Usdchfanalysis

USD/CHF Slips LowerUSD/CHF Slips Lower

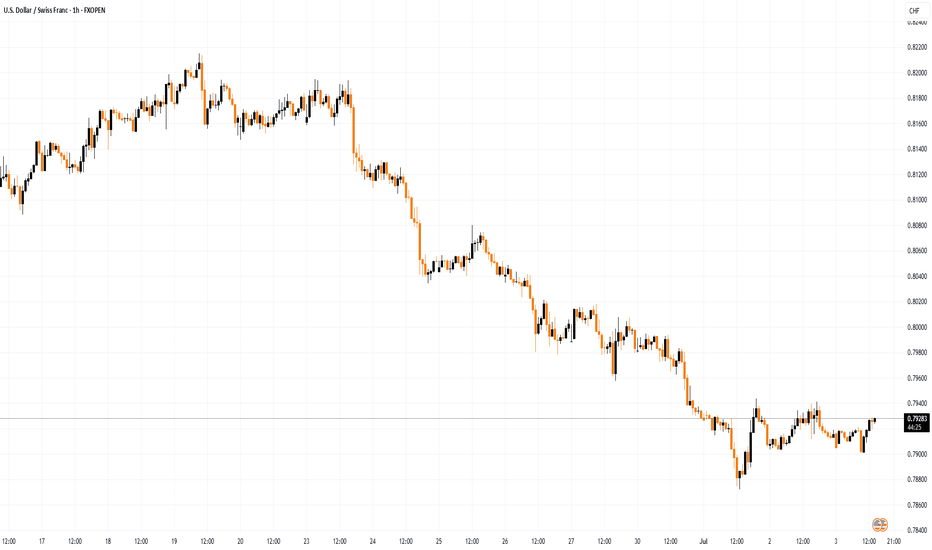

USD/CHF declined and now struggling below the 0.8000 resistance.

Important Takeaways for USD/CHF Analysis Today

- USD/CHF declined below the 0.8000 and 0.7950 support levels.

- There is a key bearish trend line forming with resistance near 0.7920 on the hourly chart at FXOpen.

USD/CHF Technical Analysis

On the hourly chart of USD/CHF at FXOpen, the pair started a fresh decline from well above the 0.8080 zone. The US Dollar dropped below the 0.8000 support to move into a negative zone against the Swiss Franc.

The bears pushed the pair below the 50-hour simple moving average and 0.7940. Finally, the bulls appeared near the 0.7870 level. A low was formed near 0.7872 and the pair is now consolidating losses.

There was a minor increase above the 23.6% Fib retracement level of the downward move from the 0.8080 swing high to the 0.7872 low. On the upside, the pair could face resistance near the 0.7920 level. There is also a key bearish trend line forming with resistance near 0.7920.

The next major resistance is near the 0.7940 level, above which the pair could test the 0.7975 level. It is close to the 50% Fib retracement level of the downward move from the 0.8080 swing high to the 0.7872 low.

If there is a clear break above the 0.7975 resistance zone, the pair could start another increase. In the stated case, it could even surpass 0.8030.

On the downside, immediate support on the USD/CHF chart is 0.7870. The first major support is near the 0.7850 level. The next major support is near 0.7800. Any more losses may possibly open the doors for a move toward the 0.7720 level in the coming days.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/CHF Exchange Rate Falls to Multi-Year LowUSD/CHF Exchange Rate Falls to Multi-Year Low

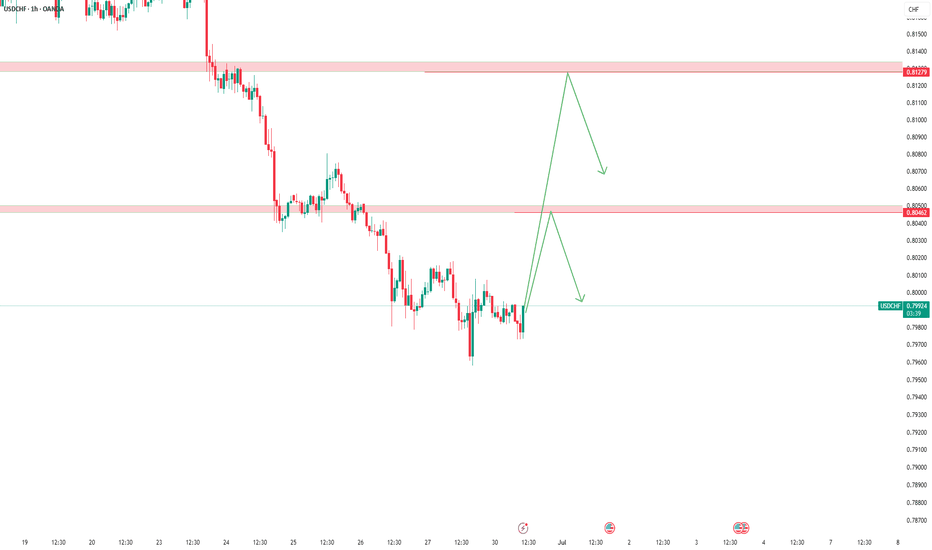

According to the chart, the USD/CHF exchange rate has settled below the key psychological level of 0.8000. The rate hasn’t been this low since the financial crisis of 2008.

On one hand, the drop in USD/CHF is driven by weakness in the US dollar. The US dollar index has fallen to its lowest level in over three years, largely due to the conflicting trade policies pursued by the Trump administration. On the other hand, geopolitical instability has increased the appeal of the Swiss franc as a so-called safe-haven asset.

Technical Analysis of the USD/CHF Chart

Since mid-May, price fluctuations have formed a downward channel (marked in red), and by the end of June the rate had stabilised around the psychological threshold of 0.8000 (indicated by an arrow) — right at the median of the channel.

However, this balance between supply and demand proved temporary, tipping in favour of sellers. As a result, we now see a decline in USD/CHF along a steep trajectory (marked in black), potentially targeting the lower boundary of the red channel — which suggests a possible move down to 0.7800 USD per franc. Along this path, support may come from the 1.618 Fibonacci extension level (0.7875); note how the 0.8055 level previously acted as support (marked with a blue arrow).

The RSI indicator confirms strong selling pressure — but will the bearish trend continue?

Much will depend on the broader fundamental context. As reported by the Wall Street Journal, the sharp strengthening of the franc against the dollar is causing growing concern at the Swiss National Bank (SNB), as an overly strong franc harms Swiss exporters. This suggests that the current market sentiment could shift dramatically if the SNB issues any relevant statements.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

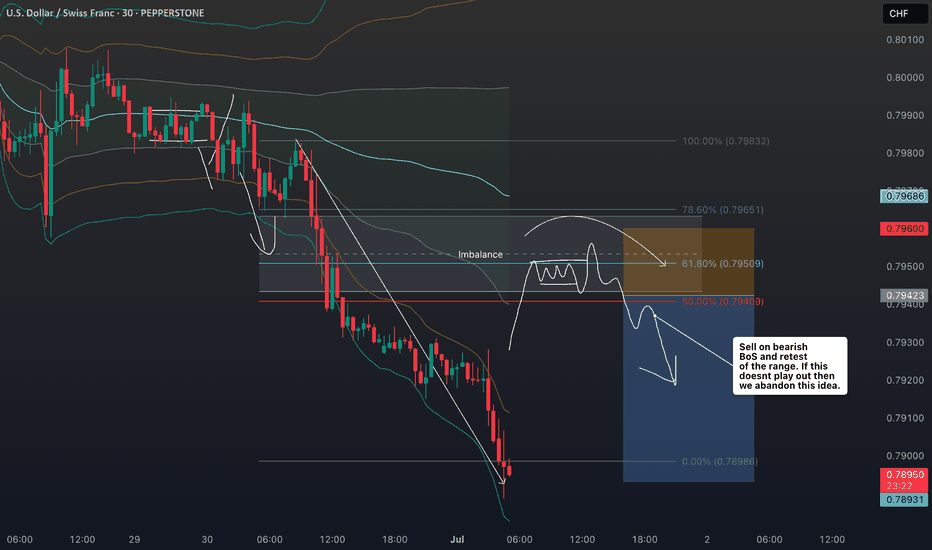

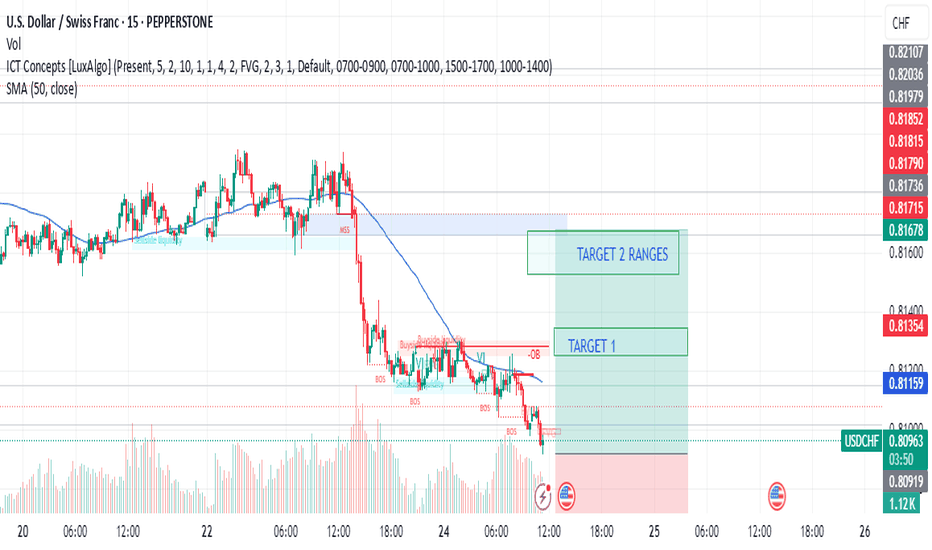

How to Trade USDCHF 's Downtrend with Precision📉 Market Breakdown: USDCHF Under Pressure

Currently keeping a close watch on USDCHF 💵🇨🇭 — the pair has been in a strong, sustained bearish trend 🔻, and the overall pressure remains clearly to the downside.

My bias is firmly bearish 📊, but I’m not rushing in. Instead, I’m patiently waiting for an optimal entry 🎯 — one that offers the right balance of confluence, structure, and reduced risk 🧠🛡️.

🎥 In today’s video, we dive into:

✅ Market structure

✅ Price action

✅ The prevailing trend

✅ Entry zones with minimized risk

I also walk you through my personal entry strategy and trading plan 📋, it's not just an idea drop.

📌 Disclaimer: This is not financial advice — the content is for educational purposes only.

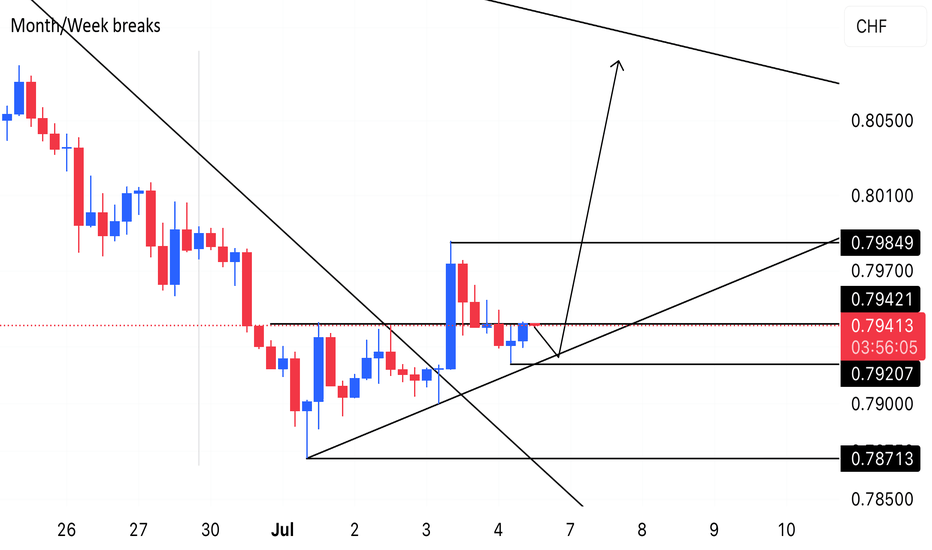

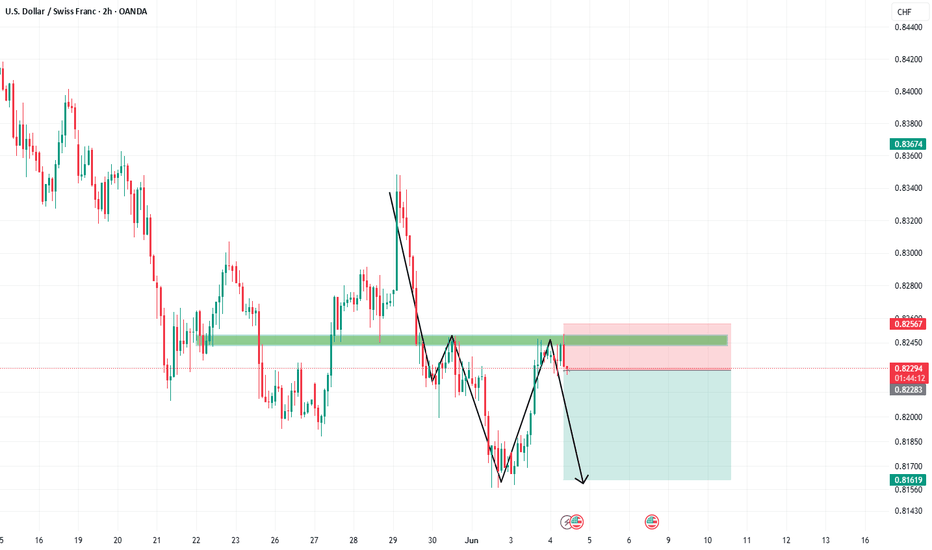

USDCHF..SHORT📌 USDCHF – Multi-Scenario Setup

This pair has two key levels: one short-term, the other long-term.

If price reaches the first level and shows solid bearish reaction, I’ll enter a short.

If that level breaks and confirms, I’ll go long—but manage the long aggressively, since I’ll look to exit around the higher level.

If the price pushes beyond even the second zone, I’ll be ready to buy again.

❗️I’m never upset by a loss or a broken level.

The market leads—I follow.

Claiming “it must drop from here” or “it has to rise” is wishful thinking, not trading.

✅ Stay calm, stay flexible, and stay prepared for every scenario.

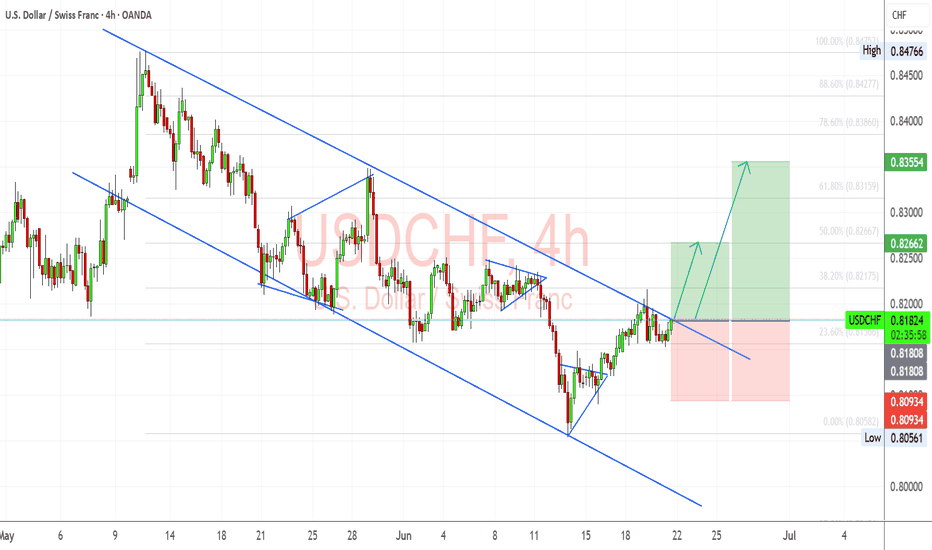

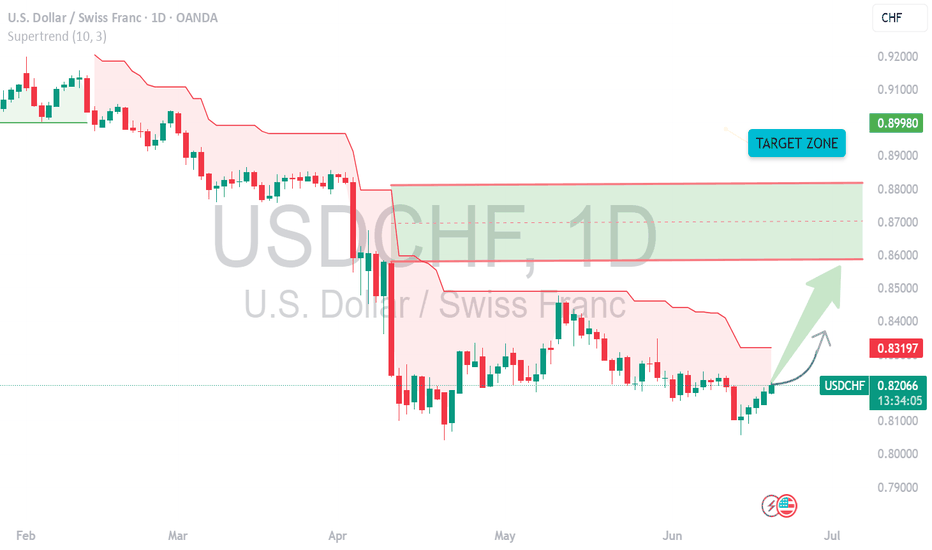

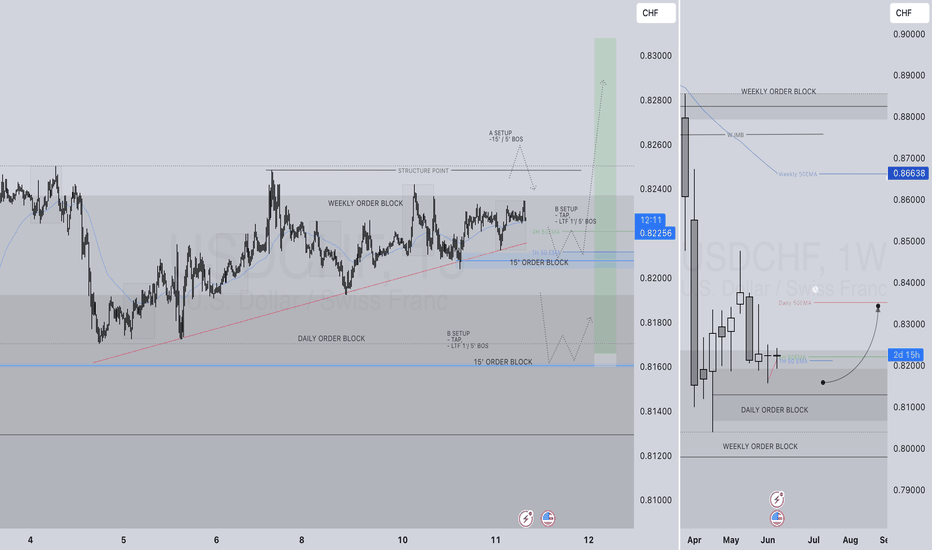

USDCHF Analysis – "Dollar Trying to Break Free from Downtrend"USDCHF is breaking out from a multi-week descending channel.

Structure shows a potential trend reversal from the June 12th low.

First bullish leg may target the 23.6% Fib level at 0.8266, followed by an extended move toward 0.8355.

Key resistance: 0.8266 and 0.8355 (Fib levels)

Stop loss: around 0.8093–0.8056 zone (previous support and breakout base)

Structure Bias: Bullish breakout after prolonged downtrend – confirmation depends on sustained move above 0.8200

📊 Current Bias: Cautiously Bullish

🧩 Key Fundamentals Driving USDCHF

USD Side (Mildly Bearish to Neutral):

FOMC held rates, Dot Plot showed only one cut expected for 2025, but Powell’s tone was less hawkish.

US Retail Sales soft, and PPI/CPI showed signs of inflation cooling.

Recent risk-off sentiment (Middle East, oil spikes, equity volatility) supports the USD.

Trump commentary and 2025 election anticipation bring long-term uncertainty.

CHF Side (Strong but potentially weakening):

SNB held rates steady, with cautious tone—no urgency to hike again.

Safe-haven flows still support CHF, but waning inflation and stronger global equity market might reduce CHF appeal.

SNB has hinted at FX intervention readiness, which could weaken CHF if necessary.

⚠️ Risks That May Reverse or Accelerate Trend

False breakout risk if 0.82 fails to hold → deeper pullback toward 0.8090

Stronger CHF demand on geopolitical fear (Israel–Iran, Ukraine)

Unexpectedly weak US data this week or renewed Fed dovish talk

🗓️ Important News to Watch

US: Core PCE, GDP revision (June 27), jobless claims

CHF: Swiss CPI, SNB FX intervention chatter

Risk sentiment: Iran/Israel tensions, equity volatility, Trump Fed commentary

🏁 Which Asset Might Lead the Broader Move?

USDCHF could mirror sentiment across CHF pairs—if risk-on resumes and CHF weakens across the board (EURCHF, NZDCHF also rallying), USDCHF may accelerate higher.

"USD/CHF Breakout - Real Deal or Trap?"🏦 SWISS BANK HEIST: USD/CHF BULLISH LOOT GRAB 🚨

(Professional Money Snatching Strategy)

🦹♂️ Attention All Market Bandits!

(Hola! Oi! Salut! Hallo! Ahlan!) 🎭💰

🔥 Thief Trading Intel Confirmed!

The USD/CHF "Swissy" vault is ready for cracking! Our bullish robbery plan targets 0.84500 - but we must escape before the bears (police) set their trap!

🔓 ENTRY: CRACKING THE SAFE

"0.82800 MA is the vault door!"

✔ Option 1: Buy Stop above MA (breakout play)

✔ Option 2: Buy Limit at swing low (15m/30m pullback)

🔔 Pro Tip: Set alerts - real thieves never miss their heist!

🚨 STOP LOSS: POLICE EVASION PLAN

📍 Thief SL: 0.81900 (below 3H swing low)

⚠️ Warning: No SL before breakout! You'll trigger the alarms!

💎 TARGET: ESCAPE WITH THE LOOT

🎯 Primary Take: 0.84500

💰 Scalpers: Long-only! Trail SL like a getaway car!

📊 MARKET CONDITIONS

⚖️ Neutral Trend (but bullish potential brewing!)

🔍 Key Intel Needed: COT reports, macro data, CHF safe-haven flows

🌐 Full Briefing: Bi0 linkss 👉🔗 (don't go in blind!)

🚦 RISK MANAGEMENT PROTOCOLS

• ❌ Avoid trading during news events

• 🔒 Always use trailing stops

• 💣 Position size = your explosive potential

🦾 SUPPORT THE SYNDICATE

💥 SMASH THAT BOOST BUTTON!

💬 Comment your heist results below!

🔔 Next robbery coming soon - stay tuned!

🤑 Remember thieves: Book profits before the Swiss police arrive!

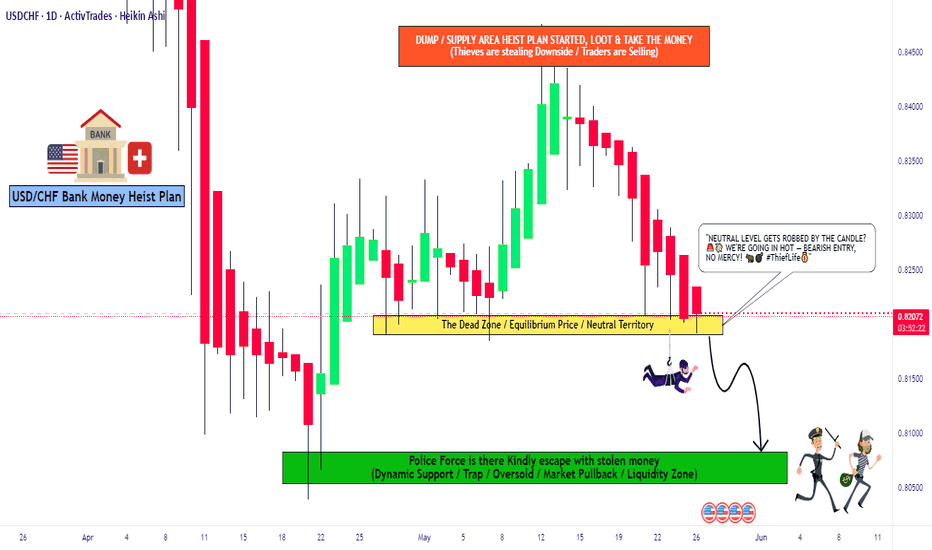

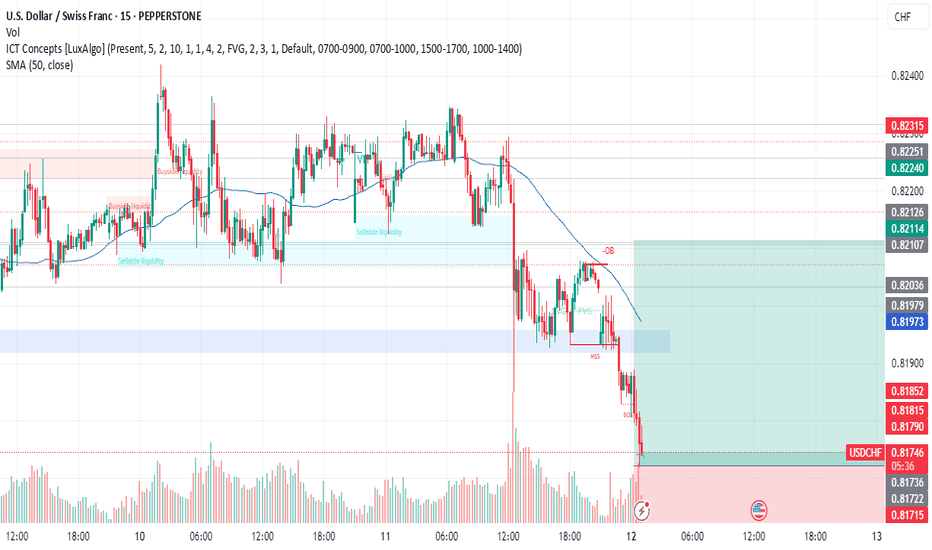

Swissy Heist: USD/CHF Bearish Breakout Blueprint🚨 Swissy Heist Alert: USD/CHF Bearish Breakout Plan for Swing/Day Traders 🌐💸

Hello, Wealth Chasers and Market Mavericks! 👋😎

Welcome to the Thief Trading Strategy, a cunning blend of technical precision and fundamental insight to conquer the USD/CHF Forex market. This is your blueprint to pull off a masterful heist on "The Swissy." Follow the plan, target the high-reward Green Zone, and navigate the traps where bullish players lurk. Let’s grab those pips and treat ourselves to the spoils! 💰🎯

📈 Trade Blueprint: USD/CHF Setup

Market: USD/CHF (Forex) 🌍

Bias: Bearish Breakout 📉

Timeframe: 4H (Swing/Day Trade) ⏰

Entry Plan 📊:

Breakout Strategy: Wait for a confirmed break below the Neutral Zone at 0.81800. Set Sell Stop orders just below 0.81800 to surf the bearish momentum. 🚀

Pullback Strategy: For safer entries, place Sell Limit orders at the nearest 15M/30M swing high (e.g., 0.82100–0.82300) after a support break. 📍

Pro Tip: Activate a price alert at 0.81800 to catch the breakout live! 🔔

Stop Loss 🛑:

📍 Set your Stop Loss above the nearest 4H swing high (e.g., 0.82750) for swing/day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open positions.

Target 🎯: Aim for 0.80700 or exit early to secure profits.

💡 Why the Bearish Bias?

The USD/CHF is showing strong bearish momentum, fueled by technical patterns and fundamental drivers. Key factors include:

Technicals: Recent support at 0.81931–0.82120 held briefly but failed to sustain bullish momentum, reinforcing a bearish tilt below key moving averages (100/200-hour MAs).

Fundamentals: Safe-haven demand for the Swiss Franc persists amid global uncertainties, with bearish patterns like an inverse cup and handle signaling further downside. For a deeper dive, check fundamental reports, COT data, sentiment analysis, and intermarket trends via Linkks🔗

⚠️ Volatility Warning: News Impact 📰

News releases can spike volatility and disrupt price action. To protect your trades:

Avoid opening new positions during major news events.

Use trailing stops to lock in gains and shield running positions.

💪 Join the Heist!

Support this Thief Trading Strategy by smashing the Boost Button! 🚀 Let’s strengthen our crew and make pips effortlessly. With this plan, you’re equipped to navigate the USD/CHF market like a pro. Stay sharp, and I’ll be back with the next heist plan soon! 🐱👤💸

Happy trading, and let’s steal those profits! 😎🎉

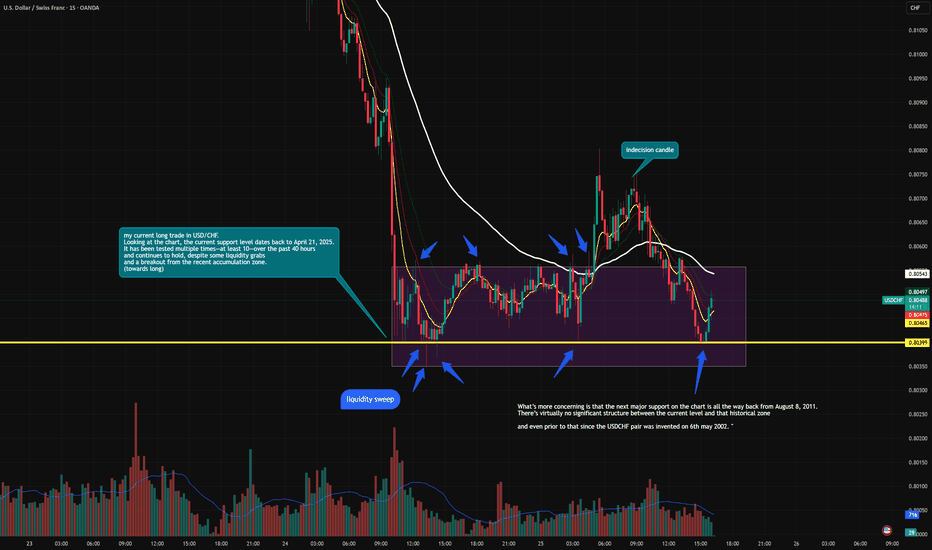

USDCHF ACCUMULATION AND DISTRIBUTION AT THE STRONGEST SUPPORTRepeated liquidity sweeps (marked with arrows) indicate smart money absorbing sell pressure.

Consolidation is happening after a significant downtrend, suggesting potential reversal.

The volume stays steady — no major breakdowns or explosive exits.

What you see here is a textbook accumulation phase forming on the USD/CHF chart — not just because of the sideways structure, but due to the repeated liquidity sweeps and smart money behavior around a long-term support level.

🔹 Major Support:

The yellow horizontal line marks a critical support level, originally established on April 21, 2025. Price has respected this level repeatedly, making it a strong base.

🔹 Liquidity Sweeps:

Multiple deep wicks below support (highlighted by blue arrows) are signs of stop-loss hunting, where price dips below key levels only to sharply recover. This is classic smart money accumulation behavior.

🔹 Volume Profile:

Volume remains stable throughout the consolidation zone — no significant exit volume, which suggests this is not distribution.

🔹 Failed Breakdowns:

Every time price breaks the range low, it’s met with quick rejections and reversals, absorbing selling pressure instead of following through → further validation of accumulation.

🔹 Historical Significance:

The concerning part? The next major support on this pair isn’t until August 8, 2011 — over a decade back! That makes this level extremely critical to hold.

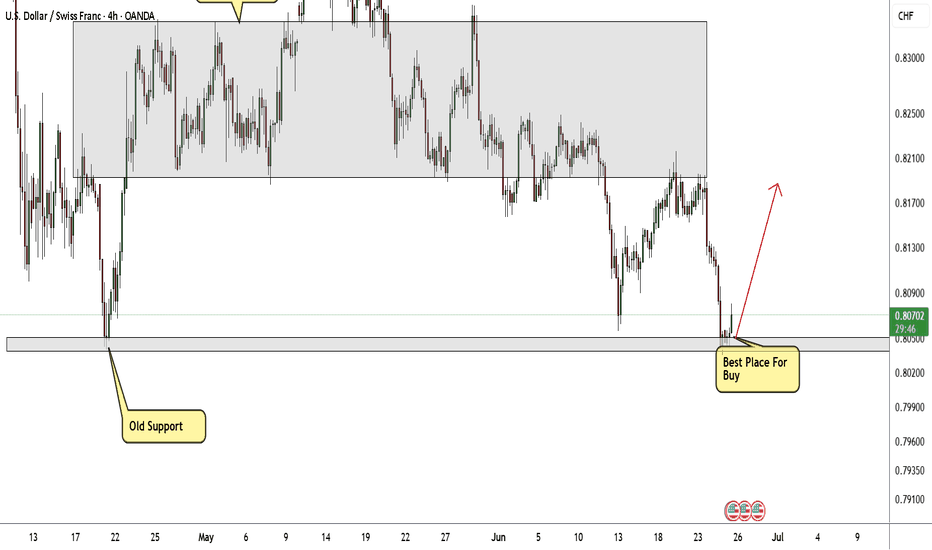

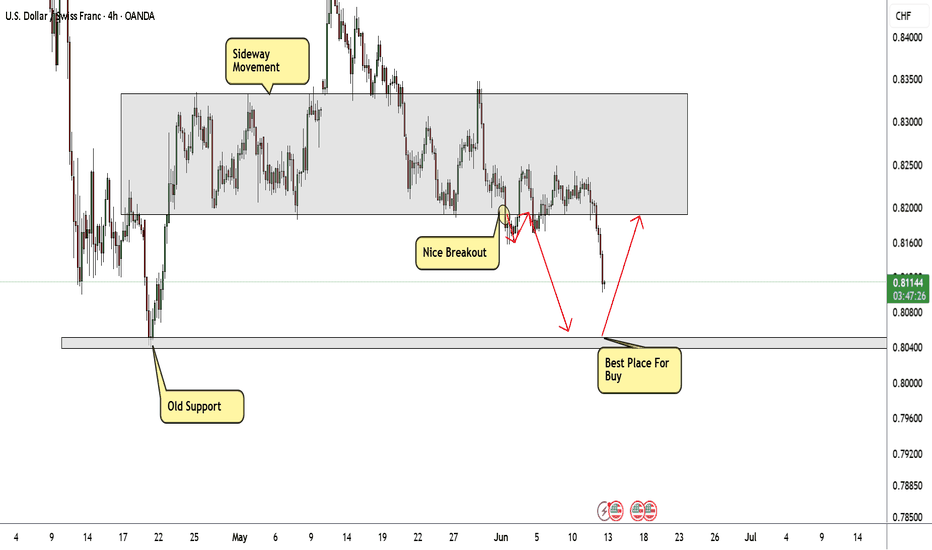

USD/CHF At Perfect Place For Buy , 250 Pips Easy To Get !Here is my opinion on USD/CHF , The price at support area that forced the price to go up last time more than 500 pips , so it`s a very strong Area to buy it again from the same support cuz it`s the lowest place the price can go up from it , and we can targeting 250 pips .

USDCHF - TIME FOR RECOVERYTeam, USDCHF has been selling off last few days

Time to make AMERICAN greater again, lolz

This price is good for entry

Please ensure once it hit your 1st target, bring STOP LOSS TO BE

Always take 50-70% from your current volume

TODAY, we short AUS200 target hit

also DAX short also hit.

Now, lets focus on USDCHF!

USDCHF H4 AnalysisUSDCHF Showing a Bearish Flag. If it breaks this zone above, Most probably can fly up to 0.82512 and higher to 0.83491. If no, Can rally between 0.80552 or even lower. Trading Analysis from 23-06-25 to 27-06-25. Take your risk under control and wait for market to break support or resistance on smaller time frame. Best of luck everyone and happy trading.🤗

USD/CHF Very Near Buying Area , Let`s Get This 200 Pips !Here is my opinion on USD/CHF , The price very near support area that forced the price to go up last time more than 500 pips , so it`s a very strong Area to buy it again if the price give us a good bullish price action , and we can targeting 250 pips .

USDCHF daily Cls model 1 Target sl setUSDCHF Trade Setup Alert 🚨

Entry Confirmed ✅ | Target Locked In 🎯 | SL in Place for Risk Control 🛡️

We’ve set our eyes on the next move for USDCHF – trade smart, not emotional.

🔹 Target: [86034

🔹 Stop Loss: 80030

Watch the price action closely — let the strategy play out! 📊📈

#USDCHF #ForexSignals #TradingSetup #RiskManagement #TradingView

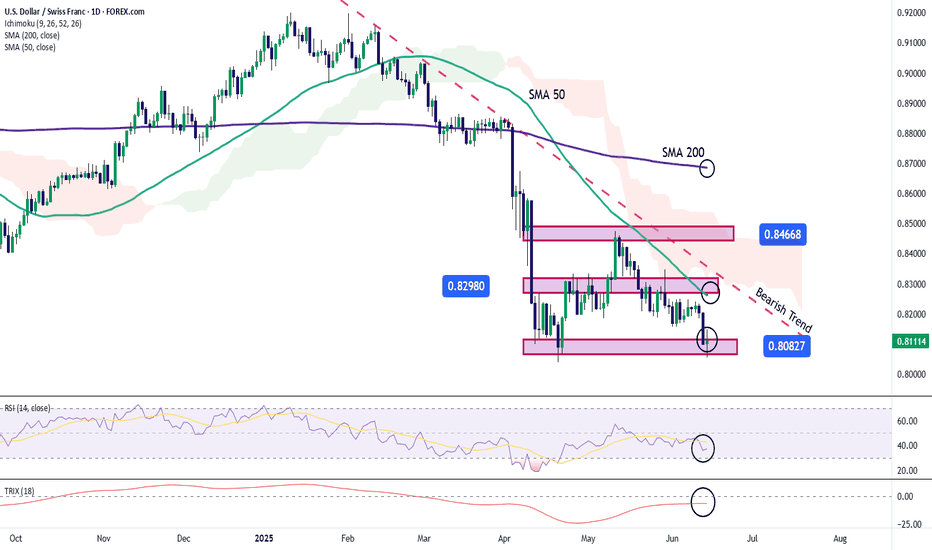

USD/CHF Hits Critical Support LevelsOver the last three trading sessions, USD/CHF has declined more than 1.5%, as a consistent bearish bias persists, pushing the pair back to multi-month lows. Selling pressure has remained firm amid uncertainty surrounding the escalation of political and military tensions in the Middle East. So far, the U.S. dollar has failed to act as a safe haven, while the Swiss franc has maintained its strength, reinforcing the current bearish trend. If this downward momentum continues, the selling trend could become even more dominant.

Consistent Bearish Trend

Since the beginning of the year, USD/CHF has shown consistent selling swings, leading to the formation of a strong downtrend in recent weeks. Currently, the selling pressure has been strong enough to drive the pair back to recent lows, and if the bearish momentum continues below this level, the downward trend may gain further relevance. In the absence of any significant bullish corrections, the bearish trend remains the dominant pattern in the short term.

RSI

The RSI line continues to move below the 50 level, indicating that selling impulses remain dominant in recent sessions. As long as RSI remains below the neutral zone, the bearish momentum is likely to persist.

TRIX

The TRIX line has been oscillating below the neutral level of 0, suggesting that the average strength of the exponential moving averages still reflects a bearish market bias. This may indicate that the current downtrend still has room to continue in the near term.

However, it is important to note that the price is currently sitting at a key support zone, which could serve as a launch point for potential bullish corrections in the upcoming sessions.

Key Levels to Watch:

0.84668 – Major Resistance: This level marks the recent high reached in past months. If buying momentum pushes the pair back up to this level, it may pose a threat to the current downtrend and trigger a more relevant bullish move.

0.82980 – Short-Term Barrier: This level aligns with the 50-period moving average. Bullish moves above this point could challenge the current bearish formation and introduce a neutral short-term bias.

0.80827 – Key Support: This level aligns with the chart’s recent lows. While it may trigger upside corrections, a break below it could reactivate significant selling pressure in upcoming sessions.

Written by Julian Pineda, CFA – Market Analyst

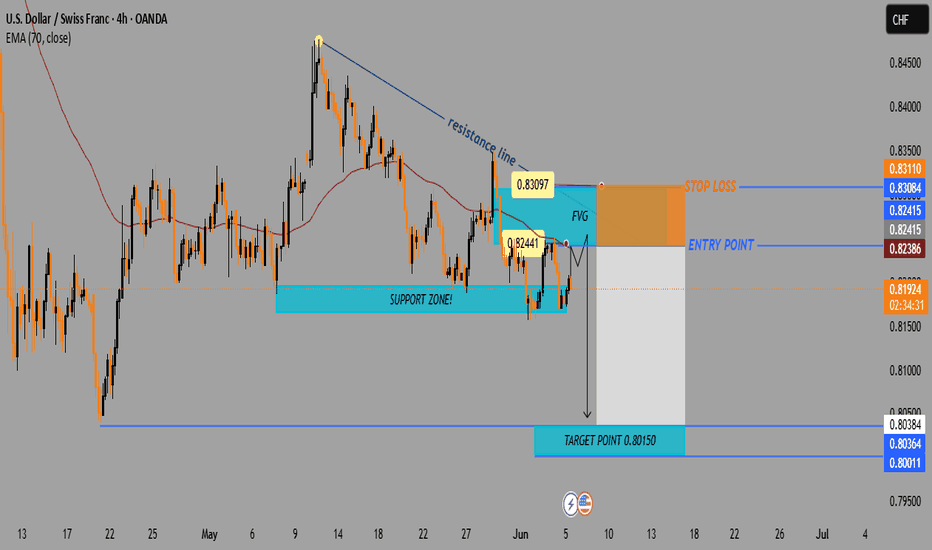

USD/CHF 4H Bearish Setup: FVG Rejection & EMA Resistance Strateg🔵 Chart Structure

🔻 Downtrend Identified

* Lower highs & lower lows forming.

* Resistance line sloping down 📉.

🧲 EMA 70 (0.82387)

* Acting as dynamic resistance 🔴.

* Price currently sitting just below it ⬇️.

💠 FVG (Fair Value Gap) — 0.82441 to 0.83097

* Price expected to fill the imbalance here.

* Confluence with resistance = 🔥 ideal sell zone.

🎯 Trade Plan (Short Setup)

🟦 Entry Point:

* 💥 0.82415

* Just under EMA + inside FVG zone.

🛑 Stop Loss:

* ❌ 0.83110

* Above FVG + above previous high = protected stop.

🎯 Take Profit:

* ✅ 0.80150

* Near prior demand zone + horizontal support.

* Target zone clearly marked in light blue 🧊.

⚖️ Risk-Reward Ratio

🎲 Estimated around 2.5:1 or better.

✅ High reward potential if resistance holds.

⚠️ Caution / Notes

🔎 Watch for bearish confirmation candles 🕯️ at entry zone.

📆 Be aware of economic news that could impact USD or CHF.

🧪 If price closes above 0.83110, setup becomes invalid ❌.

📌 Summary

Element Level Emoji

🔵 Entry 0.82415 💥

🛑 Stop Loss 0.83110 ❌

✅ Take Profit 0.80150 🎯

🔻 Trend Bias Bearish 📉

📐 Tools Used EMA, FVG, Resistance 📊

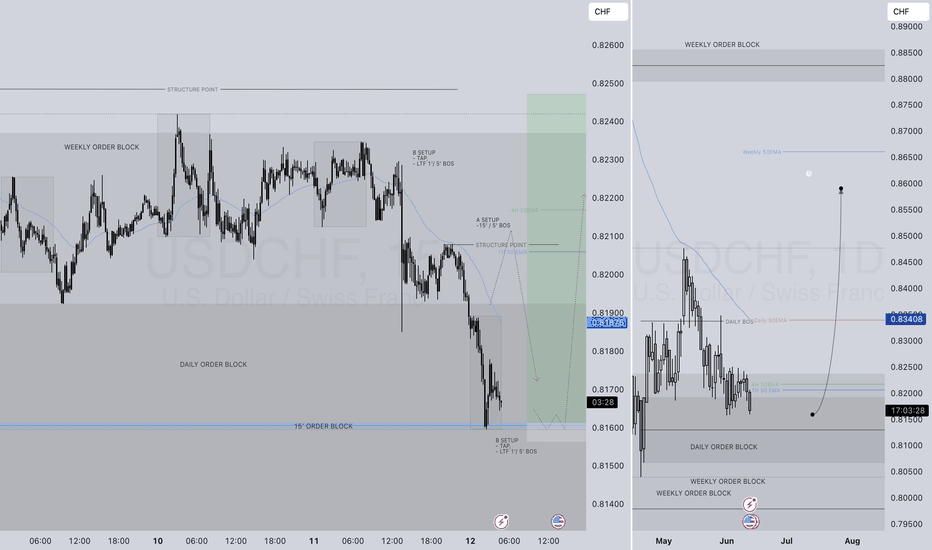

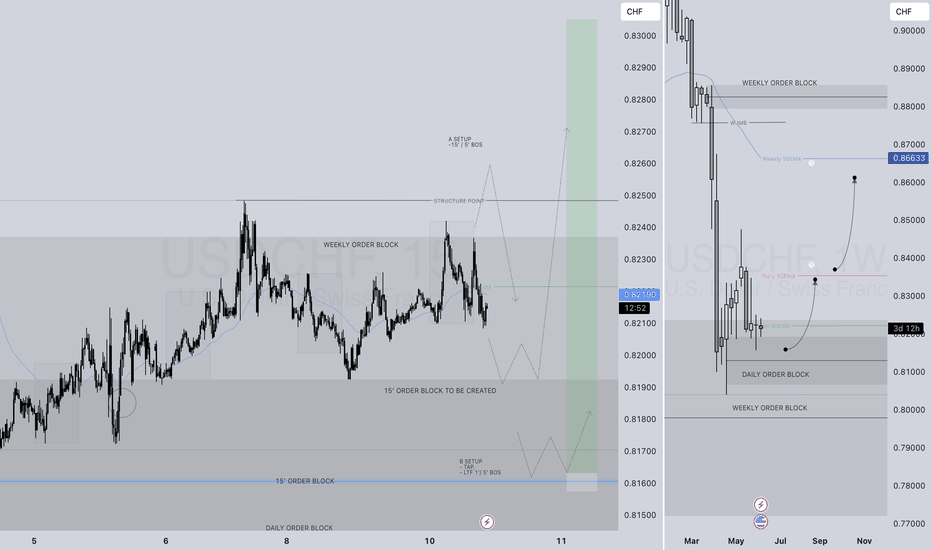

USDCHF LONG FORECAST Q2 W24 D12 Y25USDCHF LONG FORECAST Q2 W24 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF - TIME TO MAKE MILLIONSTeam, we been waiting over a week by now

Last time we kill the market well

I only trade when i see opportunity, otherwise I do not trade

Most of my trade are 95% winning ratio and accuracy.

I hope you enjoy the ride for USDCHF

Dont forget when it hit above 0.82000 zone, take 50% and the rest is above 0.8215-8230

SEAT BELL UP AND ENJOY THE RIDE.

USDCHF LONG FORECAST Q2 W24 D11 Y25👀 USDCHF LONG FORECAST Q2 W24 D11 Y25

🔥HOT PICK ALERT 🔥

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF LONG FORECAST Q2 W24 D10 Y25👀 USDCHF LONG FORECAST Q2 W24 D10 Y25

🔥HOT PICK ALERT 🔥

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCHF Primed for Monster Move to 0.92? Here's Why!In today’s video, I break down a potentially strong bullish opportunity on USDCHF and why, with the right entry signal, we might see a solid push up towards 0.88 and eventually 0.92 in the weeks and months ahead.

First off, let's check the monthly chart. In April, price finally broke and closed below the major 0.84 support, a level that held firm since 2011. Below, I've marked the massive buy zone created around the 2011 lows—interestingly, depending on your broker, you’ll notice this zone was tested during the dramatic Swiss franc unpegging event back in 2015 as well.

But here's why I don’t think we’re headed down to retest that monthly zone anytime soon. Zooming into the weekly charts, we clearly see a key weekly buy zone. This was actually the origin point for the massive move up from the 2011 lows to 0.95. This exact weekly level is already proving its significance again, given the strong buying reaction we saw here in May.

Now, zooming further into the daily charts, we had a nice bounce at that weekly buy zone, pushing price back up to retest the previous support at 0.84. If the market truly wanted lower prices, we would've seen a sharp sell-off from there. Instead, price has slowly been grinding lower, forming a clear W double-bottom pattern—a powerful reversal signal.

This all points to higher prices ahead, especially considering USDCHF currently offers one of the most attractive swap carry opportunities due to the interest rate differentials and the SNB’s hints about possibly returning to negative rates to weaken the franc.

Here's my game plan:

Wait patiently for the next bullish daily candle with a clear close above 0.83.

My first target will be the 0.88 area (previous strong resistance and weekly sell zone).

The longer-term target will be around the 0.92 resistance zone.

My stop loss will be placed comfortably below 0.80. Should we spike lower to that level, I'll remain alert for another high-probability bullish entry signal.

Let me know your thoughts below!

Market Analysis: USD/CHF Targets Upside BreakMarket Analysis: USD/CHF Targets Upside Break

USD/CHF is rising and might aim for a move towards the 0.8250 resistance.

Important Takeaways for USD/CHF Analysis Today

- USD/CHF is showing positive signs above the 0.8200 resistance zone.

- There was a break above a connecting bearish trend line with resistance at 0.8180 on the hourly chart at FXOpen.

USD/CHF Technical Analysis

On the hourly chart of USD/CHF at FXOpen, the pair declined heavily below the 0.8250 level before the bulls appeared. The US Dollar tested 0.8160 and recently started a fresh increase against the Swiss Franc.

The pair climbed above the 0.8200 resistance zone. There was a break above the 23.6% Fib retracement level of the downward move from the 0.8337 swing high to the 0.8157 low. Besides, there was a break above a connecting bearish trend line with resistance at 0.8180.

The bulls are now facing resistance near the 50% Fib retracement level of the downward move from the 0.8337 swing high to the 0.8157 low at 0.8250. The next major resistance is 0.8295.

The main resistance is near 0.8335. If there is a clear break above 0.8335 and the RSI remains above 50, the pair could start another increase. In the stated case, it could test 0.8420.

If there is another decline, the pair might test the 0.8200 support. The first major support on the USD/CHF chart is near the 0.8160 zone. A downside break below 0.8160 might spark bearish moves. The next major support is near the 0.8120 pivot level. Any more losses may possibly open the doors for a move towards the 0.8050 level in the near term.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.