USA

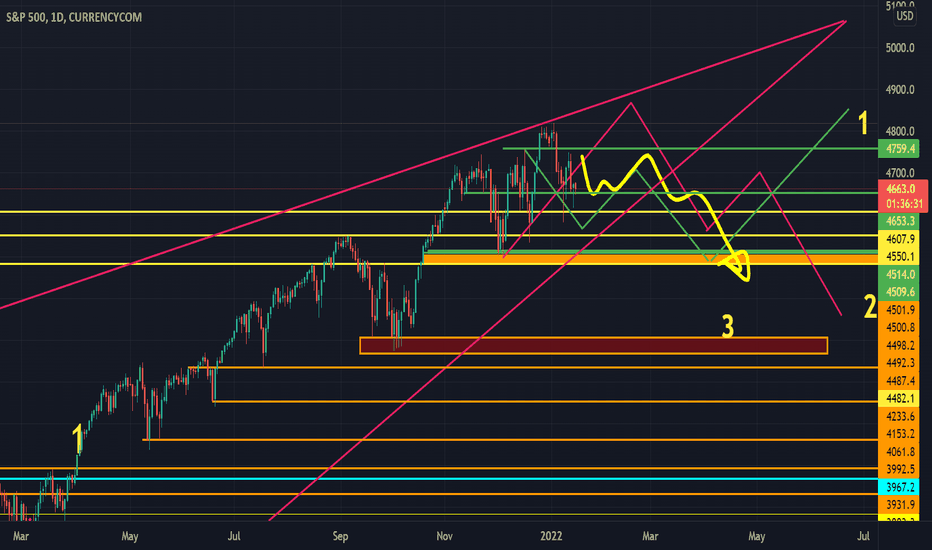

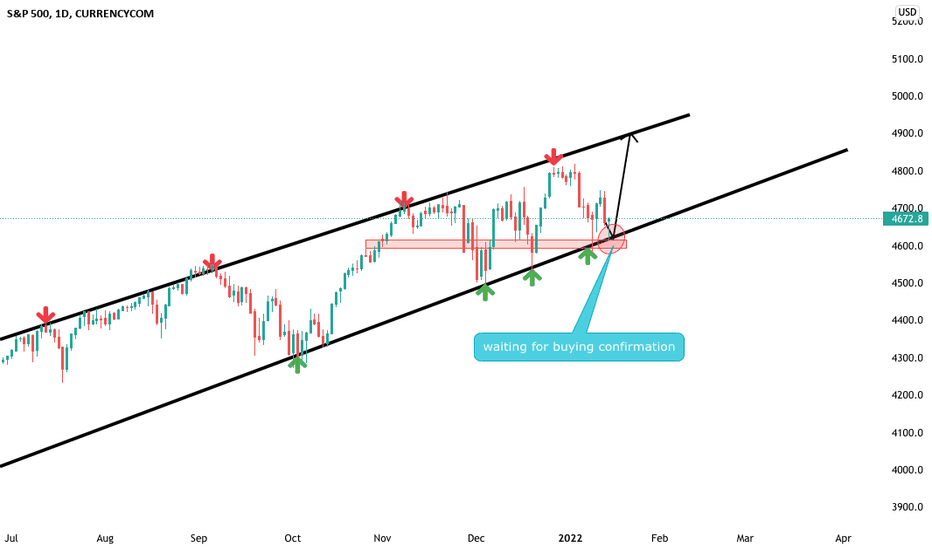

US500 SPX hello receive a cordial greeting, you have at your disposal the supports and resistances of the S&P500 in the medium term.

As well as its channels.

I hope it will help you.

Sincerely, L.E.D. In Spain on 01/17/22

US500Hey traders, in the coming week we are monitoring US500 for a buying opportunity around 4620 zone, once we will receive any bullish confirmation the trade will be executed.

Trade safe, Joe.

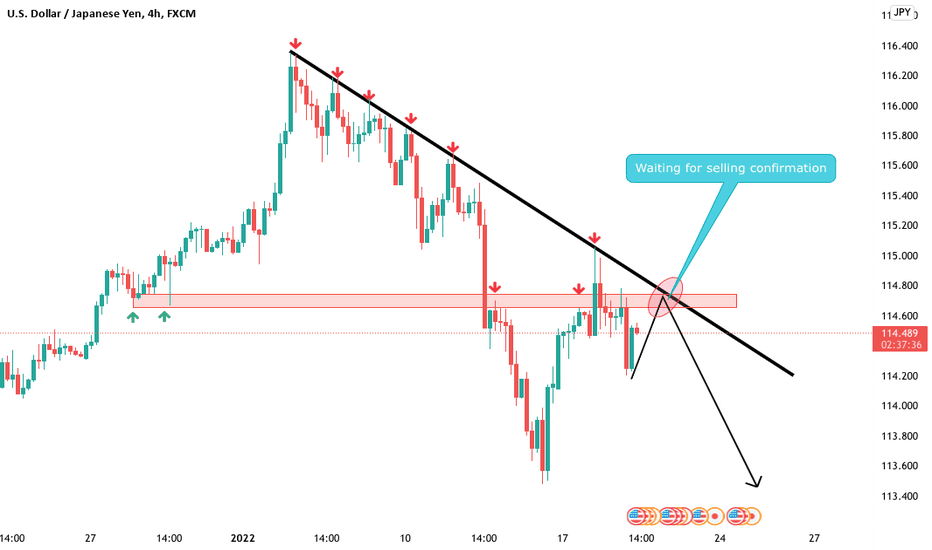

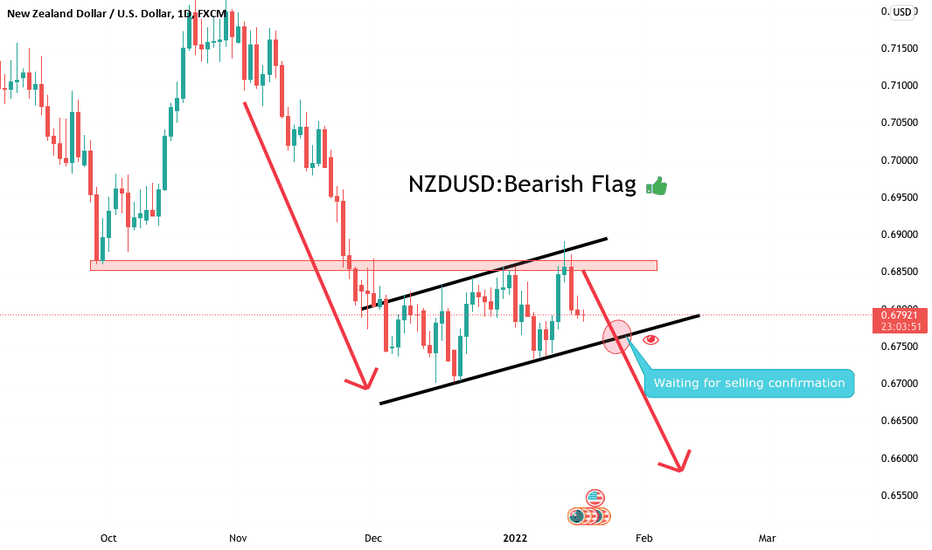

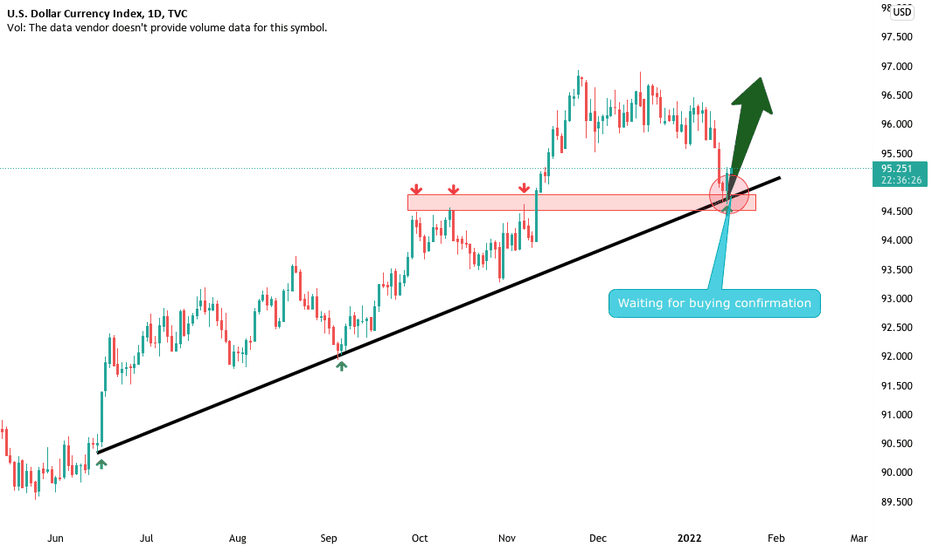

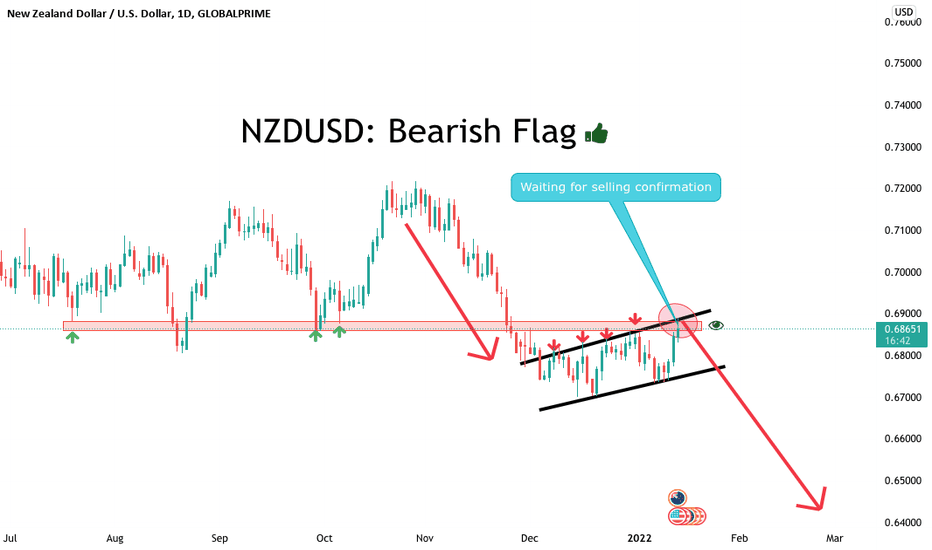

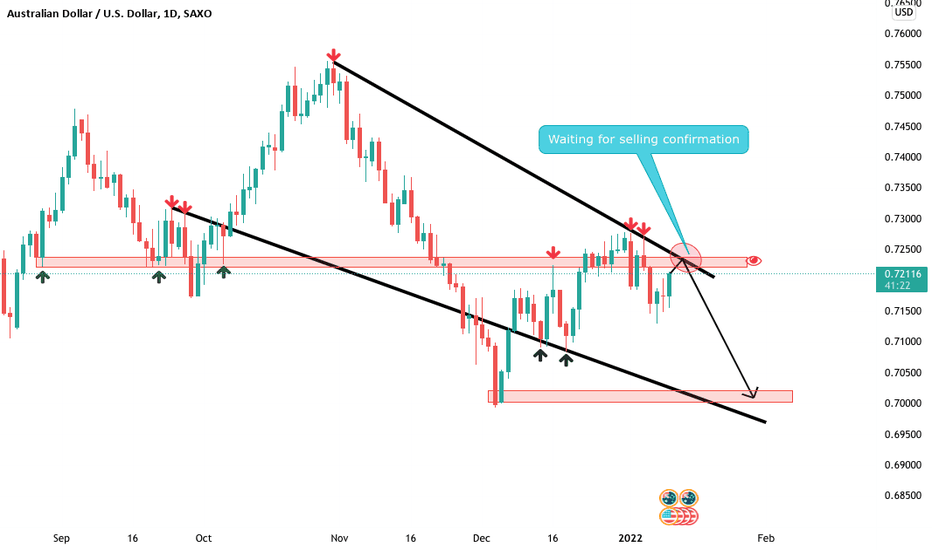

NZDUSD ShortHey traders, in this week we are monitoring NZDUSD for a selling opportunity around 0.69 zone. Once we will receive any bearish confirmation the trade will be executed.

Trade safe, Joe.

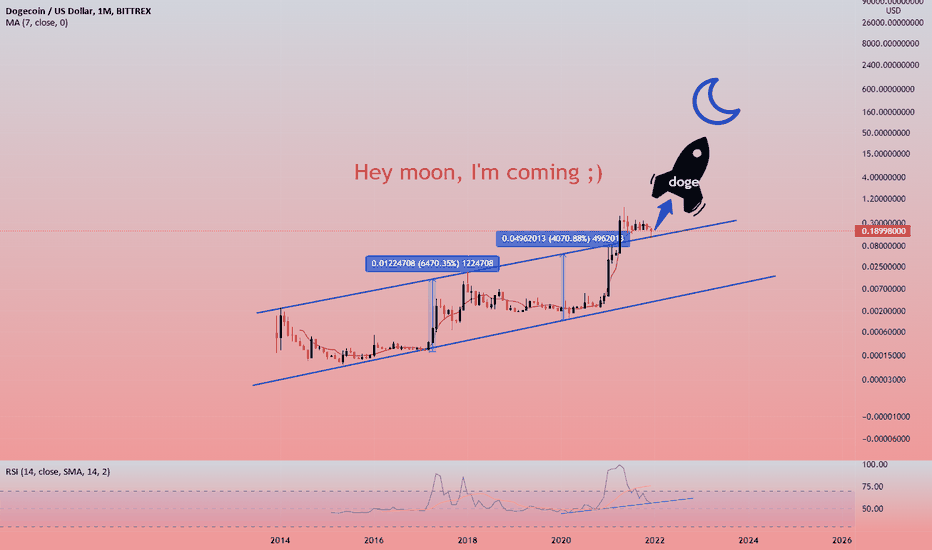

Doge: Hey moon, I'm coming ;)Does Doge want to say goodbye to Earth and say hello to the Moon?

The price is pulling back after breaking the channel upwards.

Do we have price support in this area?

It is also possible to see a positive divergence in the RSI indicator.

Will it reach the moon? (Will we change our car?🚗)

Start the new year with a gain.

Doge: Hey moon 😃, I'm coming ;)

Share your comments with us.

black mountain trade