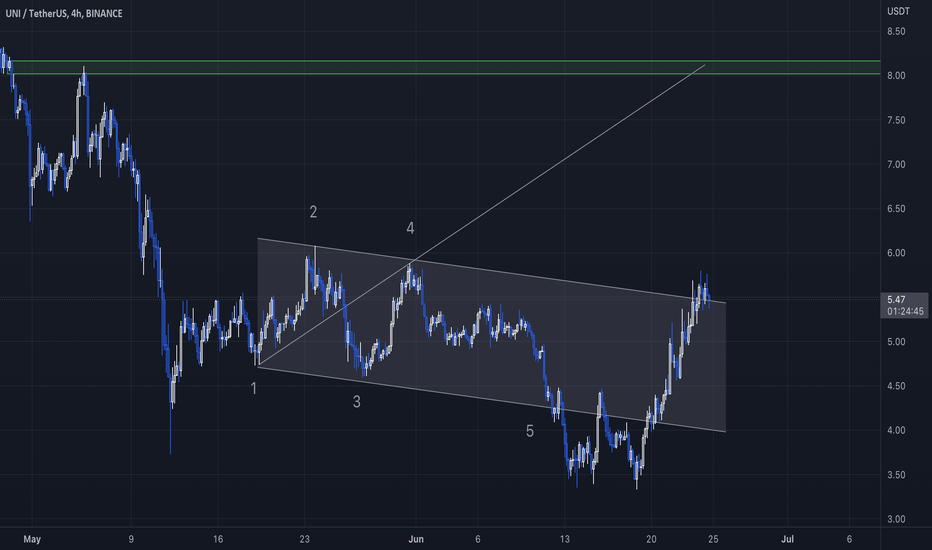

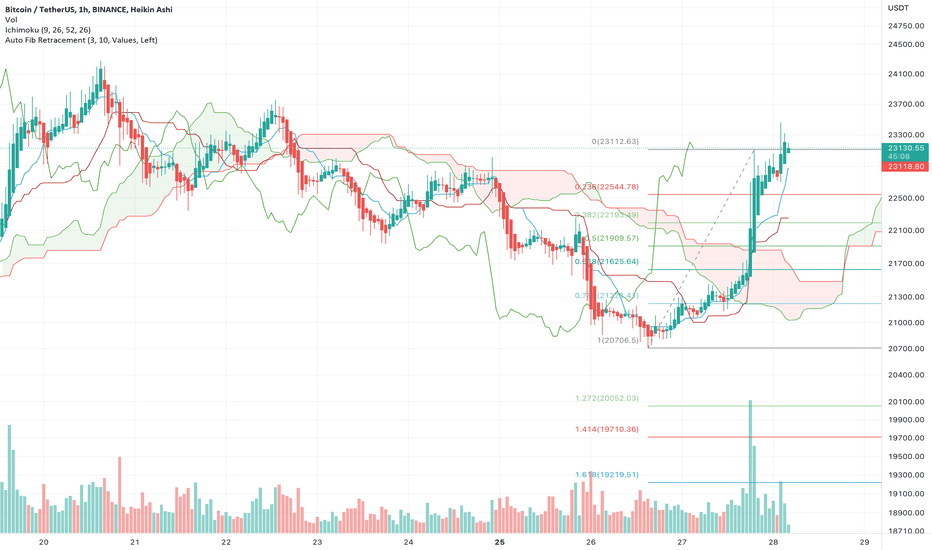

Clean bullish Wolfe Wave on $UNI.Missed out on the perfect entry on $UNI, but I will start accumulating now (even if we dip a little bit considering Bitcoin has a tendency to misbehave while ranging). Targeting around $8 as a target. Could be worth keeping some for after $8 if the market sentiment turned bullish in general.

UNI

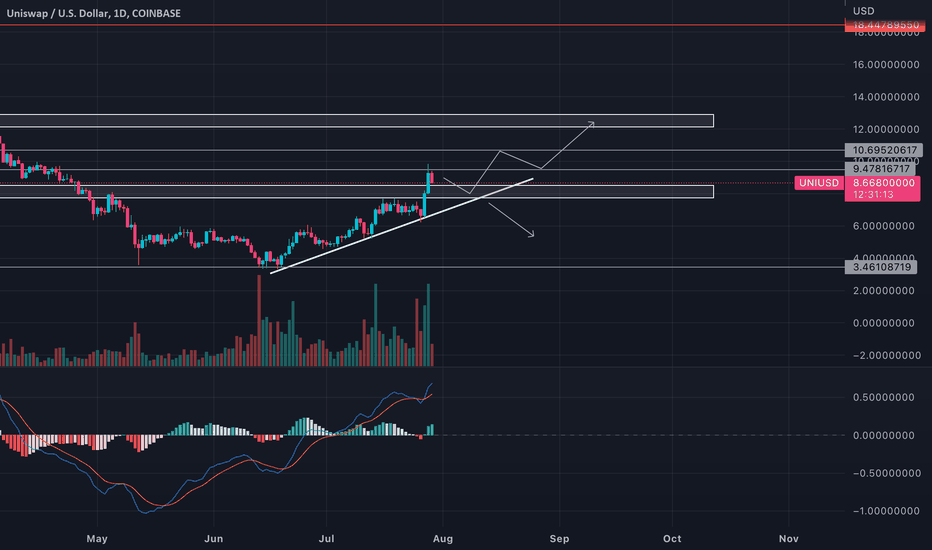

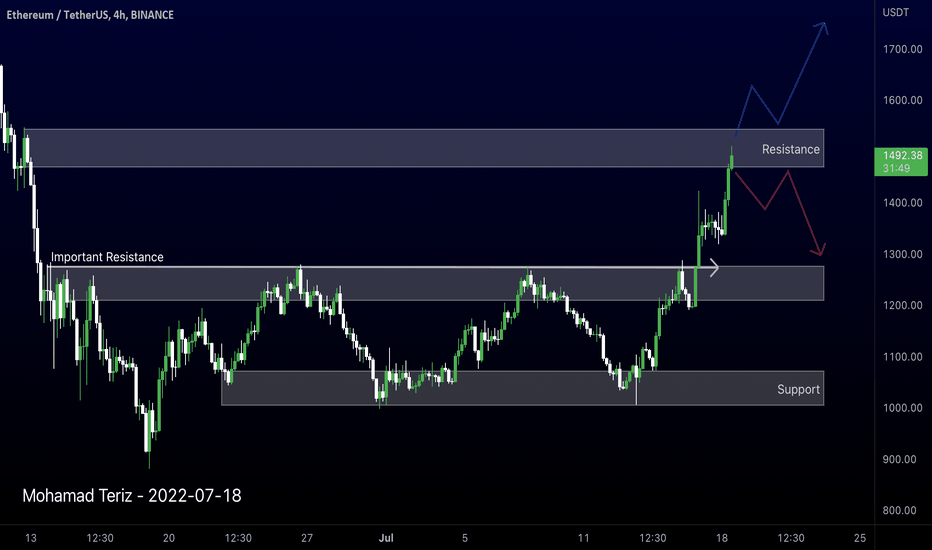

UNI IDEANot really following UNI but after a quick look, I think price action is really interesting. At the moment retracing - not sure how much, will it find a support around 8 area or is it going to bounce on the trend line? No clue. But if the whole market keeps pumping I think is possible that it goes up to 10.5 or even 12.

Keep an eye, losing the support of the trend line is not a good sign.

Let me know your thoughts :)

Don't join before you do your own research. This is a rough idea, NOT a financial advice.

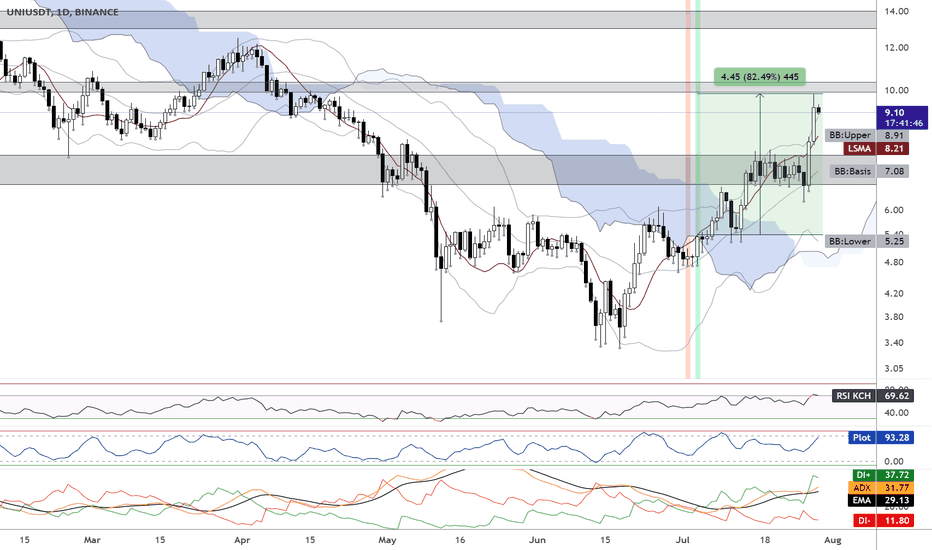

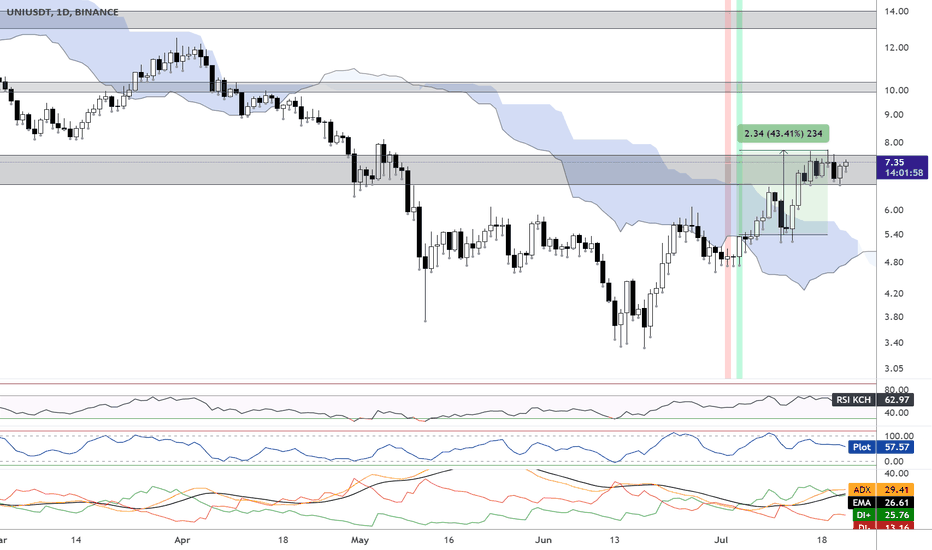

UPDATE: UNI UP 83% after bullish signal - Ready for more 🚀UNI pumped 83% after the bullish Supertrend Ninja - Clean signal (green vertical line on the background).

UNI broke out of the bullish Zone of the Ichimoku Cloud , which is bullish . The RSI is in the bullish zone at 69. If we take a look at the Average Directional Index ( ADX DI) its bullish . The +DI (Green Line) is above the -DI (Red Line). Although the green line is pointing downwards. The Trend Strength is still strong. Since the ADX (Orange Line) is above its 9 Period EMA (Black Line).

Currently UNI is also above its Bollinger Bands Upper Band, Band Basis 20 Period SMA . A retrace within the Bollinger Band and the ADX pointing downwards, means a retrace is more likely. Note: UNI also hit the resistance (grey block).

Waiting patiently on a bullish Supertrend Ninja signal served me well.

Thank you for reading.

Namasté 🙏

Disclaimer: Ideas are for entertainment purposes only. Not financial advice. Your own due diligence is highly advised before entering trades. Past performance is no guarantee of future returns.

What Indicators Do I Use:

In the chart I am using the "Supertrend Ninja - Clean", which is a trend-following indicator (Green and red vertical lines on the background). When the background of the candlestick closes green (vertical line). It indicates a possible bullish (up)trend. And red for downtrends.

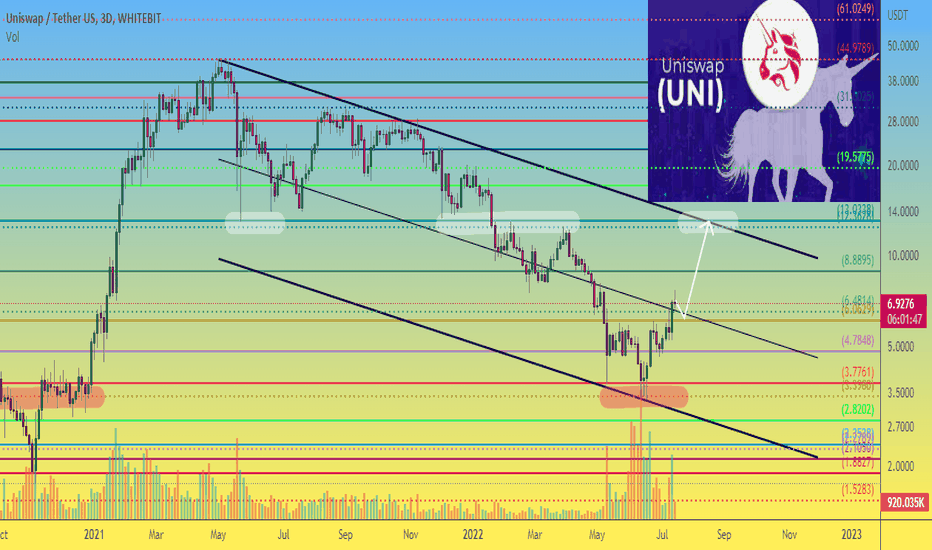

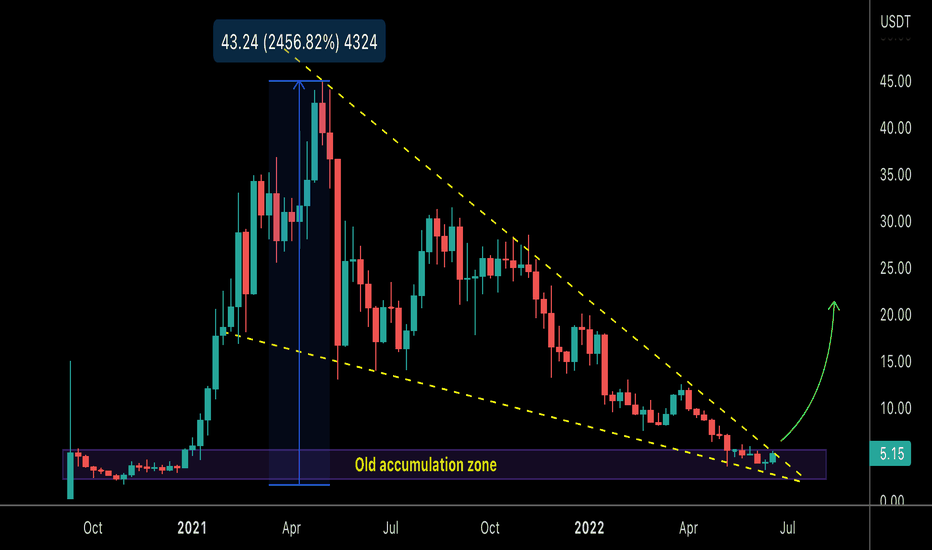

UNIUSDT 3D A unicorn appears on the Uniswap chartToday, let's take a look at the UNIUSDT trading pair on the 3-day time frame.

In general, the classic scheme, as for most altcoins - the price has been in a falling channel for more than a year.

But on the UNIUSD chart we see some cunningly hidden power of buyers, it seems to us that something interesting is being prepared around Uniswap.

Maybe some strong fundamental news is on the way?) Share, please, in the comments, because we don't follow such.

In general, the following route looks realistic for the coming month:

- correction in the area of 6 dollars (retest level that did not let up for a long time)

- fixing UNI price in the upper part of the global descending channel.

- rapid growth in the region of $12-13, and this is modest x2)

_______________________________

Since 2016 , we have been analyzing and trading the cryptocurrency market.

We transform our knowledge, trading moods and experience into ideas. Each "like under the idea" boosts the level of our happiness by 0.05%. If we help you to be calmer and richer — help us to be happier :)

UPDATE: UNI UP 43% after bullish daily signal.UNI pumped 43% after the bullish Supertrend Ninja - Clean signal (green vertical line on the background).

UNI broke out of the bullish Zone of the Ichimoku Cloud , which is bullish. The RSI is in the bullish zone at 63. If we take a look at the Average Directional Index ( ADX DI) its bullish. The +DI (Green Line) is above the -DI (Red Line). While the Trend Strength is becoming stronger. Since the ADX (Orange Line) is above its 9 Period EMA (Black Line). Currently UNI is also above its Bollinger Bands Middle, Band Basis 20 Period SMA. Which is a bullish sign as well.

Waiting patiently on a bullish Supertrend Ninja signal, before entering a long paid off.

Thank you for reading.

Namasté 🙏

Disclaimer: Ideas are for entertainment purposes only. Not financial advice. Your own due diligence is highly advised before entering trades. Past performance is no guarantee of future returns.

What Indicators Do I Use:

In the chart I am using the "Supertrend Ninja - Clean", which is a trend-following indicator (Green and red vertical lines on the background). When the background of the candlestick closes green (vertical line). It indicates a possible bullish (up)trend. And red for downtrends.

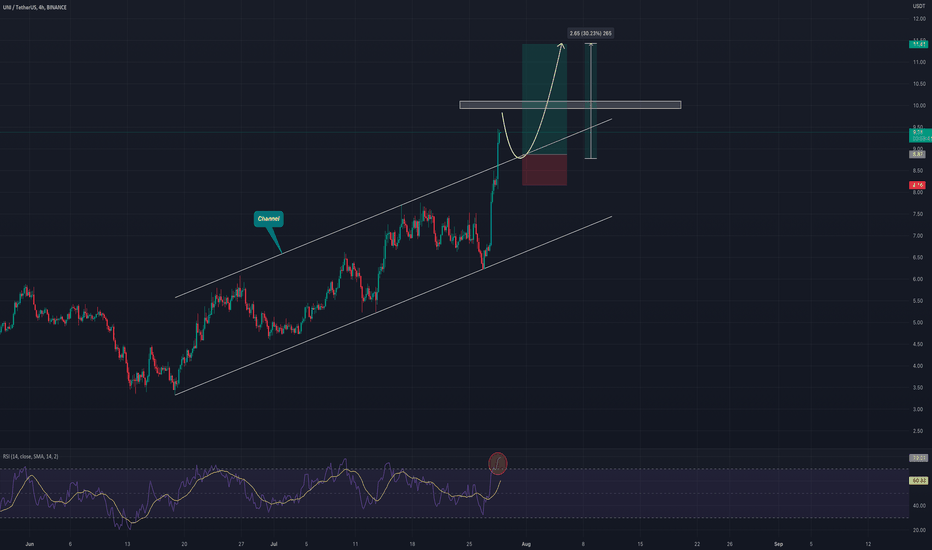

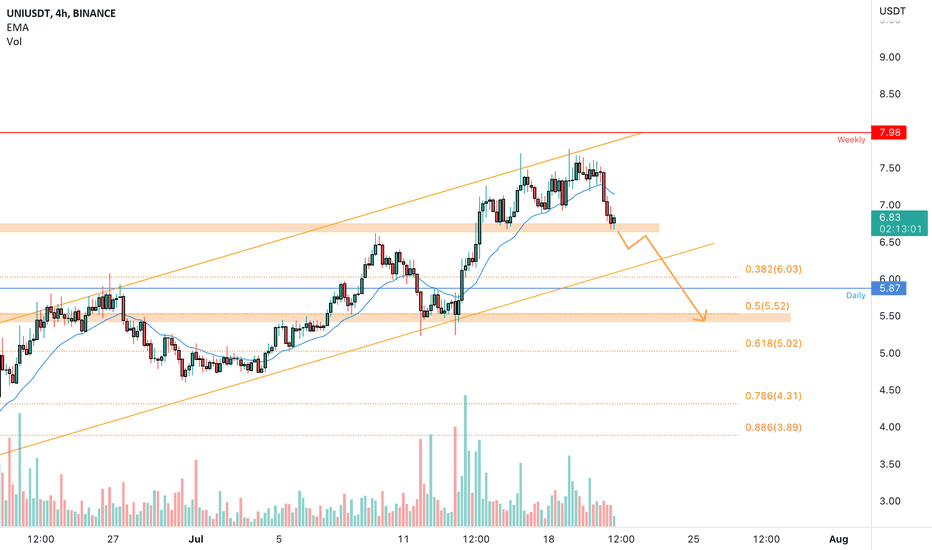

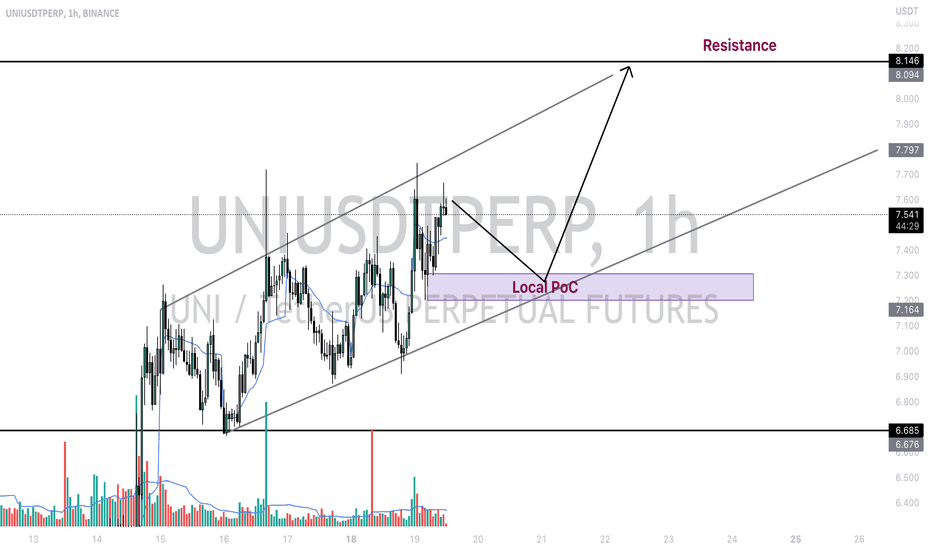

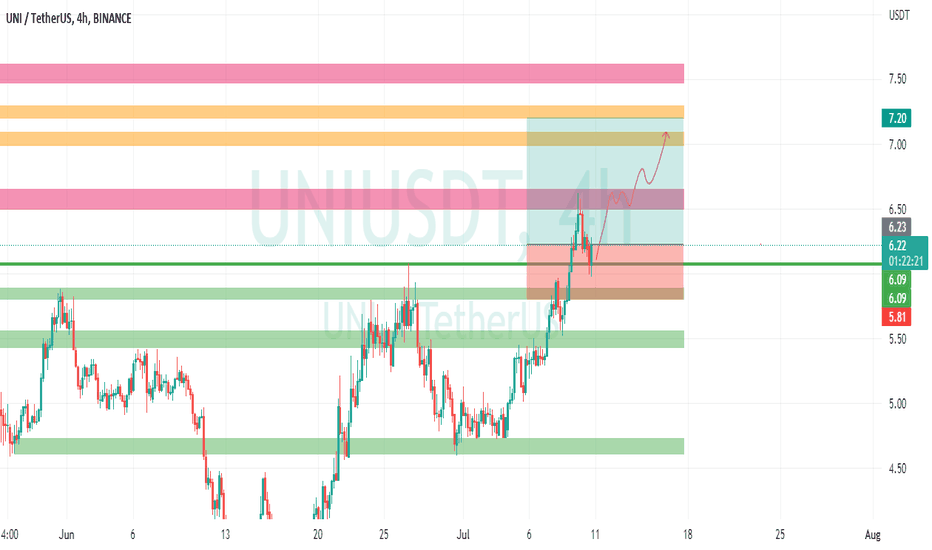

UNIUSDT is inside an ascending channel 🦐UNIUSDT on the 4h chart is trading inside an ascending channel.

The price is now testing the 4h support and might provide a deeper bearish move.

How can i approach this scenario?

I will wait for a clear break of the support and in that case, i will search for a nice short order according to the Plancton's strategy rules.

–––––

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

–––––

Follow the Shrimp 🦐

UNIUSDT Chart AnalysisWell how to start !! Everything is in green from the past few days so as UNI, it's in nice uptrend heading towards the resistance which is at around 6% above from here ( Resistance at $8.146).

Currently it's in middle of the river, so what to do now? IMO as $BTC is testing it's breakout zone, I see no reason to be bearish for short term atleast it doesn't mean that I'm suggesting you to go long here, you can trade UNI if you want but make sure you ready to take big risk cause may be the local support zone at $7.3 may hold but don't trade based on the expectations. Let the market to tell us what we need to do.

So what's next? My suggestion is to let it come to one of our zones, may be retracement towards $7.31 price zone, I'll update if I observe high interest there, with respect that you can plan your trade.

What if it headed towards straight away towards resistance well then we can observe again and based on the appearing interest at that time let's decide whether we have to be on long side or short side. See guys no need to rush planning is everything.

Disclaimer : Anything provided here are only my opinions and ideas. I am not giving any financial advices, trade at your risk.

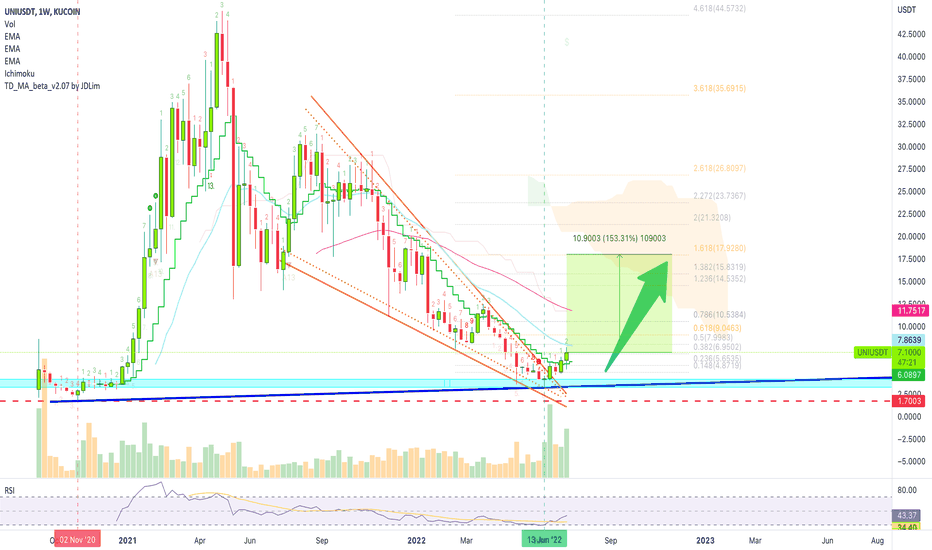

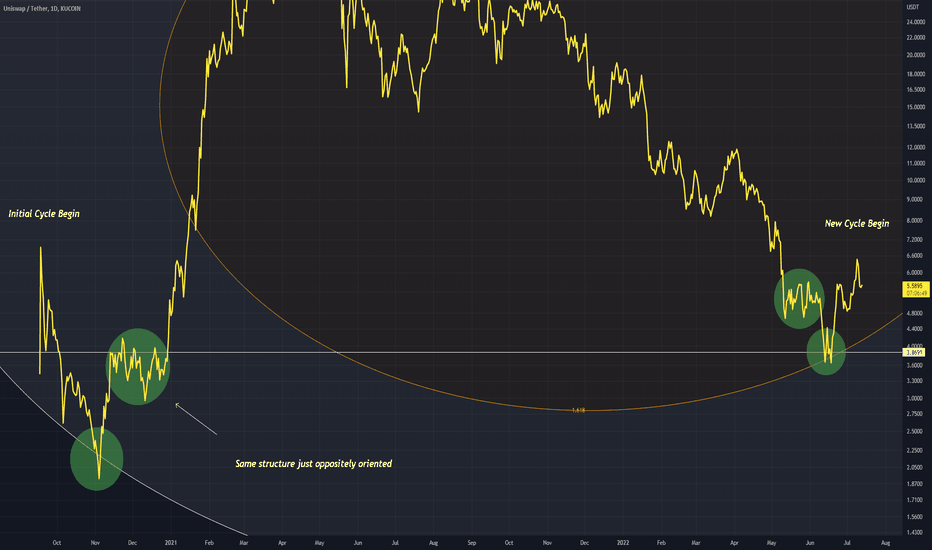

Uniswap Looks Really Strong (150% Easy Target)This is a very strong chart we have for Uniswap (UNIUSDT).

We can see a long-term higher low.

Nov. 2020 vs Jun. 2022.

The 13-June weekly candle ended in a Dragonfly Doji with the highest bull/green volume ever.

Last week UNIUSDT closed above EMA10.

The RSI moved above 40 (strong on the weekly).

Finally, we have a falling wedge pattern already breaking bullish...

All that is left is for prices to grow.

Below $3.30 is the stop.

And the targets/resistance levels can be found on the chart.

Namaste.

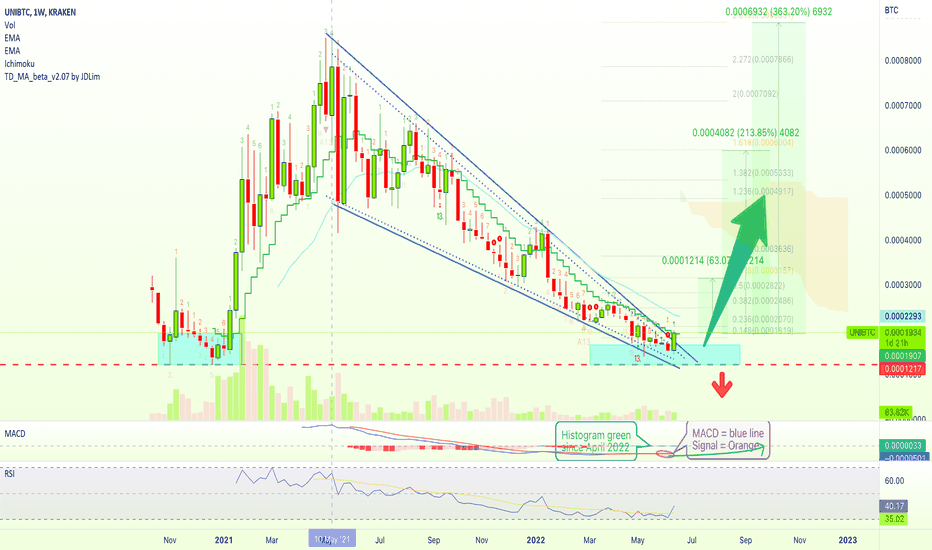

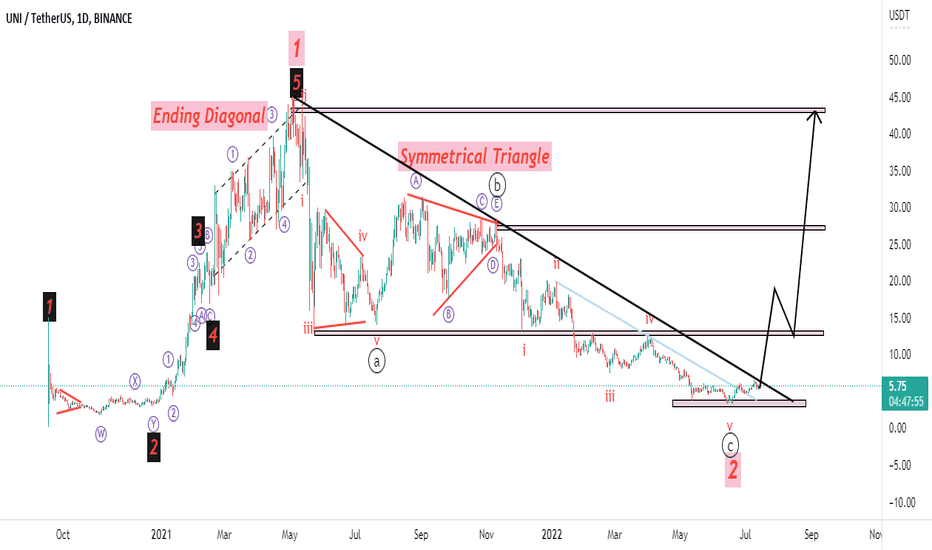

Uniswap Giant Falling Wedge (Long-Term W/ Fibs)The falling wedge is a classic pattern and one of the easiest to spot, also very accurate.

We are looking at Uniswap vs Bitcoin (UNIBTC) long-term.

We see UNIBTC is breaking out of the giant falling wedge.

This coincides with a close above EMA10.

(Confirmation needed at weeks end.)

We have a higher low this May 2022 compared to December 2020.

The RSI we consider strong at 40 on the weekly.

The MACD is still below zero but the MACD line is above the signal line while trending upwards, this is always a positive.

Chart:

Would be nice to see it grow.

Wishing you wealth & success.

Thanks for the continued support.

Namaste.

Uniswap Looks Much Better Based On Moving Averages (85%) If you have been reading the other charts/trade ideas that we share, you can easily appreciate that prices are either trading below EMA10 or just challenging it and if the chart looks good we can see it above EMA10 and sometimes above EMA50.

Now, let's have a look at Uniswap vs Tether (UNIUSDT).

See how EMA50 ($5.53) is already far behind as Uniswap moves above EMA100 ($6.55).

EMA100 is the level at which we saw a rejection back in April.

Another rejection happened 9-July and today we see a candle breaking above.

Confirmation only comes in less than 2 hours when the daily candle closes.

A close above this level, can lead to 80%+, short-term.

Mid/Long-term there can be more.

Namaste.

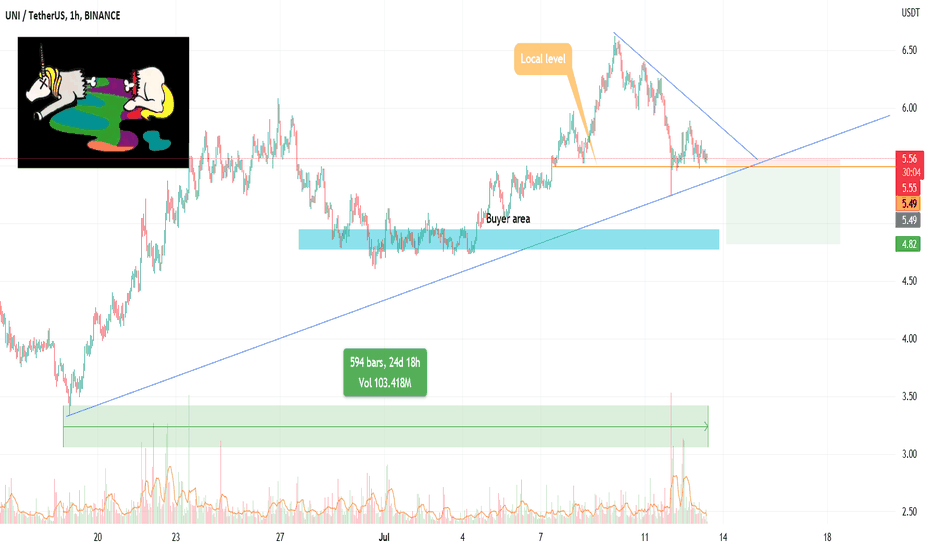

Best unicorn - Dead unicorn🦄 Reasons to take long:

⭐️ Volume appeared

⭐️ Trendline is 24 days old

⭐️ Trendline is clean

⭐️ We are in the end of formation

⭐️ Slowly squeezing local level

⭐️ Volume entered the coin

⭐️ 46 ATR

⭐️ Under VWAP

Scenario will be invalidated if coin squeezes to trendline. Then it would be wise take short

Will enter when price squeezes to the trendline on 5m timeframe, the base will form and the tape will get faster.

If you don't understand the previous sentence, just use swing stop-loss 3-5%

Fix profit by parts:

1% - 1/3

2% - 1/3, stoploss to breakeven

What's left, hold to the maximum

What do you think of this idea? What is your opinion? Share it in the comments📄🖌

If you like the idea, please give it a like. This is the best "Thank you!" for the author 😊

P.S. Always do your own analysis before a trade. Put a stop loss. Fix profit in parts. Withdraw profits in fiat and reward yourself and your loved ones

UNI UNISWAP LONG 20220711UNISWAP is in Demand Zone

Risk Reward: 3

UNI, UNISWAP, UNIUSD, UNIUSDT, CRYPTO,CRYPTOCURRENCY

DISCLAIMER

This is only a personal opinion and does NOT serve as investing NOR trading advice.

Please make your own decisions and be responsible for your own investing and trading Activities.