US RUSS 2000

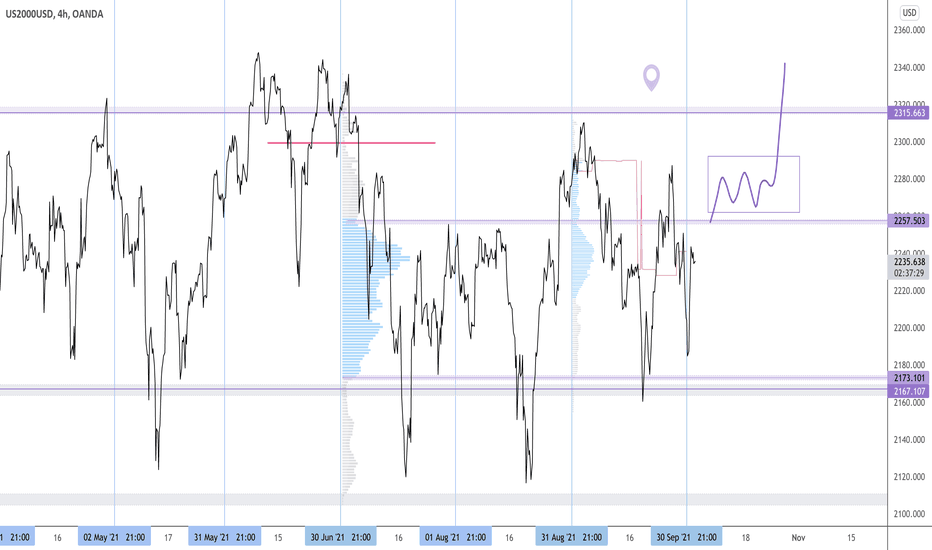

RUSSELL BREAK COMING SOON!!The Russell 2000 has been in a year long consolidation pattern - w/ price finding supply above 2315 & demand below 2165 - We are currently opening the month inside last months & last quarters value - which makes price action neutral at the moment - BUT price held up well durning this latest equity selloff showing some relative strength & a possible short term higher low - looking for a break & buildup above 2257 top setup for another test of the highs w/ probability of finally breaking out of this range increasing - however price action below this months open should b considered negative and any bullish setups would have to wait till we move back above.

Watch & see how it plays out!!!

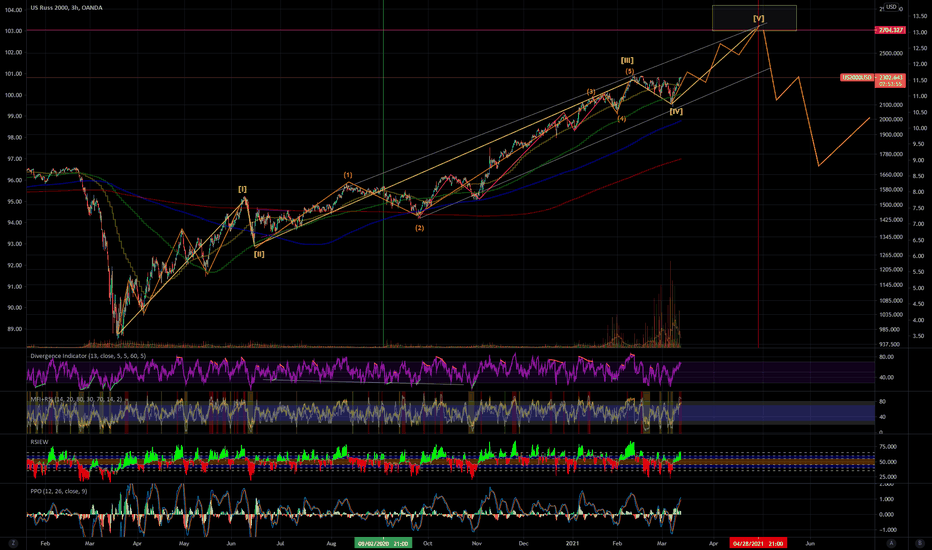

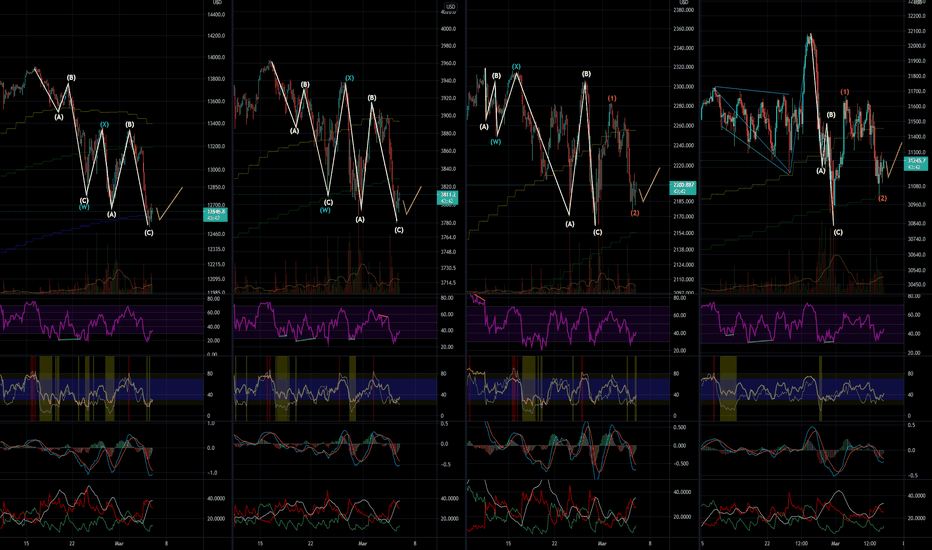

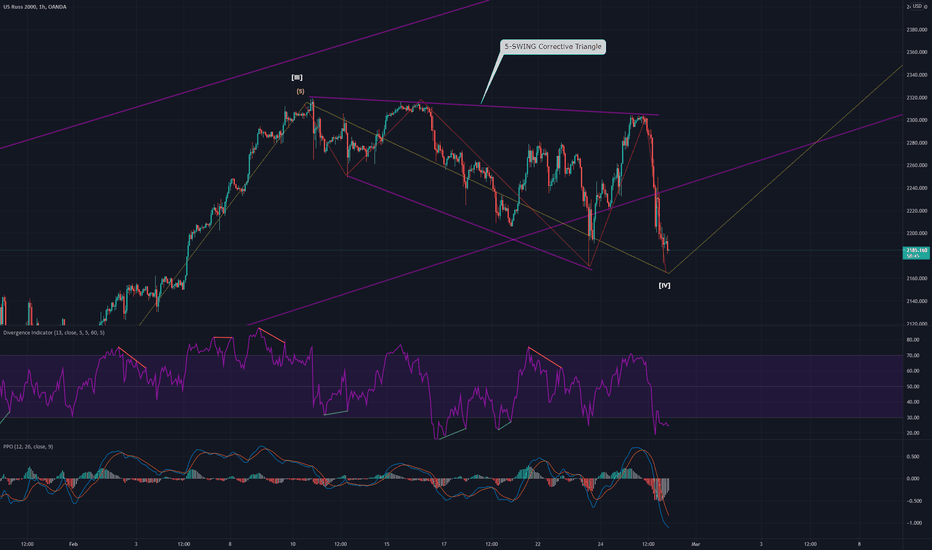

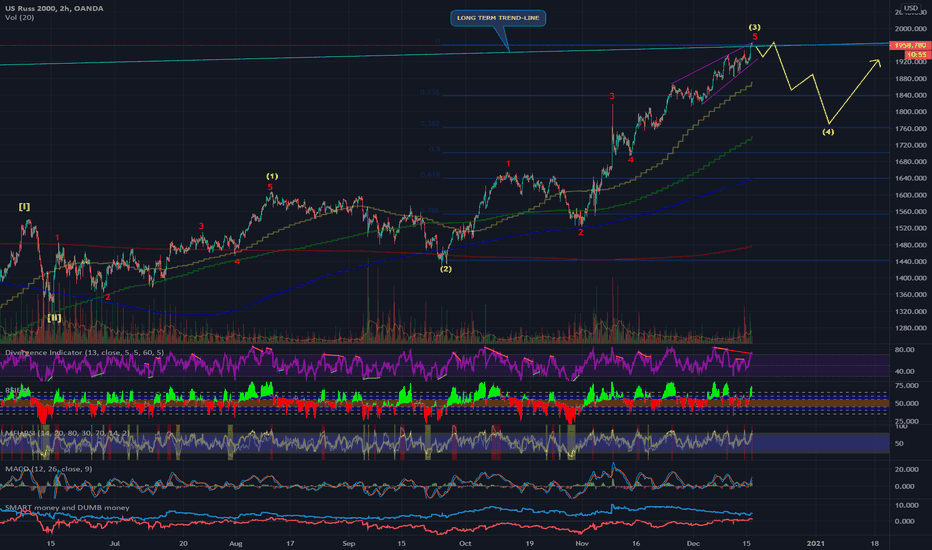

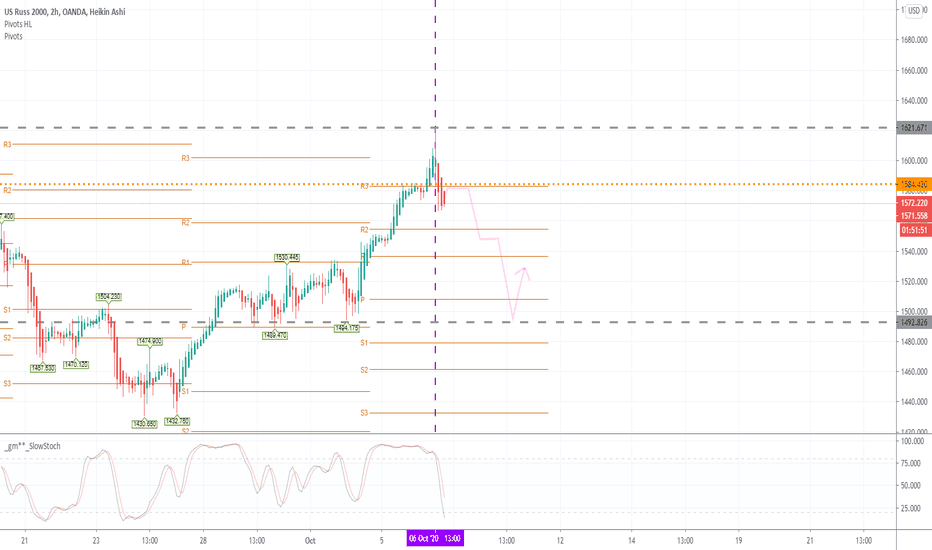

US200USD: RUSSELL 2000 updated COUNTShort-term = SHORT.

Mid-term = LONG.

This is my PERSONAL trading CHART, with no further educational explanations.

BUYING STRATEGY: Take 50% profit at 50% of previous WAVE (just do it) and place stop at purchase price.

IF price reverses lower YOUR EVEN,.... IF price continues UP-TREND then, re-buy at NEXT CORRECTIVE WAVE.

This is actually a very aggressive strategy for going in early that is why 50% "hedge" PROFIT is taken EARLY in the TRADE.

Combining ELLIOTT WAVE and THIS strategy , has SAVED my account 3-TMES during the past 3-weeks.

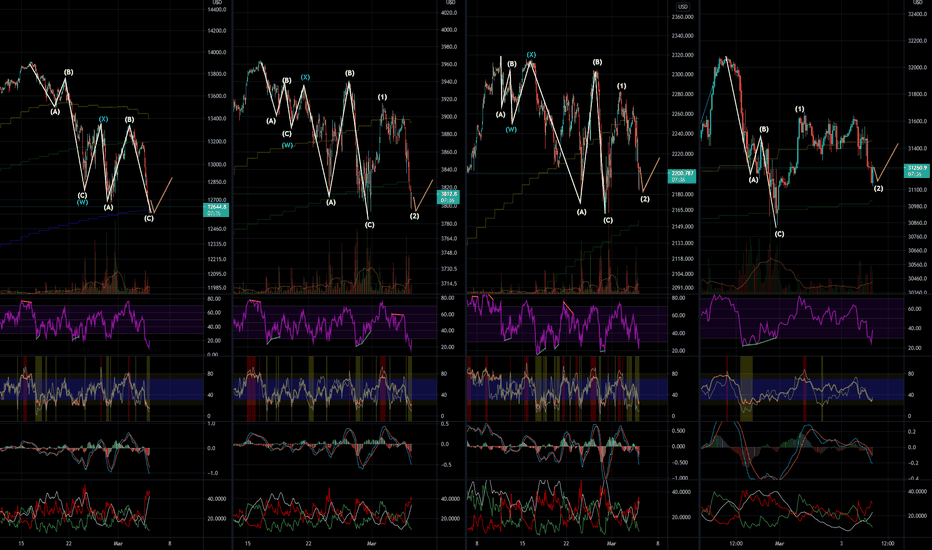

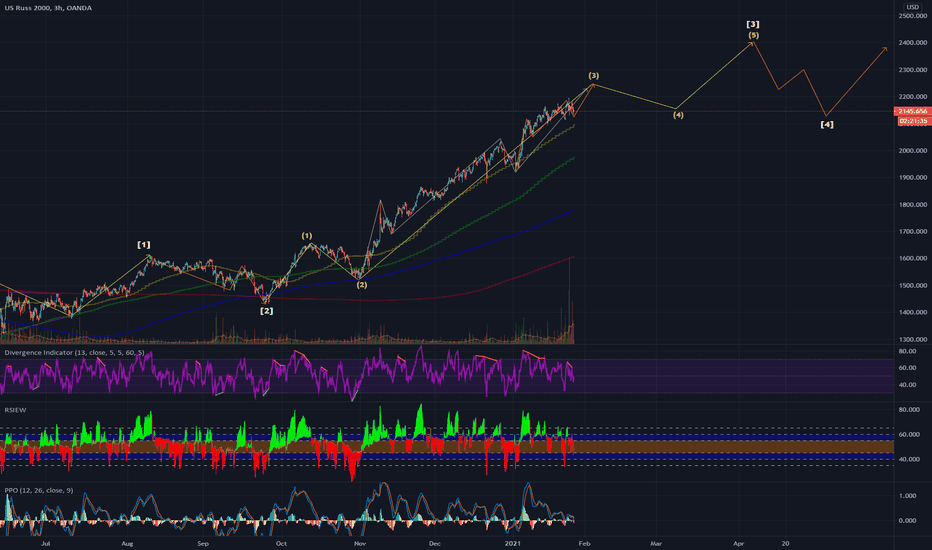

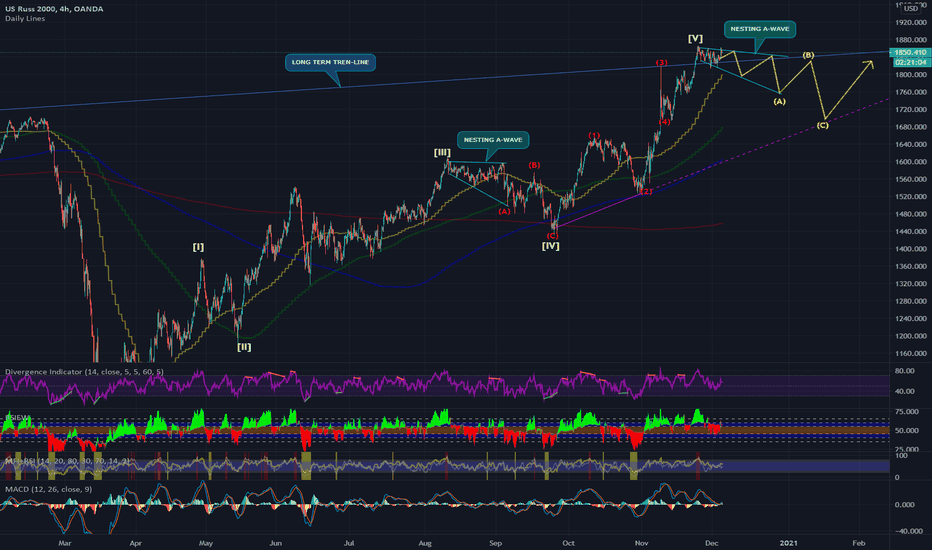

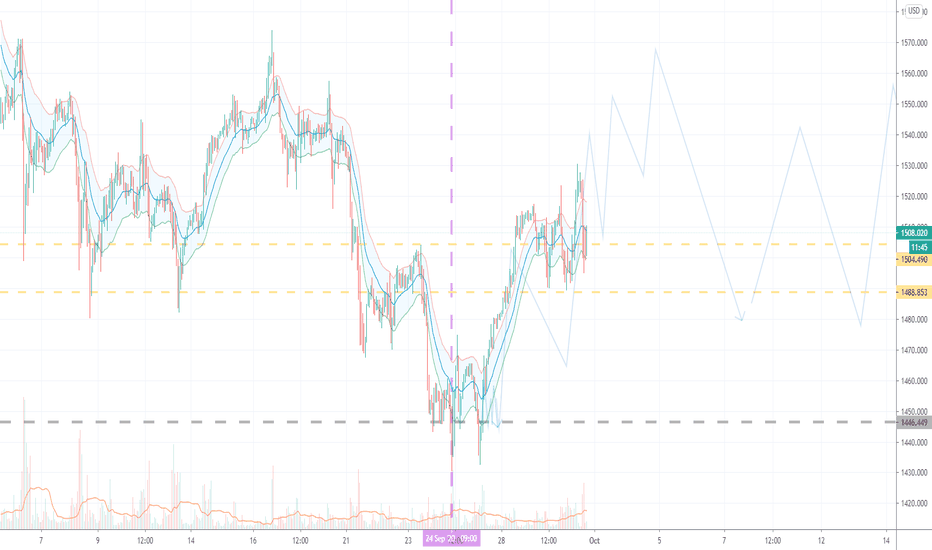

US-MARKETS : CORECTION NEARNG COMPLETIONDuring CORRECTIONS it is inciteful to create a CHART, where YOU can watch ALL the INDICES at once.

This is my PERSONAL trading CHART, with no further educational explanations.

IF you get it, YOU GET IT, if you don't, YOU DON'T. I really don't care.

We use ELLIOTT WAVE theory to determine WHAT we are looking for, (i.e. TOP or BOTTOM). THEN technical MULTI-TIME-FRAME Indicator analysis

To fine-tune to what extent price will and when. Enter and exit TRADES in steps ... NEVER go all-in or all-out at ONCE.

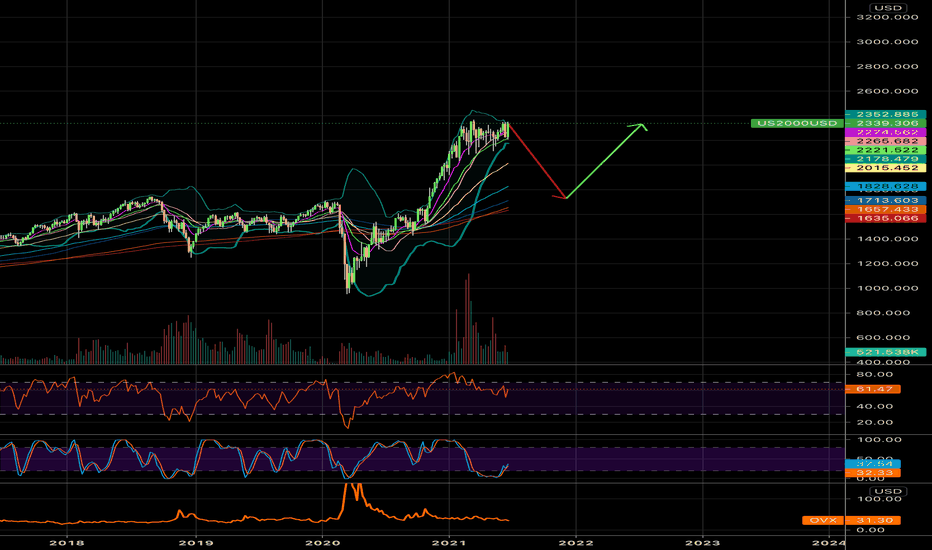

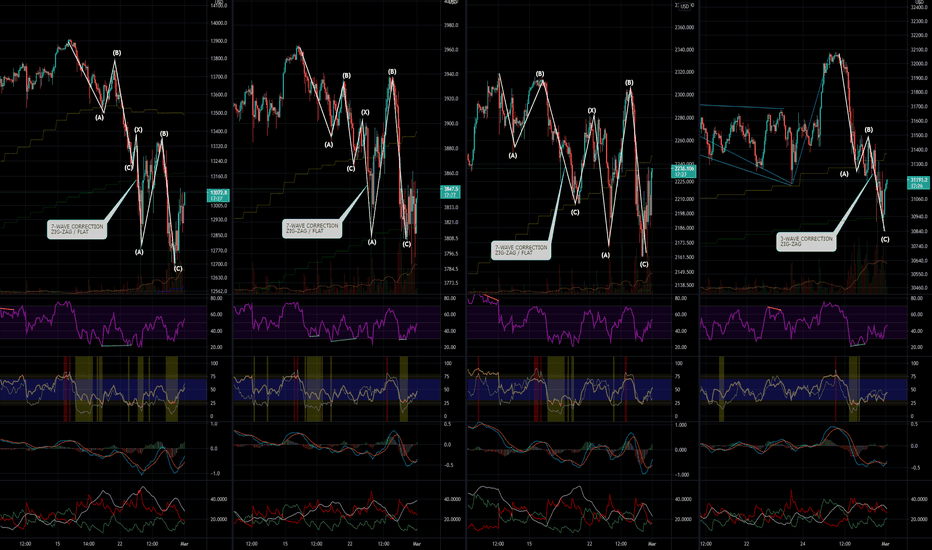

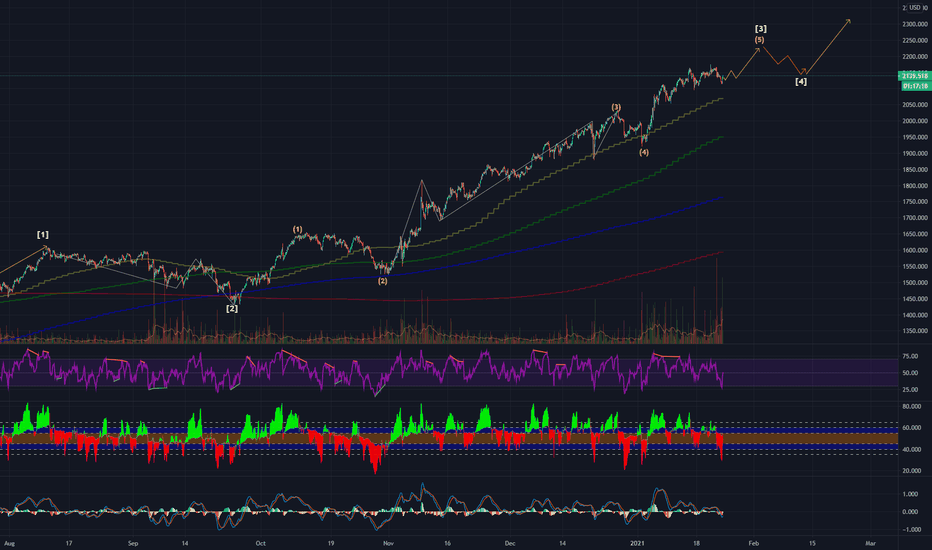

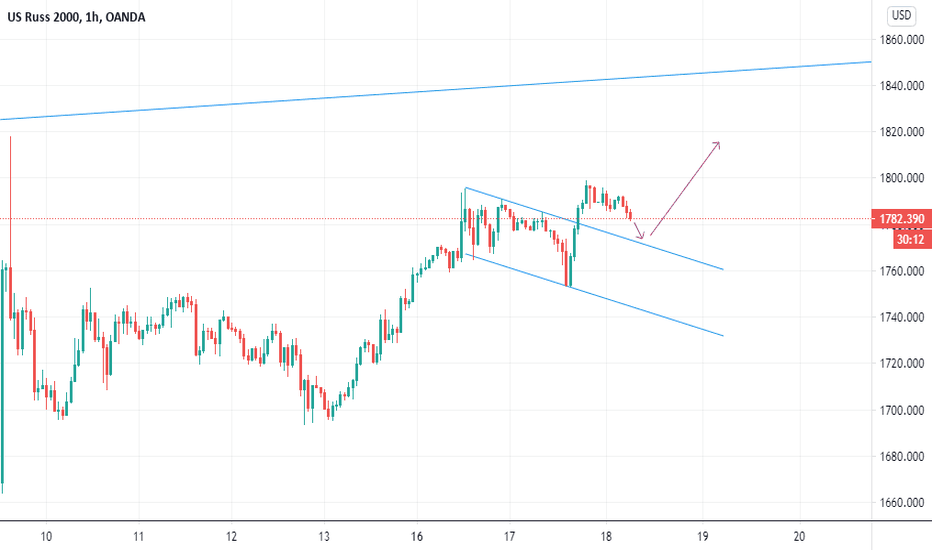

US-MARKET CORRECTION NEARLY COMPLETEDuring CORRECTIONS I find it useful to create a CHART, where YOU can watch ALL the INDICES at once.

This is my PERSONAL trading CHART, with no further educational explanations.

IF you get it, YOU GET IT, if you don't, YOU DON'T. I really don't care.

We use ELLIOTT WAVE theory to determine WHAT we are looking for, (i.e. TOP or BOTTOM). THEN technical MULTI-TIME-FRAME Indicator analysis

To fine-tune the expected move in terms of PRICE and TIMING. Enter and exit TRADES in steps ... NEVER go all-in or all-out at ONCE.

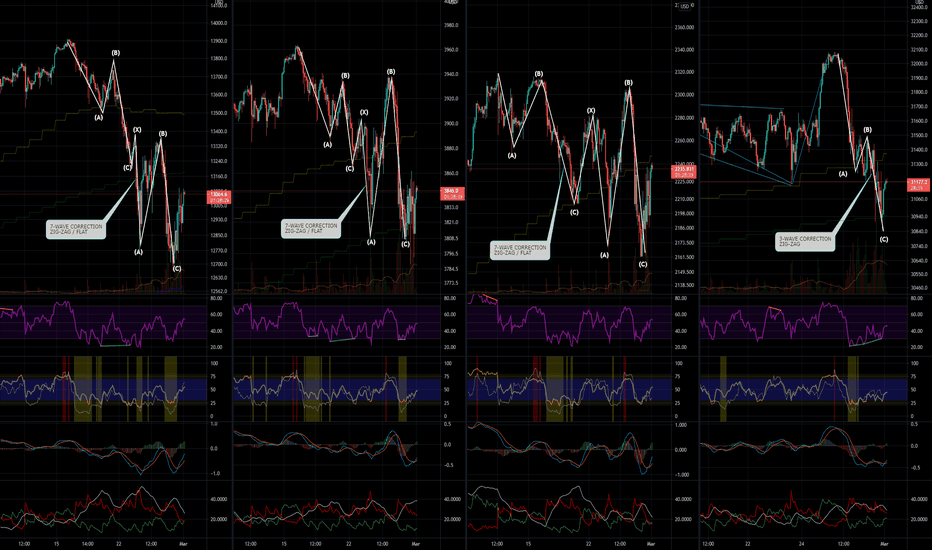

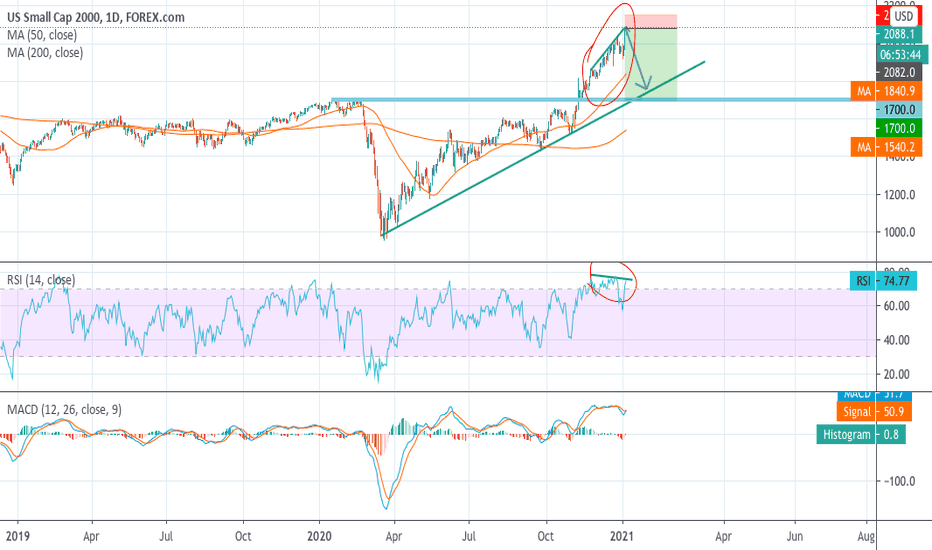

Russel small cap 2000 short ideaRussel small cap 2000 moving upside in a paralell channel and now the price arrived to the Channel upper line at 2300 usd. I think it will go down to previously support/resistance at ~2200.

Trade at your own risk.

If you like my idea, dont forget to leave a comment, follow, and like.

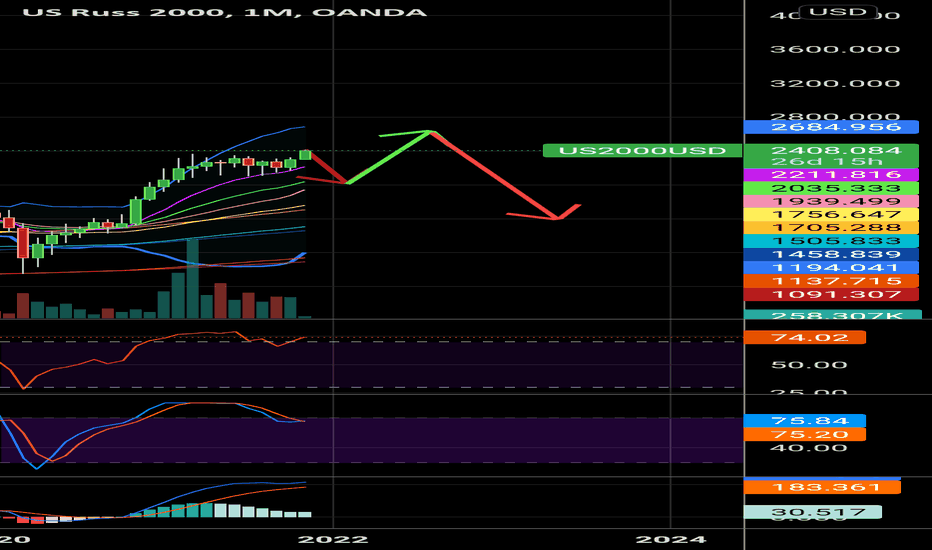

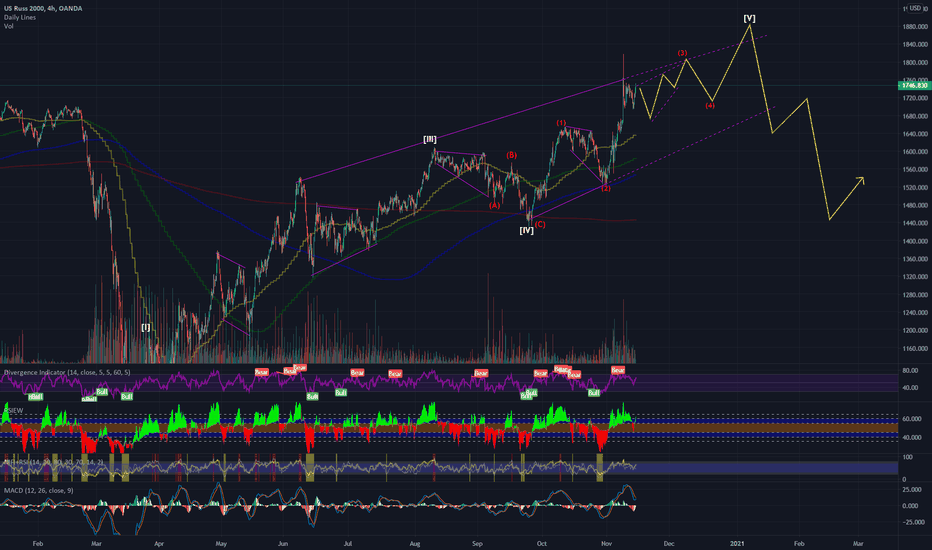

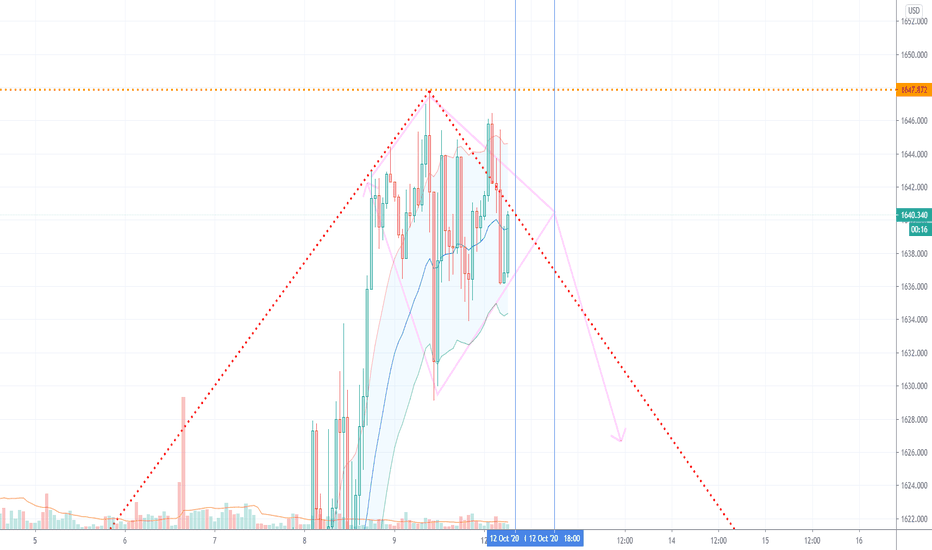

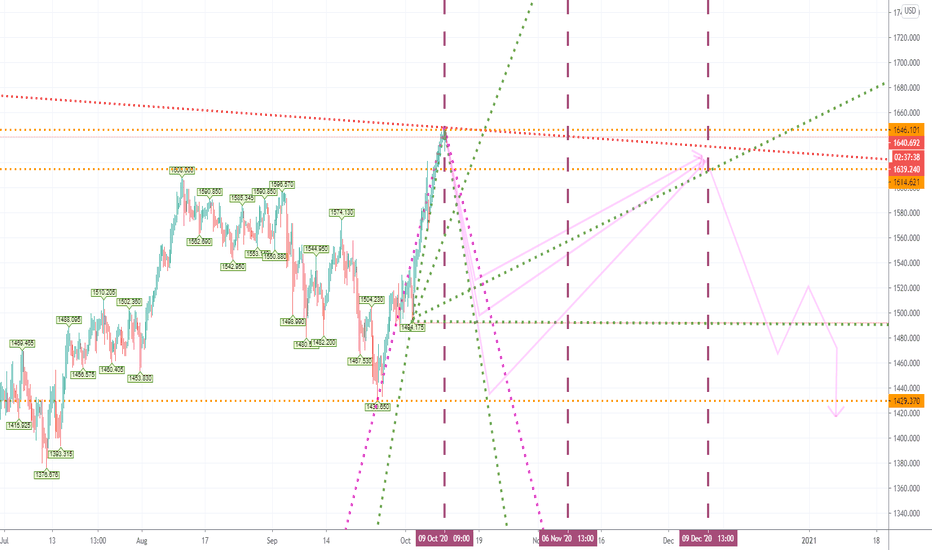

RUT US2000USD - Mt Everest top 1647!

Mt Everest reached! Officially 1647

This should be a TOP of a massive H&S 1608 - 1647 - 1608 pattern

Short to 1550/1520/1490/1430 levels UP and ZIG ZAG from there to 1608+

Nov 6th - the presidential election - should reach the second shoulder levels

the BIG DROP should be around 8th/9th December in this scenario