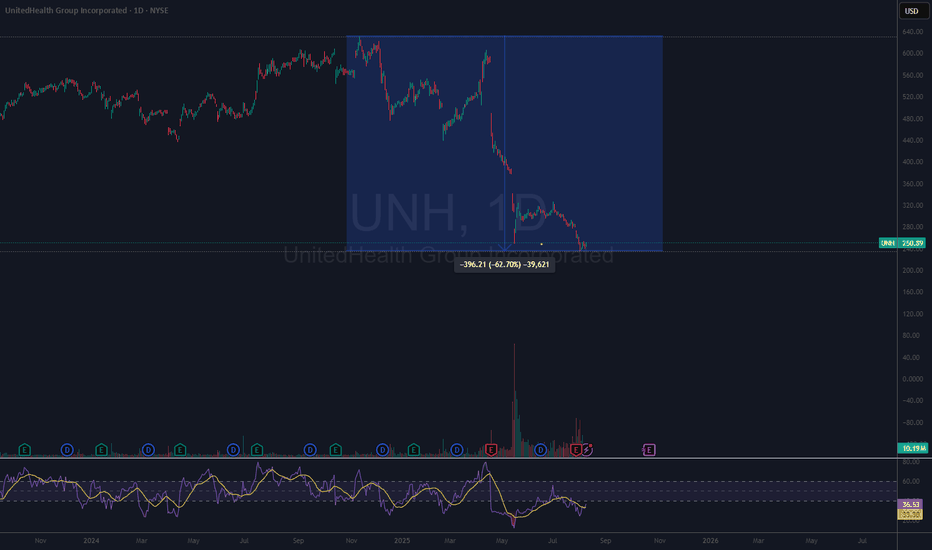

UNH a dead stock?After a 63% drop this year from its high, the stock has started seeing rebound.

- UNH's trailing P/E is near 10–11×, while forward P/E is compressed to ~15×

- The RSI had dropped to extreme oversold levels (~20) before rebounding above 39

- Despite current headwinds, UNH raised its dividend by 5%—marking 15 consecutive years of increases. Their current yield (~2.9%) is well above S&P 500 average.

- Q2 operations generated strong cash flow ($7.2B) and delivered a 20.6% return on equity, signaling disciplined capital allocation.

- High upside potential if earnings and sentiment recover.

- according to the quarterly call, New metrics set clearer expectations and reflect internal control.

This is a good stock to get into if you are looking at a 1-2 year horizon.

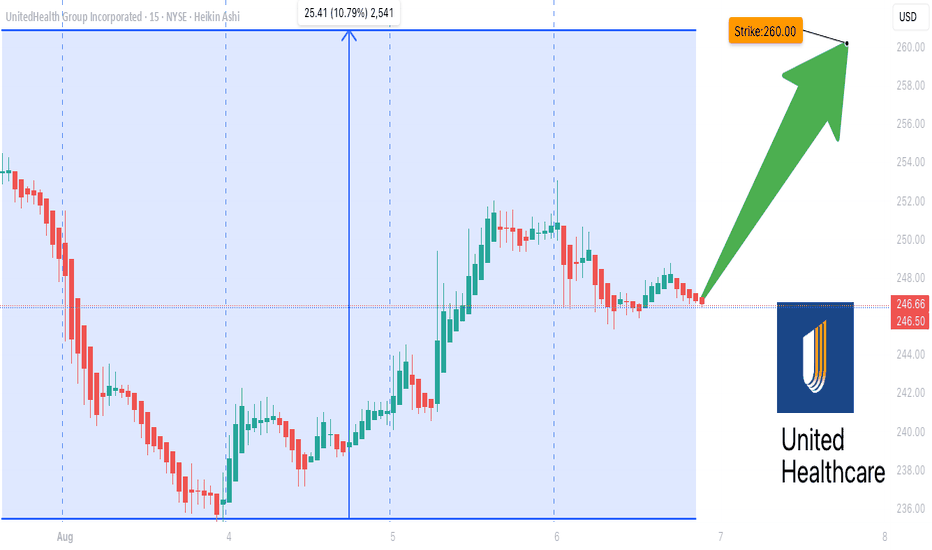

Big Money Is Betting on UNH — Are You In Yet?## 🚀 UNH Weekly Trade Idea: Bullish Momentum Brewing at \$260! 📈💥

UnitedHealth Group (\ NYSE:UNH ) is flashing bullish signals across the board:

📊 **Call/Put Ratio: 3.12** → Heavy institutional bullish flow

📈 **Daily & Weekly RSI: Rising**

💰 **Volume Increasing** → Accumulation Mode?

⚠️ **Gamma Risk HIGH** → Perfect storm for explosive moves!

---

### 🔥 Trade Setup:

🟢 **Buy 260 Call** (Exp: 08/08)

💵 Entry: \$0.69

🎯 Profit Target: \$1.03 – \$1.38

🛑 Stop Loss: \$0.34

📈 Confidence: 65%

All models aligned on this: **Bullish Bounce Likely**

Range of strikes (\$255–\$260) show heavy interest = 🚨 breakout setup

💡 **Risk Management:** High gamma = fast moves. Lock profits or cut quick. Stay nimble!

---

### 📌 Suggested Hashtags/Tags:

```

#UNH #OptionsTrading #CallOptions #BullishSetup #RSI #GammaRisk #WeeklyTrade #StockSignals #MomentumPlay #HealthcareStocks

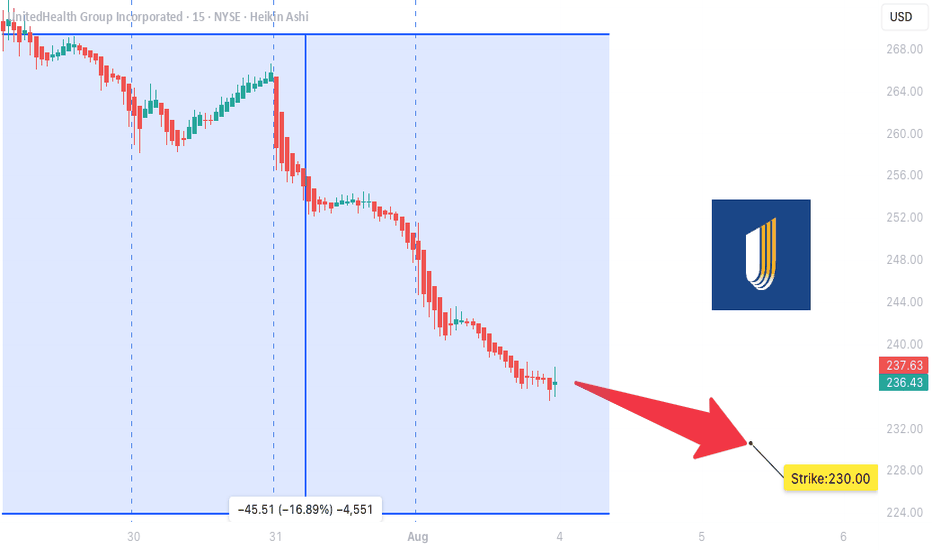

$UNH BEARISH SETUP – WEEK OF AUG 1

🔻 **\ NYSE:UNH BEARISH SETUP – WEEK OF AUG 1** 🔻

**UnitedHealth Group (UNH)** is showing classic breakdown signs. Here’s what the data says:

📉 **RSI Breakdown**

• Daily RSI: **20.6**

• Weekly RSI: **19.3**

→ Deeply oversold + no bounce = 🚨 momentum flush risk

📊 **Volume Surge**

• Weekly Volume: **145M** (1.9x avg)

→ Heavy **institutional selling**, NOT dip buying

🧠 **Options Insight**

• Call/Put Ratio: **1.17** = Slight bullish noise

• But... Expiry Gamma is 🚨HIGH = IV Crush incoming

• VIX: **20.7** = Volatility tailwinds intact

💣 **TRADE IDEA (PUT PLAY)**

• Direction: **BUY PUTS**

• Strike: **\$230**

• Expiry: **08/08/2025**

• Entry: **Monday Open**

• Target Premium: **\$0.10**

• 🎯 PT: \$0.30 | 🛑 SL: \$0.03

• Confidence: **70%**

📌 **Narrative**:

Oversold + High Volume Dump + No support bounce = Perfect storm for continuation dump. This is a high gamma play, time-sensitive, low-cost lotto setup. Risk small. Aim big.

---

💥 **Watchlist Tag**: ` NYSE:UNH AMEX:SPY AMEX:XLV `

🧠 **Strategy Tag**: #OversoldFlush #PutPlay #0DTETrap

🚀 Follow for more weekly earnings & options breakdowns!

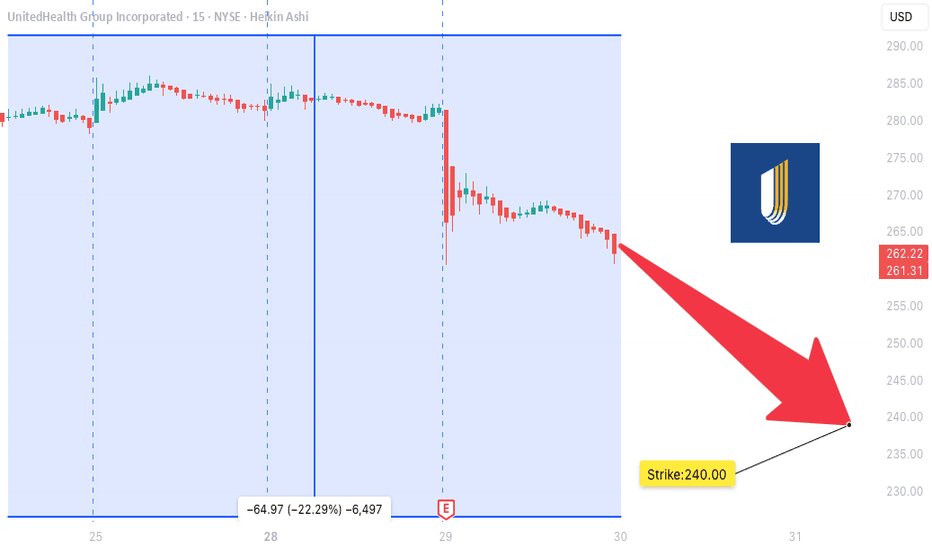

NH SWING TRADE IDEA (2025-07-29)

### 🩻 UNH SWING TRADE IDEA (2025-07-29)

**UnitedHealth Group – Bearish Setup**

📉 **Sentiment:** Moderately Bearish

📊 **Daily RSI:** 28.9 (Oversold!)

📉 **Momentum:** 5D/10D bearish

🔇 **Volume:** Weak (1.0x avg = low conviction)

💬 **Options Flow:** Neutral (C/P = 1.00)

🌬️ **VIX:** 15.71 — calm, tradable

---

### 🔻 Trade Setup

* **Play Type:** Naked PUT

* **Strike:** \$240.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.85

* **Target:** \$1.35

* **Stop:** \$0.60

* **Risk Size:** 1 contract

* **Entry Timing:** Market Open

* **Confidence:** 75% 📉

---

### 🤖 Model Consensus (5 Models)

✅ All agree: **Bearish RSI + Downward Momentum**

⚠️ Disagree on *strength* of the trend: moderate vs strong

💡 Models: Claude, Grok, Gemini, LLaMA, DeepSeek

---

### ⚠️ Key Risks

* Neutral options flow = no crowd confirmation

* Weak volume = price may stall or fake out

* Watch for VIX spikes — could flip sentiment fast

---

### 🔎 Summary for Swing Traders

**UNH \$240P → \$0.85 → \$1.35**

🧠 RSI confirms downside

⛔ Low volume = trade light, manage risk

📅 Target expiry: Aug 15

🧲 Key level: \$247.13 — if broken, ride lower

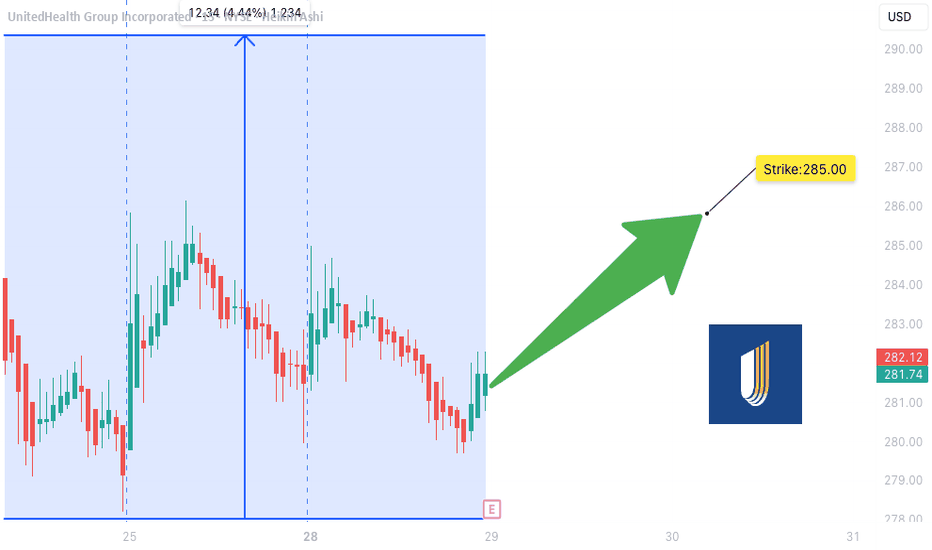

UNH Earnings Lotto Setup** (2025-07-28)

📊 **UNH Earnings Lotto Setup** (2025-07-28)

🎯 **Targeting a 2x return on post-earnings upside move**

---

### 💡 Trade Thesis:

**UnitedHealth (UNH)** is primed for a potential bounce on earnings:

* ✅ **Revenue Growth**: +9.8% YoY

* 🔥 **EPS Beat Rate**: 88% over last 8 quarters

* ⚠️ Margin compression risk from increased utilization

* 🧠 **Analyst Upgrades** trending positive

* 📉 RSI = **30.06** → Oversold territory

---

### 🔎 Options Flow & Technicals

* 🧲 Max Pain: **\$290**

* 🟢 Bullish call OI stacking at **\$285**

* ⚖️ IV Rank: **0.75** → Still has juice

* 🔻 Trading below 20D/50D MAs → Room for reversal

---

### 💰 Trade Setup

```json

{

"Instrument": "UNH",

"Direction": "Call (Long)",

"Strike": "$285",

"Entry Price": "$10.30",

"Profit Target": "$20.60 (2x)",

"Stop Loss": "$5.15 (50%)",

"Size": "1 contract",

"Expiry": "2025-08-01",

"Entry Timing": "Pre-Earnings Close (July 28)",

"Earnings Date": "2025-07-29 BMO",

"Expected Move": "±5%",

"Confidence": "70%"

}

```

---

### ⚖️ Risk/Reward

* Max Risk: 💸 \$1,030

* Max Gain: 🚀 \$1,030

* R/R Ratio: **1:2**

* Lotto-style with tight SL post-ER

---

### 🧭 Execution Plan

* 📅 Buy before close on **July 28**

* ⏰ Close same-day post ER **if target or SL hits**

* ❌ Exit manually if theta crush hits hard

---

### 🗣️ Final Note:

> “Oversold + Strong fundamentals + Positive consensus = Earnings bounce in the making.”

---

📌 Tag your UNH trades

💬 Drop your lotto setups

❤️ Like & repost if you're playing UNH this week!

\#UNH #EarningsPlay #OptionsTrading #TradingView #UNHEarnings #LottoTrade #CallOptions #HealthcareStocks #SwingTrade #RSI #IVRank #MaxPain

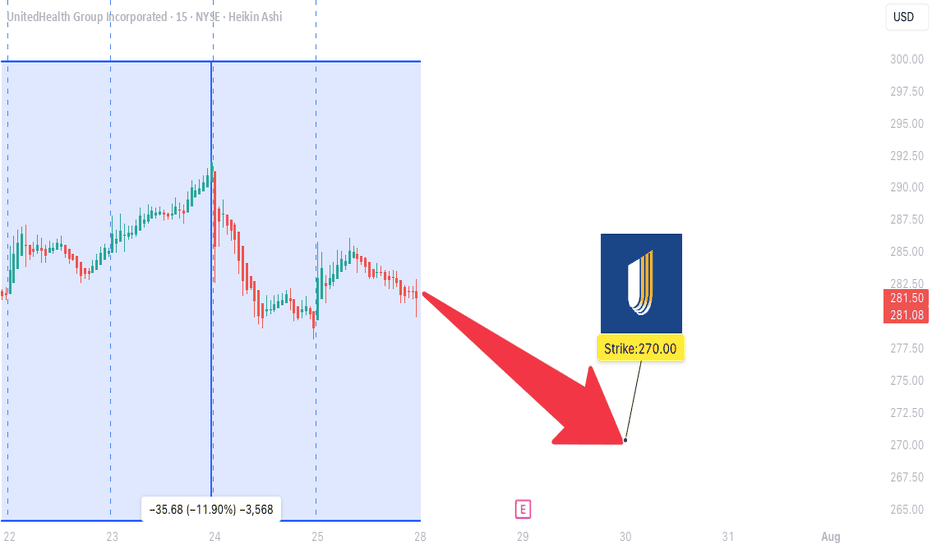

UNH WEEKLY TRADE IDEA (07/27/2025)

**🚨 UNH WEEKLY TRADE IDEA (07/27/2025) 🚨**

**Trend: Bearish Bias with Contrarian Options Flow**

🟥 **Technical Breakdown** + 🟩 **Bullish Flow Confusion** = Strategic Put Play

---

📊 **Key Technicals**

🧭 **Daily RSI:** 37.0 ⬇️

📉 **Weekly RSI:** 27.9 ⬇️ = *EXTREME BEARISH MOMENTUM*

📊 **Volume:** 1.2x prior week = *Institutional activity confirmed*

---

📈 **Options Flow Snapshot**

🟢 **Call/Put Ratio:** 1.64 → Normally bullish…

❗BUT in a falling market = **Contrarian noise** (per Gemini & Claude)

---

🔍 **Model Consensus Recap**

✅ All 5 models confirm BEARISH MOMENTUM

📉 Volume confirms downward pressure

❗ Disagreement only on *interpretation* of bullish call flow

📌 **Conclusion:** Put trade favored, but watch for surprise reversals

---

💥 **RECOMMENDED TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Buy-to-Open PUT

* **Strike**: \$270

* **Expiry**: Aug 1, 2025

* **Entry Price**: \~6.10

* **Profit Target**: \$12.00 (🔁 2x Gain)

* **Stop Loss**: \$3.00 (🔻\~50%)

📆 **Entry Timing:** Market Open Monday

📦 **Size:** 1 Contract

---

⚠️ **Key Risks to Monitor:**

* 📈 If UNH moves above \$290 (Max Pain), bearish thesis invalidates

* ⚡ Gamma risk increases mid-week — *manage actively!*

* 📉 Unexpected volume dry-up could stall momentum

---

📌 **JSON FORMAT TRADE DETAILS (For Scripts/Alerts):**

```json

{

"instrument": "UNH",

"direction": "put",

"strike": 270.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 12.00,

"stop_loss": 3.00,

"size": 1,

"entry_price": 6.10,

"entry_timing": "open",

"signal_publish_time": "2025-07-27 20:30:45 EDT"

}

```

---

💡 Summary:

Bearish momentum confirmed across models.

Flow confusion ≠ fade setup — it’s a **calculated put play**.

Trade smart, stay sharp.

🎯 Watch \$290.

💬 Tag fellow traders → \ NYSE:UNH bears unite!

\#UNH #OptionsTrading #BearishSetup #UnusualOptions #GammaRisk #MaxPain #TradingView #StockMarket

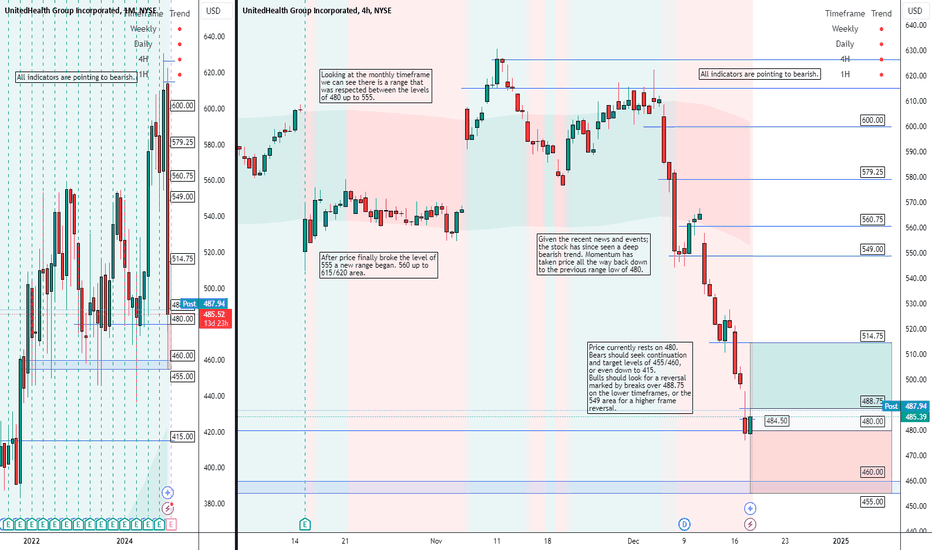

UNITEDHEALTH GROUP | THE BEAR'S CLAIM: $UNH PAYS THE PRICE Dec17UNITEDHEALTH GROUP | THE BEAR'S CLAIM: NYSE:UNH PAYS THE PRICE Dec17

UnitedHealth Group, NYSE:UNH , UNH

NYSE:UNH Trends:

NYSE:UNH Weekly Trend: Bearish

NYSE:UNH Daily Trend: Bearish

NYSE:UNH 4H Trend: Bearish

NYSE:UNH 1H Trend: Bearish

NYSE:UNH Price Target Areas:

NYSE:UNH BUY/LONG ZONE (GREEN): $488.75 - $514.75

NYSE:UNH DO NOT TRADE/DNT ZONE (WHITE): $480.00 - $488.75

NYSE:UNH SELL/SHORT ZONE (RED): $455.00 - $480.00

All indicators are pointing to bearish for $UNH. Looking at the monthly timeframe we can see there is a range that was respected between the levels of 480 up to 555. After price finally broke the level of 555 a new range began. 560 up to 615/620 area. Given the recent news and events; the stock has since seen a deep bearish trend. Momentum has taken price all the way back down to the previous range low of 480. Price currently rests on 480. Bears should seek continuation and target levels of 455/460, or even down to 415. Bulls should look for a reversal marked by breaks over 488.75 on the lower timeframes, or the 549 area for a higher frame reversal.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, unh, unitedhealth, unitedhealthgroup, NYSE:UNH , insurance, insuranceclaims, unhinsurance, unhclaims, unhdeductible, unhstock, unhprice, unhtarget, unhsetup, unhtrade, unhzone, medicare, unhanalysis, unitedhealthanalysis, unhtradeidea, unhidea, unhrecentevents,