U.S. Steel (X) Shares Drop 10% Following Presidential CommentsUnited States Steel Corporation (NYSE: NYSE:X ) shares dropped sharply after remarks from former President Donald Trump. He opposed the company's potential sale to Japan's Nippon Steel. Trump said he admired Japan but opposed the sale of an iconic American steel company.

He described U.S. Steel as “a very special company” and tied it to national interests. His statement caused a wave of uncertainty in the market. The stock dropped 15% shortly after the news. During extended trading, it fell as much as 16%.

As of 11:41 AM EDT, the stock trades at $42.03, down $3.11 (6.89%), as trading volume hits 19.7 million shares. Investors are concerned about the deal's future. U.S. Steel is central to U.S. economic and industrial discussions.

The takeover deal has raised questions about manufacturing and national security. The company is expected to report earnings between April 30 and May 5, 2025.

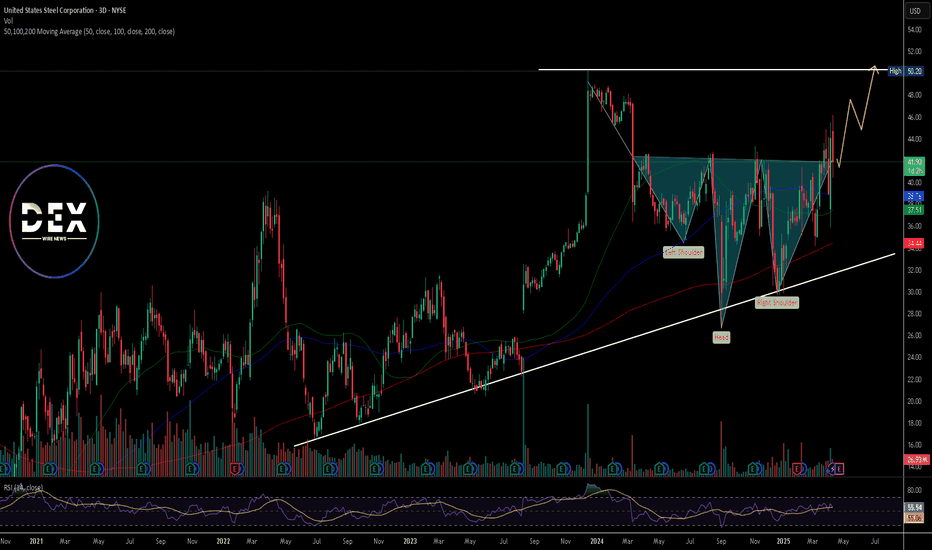

Technical Analysis

The 3-day chart shows a long-term uptrend. Price respects an ascending trendline starting at$16 in June 2022. Support lies above the 200-day moving average at $34.44. The 50-day and 100-day moving averages sit at $37.51 and $38.76, respectively.

The stock recently broke above $45 but pulled back after Trump's comments. Resistance lies at $50.20 and a breakout above this level could lead to further gains. The 3-day RSI sits at 55.89, suggesting neutral momentum that has room for the price to cover without reading an overbought reading.

However, a sharp drop could push it lower. Volume surged on the sell-off, confirming a strong market reaction. Adding to the bullish momentum is a complete head and shoulder pattern that signals potential recovery.

The short-term outlook depends on deal clarity and upcoming earnings. However, the trend remains intact above $34, and a move below could signal further downside.

Unitedstatessteelcorp

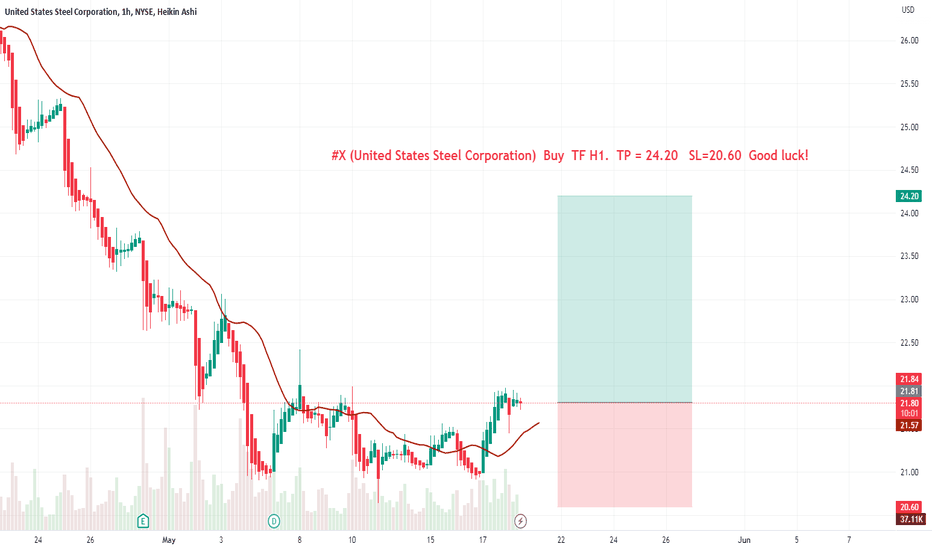

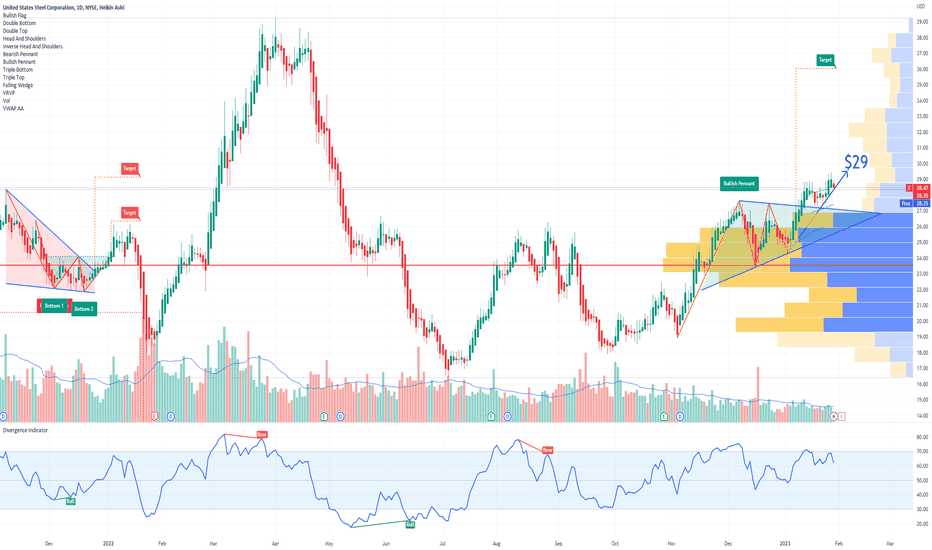

X United States Steel Options Ahead of EarningsLooking at the X United States Steel options chain ahead of earnings , I would buy the $29 strike price Calls with

2023-2-3 expiration date for about

$0.83 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

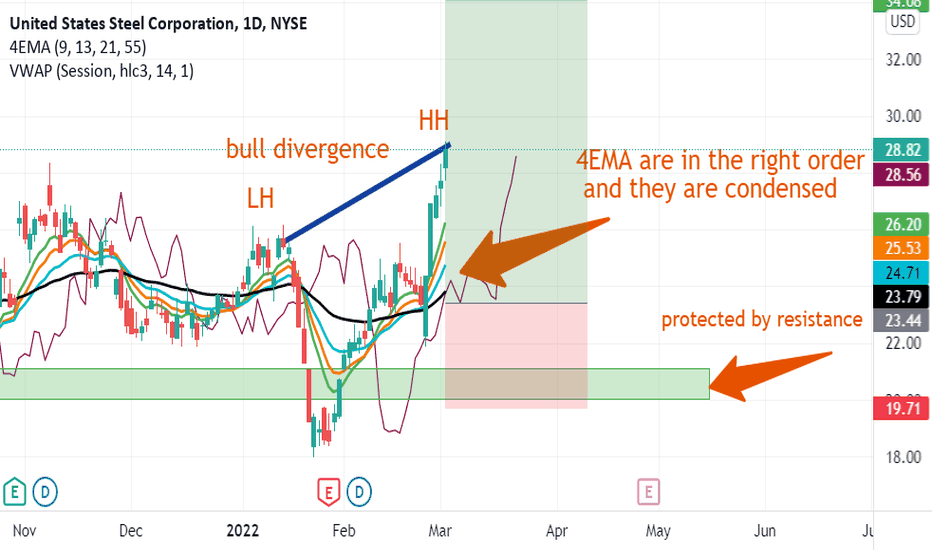

good day for "x" UNITED STATES STEEL CORPORATIONGOOD MORNING,

Today, there are several indicators for the X stock, and all of these indicators say that there is a rise in the coming days, so I think it is good to buy now.

First, we are above the VWAP and above the resistance, so we are a little protected, especially since they are resistances related to days,

Second, the 4EMA indicator is in the correct order and with a good density. It also indicates the rise in addition to MACD as well.

OPEN YOUR WALLETS AND

GOOD LUCK