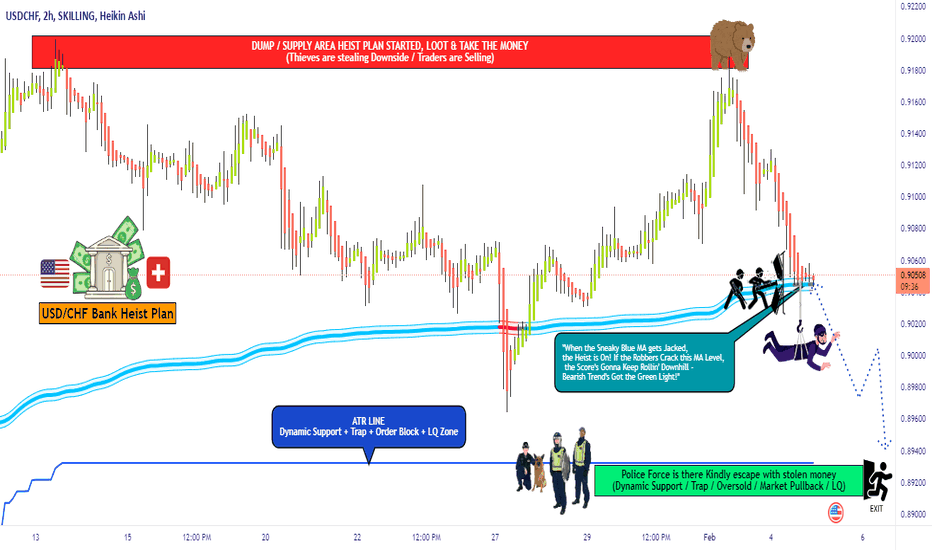

USD/CHF "The Swissy" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

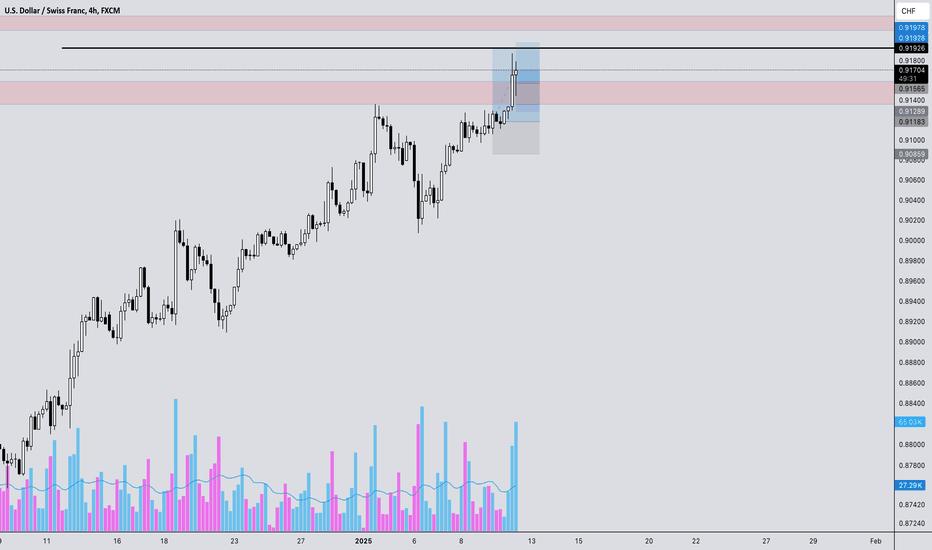

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (0.90300) then make your move - Bearish profits await!"

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.90700 (swing Trade) Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.89310 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

USD/CHF "The Swissy" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🟤Fundamental Analysis

- The Swiss National Bank (SNB) has maintained a dovish stance, keeping interest rates negative to curb the Swiss franc's appreciation.

- The US Federal Reserve has also maintained a dovish stance, keeping interest rates low to support economic growth.

🔴Macro Analysis

- The US economy has shown signs of slowing down, with GDP growth rate decreasing to 2.1% in Q4 2022.

- The Swiss economy has also shown signs of slowing down, with GDP growth rate decreasing to 0.9% in Q4 2022.

🟠Sentimental Analysis

- Institutional investors have a bearish sentiment towards the USD/CHF pair, with 52% being bearish.

- Hedge funds have decreased their long positions, with a net short exposure of 15%.

- Retail traders have a bullish sentiment towards the USD/CHF pair, with 55% being bullish.

🟡COT Analysis

- The Commitment of Traders (COT) report shows that large speculators have increased their short positions, with a net short exposure of 10,000 contracts.

- Commercial traders have decreased their long positions, with a net short exposure of 5,000 contracts.

🔵Positioning

- The USD/CHF pair is experiencing a decrease in net-long exposure, which could be a sign of a potential trend reversal.

- The market positioning is also influenced by the US dollar positioning, which has seen a reduction in net-short exposure against G10 currencies.

🟢Overall Outlook

-Based on the analysis, the USD/CHF pair is expected to move in a bearish trend, with a 55% chance of a downtrend and a 35% chance of an uptrend. However, please note that market predictions can be unpredictable and influenced by various factors.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Usdchfsignal

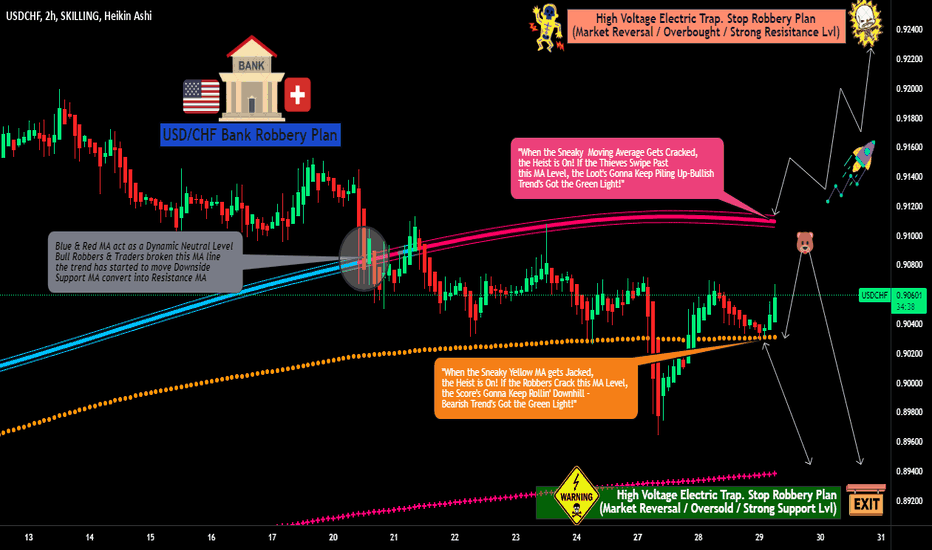

USD/CHF "The Swissie" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CHF "The Swissie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 : "The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 0.91200

Sell Entry below 0.90300

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Target 🎯: -Bullish Robbers TP 0.92400 (or) Escape Before the Target

-Bearish Robbers TP 0.89400 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The USD/CHF "The Swissie" Forex market is currently experiencing a neutral trend, with a slight bias towards bullishness., driven by several key factors.

💨Fundamental Outlook:

- Interest Rates: The Federal Reserve's interest rate decisions will impact USD/CHF. A rate hike could strengthen the dollar.

- Swiss National Bank (SNB): The SNB's monetary policy decisions will influence the Swiss franc's value. A dovish stance could weaken the franc.

- Global Economic Conditions: The ongoing global economic uncertainty and trade tensions could impact USD/CHF

💨Macro Outlook:

- US Economy: The US economy is expected to continue growing, albeit at a slower pace. The Federal Reserve's interest rate decisions will play a crucial role in shaping the economy.

- Swiss Economy: The Swiss economy is expected to remain stable, with low inflation and a strong labor market. The Swiss National Bank's (SNB) monetary policy decisions will influence the economy.

- Global Economy: The global economy is facing uncertainty due to trade tensions, geopolitical risks, and the COVID-19 pandemic. This could impact USD/CHF.

- Commodity Prices: Commodity prices, particularly oil prices, could influence USD/CHF.

💨Sentimental Outlook:

- Institutional Investors: 55% bullish, 45% bearish

- Retail Traders: 52% bullish, 48% bearish

- Hedge Funds: 58% bullish, 42% bearish

- Large Banks: 60% bullish, 40% bearish

💨Market Sentiment: The market sentiment is slightly bullish, with a majority of investors expecting USD/CHF to rise.

💨COT Data:

Current COT Data (as of January 24, 2024):

- Non-Commercial Traders (Speculators): Net long 53,129 contracts (previous week: net long 49,351 contracts)

- Commercial Traders: Net short 45,678 contracts (previous week: net short 42,191 contracts)

Upcoming COT Data (expected release on February 2, 2024):

- Expected Change: Speculators may increase their net long positions, while commercial traders may reduce their net short positions.

💨Upcoming Events:

- Federal Reserve Interest Rate Decision: Expected to impact USD/CHF

- SNB Monetary Policy Decision: Will influence the Swiss franc's value

- Global Economic Data Releases: Will provide insights into the global economic outlook

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

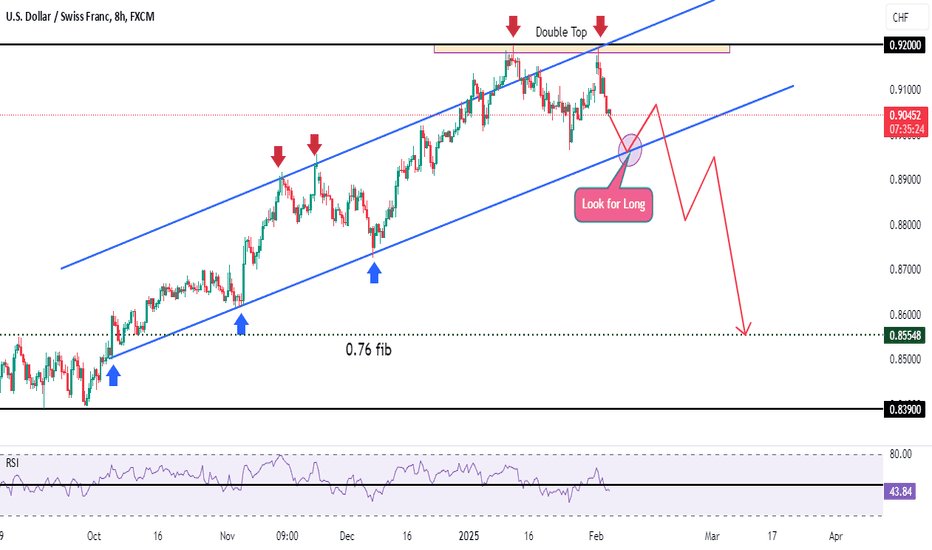

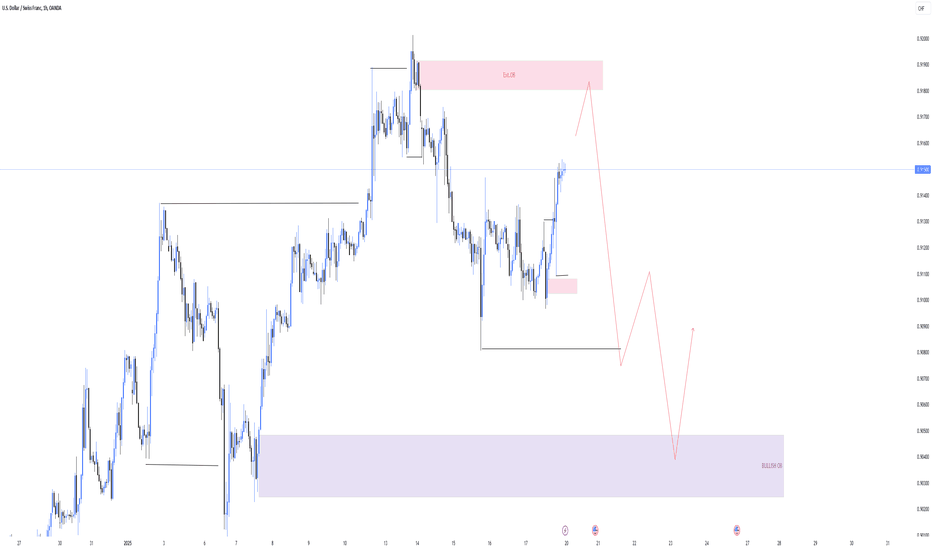

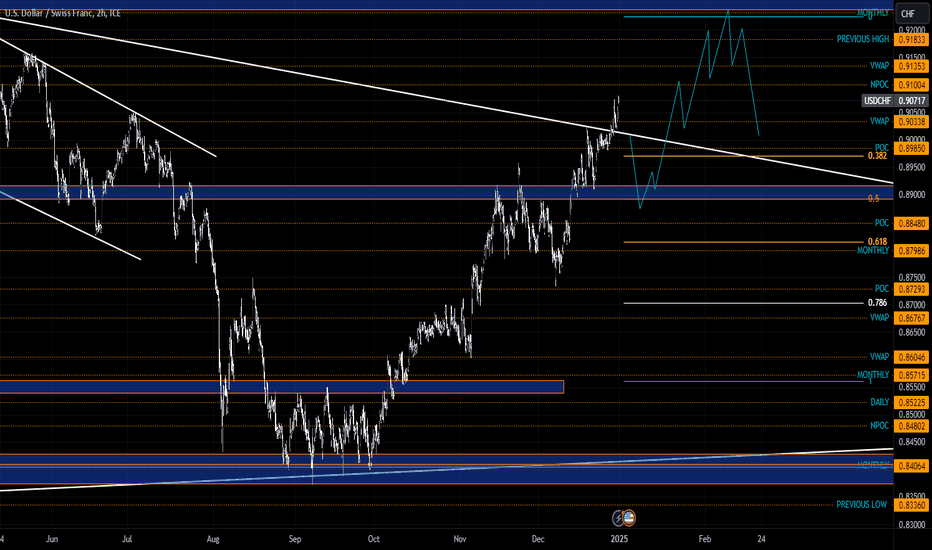

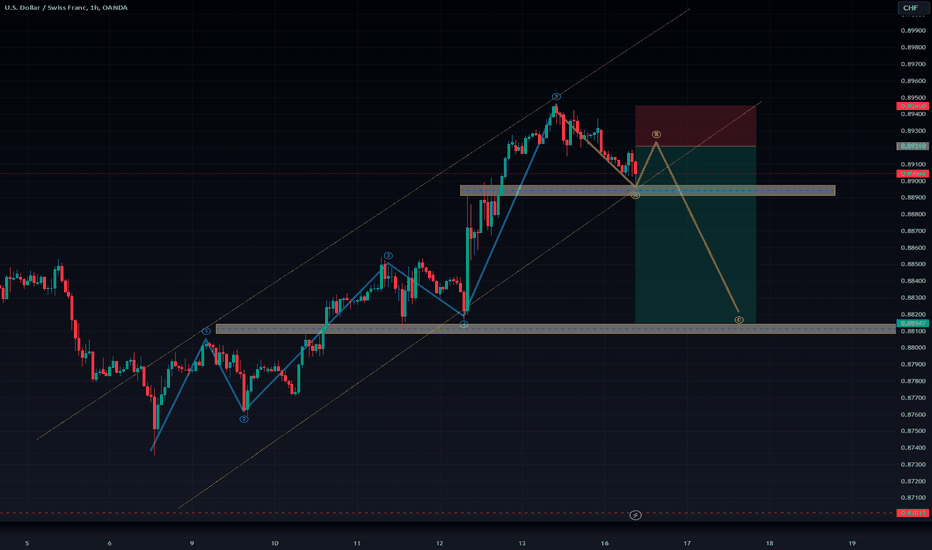

USDCHF Updatethis pair has formed and ascending channel on a higher timeframe

and formed also a double top

so now we're waiting for this pair to hit the down trendline of the channel so we can look or a long position on a lower timeframe

once the channel is broken and the candle lose below the last touch we will enter a short position also targeting take profit on 0.76 fib retracement

Follow for more

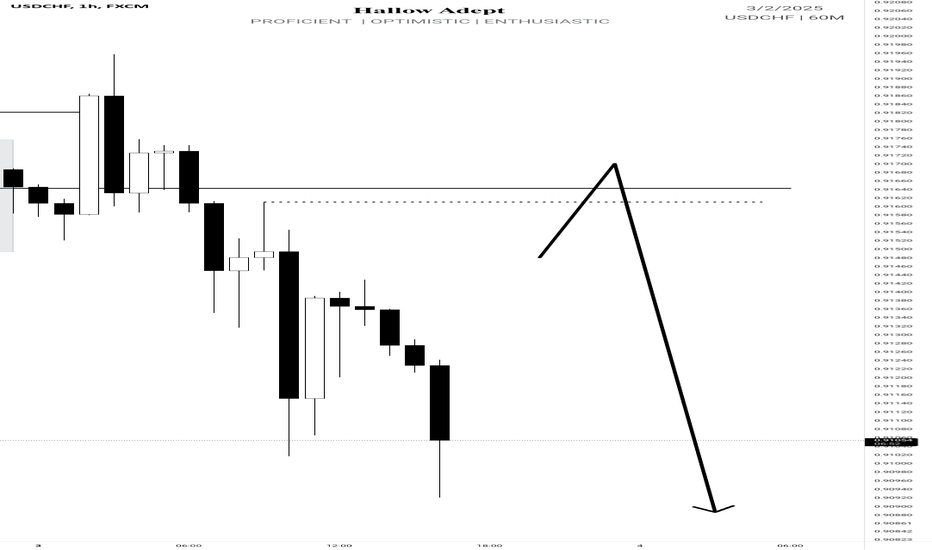

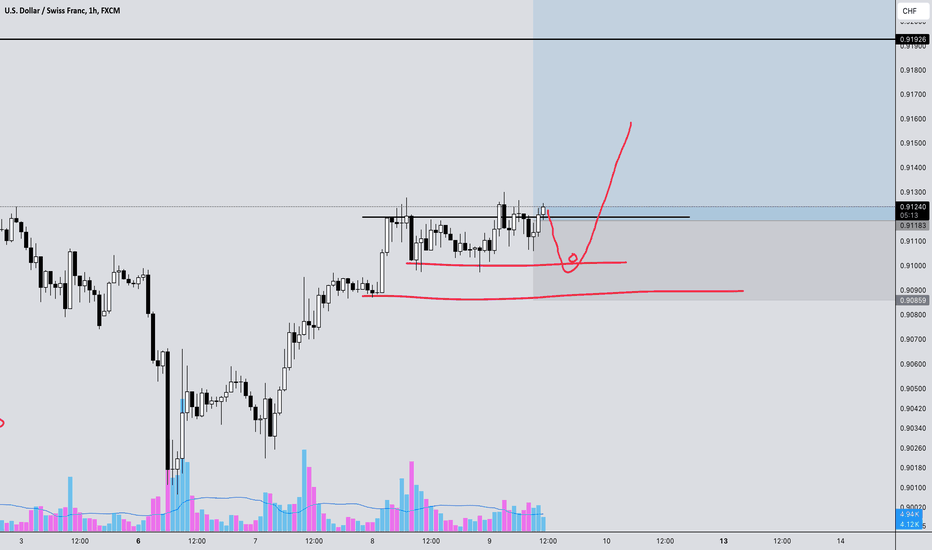

USDCHF short biasI'll be anticipating to short usdChf from 0.91643 taking the Old New York high 0.91611

I didn't see the sell opportunity that happens today to I'm anticipating a pull back to my point of interest then I ride it down.

A believe it's going to be a bearish week.

Please share if you find this insightful 🫴

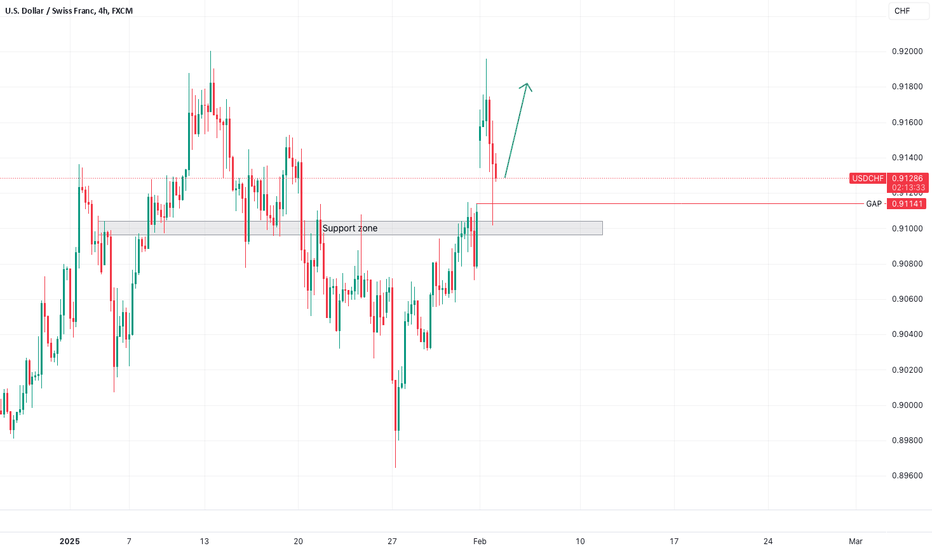

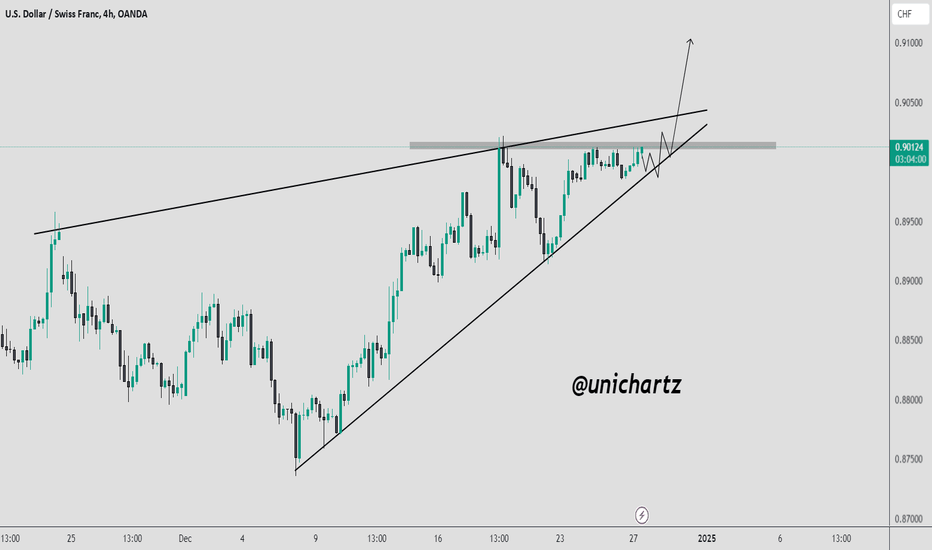

USDCHF - Bullish continuation !!Hello traders!

‼️ This is my perspective on USDCHF.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I expect price to continue bullish price action after filling the gap and rejecting from support zone + institutional big figure 0.91000.

Like, comment and subscribe to be in touch with my content!

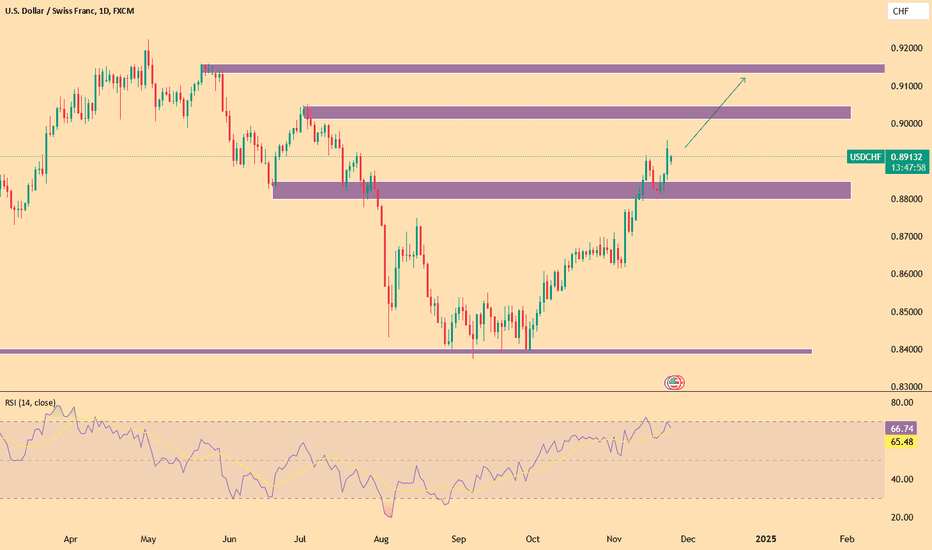

USDCHF - Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast:

0.89147 is a major support, while this level is not broken, the Midterm wave will be uptrend.

We will close our open trades, if the Midterm level 0.89147 is broken.

Technical analysis:

A trough is formed in daily chart at 0.89645 on 01/27/2025, so more gains to resistance(s) 0.91497, 0.92218, 0.94400 and more heights is expected.

Take Profits:

0.85510

0.86286

0.87474

0.88195

0.89147

0.90367

0.91497

0.92218

0.94400

0.96000

0.99200

1.01453

__________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 BOOST button,

. . . . . . . . . . . Drop some feedback below in the comment!

🙏 Your Support is appreciated!

Let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

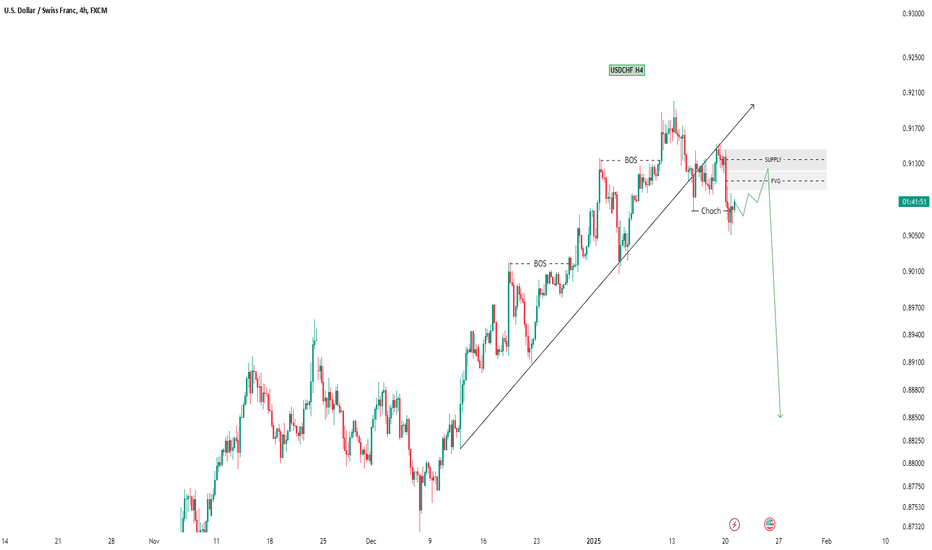

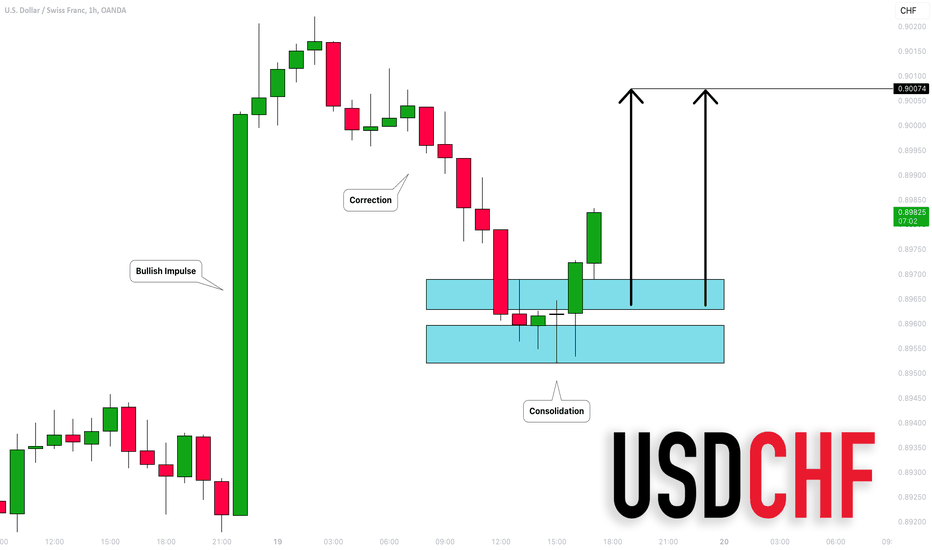

USDCHF - Short after filling the imbalance !!Hello traders!

‼️ This is my perspective on USDCHF.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. I expect price to continue the retracement to fill that huge imbalance and then to reject from bearish OB.

Fundamental news: On Wednesday (GMT+2) we will see results of Interest Rate in USA, news with high impact on currency.

Like, comment and subscribe to be in touch with my content!

USDCHF - Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast:

0.86129 is a major support, while this level is not broken, the Midterm wave will be uptrend.

__________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 BOOST button,

. . . . . . . . . . . Drop some feedback below in the comment!

🙏 Your Support is appreciated!

Let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

USDCHF TRADE IDEA : LONG | BUY (23/01/25)Price has already tapped in. I’d look for a clear entry before entering. However this is clear - price did not break aggressively on the way down - rather up.

I’m expecting a buy with ≈ RR: 2.5

N.B.: This is not financial advice. Trade safely and with caution.

USDCHF H4 Projection!Price breaks the trend line and closes below. Now, the price retests the trendline and pushes down sharply with an FVG (fair value gap). We expect the rice to mitigate the FVG and then decline further. So initiate short positions partially near the supply and FVG zone after finding a bearish price action structure.

USDCHF IdeaUSDCHF has formed a ascending channel with more than 3 touches which makes it a valid channel

we're waiting for an H4 candle to close below the last touch and a retest to the channel

when the retest get rejected we enter a short (sell) position

with a take profit which is a touch on a lower trendline and also 0.68

Follow us for more ideas and updates

USDCHF Long Trade Update: Crushing Targets with Precision!We’re back with an update on USDCHF, where our targets were successfully hit on the first position with a solid 1:2.3 RR, and the second position is still running strong. In this video, I recap the trade, from the .9153 entry to partial profits taken at the .9192 area.

If you followed my last USDCHF breakdown, you know I anticipated the USD rally, especially after the NFP boost, and it played out beautifully. For those who missed the first analysis, make sure to go back and check out the detailed breakdown of the DXY dollar index and the long-term outlook for USDCHF.

📊 Key Highlights:

• Liquidity sweep at .9157 and why this time is different from previous USDCHF price action.

• Higher low formation on the monthly chart signaling potential long-term dollar strength.

• Second target aligns with daily liquidity levels and momentum buildup, with a final spike expected soon.

Are you still watching from the sidelines while these opportunities pass you by? Learn how to spot these moves and profit alongside us.

Stay tuned as I’ll be breaking down active trades on AUDNZD, GBPJPY, and Ethereum in upcoming videos.

👉 Don’t miss this! Watch the full analysis and prepare for what’s to come.

Dollar Set to rally Before Trump is in office? #USDCHF UPDATEIn this video, we provided a quick update on our USDCHF trade that we analyzed and entered yesterday. We took some profits, broke even on the original position, and added a new position for a short-term play.

We still anticipate higher prices for the USD Dollar overall, especially as we approach President Trump’s upcoming term in office.

If you found this video helpful and want to see more like it, be sure to boost, follow, and share with your fellow traders.

Have a specific pair you’d like us to analyze? Drop it in the comments, and we’ll do our best to cover it this weekend.

Happy trading, and enjoy your weekend!

Is the Dollar Set to rally Before Trump is in office? #USDCHF In this video I go in depth as to why we believe we are set to see higher prices on USDCHF and the US Dollar as a whole.

On the monthly timeframe we can see a large ranging market for USDCHF but we believe this time it will different. Check out the video to find out why in detail! - @BlueOceanFx

Potential Upside Ahead for USD/CHF: Watch This ZoneUSD/CHF is trading within a rising wedge pattern, approaching a key resistance level around 0.9020. A breakout above this zone with confirmation could lead to further bullish momentum.

However, if the price fails to sustain above the wedge, a pullback toward the lower trendline or previous support zones is possible

DYOR, NFA

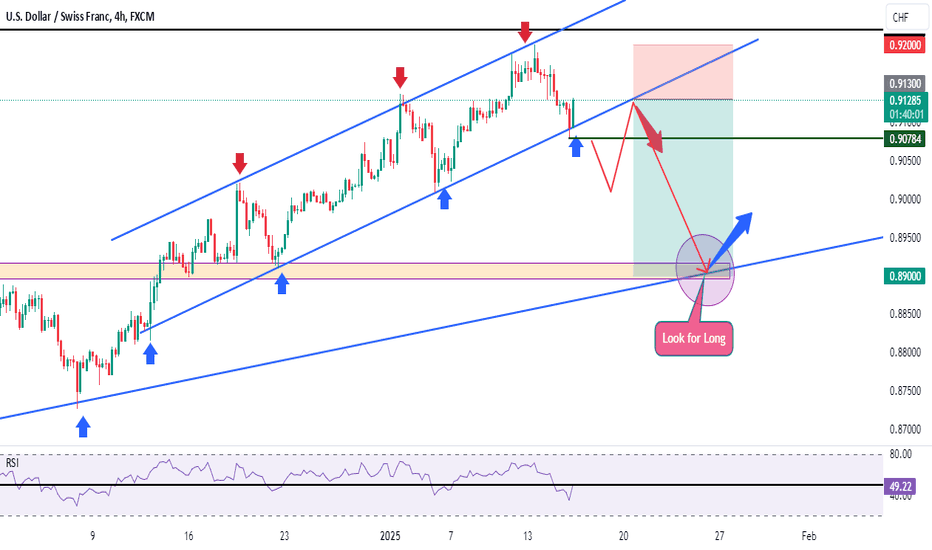

USDCHF - Long from trendline !!Hello traders!

‼️ This is my perspective on USDCHF.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is price to fill the imbalance lower and then to reject from bullish OB + trendline.

Like, comment and subscribe to be in touch with my content!

USDCHF: Bullish Move Confirmed 🇺🇸🇨🇭

It looks like a local correctional movement is over on USDCHF

and the pair is returning to a bullish trend.

The release of the today's US fundamentals made the pair

violate a resistance line of a narrow consolidation range on an hourly.

The price will most likely go up to 0.9007 level.

❤️Please, support my work with like, thank you!❤️

USDCHF - New Wave

Let's consider the scenario on the currency pair USDCHF. At the moment there is a local upward movement on the background of a decrease in the Swiss interest rate. It is not rational to consider a long entry point now, as the growth potential is not significant. But a good corrective downward movement, within the framework of intraday trading, should be taken. The resistance level 0.89227 is formed above the current price, on the senior timeframe, which is usually in priority. The level has not been tested, the first test is the most accurate. From the border of this resistance we place a limit order to sell. Stop Loss is placed, according to the rules of the trading algorithm, behind the upper boundary of resistance, taking into account the false breakdown. Such manipulation gives additional protection and limits the risk. After opening the order, a downward movement is expected, at least to the support level of 0.88750, where it will be necessary to move the stop loss to breakeven to protect the open position. At the level of 0.88758 we will fix a part of profit. The main target is the key support level 0.87867. The potential is good, the risk/profit ratio is satisfactory.