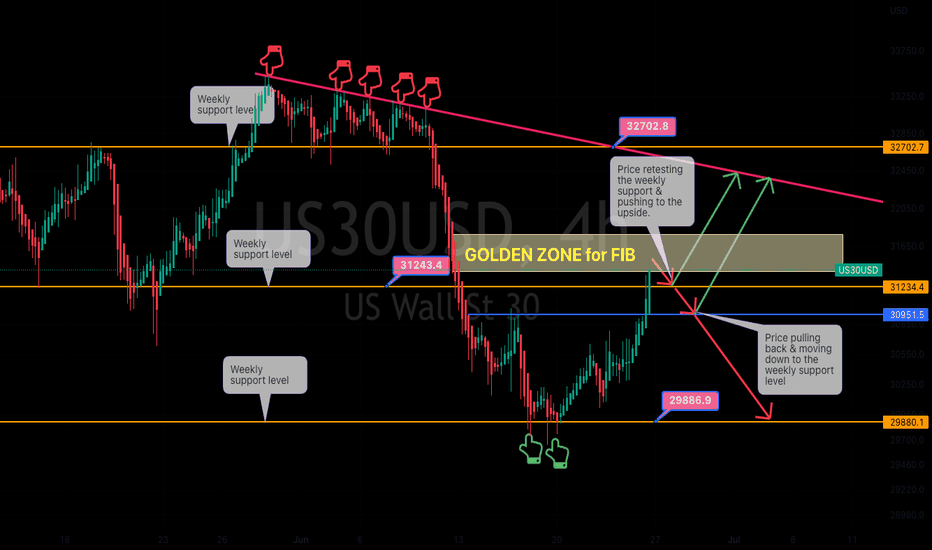

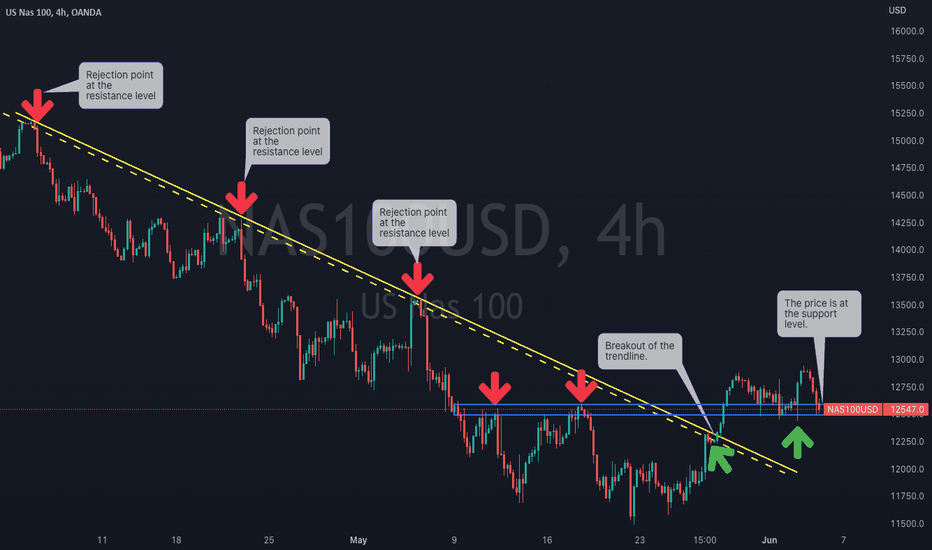

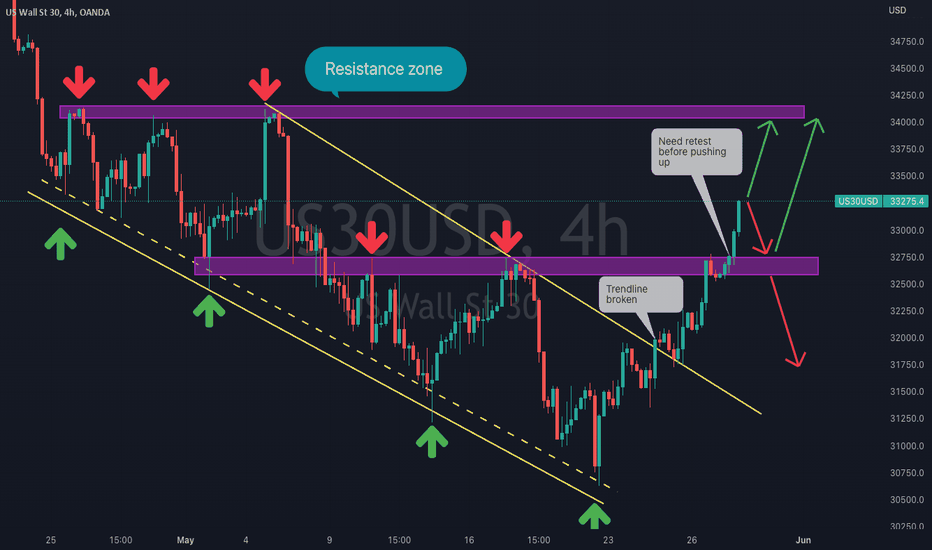

US 30 daily analysis My US 30 daily analysis on H4. The price is currently on at the resistance level. If the price, push to the up, we will see a breakout, but if the bears hold the position. The price will reject and move down. Let us remember that we're still under the bear market at this moment.

Us30update

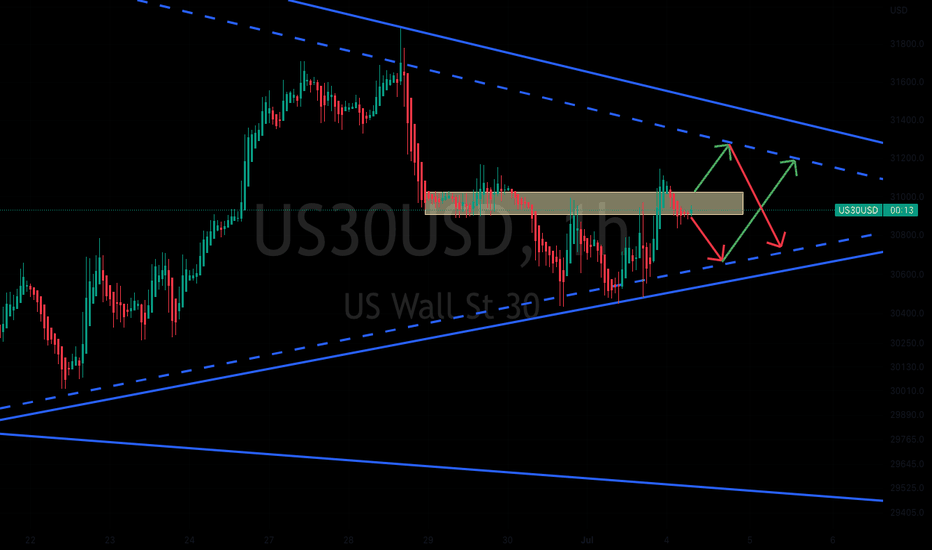

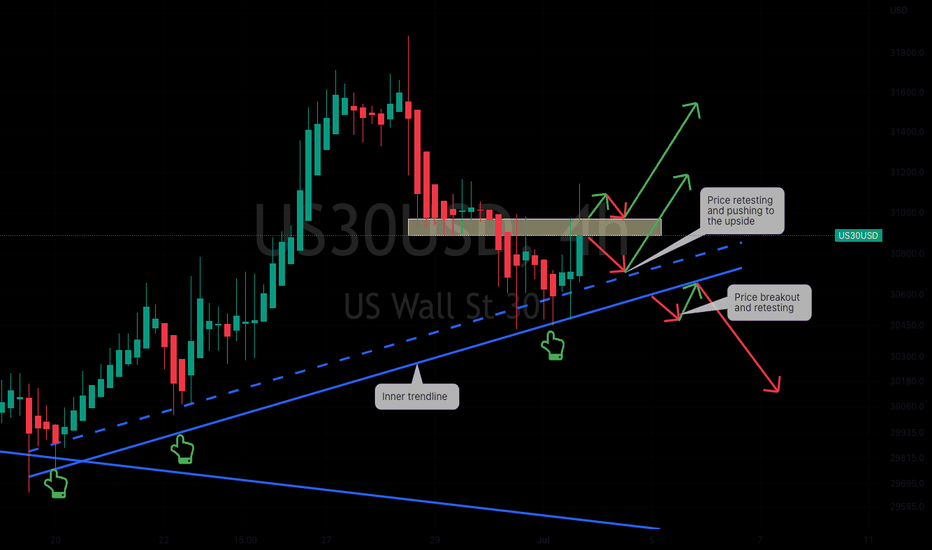

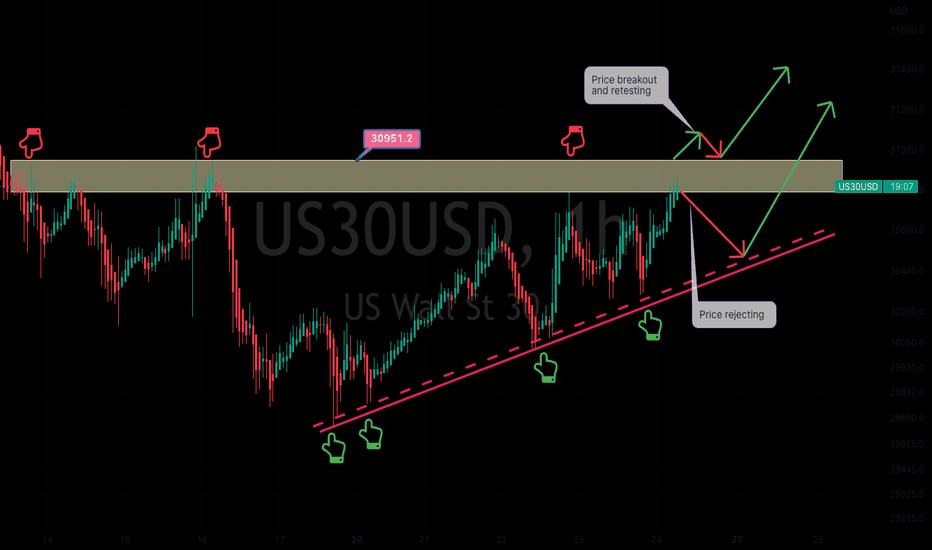

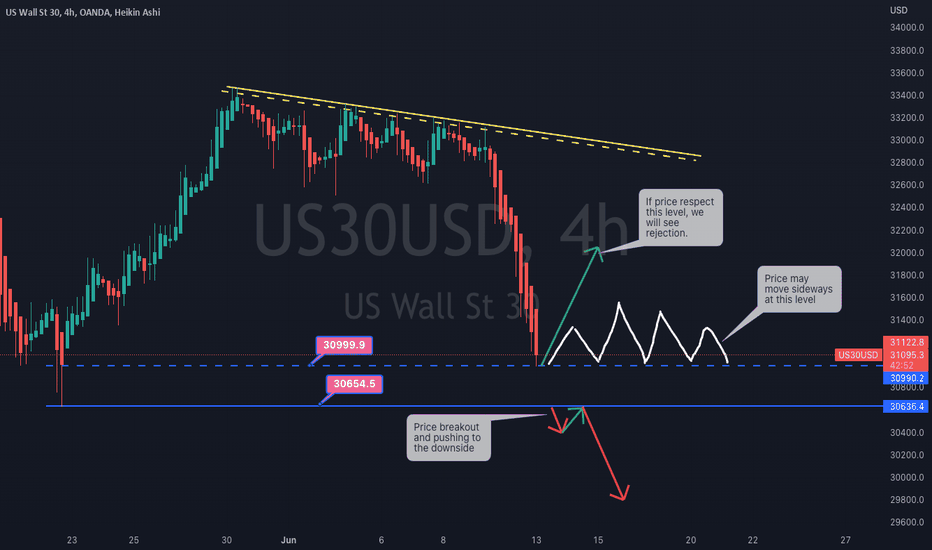

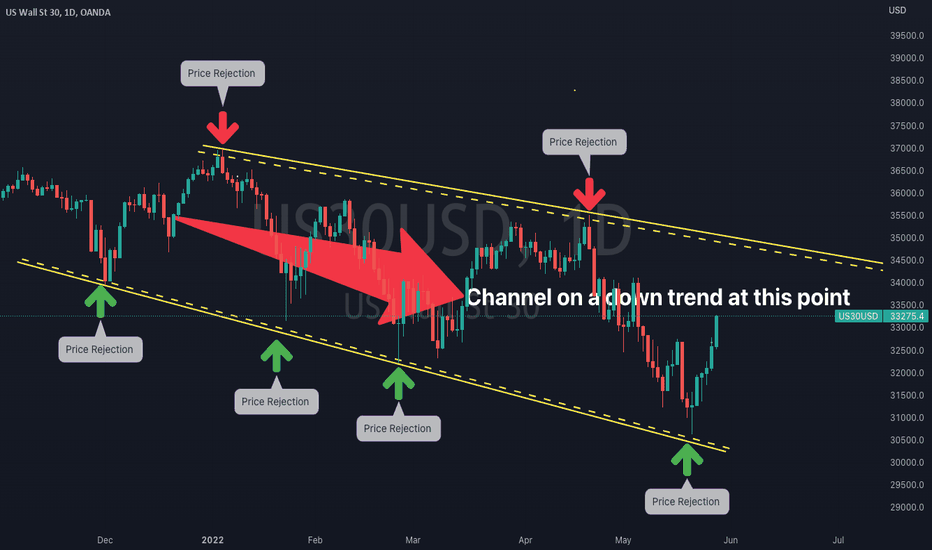

US 30 Dow Jones. Weekly Analysis for 27-01/07/22My weekly analysis for US 30. The market is pushing towards the resistance trendline. If the price breakout of the trendline, we will see the market change the direction. If not the price will still move down as we're still in the bear market. I hope you find value in my analysis. Enjoy.

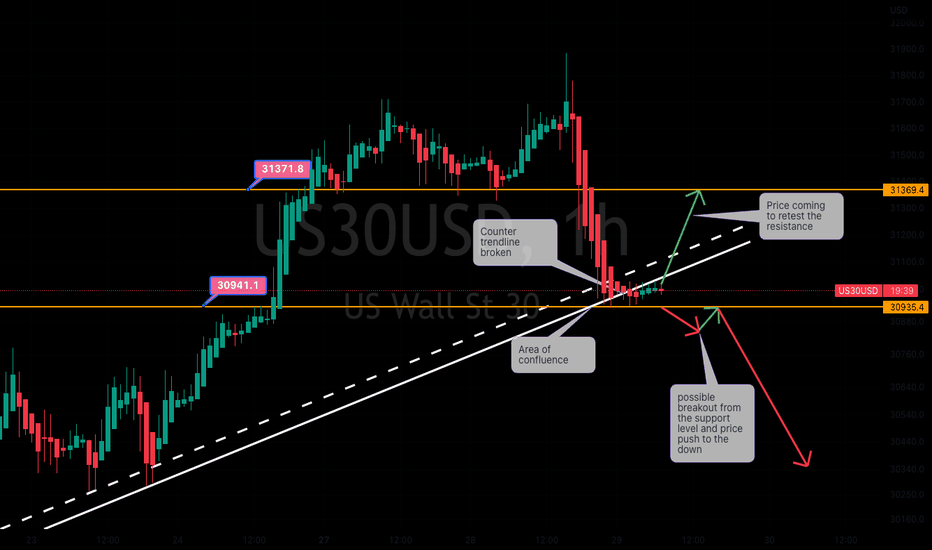

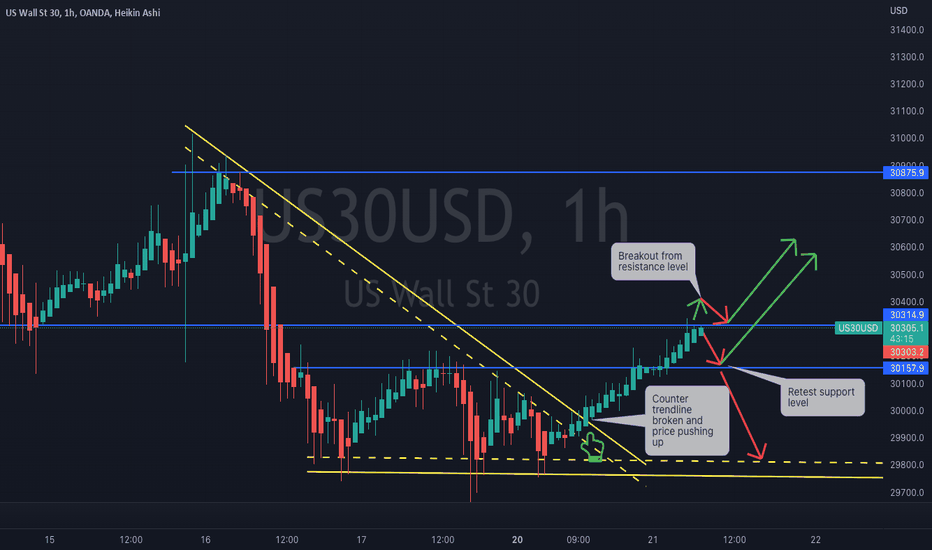

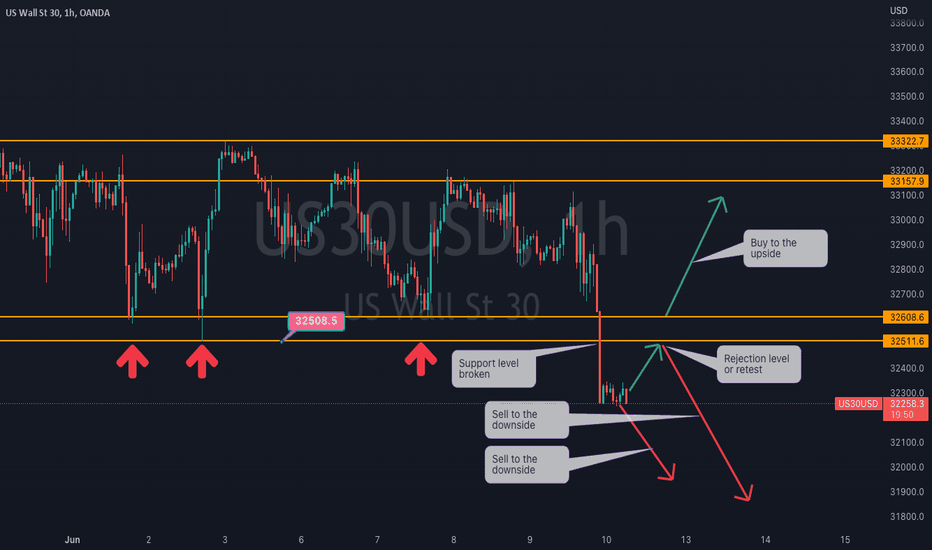

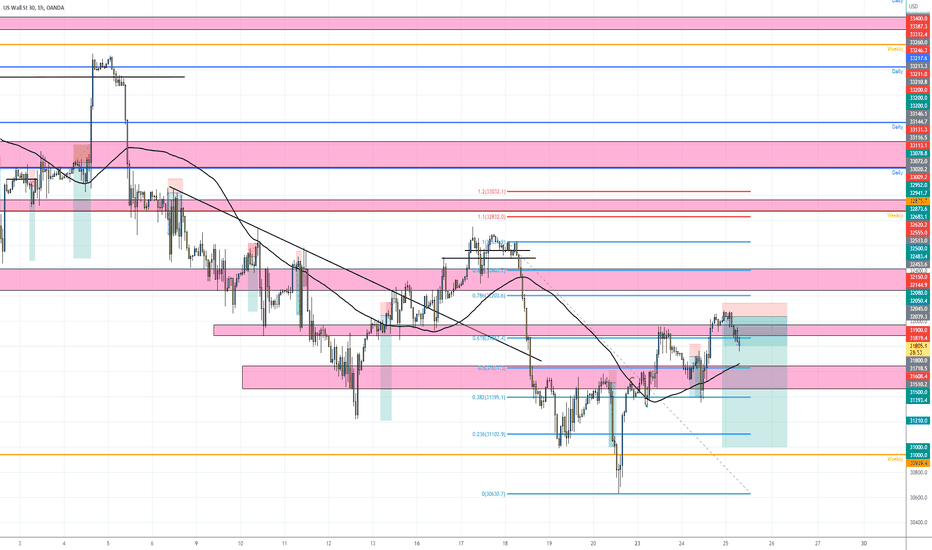

US 30 on a H1 chart The price has broken the support level. Now one need the second confirmation in a form of retest/ rejection on the recent support to be a resistance. Only than one can look for a sell opportunity. We must also remember that today we are having the CPI as per the economic calendar. That is why we need the confirmation before taking a trade.

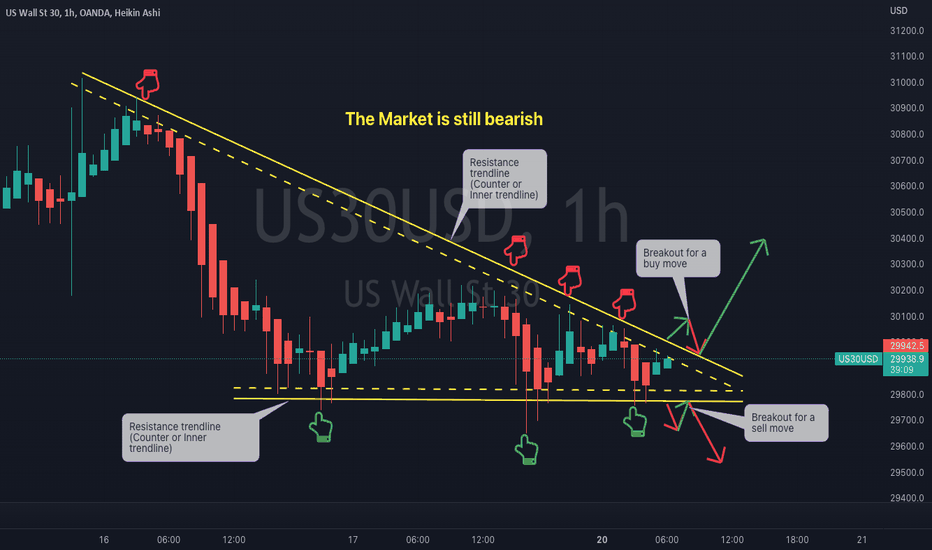

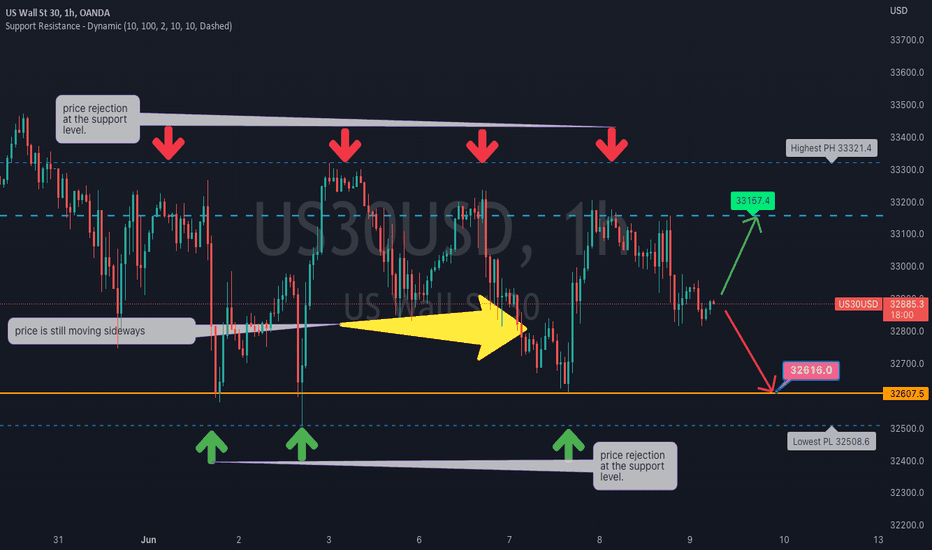

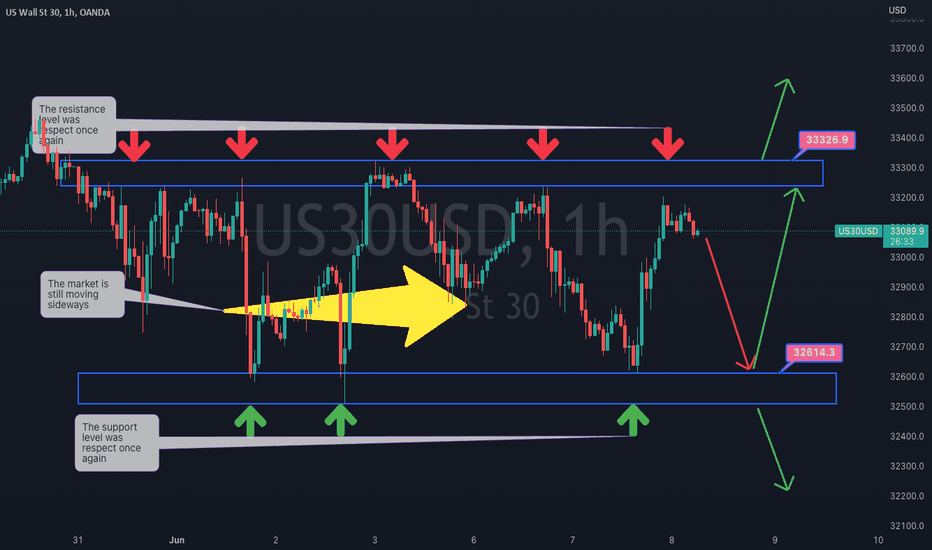

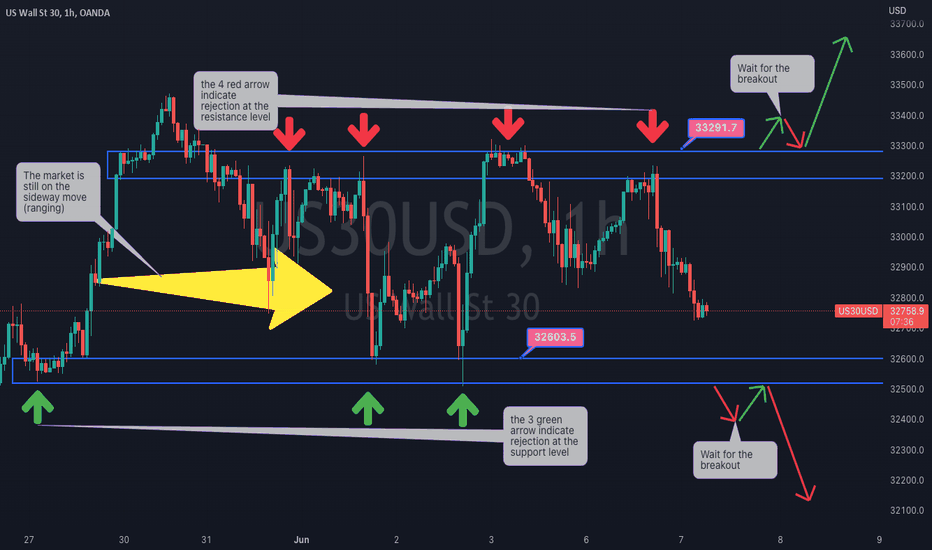

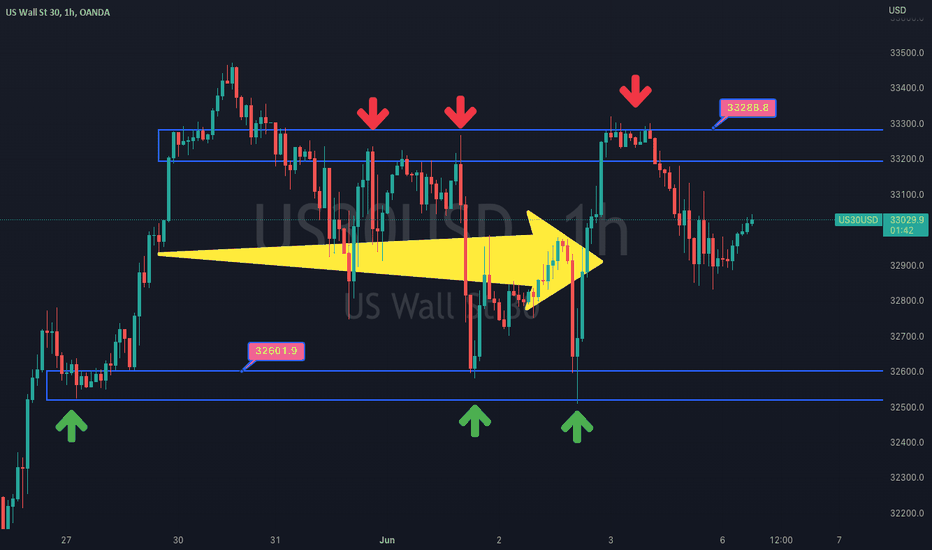

US 30 on the H1 chart This is the update on the US 30 on the H1 chart. The price is still on the sideways move. For people that trade the trending market this is for one to wait for the breakout before you can look for trading opportunity. At this moment is to sharpen up your trading plan, be aware of your trading psychology and review your trading strategy.

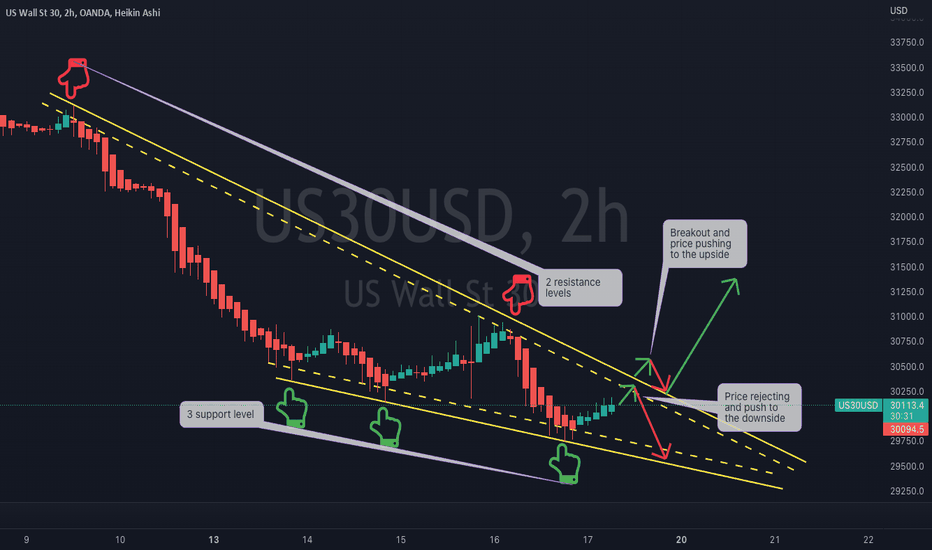

US 30 on the H4 chart The price is is currently on the support level. The are 2 possibilities that my take place at the level 1. we may see the price pushing to the upside aiming to reach the resistance or 2. the price may break it and push to the down side as we know that the market is still under the control of the bears.

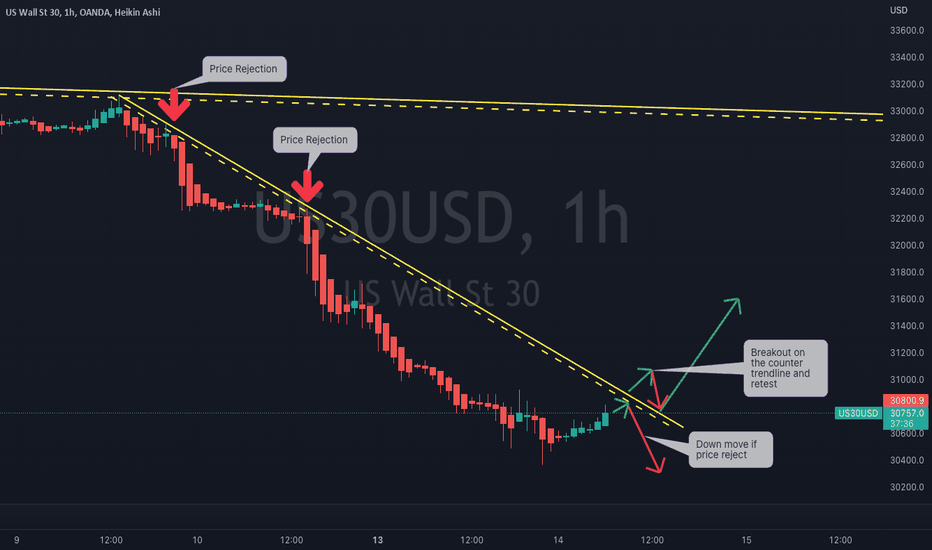

US30 - PRE NY SESSION ANALYSIS - 05252022US30 - PRE NY SESSION ANALYSIS - 05252022

Price appears to be breaking down as I post this video.

After yesterday's push up, price hung out in the 31900 - 32050 range during Asian/Early London session.

I got in to the positions I have now at approximately 32040 and my ultimate target is 31000.

Trailing stops at 100 points after price.

Let's see what happens, I'll be back with you after NY session!

Happy trading!