Usd-jpy

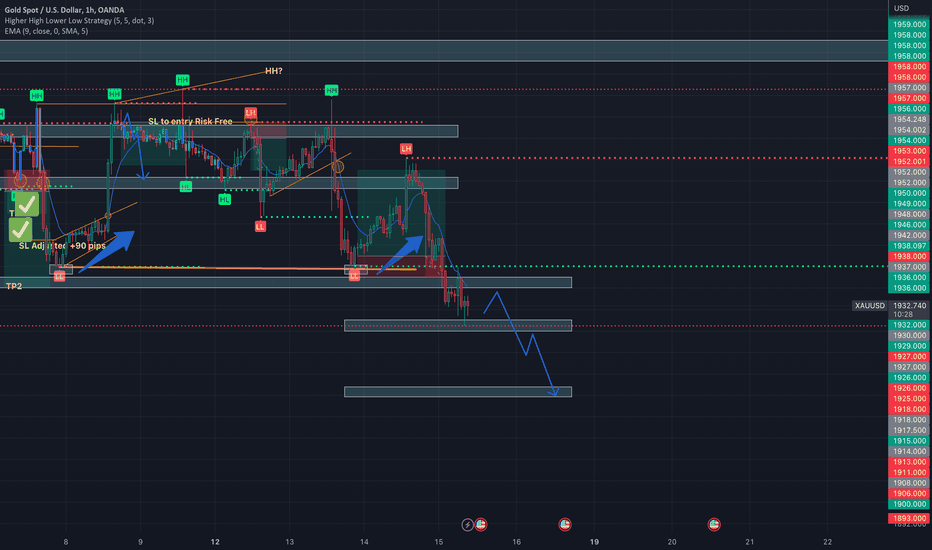

USD/JPY long ideaHello Traders

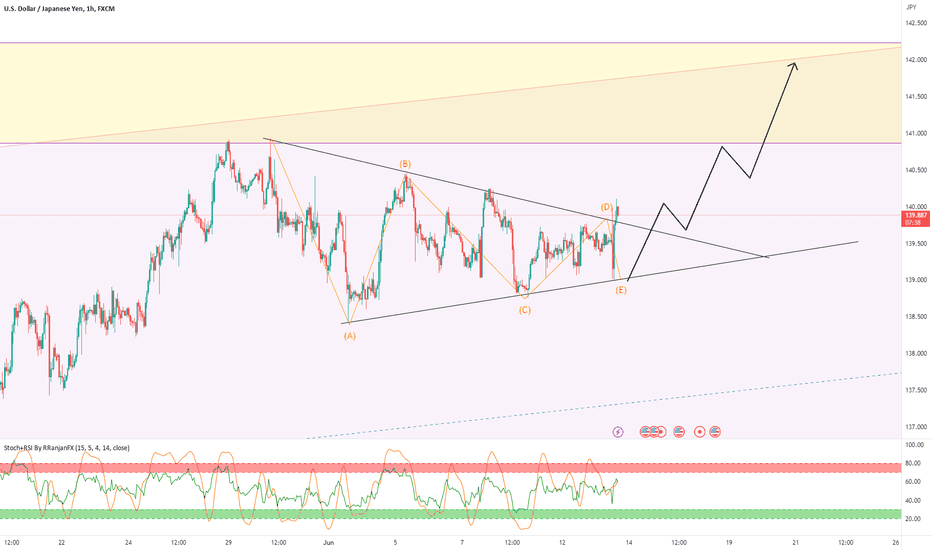

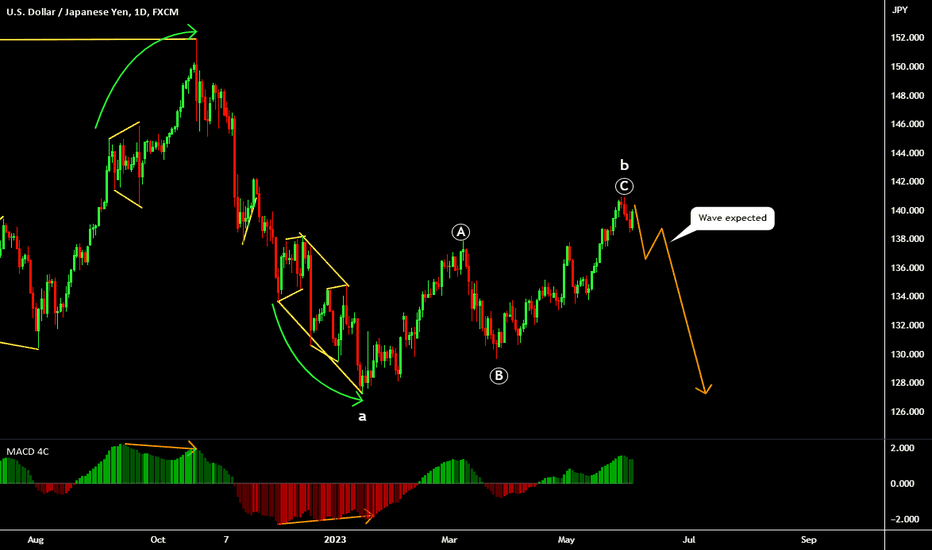

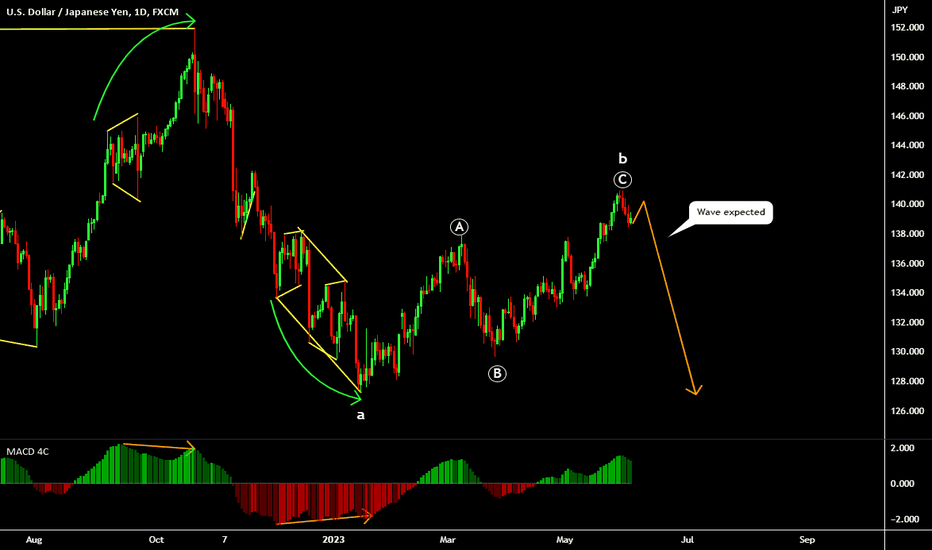

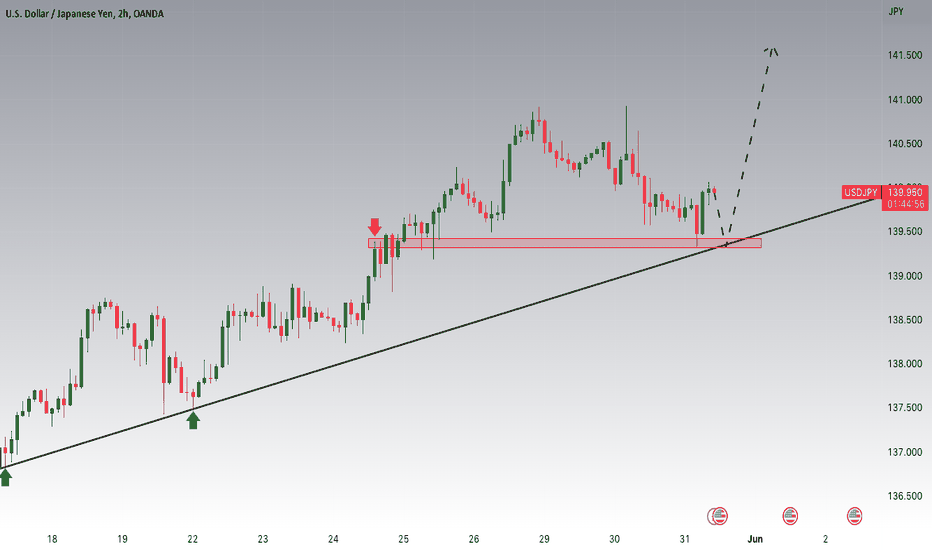

We have detected a triangle correction for USD/JPY. so we stay bullish on this pair and expect some upward moves in the next few days.

Our technical view has been shown in the chart.

If you like it then Support us by Like, Following, and Sharing.

Thanks For Reading

Team Fortuna

-RC

(Disclaimer: Published ideas and other Contents on this page are for educational purposes and do not include a financial recommendation. Trading is Risky, so before any action do your research.)

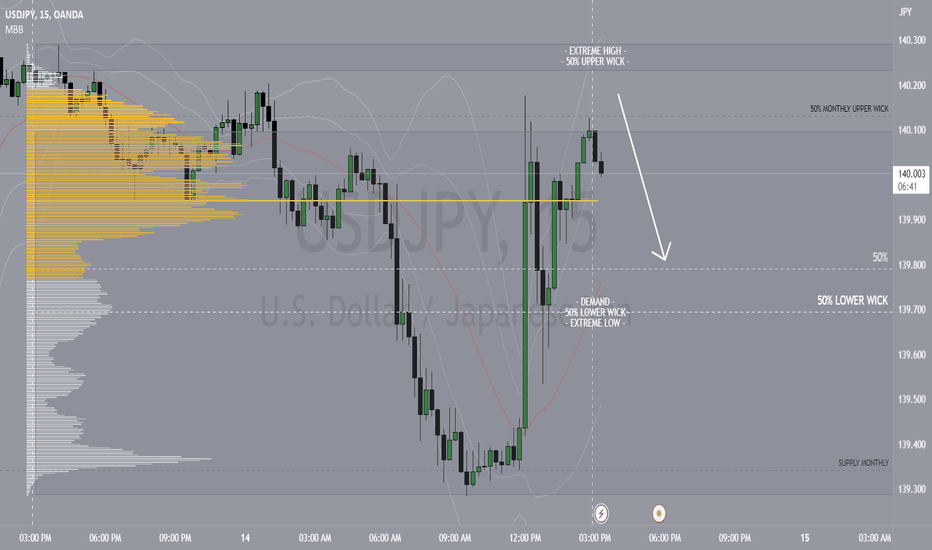

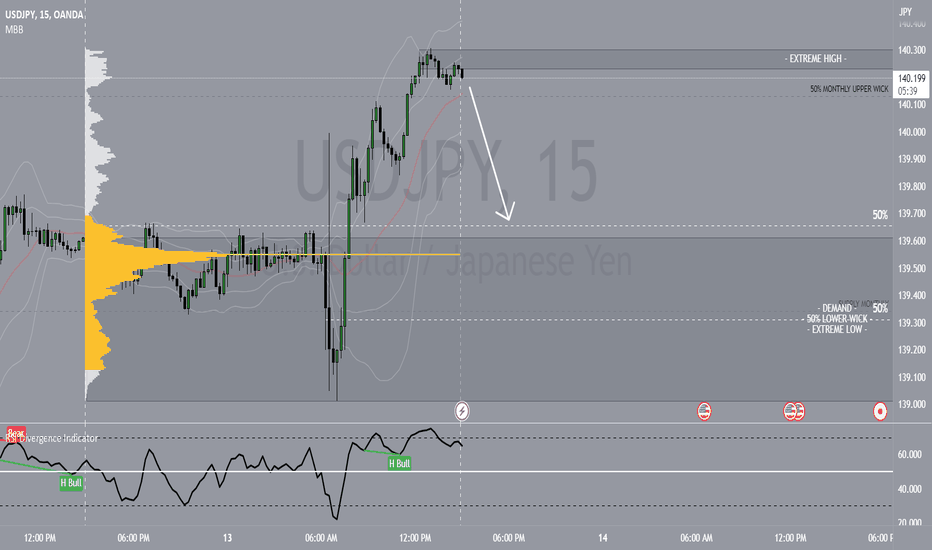

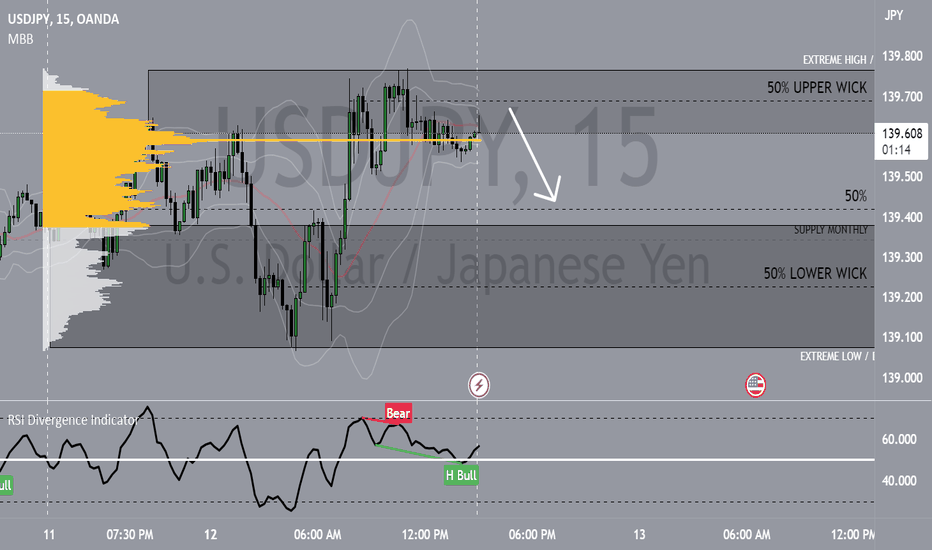

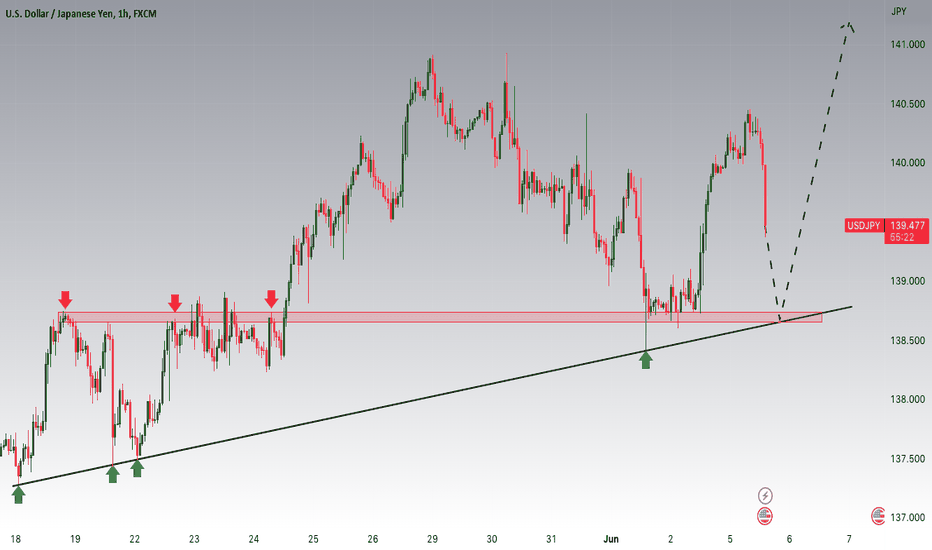

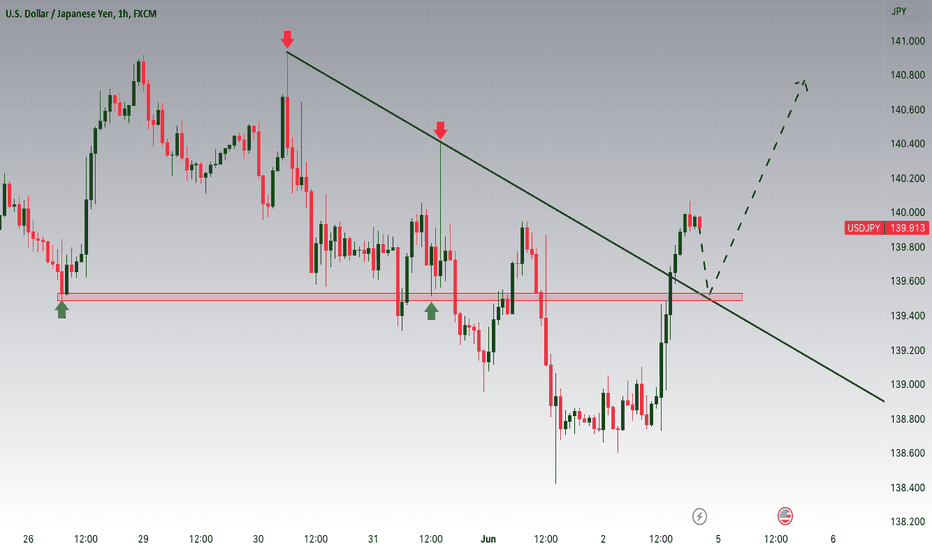

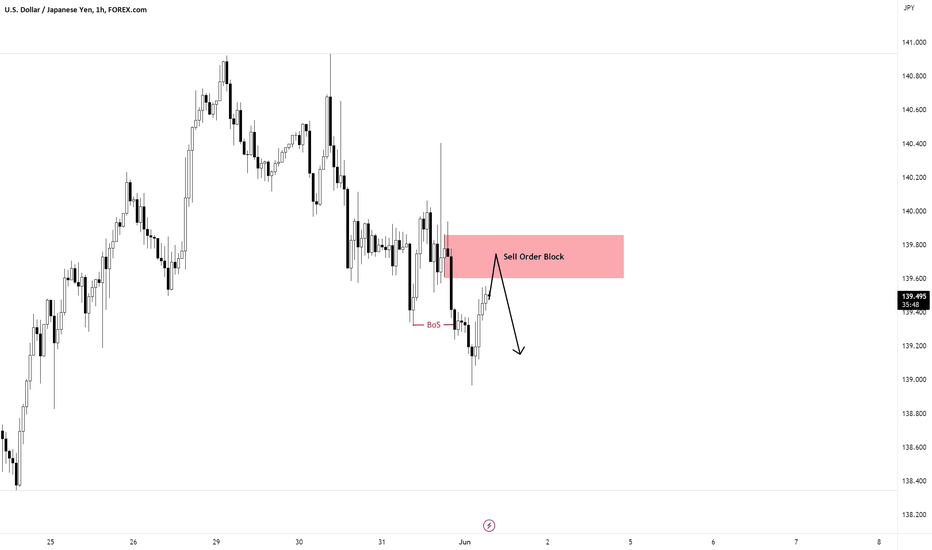

USDJPY SHORT 06/12/2023USDJPY SHORT 06/12/2023

Price currently above the supply zone still waiting for a enter confirmation. Hoping to enter short at 139.689. Targeting the market equilibrium at 139.420.

High chance of price going down as market equilibrium aligns with VAL of previous day and monthly supply zone.

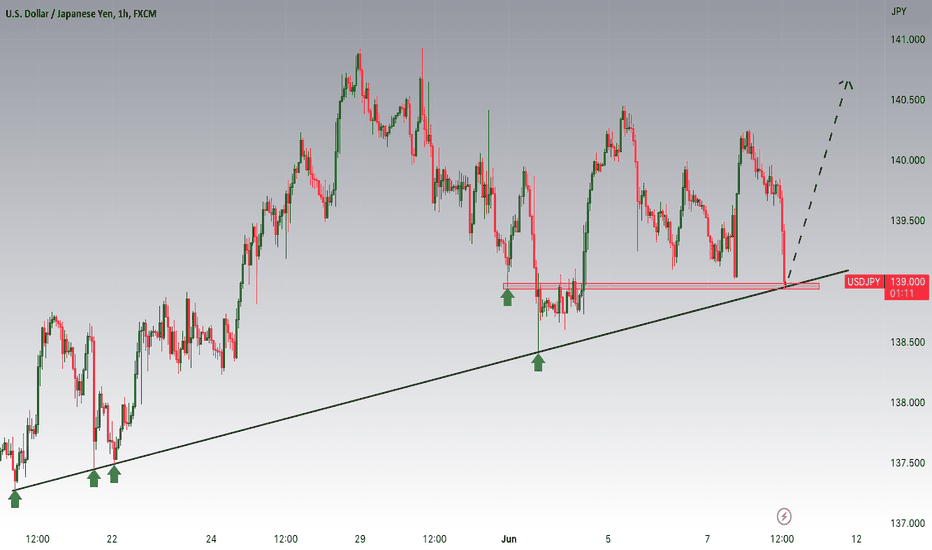

USDJPY Potential UpsidesHey Traders, in today's trading session we are monitoring USDJPY for a buying opportunity around 138.900 zone, USDJPY is trading in an uptrend and currently is in a correction phase in which it is approaching the major trend at 138.9 support and resistance zone.

Trade safe, Joe.

USDJPY Trade 160 Pips TargetYo guys I'm back. I focus on gbpjpy & usdjpy

On the Weekly & daily timeframe I'm bullish, I just follow the daily structure. We see a lot of wicks to the downside and on the 4h timeframe we hit our support level.

I always use 2 Charts (left chart for overall direction on higher timeframes and on the right chart 30-min timeframe for entries.

USD JPY - FUNDAMENTAL ANALYSIS2023-2024 Exchange Rate Forecasts From MUFG

Japanese Yen: Long-Term Pressure for Yen Gains

As far as the yen is concerned, the Bank of Japan has continued to resist policy tightening, but MUFG suspects that the position could change very quickly.

It notes; “We suspect the BoJ could pivot quickly and alter YCC without much warning.”

The bank also expects that the underlying inflation profile has increased which could have important implications for the central bank and yen.

It adds; “The sense that this time could be different is certainly building in Japan.”

An eventual policy shift is expected to boost the heavily-undervalued yen.

USDJPY approaches key decisive area The USDJPY has been trading strongly to the upside since early May with no significant corrective move to the downside.

Now, with the 50MA again crossing below the 200MA and price action showing bearish momentum, look for the USDJPY to break below the 138.75 support level formed last Friday.

Along with a downward movement on the RSI, if the USDJPY breaks below 138.75, the price could fall toward the next support level of 137.50.

Although there is another key support level at 135.55, this might be too low as a possible target level.

USDJPY Potential UpsidesHey Traders, in today's trading session we are monitoring USDJPY for a buying opportunity around 138.700 zone, USDJPY is trading in an uptrend and currently seems to be in a correction phase in which it is approaching the major trend at 138.700 support and resistance zone.

Trade safe, Joe.

USDJPY bullish but meeting resistanceUSDJPY is continuing to be bullish, at least in the weekly chart, with MACD and VolDiv supporting in bullish alignment.

141.6 is the expected resistance, thereafter, 134 a good support.

USD JPY - FUNDAMENTAL ANALYSISThe Bank of Japan's (BoJ) monetary stance remained unchanged as they didn't convene, keeping the key policy rate at -0.10% and the 10-year yield at around zero percent due to Yield Curve Control.

Several factors contributed to the Yen's weakening, including reassessments of the Federal Reserve's monetary tightening outlook, which generally boosted the dollar.

The 10-year breakeven rose significantly, hinting at rising inflation expectations in Japan. With inflation hitting new highs and property values also increasing, real yields in Japan are falling.

Despite rising inflation, the BoJ's apparent lack of urgency to change its current monetary stance has also influenced the Yen's movement.

However, there are suggestions that the BoJ might change its Yield Curve Control without much warning.

With possible political factors also in play, the overall view, according to analysts at MUFG, is of limited scope for further rise in the USD/JPY exchange rate, given the Fed's projected pause in June.

Japanese Yen Performance in May

The Yen's performance against other major currencies in May has been mixed, the Japanese currency saw a depreciation against the US dollar but a strengthening against the Euro.

"In May the yen weakened further versus the US dollar in terms of London closing rates from 136.09 to 139.68" says Derek Halpenny, Head of Research, Global Markets EMEA and International Securities at MUFG.

Bank of Japan's Monetary Stance

Despite the fluctuations, there hasn't been a change in the monetary policy of the Bank of Japan (BoJ). The central bank's current stance remained steady with a key policy rate of -0.10% and the ten-year yield managed within a +/- 50bps range due to Yield Curve Control (YCC).

"The BoJ did not meet in May and hence its current monetary stance was unchanged with the key policy rate at -0.10% and YCC restraining the 10-year yield within a range of +/-50bps around zero percent," says Halpenny.

Factors Influencing the JPY's Exchange Rate Performance

Several macroeconomic dynamics influenced the Yen's performance in May. A crucial contributor to these dynamics was a reappraisal of the Federal Reserve's perspective on monetary policy tightening in the US, which resulted in a strengthening of the US dollar.

"Firstly, the reassessment of the outlook for monetary tightening by the Fed helped lift the dollar in general in May and that helped propel USD/JPY higher," Halpenny states. He adds, "From close to a zero probability, OIS pricing now indicates around a 50% probability of another rate hike by the Fed."

Furthermore, the Yen's value was impacted by domestic economic indicators. There's been a significant increase in real yields (the returns on investments that have been adjusted for the effects of inflation) in Japan, accompanied by a surge in inflation expectations.

"Real yields have been falling sharply in Japan with inflation expectations jumping. The 10yr breakeven jumped 20bps in May and reached close to 1.00%, the highest since June 2022," Halpenny notes.

Impact of Asset Price Inflation

The rising inflation in Japan wasn't just limited to goods and services, but also included a surge in asset prices. A broad spectrum of assets, including the Topix Index, property prices, and land prices, experienced significant gains.

The TOPIX, or Tokyo Stock Price Index, is a broad stock market index that tracks all domestic companies listed on the First Section of the Tokyo Stock Exchange (TSE), the largest stock market in Japan. It includes a wide range of company sizes and sectors, making it a comprehensive barometer of the overall Japanese equity market.

"The Topix Index surged 3.6% in May in contrast to a 0.2% gain in the S&P 500. Property prices and land prices are also moving higher in Japan," says Halpenny.

Despite the rising inflation and falling real yields, the BoJ appears untroubled about the situation and is in no hurry to change its monetary policy.

"Adding to yen selling is the clear sense of a lack of urgency from Governor Ueda to change the current monetary stance," says Halpenny.

However, there are signs that the BoJ might spring a surprise and make quick alterations to its YCC policy. "We suspect the BoJ could pivot quickly and alter YCC without much warning," Halpenny states.

In the backdrop of all these factors, the outlook for the Yen seems nuanced. The combination of increasing inflation, changing monetary policy stances, and political factors all paint a picture of restrained potential for further appreciation of the Yen against the US Dollar, especially with a projected pause in the Federal Reserve's policy actions in June.

"With the Fed set to pause in June, we see limited scope for USD/JPY to move higher from here," Halpenny concludes.

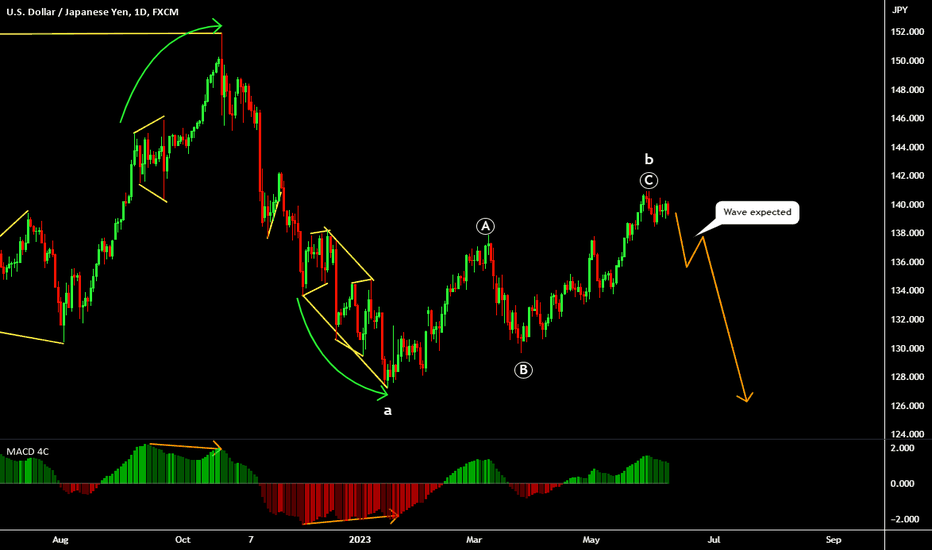

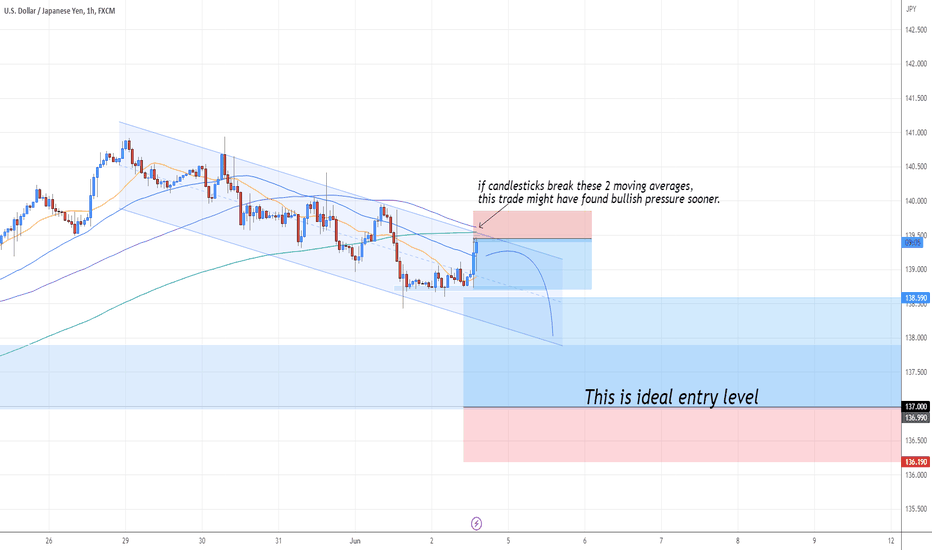

USDJPY | SELL NOW AND BUY LATER? (maybe)Hey Everyone!

I believe USDJPY can have both scenarios for the following reasons:

SELL setup:

- USDJPY has been very bullish recently and needs a strong rejection.

- Even with NFP news outcome being positive the USD is currently falling slightly.

- There is a good bearish channel and stoploss is covering our 100-200 moving averages.

Buy setup:

- After the likely rejection I believe a strong pullback to the psychological level 137.00 could trigger huge bullish pressure.

- That's where the 200 moving average is sitting on the daily and the 4h is nearby which usually trigger a reaction in the market.

- Overall market direction is also very bullish in favour for USD.

My personal opinion: I would not sell, I would wait for that pullback and stay patient, but for those who love a little risk, could be a good trade-down.

If moving averages do manage to break to the upside, this trade becomes invalid.

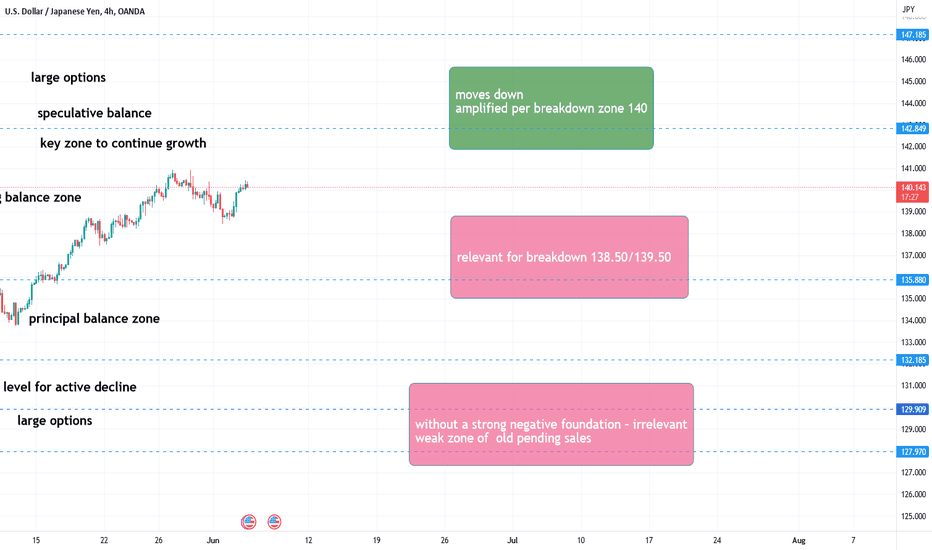

USD JPY - FUNDAMENTAL ANALYSISUSD/JPY has reversed from a high near 141, largely on the back of shrinking expectations that the Fed would hike in June. That is now priced with a 25% probability rather than a 70% probability attached to it last month. We have noted that the current environment should continue to see interest in carry trade strategies – where the Japanese yen scores poorly. However, USD/JPY looks overvalued relative to the terms of trade story – which is much better for the yen than a year ago.

In addition, there is still the risk that the Bank of Japan surprises on 16 June by further normalising its Yield Curve Control policy. That would be a yen positive. And thus it would not be a surprise to see speculator investors trying to re-position short USD/JPY above 140 – even if such a strategy has already proved painful this year.

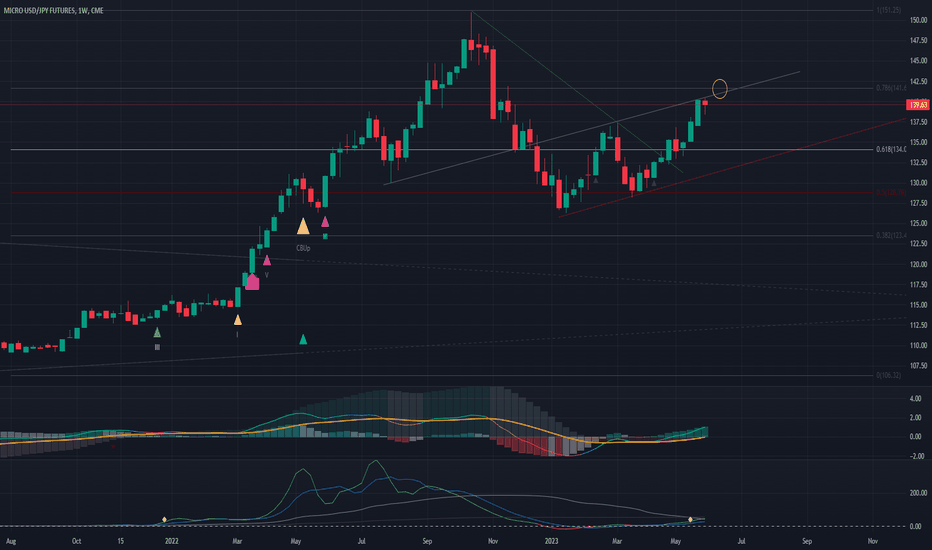

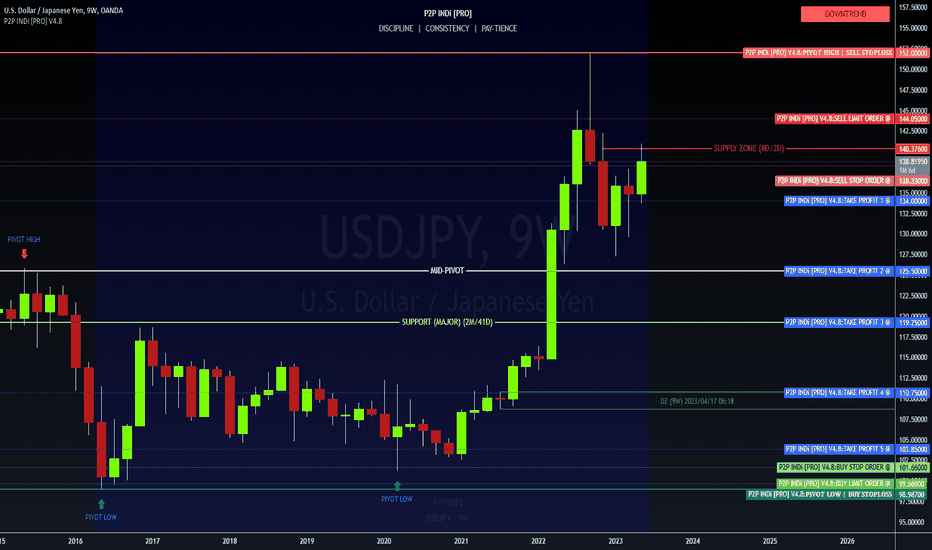

✨NEW: USDJPY ✨ SWING TRADE ✨SLO @ 144.05 ⏳

SSO @ 138.33 ⏳

TP1 @ 134.00 (shaving 25%)

TP2 @ 125.50 (shaving 25%)

TP3 @ 119.25 (shaving 25%)

TP4 @ 110.75 (shaving 25%)

TP5 @ 103.85 (shaving 25%)

BSO @ 101.66 ⏳

BLO @ 99.66 ⏳

ADDITIONAL INFO:

TP1 @ 134.00, before Pivot Low

TP2 @ 125.50, at Mid-Pivot

TP3 @ 119.25, at Major Support

TP4 @ 110.75, above Upper Demand

TP5 @ 103.85, above Lower Demand

BSO @ 101.66, after Price Action drops below

TECHNICAL ANALYSIS:

As of June 1, 2023, the USDJPY is trading around 139.80.

The RSI is overbought, which indicates that the market is due for a correction. The MACD is also starting to turn down, which could be another sign that the trend is about to change.

⚠️Be mindful that the moving averages are all sloping upwards, which is a bullish sign.

Overall, the technical analysis for the USDJPY is mixed. There are some bullish signs, however the bearish signs seem to be forging ahead. Traders should be cautious and wait for a clear downtrend to emerge before taking any short trades.

Here are some of the key levels to watch for:

* SUPPORT: 139.45

⚠️ For a more aggressive approach, you can place a Market Order to Sell once price opens and closes below Support

* RESISTANCE: 140.65

⚠️ For a more aggressive approach, you can place a Market Order to Buy once price opens and closes above Resistance

If the price breaks below the support level, it could signal a change in trend to the downside. If the price breaks above the resistance level, it could signal a continuation of the bullish trend.

Here are some of the factors that could affect the USDJPY in the near future:

* The US Federal Reserve's interest rate decision on June 15.

* The Japanese government's economic data releases.

Traders should keep an eye on these factors and adjust their positions accordingly.

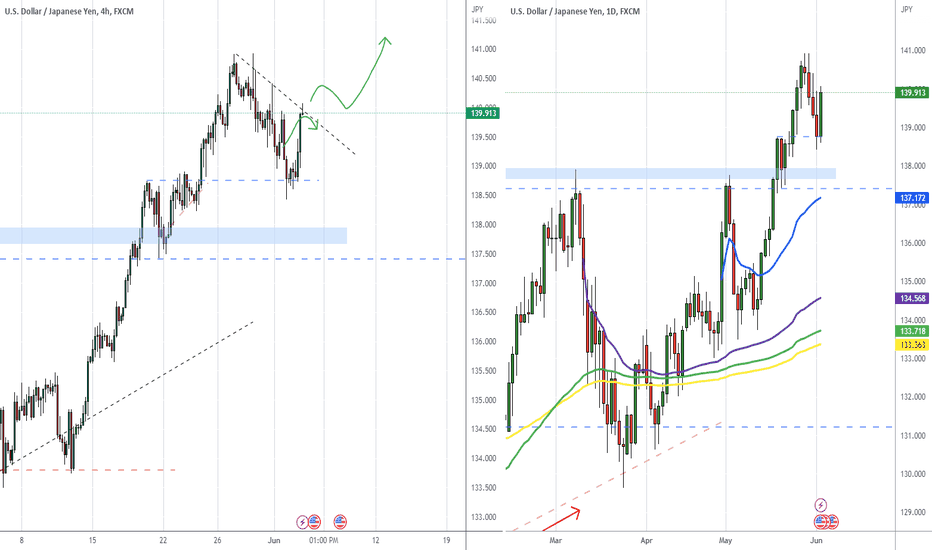

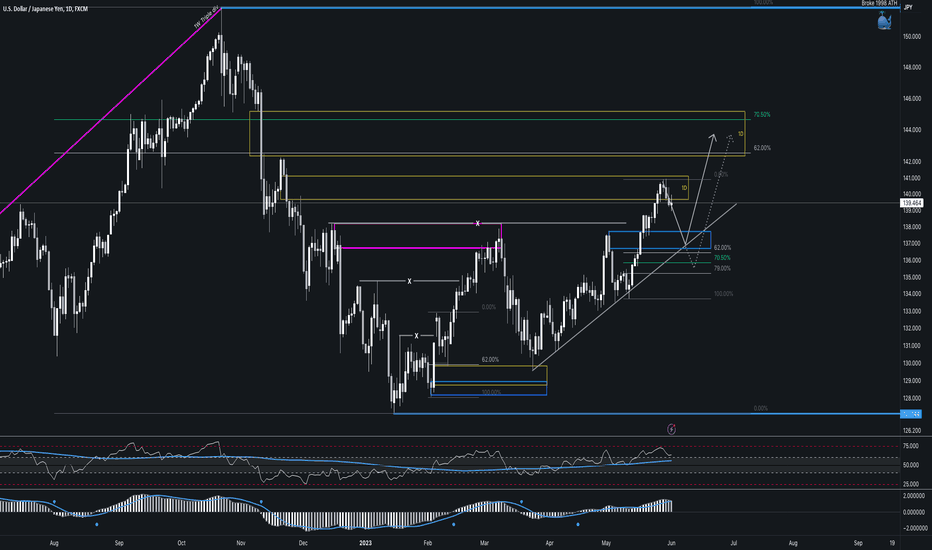

USDJPY - Potential Daily Retracement comingFundamental Analysis

The Japanese Yen is doing great lately, thanks to a mix of factors. This makes the USD/JPY pair go down for the third day in a row. The official Chinese PMI numbers for May were not so good, which makes people worry about the global economy and look for safer options. The JPY is one of them, especially because the Japanese authorities might step in to stop it from falling too much.

Japan’s Vice Finance Minister for international affairs, Masato Kanda, said they will watch the currency market closely and do what they need to do. He also said they won't rule out any option. On top of that, the US Treasury bond yields are going down too, which makes the US-Japan rate difference smaller and favors the JPY. However, the Bank of Japan (BoJ) is not so keen on the JPY rising too much, so that might limit its gains.

Another thing that helps the USD/JPY pair stay afloat is the strong US Dollar. The USD Index, which measures the Greenback against other currencies, is near its highest level since mid-March that it reached on Tuesday. It is supported by the expectations that the Federal Reserve (Fed) will keep interest rates high for longer. The markets think that the US central bank will raise interest rates by another 25 bps at the June FOMC meeting.

The US economic data, such as the Chicago PMI and JOLTS Job Openings, will influence the USD demand. Also, pay attention to what the FOMC members say and how the US bond yields change. These factors will affect the USD/JPY pair too. And don't forget to check the overall mood of the market. It can give you some clues about the USD/JPY pair and help you find short-term opportunities.

Technical Analysis

As per the daily price action we believe USD/JPY, will very likely retrace to last broken high / Trenline zone (grey arrow) before seeing any true bullish move aiming for $144 price zone. That retracement could be deeper (see dotted grey arrow), and even more complex, i.e. through a corrective wave. Right now we are watching the current level for potential retracement, which could be a nice opportunity for a short.

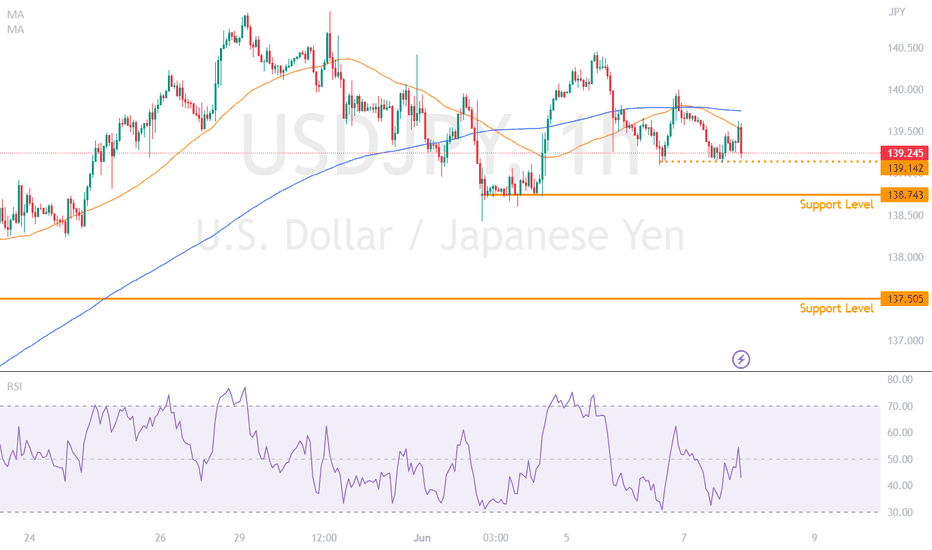

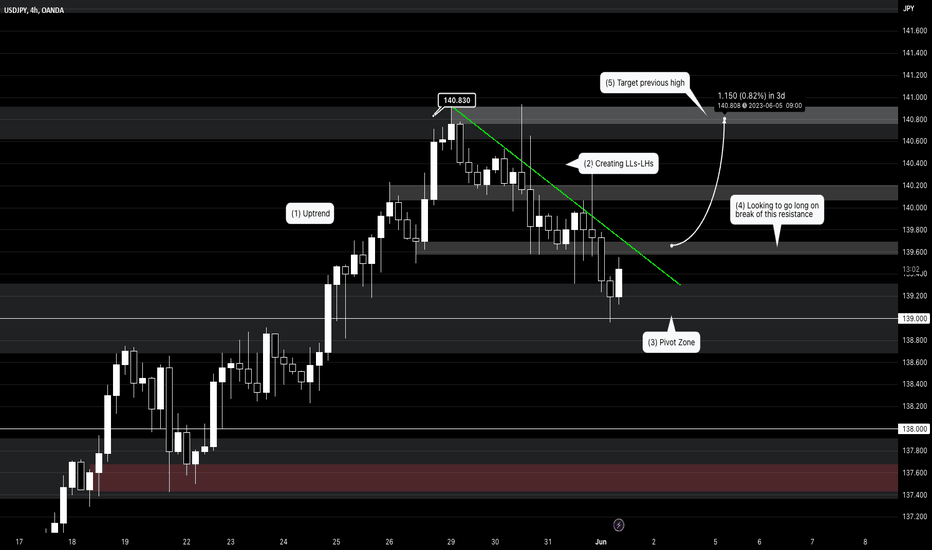

USDJPY Upside PotentialHey Traders! 👋

For Day 21/100 of our challenge, we will look at USDJPY upside potential this week.

Technicals:

- Currently on pivot area (expecting support to form)

- But price is still creating LLs-LHs

- Better to go long above 139.600

- Target previous high 140.800

Fundamentals:

- Market to price in higher probability of rate hikes as positive data continues to support this narrative

- BoJ remains with dovish policy and no changes are foreseen in the near-term

USDJPY Potential UpsidesHey Traders, in today's trading session we are monitoring USDJPY for a buying opportunity around 139.300 zone, USDJPY is trading in an uptrend and currently seems to be in a correction phase in which it is approaching the major trend at 139.300 support and resistance zone.

Trade safe, Joe.

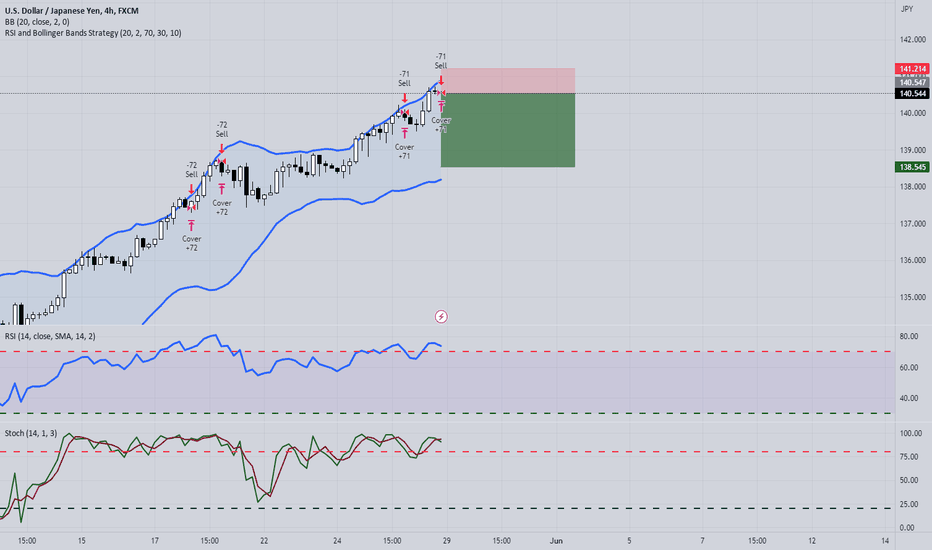

USDJPY correction time; RSI/BBAND/STOCH/HAIKEN ASHIInstructions:

1)The Relative Strength Index (RSI) shows that the asset is temporarily overbought/oversold, suggesting a possible trend reversal.

2) Bollinger Bands indicator shows that the asset is currently in an upper/lower resistance/support zone.

3) The Forex Stochastic Oscillator (Stoch) helps identify buy and sell moments based on comparing the current price with the price range over a specific time frame.

4) In addition, I use Heiken Ashi candles, which help to see the trend in a smoother and smoother way.

Intervals:

H1:

1) RSI near the 70 level and the indicator is falling

2) Price bounced off the Bollinger band

3) Stoch above 80 and the sell line (red) is on top of the buy line (green)

4) Red candle Haiken Ashi

Notes:

Additional confirmation will be the red Haiken Ashi candle on the H4 interval.

Conclusions:

Based on the analysis of the RSI, Bollinger Bands, Stoch and the Heiken Ashi candles, it appears that the USDJPY asset may be at a turning point.

Stop Lose:

Above the top of the Bollinger Band +10/15pips. SL will be set at break even after a 10/15pips gain.