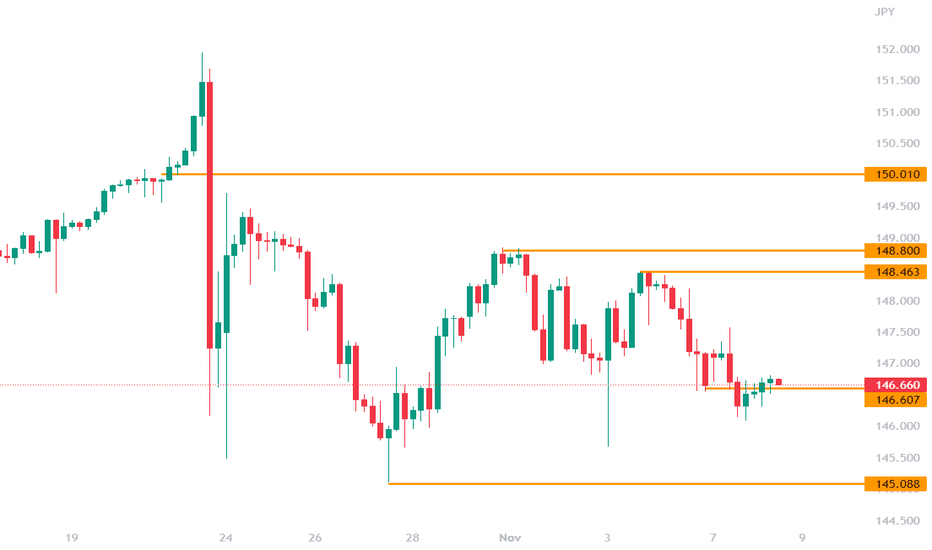

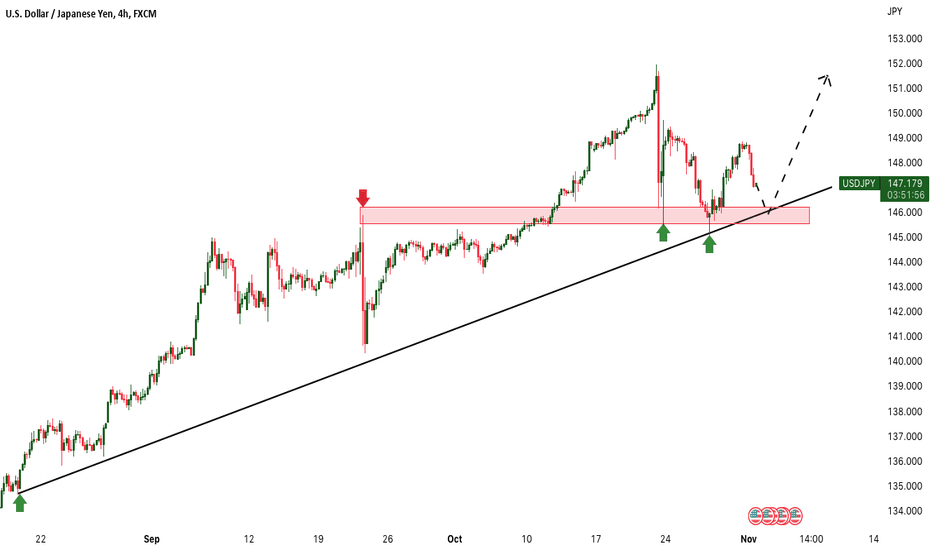

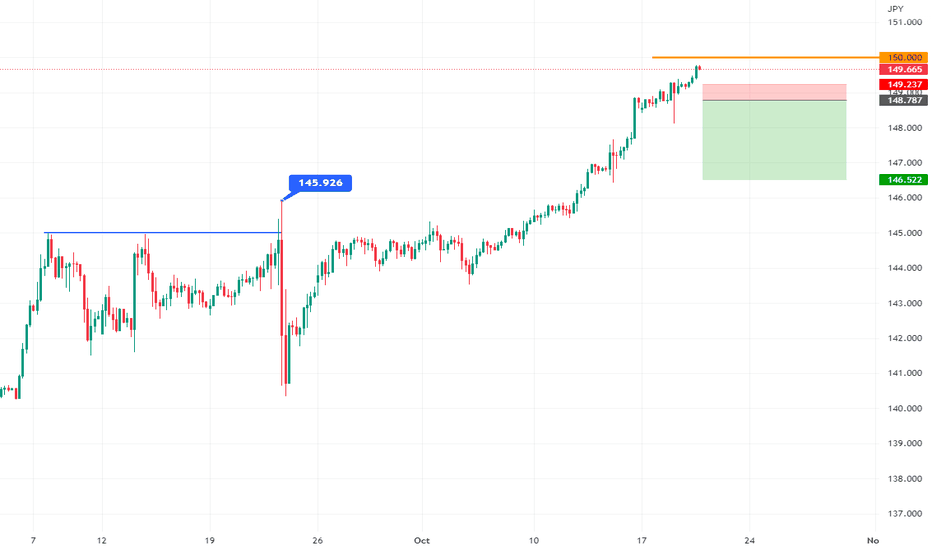

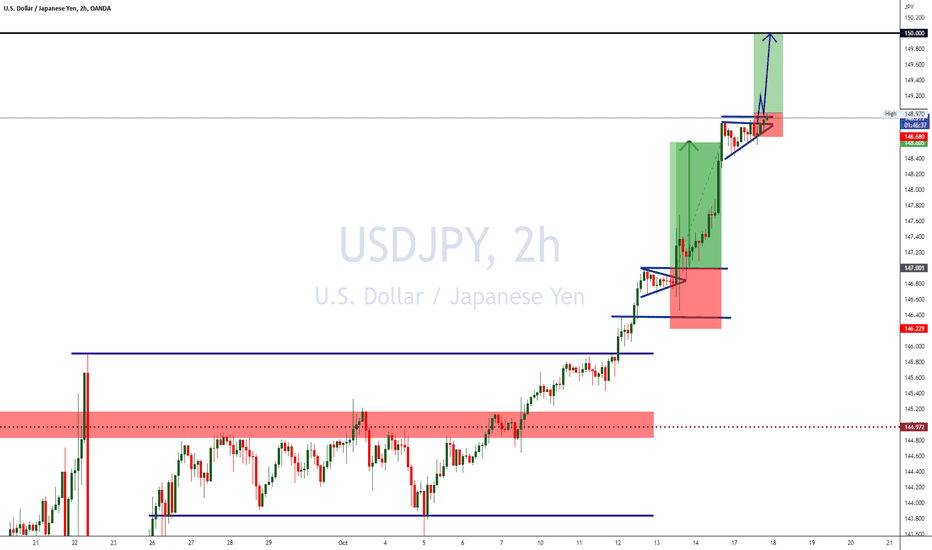

Could the USDJPY reach 149 again?The USDJPY fell slightly overnight but continues to trade along the support area of 146.70.

As the price consolidates but fails to trade lower from this support level, look for a recovery in the strength of the DXY, which could cause the USDJPY to rebound higher, toward the interim resistance 148 to 149 price area.

However, if the price breaks below 146.00, the USDJPY could trade significantly lower toward the next key support and round number level of 145.00.

Usd-jpy

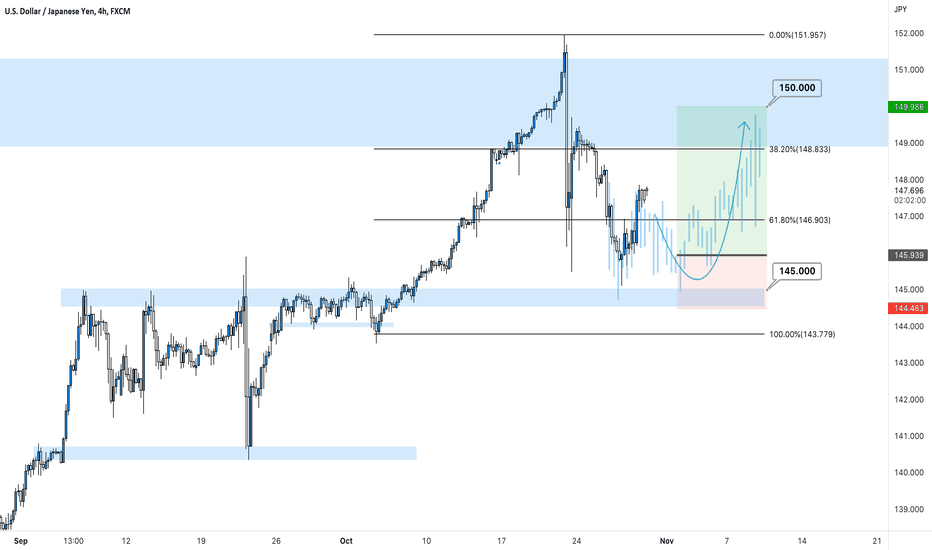

Yen ranges, despite recent volatilityThe USDJPY reversed from the high of 148.45 to reach a low of 146.60 due to the weakening of the DXY. The USDJPY is likely to continue trading within a wide range, similar to the previous week, with no clear directional bias.

If the USDJPY breaks above 148.80, it could continue climbing towards 150. However, it is more likely that the USDJPY could trade lower towards 145, especially if the price breaks below the near term support of 146.60.

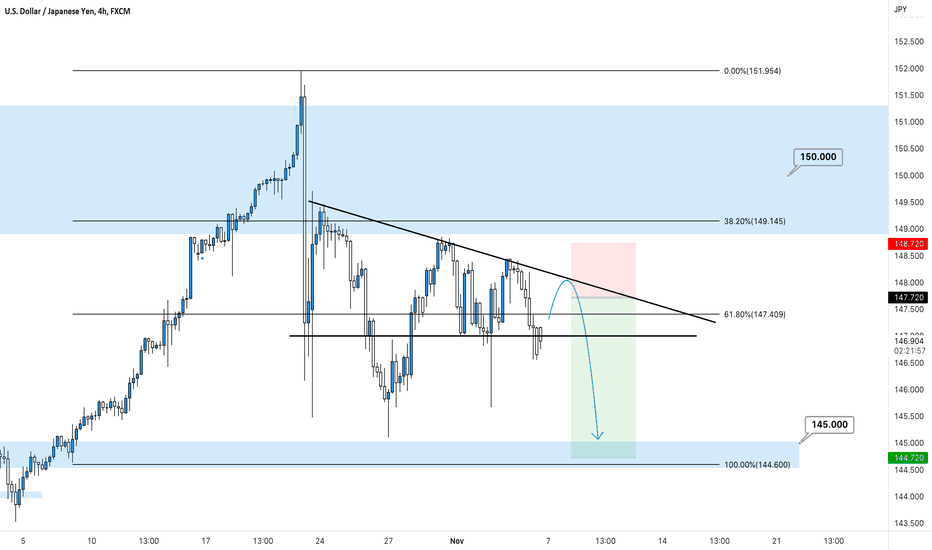

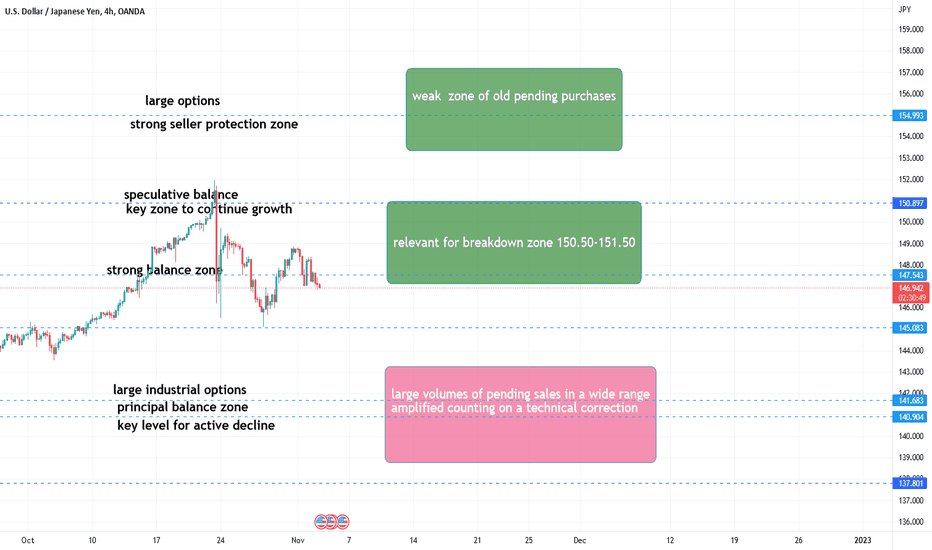

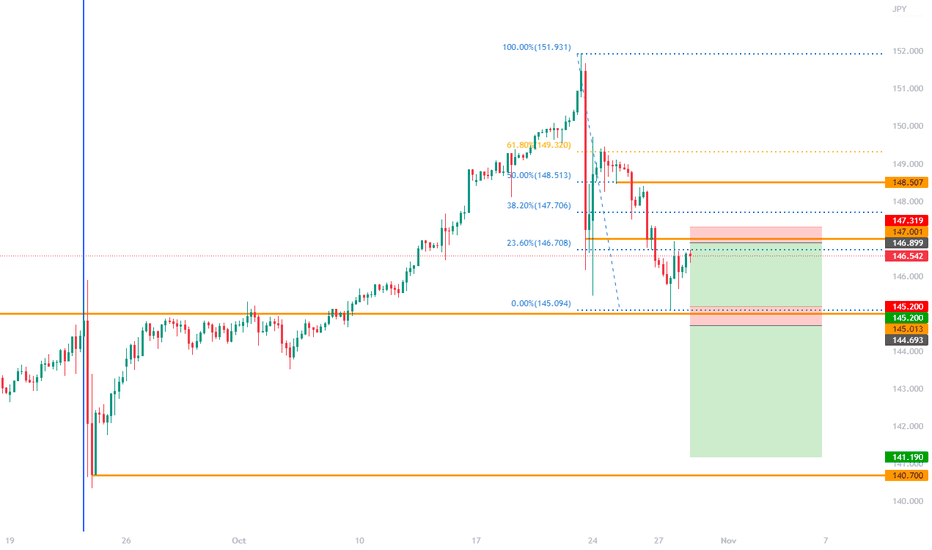

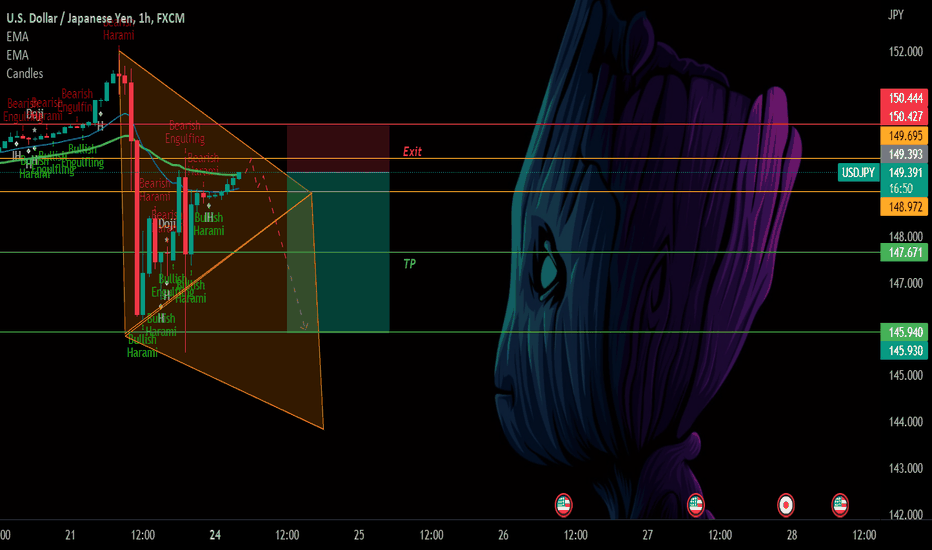

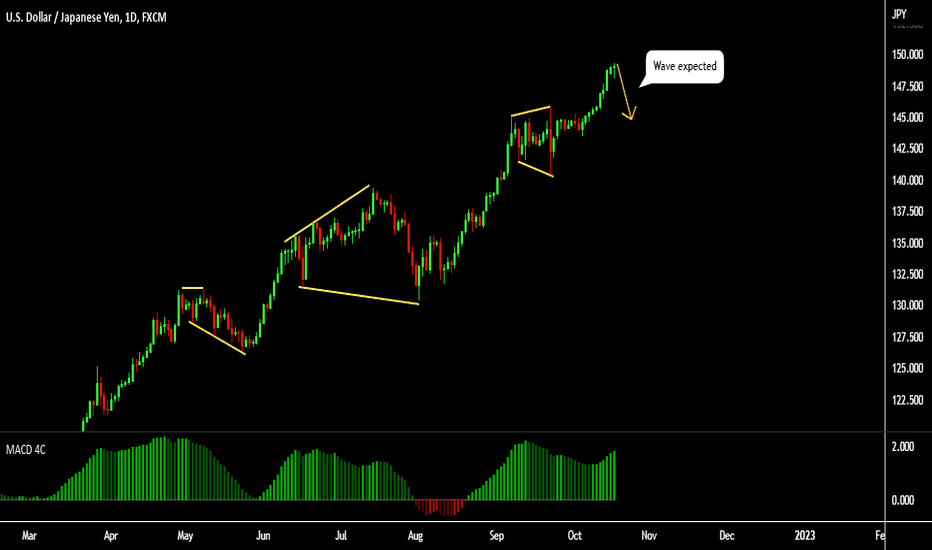

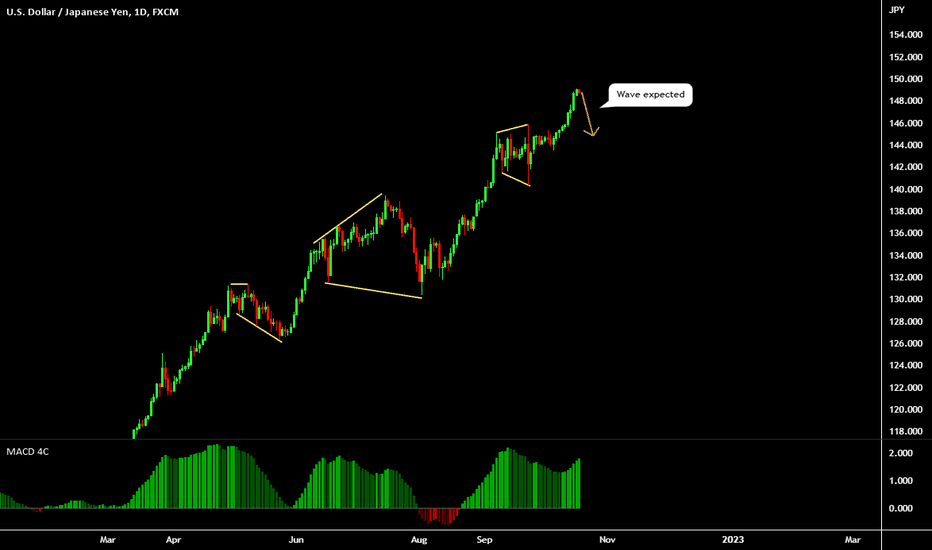

USDJPY 4hour Analysis November 6th, 2022USDJPY Bearish Idea

Weekly Trend: Bullish

Daily Trend: Bullish

4hour Trend: Bearish

Trade scenario 1: Overall we have seen UJ be extremely bullish the last few months but now we’re seeing some 4hour bearishness with a ton of consolidation.

Ideally this descending triangle pattern holds and price action continues bearish again. Look for clear bearish conviction to enter short.

Trade scenario 2: For us to consider UJ bullish again we would first need to break some lower highs and start heading toward 150.000 resistance again.

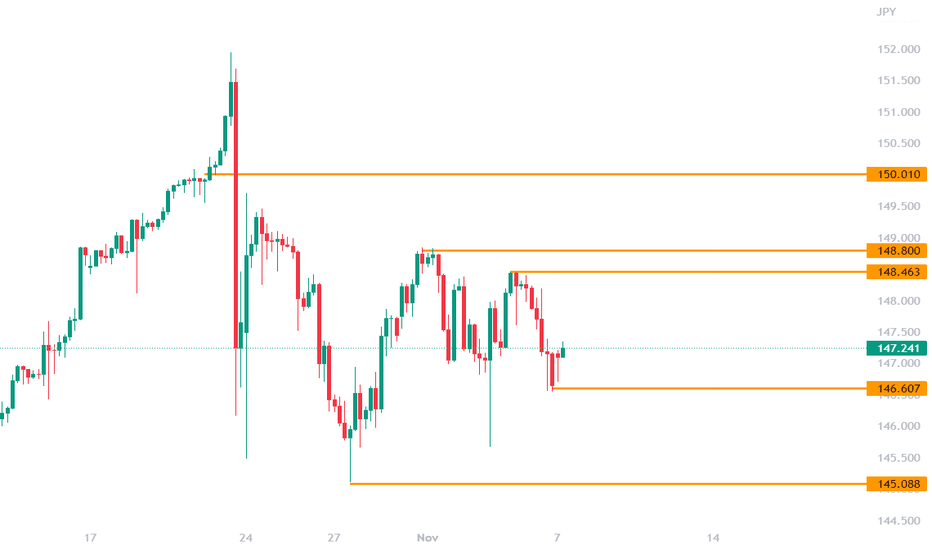

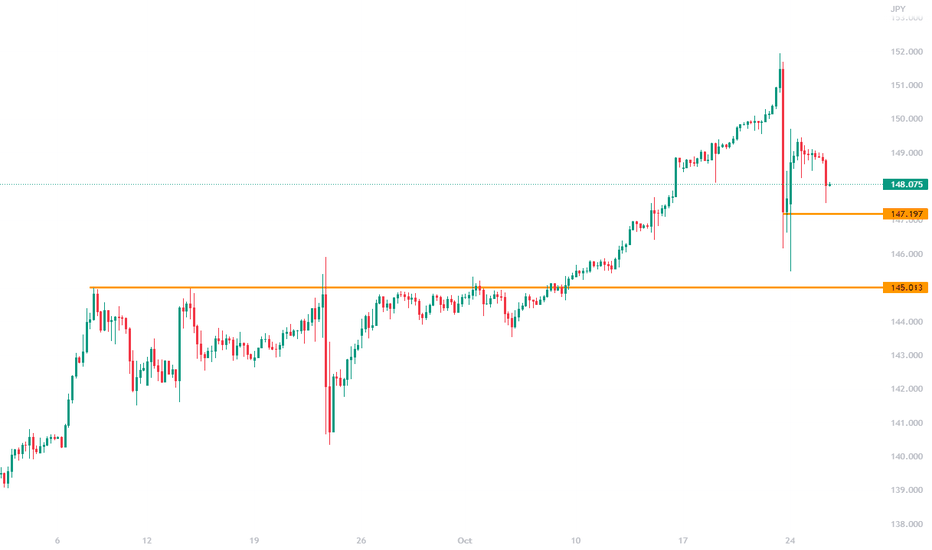

USD JPY WEEKLY ANALYSISHere is a screenshot of my Daily:

Still a lot of trading opportunity to trade the triangle until price breaks, but id rather be patient for the big move when price breaks out.

Here is a screenshot of what My weekly:

I am looking to buy once price pushes pass 148.893

I am looking to sell once price drops below 145.893

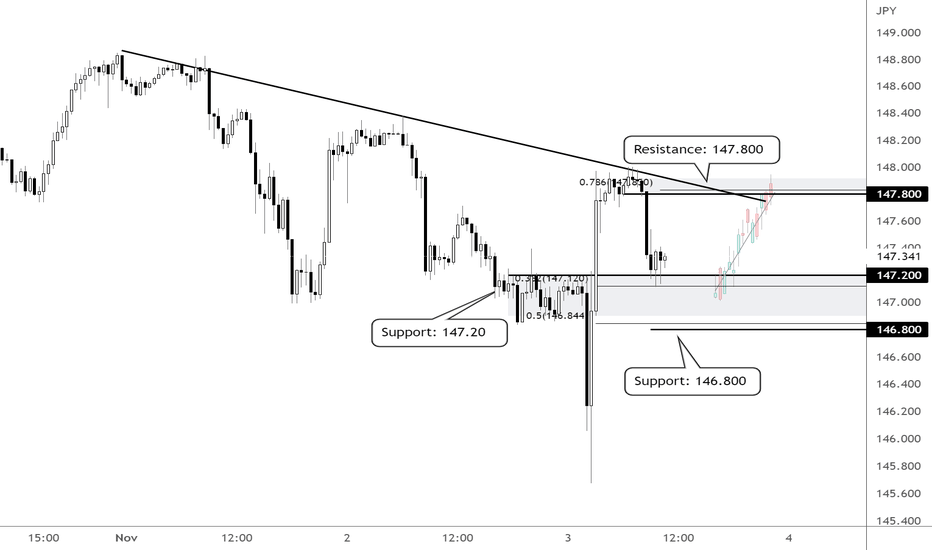

USDJPY M30: Bullish outlook seen, further upside above 147.20 On the M30 time frame, prices are testing the support zone at 147.20, in line with the 38.2% Fibonacci level where we could see further upside to the resistance zone at 147.80. The 147.80 resistance zone coincides with the graphical resistance, descending trend line and 78.6% Fibonacci retracement. Failure to hold above the support zone at 147.20 could see prices push lower to test the next support zone at 146.80.

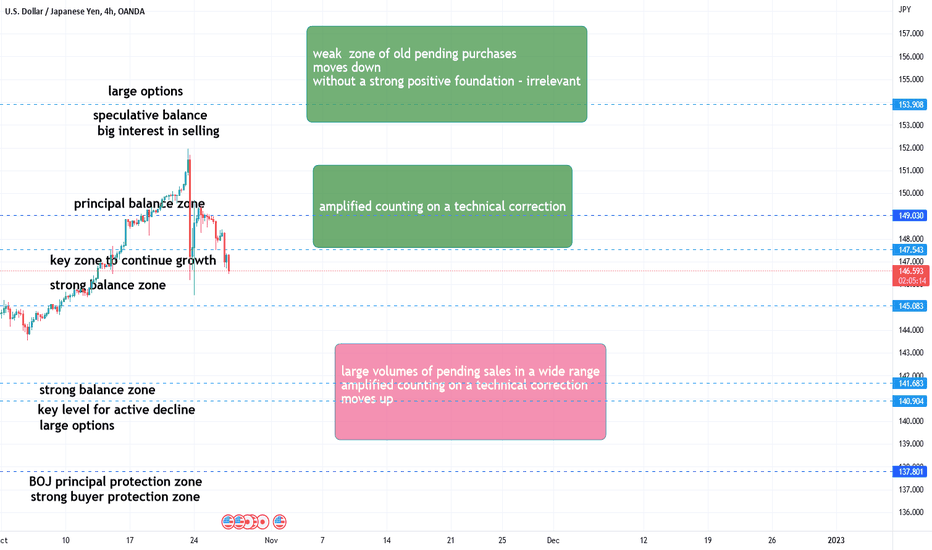

InvestMate|USD/JPY waterfall coming up💱USD/JPY waterfall coming up.

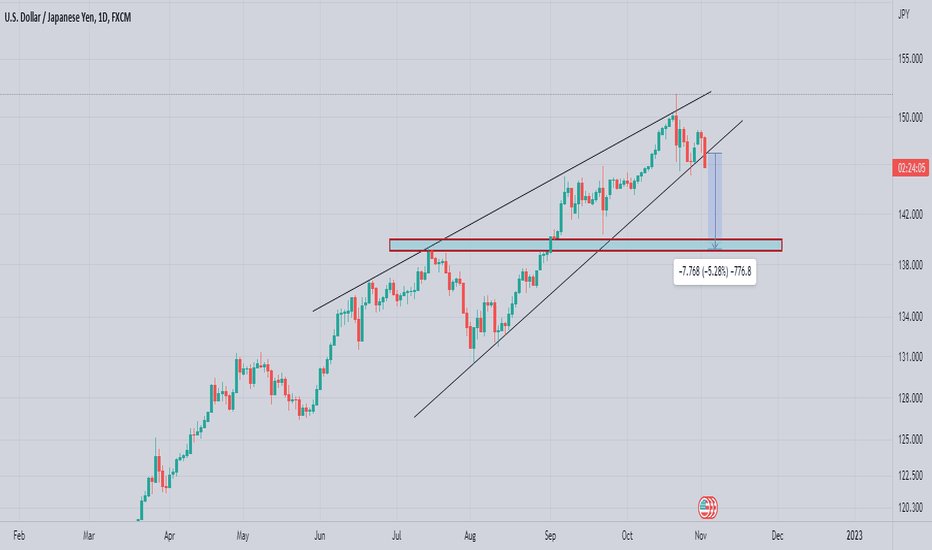

💱For some time now, since 21 October to be precise, we have seen a trend reversal on the USD/JPY pair.

💱The reversal was abrupt in nature, it was done through the monetary intervention that Japan made in order to stop weakening its currency.

💱Is there a chance that the uptrend that has been running on this pair since 3 October 2011 will be reversed?

💱Rather not, but a correction of the wave that has gained strength since January last year should finally take place.

💱I think we are in an ideal place to make such a correction.

💱This is due to the fact that Interest Rates in the US, have now been discounted and there is no longer as much of a push to raise them as a result of slowing inflation, and the not so terrible recession that most feared.

💱The market is still expecting one more interest rate hike tomorrow to the 4% level but given the positive sentiment and the already discounted news I think the decision may not have a significant impact on the price of the dollar with the Japanese yen.

💱 Confirming my thesis on the lower intervals we can see that from the intervention to the bottom measuring this wave. We made a correction of 50% after which we started to slide sharply, this can be seen by the size of the candles accompanying the descent standing out against the upward ones.

💱Wondering where the price might go I made 2 measurements. 1 measuring the fibo from the covid bottom which shows that the first important correction level falls to us at 0.236 which is at the price level of 140. The 2nd measurement is measuring the overbalance of the largest correction in the uptrend impulse lasting from the covid bottom which results at 143.

💱It is up to you to make a verdict on which of these levels we will see final

💱 Taking a position at the current moment the stop order will be at 148.280 and the take profit at one to one or around 143 giving us a risk/reward ratio of 3.72

🚀If you appreciate my work and effort put into this post I encourage you to leave a like and give a follow on my profile.🚀

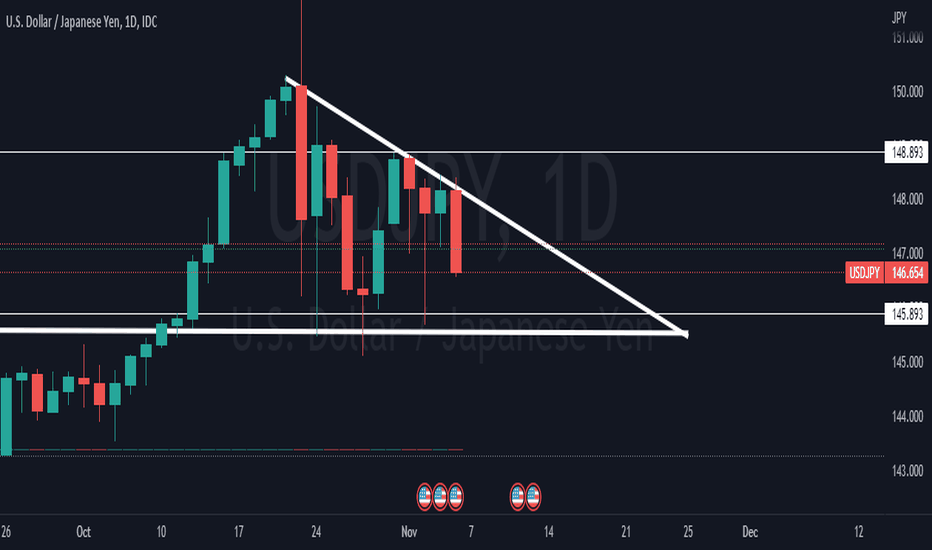

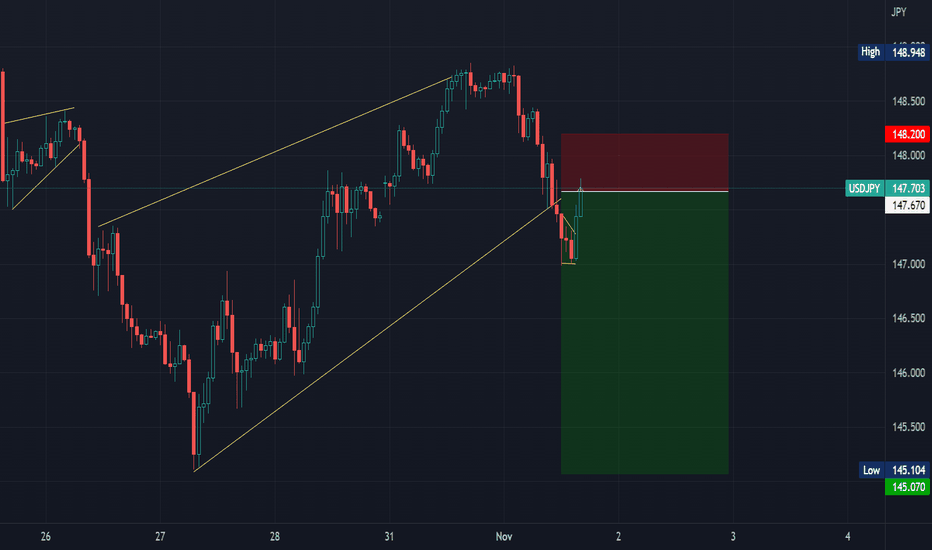

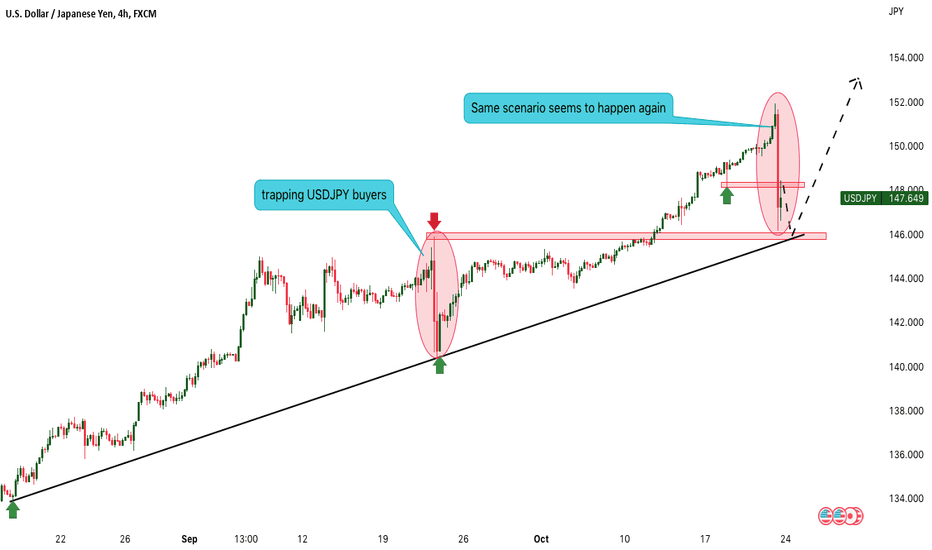

USDJPY 4hour Analysis October 30th, 2022USDJPY Bullish Idea

Weekly Trend: Bullish

Daily Trend: Bullish

4hour Trend: Bullish

Trade scenario 1: Looking very bullish going into this week. UJ is performing exactly how we want it to after the recent bearish volume we’ve seen.

Price action is currently respecting 145.000 support and could be setting up for a nice long opportunity soon.

Going into this week look for further bullish rejection off of our 145.000 support zone and look to target higher toward 150.000 resistance.

Trade scenario 2: For us to see UJ as more of a bearish chart we need to see key support at 145.000 broken. If we see this look for lower highs below to confirm the bearish trend.

Will the BoJ continue to Diverge?YES!

The BoJ is expected to release its monetary policy report today, and all signs point to the BoJ maintaining its current stance. Keeping with the negative rates of -0.1%. The BoJ is the last major central bank yet to jump onto the interest rate hike path, diverging from the rest of the world.

Releasing an unchanged monetary policy report at the last BoJ meeting in September saw the USDJPY fluctuate by almost 190 pips at the 144.50 price level before climbing higher by 135 pips to reach 145.90.

If we see a similar price action this time around, the USDJPY could fluctuate significantly along the 146.50 price level before climbing higher beyond 147 to test as high as the 148.50 (50% Fibonacci retracement level).

However, the threat of further intervention from the BoJ still looms. As the USDJPY climbs higher, look for possible action from the BoJ, to take the USDJPY back toward the 145 price level, and beyond that, the 140.70 key support level.

The safest sell-stop order would be below 145, SL: 50pips TP: 350pips (Risk to Reward of 1:6.9).

A slightly more adventurous sell-limit order would be below 147 SL: 40pips TP: 170 pips (Risk to Reward of 1:4)

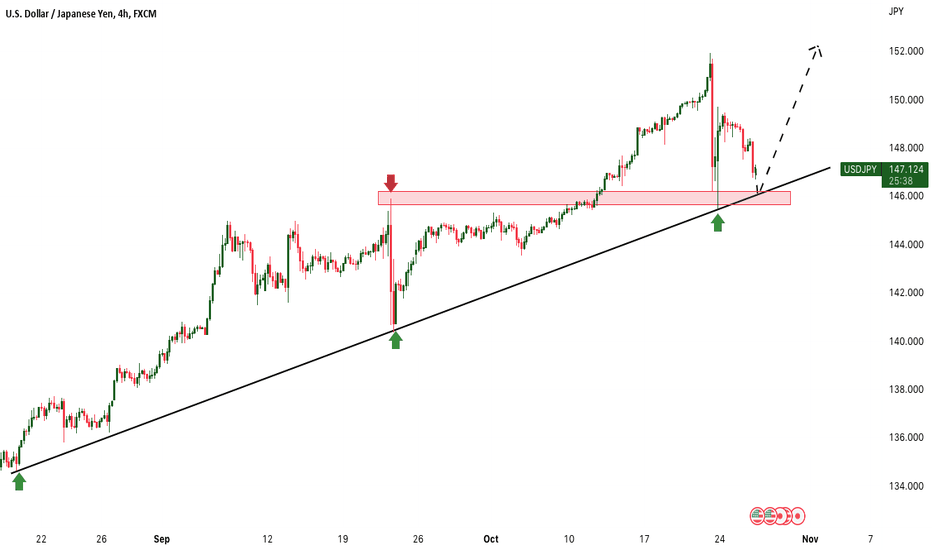

Did you hear what happened to the YEN?On Friday 21st October, the USDJPY had been climbing steadily, almost reaching the round number of 152.00. Then it reversed and spiked lower, from 151.50 reaching a low of 146.20.

This move was very similar to what happened on the 22nd of September, when the USDJPY climbed above 145 and almost reached 146 before crashing down to 140.35.

However, when the USDJPY came down in September, the BOJ did say that they had taken action to intervene and even announced that they had spent 2.84 trillion yen to prop up the yen. This time, in October, authorities from the Ministry of Finance have remained silent on whether they made any further attempts to support the currency including on Friday

With the BOJ policy decision on Friday (the intervention on 22 September was after the release of the BOJ policy decision). Look for further downside on the USDJPY, especially if the price breaks below the 147 support level, with 145 as the next key support level.

*Remember to check out my previous analysis on the Yen and the BOJ Intervention

USDJPY 4hour Analysis October 23rd, 2022USDJPY Bullish Idea

Weekly Trend: Bullish

Daily Trend: Bullish

4hour Trend: Bullish

Trade scenario 1: Last week we saw a huge drop on UJ but it is still bullish, that’s how bullish overall we have been on higher timeframes.

Ideally, we would love to see some consolidation to get a clearer look at price action but all we have is volume so scenarios are scarce.

The most likely scenario is price action surging back to 150.000 with consolidation following.

Trade scenario 2: If we are to consider another scenario we would look for price action to fall lower with consolidation closer to our 145.000 support level.

USDJPY: Japan intervention is not enough to change major trend.Hey traders, as the monetary policy in the US remains aggressive we still see a possibility of continuation to the upsides on USDJPY unless fed becomes Dovish but it's still not going to happen as inflation in the US is still an issue and the main focus for the US is to control inflation, so what we can expect? more rate hikes, more USD bulls and potentially a continuation of USDJPY uptrend. hence in the coming week we will be monitoring USDJPY for a long term buying opportunity around 146 zone, remember to avoid using tight Stop losses in this type of environments since USDJPY movements will be more volatile and violent and respecting a proper risk management is always recommended so you avoid blowing your accounts, sticking to 1% risk with proper reward ratio will not allow allow the market to you knock you off.

if you have any question don't hesitate to ask in the comment section.

The If, When, How of the BoJ interventionAs the Yen continues to weaken, the market consensus is that the BoJ is most likely to intervene when the price hits the round number level of 150.

Understanding the previous time the BoJ intervened (non stealth) on 22nd September 2022, there are a few learning points to note:

- The market consensus price level then was 145. However, the BoJ intervened only when the USDJPY climbed to reach 145.90. ( Noteworthy : A hard and fast number probably isn't what the BoJ is paying attention to, OR market consensus is generally wrong)

- The BoJ is deemed to have intervened (stealth) twice more since the 22nd September 2022 (13th & 18th October). But these saw lesser price volatility and were quickly and easily reversed. ( Noteworthy : Stealth intervention doesn't seem to work well)

- The BoJ intervention on 22nd September was after the BoJ policy report and the actions were announced by the BoJ. ( Noteworthy : The next BoJ policy report is soon! On the 28th October)

How to prepare and take advantage of a BoJ intervention?

- Utilise a sell stop pending order.

- Judging from the previous intervention which had more than 500pip move and almost no whipsaw; you could apply the pending order below the round number level (in this case, below 149)

- And if the price continues to climb, just shift the order up accordingly.

- However, always ensure that you have a StopLoss: approximately 45 pips and a TakeProfit: of at least 200 pips which would allow you to have a very good R:R.

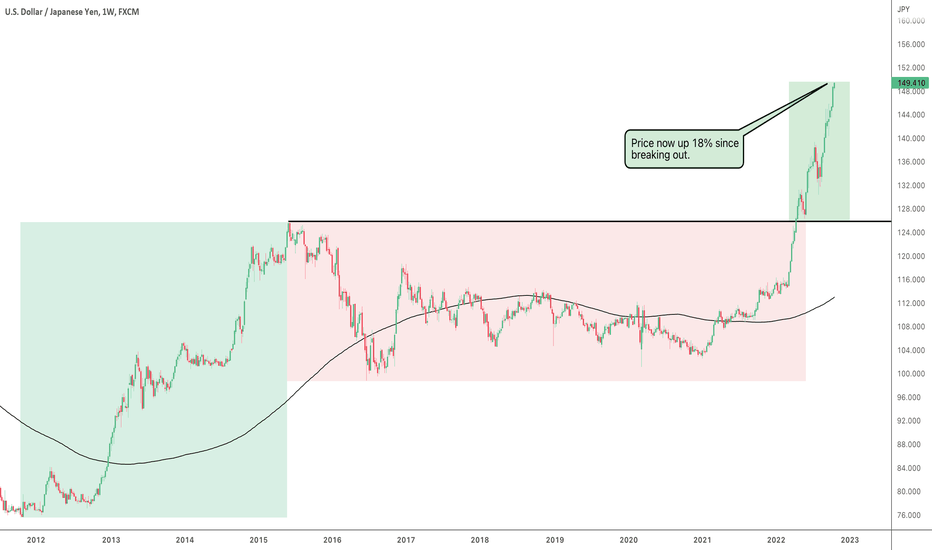

USDJPY Up 18%The USDJPY is now up 18% since breaking out from the major resistance at

125.85 from the June 2015 high. In the recent post for the USDJPY, price was

up 11%, so it has seen good growth since then.

The move is no surprise as price broke out from long-term consolidation, lasting

almost 7 years. Following this strong current move, we can expect another period

of long-term consolidation. This is why we want to catch the big moves as they happen.

Price is now approaching the 150 round number which is a psychological level of

resistance. We may see price hesitate around this level. Whether price will break

beyond 150 or reverse will be down to who comes out on top, the buyers or the sellers.

We have multiple positions in this forex pair. We are now managing our positions and

will compound if and when the time is right.

If you like enjoyed this post, make sure to like, and follow for more quality content!

If you have any questions or comments, comment below. We reply to every comment!

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

USD JPY - FUNDAMENTAL DRIVERSUSD

FUNDAMENTAL OUTLOOK: BULLISH

BASELINE

With headline CPI above 8% and Core CPI seeing another acceleration in the SEP CPI data, the Fed is under pressure to continue hiking rates and ramping up QT. Markets expect another 75bsp hike in NOV and currently prices the terminal rate at 4.8%. The Fed is on a data-dependent (meeting-by-meeting) policy stance, meaning incoming growth, inflation and jobs data remains a key driver for short-term USD volatility where we expect a cyclical reaction with incoming data for both the USD and US10Y (good data expected to be supportive for the USD while bad data is expected to pressure the USD). Another choppy week for the USD finishing 0.5% stronger on the week but keeping a small range. With a quiet week ahead on the data side, the USD is most likely going to get most of it’s momentum from overall risk flows.

POSSIBLE BULLISH SURPRISES

With the Fed signalling a data dependent policy stance, we expect a cyclical reaction from the USD with incoming US data. Thus, extremely good growth, inflation or jobs data is expected to trigger short-term bullish reactions in the USD. If the cyclical outlook continues to weaken, the USD’s safe haven status still matters. Any incoming catalysts that increase deep recession fears and triggers strong moves lower in risk assets & bonds can trigger safe haven flows into the USD. With a lot priced for the Fed and USD, the bar is high for hawkish Fed surprises, but any aggressive Fed speak talking up a >5.0% terminal rate can trigger further USD upside.

POSSIBLE BEARISH SURPRISES

With the Fed signalling a data dependent policy stance, we expect a cyclical reaction from the USD with incoming US data. Thus, extremely bad growth, inflation or jobs data is expected to trigger short-term bearish reactions in the USD. If the cyclical outlook starts to improve, the USD’s safe haven status still matters. Any incoming catalysts that decrease deep recession fears and triggers strong moves higher in risk assets & bonds can trigger safe haven outflows out of the USD. With a lot priced in for the Fed and the USD, it won’t take much to disappoint on the dovish side. Any big concerns about growth from Fed speakers could trigger outflows.

BIGGER PICTURE

The fundamental outlook for the USD remains bullish as long as the Fed stays hawkish and cyclical concerns put pressure on risk sentiment. The data dependent stance from the Fed means that short-term data surprises can pull the USD either way and would be our preferred way of trading the Dollar right now. The calendar is extremely light in the week ahead, which means overall risk sentiment could be the biggest source of momentum (which means keeping a close eye on further equity and bond market sell offs). Keep in mind earnings season gets a bit mor exciting this week and will be important to watch for risk.

JPY

FUNDAMENTAL OUTLOOK: BEARISH

BASELINE

In recent weeks, yield differentials of course have been the biggest driver for the JPY with the BoJ keeping 10-year JGB yields capped at 0.25% with yield curve control while other central banks are hiking rates aggressively. Thus, right now the JPY is pressured as yields have soared for the sky, but the threat and risk of further intervention could keep weakness limited. Japanese authorities intervened in the FX market in September by buying JPY and selling Dollars for the first time since 1998. The intervention saw some short-term downside of USDJPY , but as of Friday USDJPY almost reached 149 without any sign of further intervention action. The bias for USDJPY remains higher fundamentally speaking as yield differentials are still very wide, so unless authorities actively intervene the JPY can continue to weaken. The risk of buying is that we buy into interventions, which means risks are high.

POSSIBLE BULLISH SURPRISES

Catalysts that push US10Y lower (less hawkish Fed, lower UC CPI , lower growth) could trigger bullish reactions from the JPY. Any catalyst that triggers meaningful downside in key commodities like Oil (deteriorating demand outlook, ease in supply shortage) could trigger bullish JPY reactions. Any additional intervention from the BoJ or MoF. Watch Core CPI on Friday. Any print above 3.4% would be the highest inflation in 40 years and could spark speculation of less dovish policy action from the BoJ and should be JPY positive.

POSSIBLE BEARISH SURPRISES

Any catalysts that push US10Y higher (more aggressive Fed, higher US CPI , better growth) could pressure the JPY. Catalyst that triggers meaningful upside in Oil (deteriorating demand, increased supply) could trigger JPY downside. Reluctance from BoJ and MoF for intervening around the 145 level in USDJPY could spark speculative buying. Watch Core CPI on Friday. If Core CPI prints below 3.4% and BoJ officials talk down the rise as mostly transitory it could add further pressure on the JPY.

BIGGER PICTURE

The fundamental outlook remains bearish for the JPY due to yield differentials and the impact of a weaker JPY on the current account balance. As long as US10Y remain elevated and the BoJ stays stubbornly dovish and no currency intervention occurs, the bias remains lower. But take note of positioning which means we don’t want to chase the JPY lower, especially with the risk of further currency intervention should the JPY continue to weaken. The best opportunities for now remain short-term focused on further intervention or strong moves lower in US yields.

USD JPY - FUNDAMENTAL DRIVERSUSD

FUNDAMENTAL OUTLOOK: BULLISH

BASELINE

With headline CPI above 8% and Core CPI seeing another acceleration in the SEP CPI data, the Fed is under pressure to continue hiking rates and ramping up QT. Markets expect another 75bsp hike in NOV and currently prices the terminal rate at 4.8%. The Fed is on a data-dependent (meeting-by-meeting) policy stance, meaning incoming growth, inflation and jobs data remains a key driver for short-term USD volatility where we expect a cyclical reaction with incoming data for both the USD and US10Y (good data expected to be supportive for the USD while bad data is expected to pressure the USD). Another choppy week for the USD finishing 0.5% stronger on the week but keeping a small range. With a quiet week ahead on the data side, the USD is most likely going to get most of it’s momentum from overall risk flows.

POSSIBLE BULLISH SURPRISES

With the Fed signalling a data dependent policy stance, we expect a cyclical reaction from the USD with incoming US data. Thus, extremely good growth, inflation or jobs data is expected to trigger short-term bullish reactions in the USD. If the cyclical outlook continues to weaken, the USD’s safe haven status still matters. Any incoming catalysts that increase deep recession fears and triggers strong moves lower in risk assets & bonds can trigger safe haven flows into the USD. With a lot priced for the Fed and USD, the bar is high for hawkish Fed surprises, but any aggressive Fed speak talking up a >5.0% terminal rate can trigger further USD upside.

POSSIBLE BEARISH SURPRISES

With the Fed signalling a data dependent policy stance, we expect a cyclical reaction from the USD with incoming US data. Thus, extremely bad growth, inflation or jobs data is expected to trigger short-term bearish reactions in the USD. If the cyclical outlook starts to improve, the USD’s safe haven status still matters. Any incoming catalysts that decrease deep recession fears and triggers strong moves higher in risk assets & bonds can trigger safe haven outflows out of the USD. With a lot priced in for the Fed and the USD, it won’t take much to disappoint on the dovish side. Any big concerns about growth from Fed speakers could trigger outflows.

BIGGER PICTURE

The fundamental outlook for the USD remains bullish as long as the Fed stays hawkish and cyclical concerns put pressure on risk sentiment. The data dependent stance from the Fed means that short-term data surprises can pull the USD either way and would be our preferred way of trading the Dollar right now. The calendar is extremely light in the week ahead, which means overall risk sentiment could be the biggest source of momentum (which means keeping a close eye on further equity and bond market sell offs). Keep in mind earnings season gets a bit mor exciting this week and will be important to watch for risk.

JPY

FUNDAMENTAL OUTLOOK: BEARISH

BASELINE

In recent weeks, yield differentials of course have been the biggest driver for the JPY with the BoJ keeping 10-year JGB yields capped at 0.25% with yield curve control while other central banks are hiking rates aggressively. Thus, right now the JPY is pressured as yields have soared for the sky, but the threat and risk of further intervention could keep weakness limited. Japanese authorities intervened in the FX market in September by buying JPY and selling Dollars for the first time since 1998. The intervention saw some short-term downside of USDJPY, but as of Friday USDJPY almost reached 149 without any sign of further intervention action. The bias for USDJPY remains higher fundamentally speaking as yield differentials are still very wide, so unless authorities actively intervene the JPY can continue to weaken. The risk of buying is that we buy into interventions, which means risks are high.

POSSIBLE BULLISH SURPRISES

Catalysts that push US10Y lower (less hawkish Fed, lower UC CPI, lower growth) could trigger bullish reactions from the JPY. Any catalyst that triggers meaningful downside in key commodities like Oil (deteriorating demand outlook, ease in supply shortage) could trigger bullish JPY reactions. Any additional intervention from the BoJ or MoF. Watch Core CPI on Friday. Any print above 3.4% would be the highest inflation in 40 years and could spark speculation of less dovish policy action from the BoJ and should be JPY positive.

POSSIBLE BEARISH SURPRISES

Any catalysts that push US10Y higher (more aggressive Fed, higher US CPI, better growth) could pressure the JPY. Catalyst that triggers meaningful upside in Oil (deteriorating demand, increased supply) could trigger JPY downside. Reluctance from BoJ and MoF for intervening around the 145 level in USDJPY could spark speculative buying. Watch Core CPI on Friday. If Core CPI prints below 3.4% and BoJ officials talk down the rise as mostly transitory it could add further pressure on the JPY.

BIGGER PICTURE

The fundamental outlook remains bearish for the JPY due to yield differentials and the impact of a weaker JPY on the current account balance. As long as US10Y remain elevated and the BoJ stays stubbornly dovish and no currency intervention occurs, the bias remains lower. But take note of positioning which means we don’t want to chase the JPY lower, especially with the risk of further currency intervention should the JPY continue to weaken. The best opportunities for now remain short-term focused on further intervention or strong moves lower in US yields.

YEN TARGETING 150.00Yen have been scaling through new territory marking up new highs since 35yrs back.

Currently, the pair is consolidating. forming an ascending triangle (a bullish trend continuation pattern)

A Buy at the break of the upper trend line would indicate a sufficient bullish rally and buyer could begin to ride the price towards the 150.00 mark.