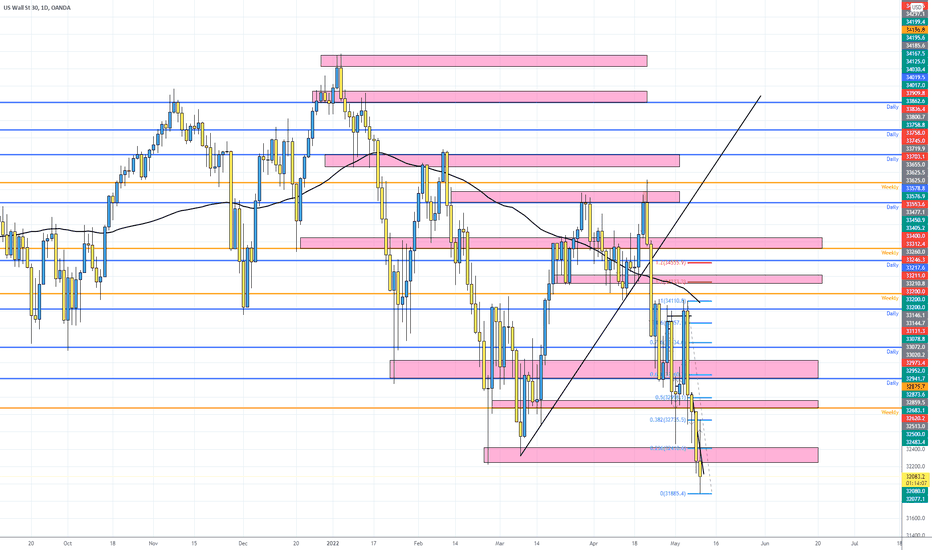

Us30short

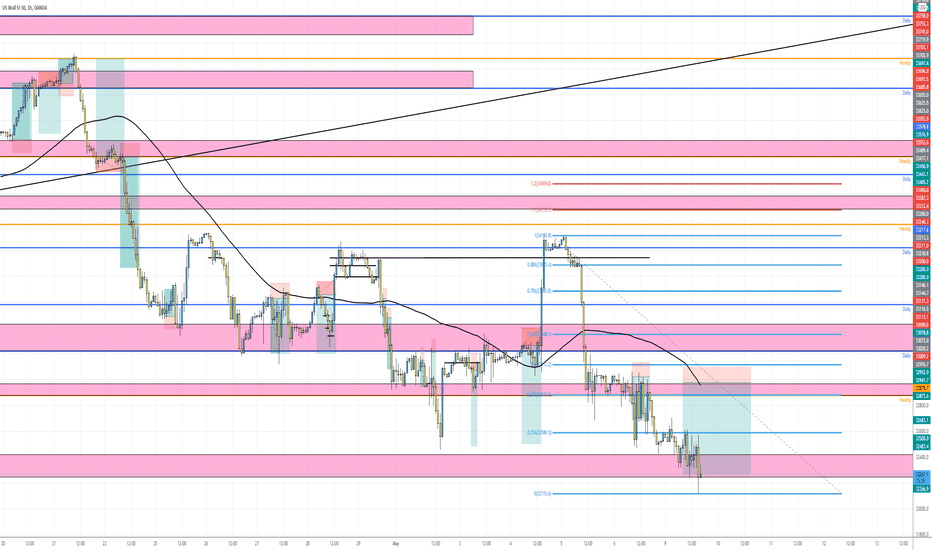

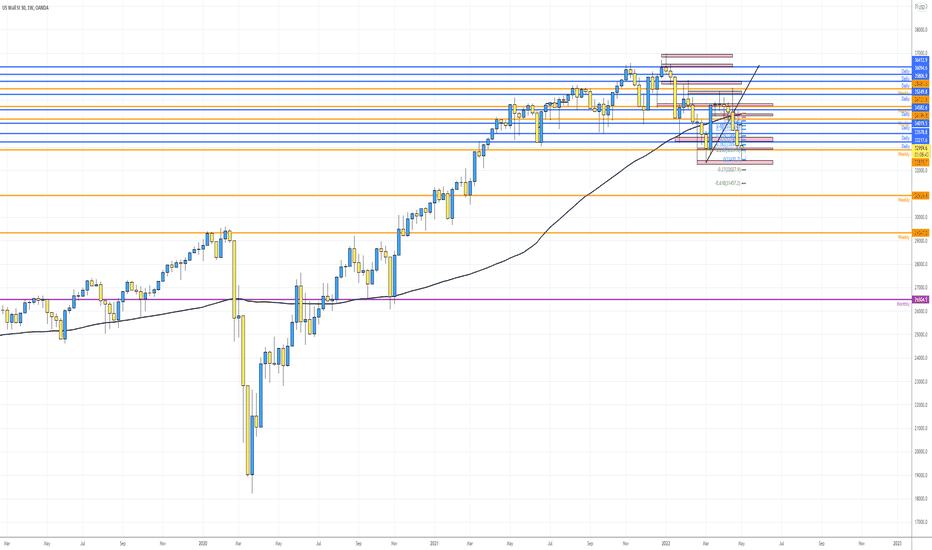

Supply then Fall?US30 - Similar story so SPX, waiting for SPX to hit the supply and reverse, if so US30 will probably do the same, I will be watching both for confirmations, I want to see a reverse from supply and price fall to demand swiping liquidity below.

Let me know your thoughts!

* Disclaimer **

These ideas I never trade until the end target with my initial lots, I focused on high probable entries with higher lots and use a specific partial taking strategy giving me a very high win rate and take most of my profits very early, I only leave a small % of my capital to run the entire trade. On the flip side im constantly monitoring LTF momentum and will close early if things change, these analysis's are for research purposes only.

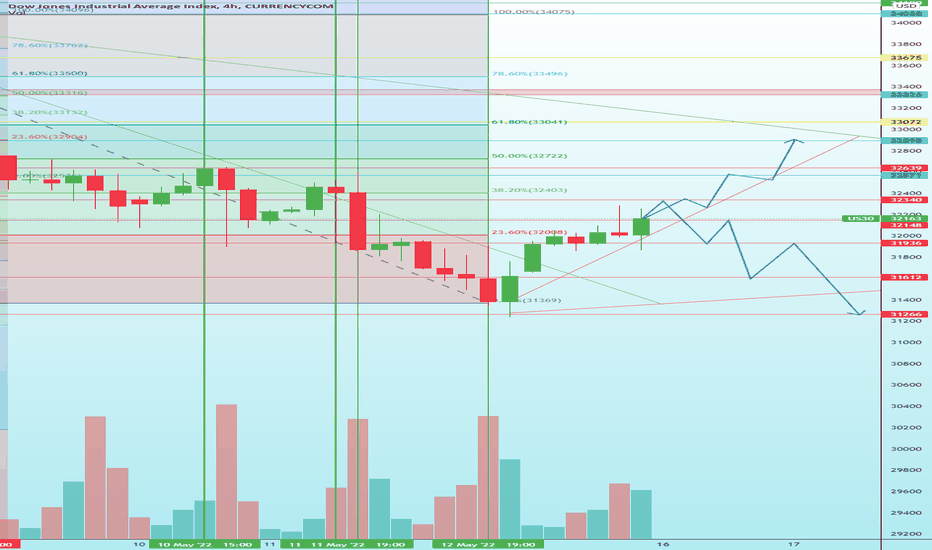

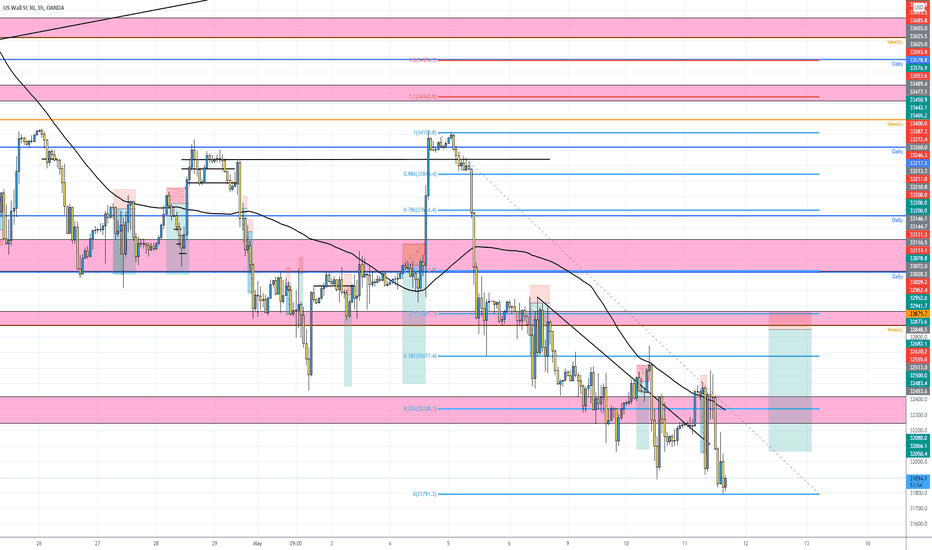

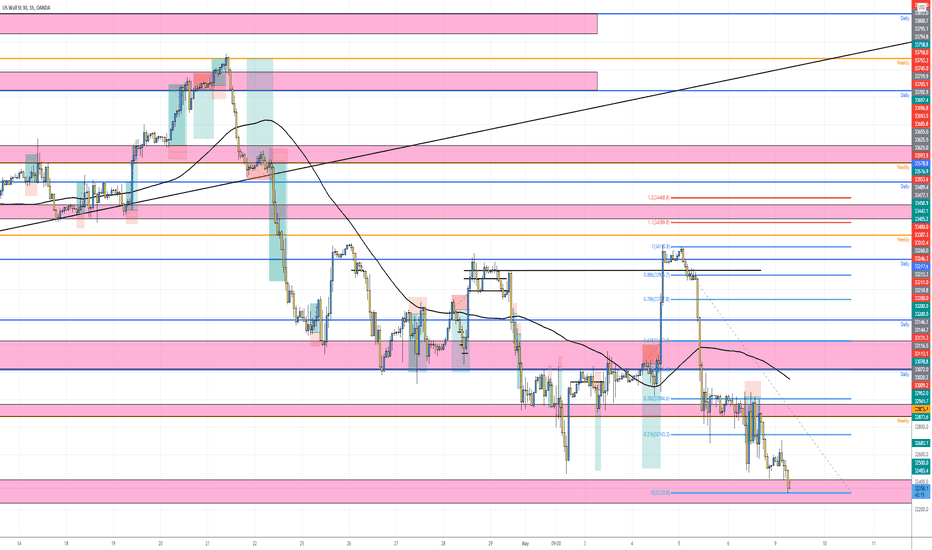

US30 : breakout or break down? IntraweekAs I said in previous week’s intraday technical analysis, US30 is going to test the support of 32500 and then reverse the trend, the US30 did tested the support of 32500 on the opening day, it failed to test the support and the downtrend continued with another 100% move towards downside before making any significant pull back. The price took support from 31200 and then reversed the trend. in coming week US30 may test the support of 31200 before making clear trend.the price is expected to take correction from either current level 32100 or from 32400. My idea is still to go short on US30 as soon as the price gets rejection with high volumes.

If you like this or if you think the opposite of this or if there is any other opinion, mention it in the comments. I am open to all kind of suggestions and critics

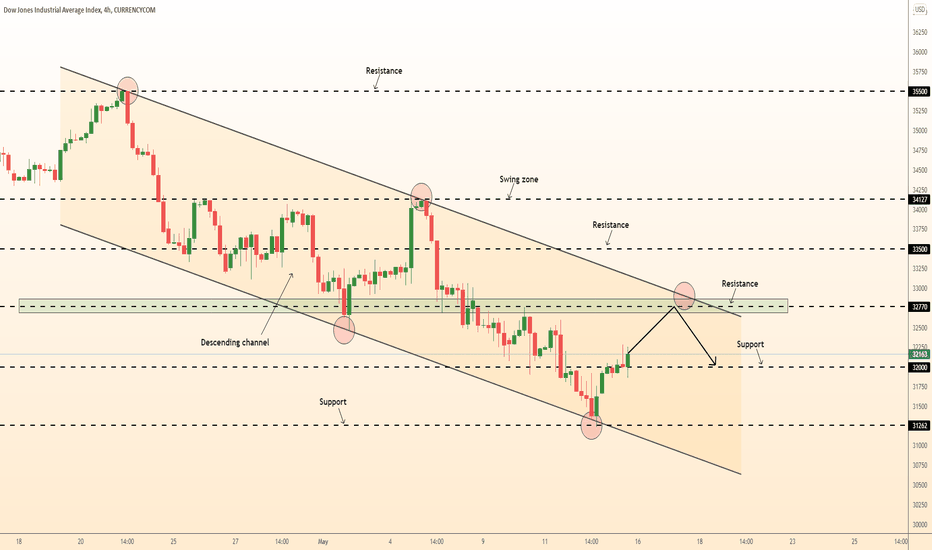

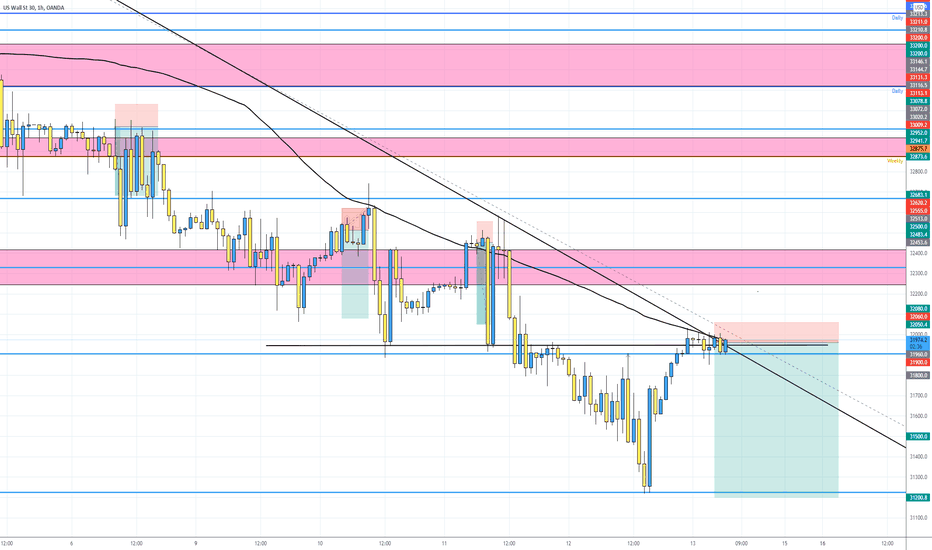

DeGRAM | US30 short!US30 has made lower lows and lower close on the daily timeframe.

Obviously, we are in a downtrend, so we look for shorting opportunities.

Price is forming a beautiful descending channel.

We expect the price to retrace to its previous level and then go short.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

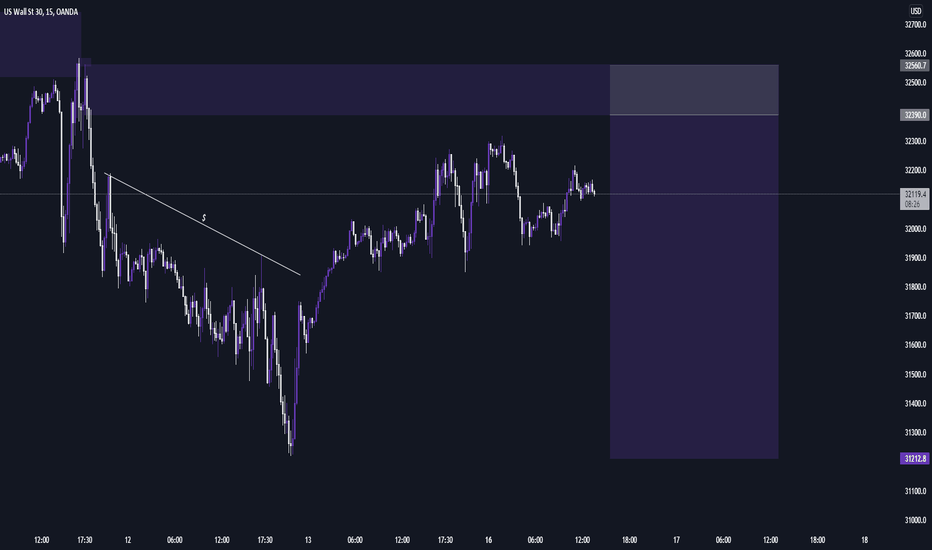

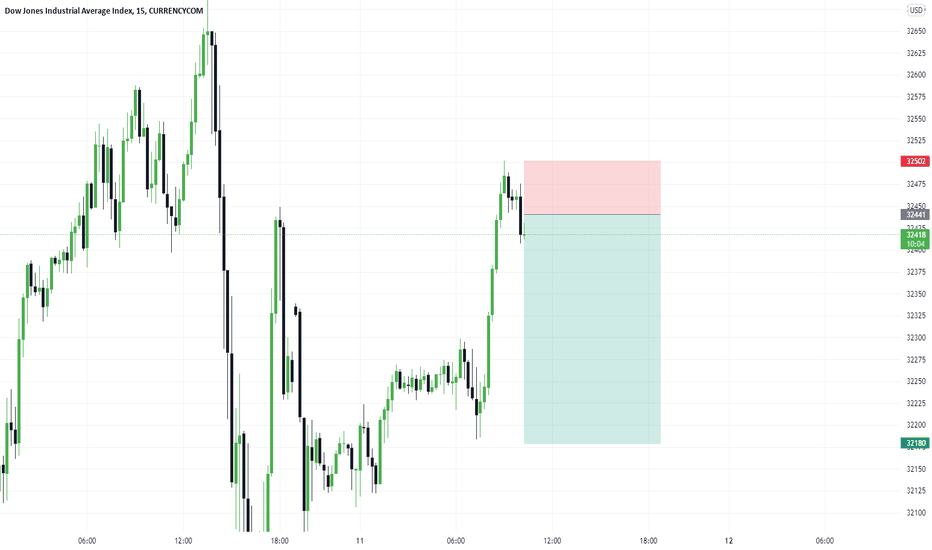

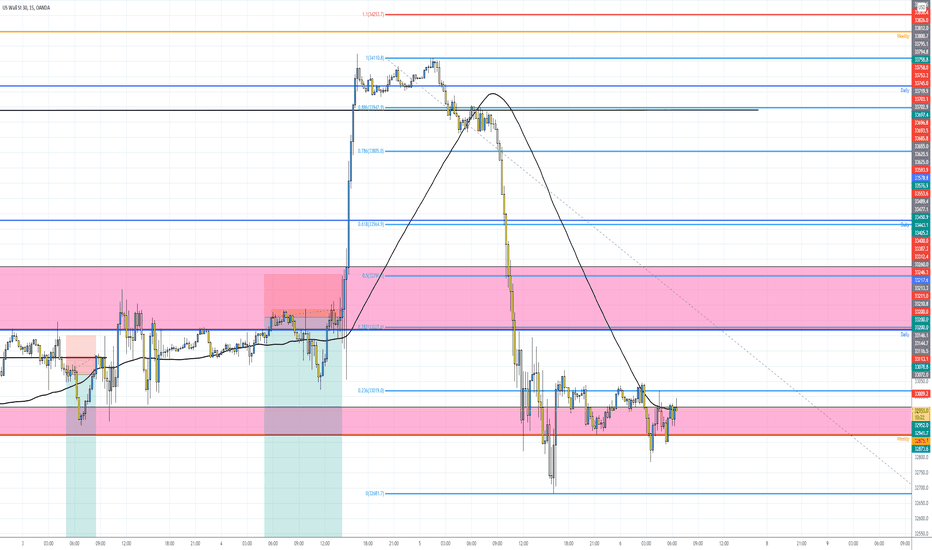

US30 - POST NY SESSION ANALYSIS - 05132022US30 - POST NY SESSION ANALYSIS - 05132022

Price bounced around today, didn't go in the direction of my target.

I got stopped out around 32050.

A couple hours later I re-entered when price started to show exhaustion around the 32050 level which I was previously stopped out at.

This was showing some confluence with the MA 66 as a static resistance on the H1 timeframe, along with exhaustion showing on the lower timeframe; M15, M5.

I set my stop clear out of structure at 32150.

Initially price went in my direction about 100 points.

Then it pushed straight back up to my SL at 32150.

Did not re-enter and price has just bounced around from about 32200 to 31900.

The weekly candle is closing exhausted bearish, this upcoming week might be a pullback, possibly looking for short term buys.

I have entered 1 small re-entry order at 32159 which I'm going to leave thru the weekend with my usual 100 point stop at 32260.

Let's see if I get stopped out right at market open or what happens.

Time to enjoy my weekend; relax, a little backtesting/wsa video watching/reading, and prepare for a new week :)

Have a great weekend!

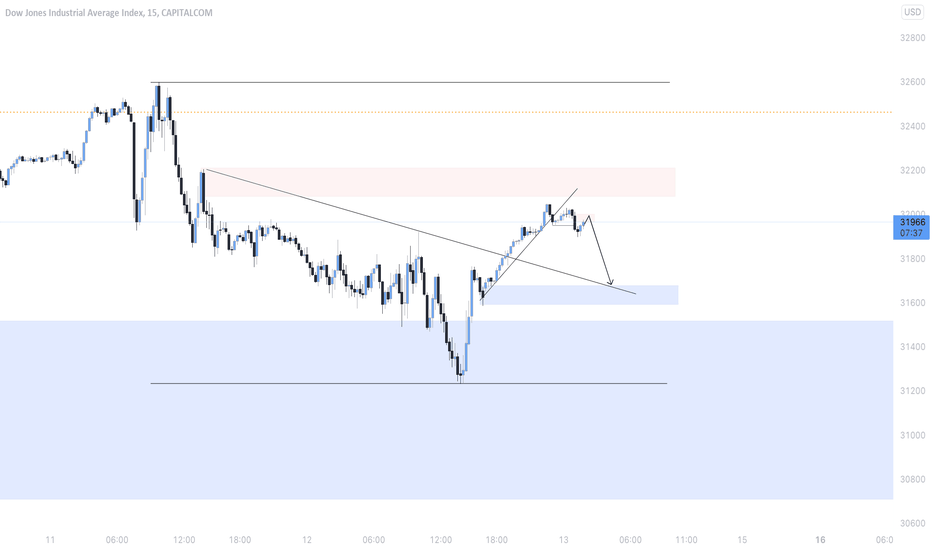

US30 - PRE NY SESSION ANALYSIS - 05132022US30 - PRE NY SESSION ANALYSIS - 05132022

As anticipated, price pushed back up during Asian and London session and is now hanging out around the 32000 level.

I have entered a sell position @ approximately 31960 with a 100 point stop which is clearly above previous recent structure lower highs.

There is also confluence in this area with the MA 66 acting as a static resistance, the 23.6 fib level, and a random support/resistance level which is also behaving as resistance at this time.

I am anticipating for price to drop to retest this week's previous low of approximately 31200 which is my TP.

I'll be moving my stops into profit as it starts heading in my direction.

If I get stopped out I'll probably call it quits for the week unless I see price pullback to the 38.2 fib level and show signs of exhaustion/reversal to consider a re-entry.

No major US news today which is good.

Good luck today and see you after NY session this afternoon!

Short then Long?If this supply holds ill be shorting down to the trendline break!

Let me know your thoughts! |

* Disclaimer **

These ideas I never trade until the end target with my initial lots, I focused on high probable entries with higher lots and use a specific partial taking strategy giving me a very high win rate and take most of my profits very early, I only leave a small % of my capital to run the entire trade. On the flip side im constantly monitoring LTF momentum and will close early if things change, these analysis's are for research purposes only.

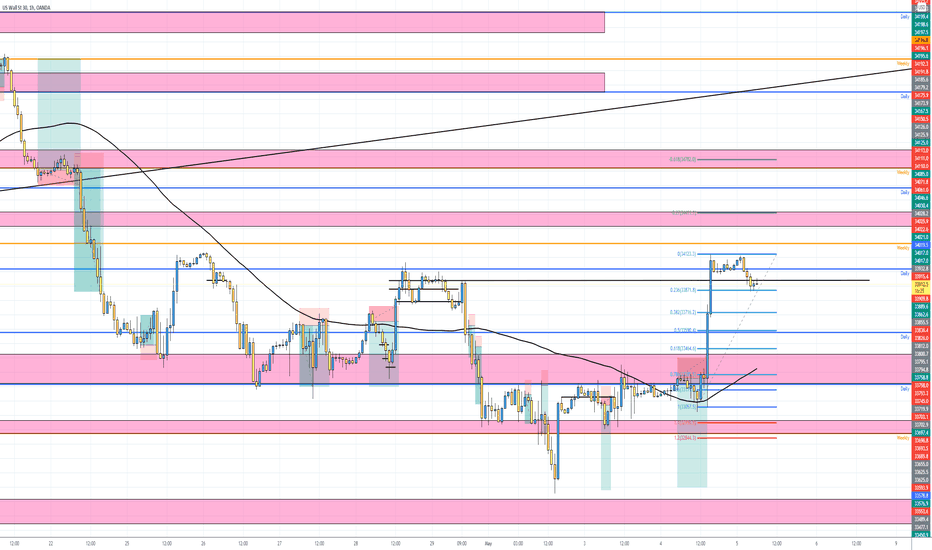

US30 - POST NY SESSION ANALYSIS - 05122022US30 - POST NY SESSION ANALYSIS - 05122022

Nice trading day today locking in about 300 points.

Got in at 11AM EST on a 15min exhausted bullish candle with a big wick.

Entered approximately 31800 and rode down to 31500.

Price has since pushed down further to approximately 31200.

Over the next hours of Asian and London session I am looking for price to pullback to approximately this same 31800 - 32000 level.

If it does, I will be looking for exhaustion/reversal patterns forming with confluences of being near previous structure highs, fib PRZ levels, and supply/demand areas.

By the end of this week, price may potentially drop all the way to the weekly support/resistance level of approximately 30900.

Have a good night and see you before NY session tomorrow!

US30 - PRE NY SESSION ANALYSIS - 05122022US30 - PRE NY SESSION ANALYSIS - 05122022

At the time of this post price is currently around 31600 and appears to be running out of gas.

During Asian and London session price has continued to push down.

US - PPI news at 8:30AM EST so we will see what effect this has.

Currently I don't see any entry for my edge, there may be some short-term countertrend buy opportunities but I am not targeting those.

I am going to wait for price to pull back up to previous levels of structure, aligning with support/resistance levels, supply/demand zones, and fib levels while price is exhibiting signs of exhaustion/reversal to get back in on another sell order to continue riding the downward wave.

Have a great trading day and see you after NY session today!

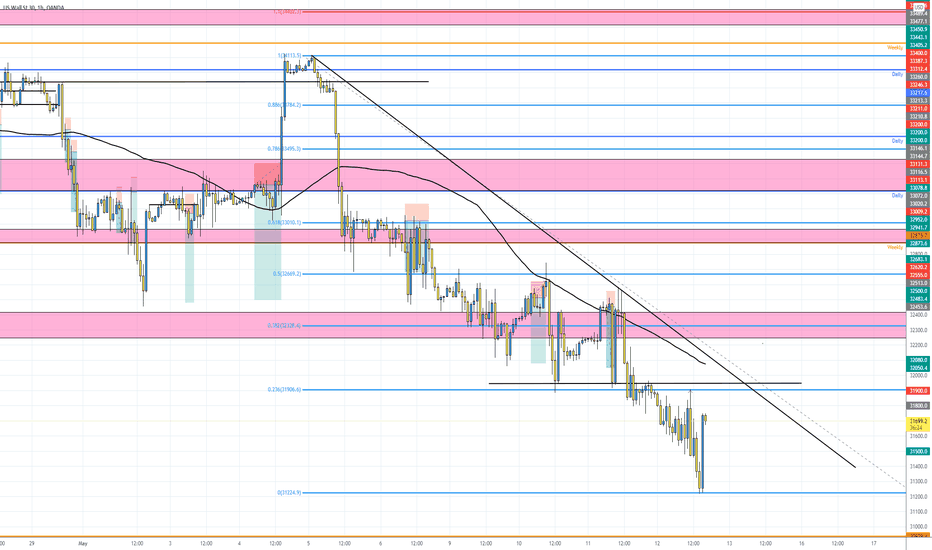

US30 - POST NY SESSION ANALYSIS - 05112022US30 - POST NY SESSION ANALYSIS - 05112022

Now THAT was a trade!

After my last post, price DROPPED after the negative US - PPI news.

I was in around 32450 and right at 8:30AM she dropped to the floor, at one point going as low as 31800.

I secured profits the whole way down starting at 1:3 RRR approximately at 32150.

Hit my TP of 32000

Had a trailing stop running, moved it all the way down to 32050 as price was around 31900.

Price came back and stopped me out shortly after NY market open @ 9:30AM

I was away from my station but in retrospect, price went back up around my previous entry point and exhibited beautiful exhaustion along with a double top around this 32500 level roughly.

Anyone in the market at that time could have gotten a sweet 1:5 - 1:6 RRR trade.

Awesome trading day, completely satisfied with my gains!

Let's see if we have a fresh high probability opportunity tomorrow morning :)

Have a great night!

US30 - PRE NY SESSION ANALYSIS - 05112022US30 - PRE NY SESSION ANALYSIS - 05112022

Price has pushed back up to approximately 32450 level over last few hours.

Although US Core PPI data is due now at 8:30AM EST, I have still entered a few positions around this 32450 level as the last couple of hour candles showed some signs of exhaustion near the 23.6 fib level and a previous structure lower high.

I am targeting 32000, a level which was touched yesterday.

If I'm stopped out at 32555 then I will be monitoring price to see if it exhibits exhaustion at higher structure levels near the 38.2 fib around 32700

See you after NY session today!

Happy Hunting!

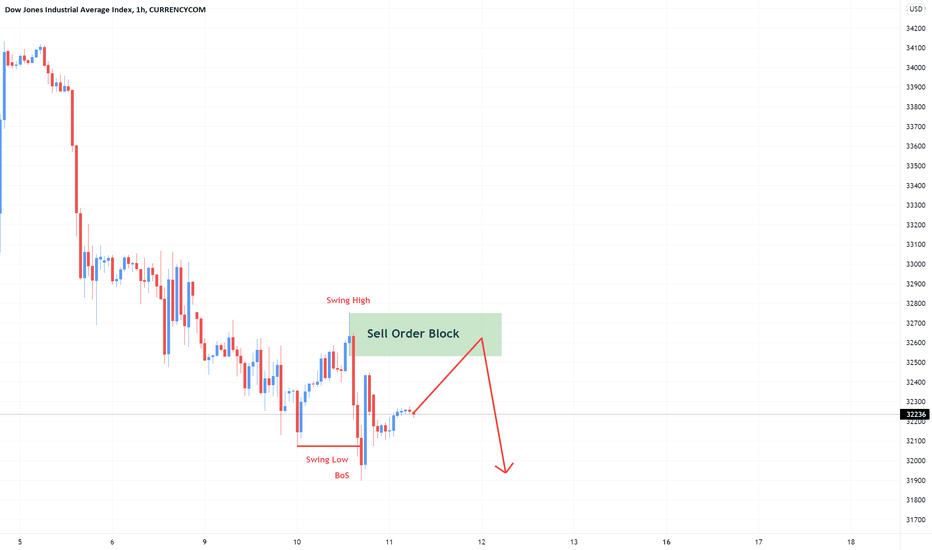

Dow Jones Prediction H1Here is my view for US30 on H1. The price could go down, you can put a pending order on the Order block or find an entry on LTF within OB Zone. Trade Safe!

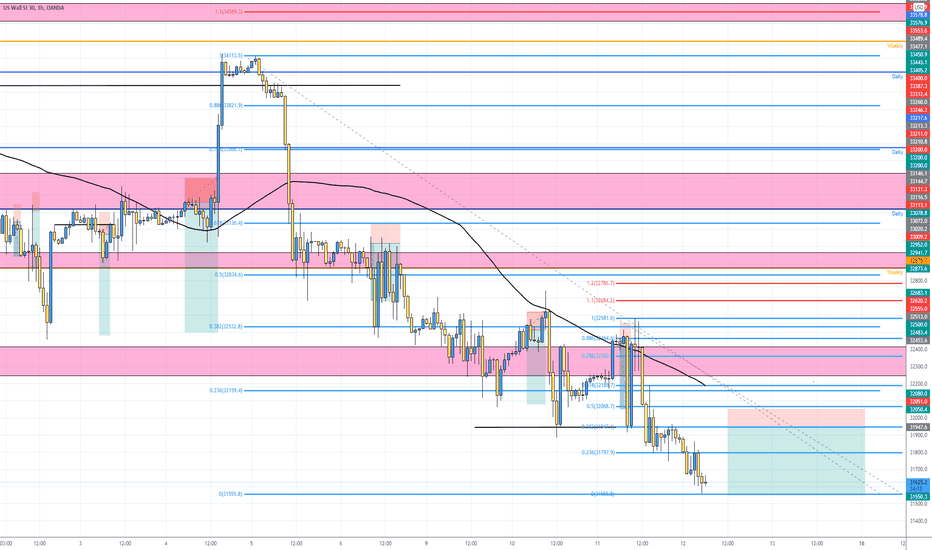

US30 - POST NY SESSION ANALYSIS - 05102022US30 - POST NY SESSION ANALYSIS - 05102022

Big drop today as expected but unfortunately I was stopped out and didn't reenter :/

Price is now bouncing around 32100 and I am looking for a pullback with signs of exhaustion/reversal for another bearish entry.

Let's see what Asian and early London sessions bring in.

Have a good night!

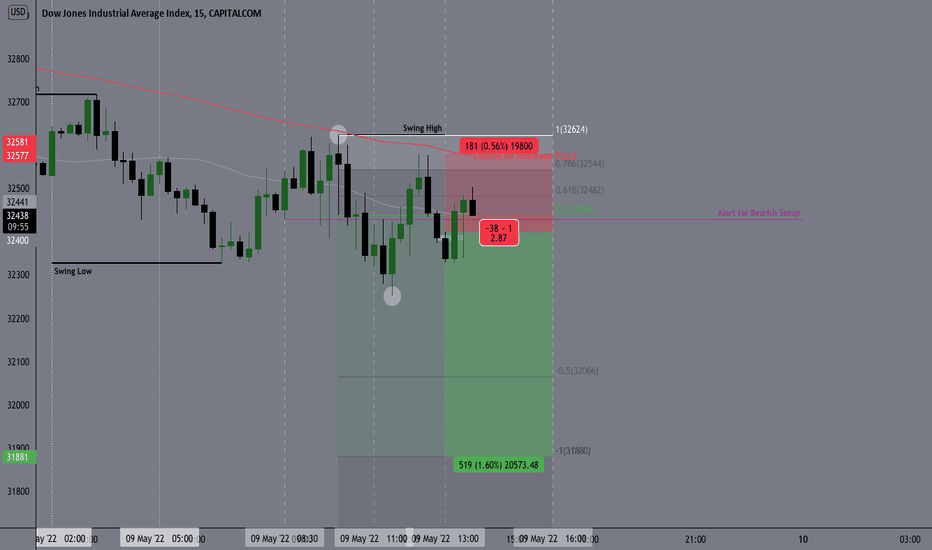

US30 - PRE NY SESSION ANALYSIS - 05102022US30 - PRE NY SESSION ANALYSIS - 05102022

Price dropped a bit and pulled back during Asian and early NY session.

It did not pull back to the zone that I was hoping for which would have lined up with a weekly SR level and 38.2 fib but it has pulled back to the 23.6 fib level which aligns with the structure highs formed over the last few hours.

I have entered a short position around 32513 targeting previous structure low of 32080

My stop is approximately at 32620 approximately 100 points above my entry and also above the same structure highs formed over the last few hours at this 23.6 fib level.

I will be trailing my stop by approximately 100 points once the trade passes 150-200 points profit.

No major news today which is great.

Let's see how this plays out :)

US30: Intraday Technical AnalysisUS30 stayed sideways between 32500 and 32300 with false breakout both upside and downside. Today there are a more than three FEDs addresses at different times. My idea is that the US30 will test the supports of 32200 once again and resistance of 32600.My target is entry at 32200 after confirmation of support and my target goal will be 32500 and 32600 for intraday.

If you like this or if you think the opposite of this or if there is any other opinion, mention it in the comments. I am open to all kind of suggestions and critics

US30 - POST NY SESSION ANALYSIS - 05092022Price just kind of bounced around today around the new structure lows formed over the last day or so.

I am looking for price to pull back up a bit to previous structure lower highs in confluence with a supply/demand zone in that same area as well as a weekly support/resistance level and 38.2 fib.

Expect price to move sideways during Asian session tonight and hopefully pullback during early London session, exhibit some exhaustion/reversal signs, and then I will get in with approximately 1:6 RRR which is fantastic.

I will see you before NY session tomorrow!

Goodnight!

US30 - PRE NY SESSION ANALYSIS - 05092022US30 - PRE NY SESSION ANALYSIS - 05092022

The bears have continue their push down starting off this new week, getting down into the 32500 range.

I anticipate that price will continue to drop as there are no major support levels to hold price up for a good ways.

I am looking and waiting for a pullback to previous levels of supply/demand and then exhibit signs of exhaustion and reversal on the lower timeframes up to H1 to consider an sell entry to continue the downward wave.

At the time of this writing I don't see that entry opportunity yet but I will have my eye on it.

Happy Monday!

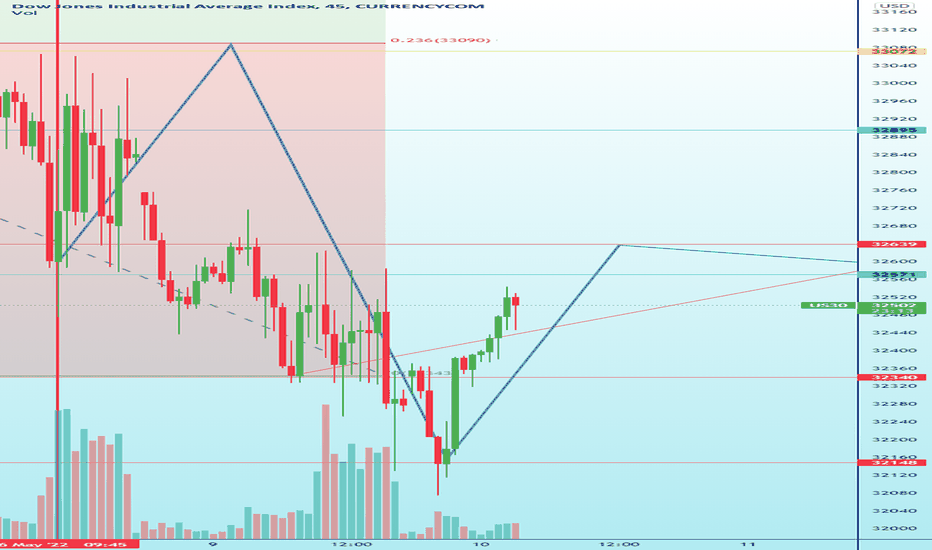

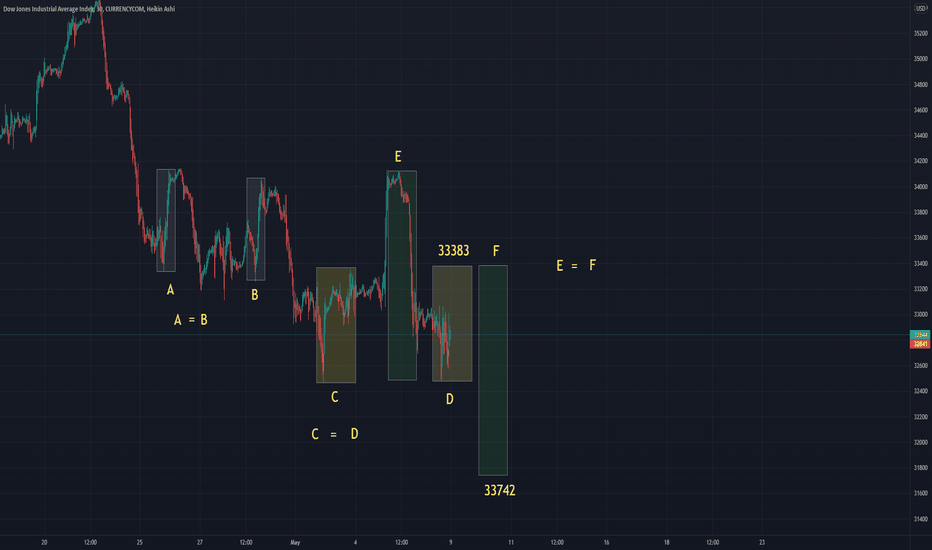

US30 analysisThis is what we expect from Dow Jones stock next week, and after the last point we will have a strong uptrend.

US30 - POST NY SESSION ANALYSIS - 05062022Price has just been bouncing around all day after NFP.

No real direction just bouncing back and forth between 32900 and 33100

I think the bearish momentum is still definitely intact.

Will continue to be looking for shorts starting off this new week.

Enjoy your weekend and see you pre NY session on Monday!

US30 - PRE NY SESSION ANALYSIS - 05062022NFP DAY!!!

Since my last post, price has literally just moved sideways.

Currently there is very little volume in anticipation of NFP @ 8:30AM EST

I don't currently see an entry but I am looking for price to pull back into the 33200-33400 range and exhibit signs of exhaustion/reversal.

At that point I will consider and entry but it looks like that is atleast a couple hours away.

Also have to take into account that it is Friday and I don't particularly like holding trades over the weekend so I may just sit out today and come back fresh next week unless I see a really good opportunity: 1:3 RRR and SL outside of structure.

Let's see what happens today.

Watch out for news and Happy Friday!

US30 - PRE NY SESSION ANALYSIS - 05052022Happy Cinco de Mayo!

Daddy J. Powell sent the market soaring 1000 points with his bullish remarks despite runaway inflation and economic contraction last month.

I think the bullish bias from larger timeframes may still be intact.

We will see where the market goes over the next few hours. May stay out today we'll see.