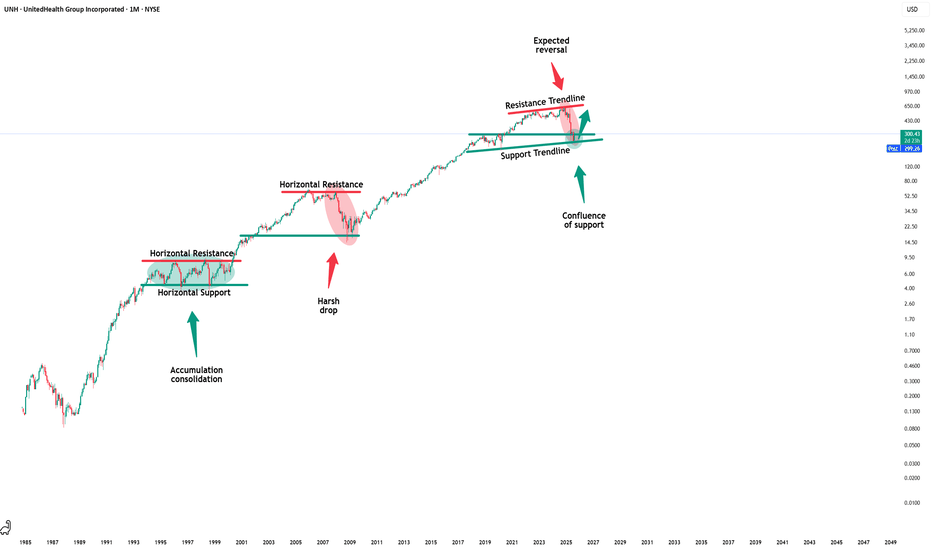

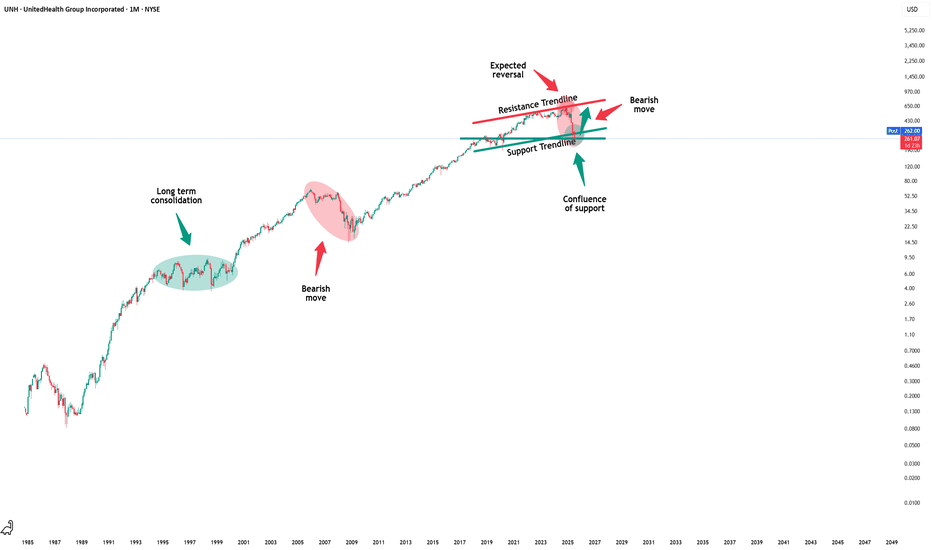

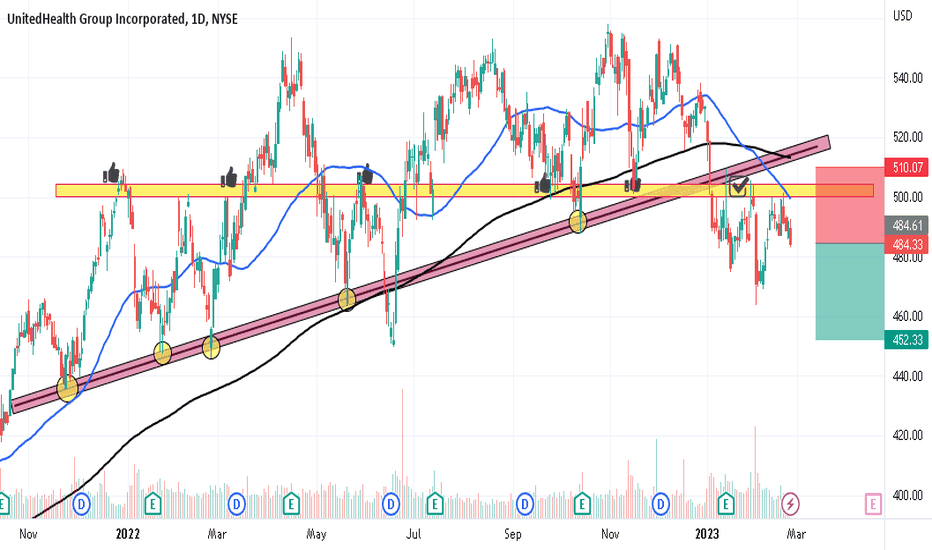

United Health - The ultimate prediction!🚑United Health ( NYSE:UNH ) will bottom now:

🔎Analysis summary:

Over the course of the past fourty years, we always witnessed strong drops on United Health. Each drop was expected though and always followed by new all time highs. Therefore history tells us that we now witnessed a bottom and United Health will rally quite soon.

📝Levels to watch:

$300

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Unhshares

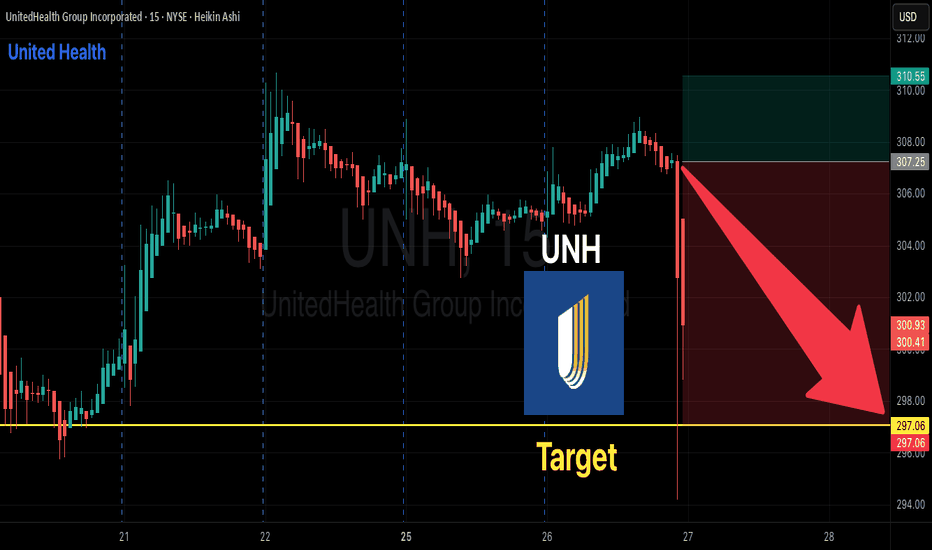

UNH Breakdown Ahead?= 297.5 PUT Jackpot

# 🚨 UNH Weekly Options Alert (2025-08-26) 🚨

🔥 Tactical Bearish Play or Sit Out? 🔥

### 📊 Key Takeaways

* ⚖️ Multi-timeframe conflict: Daily RSI \~61.7 (neutral-bullish) vs Weekly RSI 36.5 (bearish).

* 📉 Weekly trend = bearish, weak volume (0.4x).

* 📈 Options flow mildly bullish (C/P \~1.21) but no strong conviction.

* 📰 DOJ probe news = extra downside risk.

* 🤔 Most models say **NO TRADE** → but DeepSeek signals a tactical bearish PUT.

---

### 🎯 Trade Idea (High Risk / Tactical)

* 🏦 **Instrument**: \ NYSE:UNH

* ⬇️ **Direction**: PUT (short bias)

* 🎯 **Strike**: 297.50

* 💵 **Entry Price**: \$3.10 (midpoint)

* 💰 **Profit Target**: \$4.96 (+60%)

* 🛑 **Stop Loss**: \$1.86 (-40%)

* 📅 **Expiry**: 2025-08-29 (weekly)

* 📏 **Size**: 1 contract (conservative)

* ⏰ **Entry Timing**: At open

---

### ⚠️ Risks

* 📰 News volatility → DOJ probe can cause sharp reversals.

* ⌛ 3 DTE = **fast time decay** & gamma risk.

* 📉 Low volume = lack of institutional conviction.

---

### 🧭 Conclusion

* Majority: 🚫 No trade → wait for RSI alignment + stronger volume.

* Tactical bears: ✅ Take small PUT at 297.5 for downside skew.

---

### 📌 TRADE JSON (for algos/automation)

```json

{

"instrument": "UNH",

"direction": "put",

"strike": 297.5,

"expiry": "2025-08-29",

"confidence": 0.55,

"profit_target": 4.96,

"stop_loss": 1.86,

"size": 1,

"entry_price": 3.10,

"entry_timing": "open",

"signal_publish_time": "2025-08-26 18:42:52 EDT"

}

```

---

🔥 Suggested **title for TradingView post**:

**“🚨 UNH Weekly Options Play – DOJ Probe Sets Up Tactical Bearish PUT (297.5 Strike)”**

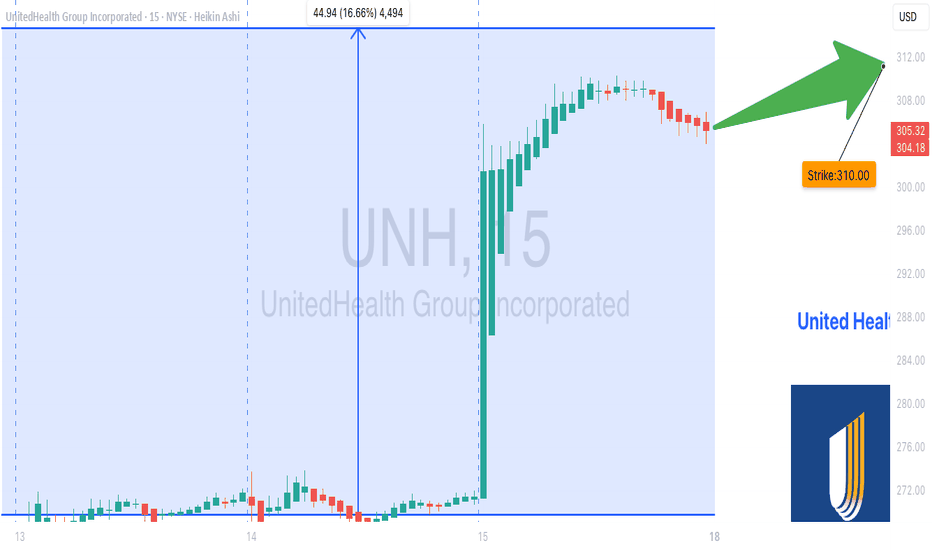

UNH Options Momentum Heating Up – Big Gains in Sight!

# 🚀 UNH Weekly Options Analysis (2025-08-17) – Don’t Miss Out!

### 🔎 Market Overview

UNH shows **strong bullish momentum**: Call/Put ratio at 2.56, rising daily RSI at 71.9, and institutional volume up 1.8x from last week confirm the bullish outlook. Weekly RSI at 37.5 suggests moderate resistance, so caution is advised. Low VIX (\~15) keeps gamma risk low, creating an optimal environment for directional trades.

---

### 📊 Key Model Insights

* **Call/Put Ratio:** 2.56 → strong bullish flow

* **Daily RSI:** 71.9 → strong short-term momentum

* **Weekly RSI:** 37.5 → moderate upward trend, watch resistance

* **Volume:** 1.8x previous week → institutional buying confirmed

* **Volatility:** Low VIX → low gamma risk

---

### 📊 Recommended Trade

* **Direction:** CALL (Long)

* **Strike:** \$310.00

* **Expiry:** 2025-08-22

* **Entry Price:** \$5.10 (aim for better at market open)

* **Stop Loss:** \$2.05 (\~60% of premium)

* **Profit Target:** \$7.65 – \$10.20 (50–100% gain)

* **Entry Timing:** Market Open

* **Confidence:** 75%

---

### ⚠️ Key Risks

* Momentum changes → monitor for trend reversal

* Gamma exposure → watch for VIX spikes approaching expiry

* Weekly close → exit by Thursday to avoid gamma decay Friday

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 310.00,

"expiry": "2025-08-22",

"confidence": 0.75,

"profit_target": 7.65,

"stop_loss": 2.05,

"size": 1,

"entry_price": 5.10,

"entry_timing": "open",

"signal_publish_time": "2025-08-17 12:11:11 EDT"

}

```

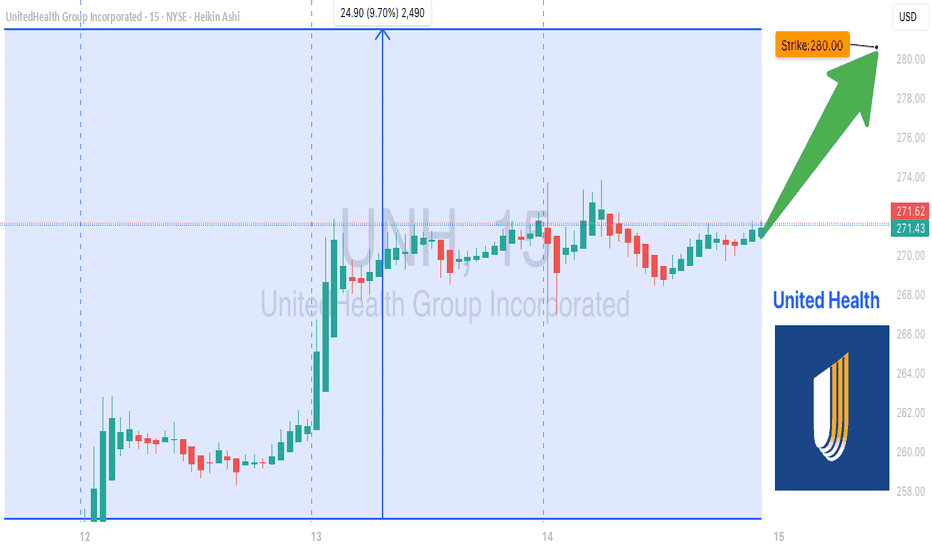

UNH $280 Calls on Fire – Momentum Exploding Today!🚀 UNH Bulls Target \$280 – One-Day Call Sprint

**Sentiment:** 🟢 *Moderate Bullish*

* **Daily RSI:** 55.7 📈

* **Call/Put Ratio:** 2.82 → strong bullish flow

* **Volume:** Weak (0.5× last week) → watch for hesitation

* **VIX:** 15.0 → favorable for directional trades

* **Gamma Risk:** HIGH — expiry in 1 day ⚡

---

### 📊 **Consensus Snapshot**

✅ Multiple models highlight bullish options flow

⚠️ Weak volume & resistance near \$272.19 = caution

💡 High gamma requires tight risk management

---

### 🎯 **Trade Setup**

* **Type:** CALL (Single-leg)

* **Strike:** \$280.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.70

* **Profit Target:** \$0.91 – \$1.40 (+30–100%)

* **Stop Loss:** \$0.42 (≈40%)

* **Confidence:** 65%

* **Entry Timing:** Market open

---

💬 *High-risk, high-momentum expiry play — monitor closely.*

📌 *Not financial advice. DYOR.*

---

**#UNH #OptionsTrading #CallOptions #TradingSignals #DayTrading #StocksToWatch #GammaRisk #OptionsFlow**

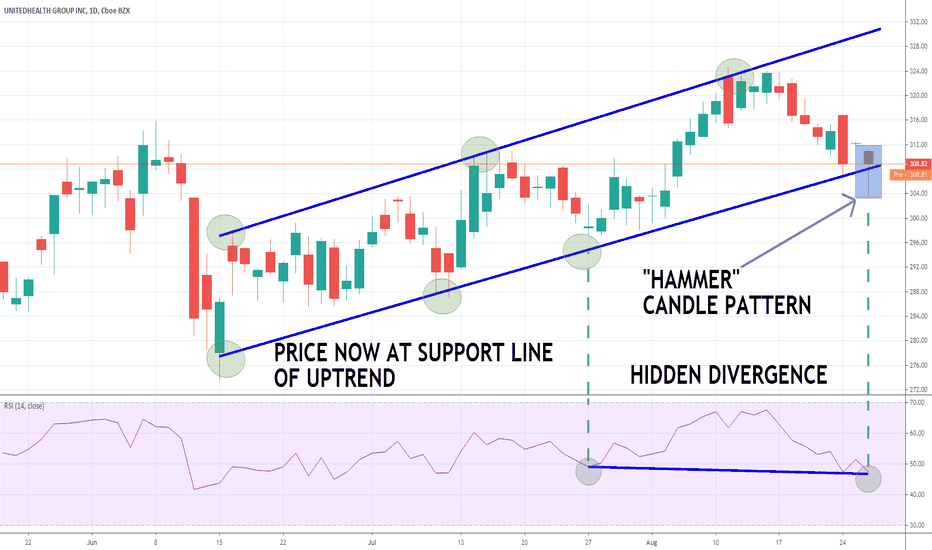

United Health - The perfect time to buy!⛑️United Health ( NYSE:UNH ) finished its massive drop:

🔎Analysis summary:

Over the past couple of months, United Health managed to drop an incredible -60%. This drop however was not unexpected and just the result of a retest of a massive resistance trendline. Considering the confluence of support though, a bullish reversal will emerge quite soon.

📝Levels to watch:

$250

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

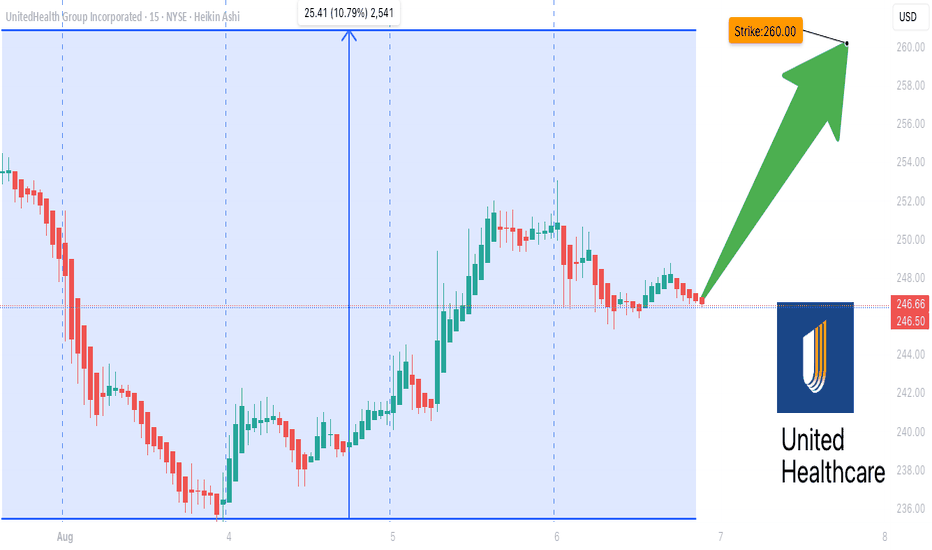

Big Money Is Betting on UNH — Are You In Yet?## 🚀 UNH Weekly Trade Idea: Bullish Momentum Brewing at \$260! 📈💥

UnitedHealth Group (\ NYSE:UNH ) is flashing bullish signals across the board:

📊 **Call/Put Ratio: 3.12** → Heavy institutional bullish flow

📈 **Daily & Weekly RSI: Rising**

💰 **Volume Increasing** → Accumulation Mode?

⚠️ **Gamma Risk HIGH** → Perfect storm for explosive moves!

---

### 🔥 Trade Setup:

🟢 **Buy 260 Call** (Exp: 08/08)

💵 Entry: \$0.69

🎯 Profit Target: \$1.03 – \$1.38

🛑 Stop Loss: \$0.34

📈 Confidence: 65%

All models aligned on this: **Bullish Bounce Likely**

Range of strikes (\$255–\$260) show heavy interest = 🚨 breakout setup

💡 **Risk Management:** High gamma = fast moves. Lock profits or cut quick. Stay nimble!

---

### 📌 Suggested Hashtags/Tags:

```

#UNH #OptionsTrading #CallOptions #BullishSetup #RSI #GammaRisk #WeeklyTrade #StockSignals #MomentumPlay #HealthcareStocks

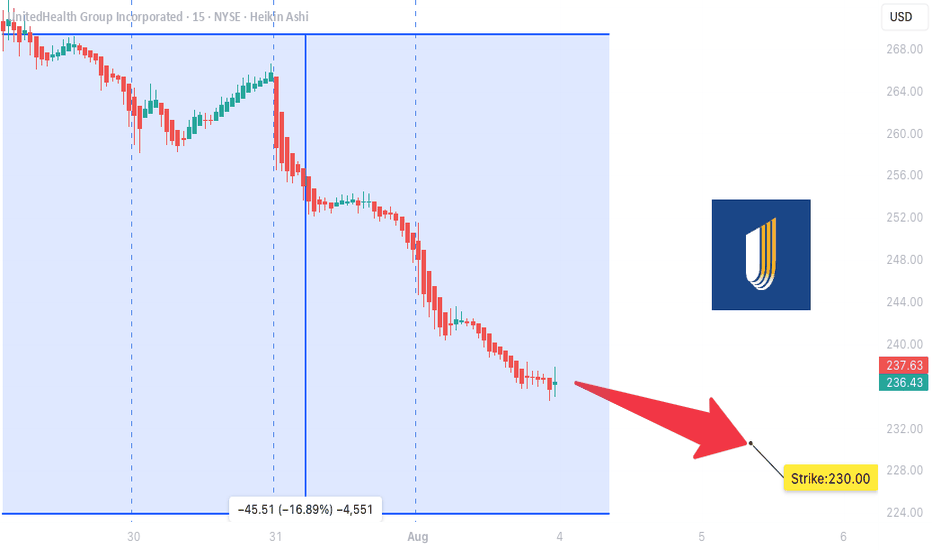

$UNH BEARISH SETUP – WEEK OF AUG 1

🔻 **\ NYSE:UNH BEARISH SETUP – WEEK OF AUG 1** 🔻

**UnitedHealth Group (UNH)** is showing classic breakdown signs. Here’s what the data says:

📉 **RSI Breakdown**

• Daily RSI: **20.6**

• Weekly RSI: **19.3**

→ Deeply oversold + no bounce = 🚨 momentum flush risk

📊 **Volume Surge**

• Weekly Volume: **145M** (1.9x avg)

→ Heavy **institutional selling**, NOT dip buying

🧠 **Options Insight**

• Call/Put Ratio: **1.17** = Slight bullish noise

• But... Expiry Gamma is 🚨HIGH = IV Crush incoming

• VIX: **20.7** = Volatility tailwinds intact

💣 **TRADE IDEA (PUT PLAY)**

• Direction: **BUY PUTS**

• Strike: **\$230**

• Expiry: **08/08/2025**

• Entry: **Monday Open**

• Target Premium: **\$0.10**

• 🎯 PT: \$0.30 | 🛑 SL: \$0.03

• Confidence: **70%**

📌 **Narrative**:

Oversold + High Volume Dump + No support bounce = Perfect storm for continuation dump. This is a high gamma play, time-sensitive, low-cost lotto setup. Risk small. Aim big.

---

💥 **Watchlist Tag**: ` NYSE:UNH AMEX:SPY AMEX:XLV `

🧠 **Strategy Tag**: #OversoldFlush #PutPlay #0DTETrap

🚀 Follow for more weekly earnings & options breakdowns!

UnitedHealth (UNH) Shares Plunge Following Earnings ReportUnitedHealth (UNH) Shares Plunge Following Earnings Report

Yesterday, prior to the opening of the main trading session, UnitedHealth released its quarterly results along with forward guidance. As a result, UNH shares dropped by over 7%, signalling deep disappointment among market participants. According to media reports:

→ Earnings per share came in at $4.08, missing analysts’ expectations of $4.48.

→ Revenue guidance was set at $445.5–448 billion, falling short of the anticipated $449.07 billion.

→ Concerns were further fuelled by rising costs and declining profitability, which the company attributed to the continued impact of Medicare funding cuts.

Consequently, the UNH share price dropped to its lowest level of 2025, last seen on 15 May.

Technical Analysis of UNH Stock Chart

In our end-of-May analysis, we updated the descending channel on the UNH stock chart and highlighted that following the recovery from the May low (marked by arrow 1), sellers could regain control. Since then:

→ Throughout June, the share price exhibited signs of supply-demand equilibrium around the psychological $300 level.

→ However, after an unsuccessful rally that formed peak A (which now resembles a bull trap), the balance shifted in favour of the bears. The price began to slide lower along the median line of the descending channel (illustrated by arrow 2).

This pattern was a red flag, particularly against the backdrop of a broadly rising equity market since the beginning of summer. Even if the bulls had hope, yesterday's candle could have completely extinguished it:

→ The session opened with a wide bearish gap.

→ During the day, bulls attempted a recovery, but failed — the candlestick closed at the daily low, leaving a long upper wick, a classic sign of selling pressure.

In this context, we could assume that:

→ Bears may seek to extend their advantage and test the year’s low;

→ The bearish gap area (highlighted in purple), reinforced by the descending channel’s median line, could act as resistance during any potential recovery.

At the same time, the $250 psychological level appears to be a strong support zone. This is backed by the 15 May bullish pin bar formed on record trading volumes — a potential sign of institutional interest in accumulating shares of this healthcare giant in anticipation of a long-term recovery.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

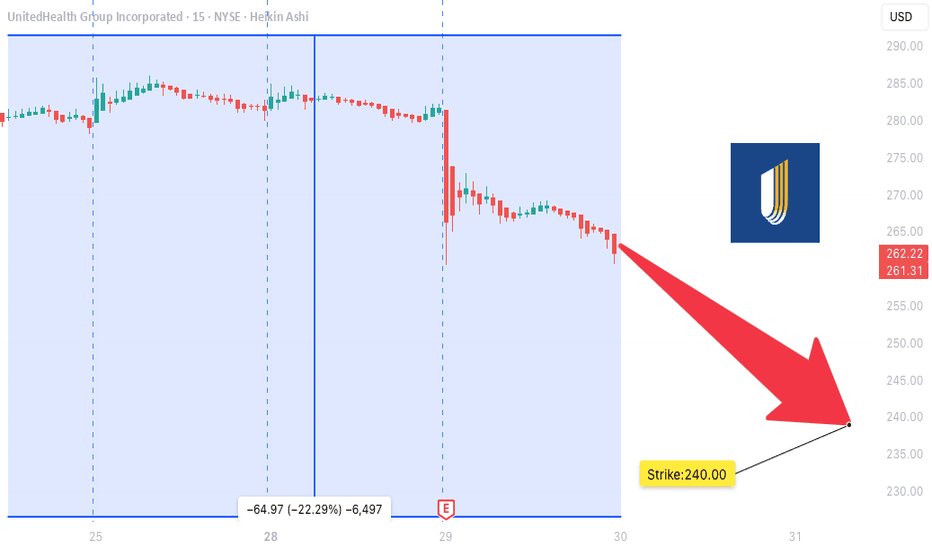

NH SWING TRADE IDEA (2025-07-29)

### 🩻 UNH SWING TRADE IDEA (2025-07-29)

**UnitedHealth Group – Bearish Setup**

📉 **Sentiment:** Moderately Bearish

📊 **Daily RSI:** 28.9 (Oversold!)

📉 **Momentum:** 5D/10D bearish

🔇 **Volume:** Weak (1.0x avg = low conviction)

💬 **Options Flow:** Neutral (C/P = 1.00)

🌬️ **VIX:** 15.71 — calm, tradable

---

### 🔻 Trade Setup

* **Play Type:** Naked PUT

* **Strike:** \$240.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.85

* **Target:** \$1.35

* **Stop:** \$0.60

* **Risk Size:** 1 contract

* **Entry Timing:** Market Open

* **Confidence:** 75% 📉

---

### 🤖 Model Consensus (5 Models)

✅ All agree: **Bearish RSI + Downward Momentum**

⚠️ Disagree on *strength* of the trend: moderate vs strong

💡 Models: Claude, Grok, Gemini, LLaMA, DeepSeek

---

### ⚠️ Key Risks

* Neutral options flow = no crowd confirmation

* Weak volume = price may stall or fake out

* Watch for VIX spikes — could flip sentiment fast

---

### 🔎 Summary for Swing Traders

**UNH \$240P → \$0.85 → \$1.35**

🧠 RSI confirms downside

⛔ Low volume = trade light, manage risk

📅 Target expiry: Aug 15

🧲 Key level: \$247.13 — if broken, ride lower

UNH Earnings Lotto Setup** (2025-07-28)

📊 **UNH Earnings Lotto Setup** (2025-07-28)

🎯 **Targeting a 2x return on post-earnings upside move**

---

### 💡 Trade Thesis:

**UnitedHealth (UNH)** is primed for a potential bounce on earnings:

* ✅ **Revenue Growth**: +9.8% YoY

* 🔥 **EPS Beat Rate**: 88% over last 8 quarters

* ⚠️ Margin compression risk from increased utilization

* 🧠 **Analyst Upgrades** trending positive

* 📉 RSI = **30.06** → Oversold territory

---

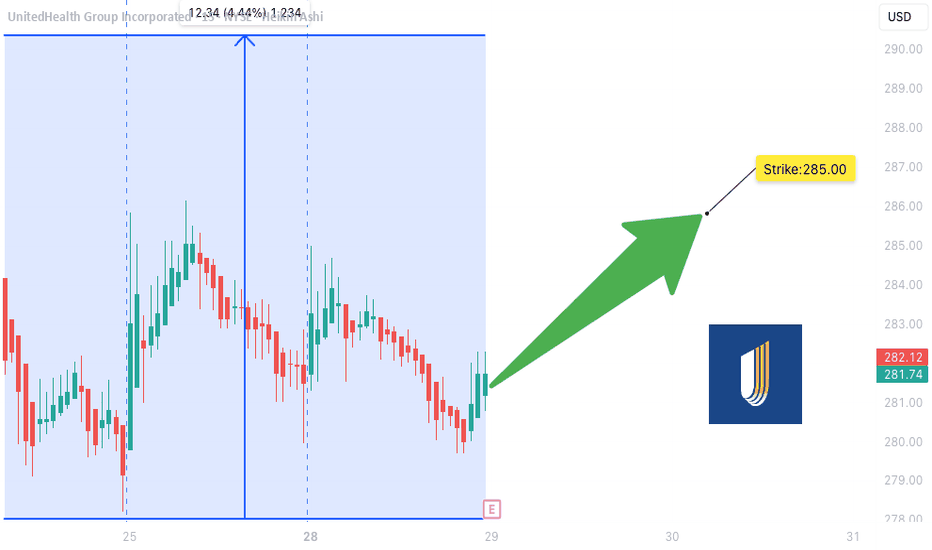

### 🔎 Options Flow & Technicals

* 🧲 Max Pain: **\$290**

* 🟢 Bullish call OI stacking at **\$285**

* ⚖️ IV Rank: **0.75** → Still has juice

* 🔻 Trading below 20D/50D MAs → Room for reversal

---

### 💰 Trade Setup

```json

{

"Instrument": "UNH",

"Direction": "Call (Long)",

"Strike": "$285",

"Entry Price": "$10.30",

"Profit Target": "$20.60 (2x)",

"Stop Loss": "$5.15 (50%)",

"Size": "1 contract",

"Expiry": "2025-08-01",

"Entry Timing": "Pre-Earnings Close (July 28)",

"Earnings Date": "2025-07-29 BMO",

"Expected Move": "±5%",

"Confidence": "70%"

}

```

---

### ⚖️ Risk/Reward

* Max Risk: 💸 \$1,030

* Max Gain: 🚀 \$1,030

* R/R Ratio: **1:2**

* Lotto-style with tight SL post-ER

---

### 🧭 Execution Plan

* 📅 Buy before close on **July 28**

* ⏰ Close same-day post ER **if target or SL hits**

* ❌ Exit manually if theta crush hits hard

---

### 🗣️ Final Note:

> “Oversold + Strong fundamentals + Positive consensus = Earnings bounce in the making.”

---

📌 Tag your UNH trades

💬 Drop your lotto setups

❤️ Like & repost if you're playing UNH this week!

\#UNH #EarningsPlay #OptionsTrading #TradingView #UNHEarnings #LottoTrade #CallOptions #HealthcareStocks #SwingTrade #RSI #IVRank #MaxPain

UNH WEEKLY TRADE IDEA (07/27/2025)

**🚨 UNH WEEKLY TRADE IDEA (07/27/2025) 🚨**

**Trend: Bearish Bias with Contrarian Options Flow**

🟥 **Technical Breakdown** + 🟩 **Bullish Flow Confusion** = Strategic Put Play

---

📊 **Key Technicals**

🧭 **Daily RSI:** 37.0 ⬇️

📉 **Weekly RSI:** 27.9 ⬇️ = *EXTREME BEARISH MOMENTUM*

📊 **Volume:** 1.2x prior week = *Institutional activity confirmed*

---

📈 **Options Flow Snapshot**

🟢 **Call/Put Ratio:** 1.64 → Normally bullish…

❗BUT in a falling market = **Contrarian noise** (per Gemini & Claude)

---

🔍 **Model Consensus Recap**

✅ All 5 models confirm BEARISH MOMENTUM

📉 Volume confirms downward pressure

❗ Disagreement only on *interpretation* of bullish call flow

📌 **Conclusion:** Put trade favored, but watch for surprise reversals

---

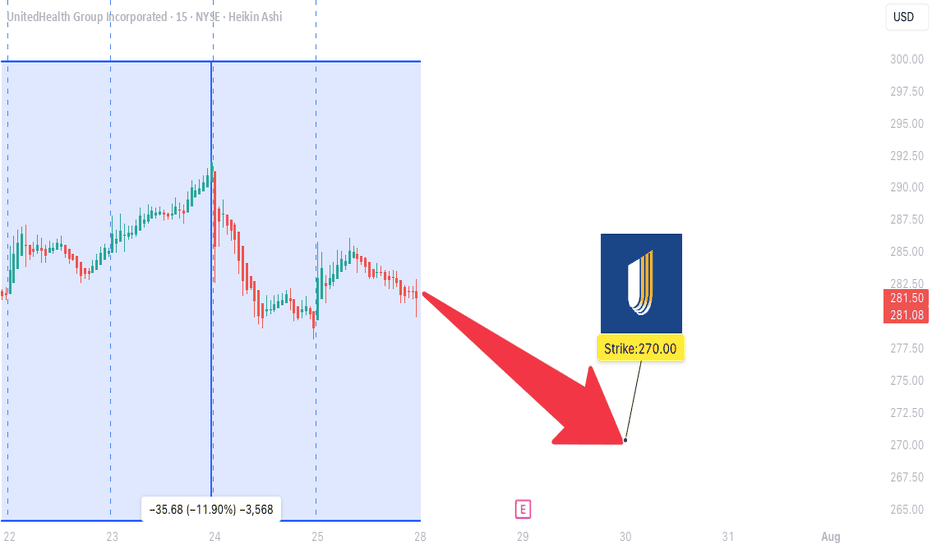

💥 **RECOMMENDED TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Buy-to-Open PUT

* **Strike**: \$270

* **Expiry**: Aug 1, 2025

* **Entry Price**: \~6.10

* **Profit Target**: \$12.00 (🔁 2x Gain)

* **Stop Loss**: \$3.00 (🔻\~50%)

📆 **Entry Timing:** Market Open Monday

📦 **Size:** 1 Contract

---

⚠️ **Key Risks to Monitor:**

* 📈 If UNH moves above \$290 (Max Pain), bearish thesis invalidates

* ⚡ Gamma risk increases mid-week — *manage actively!*

* 📉 Unexpected volume dry-up could stall momentum

---

📌 **JSON FORMAT TRADE DETAILS (For Scripts/Alerts):**

```json

{

"instrument": "UNH",

"direction": "put",

"strike": 270.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 12.00,

"stop_loss": 3.00,

"size": 1,

"entry_price": 6.10,

"entry_timing": "open",

"signal_publish_time": "2025-07-27 20:30:45 EDT"

}

```

---

💡 Summary:

Bearish momentum confirmed across models.

Flow confusion ≠ fade setup — it’s a **calculated put play**.

Trade smart, stay sharp.

🎯 Watch \$290.

💬 Tag fellow traders → \ NYSE:UNH bears unite!

\#UNH #OptionsTrading #BearishSetup #UnusualOptions #GammaRisk #MaxPain #TradingView #StockMarket

UNH Weekly Options Play – Bearish Setup (7/21/2025)

📉 UNH Weekly Options Play – Bearish Setup (7/21/2025)

RSI Breakdown 📊 | Institutional Hedging? 🤔 | Bearish Trend Confirmed 🚨

⸻

🧠 Multi-Model Analysis Summary

🔻 RSI Trends: Falling daily + weekly RSI → strong bearish momentum

📉 Volume: Consistently negative across models → confirms selling pressure

🧠 Options Flow: High Call/Put ratio (3.01) — debated as bullish hedge vs short cover

📌 Outcome: Consensus bearish, with minor short-term upside risk due to calls

⸻

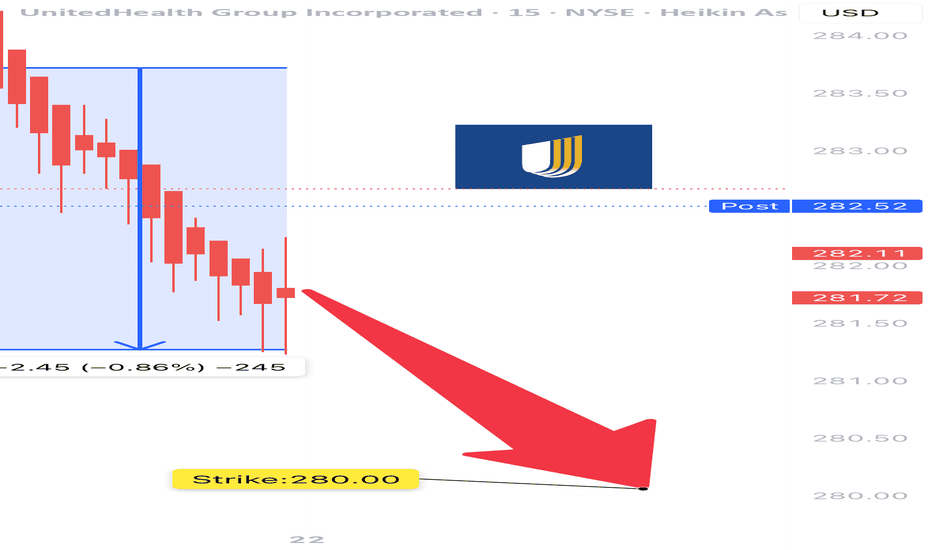

🎯 TRADE IDEA – UNH $280 PUT

💥 Direction: Bearish

🧾 Strike: $280 Put

📆 Expiry: July 25, 2025

💵 Entry: $2.35

🛑 Stop: $1.18 (≈50% loss cap)

🎯 Target: $4.70 (≈100% gain)

📈 Confidence: 70%

⏰ Entry Time: Market Open

⸻

📎 Why Take This Trade?

✅ RSI + volume = bearish momentum confirmed

✅ Volatility is favorable for option premium expansion

❗️ Watch for gamma near expiry & unexpected institutional sentiment shifts

⸻

📊 TRADE_DETAILS JSON

{

"instrument": "UNH",

"direction": "put",

"strike": 280.0,

"expiry": "2025-07-25",

"confidence": 0.70,

"profit_target": 4.70,

"stop_loss": 1.18,

"size": 1,

"entry_price": 2.35,

"entry_timing": "open",

"signal_publish_time": "2025-07-21 12:49:28 EDT"

}

⸻

🔥 #UNH #OptionsTrade #BearishSetup #WeeklyTrade #PutOptions #InstitutionalFlow #MarketMomentum #VolatilityPlay

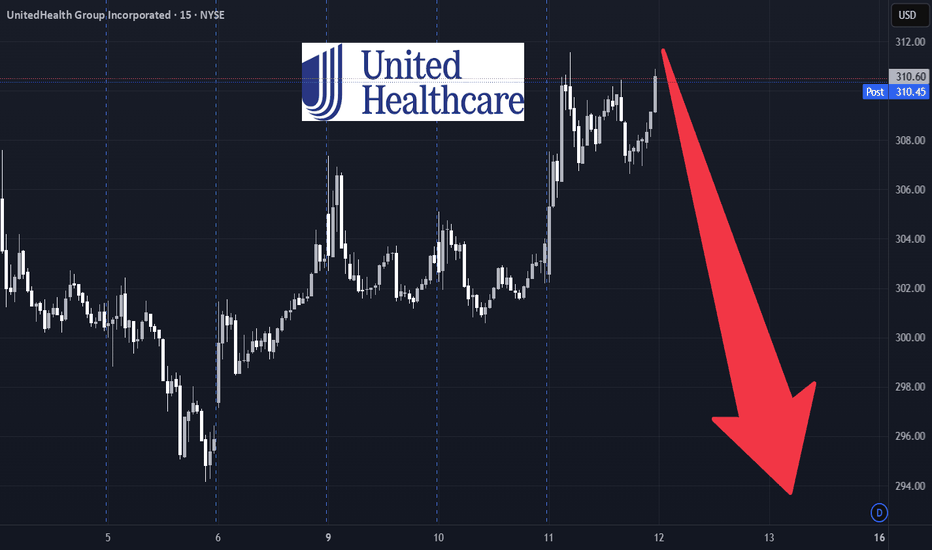

UNH Weekly Options Setup – Short-Term Pullback Risk (2025-06-11)📉 UNH Weekly Options Setup – Short-Term Pullback Risk (2025-06-11)

Ticker: NYSE:UNH (UnitedHealth Group)

Bias: Short-Term Bearish

Setup Timing: Market Open | Confidence: 70%

🔍 AI Model Consensus Overview

📍 Price: ~$310.56

📈 Momentum: Strong intraday bullish momentum — price above 10, 50, and 200 EMAs

📉 RSI: 5-min RSI ~79 → overbought

🎯 Max Pain: $300 → potential gravitational pull

🧠 Sentiment Split:

Bullish Models: Grok/xAI & DeepSeek

→ Focus on short-term momentum and trend continuation

Bearish Models: Llama/Meta & Gemini/Google

→ Emphasize overbought conditions & option pressure to steer price toward $300

⚖️ Strategic Summary

All models agree that:

• UNH is technically strong, but very overbought

• Max pain at $300 presents a downside magnet

• Both call and put options have tradable liquidity

Disagreement:

• Bulls see trend continuation

• Bears expect short-term correction before any continuation

✅ Recommended Trade

🎯 Direction: PUT

🛒 Strike: $300

📅 Expiry: 2025-06-13

💵 Entry Price: $0.60

🎯 Profit Target: $0.90 (+50%)

🛑 Stop Loss: $0.30 (–50%)

📈 Confidence: 70%

⏰ Entry Timing: Market open

⚠️ Risk Factors

• Continuation of bullish breakout can kill put value fast

• Sharp intraday whipsaws common near RSI extremes

• Price staying pinned above $310 would weaken max pain magnet effect

• Use tight stop-losses and limited position sizing

📣 Do you fade overbought RSI or ride momentum on NYSE:UNH ?

💬 Drop your setup 👇 & follow for more AI-backed trade ideas.