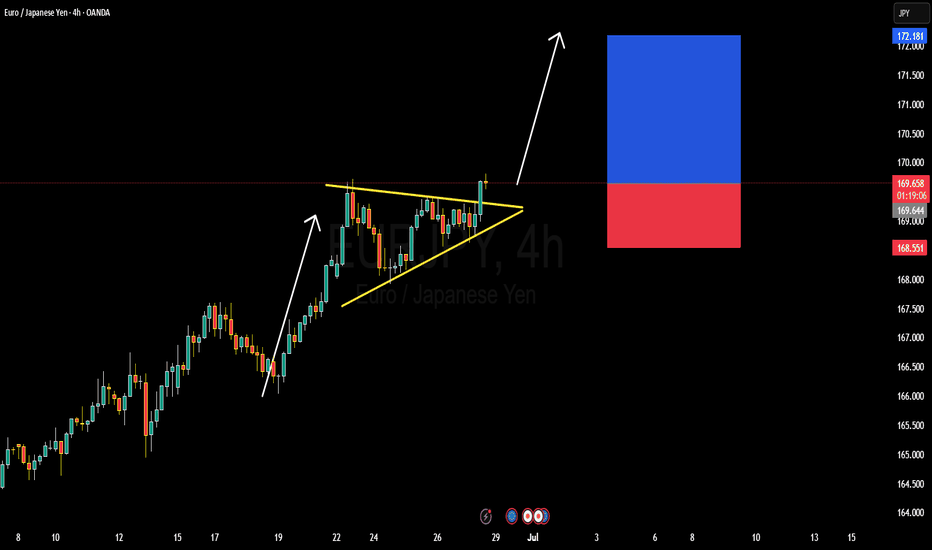

EURJPY BULLISH OR BEARISH DETAILED ANALYSISEURJPY has just broken out of a well-defined bullish pennant pattern on the 4H timeframe, confirming strong continuation potential to the upside. The price is currently hovering around 169.60 after consolidating in a tight structure, respecting both dynamic trendline support and horizontal resistance. This breakout signals renewed bullish momentum, and I'm now targeting the 172.10 zone as the next significant resistance level. The structure is clean, volume supported the breakout, and price action is aligned with the dominant uptrend.

Despite a relatively quiet start to the week—largely influenced by global risk-off sentiment surrounding Middle East tensions—EURJPY has held firm. Now that geopolitical jitters are easing slightly, yen weakness is resurfacing. The Bank of Japan remains firmly dovish, maintaining ultra-loose policy, while the Euro is supported by hawkish commentary from the ECB as inflation in the eurozone remains sticky. This divergence continues to fuel the long-term bullish bias for EURJPY.

Fundamentally, Japanese economic indicators remain soft, and there's still no clarity on when the BoJ will meaningfully shift policy. Meanwhile, EUR zone confidence indicators have stabilized, and speculation is growing around the ECB holding rates higher for longer into Q3. With widening yield differentials and a favorable risk sentiment return, this pair is positioned well for upside movement. Current momentum supports the probability of reaching the 172.00–172.10 area as risk appetite rebuilds across markets.

Technically and fundamentally aligned, EURJPY offers one of the strongest bullish continuation opportunities on the board right now. I will continue to monitor for minor dips as potential add-on areas, aiming for a full extension of the measured move from the pennant formation. Patience pays in setups like this where structure, sentiment, and macro all align.

Usdca

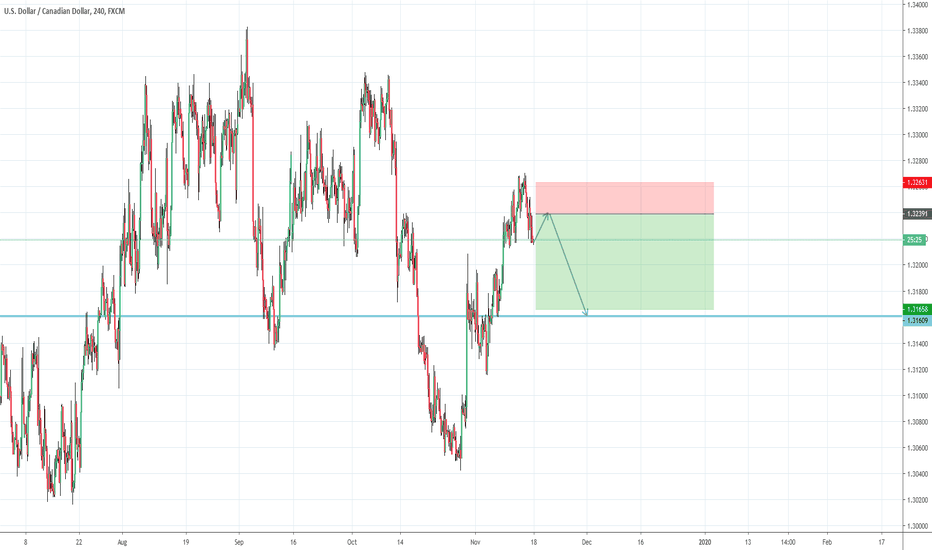

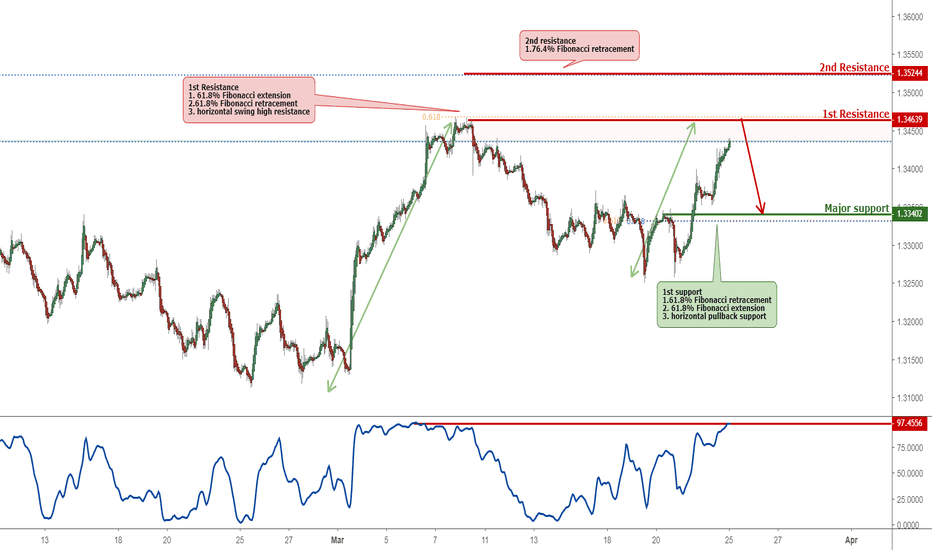

USDCAD Approaching Support, Prepare For A BounceUSDCAD is approaching its resistance at 1.3464 (horizontal swing high resistance, 61.8% Fibonacci extension, 61.8 % Fibonacci retracement) where it could potentially drop to its support at 1.3340 (61.8% Fibonacci retracement, 61.8% Fibonacci extension, horizontal pullback support).

Stochastic (89, 5, 3) is approaching its support where a corresponding bounce could occur.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

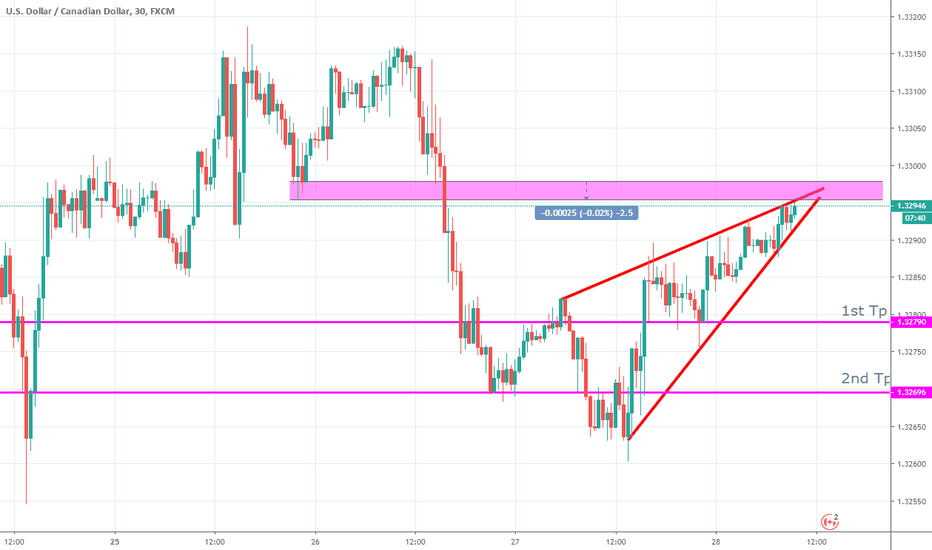

USDCAD 4H LONG TRADEThe USDCAD often rises when the EURUSD falls.

Price is stretched away from the ma's

Macd is stretched away from 0 level line

Macd has crossed above red signal line which means possible bullish move

Wait for price to get above current price action

There is a previous and current fractal low creating a previous fractal breakout

Buy stop @ 1.2633

Take Profit @ 1.2690

SL @ 1.2575