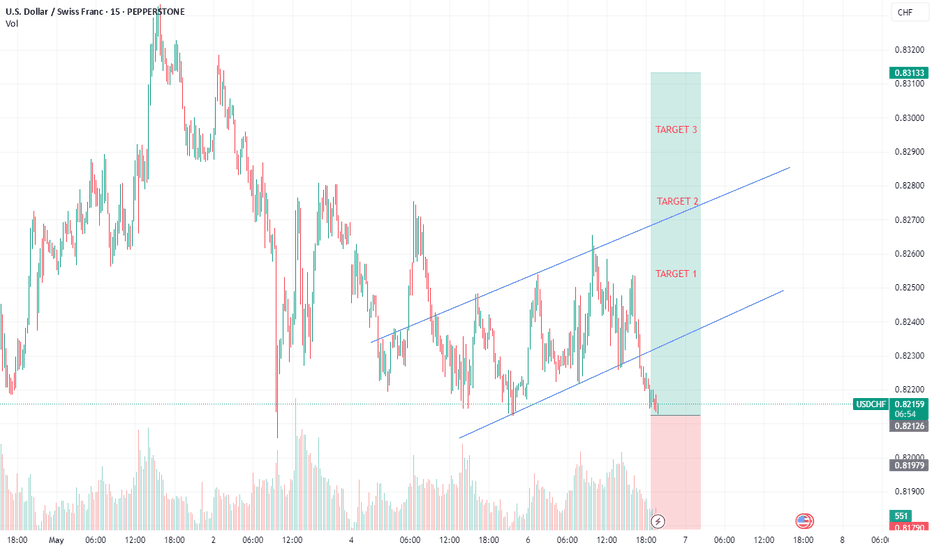

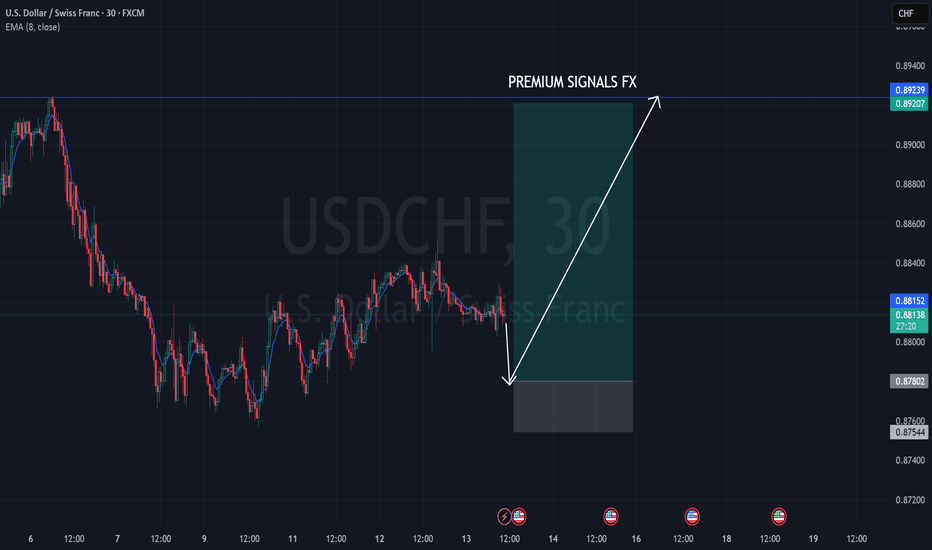

USDCHF - another opportunityTeam, this week, we done many trades with USDCHF and very successfully,

Tomorrow RATE announce and NO change.

that mean the USD will like moving strong against most currencies,

We found opportunity to RE-ENTER the USDCHF again

Target base on the chart.

TARGET 1 - reduce 30% volume

TARGET 2 - reduce another 50%

Target 3 - close the remaining

Please follow it accordingly. Do NOT forget to bring trail stop loss to BE once target 1 meet.

Usdchfsignal

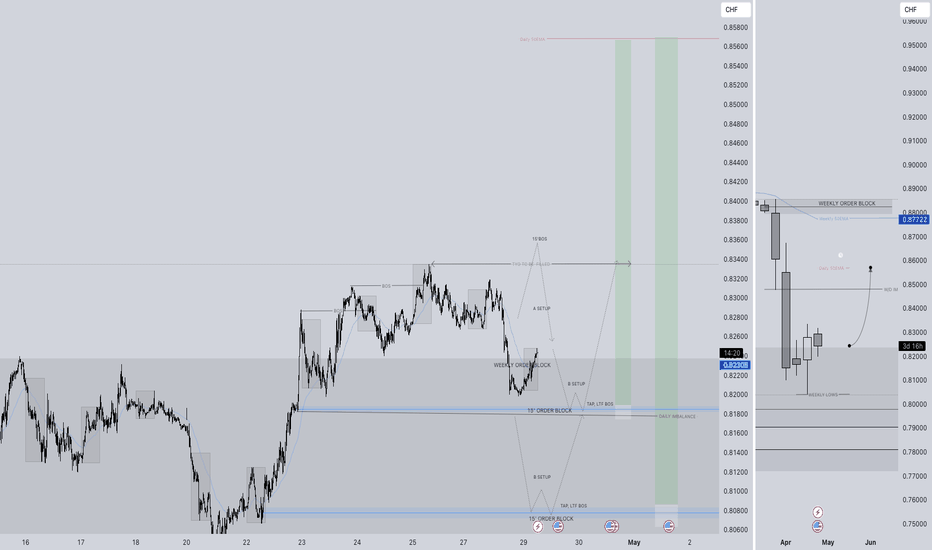

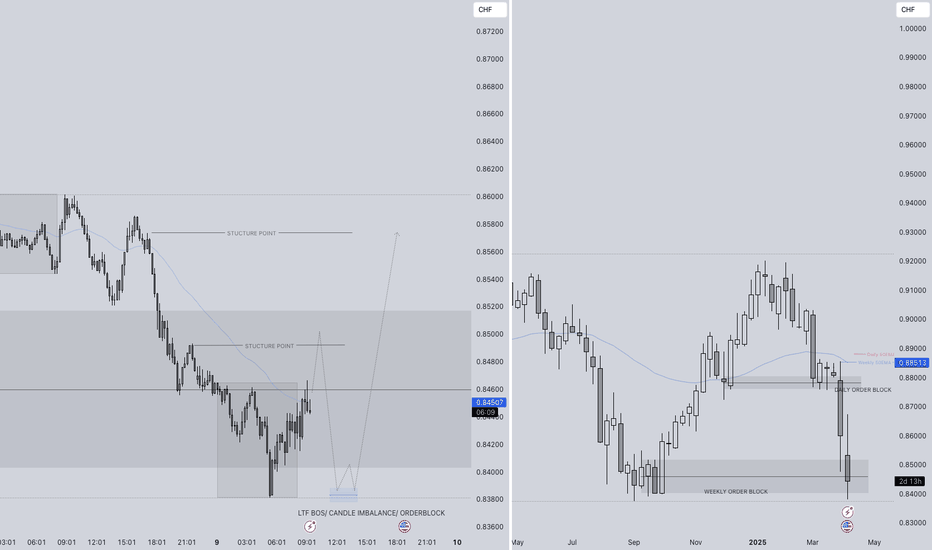

USDCHF LONG FORECAST Q2 W19 D6 Y25USDCHF LONG FORECAST Q2 W19 D6 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

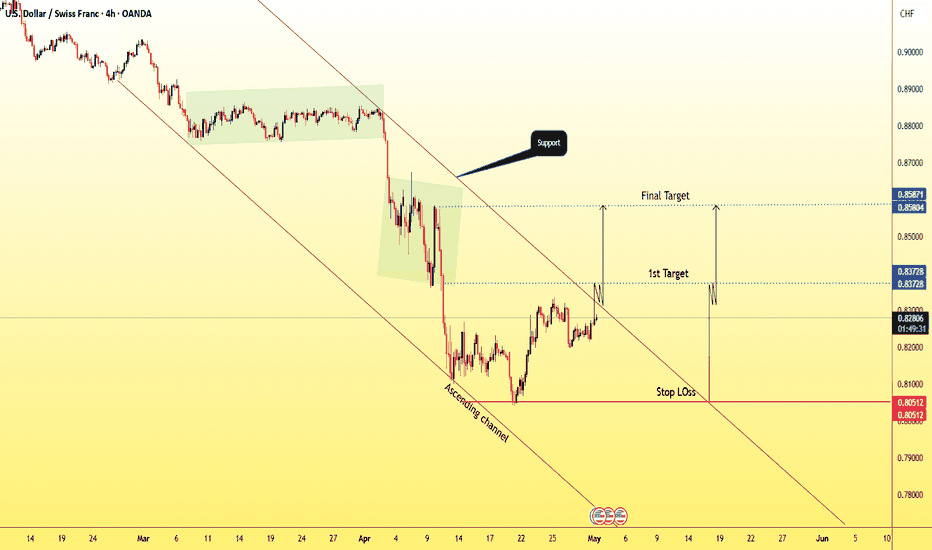

USDCHF STRONG BULLIDH (UPTREND) SCENARIOTrade Setup: BUY

Entry Zone (Buy Price Range):

Between 0.81500 – 0.82500 (ideal pullback or breakout entry range depending on current price action)

Stop Loss (Risk Management):

0.80500

Below recent swing low and key support zone

Take Profit Targets:

Target 1: 0.83700 (near-term resistance or Fibonacci level)

Final Target: 0.85800 (major resistance / long-term objective)

Trade Management Plan:

1. After Entry:

Monitor price action at 0.83000–0.83700.

Consider partial profits at Target 1 and move stop to break even.

2. If Target 1 Hits:

Lock profits and trail stop loss below higher lows for continuation to 0.85800.

3. Exit Plan:

Exit completely if price breaks below 0.80500 with strong bearish momentum.

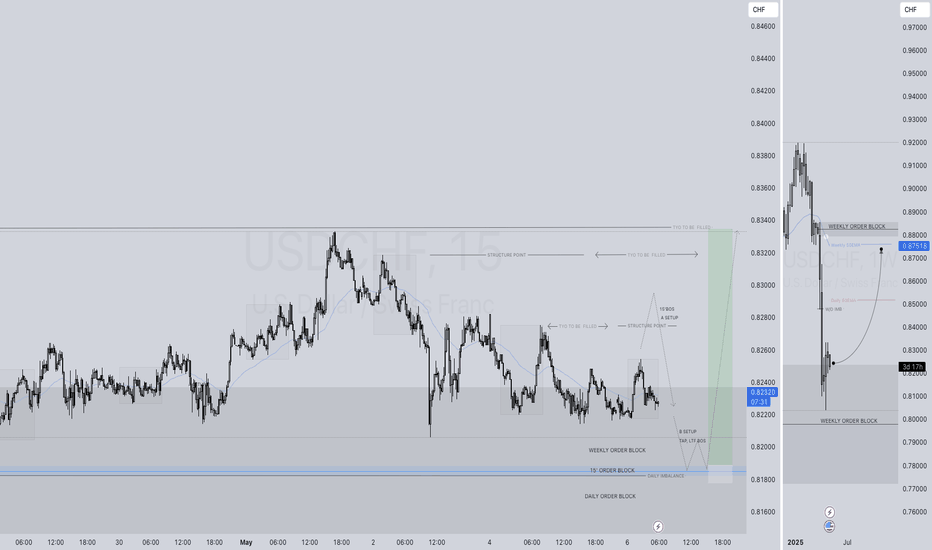

USDCHF LONG FORECAST Q2 W18 D30 Y25USDCHF LONG FORECAST Q2 W18 D30 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

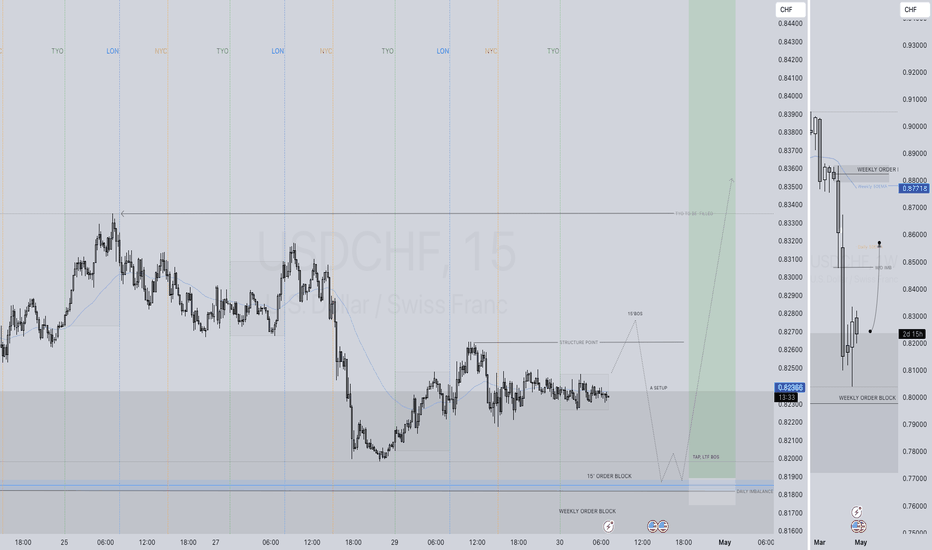

USDCHF LONG FORECAST Q2 W18 D29 Y25USDCHF LONG FORECAST Q2 W18 D29 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

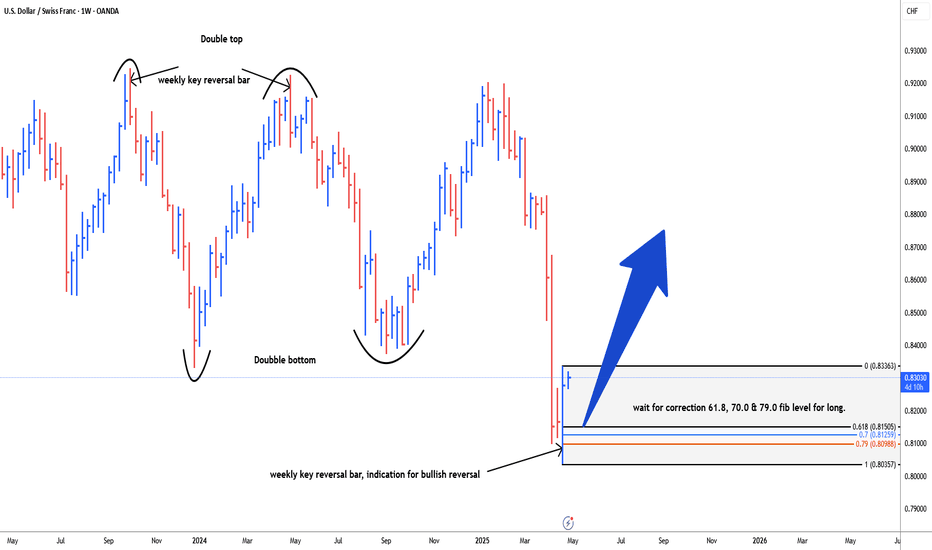

USDCHF possible bullish reversal for 08470 & 0.8530#usdchf weekly bar is a key reversal bar, made a new low, closed towards high. market liquidity sweep below the previous double bottom. weekly key reversal bar is an early indication for bullish reversal. trend is quite bearish. better to wait for correction i.e. 61.8fib level, 70.0fib level and 79.0fib level as well. stop loss below the key reversal bar. Initial take profit level is 0.8470, next one is 0.8525-30.

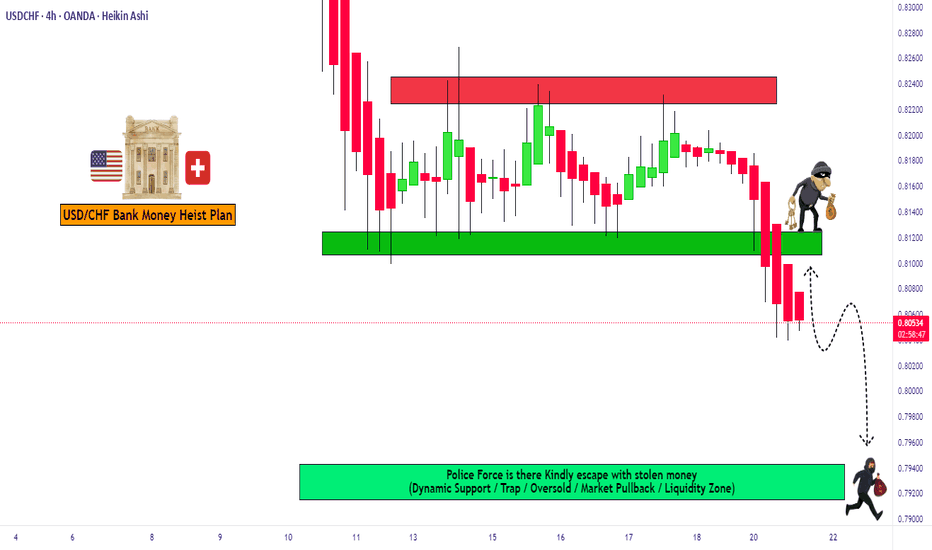

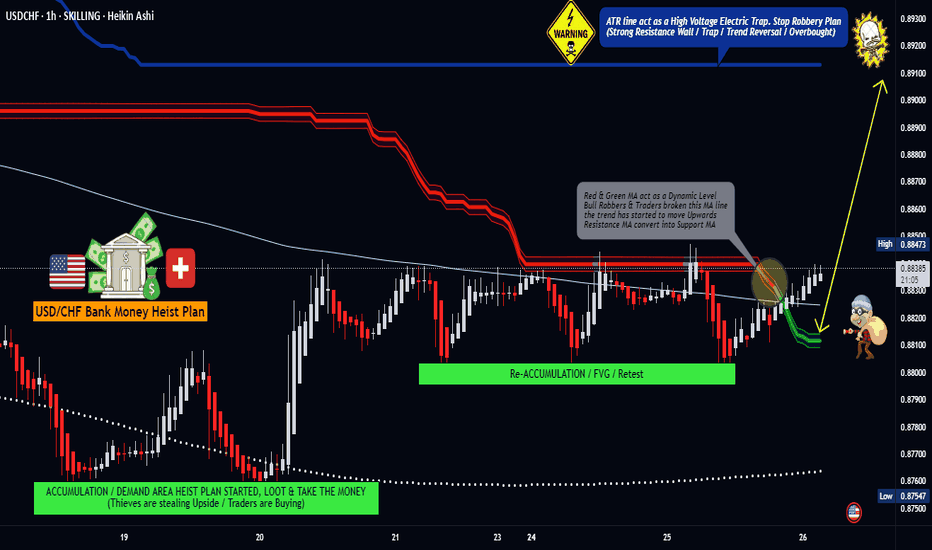

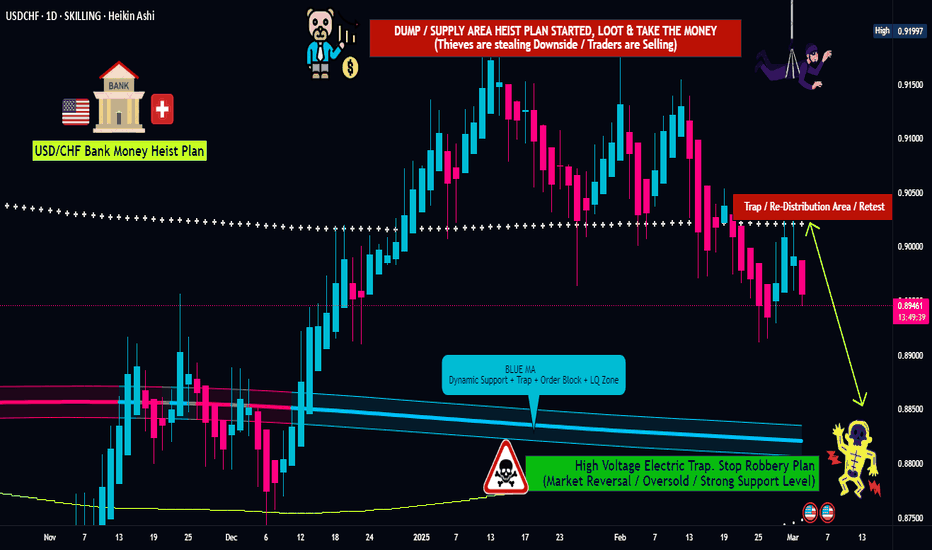

USD/CHF "The Swissy" Forex Market Heist Plan Bearish (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.81400) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.79300 (or) Escape Before the Target

💰💵💸USD/CHF "The Swissy" Forex Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

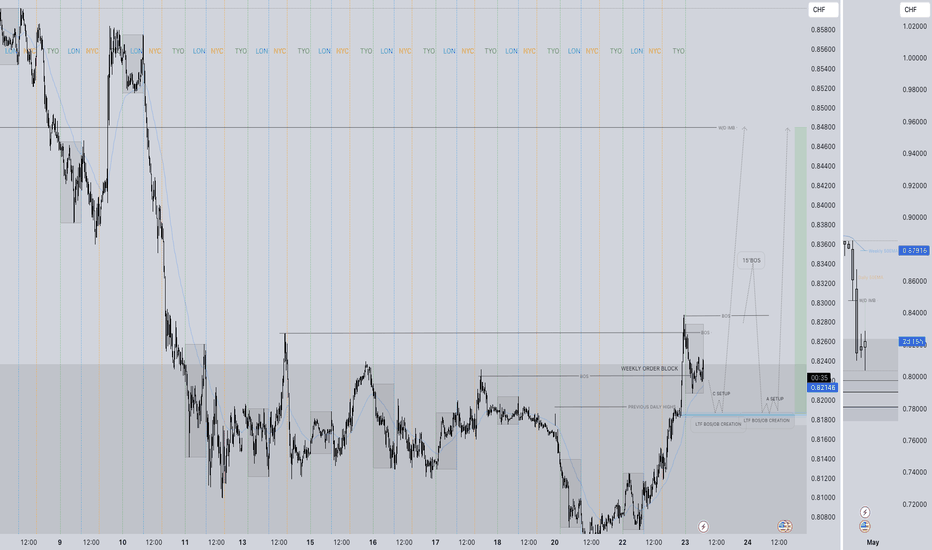

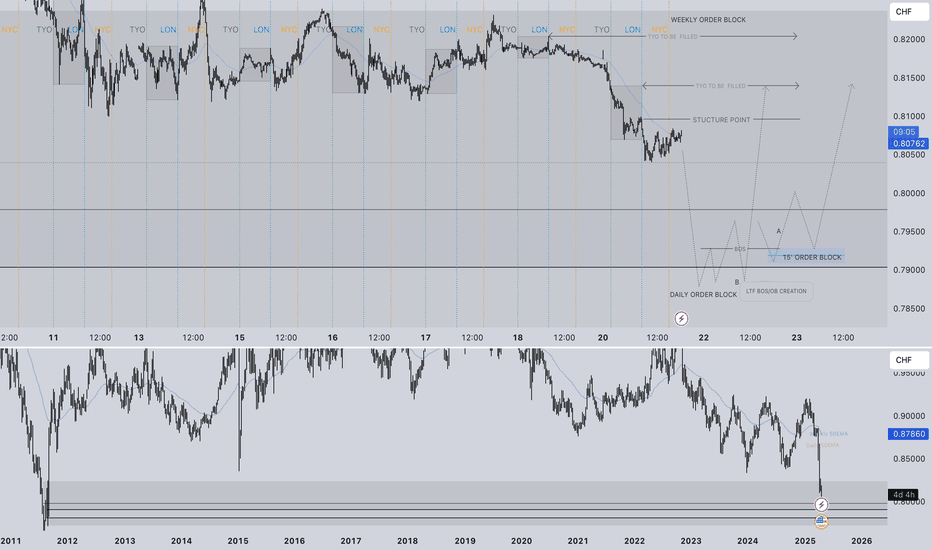

USDCHF LONG FORECAST Q2 W17 D23 Y25USDCHF LONG FORECAST Q2 W17 D23 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Trade confluences

- Weekly order block rejection

- Weekly imbalance to be filled

- Daily bullish close

- 4H 50 EMA supporting long position

- Intraday breaks of structure

- 15’ order block created

- Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

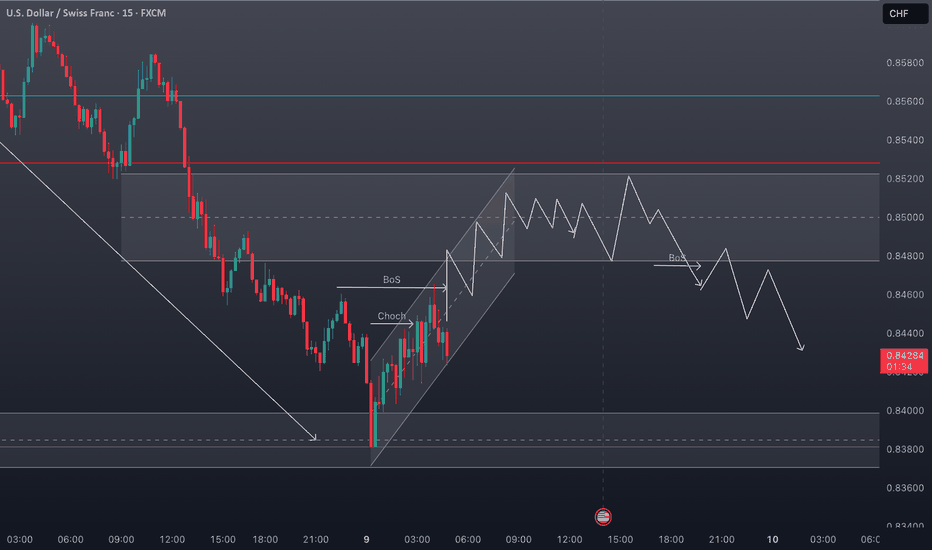

USDCHF LONG FORECAST Q2 W17 D22 Y25USDCHF LONG FORECAST Q2 W17 D22 Y25

Summary

- Weekly order block

- Daily order block

- Price is currently bearish

Requirements

- Wait for a comprehensive bullish turn around in price action

- 15' break of structure

USDCHF LONG FORECAST Q2 W17 D22 Y25

FRGNT X

IG - JCFRGNT

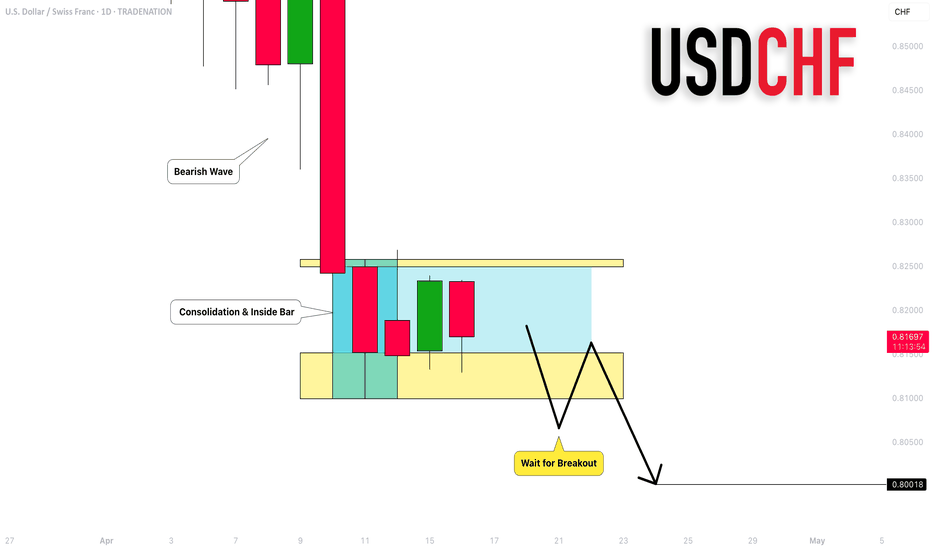

USDCHF: Your Next Bearish Signal 🇺🇸🇨🇭

USDCHF is consolidating after a massive selloff that we saw last week.

The price formed inside bar candlestick pattern and is currently

stuck within the range of the mother's bar.

Your next confirmation to sell will be a violation and a candle close

below 0.8098.

With a high probability, the pair will continue falling then

and reach at least 0.8 psychological level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

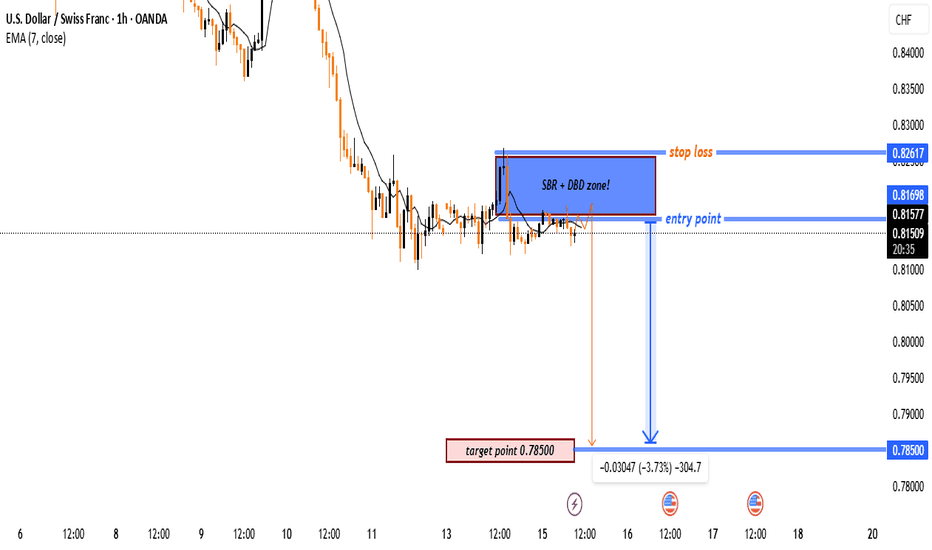

"USD/CHF Bearish Reversal Setup – SBR + DBD Zone in Play"🔵 Entry Zone: 0.81698

📍 Located in a SBR + DBD zone

🛑 Acts as resistance where price previously dropped

🔴 Stop Loss: 0.82617

🚫 Above the supply zone for safety

🛡️ Protects against fake breakouts

🟢 Target: 0.78500

🎯 Based on previous support/demand

🧲 High reward potential

Risk/Reward

📉 Risk (SL to Entry): ~91.9 pips

📈 Reward (Entry to Target): ~319.8 pips

⚖️ R:R Ratio: ~3.48 : 1

✅ High potential trade

Indicators

🟡 EMA (7) shows downward trend

📉 Price is moving below EMA – bearish pressure

Trade Plan

🕵️♂️ Wait for price to retest the zone

📉 Look for bearish confirmation (e.g., bearish engulfing)

🔽 Enter short

✅ Secure profits at target or trail stop if price moves in favor

USDCHF Imbalance Zone Possible Set Up for Bearish ContinuationBased on the current analysis of USDCHF, there's a compelling bearish setup forming on the 4-hour timeframe. Let's dive into the details! 🔍

Fundamental Analysis 💹

USDCHF is currently under significant bearish pressure at 0.8655 📉. The Swiss Franc has been strengthening against the USD, likely due to its safe-haven status amid current market uncertainties. This fundamental backdrop supports our technical bearish bias! 🇨🇭

Technical Analysis on 4H Chart 📈

The price is trading below both the 20 EMA (0.8677) and 50 EMA (0.8715) 📊, confirming the bearish momentum. This bearish EMA alignment creates a perfect environment for short entries! ⚡

Imbalance Zone Opportunity 🎯

There's a clear imbalance zone between 0.8664 - 0.8674 that hasn't been properly retested yet. This zone represents an area where price moved quickly, leaving behind unfilled orders. If price retraces into this zone, it could act as a magnet for sellers! 💰

The Perfect Setup 🔄

Wait for price to retrace into the imbalance zone (0.8664 - 0.8674) ⬆️

Look for bearish price action confirmation (engulfing candles, rejection wicks) 🕯️

Confirm a bearish structure break after the retracement 📉

Enter short position with stops above the recent swing high (~0.8680) 🚫

Target the equilibrium level (0.8661) as first take-profit 🎯

Extended targets at previous lows or 1:2 risk-reward ratio 💸

Risk Management ⚠️

Keep your stop loss tight above the imbalance zone

Consider scaling out at key support levels

Total risk should not exceed 1-2% of your trading capital 💵

This setup offers an excellent risk-to-reward opportunity if executed properly! The bearish momentum is strong, with both EMAs confirming the downtrend. The imbalance zone provides a high-probability entry point for shorts! 🔥

USDCHF's 4H Bullish Structure Break – Is It Time to Buy?After a bearish phase, the USDCHF has turned its momentum around following Trump's announcement of a 90-day tariff pause. This news injected fresh optimism into the markets, triggering a rally that overturned previous downtrends. On the four-hour chart, we observe a break of structure that hints at a bullish reversal. The ideal entry point appears to be the pullback to the 50% Fibonacci retracement level—a historically reliable support zone—setting up a clean long opportunity. Current market sentiment, bolstered by easing geopolitical tensions and renewed risk appetite, supports this bullish outlook. As always, use appropriate risk management strategies and treat this analysis as a trade idea rather than financial advice. 🚀📈💹

USD/CHF Bearish Trade Setup – Supply Zone Rejection🔹 CHoCH (Change of Character) – 📉 A key shift in market structure indicating bearish momentum.

🔹 SBR + DBD Zone (Support Becomes Resistance & Drop Base Drop) – 🚧 This blue zone is a strong resistance area where sellers are likely to step in.

🔹 Stop Loss (🚨) – Positioned above 0.84742, marking a risk level if price moves against the trade.

🔹 Entry Zone (🔵) – Inside the resistance zone, where price is expected to reject and continue downward.

🔹 Target Zone (🎯) – 0.82553, indicating a potential profit of around 2.01% downward movement (-169.7 pips).

🔹 Bearish Confirmation (🔻) – Price already reacted to the zone, showing rejection.

This chart suggests a short-selling opportunity, expecting the price to drop further after rejecting resistance. 📊🔥

USD/CHF Swiss-dollar Forex Bank Heist Plan (Day/Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "Swiss-dollar" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (0.87900) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.89150 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/CHF "Swiss-dollar" Forex Bank Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

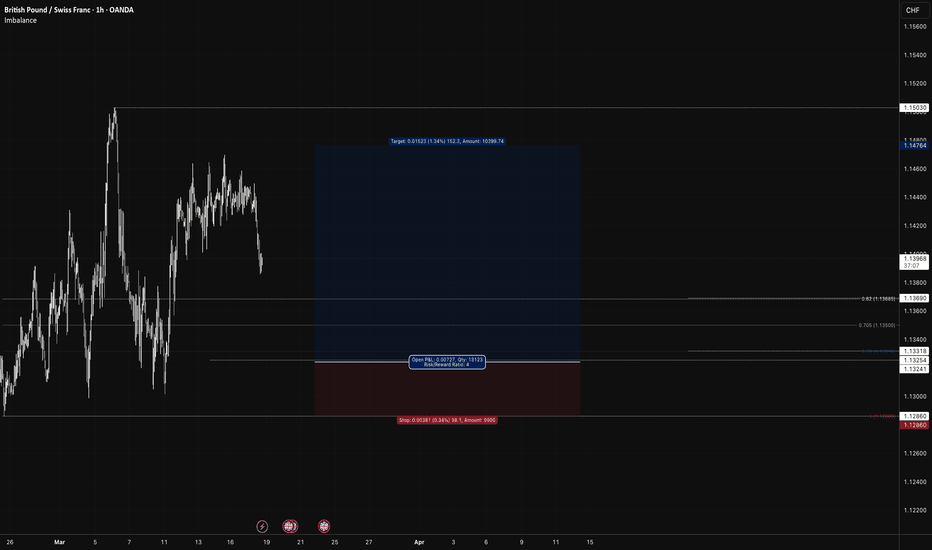

USD/CHF (Long)USD/CHF

Daily:

Price > 200EMA

Swing Period 10

Swing Low: 1.10884

Swing Low: 1.15030

Volume Imbalance: 3 Candles

Daily Order Block: 1.12253 / 1.11294

H4:

Price > 200EMA

Swing Period: 7

Swing High: 1.15030

Swing Low: 1.12860

Volume Imbalance: 2 Candles

H4 Order Block: 1.13452 / 1.13089

H1:

Swing Period: 5

Swing High: 1.15030

Swing Low: 1.12860

Volume Imbalance: 25 Candles

H1 Order Block: 1.13452 / 1.13089

Model 1:

Entry Price: 1.13241

Stop Loss: 1.12860

TP1: 1.14003 @ 1:2 / 50%

TP2: 1.14383 @ 1:3 / 25%

SL: Breakeven

TP3: 1.14764 @ 1:4 / 25%

Model 2:

Entry Price: 1.13690 - 1.13318

Entry Trigger: 9EMA X 21EMA

SL: Above recent swing low

TP1: 1:2

SL: Trailing 9EMA

USD/CHF "The Swissy" Forex Market Heist Plan Bearish🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.90500 (swing Trade) Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.88000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

USD/CHF "The Swissy" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🌟Fundamental Analysis

The USD/CHF pair is influenced by:

Interest Rate Differential: The difference between the Federal Reserve's interest rates and the Swiss National Bank's interest rates.

Economic Growth: The US GDP growth rate and the Swiss GDP growth rate.

Inflation Rates: The US inflation rate and the Swiss inflation rate.

🌟Macroeconomic Analysis

Key macroeconomic indicators to watch:

US GDP Growth Rate: Expected to slow down in 2025.

Swiss GDP Growth Rate: Expected to remain stable in 2025.

US Inflation Rate: Expected to decrease in 2025.

Swiss Inflation Rate: Expected to remain low in 2025.

🌟COT Data Analysis

The latest Commitment of Traders (COT) report shows:

Net Long Positions: Decreased by 10,000 contracts.

Net Short Positions: Increased by 5,000 contracts.

🌟Market Sentimental Analysis

Market sentiment for USD/CHF is:

Bearish: 55% of investors expect the pair to fall.

Bullish: 30% of investors expect the pair to rise.

Neutral: 15% of investors remain neutral.

🌟Positioning Analysis

Traders are advised to:

Consider short-term investments: As the USD/CHF pair is expected to experience high volatility.

Monitor market news: As central bank decisions and global economic data may impact the pair.

🌟Quantitative Analysis

Technical indicators show:

Moving Averages: The 50-day and 200-day moving averages are indicating a bearish trend.

Relative Strength Index (RSI): The RSI is indicating an oversold condition.

🌟Intermarket Analysis

The USD/CHF pair is highly correlated with:

EUR/USD: A stronger euro may boost the Swiss franc against the US dollar.

USD/JPY: A weaker US dollar may boost the Swiss franc against the yen.

🌟News and Events Analysis

Upcoming events that may impact the USD/CHF pair include:

Federal Reserve Monetary Policy Decision: March 19, 2025

Swiss National Bank Monetary Policy Decision: March 20, 2025

🌟Next Trend Move

The USD/CHF pair may experience a:

Bearish move: Driven by the interest rate differential and economic growth.

🌟Overall Summary Outlook

The USD/CHF pair is expected to:

Experience high volatility: Due to central bank decisions and global economic data.

Remain bearish: In the short-term, driven by the interest rate differential and economic growth.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CHF "The Swissy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗USD/CHF "The Swissy" ˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (0.90700) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.88500 & 0.88000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

USD/CHF "The Swissy" Forex Market is currently experiencing a Bearish trend in short term,{{{(>HIGH CHANCE FOR BULLISHNESS IN FUTURE<)}}} driven by several key factors.

⭐1. Fundamental Analysis

Fundamental analysis evaluates the economic indicators driving the USD/CHF pair:

US Economic Indicators:

GDP Growth: 2.3% – Indicates robust economic expansion.

Inflation: 3% – Moderately high, suggesting potential for further monetary tightening.

Interest Rates: 4.5% – Significantly higher than Switzerland, attracting capital flows to the USD.

Trade Balance: Deficit of -98.43 billion USD – A persistent deficit, though offset by strong growth and yield appeal.

Switzerland Economic Indicators:

GDP Growth: 0.2% – Slow growth, reflecting a weaker economic performance.

Inflation: 0.4% – Very low, indicating stable but minimal price pressures.

Interest Rates: 0.5% – Low rates, reducing attractiveness for CHF-denominated assets.

Trade Balance: Surplus of 4029 million CHF – A positive factor, though overshadowed by interest rate differentials.

Key Insight: The significant interest rate differential (4.5% vs. 0.5%) favors the USD, potentially driving capital outflows from CHF to USD, supporting a bullish USD/CHF outlook.

⭐2. Macroeconomic Factors

Macroeconomic conditions provide context for currency movements:

Global GDP Growth: Projected at 3.3% for 2025, with mixed regional performances.

US Economy: Strong growth (2.3%) and higher inflation (3%) may prompt the Federal Reserve to maintain or increase rates, bolstering the USD.

Swiss Economy: Low growth (0.2%) and inflation (0.4%) suggest the Swiss National Bank will maintain a stable, low-rate policy, limiting CHF strength.

Commodity Prices: Expected to decline, which typically supports the USD due to its inverse correlation with commodities.

Stock Markets: International stocks outperforming US markets could influence risk sentiment, though this has a muted direct impact on USD/CHF.

Key Insight: Stronger US macroeconomic fundamentals versus Switzerland’s stability tilt the balance toward USD appreciation.

⭐3. Global Market Analysis

Global factors influencing the USD/CHF pair:

Geopolitical Events: Potential tensions could boost CHF as a safe-haven currency, though no specific events are currently noted.

Central Bank Policies:

Federal Reserve: Possible further rate hikes if US data remains strong, supporting USD.

Swiss National Bank: Likely to maintain low rates, limiting CHF upside.

Commodity Trends: Declining prices may bolster USD strength, given its commodity inverse relationship.

Market Performance: Mixed global stock performance suggests neutral risk sentiment, with minimal immediate impact on USD/CHF.

Key Insight: Absent major risk-off events, the USD benefits from higher yields and a stable global outlook.

⭐4. COT Data (Commitment of Traders)

COT data reflects trader positioning:

Non-Commercial Traders: Likely net long USD against CHF, driven by the interest rate differential and stronger US economic outlook.

Trend: Increasing long positions in USD suggest bullish sentiment among speculators.

Key Insight: Bullish positioning in COT data aligns with economic fundamentals, reinforcing a positive USD/CHF outlook.

⭐5. Intermarket Analysis

Correlations with other asset classes:

USD and Commodities: Typically inversely correlated; declining commodity prices could strengthen the USD.

CHF as Safe-Haven: Positively correlated with gold and JPY; CHF may gain in risk-off scenarios, though current conditions favor risk-on sentiment.

Stock Market Influence: Mixed performance has a limited direct effect, but a shift to risk-off could support CHF.

Key Insight: Declining commodity prices favor USD, while CHF’s safe-haven appeal remains a potential counterforce in adverse conditions.

⭐6. Quantitative Analysis

Technical indicators based on the current price of 0.89700:

Moving Averages: Assuming the price is above key moving averages (e.g., 50-day or 200-day), this suggests an uptrend.

Relative Strength Index (RSI): If not in overbought territory (e.g., below 70), there’s room for further gains.

Support/Resistance Levels:

Support: 0.8900 – A potential downside target if the trend reverses.

Resistance: 0.9009 and 0.9026 – Upside targets if bullish momentum continues.

Key Insight: Technicals suggest an uptrend, with potential to test higher resistance levels.

⭐7. Market Sentiment Analysis

Sentiment gauged from trader behavior:

Current Sentiment: Likely moderately bullish on USD/CHF, reflecting economic and technical factors.

Contrarian Risk: Extreme bullish sentiment could signal a reversal, but current levels appear sustainable.

Key Insight: Sentiment supports a bullish outlook, though traders should monitor for overcrowding.

⭐8. Positioning

Trader positioning insights:

Speculative Positions: Increased long positions in USD, as per COT data assumptions, indicate confidence in further gains.

Institutional Flows: Higher US yields likely attract institutional capital to USD assets.

Key Insight: Positioning reinforces the bullish case for USD/CHF.

⭐9. Next Trend Move

Direction: Likely upward, driven by interest rate differentials, technical momentum, and economic strength.

Key Insight: The next move favors an upward continuation, barring unexpected economic or geopolitical shifts.

Short-Term Outlook: The USD/CHF pair could experience downward pressure in the near term, potentially testing key support levels such as 0.8900. If this level is breached, the pair might decline further toward 0.8850 or lower.

⭐10. Overall Summary Outlook

Summary: The USD/CHF pair, at 0.89700 on March 4, 2025, exhibits a bullish outlook. Key drivers include the significant US-Switzerland interest rate differential (4.5% vs. 0.5%), stronger US GDP growth (2.3% vs. 0.2%), and higher inflation (3% vs. 0.4%). Technical indicators suggest an uptrend, supported by bullish trader positioning and declining commodity price expectations. Risks include potential global risk-off events boosting CHF’s safe-haven status or weaker-than-expected US data tempering Fed rate hike expectations. However, the prevailing trend points to further USD appreciation.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩